-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IRS Tax Forms - page 3

-

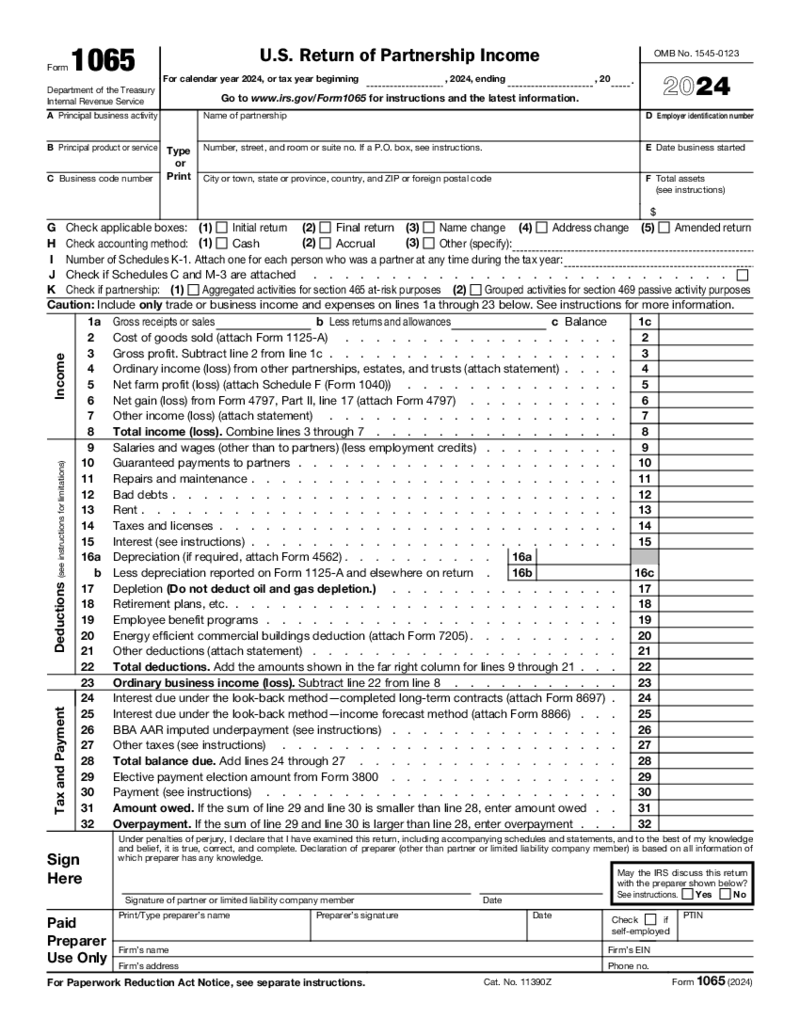

IRS 1065 Form (2024)

What Is IRS 1065 2024?

IRS Form 1065 PDF is an official form required by taxpayers who formed a partnership with each other. IRS 1065 is also known as the US Return of Partnership Income. It must be filled fo

IRS 1065 Form (2024)

What Is IRS 1065 2024?

IRS Form 1065 PDF is an official form required by taxpayers who formed a partnership with each other. IRS 1065 is also known as the US Return of Partnership Income. It must be filled fo

-

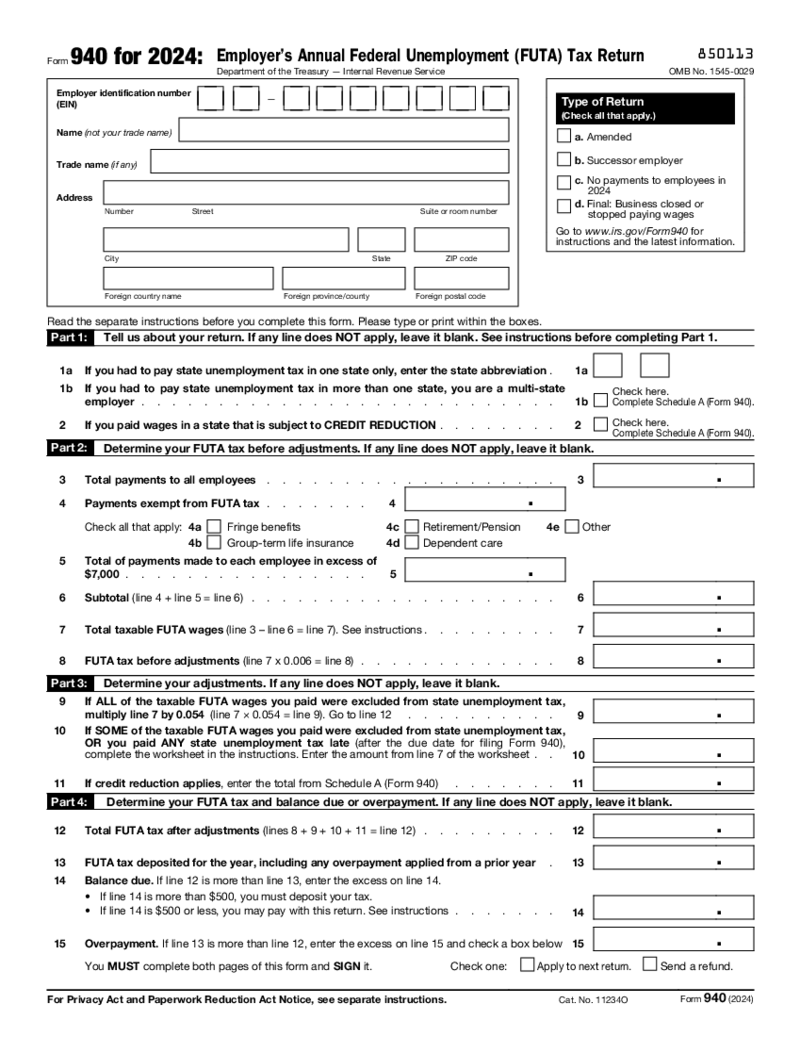

Form 940

What Is IRS 940 Form 2024?

IRS 940 Form is a federal non-fillable form by the Internal Revenue Service of the US. It is designed to provide comprehensive information about the IRS 940 fillable form. It allows you to get acquainted with the process of fili

Form 940

What Is IRS 940 Form 2024?

IRS 940 Form is a federal non-fillable form by the Internal Revenue Service of the US. It is designed to provide comprehensive information about the IRS 940 fillable form. It allows you to get acquainted with the process of fili

-

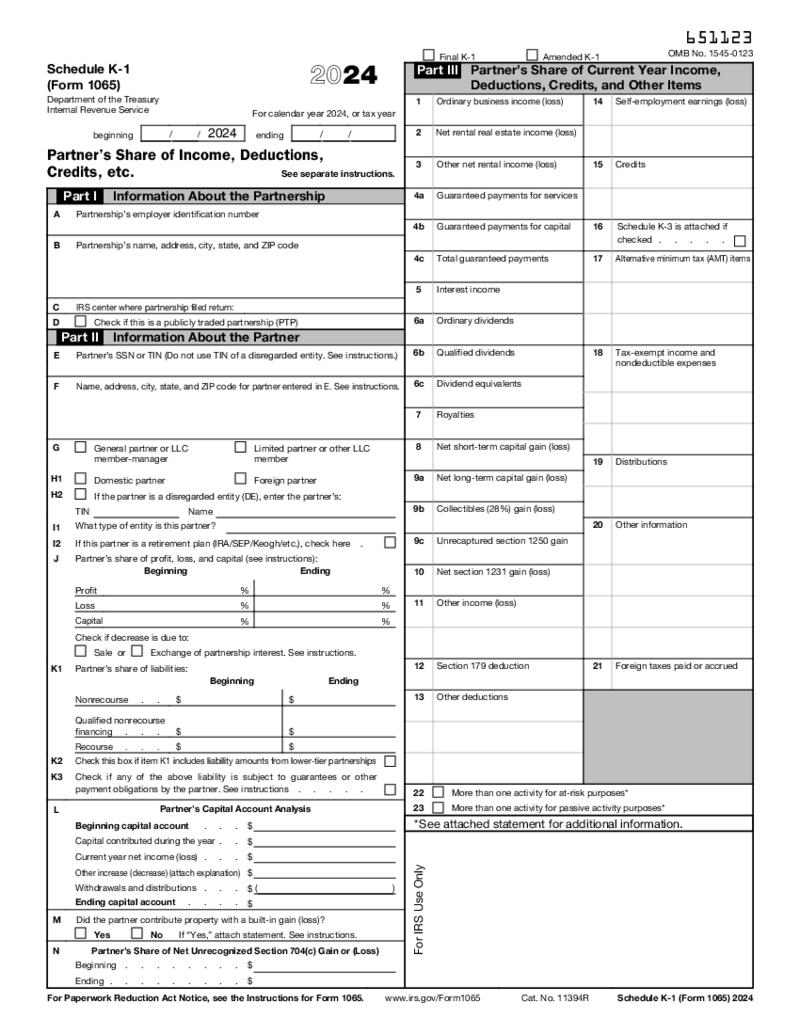

Schedule K-1 Form 1065 (2024)

What Is IRS Schedule K-1 (Form 1065) 2024

Schedule K-1 Tax Form 1065 is an IRS tax form issued annually for the purpose of documenting the revenue, profits, losses, and credits of each partner within a business entity, as well as other IRS-focused financi

Schedule K-1 Form 1065 (2024)

What Is IRS Schedule K-1 (Form 1065) 2024

Schedule K-1 Tax Form 1065 is an IRS tax form issued annually for the purpose of documenting the revenue, profits, losses, and credits of each partner within a business entity, as well as other IRS-focused financi

-

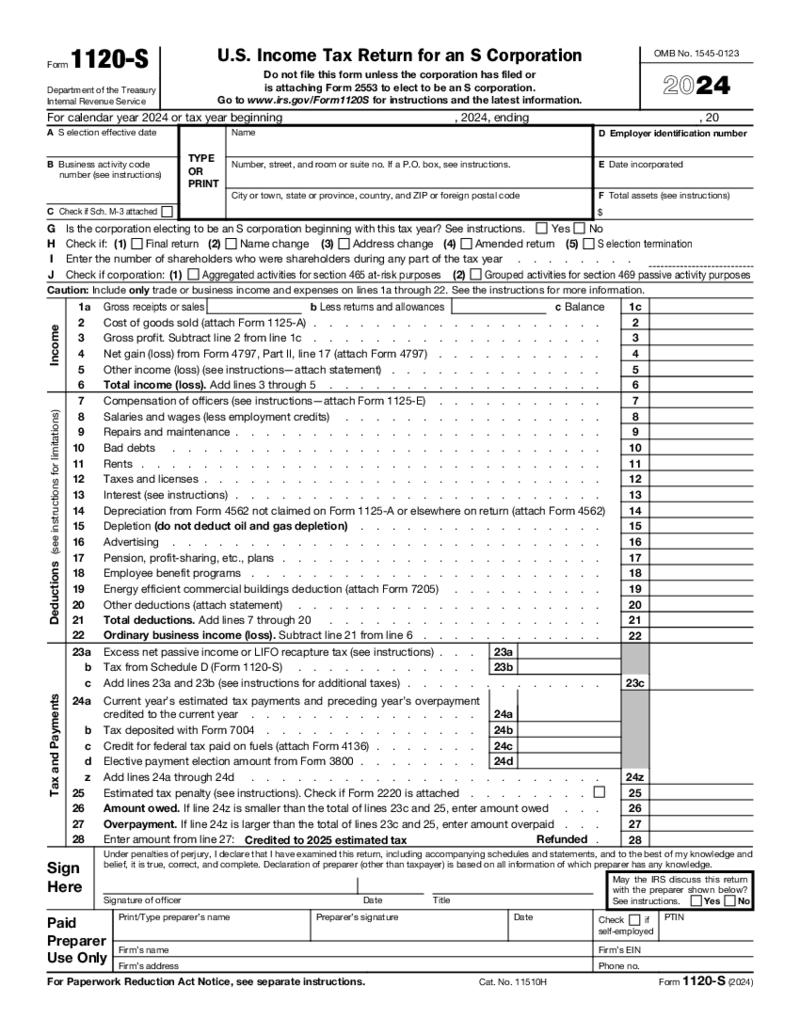

Form 1120-S (2024)

What is IRS Form 1120S?

IRS 1120S is the form created by the Internal Revenue Service for S corporations as an income tax return yearly report. S corporations are business structures that were made the way their owners can avoid double taxation. Each shar

Form 1120-S (2024)

What is IRS Form 1120S?

IRS 1120S is the form created by the Internal Revenue Service for S corporations as an income tax return yearly report. S corporations are business structures that were made the way their owners can avoid double taxation. Each shar

-

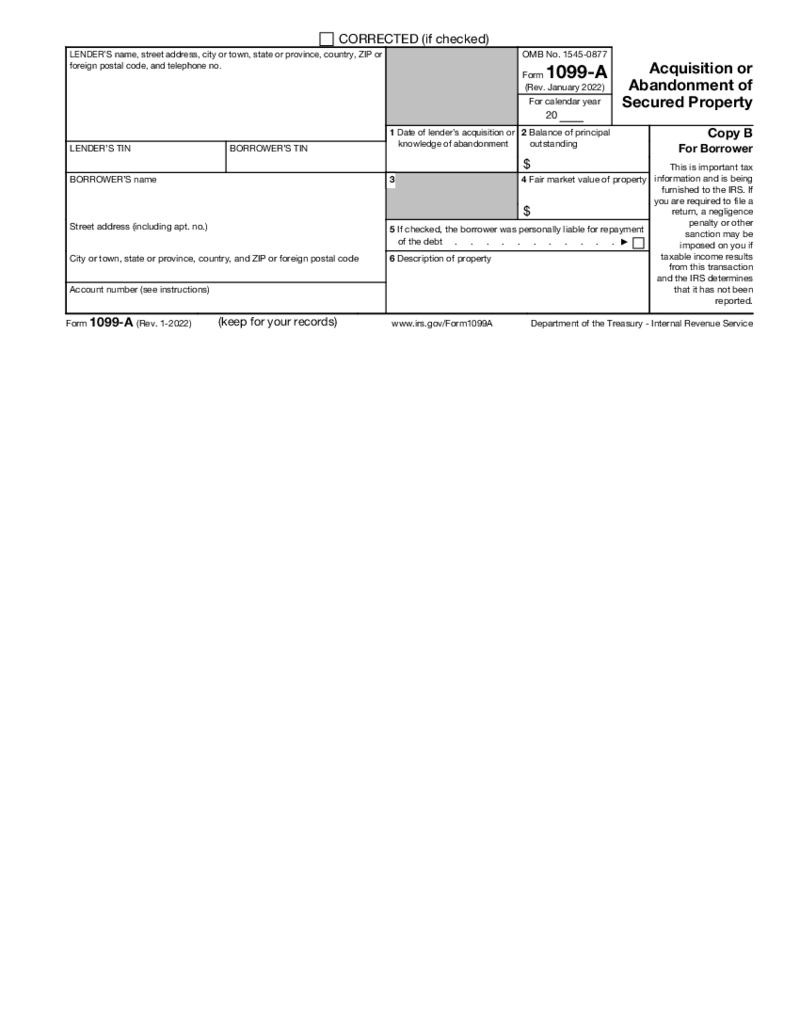

Form 1099-A (2022)

What Is Form 1099-A?

Form 1099-A is the acquisition or abandonment of secured property definition, which is needed to inform about various transactions not related to wages. Form 1099-A is commonly applied when an estate has been transferred because of fo

Form 1099-A (2022)

What Is Form 1099-A?

Form 1099-A is the acquisition or abandonment of secured property definition, which is needed to inform about various transactions not related to wages. Form 1099-A is commonly applied when an estate has been transferred because of fo

-

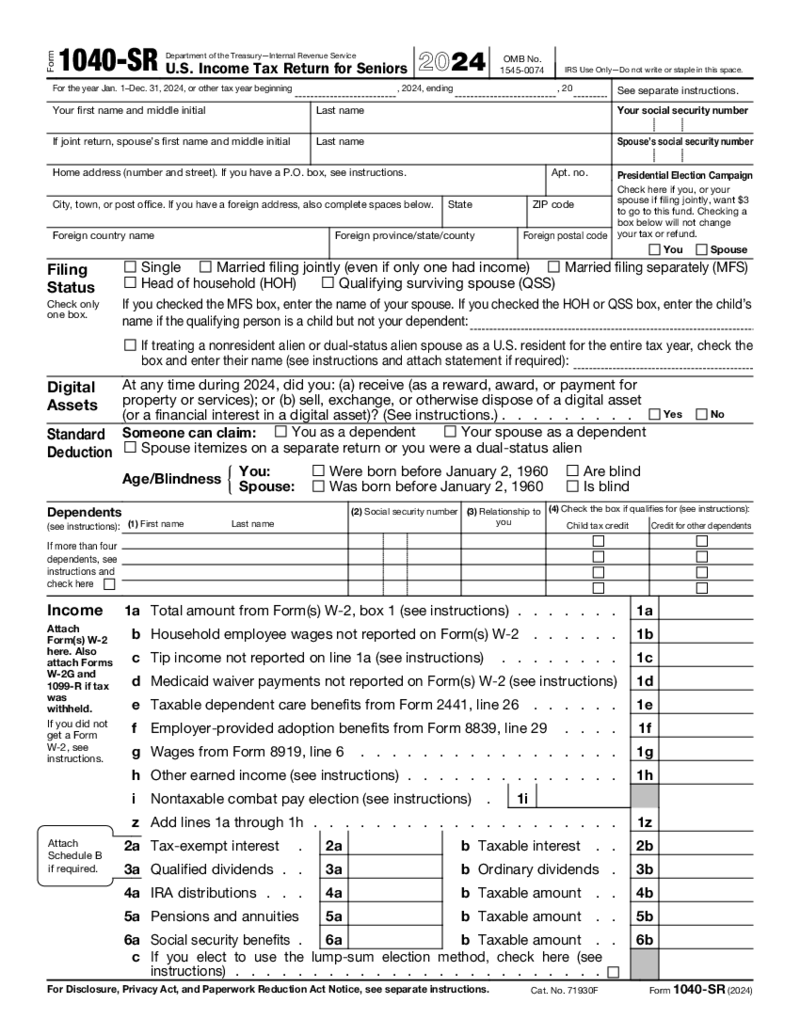

Form 1040-SR (2024)

What Is the 1040-SR form 2023 - 2024

This document is used for the adults (65 years old or higher) to file their taxes through the IRS system to report other sources of income. One can download the 1040-SR blank PDF form for free from the PDFLiner and pri

Form 1040-SR (2024)

What Is the 1040-SR form 2023 - 2024

This document is used for the adults (65 years old or higher) to file their taxes through the IRS system to report other sources of income. One can download the 1040-SR blank PDF form for free from the PDFLiner and pri

-

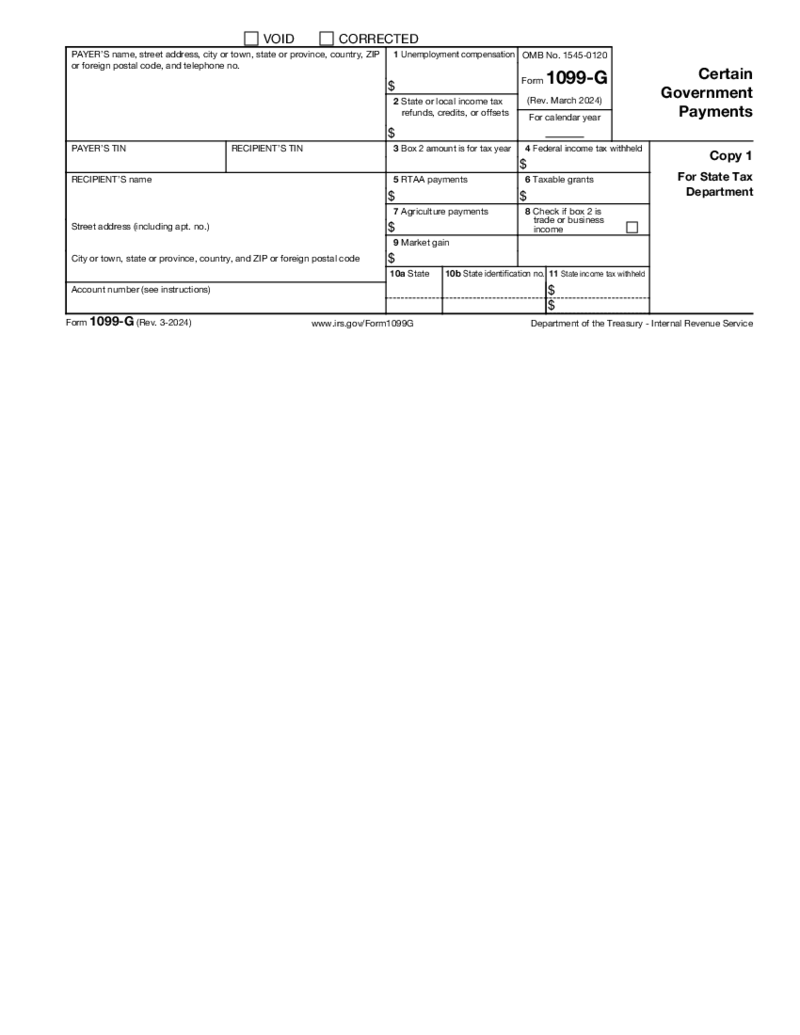

Form 1099-G (2025)

What Is a 1099 G Form (2025)?

If you are looking for what is a 1099-G form, you might need it for unemployment compensation. Yet, this form is used for certain government payments. It includes tax refunds, offsets, credits, unemployment compensation, and

Form 1099-G (2025)

What Is a 1099 G Form (2025)?

If you are looking for what is a 1099-G form, you might need it for unemployment compensation. Yet, this form is used for certain government payments. It includes tax refunds, offsets, credits, unemployment compensation, and

-

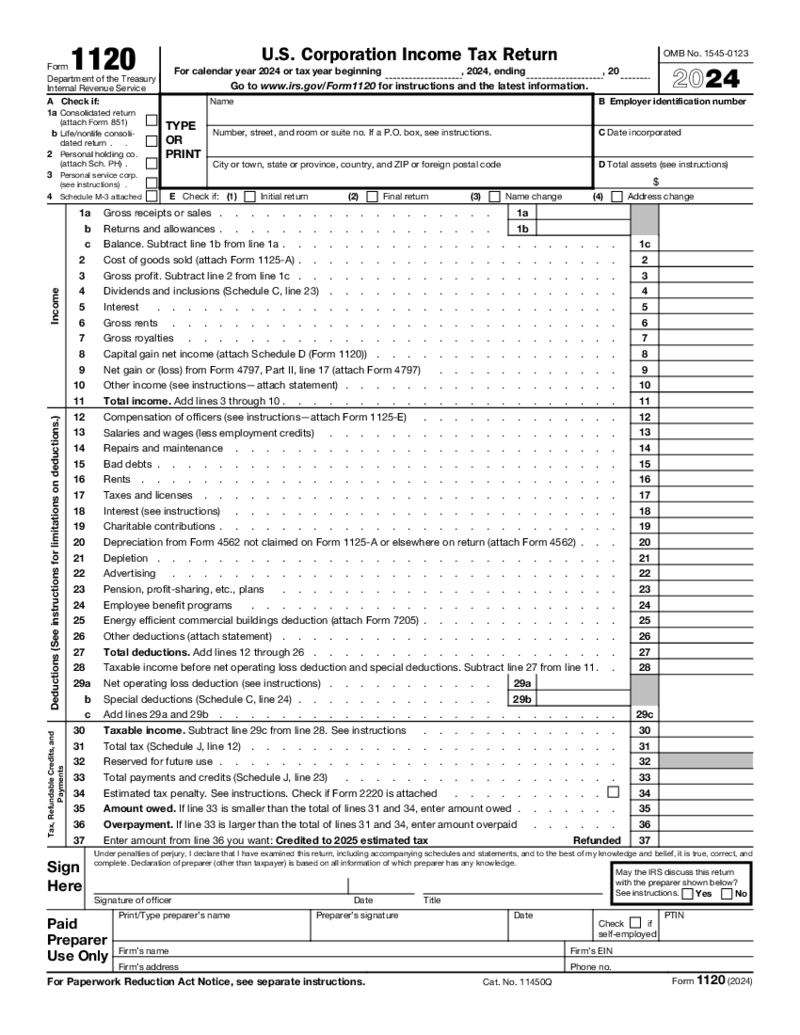

Form 1120 (2024)

What is Fillable Form 1120 - Corporation Income Tax Return?

Fillable Form 1120 2024 - Corporation Income Tax Return is a form that helps US domestic corporations to fill out their income and losses. The 1120 tax form is issued by the IRS and should b

Form 1120 (2024)

What is Fillable Form 1120 - Corporation Income Tax Return?

Fillable Form 1120 2024 - Corporation Income Tax Return is a form that helps US domestic corporations to fill out their income and losses. The 1120 tax form is issued by the IRS and should b

-

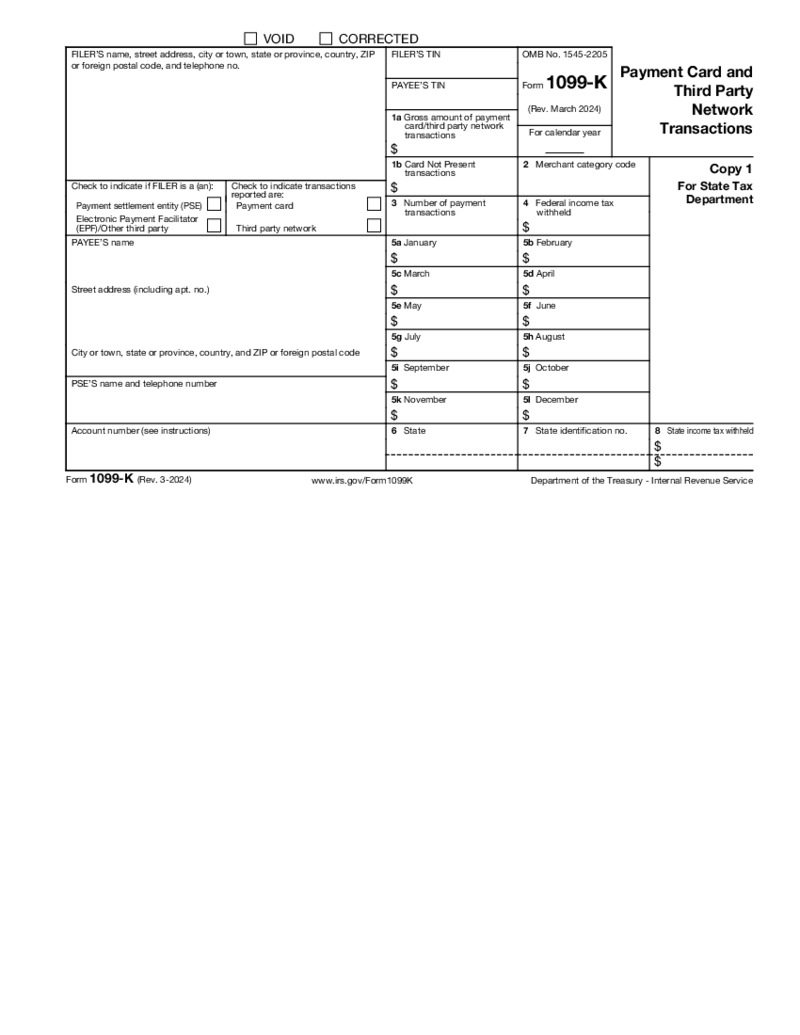

Form 1099-K (2024)

What Is Form 1099-K (2024)?

The IRS Form 1099-K is also known as Payment Card and Third Party Network Transactions. The form has to be completed with the tax return from the private person. What is a 1099-K form? This is the information on the payment tra

Form 1099-K (2024)

What Is Form 1099-K (2024)?

The IRS Form 1099-K is also known as Payment Card and Third Party Network Transactions. The form has to be completed with the tax return from the private person. What is a 1099-K form? This is the information on the payment tra

-

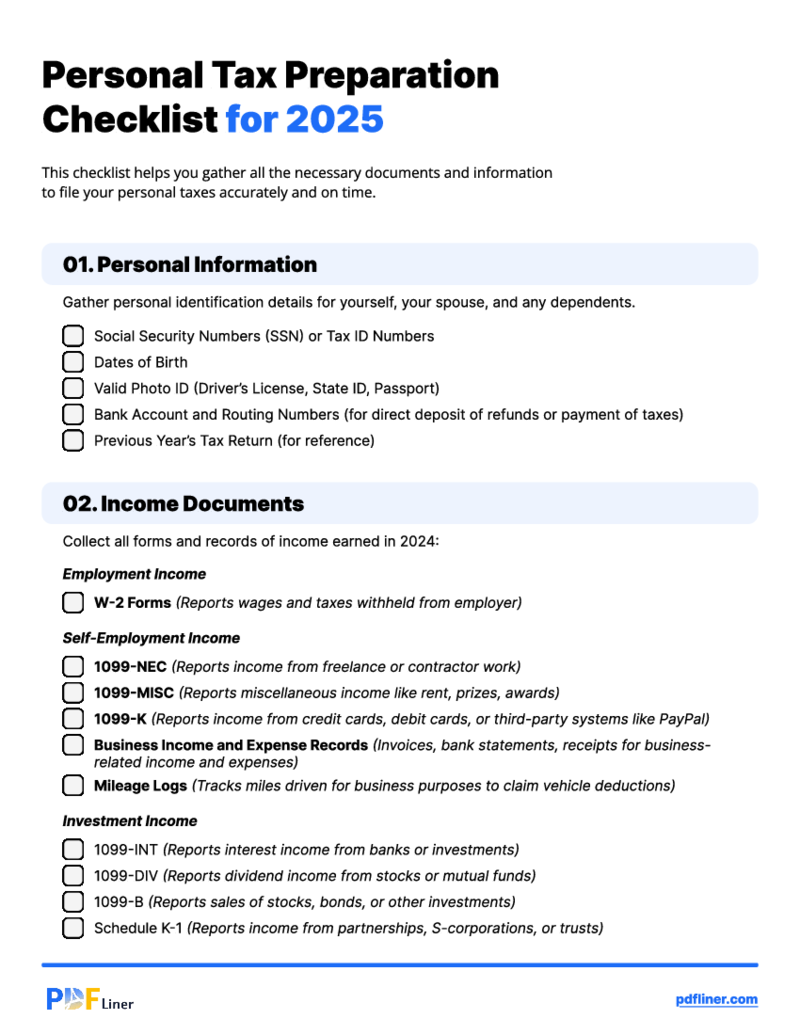

Tax Prep Checklist

What Is a Tax Prep Checklist?

It’s a template that grants you the possibility to prepare all the necessary files and data for sorting out your tax return. Aside from personal data, the files have details related to your income, tax deductions, and o

Tax Prep Checklist

What Is a Tax Prep Checklist?

It’s a template that grants you the possibility to prepare all the necessary files and data for sorting out your tax return. Aside from personal data, the files have details related to your income, tax deductions, and o

-

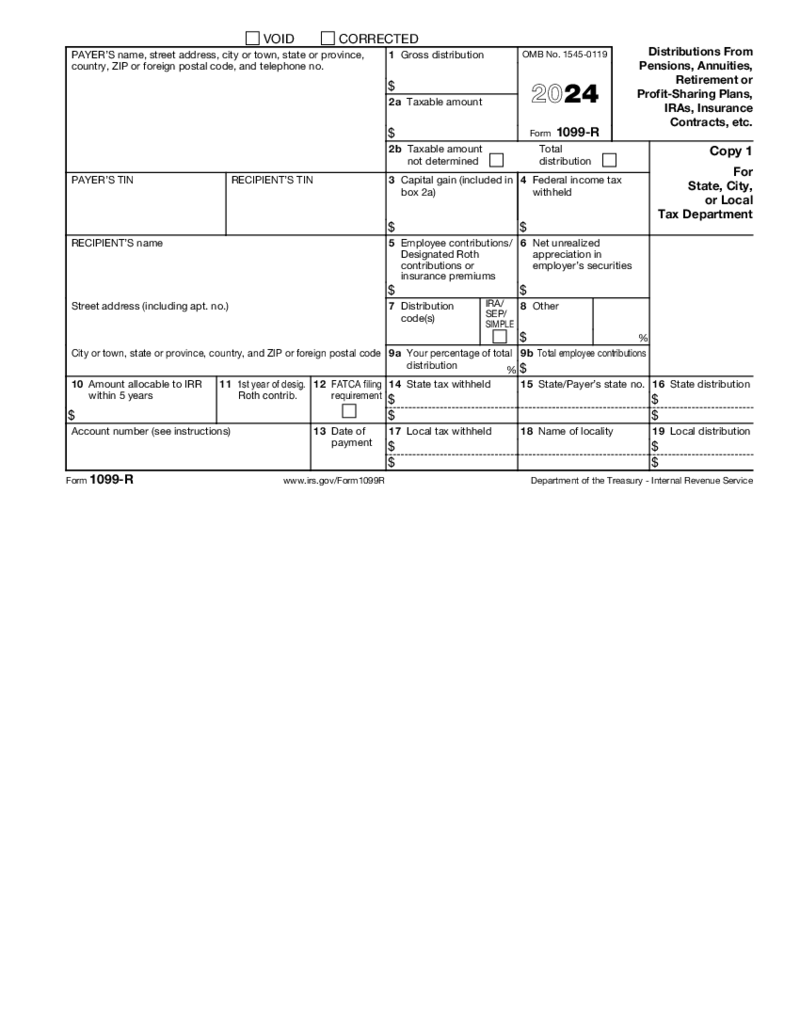

Form 1099-R (2024)

What Is Form 1099-R 2026?

Form 1099-R is used to report the distributions a person gets from pensions, annuities, etc. You should fill out this form if the amount of designated distribution is more than $10. The 1099-R form is filed with other fillable IR

Form 1099-R (2024)

What Is Form 1099-R 2026?

Form 1099-R is used to report the distributions a person gets from pensions, annuities, etc. You should fill out this form if the amount of designated distribution is more than $10. The 1099-R form is filed with other fillable IR

Search by State

FAQ

-

When will the IRS finalize forms for 2023-2024?

April 18, 2024, is the last day for submitting your returns. Go the extra mile if necessary to file the needed forms in a timely manner if you want to avoid penalties and preserve peace of mind as this upcoming tax year is finalized.

-

How to mail tax forms to the IRS?

You can use your usual email account to send your online IRS tax forms to your assigned IRS employee at their email address. Not feeling comfortable emailing your sensitive files? Send the docs with eFax or via regular mail.

-

Where to find IRS tax forms?

You can find the templates on their official website. As a fine alternative, find the necessary templates on PDFLiner and fill them out online. Our platform offers super handy tools for adjusting any PDF file to suit your most intricate needs.

-

How to request tax forms from the IRS?

In the majority of cases, you won’t have to request those forms. Most of them are available for free on their official site. They’re not as convenient as PDF templates offered here, though. Simply because our templates are fully fillable and modifiable in the digital format. That’s what we call convenience.

-

How to check if the IRS received tax forms?

There are several methods of doing it. First, you can utilize their application called Where’s My Refund. Second, you can check your IRS account details. Third, you can call them by phone. Ultimately, you can check out updates within the e-filing service of your choice. Simple as that.