-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

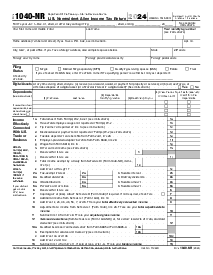

Fillable Form 1040 (2021)

Get your Form 1040 (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

How to Fill Out Form 1040 (2021) Using PDFLiner

Filing taxes can be daunting, but with the right tools, it becomes much more manageable. One such tool is PDFLiner, a user-friendly online platform for easy form filling and management. In this article, we'll guide you through the process of filling out Form 1040 for the 2021 tax year using PDFLiner.

Step 1: Access PDFLiner

First, navigate to the PDFLiner website and log in to your account. If you don’t have an account yet, you can easily create one by signing up. PDFLiner offers a variety of subscription plans, including a free trial, so you can choose the one that best fits your needs.

Step 2: Find Form 1040

Once you're logged in, use the search bar to find Form 1040 for the 2021 tax year. PDFLiner has an extensive library of tax forms, so finding the correct one should be straightforward. Click on the form to open it in the PDF editor.

Step 3: Fill in Personal Information

Begin by filling out your personal information at the top of Form 1040. This includes your name, Social Security number, and filing status. PDFLiner allows you to type directly into the fields, making this step quick and easy.

Step 4: Report Income

Next, proceed to the income section. Enter your wages, salaries, tips, and other income sources in the appropriate boxes. If you have multiple sources of income, ensure you report each one accurately. PDFLiner's intuitive interface makes it easy to add additional lines or notes if needed.

Step 5: Adjustments to Income

In this section, you can enter any adjustments to your income, such as contributions to retirement accounts or student loan interest. PDFLiner provides a helpful guide and prompts to ensure you don’t miss any potential adjustments.

Step 6: Calculate Tax and Credits

Fill out the sections related to tax and credits. Enter your deductions, which could include standard or itemized deductions, and any credits you qualify for. PDFLiner’s built-in calculator can assist in ensuring your totals are accurate.

Step 7: Other Taxes

If you owe any other taxes, such as self-employment tax, report them in this section. PDFLiner helps by providing easy-to-understand instructions and links to additional forms if needed.

Step 8: Payments

Record any tax payments you have already made, including withholding and estimated tax payments. This helps in calculating your total tax liability or refund accurately.

Step 9: Review and Sign

Before submitting your form, take advantage of PDFLiner’s review feature. It allows you to check for errors or omissions and ensures that all necessary fields are completed. Once you’re satisfied with the form, sign it electronically using PDFLiner’s e-signature feature.

Step 10: Submit

After reviewing and signing, you can download your completed Form 1040 or submit it directly through PDFLiner if supported. Keep a copy for your records.

Conclusion

Using PDFLiner to fill out Form 1040 for the 2021 tax year simplifies the process. With its intuitive interface, helpful guides, and electronic submission options, you can confidently and efficiently complete your tax return. Start your tax filing process with PDFLiner today and take the stress out of tax season.

For more detailed assistance or specific queries about filling out Form 1040 using PDFLiner, feel free to explore the platform’s resources or contact their support team. Happy filing!

Fillable online Form 1040 (2021)