-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IRS Tax Forms - page 26

-

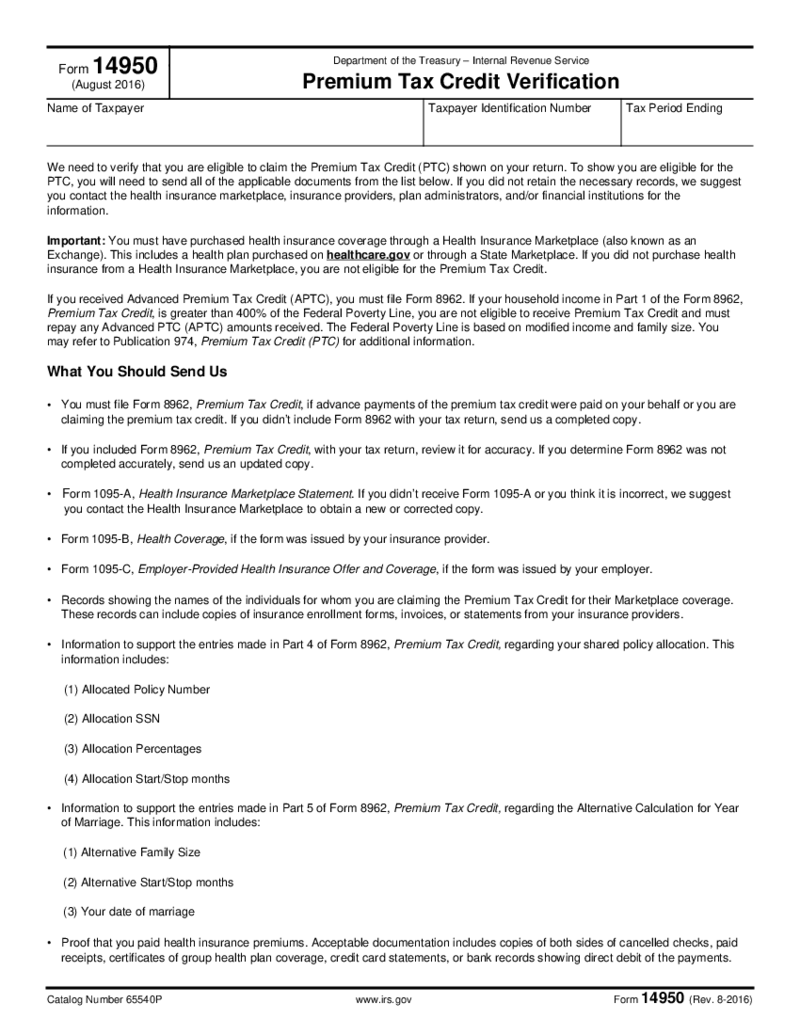

Form 14950

1. What is a 14950 Form?

The fillable Form 14950 is a small official IRS PDF tax form (full title Premium Tax Credit Verification) that is used for verification of taxpayer eligibility to claim the PTC (Premium Tax Credit). The form enlists all the docume

Form 14950

1. What is a 14950 Form?

The fillable Form 14950 is a small official IRS PDF tax form (full title Premium Tax Credit Verification) that is used for verification of taxpayer eligibility to claim the PTC (Premium Tax Credit). The form enlists all the docume

-

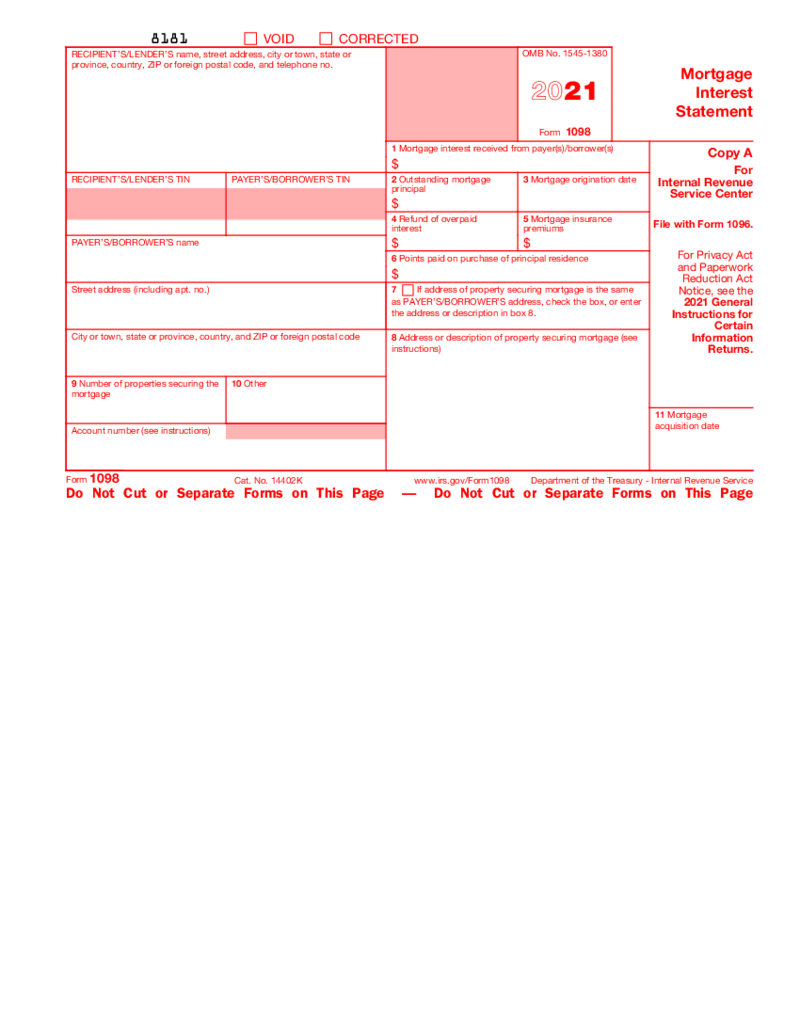

Form 1098 (2021)

1. What is a 1098 2021 Form?

The IRS Form 1098 for 2021 is the Mortgage Interest Statement tax form for 2021. If you are looking for a current version of Form 1098 you can also find it on PDFLiner.&nb

Form 1098 (2021)

1. What is a 1098 2021 Form?

The IRS Form 1098 for 2021 is the Mortgage Interest Statement tax form for 2021. If you are looking for a current version of Form 1098 you can also find it on PDFLiner.&nb

-

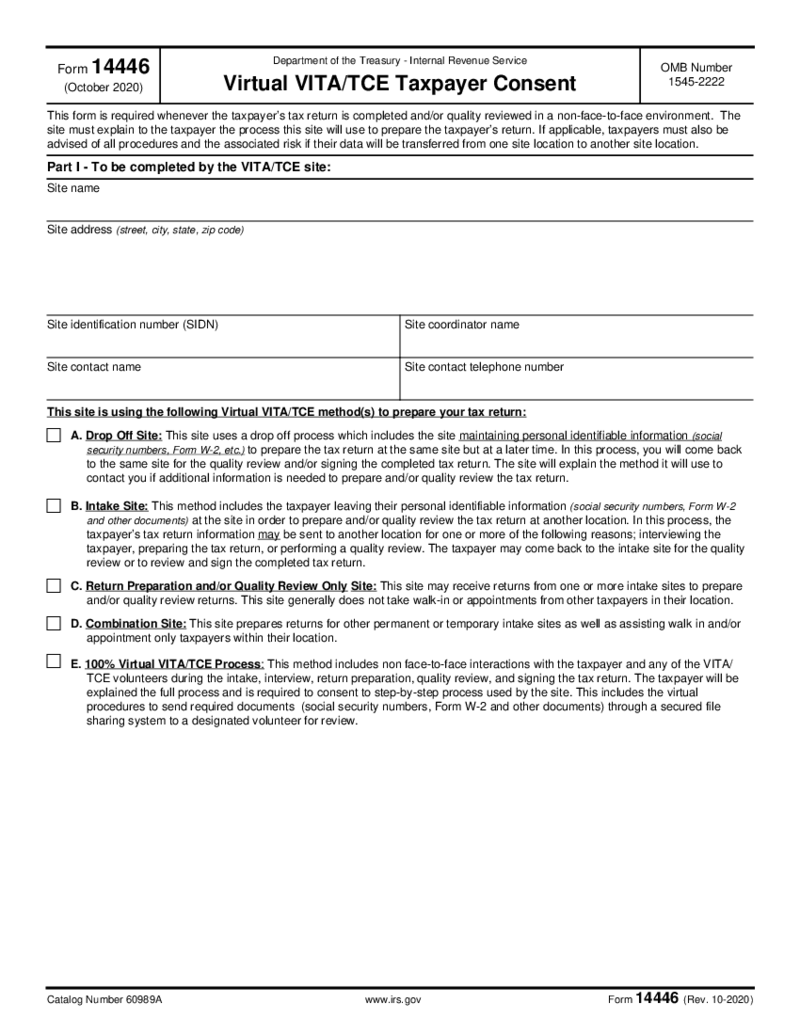

Form 14446

What Is 14446 Form?

Form 14446 is required if a taxpayer applies for free tax calculation assistance from VITA/TCE remotely, via one of the specializing sites. This form is used for getting the taxpayer’s consent to have their data processed di

Form 14446

What Is 14446 Form?

Form 14446 is required if a taxpayer applies for free tax calculation assistance from VITA/TCE remotely, via one of the specializing sites. This form is used for getting the taxpayer’s consent to have their data processed di

-

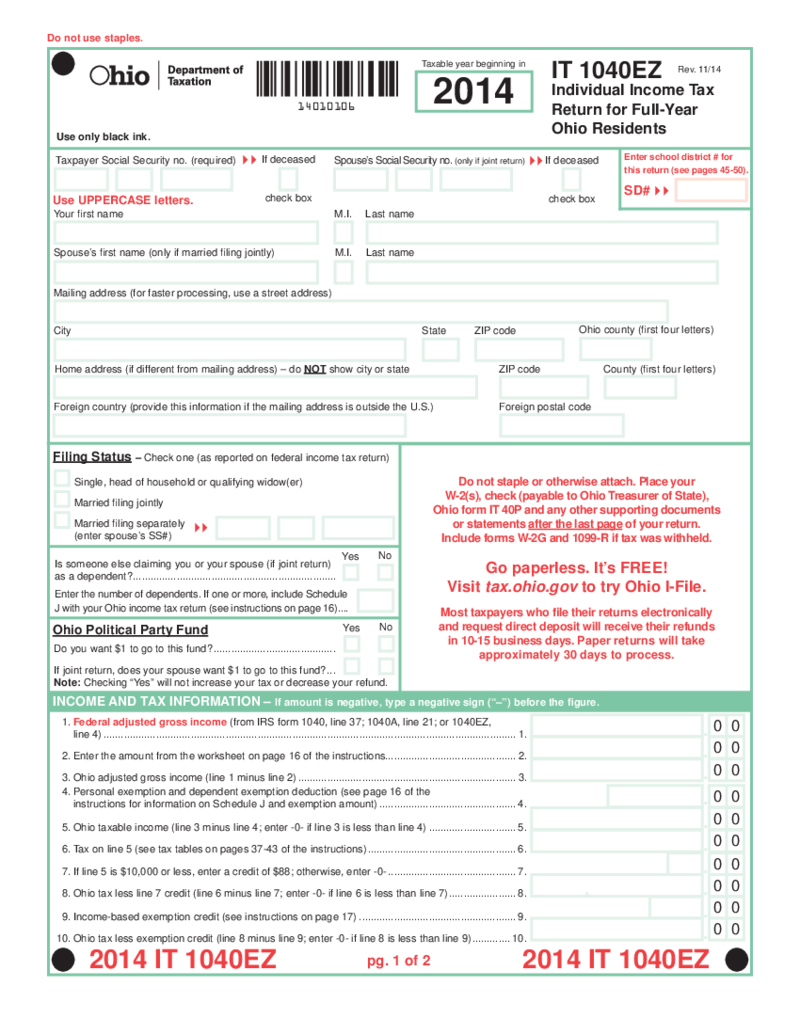

Ohio Form IT 1040EZ

What is the Ohio IT 1040EZ Form

The Ohio IT 1040EZ Form is a simplified version of the Ohio IT 1040 Form. It's designed for taxpayers who meet specific criteria, ensuring that their tax situation is simple enough to use this form. Those who have intri

Ohio Form IT 1040EZ

What is the Ohio IT 1040EZ Form

The Ohio IT 1040EZ Form is a simplified version of the Ohio IT 1040 Form. It's designed for taxpayers who meet specific criteria, ensuring that their tax situation is simple enough to use this form. Those who have intri

-

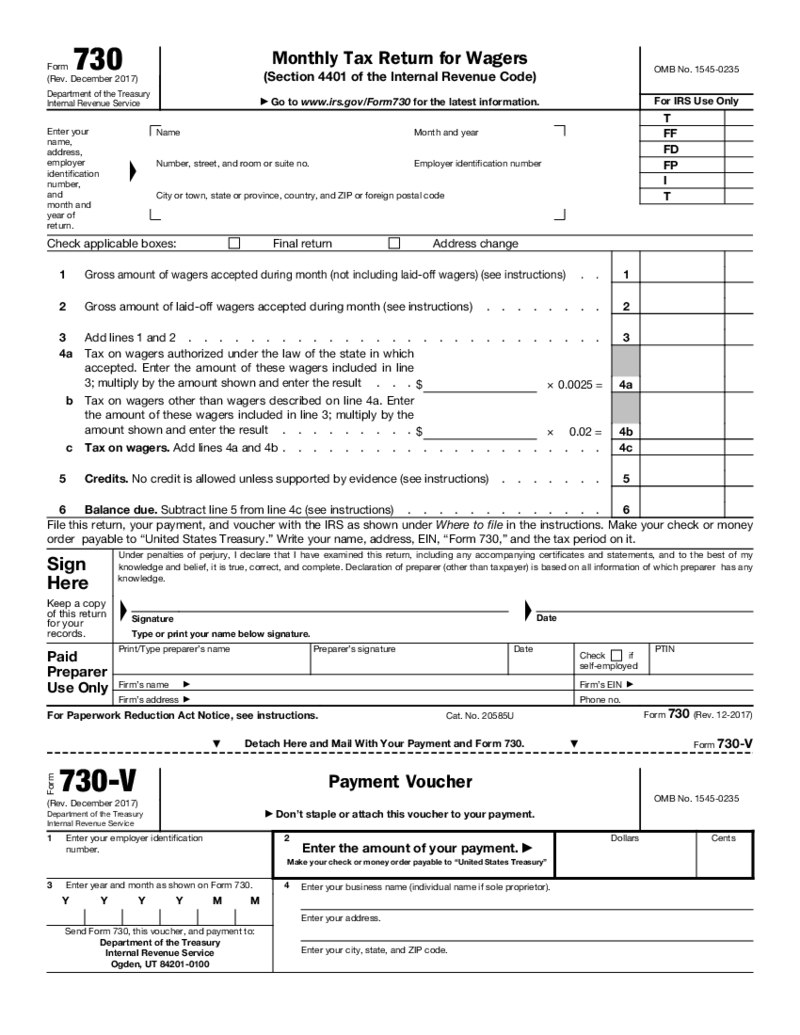

Form 730

What Is Form 730?

Form 730 is the form used for reporting and paying the tax on wagers accepted in the US or placed by an individual who lives in/is a citizen of the US. If you’re in the wagering business (running or participating in profit-based lo

Form 730

What Is Form 730?

Form 730 is the form used for reporting and paying the tax on wagers accepted in the US or placed by an individual who lives in/is a citizen of the US. If you’re in the wagering business (running or participating in profit-based lo

-

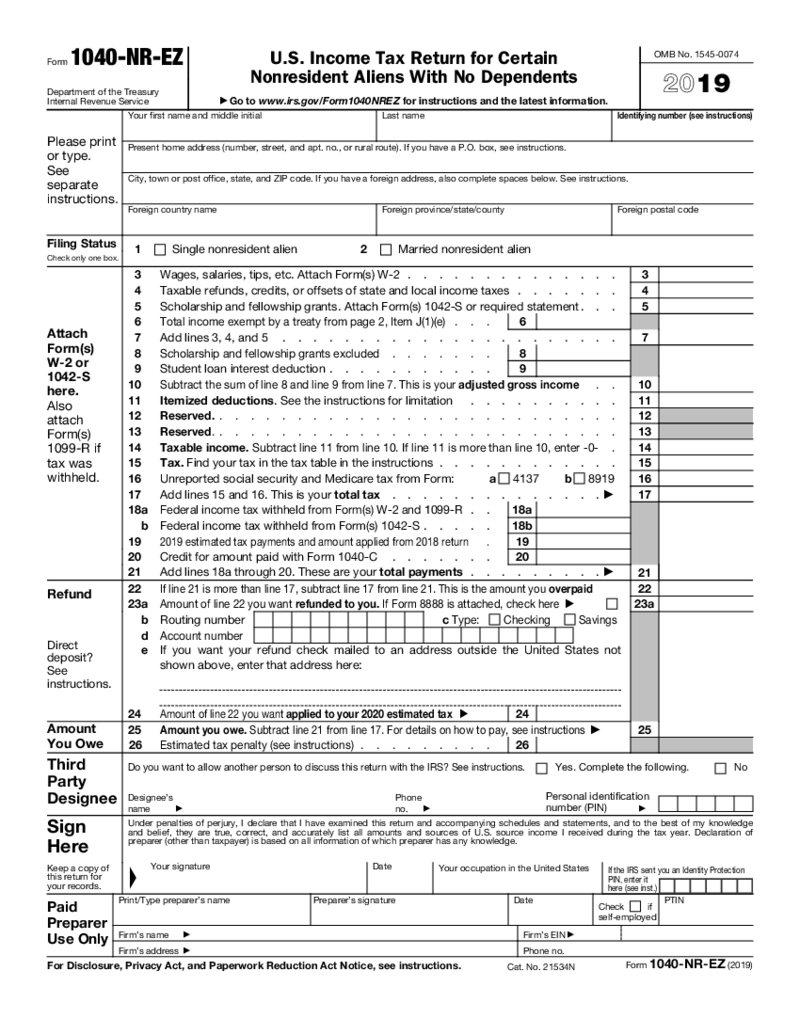

Form 1040-NR-EZ

What is 1040-NR or form 1040NR-EZ: Brief Outline

Wondering about the details of IRS form 1040 NR EZ? It’s a basic variation of the IRS tax return for foreigners (officially known as nonresident aliens). Now, let’s get the ‘alien’ t

Form 1040-NR-EZ

What is 1040-NR or form 1040NR-EZ: Brief Outline

Wondering about the details of IRS form 1040 NR EZ? It’s a basic variation of the IRS tax return for foreigners (officially known as nonresident aliens). Now, let’s get the ‘alien’ t

-

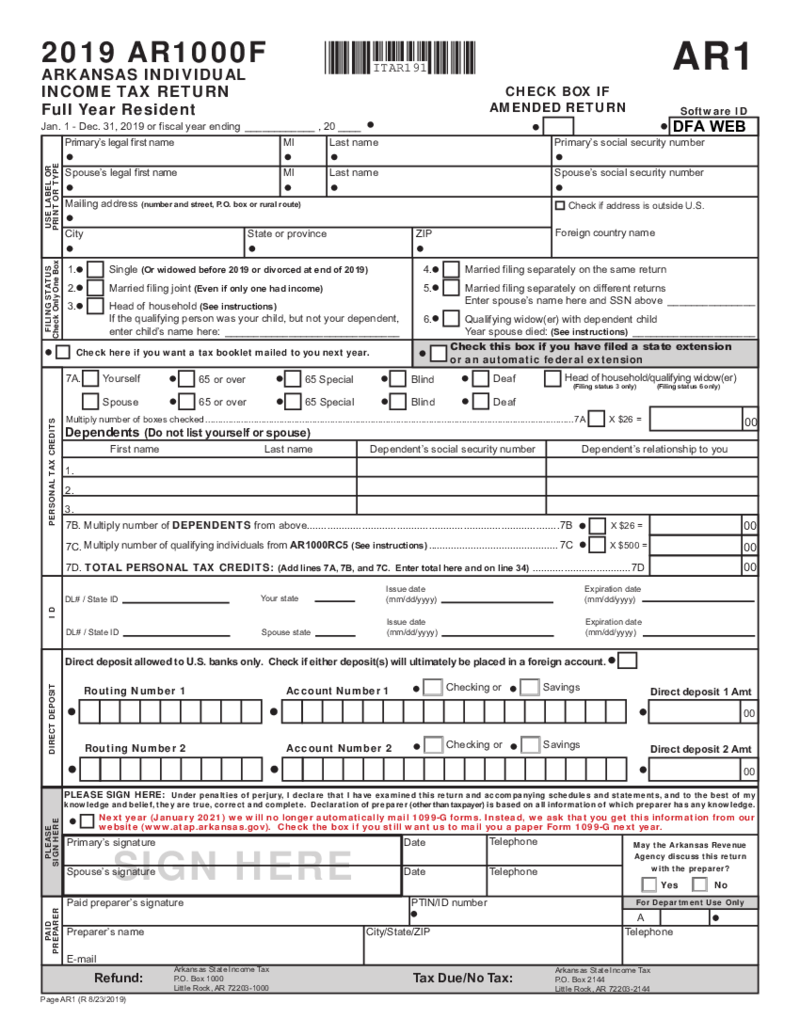

Arkansas Form AR1000F

Understanding the AR1000F Form

The AR1000F form, officially known as the Full Year Resident Individual Income Tax Return, is a key component of fiscal obligations for Arkansas taxpayers. It's a document by which residents report their annual income de

Arkansas Form AR1000F

Understanding the AR1000F Form

The AR1000F form, officially known as the Full Year Resident Individual Income Tax Return, is a key component of fiscal obligations for Arkansas taxpayers. It's a document by which residents report their annual income de

-

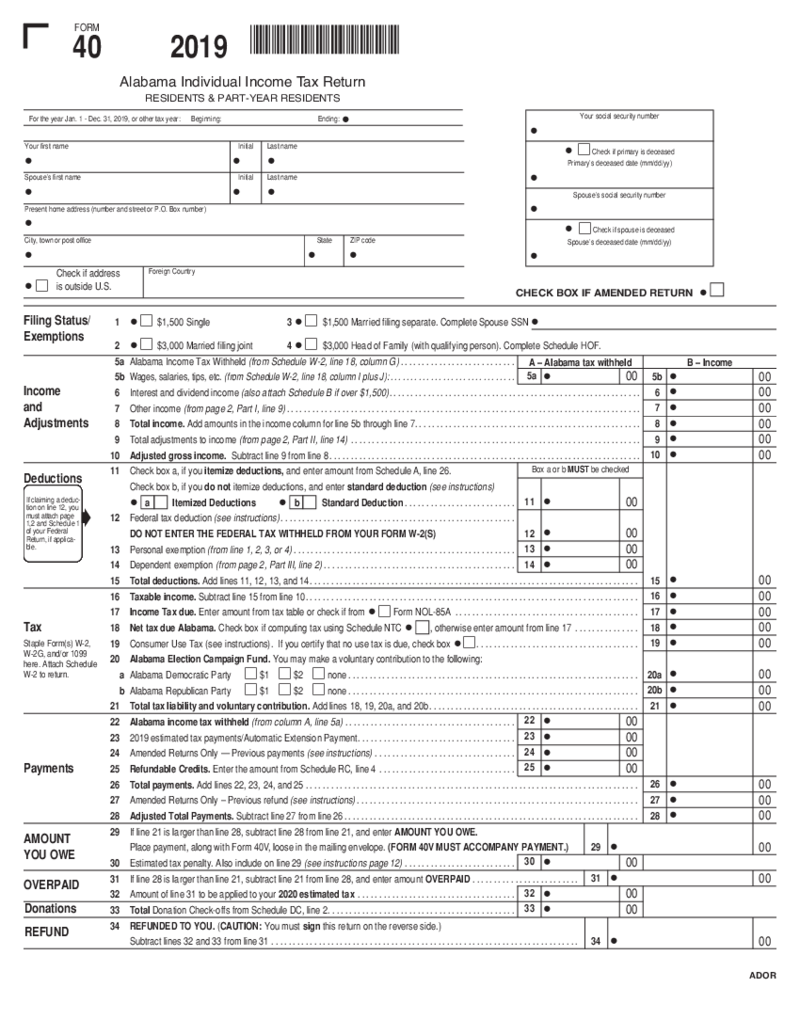

Alabama Form 40 (2019)

What Is Alabama Form 40?

The state of Alabama form 40 is the standard income tax form for Alabama residents. It enables taxpayers to calculate their total income, tax deductions, and any refunds or additional taxes owed to the state. As with federal tax f

Alabama Form 40 (2019)

What Is Alabama Form 40?

The state of Alabama form 40 is the standard income tax form for Alabama residents. It enables taxpayers to calculate their total income, tax deductions, and any refunds or additional taxes owed to the state. As with federal tax f

-

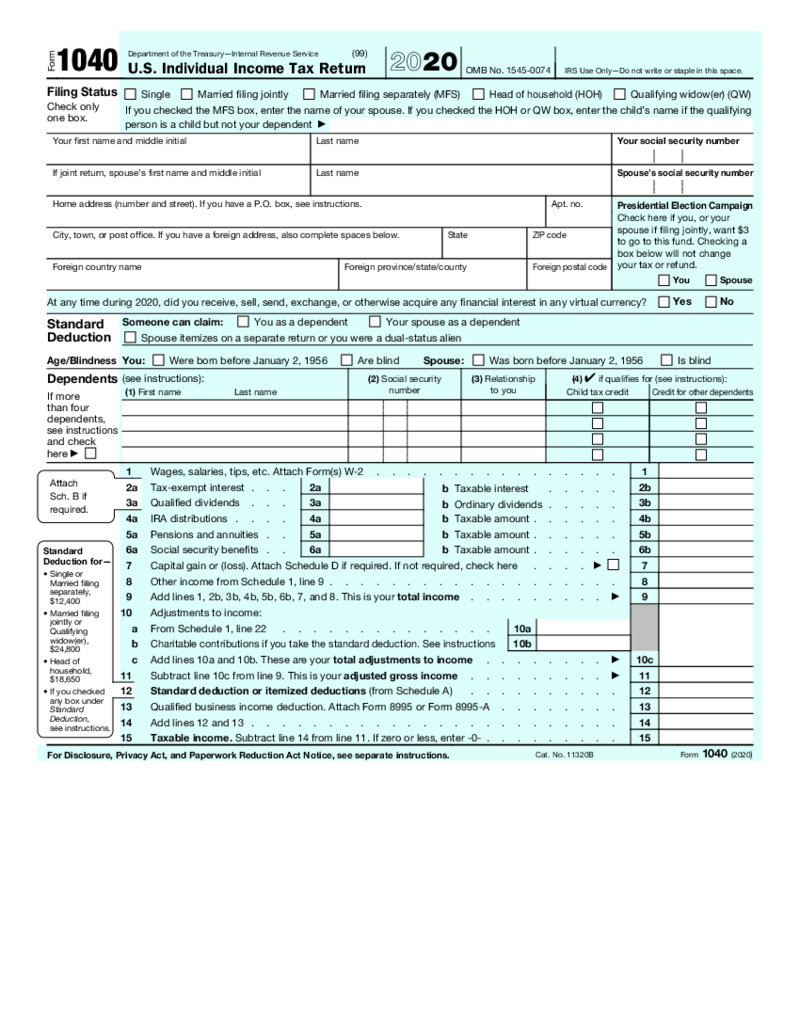

Form 1040 (2020)

Form 1040 (2020)

✓ Easily fill out and sign forms

✓ Download blank or editable online

Form 1040 (2020)

Form 1040 (2020)

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

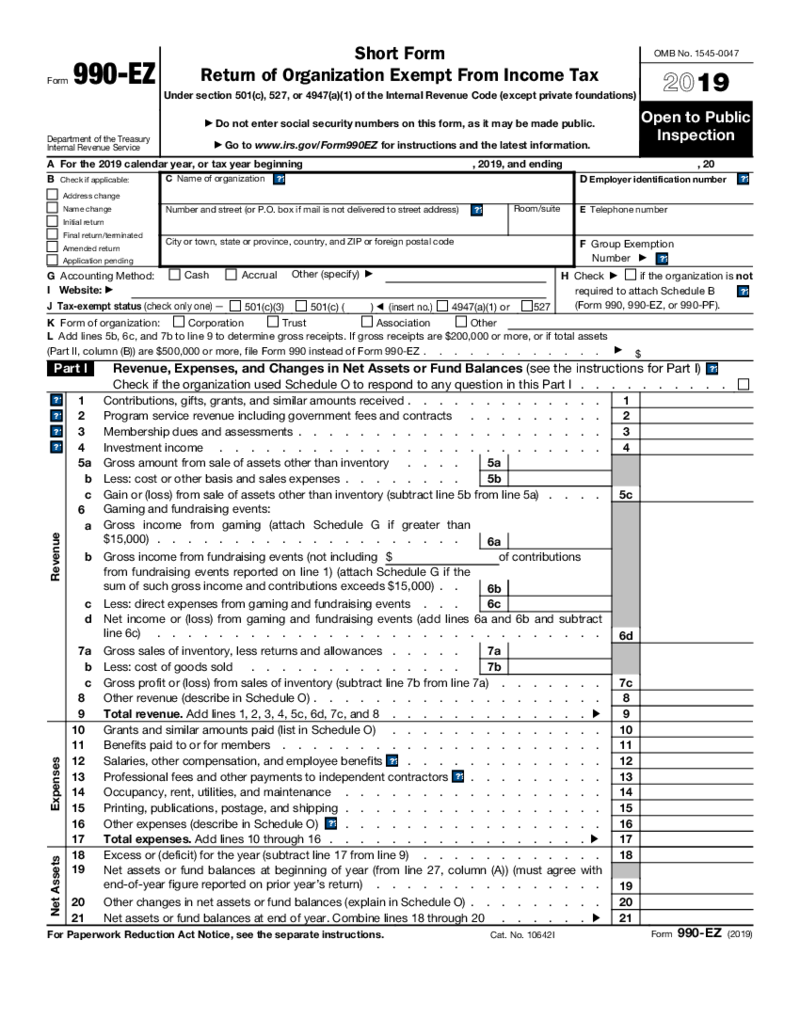

Form 990-EZ (2019)

What is Form 990-EZ 2019?

The 2019 IRS Form 990 EZ is a short form for income tax-exempt organizations. This form is commonly used by eligible organizations to file an annual return with the IRS. Form 990-EZ 2019 is a simplified version of Form 990 and is

Form 990-EZ (2019)

What is Form 990-EZ 2019?

The 2019 IRS Form 990 EZ is a short form for income tax-exempt organizations. This form is commonly used by eligible organizations to file an annual return with the IRS. Form 990-EZ 2019 is a simplified version of Form 990 and is

-

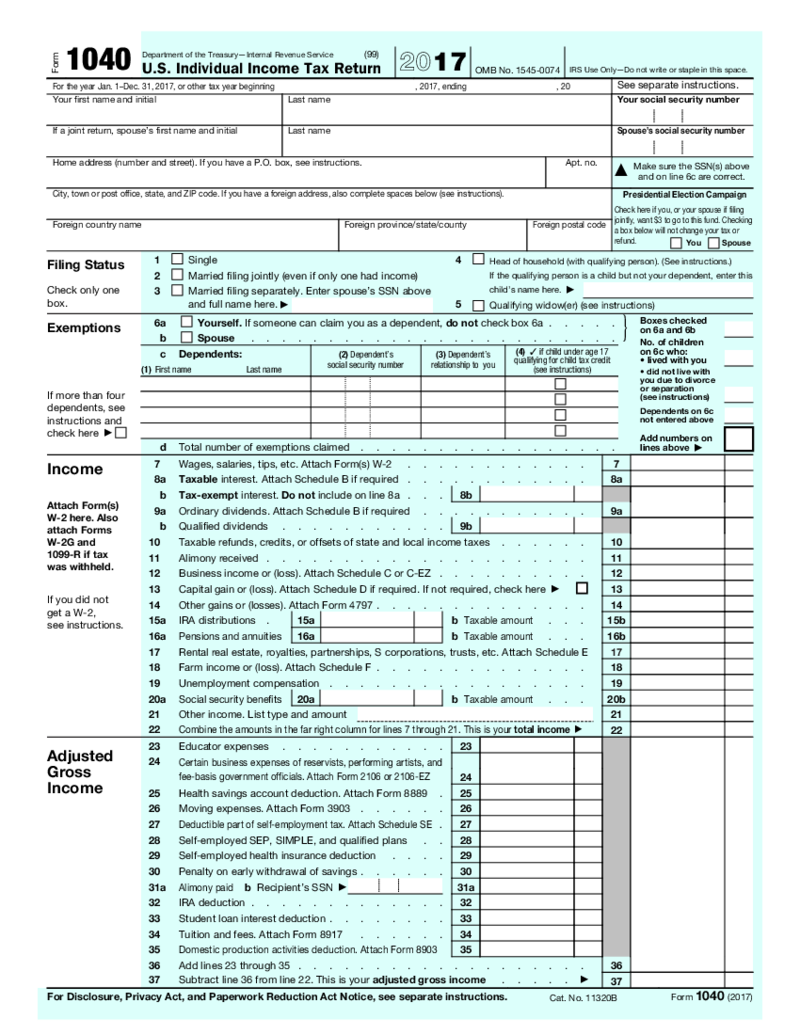

Form 1040 (2017)

What is form 1040?

IRS 1040 form is a necessary document that must be filled by all US citizens to declare their income for the year. Although there is a standard form template, its variations can be changed according to the groups of taxpayers it w

Form 1040 (2017)

What is form 1040?

IRS 1040 form is a necessary document that must be filled by all US citizens to declare their income for the year. Although there is a standard form template, its variations can be changed according to the groups of taxpayers it w

-

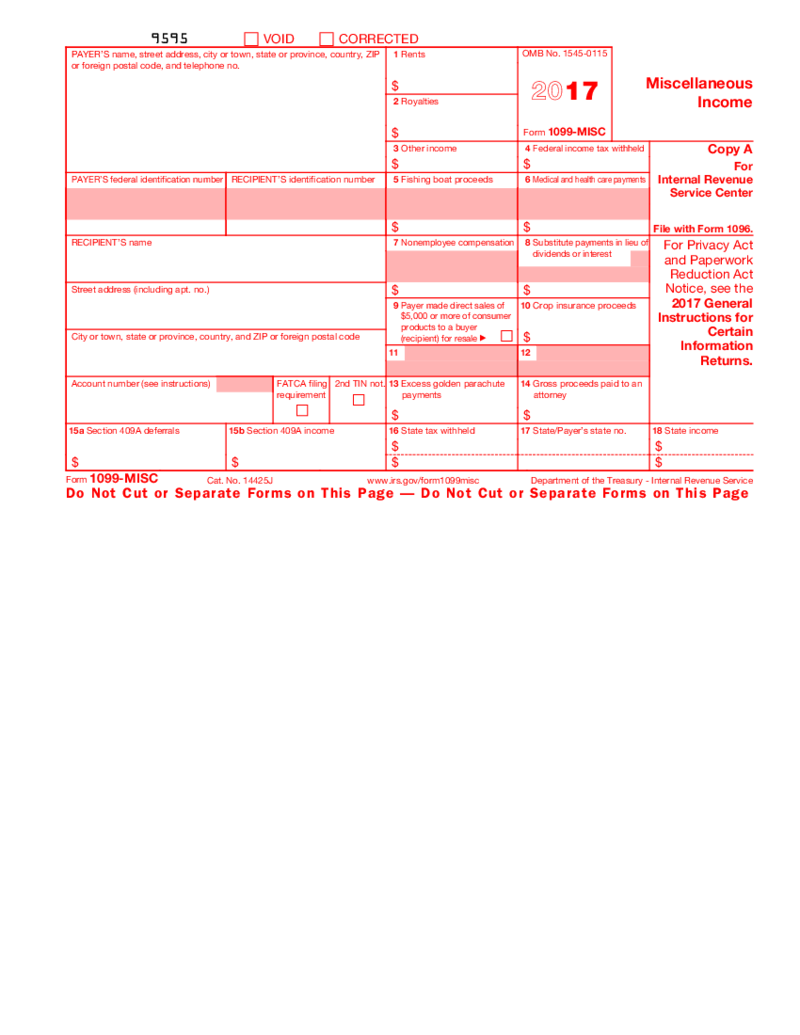

Form 1099-MISC (2017)

What is the 1099-MISC Form?

A 1099-MISC Form is a federal form that is filled by independent contractors to report about the number of received taxable payments from businesses and persons. This form is called to minimize underreporting of self-employed w

Form 1099-MISC (2017)

What is the 1099-MISC Form?

A 1099-MISC Form is a federal form that is filled by independent contractors to report about the number of received taxable payments from businesses and persons. This form is called to minimize underreporting of self-employed w

Search by State

FAQ

-

When will the IRS finalize forms for 2023-2024?

April 18, 2024, is the last day for submitting your returns. Go the extra mile if necessary to file the needed forms in a timely manner if you want to avoid penalties and preserve peace of mind as this upcoming tax year is finalized.

-

How to mail tax forms to the IRS?

You can use your usual email account to send your online IRS tax forms to your assigned IRS employee at their email address. Not feeling comfortable emailing your sensitive files? Send the docs with eFax or via regular mail.

-

Where to find IRS tax forms?

You can find the templates on their official website. As a fine alternative, find the necessary templates on PDFLiner and fill them out online. Our platform offers super handy tools for adjusting any PDF file to suit your most intricate needs.

-

How to request tax forms from the IRS?

In the majority of cases, you won’t have to request those forms. Most of them are available for free on their official site. They’re not as convenient as PDF templates offered here, though. Simply because our templates are fully fillable and modifiable in the digital format. That’s what we call convenience.

-

How to check if the IRS received tax forms?

There are several methods of doing it. First, you can utilize their application called Where’s My Refund. Second, you can check your IRS account details. Third, you can call them by phone. Ultimately, you can check out updates within the e-filing service of your choice. Simple as that.