-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

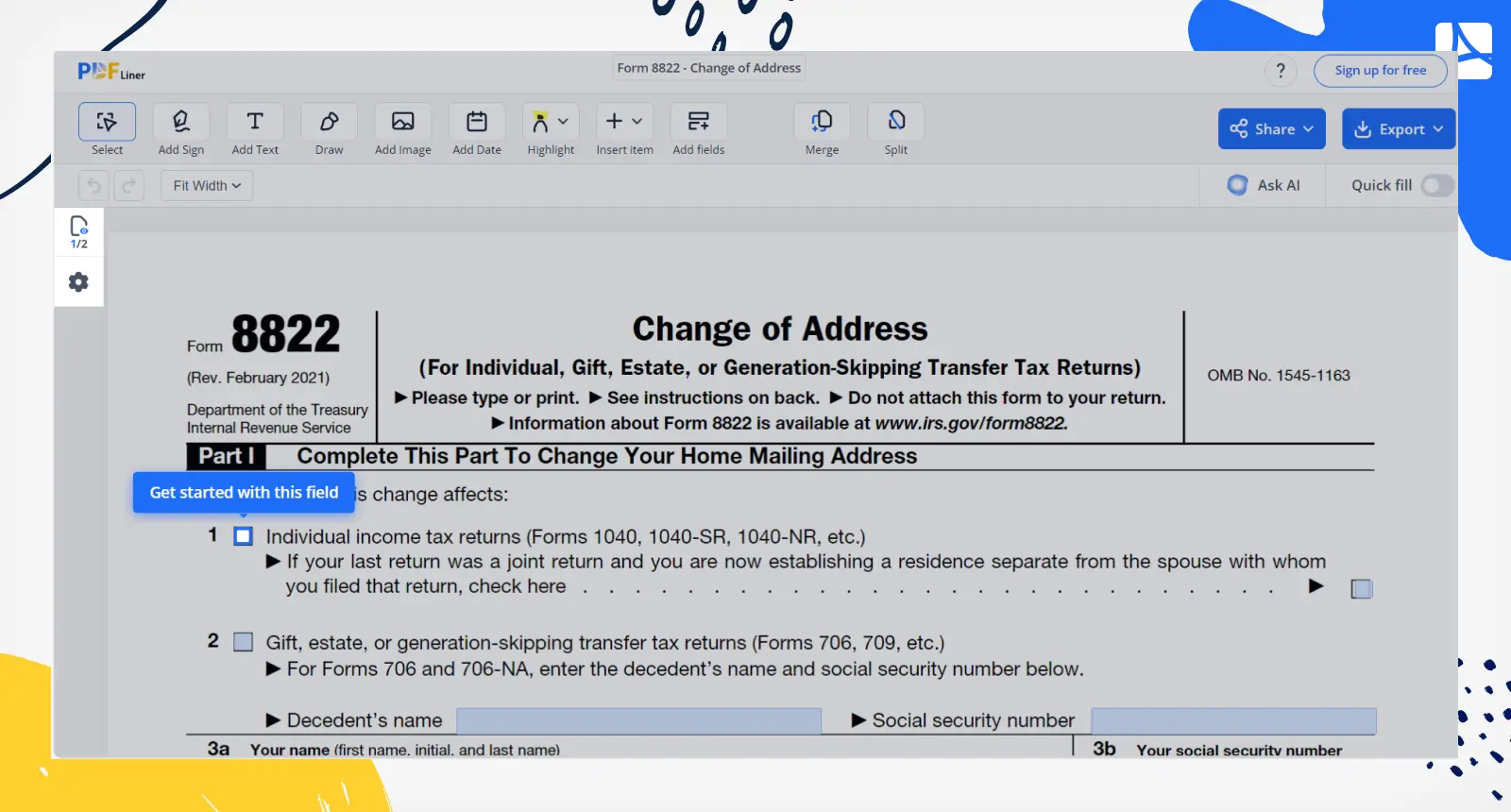

Form 8822 - Change of Address

Get your Form 8822 - Change of Address in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is IRS Form 8822?

Also called Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns), Form 8822 is a document for updating your address with the IRS. It's used when you move or have new contact info and need to notify the authorities to make sure they send your tax-related correspondences to the correct place. In PDFLiner's library of free pre-designed blanks, you can find a fillable template of any document, including the IRS Form 8822 Change of Address.

The Importance of Filing Form IRS 8822

If you want to maintain accurate communication with the IRS, using the Change of Address IRS Form 8822 is paramount. Below, we've narrowed down the reasons why filing this document is vital:

- Correct Communication. It guarantees that the IRS sends important tax-related mail to your updated address.

- Compliance. It assists you in staying compliant by receiving essential tax notices promptly.

- Avoiding Hassles. It prevents delays or issues with tax matters due to outdated contact information.

- Smooth Transactions. It contributes to smooth interactions with the authorities, as well as prevents misunderstandings or missed communications.

Now that you’ve embraced the importance of this document, let’s switch to our expert Form 8822 instructions.

How to Fill Out Form 8822 IRS

First and foremost, sign up to PDFLiner, log in, and find the IRS 8822 Form Change Address in our extensive catalog of pre-designed document templates. After that, follow these 8 vital steps to cope with the completion task:

- Type your name, old address, and new address.

- Add your SSN or individual taxpayer identification number (ITIN).

- Check the box that matches your status.

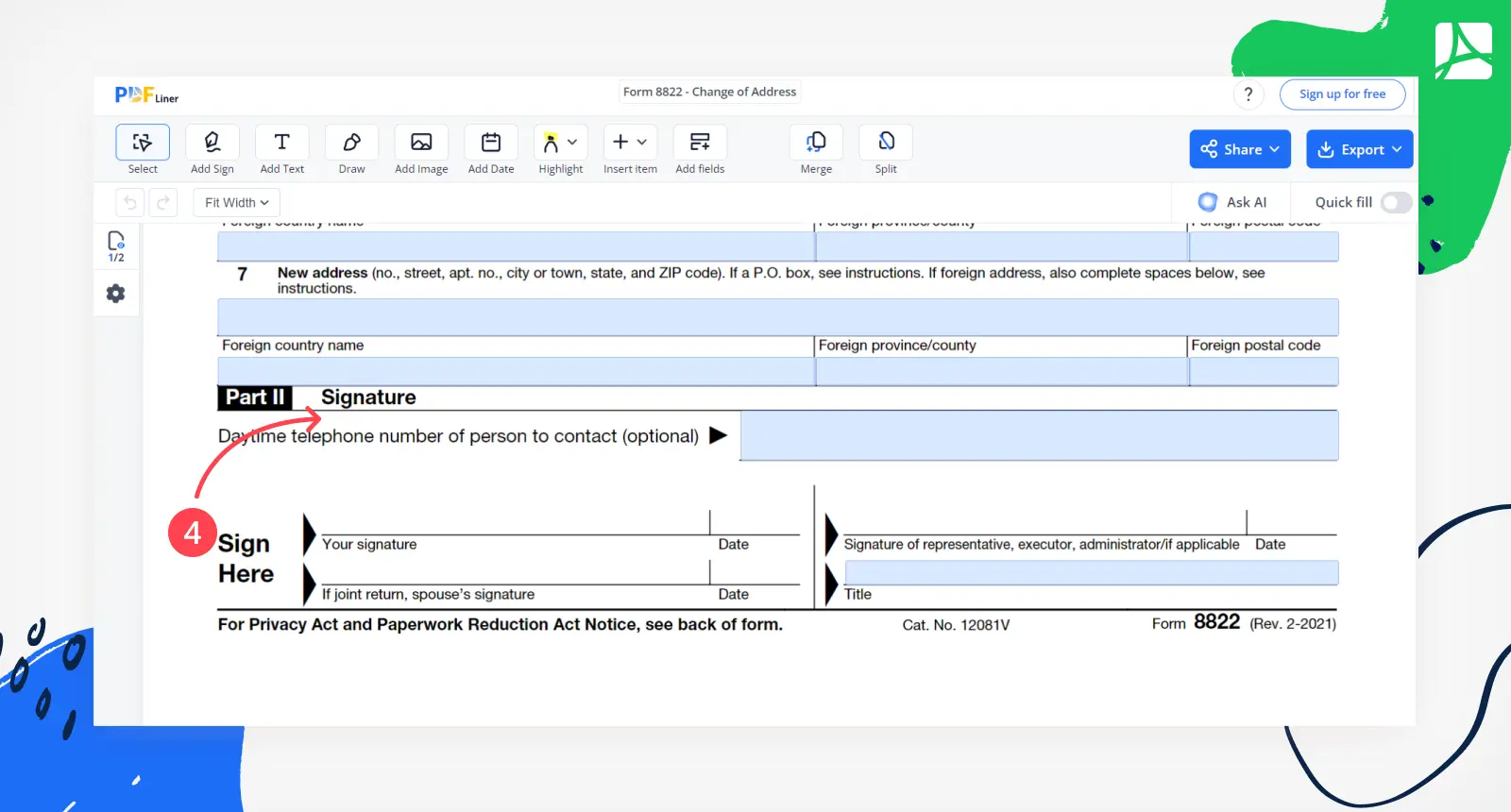

- Position your digital signature and date on the IRS 8822 Form online:

- Include details if someone else needs their contact info updated too.

- If needed, provide information about the estate or trust.

- Attach documents if there's a name change.

- Double-check the document to make sure you haven't made any mistakes.

Last but not least, save time and hassle by using PDFLiner for swift and accurate 8822 Form Change Address completion and submission. PDFLiner is a reliable platform that significantly speeds up the form-filling process, making it convenient and time-saving for updating your contact info with the authorities.

Where Do You Mail Form 8822?

When you're ready to mail Form 8822 Change Address, check the IRS instructions on the document for the correct mailing address (you can find the address list on page two of the template). Depending on your state, use the address provided in the form's instructions. Go the extra mile to send the completed file promptly to the right IRS location according to the instructions. Consider using a mailing service that offers confirmation for receipt.

Fillable online Form 8822 - Change of Address