-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Oklahoma Tax Forms

-

Form OW-15 Nonresident Member Withholding Exemption Affidavit

What Is Form OW-15?

Oklahoma Form OW-15, also known as the Nonresident Member Withholding Exemption Affidavit, is a document utilized by nonresident individuals, partnerships, or shareholders of

Form OW-15 Nonresident Member Withholding Exemption Affidavit

What Is Form OW-15?

Oklahoma Form OW-15, also known as the Nonresident Member Withholding Exemption Affidavit, is a document utilized by nonresident individuals, partnerships, or shareholders of

-

Oklahoma Form 511NR

Understanding Oklahoma Form 511NR for Part-Year and Non-Residents

When it comes time to handle state tax obligations in the Sooner State, part-year residents and non-residents must acquaint themselves with Oklahoma Form 511NR. This specialized document is

Oklahoma Form 511NR

Understanding Oklahoma Form 511NR for Part-Year and Non-Residents

When it comes time to handle state tax obligations in the Sooner State, part-year residents and non-residents must acquaint themselves with Oklahoma Form 511NR. This specialized document is

-

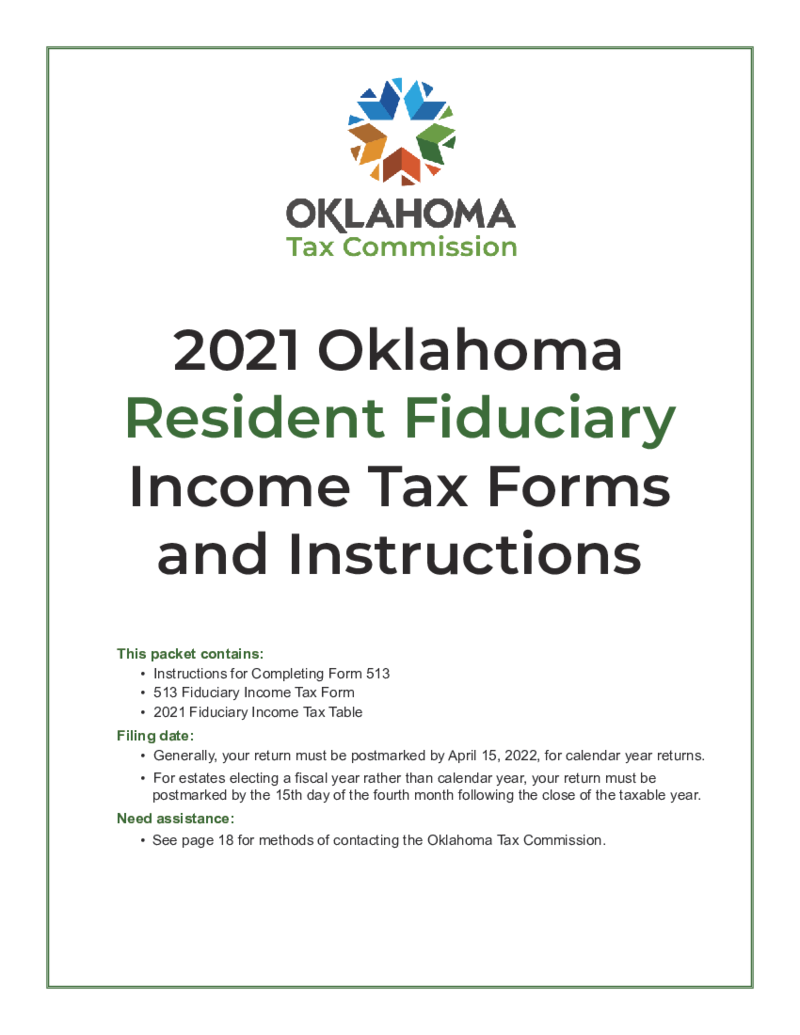

Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet and Instructions

What Is Oklahoma Form 513?

Form 513, also referred to as the Oklahoma Resident Fiduciary Income Tax Return Packet, is a document required by the Oklahoma Tax Commission (OTC). It's used by trustees, executors, or administrators of an estate or trust t

Form 513 Oklahoma Resident Fiduciary Income Tax Return Packet and Instructions

What Is Oklahoma Form 513?

Form 513, also referred to as the Oklahoma Resident Fiduciary Income Tax Return Packet, is a document required by the Oklahoma Tax Commission (OTC). It's used by trustees, executors, or administrators of an estate or trust t

-

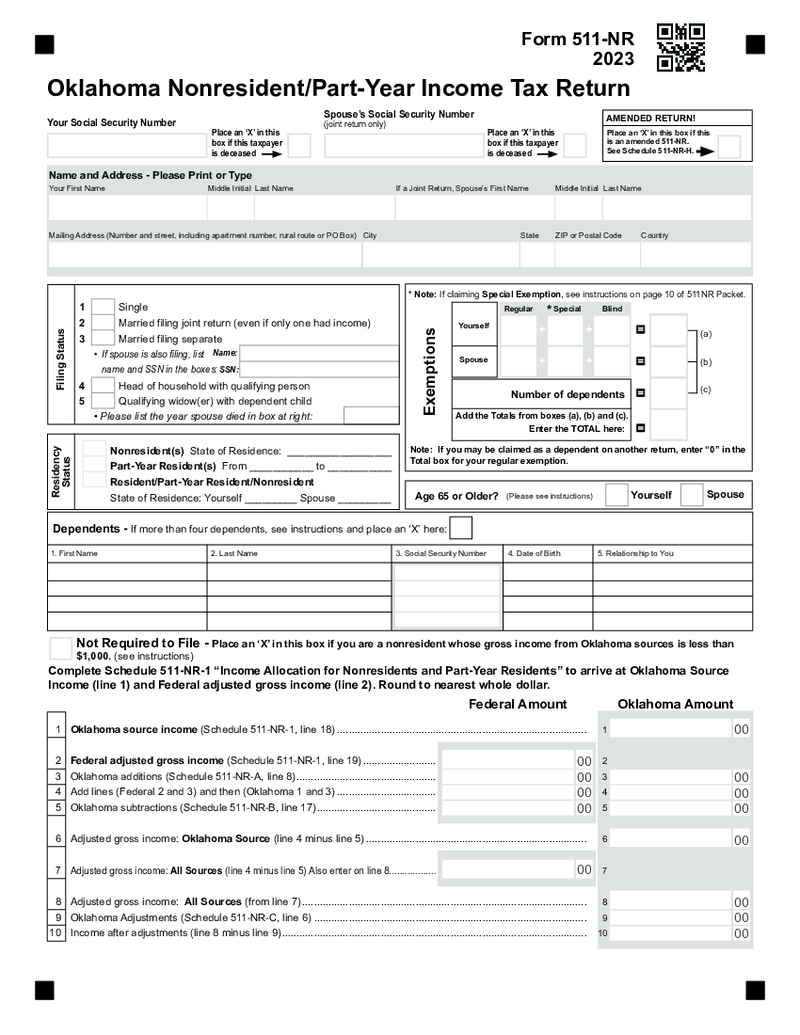

Form 511-NR - Oklahoma Nonresident and Part-Year Resident Income Tax Return Form

Understanding Oklahoma Tax Form NR 511

Filing state income taxes can often be a complex process, especially for those who may not be full-time residents. In Oklahoma, non-residents and part-time residents need to use a special tax form to comply with stat

Form 511-NR - Oklahoma Nonresident and Part-Year Resident Income Tax Return Form

Understanding Oklahoma Tax Form NR 511

Filing state income taxes can often be a complex process, especially for those who may not be full-time residents. In Oklahoma, non-residents and part-time residents need to use a special tax form to comply with stat

-

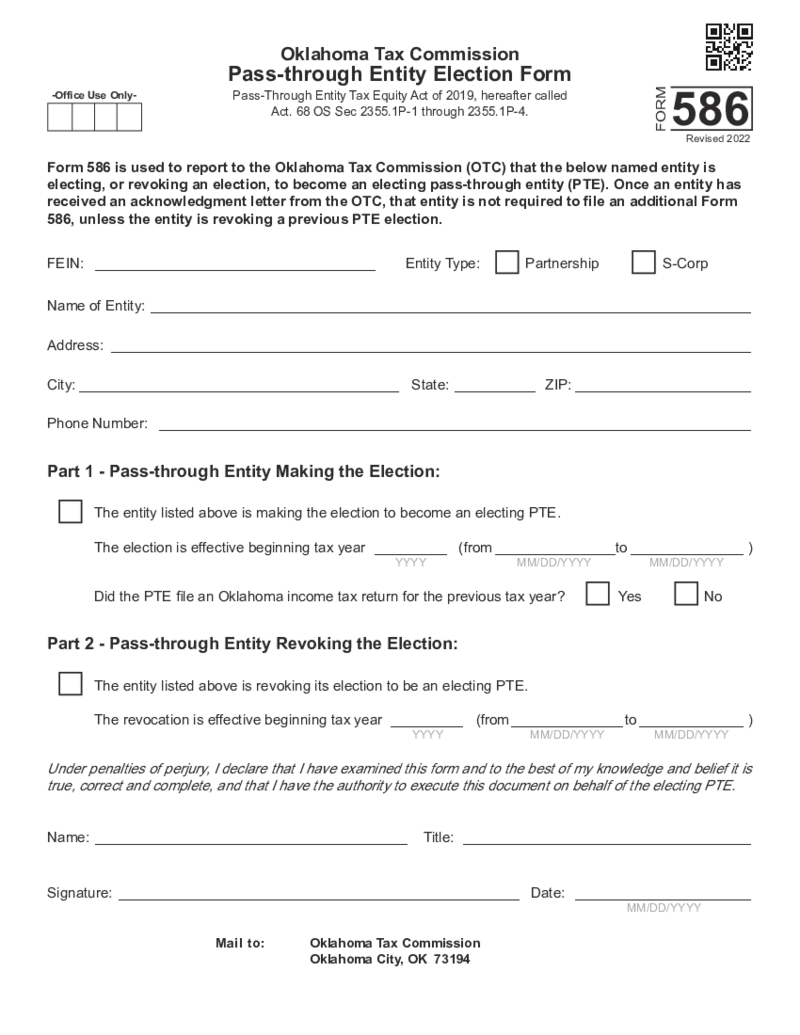

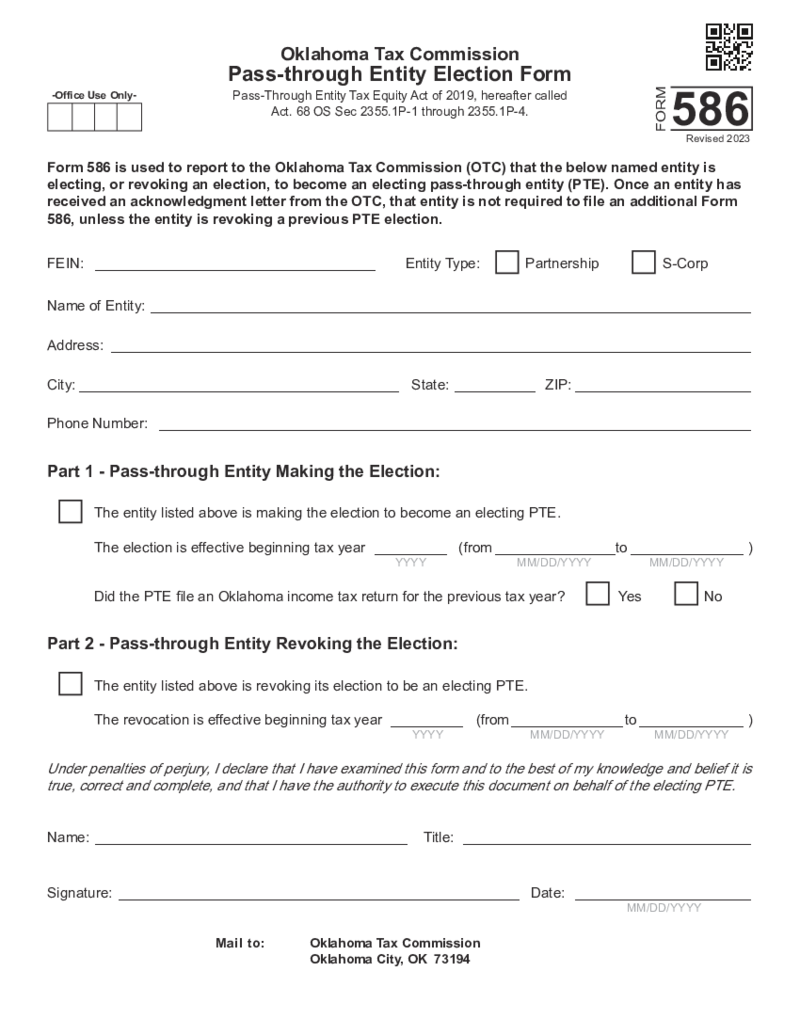

Form 586 Oklahoma Pass-through Entity Election Form (2022)

Form 586 Oklahoma Pass-through Entity Election Form (2022)

Form 586 Oklahoma Pass-through Entity Election Form (2022)

Form 586 Oklahoma Pass-through Entity Election Form (2022)

-

Form 586 Oklahoma Pass-through Entity Election Form

What Is Oklahoma Form 586?

Form 586 is a critical document utilized by certain business entities in the state of Oklahoma. Specifically designed for pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs).

Form 586 Oklahoma Pass-through Entity Election Form

What Is Oklahoma Form 586?

Form 586 is a critical document utilized by certain business entities in the state of Oklahoma. Specifically designed for pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs).

-

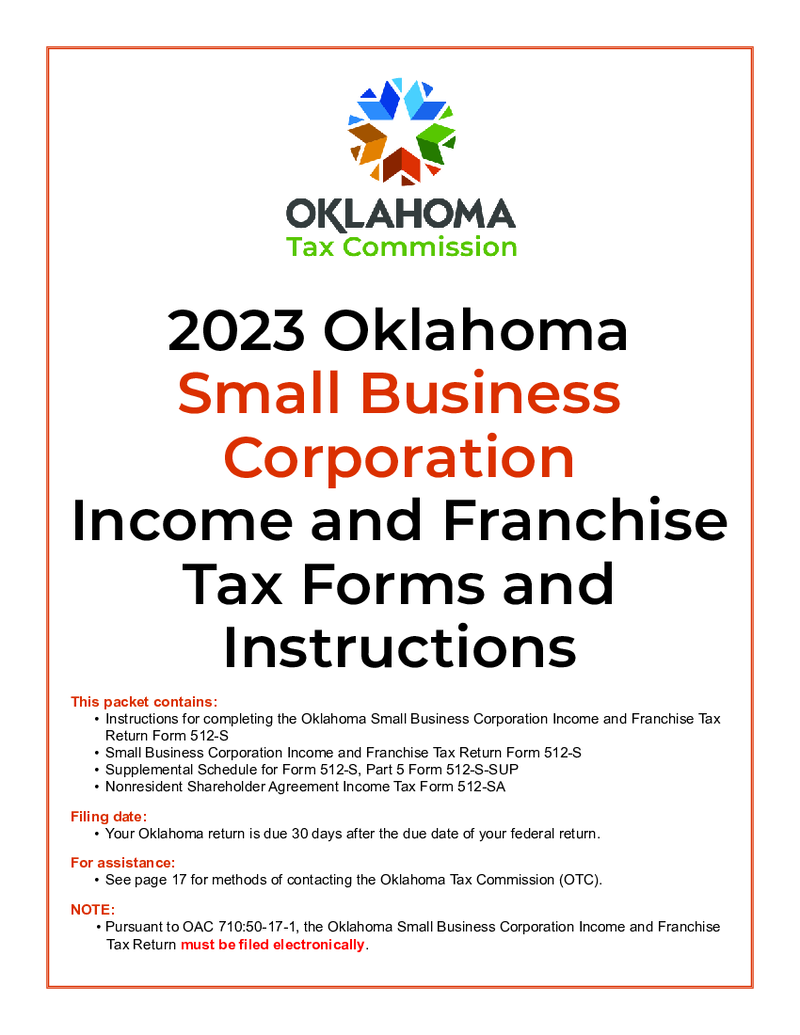

Oklahoma Form 512-S

Understanding the Oklahoma Form 512 S

Navigating state tax forms can be complex, but understanding the Oklahoma Form 512-S is essential for certain entities conducting business within the Sooner State. This specific Oklahoma form is a crucial document for

Oklahoma Form 512-S

Understanding the Oklahoma Form 512 S

Navigating state tax forms can be complex, but understanding the Oklahoma Form 512-S is essential for certain entities conducting business within the Sooner State. This specific Oklahoma form is a crucial document for

-

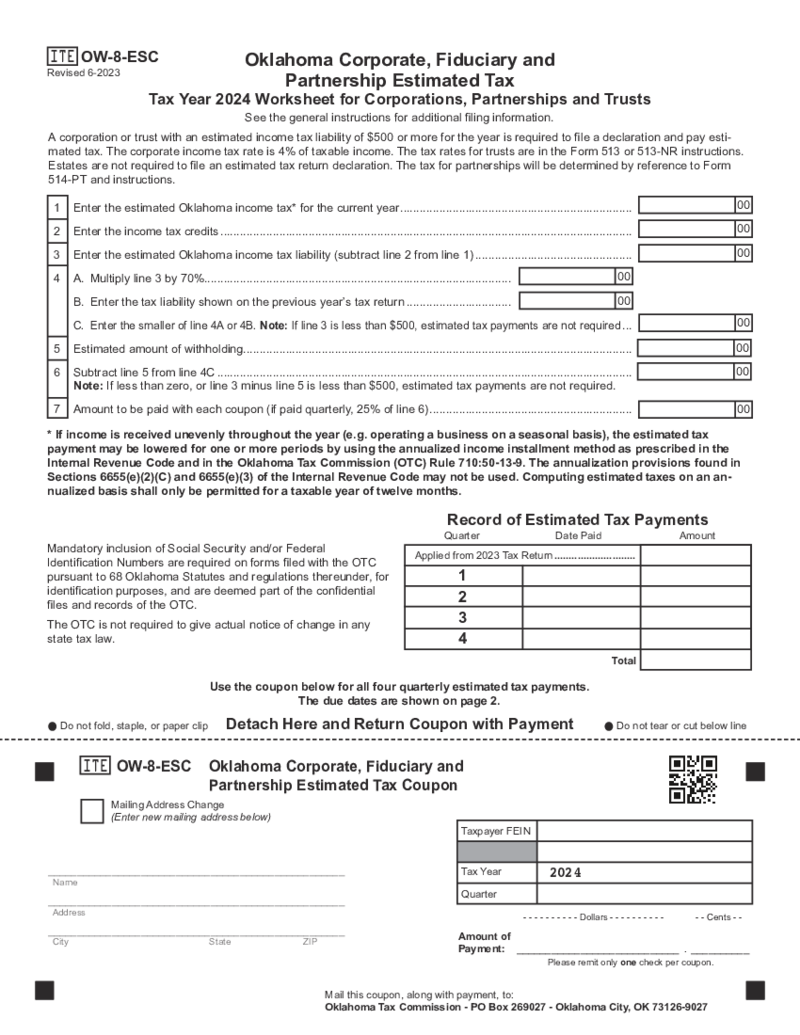

Form OW-8-ESC Oklahoma Corporate

What Is Form OW 8 ESC?

Form OW-8-ESC serves as a tool for Oklahoma corporations to calculate and pay their estimated income taxes quarterly. This form is primarily used by businesses that anticipate owing at least $500 in state income tax after subtractin

Form OW-8-ESC Oklahoma Corporate

What Is Form OW 8 ESC?

Form OW-8-ESC serves as a tool for Oklahoma corporations to calculate and pay their estimated income taxes quarterly. This form is primarily used by businesses that anticipate owing at least $500 in state income tax after subtractin

-

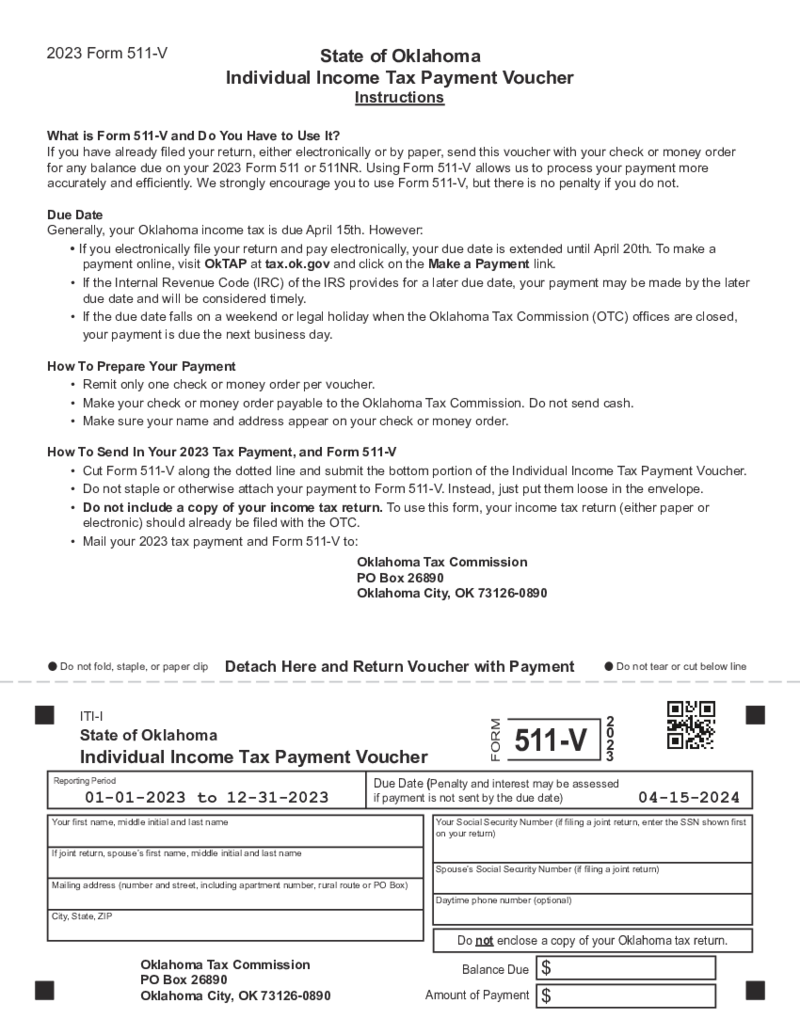

Oklahoma Form 511-V Individual Income Tax Payment Voucher

What Is Oklahoma Tax Form 511 V?

Oklahoma Tax Form 511-V is designed for use by taxpayers who need to make a payment on their state income tax but are not doing so electronically. It serves as a companion document to the primary tax return, ensuring that

Oklahoma Form 511-V Individual Income Tax Payment Voucher

What Is Oklahoma Tax Form 511 V?

Oklahoma Tax Form 511-V is designed for use by taxpayers who need to make a payment on their state income tax but are not doing so electronically. It serves as a companion document to the primary tax return, ensuring that

-

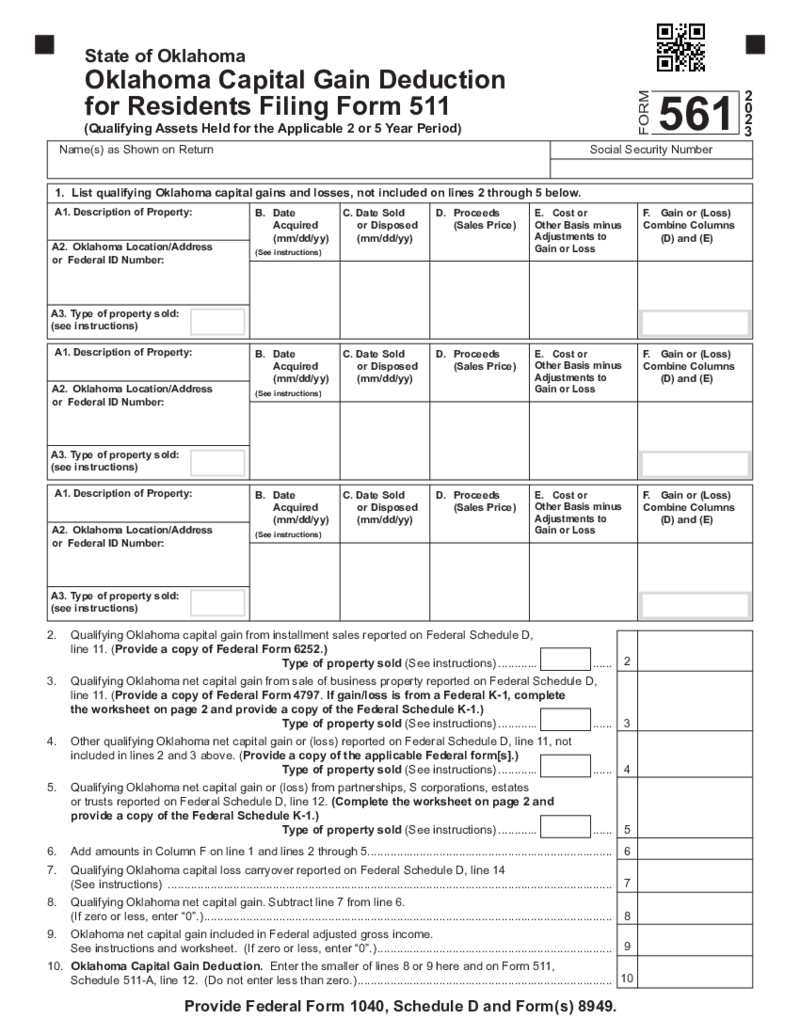

Oklahoma Capital Gain Deduction for Residents Filing Form 511 - Form 561

How to Redact and Fill Out Oklahoma Form 511 Online?

Oklahoma Form 511 is a tax form used by residents of Oklahoma to report and pay their state income tax. To redact and fill out Oklahoma 511 form online, you should follow these steps:

Oklahoma Capital Gain Deduction for Residents Filing Form 511 - Form 561

How to Redact and Fill Out Oklahoma Form 511 Online?

Oklahoma Form 511 is a tax form used by residents of Oklahoma to report and pay their state income tax. To redact and fill out Oklahoma 511 form online, you should follow these steps:

-

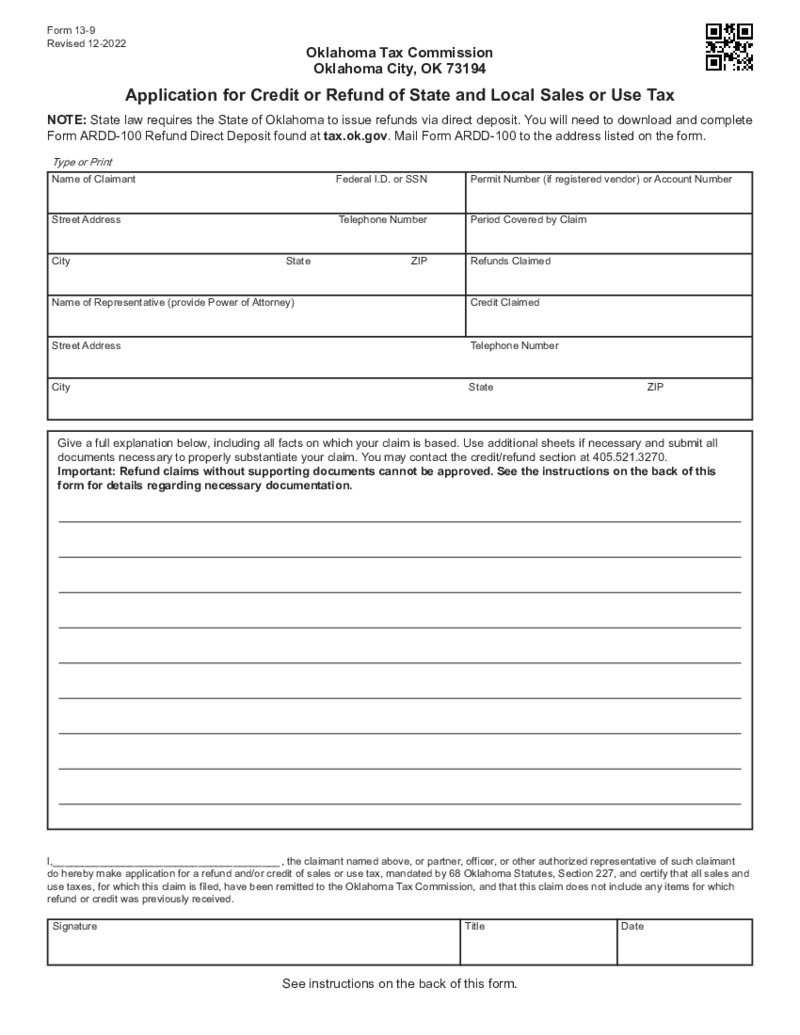

Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax

What Is Form 13 9?

Oklahoma Form 13-9 is a state-specific document utilized by taxpayers to request refunds or credits for overpaid sales or use taxes. These overpayments can occur for various reasons, such as erroneous computations, canceled transactions

Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax

What Is Form 13 9?

Oklahoma Form 13-9 is a state-specific document utilized by taxpayers to request refunds or credits for overpaid sales or use taxes. These overpayments can occur for various reasons, such as erroneous computations, canceled transactions

What are Oklahoma Tax Forms?

If you are looking for Oklahoma tax forms, you are probably a taxpayer who lives and works or a nonresident who works in Oklahoma. There are federal tax templates created by the IRS that have to be filed annually. Apart from that residents of each state have to learn the state documents they need to provide. Normally, both federal and state forms have numerous similarities. Oklahoma income tax forms are mainly created and provided by the State of Oklahoma Tax Commission.

You will find over 45 different tax forms on PDFLiner. The library is growing with the appearance of new templates. Some of these documents can be used for years, others require updated versions. Each of them has a detailed description inside.

Most Popular Oklahoma Tax Forms

Whenever you need state of Oklahoma tax forms, you have to make sure that you’ve picked the right one. This is not the simplest action since you have multiple options in front of you. Some of these templates look the same at the beginning. This is why PDFLiner has descriptions of all Oklahoma tax forms 2022 under the icons. You will be able to pick the one you need. If you know exactly which Oklahoma estimated tax payments 2022 forms are required use the search bar.

Those who just gather templates in their own library for the future can pick forms that are currently on demand. Here is the list of documents you may need as well:

- Forms 561-F. The form is widely known as Oklahoma Capital Gain Deduction for Trusts and Estates Filing Form 513. The name says for itself that you need to send the template after you’ve sent Form 513 or together with it. You need to inform the Oklahoma state of the assets that were held for the applicable holding period of time. Form 513 does not include any capital gains and losses of Oklahoma capital, which you need to report.

- Form EF. Among Oklahoma state income tax forms, this one is the most popular nowadays. This is the Income Tax Declaration form for Electronic Filing in Oklahoma. It goes together with forms 513-NR, 513, 512-S, 512, and 514. You don’t have to send this form to the Oklahoma Tax Commission unless it is requested, even though it was created by this department. Instead, you have to keep it to your own records. You need to include the tax return information, as well as a declaration of the partner or the officer.

- Form 504-C. It is named Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations, Partnerships, and Fiduciaries. You can use this form only if you are a representative of the corporation or other organizations mentioned above. You can’t use it as an individual taxpayer. If you represent yourself you need a 504-I form. Pay attention to the fact that this form does not offer you a delay in time for tax payment. This is one of the Oklahoma state tax forms that provide you time to prepare the document properly.

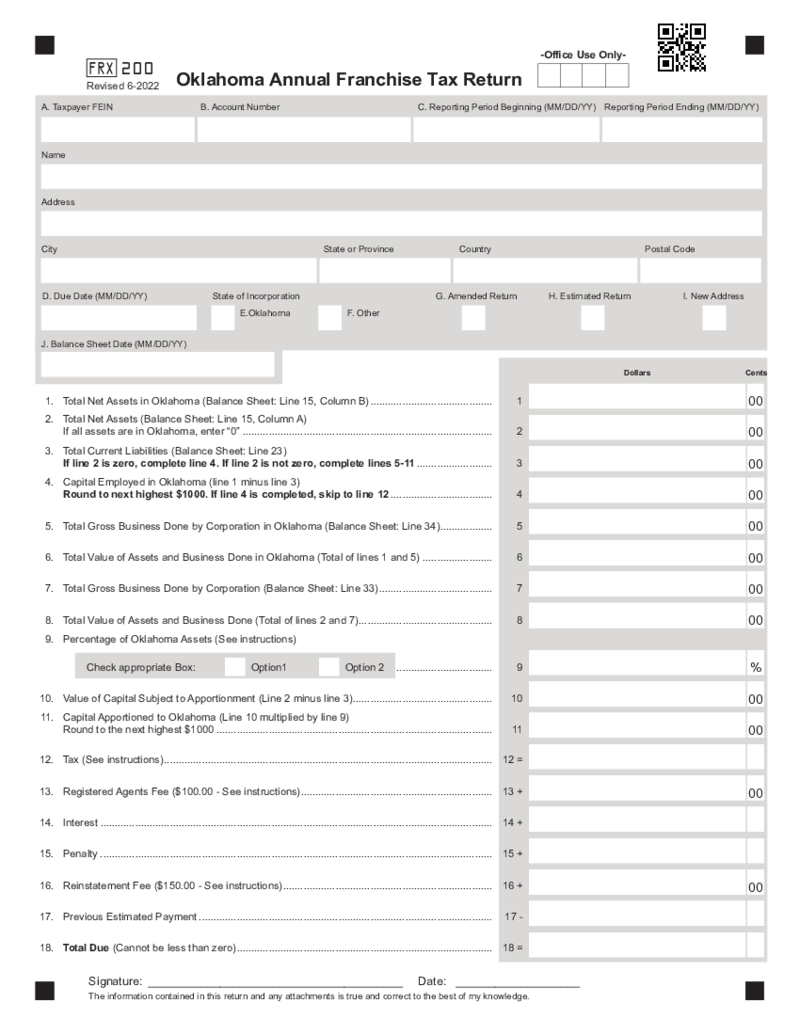

- Form FRX 200. This is an Oklahoma Annual Franchise Tax Return. You need to indicate the FEIN of the taxpayer, the number of accounts, and the reporting period. Name the total net assets and the total gross of your business in Oklahoma. This is not the tax report, and you have to use another form for it.

- Form OTC 998. Its name is State of Oklahoma Application for 100 percent Disabled Veterans Real Property Tax Exemption. Before you fill it out, make sure you have an updated version for this year. Provide information on the applicant and the partnership as well.

Where to Get Oklahoma Tax Forms?

You can find any documents you need online, from Oklahoma unemployment tax forms to partnerships and sales taxes. The most popular source is the official website of the Tax Commission of Oklahoma State. Yet, it is not the quickest way since you need to dig through numerous forms that can’t be related to taxes at all. If you are looking for the form you can try PDFLiner. It has a well-organized library with a description of each form. Here is what you need to do once you found Oklahoma state tax return forms on PDFLiner:

- Choose the document you need on the page.

- Press Fill Online icon there.

- Wait till the form is opened and complete its sections.

- Send the form to the other party. You may sign it electronically via PDFLiner too.

FAQ:

-

Where to send Oklahoma tax forms?

You can send Oklahoma tax return forms to the Oklahoma Tax Commission if it is indicated in the form. There are detailed instructions on how and where to send them. Normally the officials prefer to receive electronic documents via email or download them online via the website. If there is a requirement to send the form by regular mail the address is included in the form.

-

Where to mail Oklahoma tax forms?

If you are not sure where to send the form, and there is no instruction in the document, contact Oklahoma Tax Commission. Before you do that, you can check out their website. If there are no specific rules, ask the support team.