-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Schedule 8812 Form 1040 (2023)

Get your Schedule 8812 Form 1040 (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

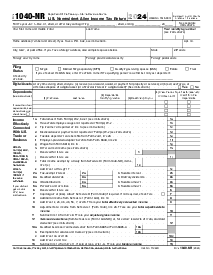

Understanding Schedule 8812 Form 1040 for Tax Year 2023

Managing your taxes can be a complex task, but the right information and tools can simplify the process. When it comes to claiming credits for qualifying children or dependents, form 1040 Schedule 8812 is a vital document that taxpayers need to understand. This form helps you calculate the Additional Child Tax Credit, which can enhance your tax savings.

Eligibility requirements to consider

Before delving into the Schedule 8812 form 1040, realize that not everyone will need to fill out this form. Your eligibility hinges on several factors, including:

- The number of children you can claim

- Your income level

- The amount of tax you owe

- Specific criteria for the Child Tax Credit

How to Fill Out Form 1040 Schedule 8812

When it comes to completing this schedule, the key is to proceed methodically. Here's a step-by-step form 1040 schedule 8812 instructions to guide you through the process:

- Begin by entering the name as displayed on your tax return at the top section of the form.

- Directly beside your name, input your Social Security Number (SSN) for identification purposes.

- Proceed to the first major part where you'll declare eligibility and calculate the Child Tax Credit or credit for other dependents if applicable. Here, follow the instructions for each line to enter the correct amounts, starting with the total number of qualifying children and other dependents.

- In part two (first subsection), where all filers compute the Additional Child Tax Credit, use the worksheet provided within the instructions to calculate the credit. Use the earned income amount from your tax return and follow the step-by-step calculations outlined to determine the amount to enter on this part of the form.

- The second subsection of part two asks filers with three or more children to calculate the credit using their combined earnings. If this applies to you, calculate additional credits due using the worksheet specific for filers with three or more qualifying children or if living in Puerto Rico.

- Transition to the third subsection of part two where you calculate the Additional Child Tax Credit. This is the section where filers will tally the additional credits they can claim based on the previous two sections.

- After you've completed the necessary calculations and fields, double-check all entries to ensure accuracy.

Utilizing online resources for filling out your form

In a digital age where convenience is key, PDFliner provides a user-friendly platform for filling out your IRS form 1040 schedule 8812 electronically. PDFliner allows you to complete the form online, making it easier to fill out, save, share, and print or submit your forms directly. This approach ensures your tax information is handled accurately and efficiently.

Form Versions

2020

Schedule 8812 Form 1040 (2020)

2022

Schedule 8812 Form 1040 (2022)

Fillable online Schedule 8812 Form 1040 (2023)