-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Virginia Tax Forms

-

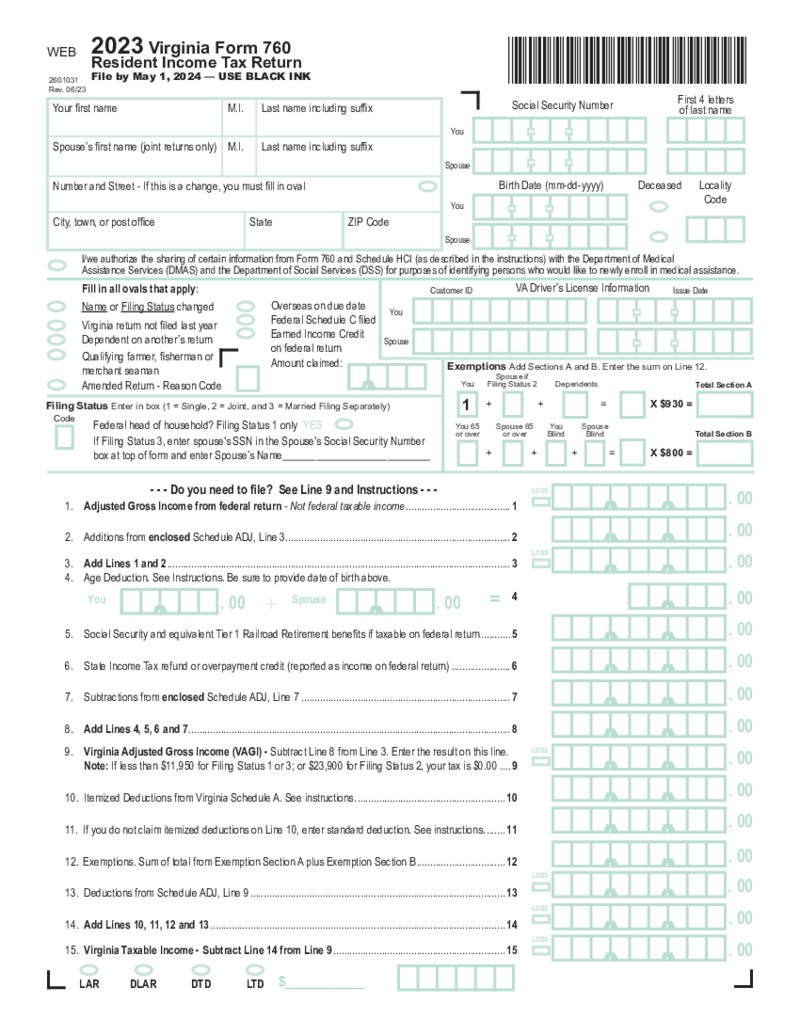

Virginia Form 760

What Is Virginia Tax Form 760?

Virginia Form 760, also known as Individual Income Tax Return is used to review and confirm the person’s tax ret

Virginia Form 760

What Is Virginia Tax Form 760?

Virginia Form 760, also known as Individual Income Tax Return is used to review and confirm the person’s tax ret

-

Virginia Schedule OSC

What is Virginia Schedule OSC form?

Virginia Schedule OSC is a supplemental schedule that should be attached to Virginia Tax Form 760. It is used for the residents of Virginia working in other states to claim a credit for taxes paid to those states. This

Virginia Schedule OSC

What is Virginia Schedule OSC form?

Virginia Schedule OSC is a supplemental schedule that should be attached to Virginia Tax Form 760. It is used for the residents of Virginia working in other states to claim a credit for taxes paid to those states. This

-

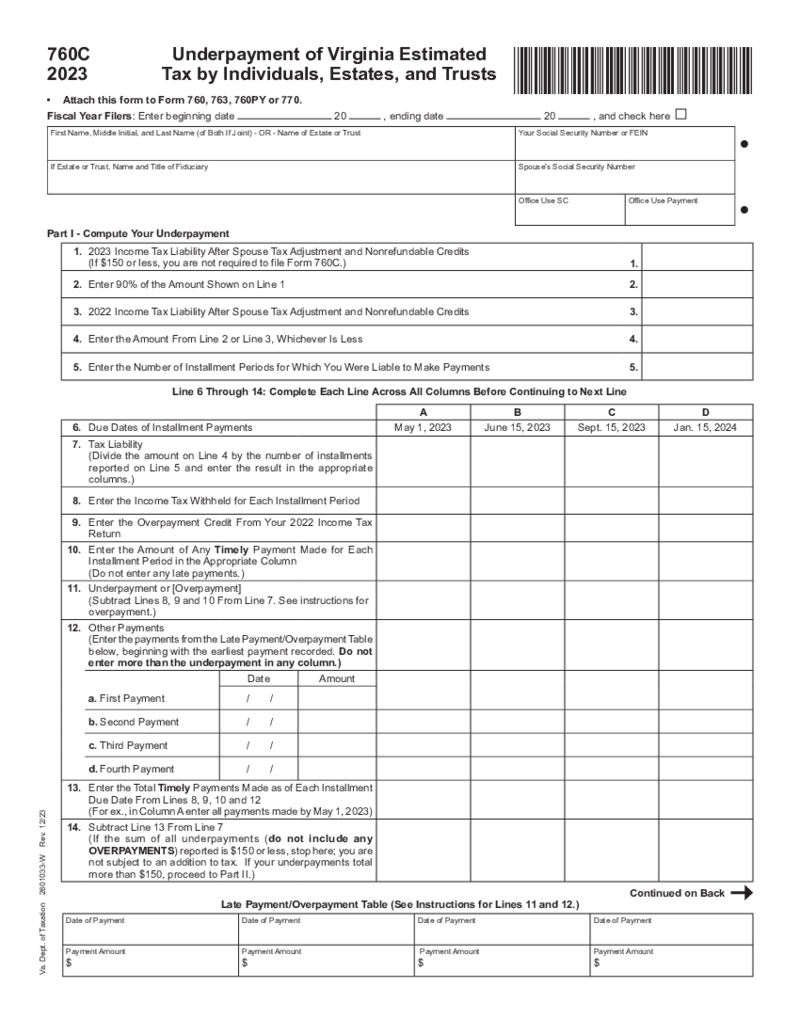

Form 760C

What Is a VA Form 760C?

Taxpayers extensively utilize Virginia tax form 760C to itemize their deductions when they cannot or don't choose to use the standard deduction. This form is used when filing tax returns in Virginia. It is aptly named the

Form 760C

What Is a VA Form 760C?

Taxpayers extensively utilize Virginia tax form 760C to itemize their deductions when they cannot or don't choose to use the standard deduction. This form is used when filing tax returns in Virginia. It is aptly named the

-

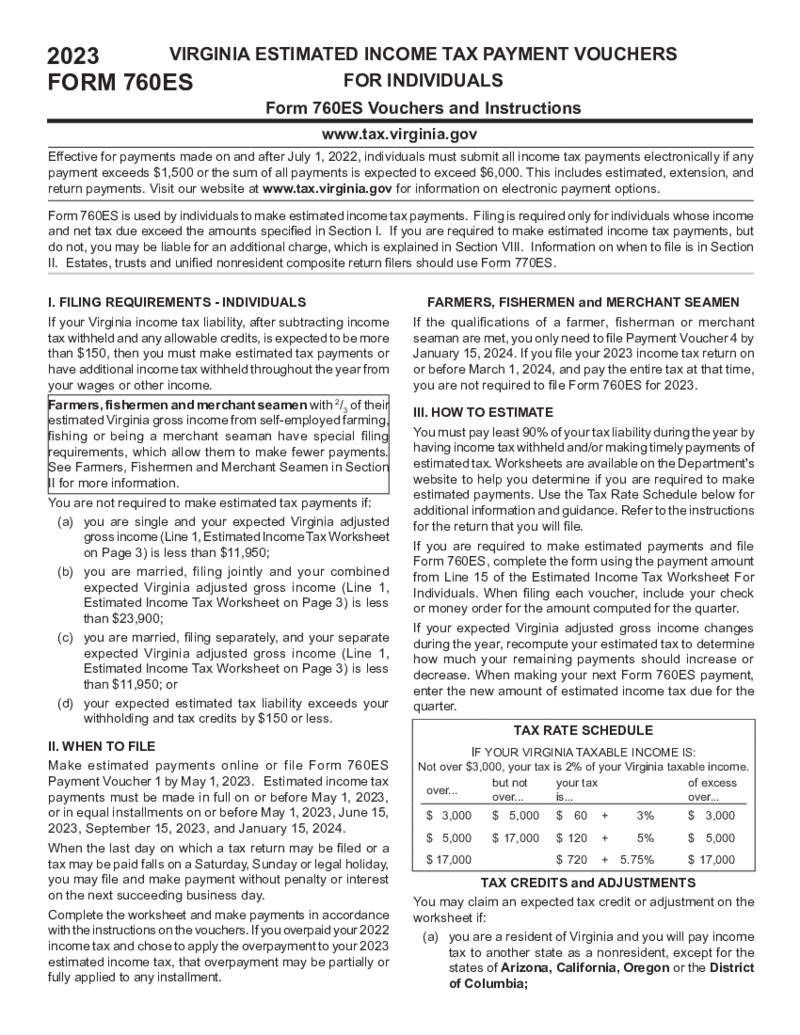

Form 760-ES

Understanding VA Form 760 ES

Form 760 ES, also known as the Virginia Estimated Income Tax Payment Vouchers for Individuals, is essential for taxpayers in the US. This highly specific state tax form is intended primarily for the residents of Virginia and i

Form 760-ES

Understanding VA Form 760 ES

Form 760 ES, also known as the Virginia Estimated Income Tax Payment Vouchers for Individuals, is essential for taxpayers in the US. This highly specific state tax form is intended primarily for the residents of Virginia and i

-

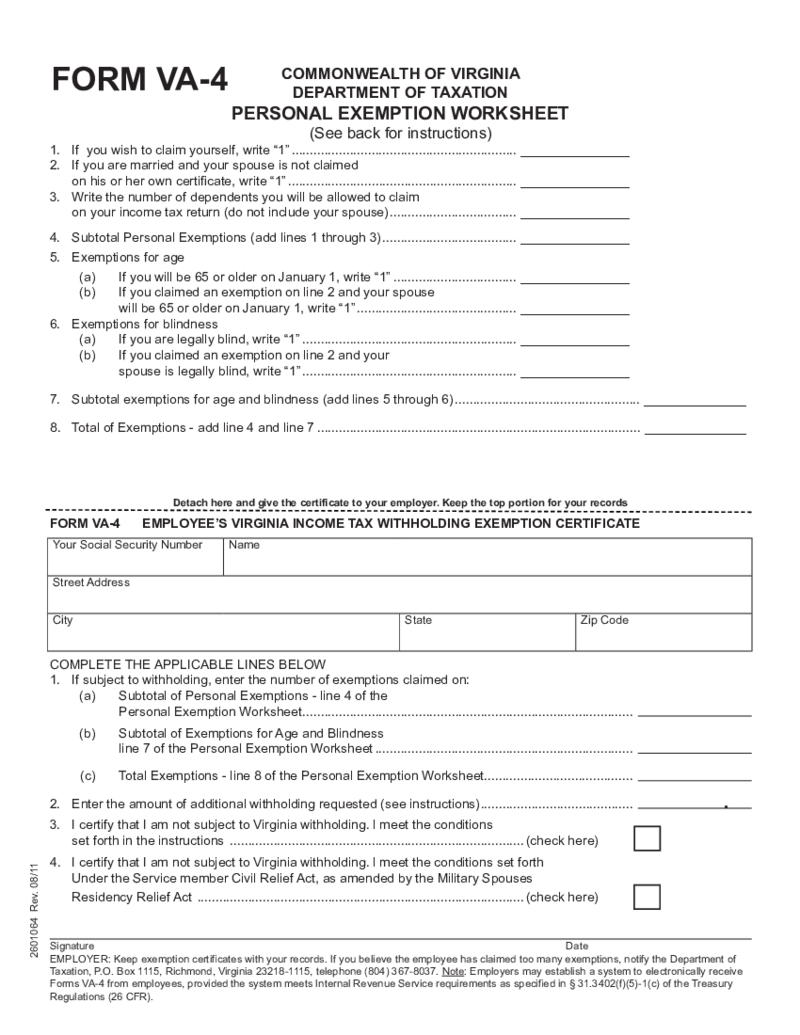

Form VA-4

What Is Virginia VA-4 Form?

Simply put, the VA Form VA-4 is the state of Virginia’s equivalent to the W-4 provided by the federal government. This form aids employees in determining the exact amount of state income tax that their employers should wi

Form VA-4

What Is Virginia VA-4 Form?

Simply put, the VA Form VA-4 is the state of Virginia’s equivalent to the W-4 provided by the federal government. This form aids employees in determining the exact amount of state income tax that their employers should wi

-

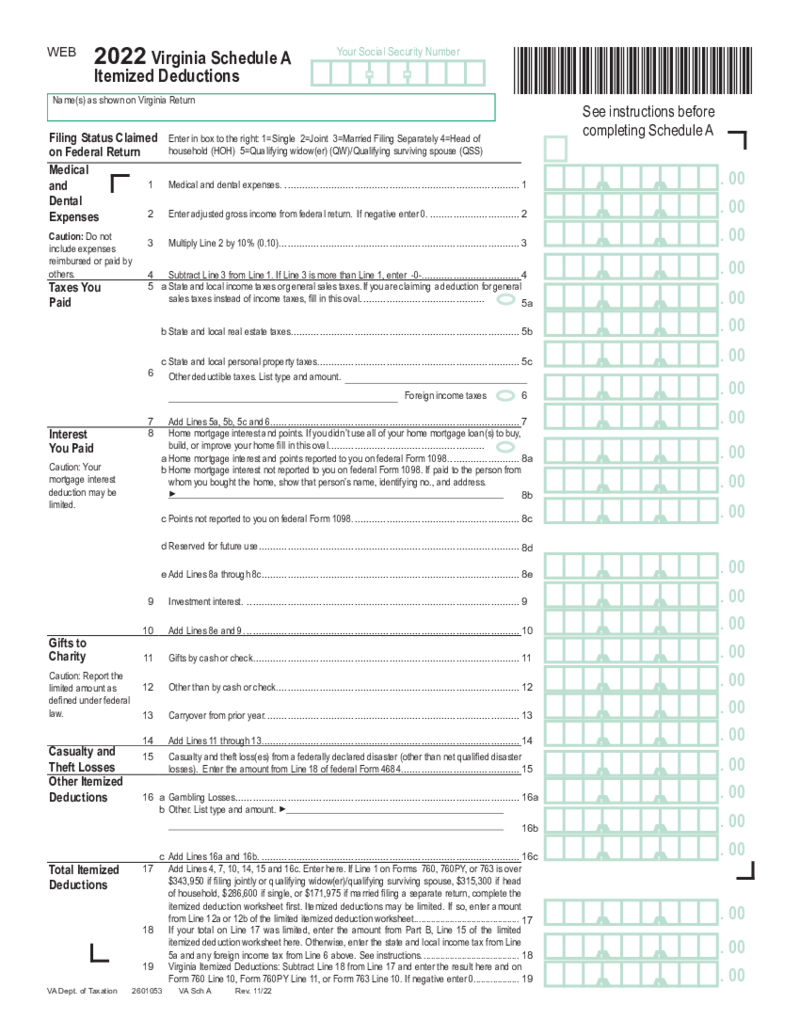

Virginia Schedule A Itemized Deductions

How to Redact and Fill Out Virginia Schedule-A Online?

To redact and fill out Virginia schedule-a online, you will need to follow these steps:

Obtain a copy of the form: You can find a copy of the Virginia schedule a form on the Virginia

Virginia Schedule A Itemized Deductions

How to Redact and Fill Out Virginia Schedule-A Online?

To redact and fill out Virginia schedule-a online, you will need to follow these steps:

Obtain a copy of the form: You can find a copy of the Virginia schedule a form on the Virginia

-

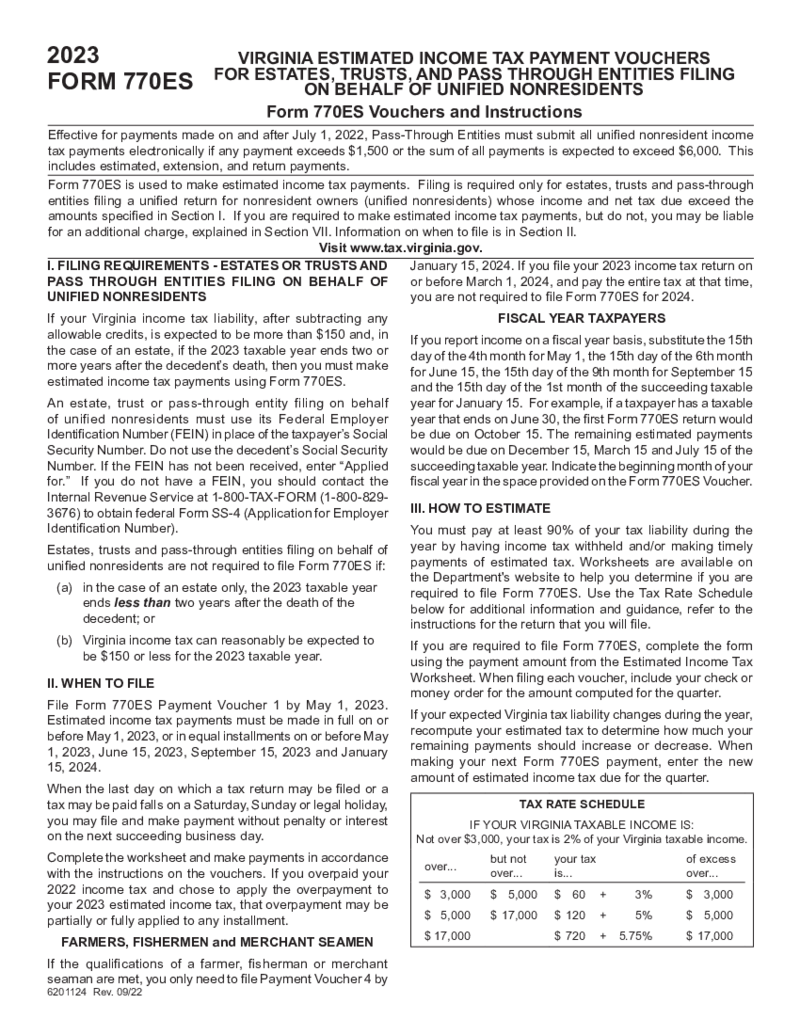

Virginia Form 770ES

What Is a Form 770ES Virginia

Form 770ES, also known as the Virginia Estimated Income Tax Payment Voucher for Estates and Trusts, is an essential document for fiduciaries responsible for managing an estate or trust that generates income within the Commonw

Virginia Form 770ES

What Is a Form 770ES Virginia

Form 770ES, also known as the Virginia Estimated Income Tax Payment Voucher for Estates and Trusts, is an essential document for fiduciaries responsible for managing an estate or trust that generates income within the Commonw

-

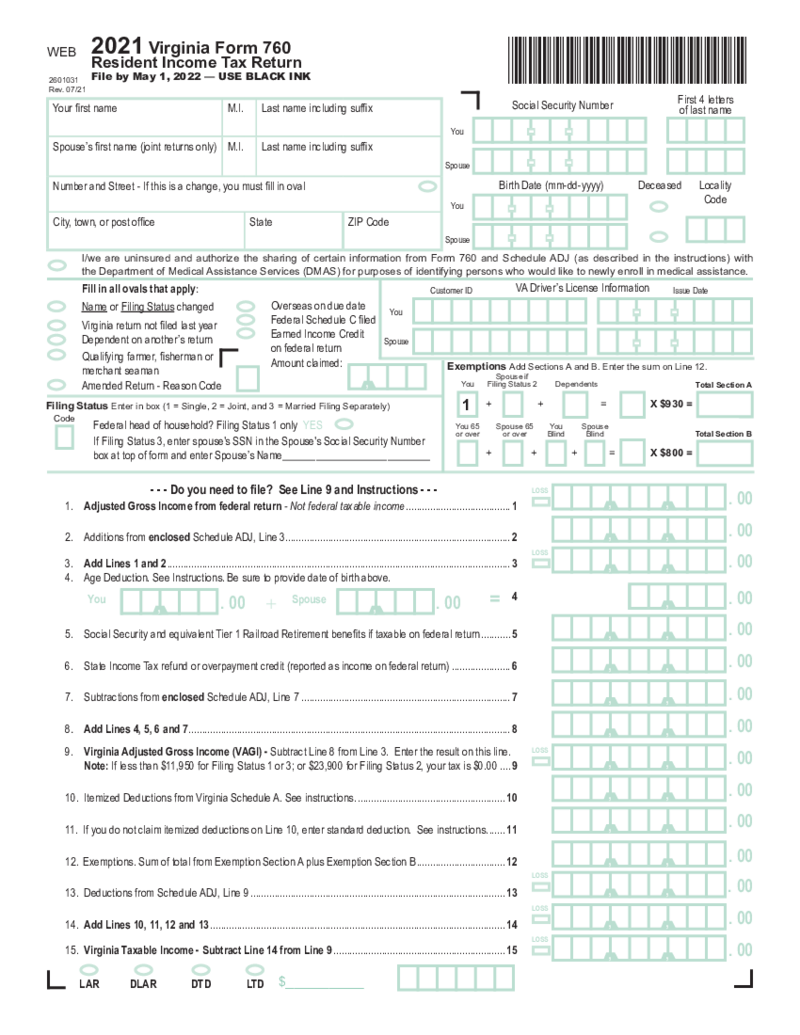

Virginia Income Tax Return Form 760 (2021)

What Is Form 760 Virginia Individual Income Tax Return

The Virginia Resident Form 760 Individual Income Tax Return is the foundational document residents of the Commonwealth of Virginia use to report their annual income tax. The form is d

Virginia Income Tax Return Form 760 (2021)

What Is Form 760 Virginia Individual Income Tax Return

The Virginia Resident Form 760 Individual Income Tax Return is the foundational document residents of the Commonwealth of Virginia use to report their annual income tax. The form is d

-

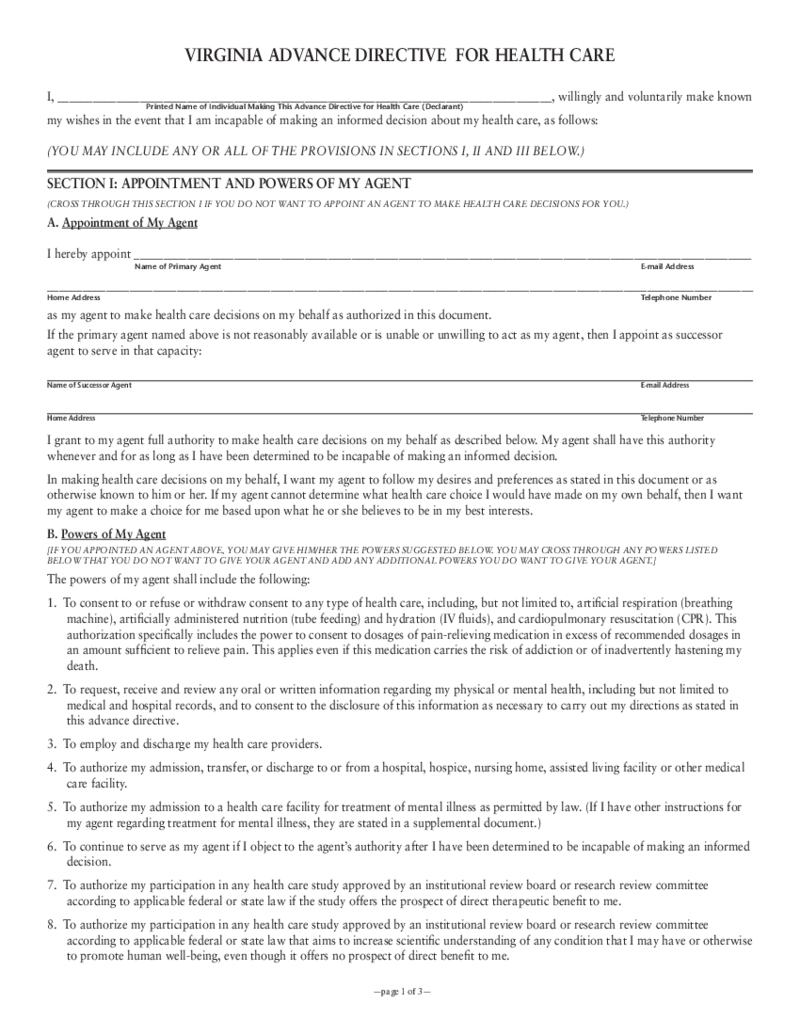

Virginia Advance Health Care Directive Form

What is Virginia Advance Directive for Health Care Form?

The fillable Virginia Advance Directive for Health Care is a mix of attorney medical power and the living will that provides a person with the selection of end-of-life treatment. This is not a busin

Virginia Advance Health Care Directive Form

What is Virginia Advance Directive for Health Care Form?

The fillable Virginia Advance Directive for Health Care is a mix of attorney medical power and the living will that provides a person with the selection of end-of-life treatment. This is not a busin

-

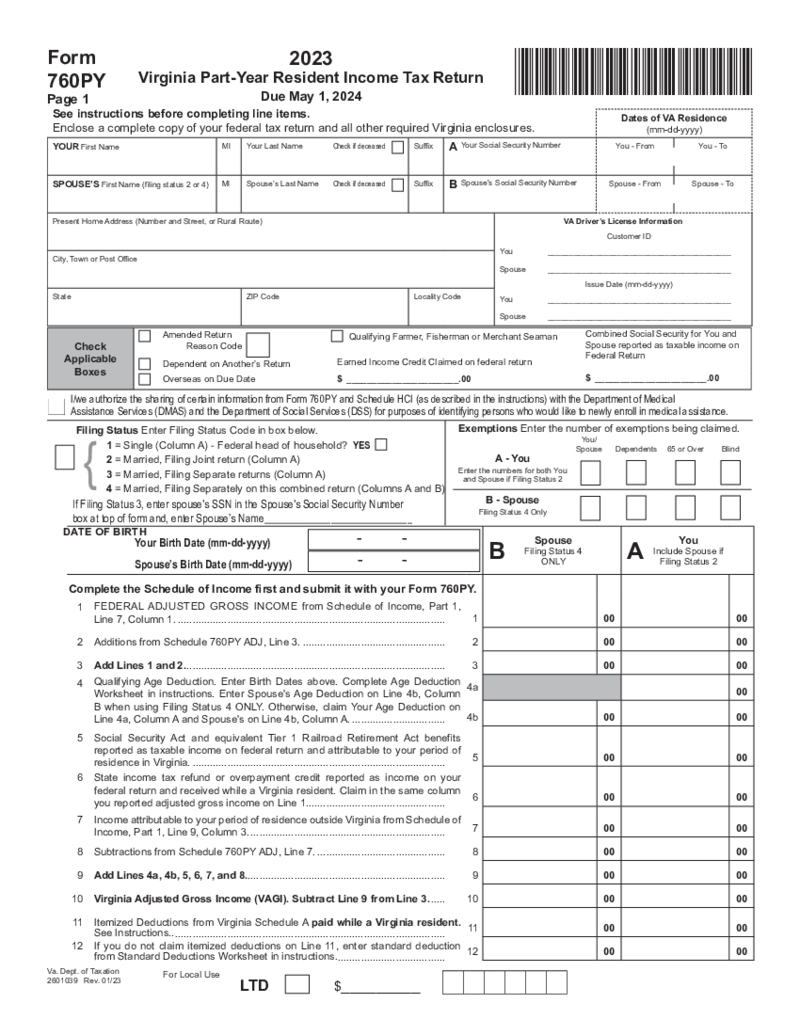

Virginia 760PY Part-Year Resident Individual Income Tax Return

Understanding the Virginia 760PY Form

The Virginia 760PY part-year resident individual income tax return form, commonly known as the form 760PY, is generally used by individuals who resided in Virginia for only part of the tax year. If you've lived in

Virginia 760PY Part-Year Resident Individual Income Tax Return

Understanding the Virginia 760PY Form

The Virginia 760PY part-year resident individual income tax return form, commonly known as the form 760PY, is generally used by individuals who resided in Virginia for only part of the tax year. If you've lived in

-

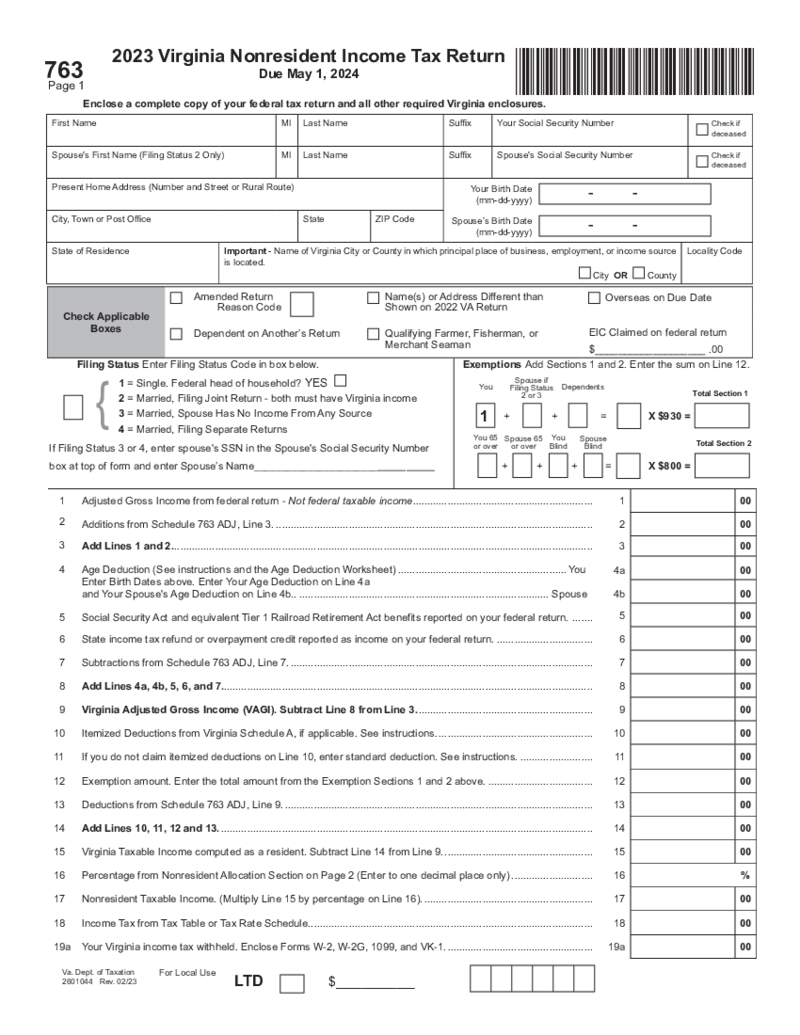

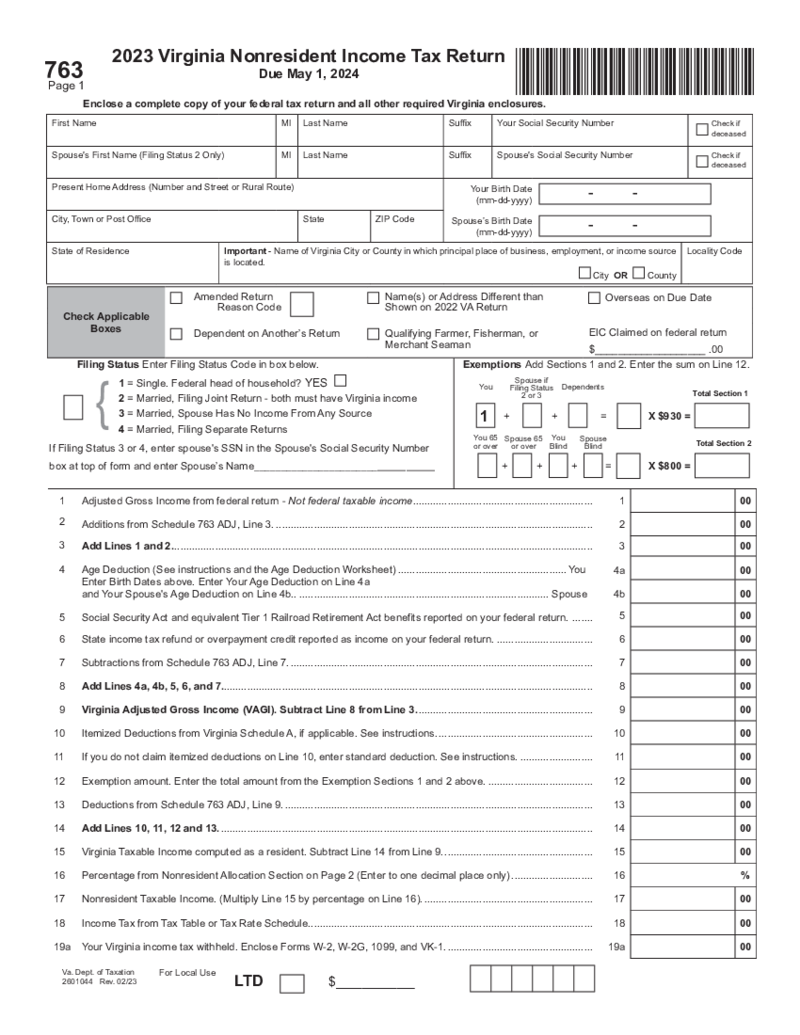

Form 763

What Is a Form 763 Virginia?

The VA 763 form, officially known as the Nonresident Individual Income Tax Return Form 763, is issued by the Virginia Department of Taxation. This form is intended for nonresidents who earned income in Virginia during the tax

Form 763

What Is a Form 763 Virginia?

The VA 763 form, officially known as the Nonresident Individual Income Tax Return Form 763, is issued by the Virginia Department of Taxation. This form is intended for nonresidents who earned income in Virginia during the tax

-

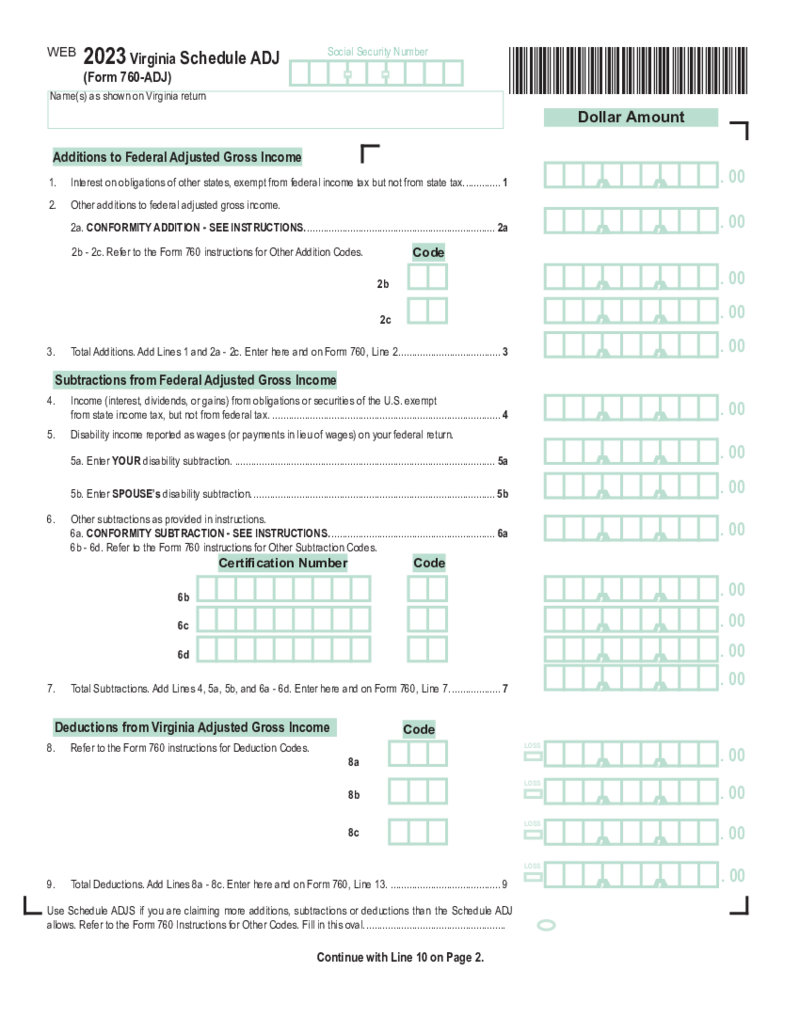

Form 760-ADJ

Understanding VA Form 760 ADJ

If you’re a Virginia resident, you’ve likely come across Virginia form 760 schedule ADJ, especially during tax season. It is used by residents to make adjustments to their income, claim credits, or calculate speci

Form 760-ADJ

Understanding VA Form 760 ADJ

If you’re a Virginia resident, you’ve likely come across Virginia form 760 schedule ADJ, especially during tax season. It is used by residents to make adjustments to their income, claim credits, or calculate speci

What are Virginia Tax Forms?

Virginia tax forms were created by the Virginia Department of Taxation for all residents of the state who pay taxes or for non-residents who work there. Based on your specific circumstances you may choose the form you need to send to the officials. These forms have similarities with federal forms that you receive from the IRS, however, they stand separately and must be filed due to the deadline as well as IRS documents. These forms are all connected to the taxes you pay and the income you receive.

PDFLiner has a growing collection of Virginia state tax forms. All the blanks are gathered on one page, described, and available for download. You can pick one based on the name or description.

Most Popular Virginia Tax Forms

There are dozens of different Virginia tax forms 2022 you can use to report your income. It is easy to get lost among them. If you know which one you need, just pick it and complete it. If you are not sure, ask the authorities. Some forms are definitely on demand during the tax report period, while others continue to be filed for specific rare cases. Here are the most known Virginia income tax forms that may be helpful for you as well:

- Form 760. This is the Resident Income Tax Return form that you have to file till May 1, 2023. It was created by the Virginia Department of Taxation to help you to make reports on tax returns simple. This document is used not only to record your income and taxes you pay for the state but also to record Virginia's Adjusted Gross Income. It has numerous similarities with federal tax reports, and also contains information the local government requires from the citizens. There is a strict deadline you need to follow.

- Form 760ES. This is Virginia Estimated Income Tax Payment Vouchers for Individuals. It is one of these Virginia state tax forms 2022 you need to fill if you provided a specific amount of payments during a specific period of time. The form must be completed if you make payments of over $1,500 or a total sum of $6,000. Calculate the payments that were made after July 1, 2022. These payments can be extended, estimated, or returned. The form can be sent electronically to the department.

- Form 770ES. It is known as Virginia Estimated Income Tax Payment Vouchers for Estates, Trusts, and Pass-Through Entities Filing On Behalf of Unified Nonresidents. It belongs to the Vouchers and Instructions section. It is made for reports on estimated income tax payments. This document must be filed by the nonresident estate, pass-through entities, or trusts owners, whose income exceeds a specific amount of money $1,500. Residents of Virginia have to file another form.

- Virginia Schedule A Itemized Deductions. The form is made for taxpayers who need to provide extra information on itemized deductions. You have to calculate expenses spent on dental and medical services. Apart from that, mention the taxes that were paid by you. Include the interest that was paid, and gifts that are considered charity. If you have theft losses during the year, they must be reported. If you have any extra itemized deductions you want to mention, like gambling losses you have to provide them in a separate section.

- Form 760PY. Virginia Part-Year Resident Income Tax Return. The document must be filed by part-year residents of Virginia state. The information must be provided similarly to the one you share in form 760.

How to Get Virginia Tax Forms?

Whether you are filing Virginia sales tax exemption forms or simple tax reports, these documents can be found online. The first source of the blanks is the Virginia Department of Taxation's official website. There are forms from different spheres of interest for all possible cases. If you are interested in tax-related documents only and you need to find something fast you can use PDFLiner. It has a well-organized section for such blanks. Moreover, you can fill in any templates you want right there. When you find the Virginia state tax withholding forms you are looking for, follow these steps:

- Pick one document you need.

- Press the Fill Online option.

- Complete the form when the editor is opened.

- Print it or send it online. If you need to sign it, use an e-signature from the editor.

FAQ:

-

Where to find Virginia state tax forms?

They are all available on the Internet. You have several options here. You can use the official website of the Virginia Tax Department or PDFLiner which allows you to complete these forms once you find them. Later you can send the form back to the official website.

-

Does Virginia have a state income tax form?

Yes, Virginia has its own state income tax report form. This form is described above. It has the number Form 760. The form has numerous similarities with IRS national form. However, you still have to report federal income taxes too.