-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Pennsylvania Tax Forms

-

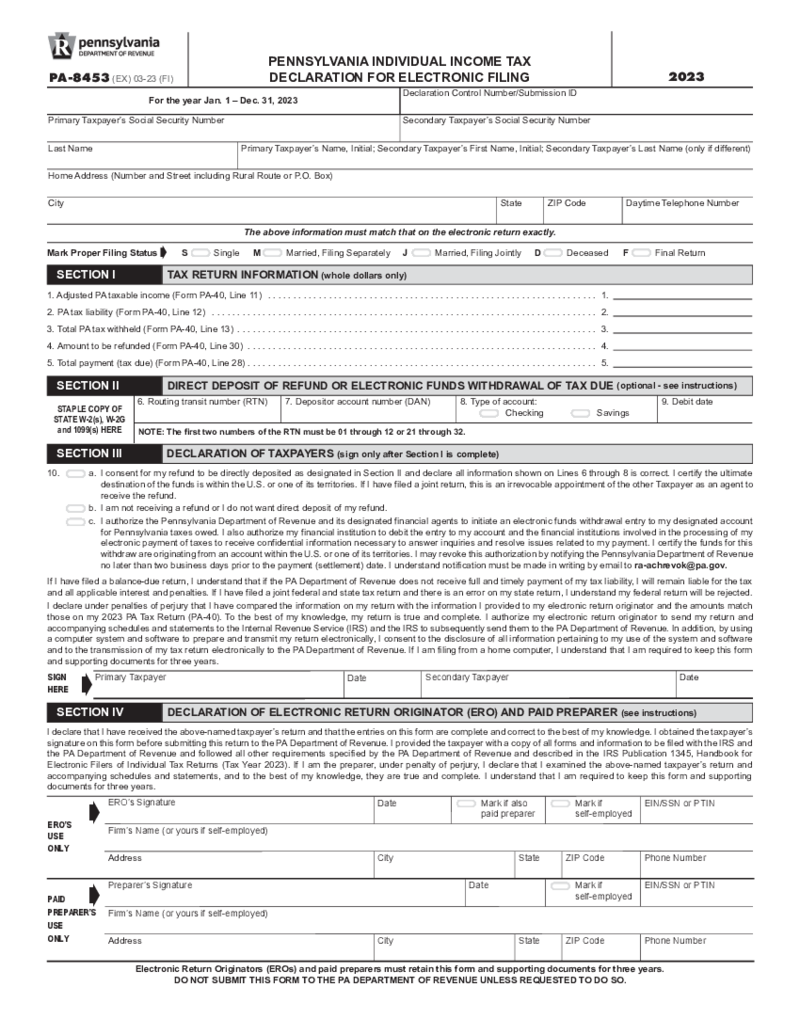

Pennsylvania Form PA-8453

What is the PA-8453 Form?

The fillable PA-8453 form is made for the declaration of individual tax income from Pennsylvania citizens via electronic fi

Pennsylvania Form PA-8453

What is the PA-8453 Form?

The fillable PA-8453 form is made for the declaration of individual tax income from Pennsylvania citizens via electronic fi

-

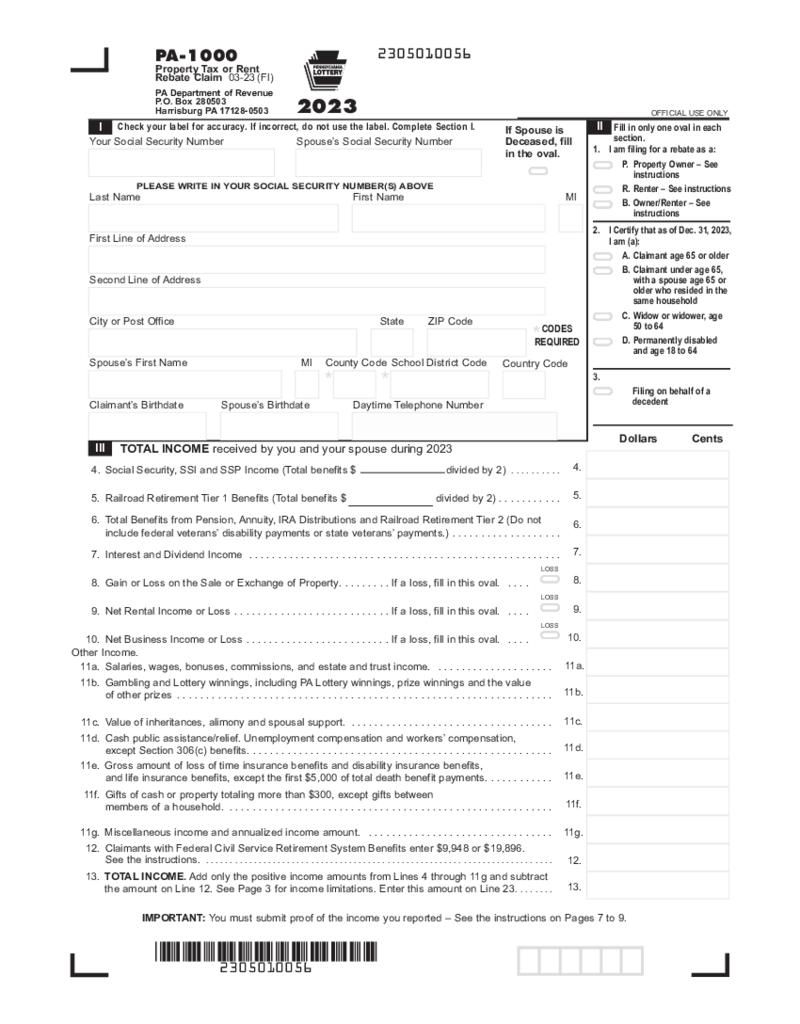

Form PA-1000, Property Tax or Rent Rebate Claim (2023)

Understanding the PA 1000 Tax Form

Before diving into the details, it's essential to understand what the PA 1000 rebate form is. The PA 1000 tax form provides eligible Pennsylvanians with a rebate on their property taxes or rents paid in the prior yea

Form PA-1000, Property Tax or Rent Rebate Claim (2023)

Understanding the PA 1000 Tax Form

Before diving into the details, it's essential to understand what the PA 1000 rebate form is. The PA 1000 tax form provides eligible Pennsylvanians with a rebate on their property taxes or rents paid in the prior yea

-

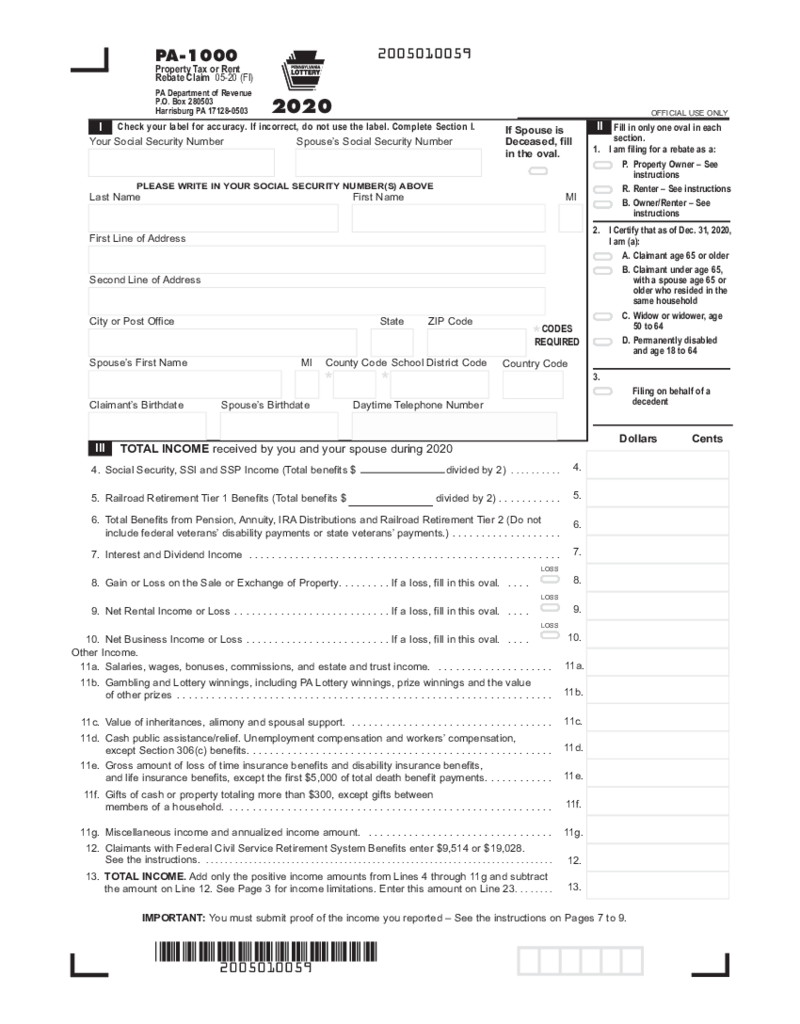

Form PA-1000 (2020)

What Is a Form PA-1000

Form PA-1000, also known as the Property Tax or Rent Rebate Claim, is a document qualifying Pennsylvania residents utilize to claim a rebate on property taxes or rent paid during the previous year. This form is particularly benefici

Form PA-1000 (2020)

What Is a Form PA-1000

Form PA-1000, also known as the Property Tax or Rent Rebate Claim, is a document qualifying Pennsylvania residents utilize to claim a rebate on property taxes or rent paid during the previous year. This form is particularly benefici

What are Pennsylvania Tax Forms?

Pennsylvania tax forms were created to ease the life of taxpayers who live and work or only work in the state. The forms were created and released by the Pennsylvania Department of Revenue. This is the state and not the federal body which means that you still need to use federal forms created by the IRS to report the taxes to the US government. These forms have local importance since there are differences in some legislative aspects.

PDFLiner offers IRS Pennsylvania state tax forms to everyone. The number of templates is constantly rising based on the work of the PA Revenue Department. You may choose the blank you need and fill it out online in no time.

Most Popular Pennsylvania Tax Forms

There are dozens of Pennsylvania income tax forms available for PA citizens. All they need to do is to choose the specific form they require. Some people are still unaware of the documents they need to provide to the IRS and to the PA Department of Revenue. To avoid mistakes you can contact the department in advance. Once you find the form you need, complete it. Here are the top 5 Pennsylvania state tax forms citizens download the most:

- Form PA-1000. This form is known as Property Tax or Rent Rebate Claim. It is created by the PA Department of Revenue. Once you finish it you need to send the form to PO Box 280503 Harrisburg PA 17128-0503 to the Department of Revenue. Make sure you follow the deadline. There are direct instructions for each section you fill. You have to be specific about income and taxes. At the end of the form, you need to make a claimant oath about the correct and true information by providing an access to the Department to the personal records.

- Form PA-1000 A. Among state Pennsylvania tax forms you may never need this form, yet, since the document is quite popular, it is better to keep it in your library. It is called Deceased Claimant and/or Multiple Home Prorations. You have to be specific about the taxes you pay for the property and if you have ever sold houses and paid taxes for them.

- Form DEX-41. This one also belongs to the type of Pennsylvania estate tax forms. It is known as an Application for Property Tax/Rent Rebate Due the Decedent. It must be filled with information on the decedent and the application submitter. The affidavit must be signed and notarized. Once you complete the form, make sure that there all the signatures are present, you can file it to the Department of Revenue, in the Bureau of Individual Taxes section.

- Power of Attorney and Declaration of Representative. The form is created by the Pennsylvania Department of Revenue for their representatives to speak on the confidential matters of tax records with the third parties that were designated for this. You may need it from other Pennsylvania tax return forms to make sure that the information in the tax records is true and complete. The form has its own limit in time and can be used only during the tax report period.

- Form PA-8453. This is a Pennsylvania Individual Income Tax Declaration for Electronic Filing. It is widely used among other Pennsylvania state income tax forms by the residents of the state. It provides information on the taxpayer, including SSN, tax return information, deposits, and taxpayer’s declaration.

How to Get Pennsylvania Tax Forms?

There is nothing complicated in getting the Pennsylvania income tax return forms you need. The first thing you need to do is to go to the official PA Department of Revenue website and check out the documents. If you don’t have much time to search through the gigantic library that contains all the forms taxpayers may ever need in the state, go to the PDFLiner. The editor contains fresh and important Pennsylvania estimated tax forms gathered in one place. Once you find the one you need to follow these steps:

- Read the description below and pick the most appropriate blank.

- Click the button Fill Online.

- Wait till the form is opened so you can fill it out.

- You can sign it via PDFLiner and send it to the recipient.

FAQ:

-

Where can I download PA tax forms?

All Pennsylvania local income tax forms are available on the PA Department of Revenue website. However, the simplest way to download the form is to use the PDFLiner editor. You can quickly find the document and print it, download it on your device, or fill it online and send it to the other party.

-

Where to send Pennsylvania tax forms?

There is an address of the Pennsylvania Department of Revenue available in each tax form you are filling. Some forms have different addresses based on the authorities that work in the specific area. In some cases, the PA Department of Revenue offers to send documents online via email or their website.