-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Arizona Tax Forms

-

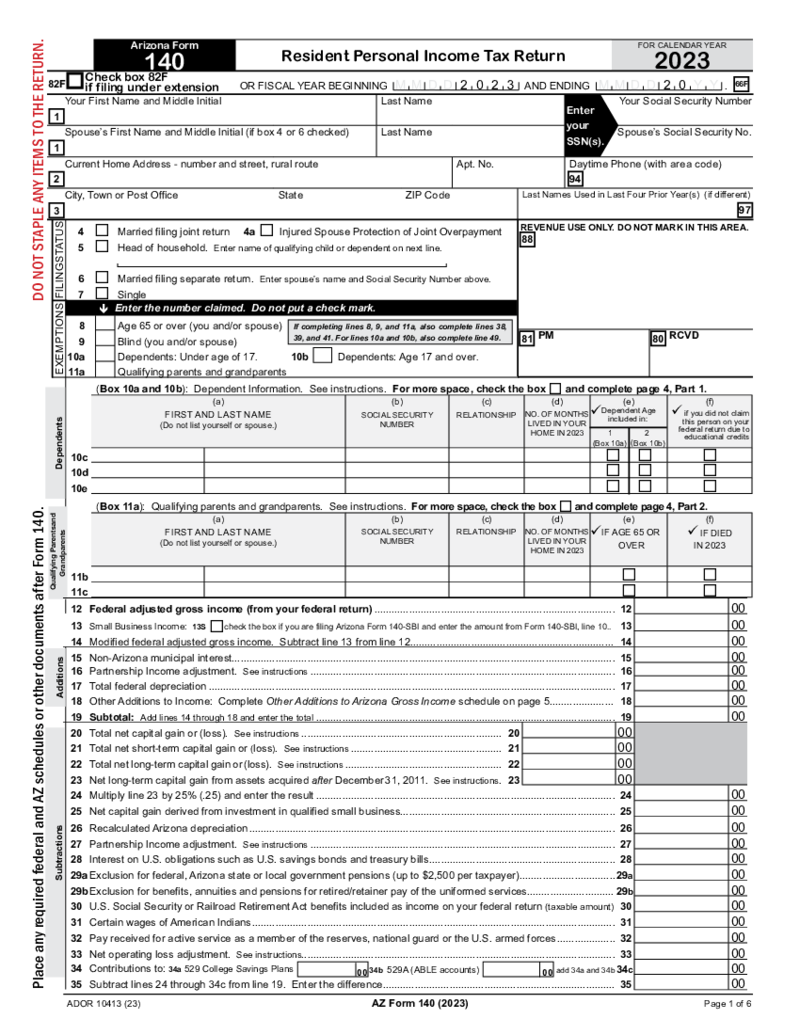

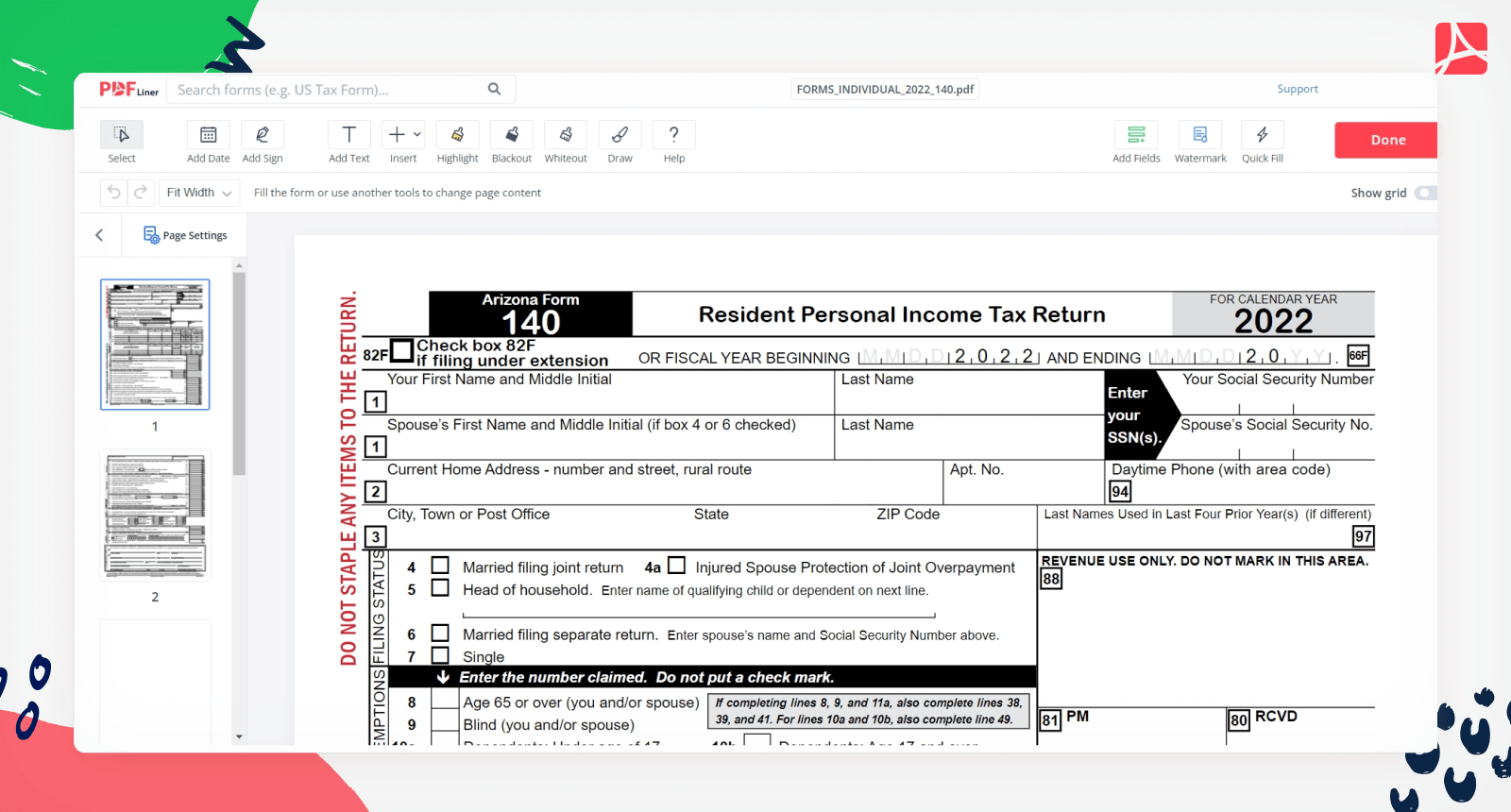

Arizona Form 140 (2023)

Understanding Arizona Form 140 2023

Form 140 is a tax form used by Arizona residents to file their individual income tax returns. It's important to note that Arizona residents who earn income in other states are required to file a nonresident tax

Arizona Form 140 (2023)

Understanding Arizona Form 140 2023

Form 140 is a tax form used by Arizona residents to file their individual income tax returns. It's important to note that Arizona residents who earn income in other states are required to file a nonresident tax

-

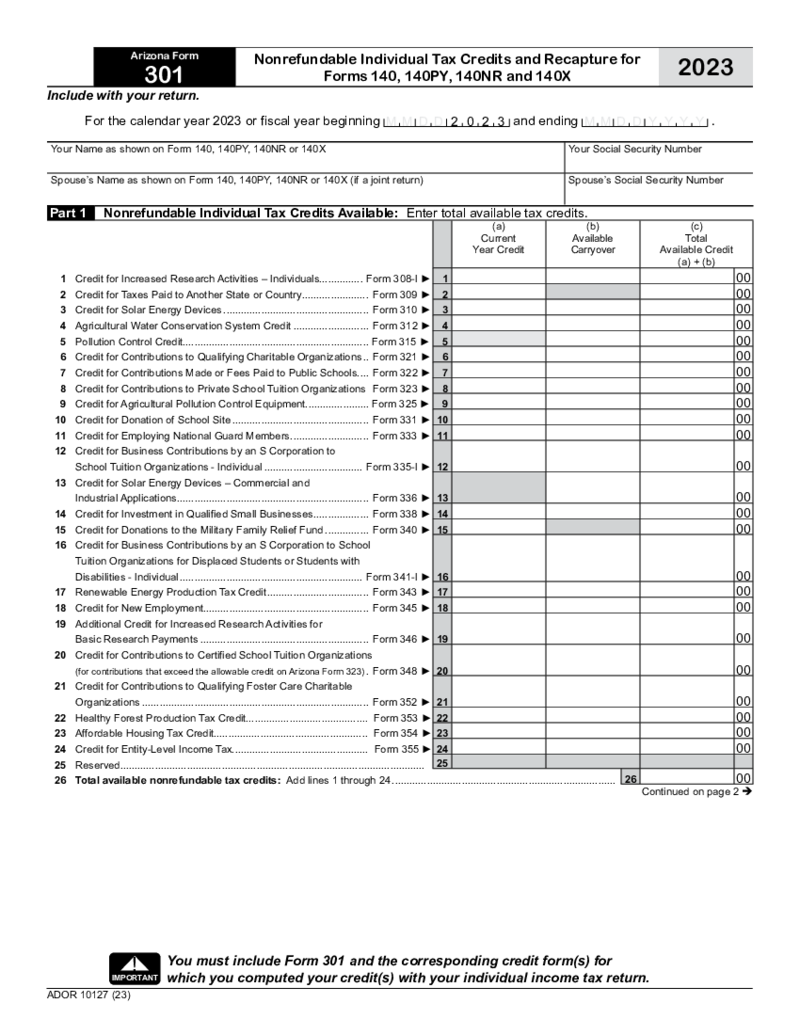

Arizona Form 301

What Is Arizona Form 301?

Arizona Form 301 is the initial document that needs to be prepared by taxpayers in Arizona who intend to claim one or multiple tax credits. It acts as a summary to include all the credits you may be eligible for and must accompan

Arizona Form 301

What Is Arizona Form 301?

Arizona Form 301 is the initial document that needs to be prepared by taxpayers in Arizona who intend to claim one or multiple tax credits. It acts as a summary to include all the credits you may be eligible for and must accompan

-

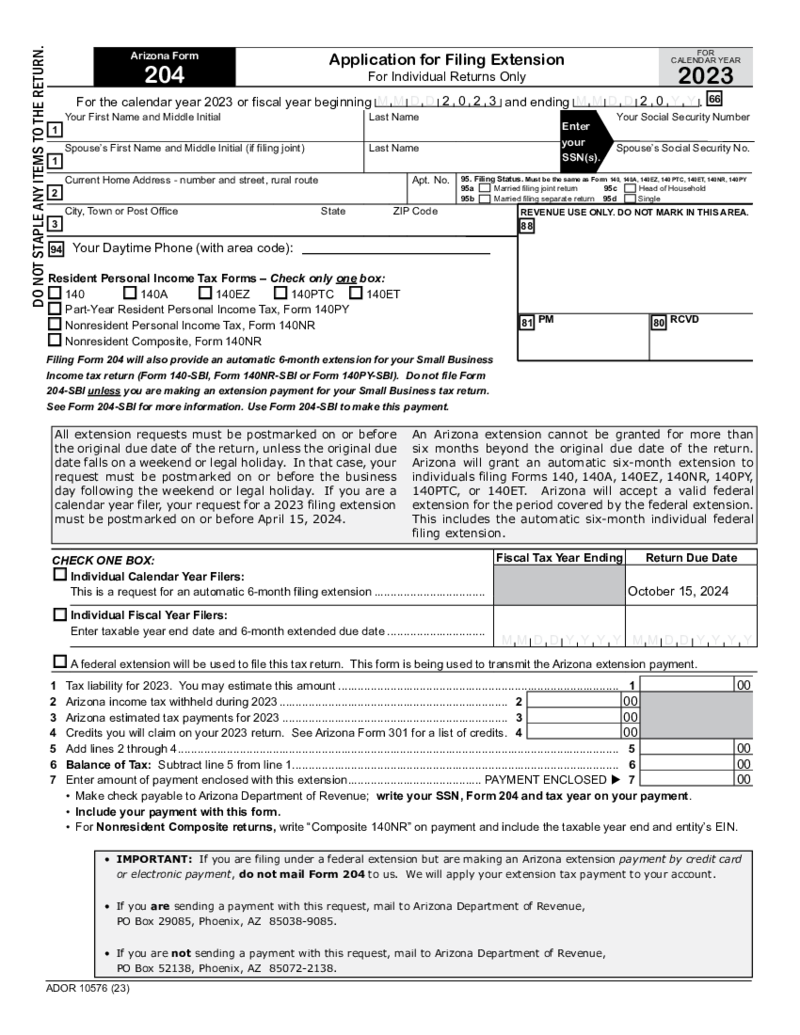

Arizona Tax Extension Form 204

What Is Arizona State Tax Form 204?

Form 204 is a tax extension form specifically for Arizona State filing purposes. Individuals and businesses that require additional time to prepare their income tax returns can submit this form to the Arizona Department

Arizona Tax Extension Form 204

What Is Arizona State Tax Form 204?

Form 204 is a tax extension form specifically for Arizona State filing purposes. Individuals and businesses that require additional time to prepare their income tax returns can submit this form to the Arizona Department

-

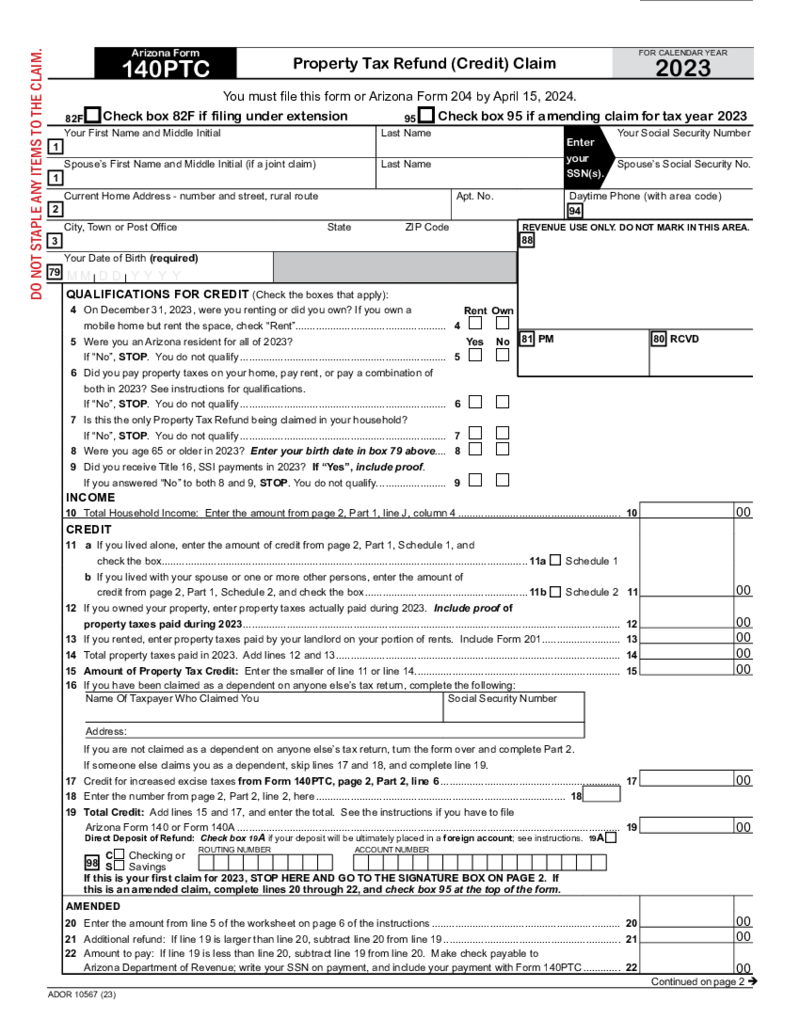

Arizona Form 140 PTC

What Is AZ Form 140 PTC

AZ Form 140 PTC, or the property tax credit form, is pertinent to Arizona. This tax form provides a convenient vehicle for taxpayers over 65 or those receiving supplemental security income to be eligible for a tax

Arizona Form 140 PTC

What Is AZ Form 140 PTC

AZ Form 140 PTC, or the property tax credit form, is pertinent to Arizona. This tax form provides a convenient vehicle for taxpayers over 65 or those receiving supplemental security income to be eligible for a tax

-

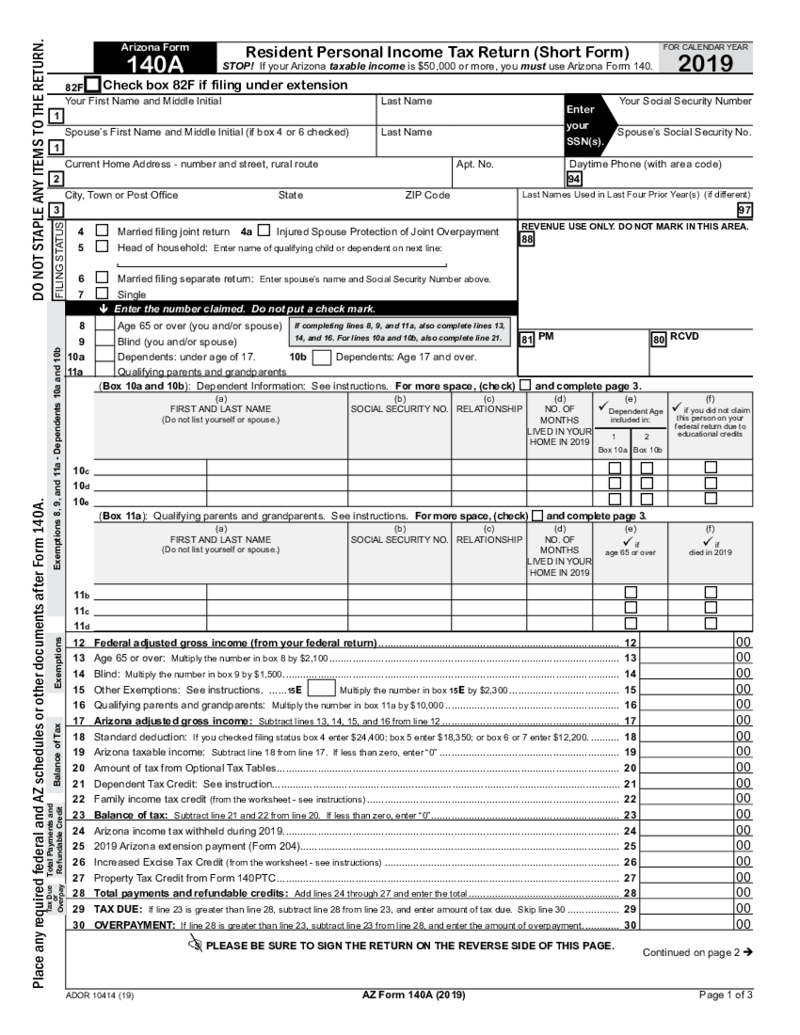

Arizona Form 140A (2019)

What is 140A Form?

The form Arizona 140A as known as Arizona Resident Personal Income Tax is submitted to ADR if your Arizona taxable income is $50,000 or more.

What I need Form 140A for?

If you are an Arizona resident and yo

Arizona Form 140A (2019)

What is 140A Form?

The form Arizona 140A as known as Arizona Resident Personal Income Tax is submitted to ADR if your Arizona taxable income is $50,000 or more.

What I need Form 140A for?

If you are an Arizona resident and yo

-

Arizona Form AZ-140V

What Is Form AZ 140V

Form AZ 140V, also known as the Arizona Individual Income Tax Payment Voucher, is a document Arizona residents utilize to accompany their state income tax payments when the payment is not made electronically. This vou

Arizona Form AZ-140V

What Is Form AZ 140V

Form AZ 140V, also known as the Arizona Individual Income Tax Payment Voucher, is a document Arizona residents utilize to accompany their state income tax payments when the payment is not made electronically. This vou

-

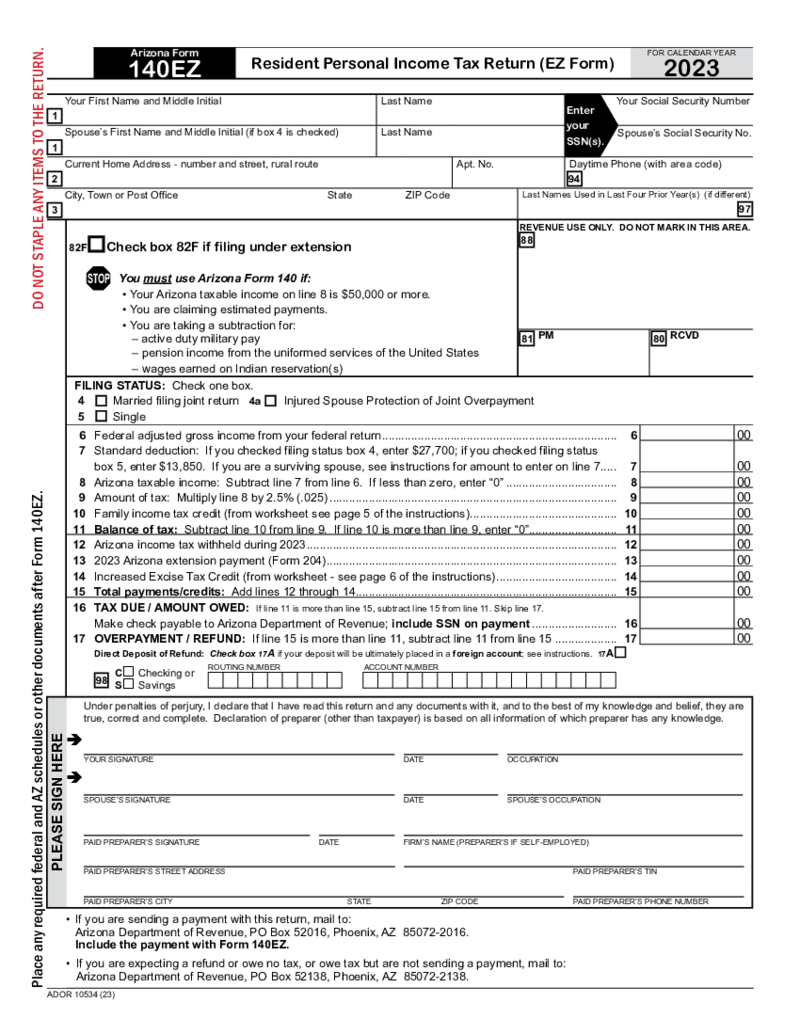

Arizona Form 140EZ

What Is the Arizona Form 140EZ?

The Arizona 140EZ form is a streamlined tax return form for eligible residents in Arizona. Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a relatively straightforwar

Arizona Form 140EZ

What Is the Arizona Form 140EZ?

The Arizona 140EZ form is a streamlined tax return form for eligible residents in Arizona. Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a relatively straightforwar

-

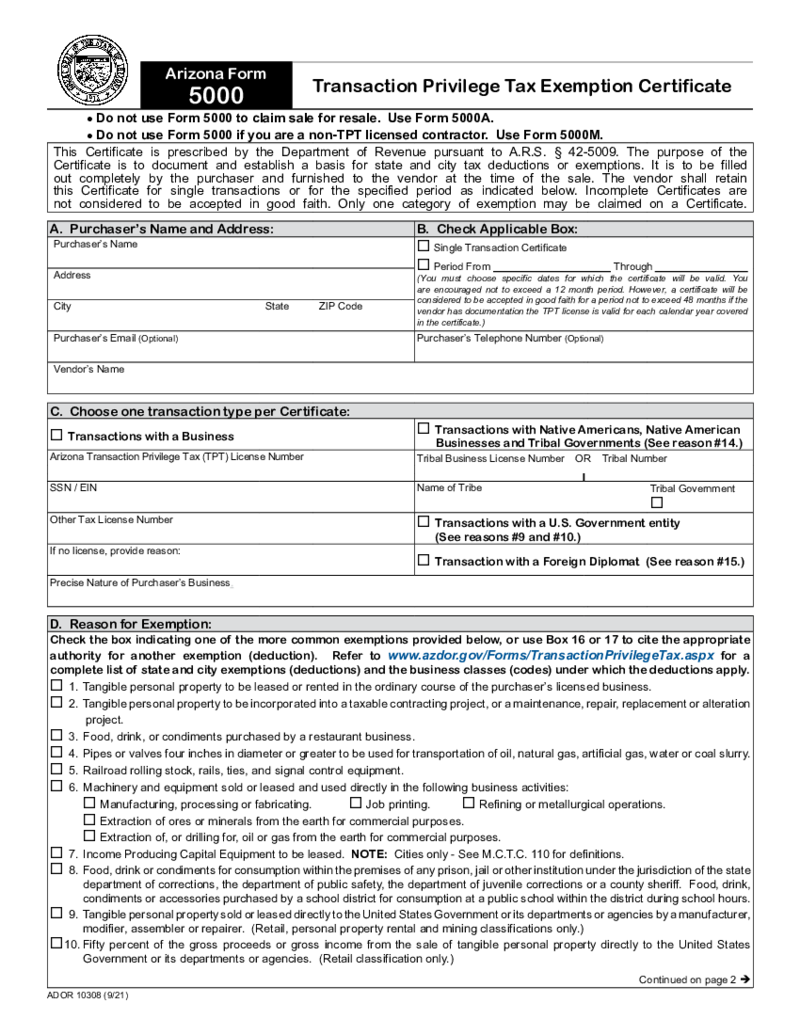

Arizona Tax Form 5000

Understanding the Arizona 5000 Form

The Arizona form 5000 is a crucial tool for taxpayers and businesses in Arizona. This tax form is utilized to claim and document sales tax exemptions for qualifying transactions made in the state. Whether you are a busi

Arizona Tax Form 5000

Understanding the Arizona 5000 Form

The Arizona form 5000 is a crucial tool for taxpayers and businesses in Arizona. This tax form is utilized to claim and document sales tax exemptions for qualifying transactions made in the state. Whether you are a busi

-

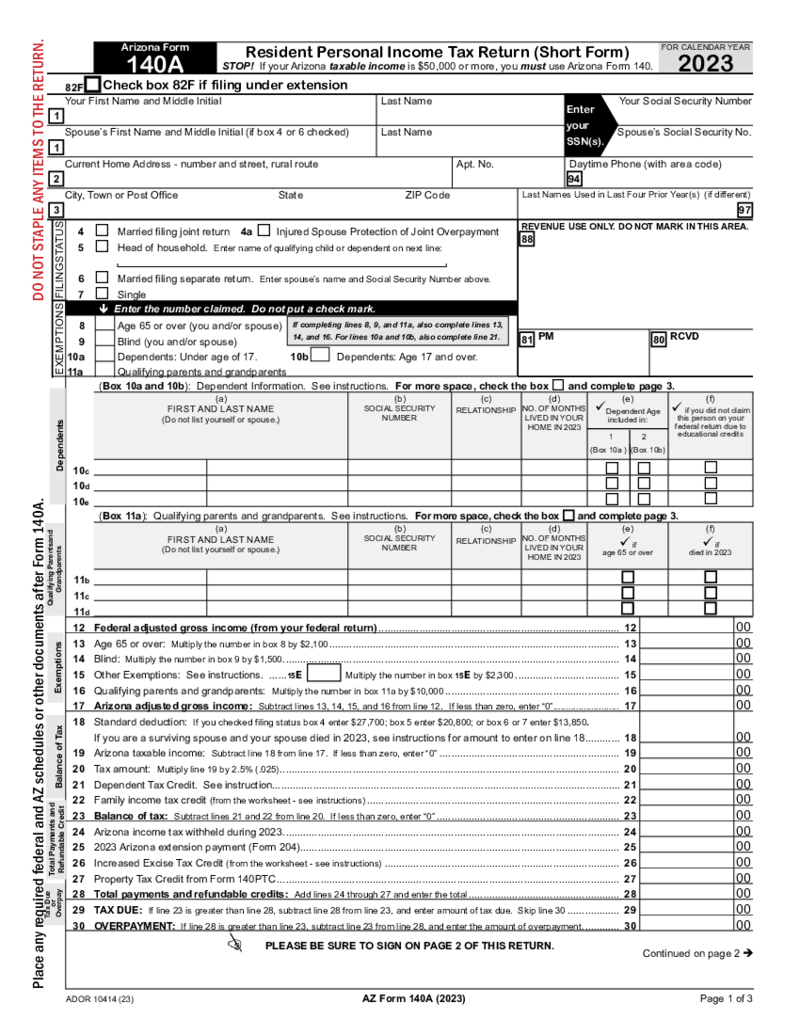

Arizona Form 140A

Overview: Arizona 140A Tax Form

The Arizona 140A tax form is a shorter and simpler tax return form, particularly when compared to other state forms. This is an excellent option for Arizona residents to file their state taxes if they have a straightforward

Arizona Form 140A

Overview: Arizona 140A Tax Form

The Arizona 140A tax form is a shorter and simpler tax return form, particularly when compared to other state forms. This is an excellent option for Arizona residents to file their state taxes if they have a straightforward

-

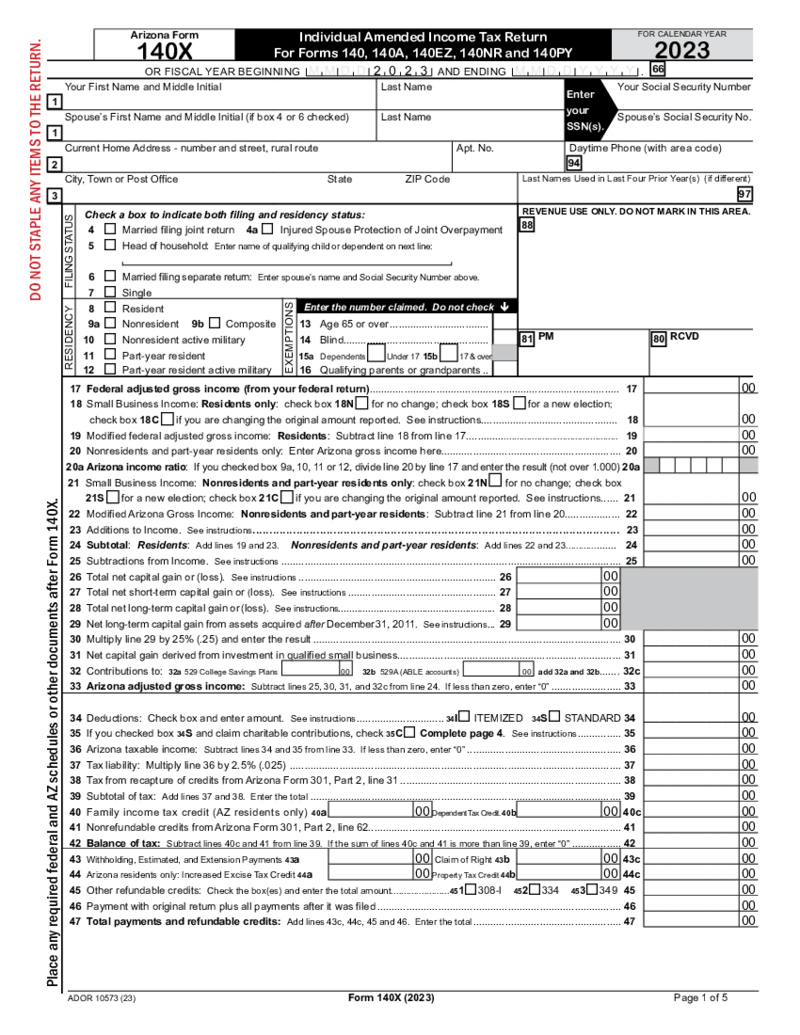

Arizona Form 140X

What Is 140X Form?

Filing taxes is an annual responsibility that sometimes may need corrections post-submission. When an individual in Arizona needs to amend their state tax return, the Arizona Form 140X is the go-to document. Its official title is the &l

Arizona Form 140X

What Is 140X Form?

Filing taxes is an annual responsibility that sometimes may need corrections post-submission. When an individual in Arizona needs to amend their state tax return, the Arizona Form 140X is the go-to document. Its official title is the &l

-

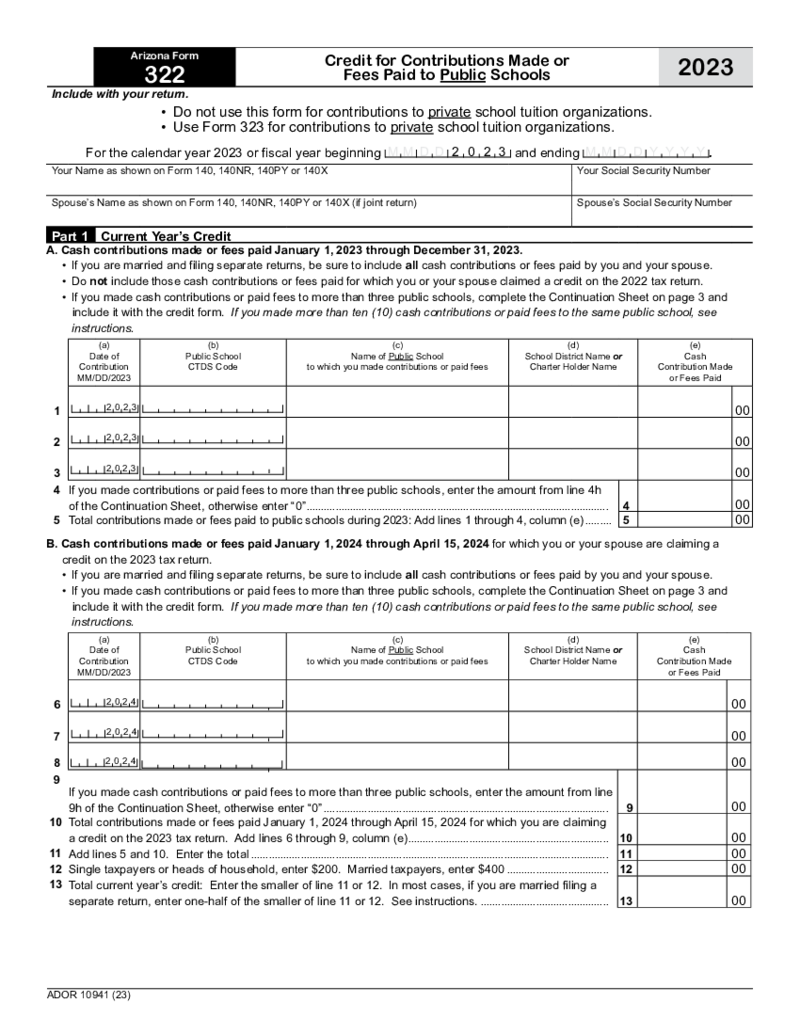

Arizona Tax Form 322

Understanding Arizona State Tax Form 322

State of Arizona Form 322, also known as Form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their Arizona income tax return. This form is for individuals w

Arizona Tax Form 322

Understanding Arizona State Tax Form 322

State of Arizona Form 322, also known as Form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their Arizona income tax return. This form is for individuals w

What Are Arizona Tax Forms?

If you reside in The Grand Canyon State or if your earnings are generated there, it’s likely that Arizona income tax is what you’ll need to deal with. And that’s where completing and submitting Arizona income tax forms kicks in. Does the whole thing totally stress you out? No worries, PDFLiner is here to make the tax filing process as fast and effortless as can be for you. In this category, you’ll lay your hands on the templates of the Arizona state tax forms, perfectly customizable and 100% free of charge. With our assistance, you are sure to succeed in keeping your business in good standing with the Internal Revenue Service, as well as the Arizona Department of Revenue.

Most Popular Arizona State Tax Return Forms

Tax season is a stressful period, especially for small business owners. Aside from focusing on your primary field of work, you also have to deal with piles of exhausting tax docs. To ensure you’re effective in your tax affairs to the maximum, switch from online file management to digital filing. Make use of our multiple templates and editing features and you’ll never want to go back to the highly time-consuming paper-based tax management.

Below, we’ve outlined the most frequently used Arizona fillable tax forms. Look through them and lay your fingertips on any of them whenever necessary.

- Arizona Form 140X. This document is utilized by individual taxpayers for the purpose of altering the reported amounts of the already filed return. Thus, the form serves to correct mistakes or provide updated data in the initial report. The four-pager requires ID information about the taxpayer, along with the necessary amendments to the original version of the return.

- Arizona Form 140NR. Also known as Nonresident Personal Income Tax Return, the file is utilized to document and report your earnings throughout the financial year. The thing is, Arizona is among the states that have standalone tax return files for nonresidents or part-year residents (individuals who earn money in Arizona but live in a different state). And that’s where this particular form comes into play.

- Arizona Form AZ-140V. Also referred to as Arizona Individual Income Tax Payment Voucher for Electronic Filing, the form is pretty self explanatory. It requires you to indicate your full name and address, social security number, filing status, as well as the payment amount.

- Arizona Form 140PTC. Known as Property Tax Refund (Credit) Claim, this document is utilized for filing an original claim for the real estate tax credit. The form consists of a whopping 20 pages and may seem overwhelming to deal with. Feel free to turn to high-quality legal help whenever you feel that any of the tax documents you come across on our site is too complicated for you to fill out under your own steam. Being a jack-of-all-trades is really not something you should waste your precious time on.

- Arizona Form 140ES. Known as Individual Estimated Income Tax Payment, this form is utilized for reporting your yearly-earned income. The two-pager collects sensitive information about you, so ensure it’s under stringent protection as you decide about the best-suiting method of filing it to the corresponding authorities. Remember that security-wise, PDFLiner is the best solution for submitting your Arizona state tax withholding forms.

Where to Get Arizona State Income Tax Forms?

You’re welcome to explore and make use of these forms here in the PDFLiner extensive gallery of free predesigned templates. Along with the almost limitless freedom of choice, our platform also grants you the possibility to edit the forms the way you see fit.

Looking for healthcare-related or real estate forms? Great. PDFLiner is not all about tax forms or Arizona. We have a treasure trove of niche-specific templates catering to a wide array of your needs. Alternatively, you can find the needed forms on the official IRS website, but considering the perks we’ve just described, this alternative is not something you should seriously consider.

Where to File Your Arizona State Tax Forms

File the copies of your tax forms with the Arizona Department of Revenue. With regard to the best method of form submission, it’s entirely up to you. The most convenient and stress-free way to file your tax returns is via PDFLiner. Going smartly digital in this respect allows for hours of treasured time saved and maximum data protection.

Avoiding state tax issues and potential financial liability for failing to pay your taxes is vital. With that said, to succeed in your tax affairs, equip yourself with the best and most time-saving tools on the scene.

FAQ

-

What tax forms do you file every quarter in Arizona?

Arizona Form A1-QRT, also known as Arizona Quarterly Withholding Tax Return, is among those quarterly forms. You can find it in our ample gallery and fill it out by making the most of our top-notch customization functionality.

-

How to order Arizona tax forms?

No need to order or pay for your tax forms any longer. Just find the needed file in this category to further download it and print it out. Alternatively, complete the form online with PDFLiner to take your file automation to the next level.

-

Where do I send my Arizona state tax forms?

Feel free to send your tax forms to the Arizona Department of Revenue. Don’t forget that filing your tax docs online is a fast, easy, and buttery-smooth way of having yourself a hassle-free tax season.