-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Colorado Tax Forms

-

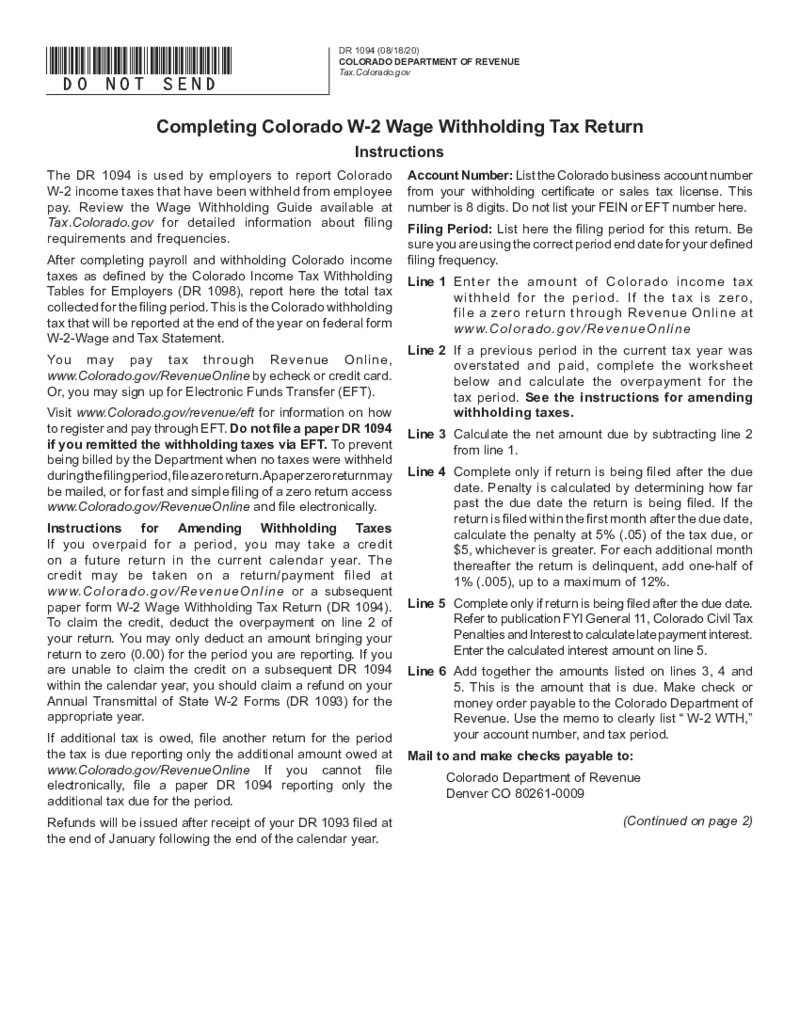

Colorado W-2 Wage Withholding Tax Return

What is Colorado W-2 Wage Withholding Tax Return?

The Colorado W-2 is a tax form that employers must file to report the income earned by their employees and the taxes withheld from their wages. The Colorado Department of Revenue uses the information provi

Colorado W-2 Wage Withholding Tax Return

What is Colorado W-2 Wage Withholding Tax Return?

The Colorado W-2 is a tax form that employers must file to report the income earned by their employees and the taxes withheld from their wages. The Colorado Department of Revenue uses the information provi

-

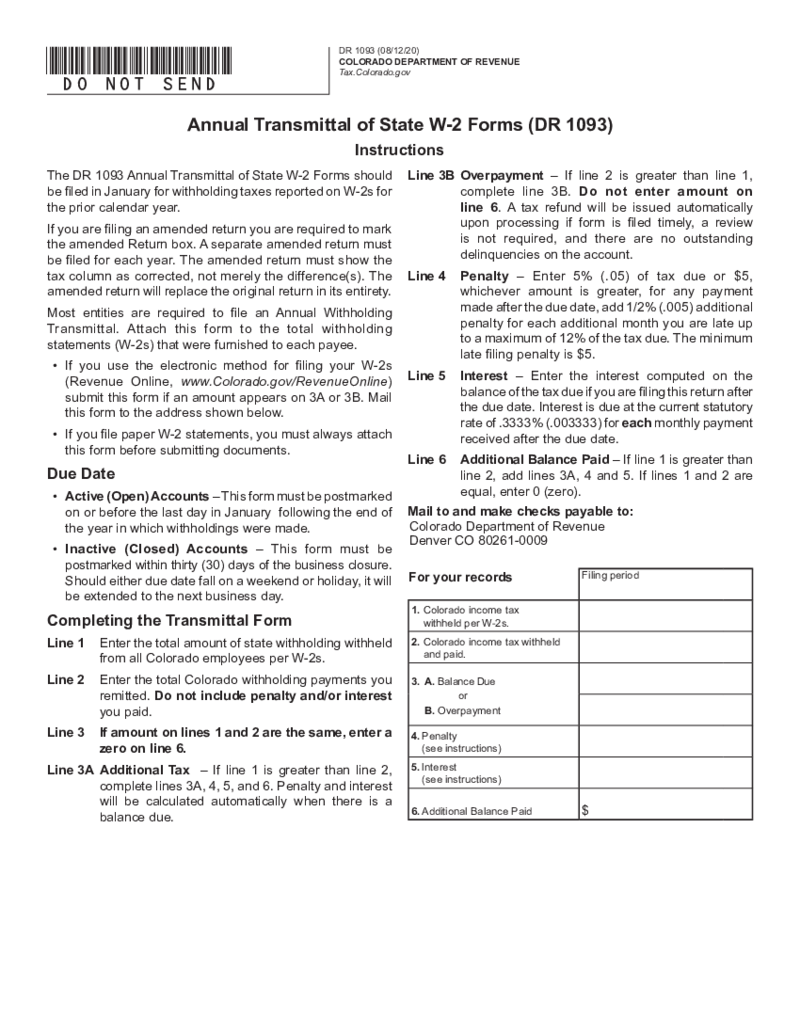

Colorado Annual Transmittal of State W-2

Understanding Colorado Annual Transmittal of State W 2 Forms

Submitting tax documents is a fundamental responsibility for employers in Colorado, and it includes the Colorado Annual Transmittal of State W-2 forms. This

Colorado Annual Transmittal of State W-2

Understanding Colorado Annual Transmittal of State W 2 Forms

Submitting tax documents is a fundamental responsibility for employers in Colorado, and it includes the Colorado Annual Transmittal of State W-2 forms. This

-

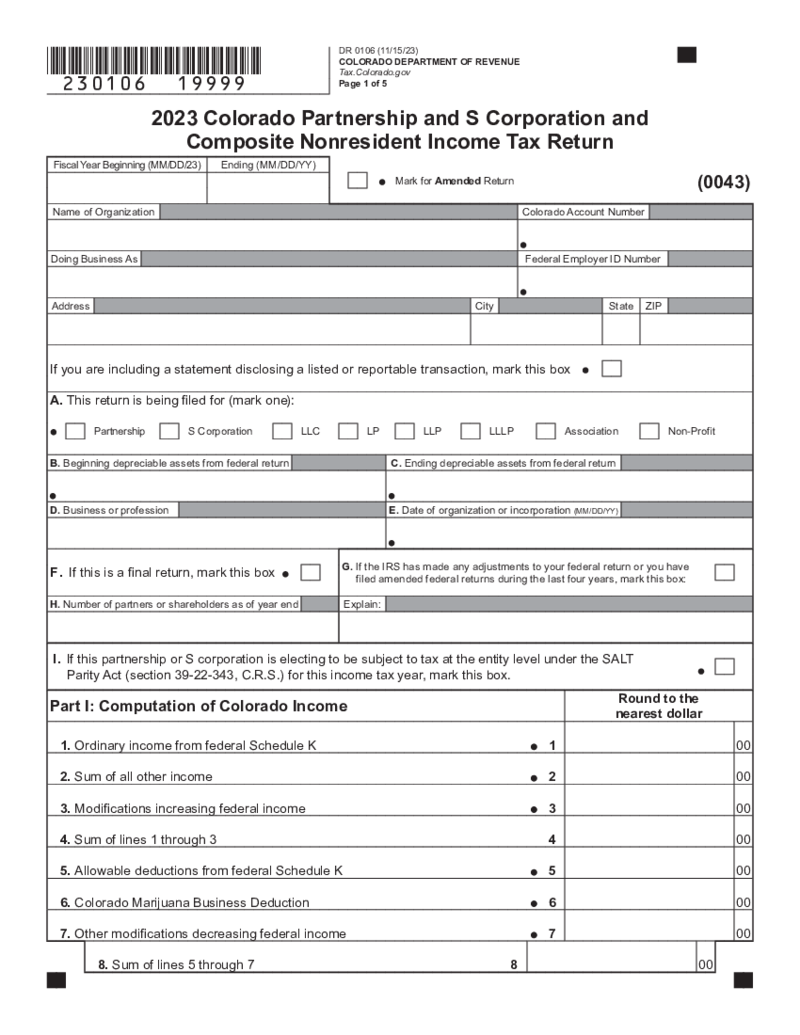

Colorado Form 106

What Is a Form 106 Colorado?

Colorado Form 106 is the state's annual report form that most businesses in Colorado are required to file. It is also known as the "Periodic Report" or "Statement of Trade Name" form. The Colorado Secre

Colorado Form 106

What Is a Form 106 Colorado?

Colorado Form 106 is the state's annual report form that most businesses in Colorado are required to file. It is also known as the "Periodic Report" or "Statement of Trade Name" form. The Colorado Secre

-

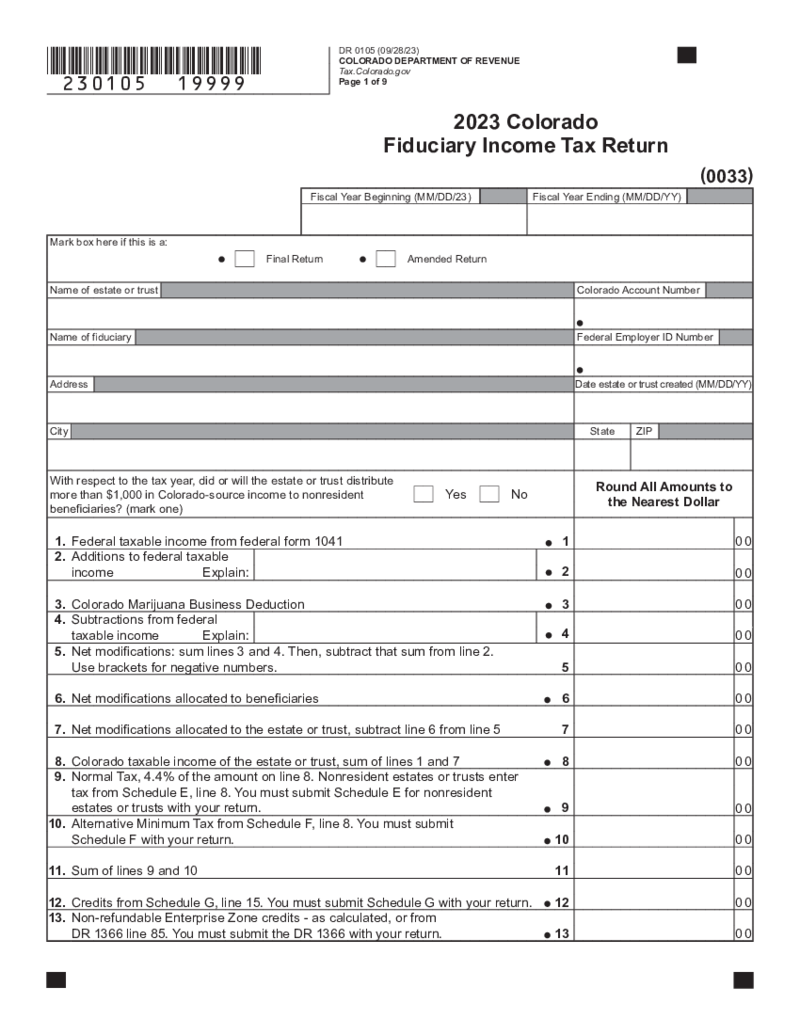

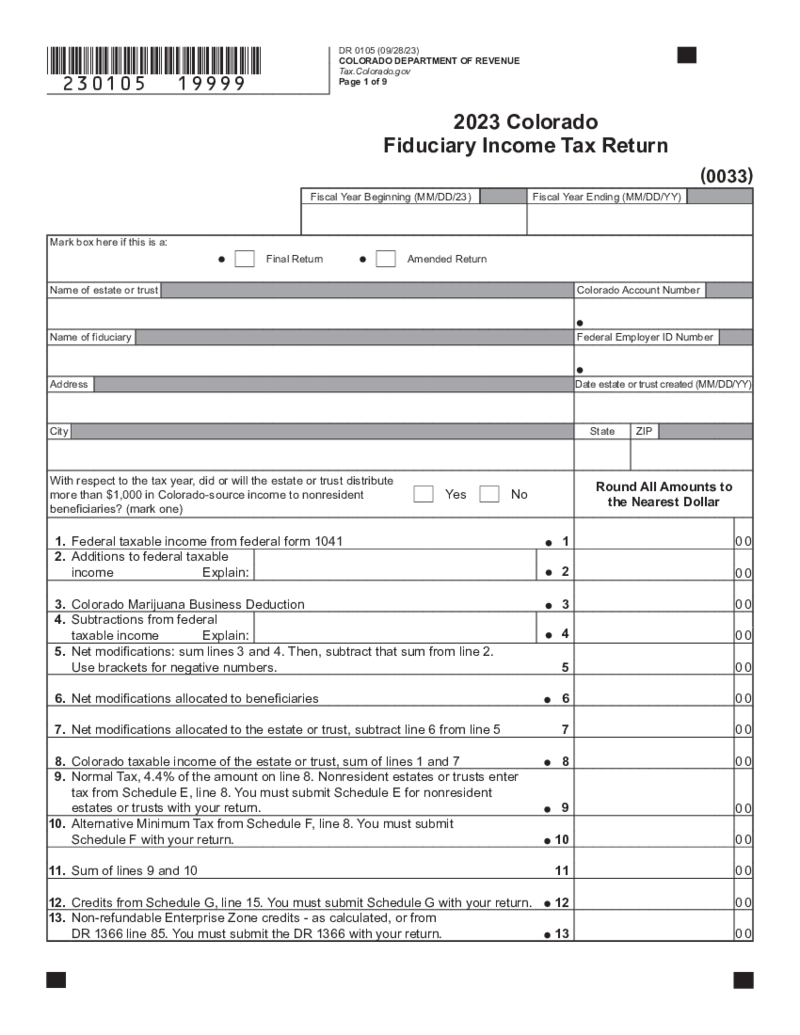

Fiduciary Income Tax Return Colorado

What Is Colorado Fiduciary Income Tax Return

When managing estates and trusts in Colorado, understanding the fiduciary income tax return is essential. This specific tax document, formally known as form 1041, pertains to income from estate

Fiduciary Income Tax Return Colorado

What Is Colorado Fiduciary Income Tax Return

When managing estates and trusts in Colorado, understanding the fiduciary income tax return is essential. This specific tax document, formally known as form 1041, pertains to income from estate

-

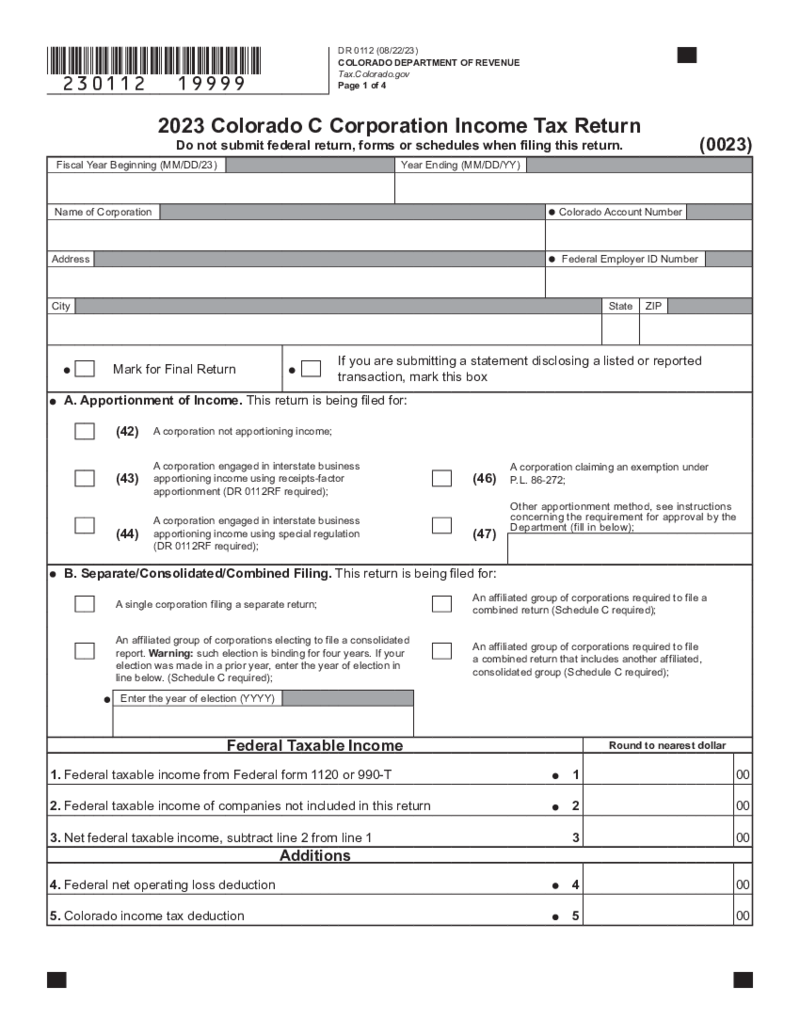

Colorado Form 112

What is Colorado Form 112?

The "Form 112 Colorado" is the official state income tax return document that C corporations are required to file in Colorado. This document allows businesses to report their income, calculate their Colorado tax liabil

Colorado Form 112

What is Colorado Form 112?

The "Form 112 Colorado" is the official state income tax return document that C corporations are required to file in Colorado. This document allows businesses to report their income, calculate their Colorado tax liabil

-

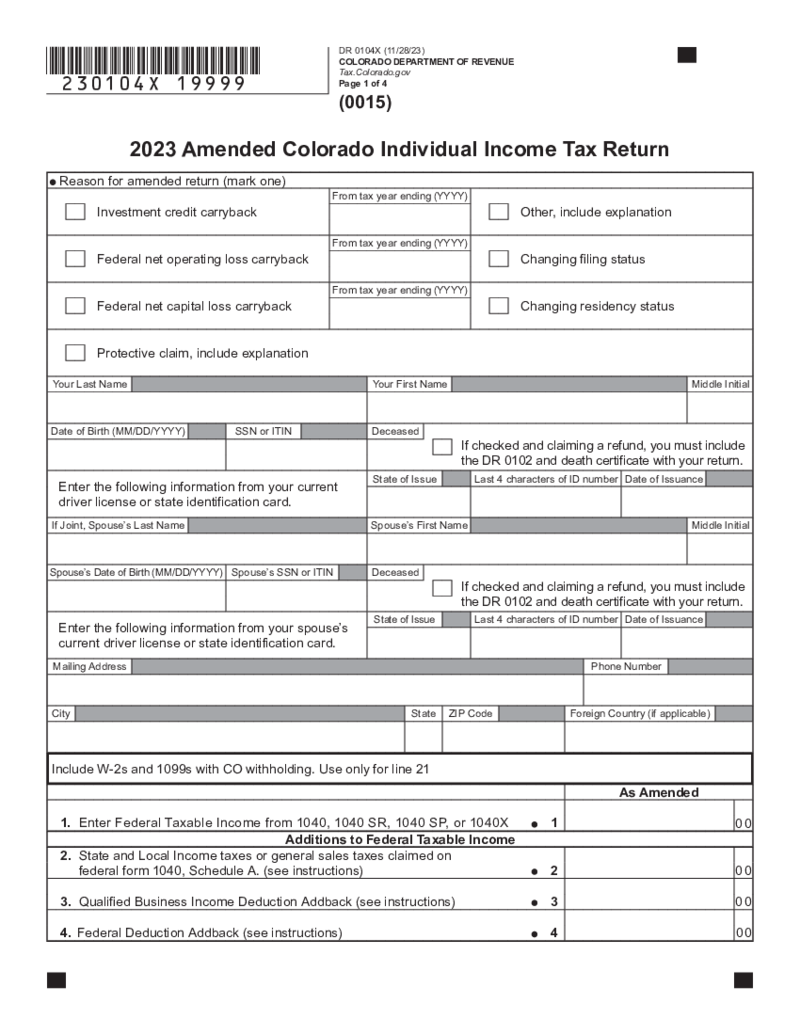

Form 104X Amended Colorado Individual Income Tax Return

What is Colorado Form 104X

Before we delve into the details, it's essential to understand what the 104X form is and why it's crucial for Colorado residents. Colorado Form 104X, also recognized as the IRS Form 104X, is a document utilized by taxpay

Form 104X Amended Colorado Individual Income Tax Return

What is Colorado Form 104X

Before we delve into the details, it's essential to understand what the 104X form is and why it's crucial for Colorado residents. Colorado Form 104X, also recognized as the IRS Form 104X, is a document utilized by taxpay

-

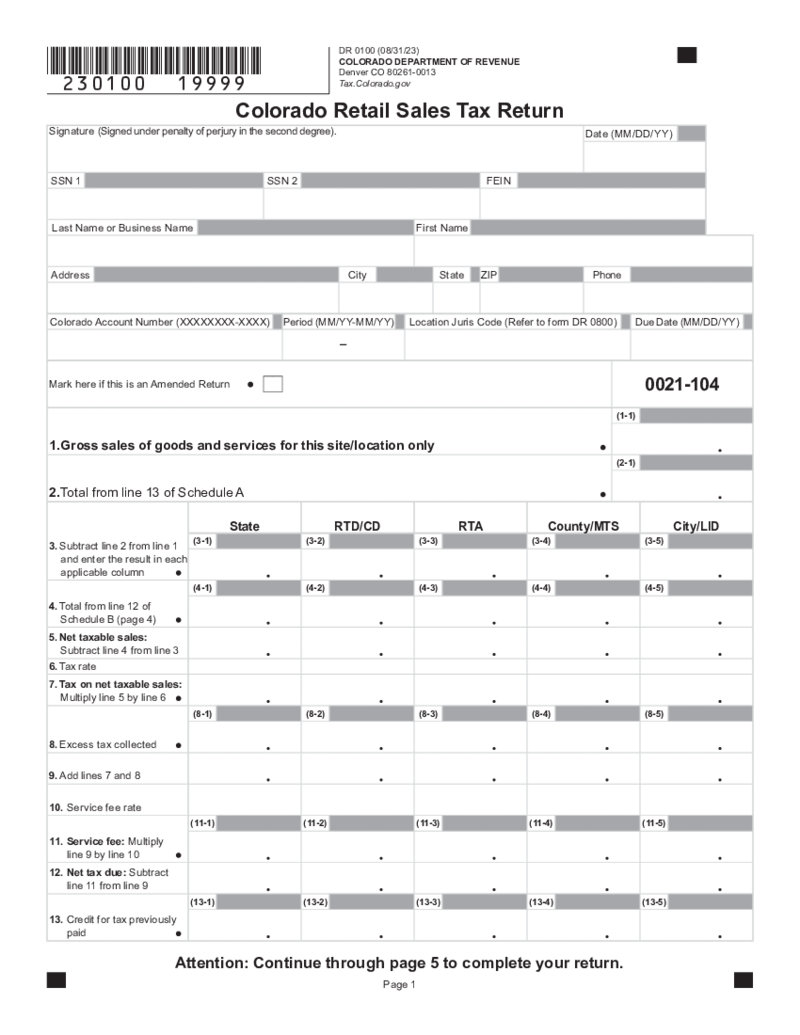

Colorado Retail Sales Tax Return

Understanding the Colorado Retail Sales Tax Return Form

Colorado retail sales tax return form is a document that every retail business in the state needs to fill out and submit to the Colorado Department of Revenue. This form reports sales, calculates tax

Colorado Retail Sales Tax Return

Understanding the Colorado Retail Sales Tax Return Form

Colorado retail sales tax return form is a document that every retail business in the state needs to fill out and submit to the Colorado Department of Revenue. This form reports sales, calculates tax

-

Colorado Fiduciary Income Tax Return

What Is a Colorado Fiduciary Income Tax Return?

A fiduciary income tax return is filed on behalf of a trust or estate to report income, deductions, and credits to the state tax authority. In Colorado, this form is an acknowledgement of the responsibility

Colorado Fiduciary Income Tax Return

What Is a Colorado Fiduciary Income Tax Return?

A fiduciary income tax return is filed on behalf of a trust or estate to report income, deductions, and credits to the state tax authority. In Colorado, this form is an acknowledgement of the responsibility

-

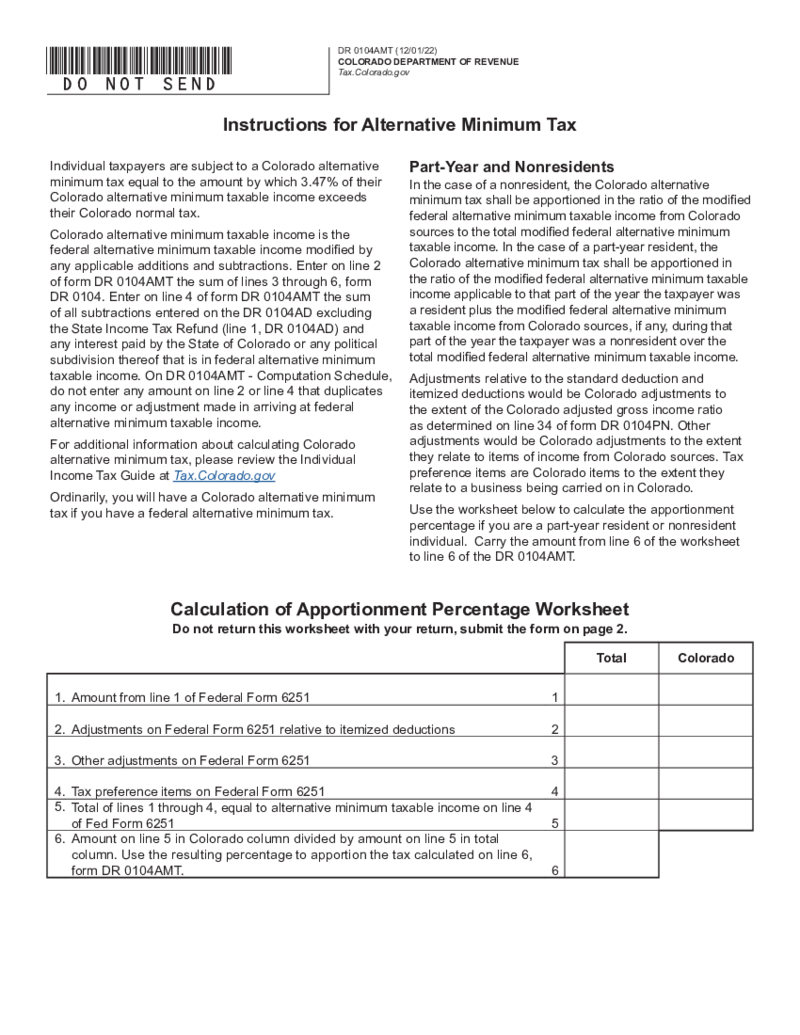

Colorado Form 104AMT (2022)

What Is Colorado Tax Form 104AMT

Colorado Tax Form 104AMT is a tool for calculating the Alternative Minimum Tax (AMT) for state residents. AMT ensures that taxpayers with substantial income cannot excessively reduce their tax liability th

Colorado Form 104AMT (2022)

What Is Colorado Tax Form 104AMT

Colorado Tax Form 104AMT is a tool for calculating the Alternative Minimum Tax (AMT) for state residents. AMT ensures that taxpayers with substantial income cannot excessively reduce their tax liability th

-

Colorado Tax Booklet

What Is A Colorado Tax Booklet

The Colorado Tax Booklet is a comprehensive resource provided by the Colorado Department of Revenue for taxpayers in the state. It encompasses all the information and forms re

Colorado Tax Booklet

What Is A Colorado Tax Booklet

The Colorado Tax Booklet is a comprehensive resource provided by the Colorado Department of Revenue for taxpayers in the state. It encompasses all the information and forms re

-

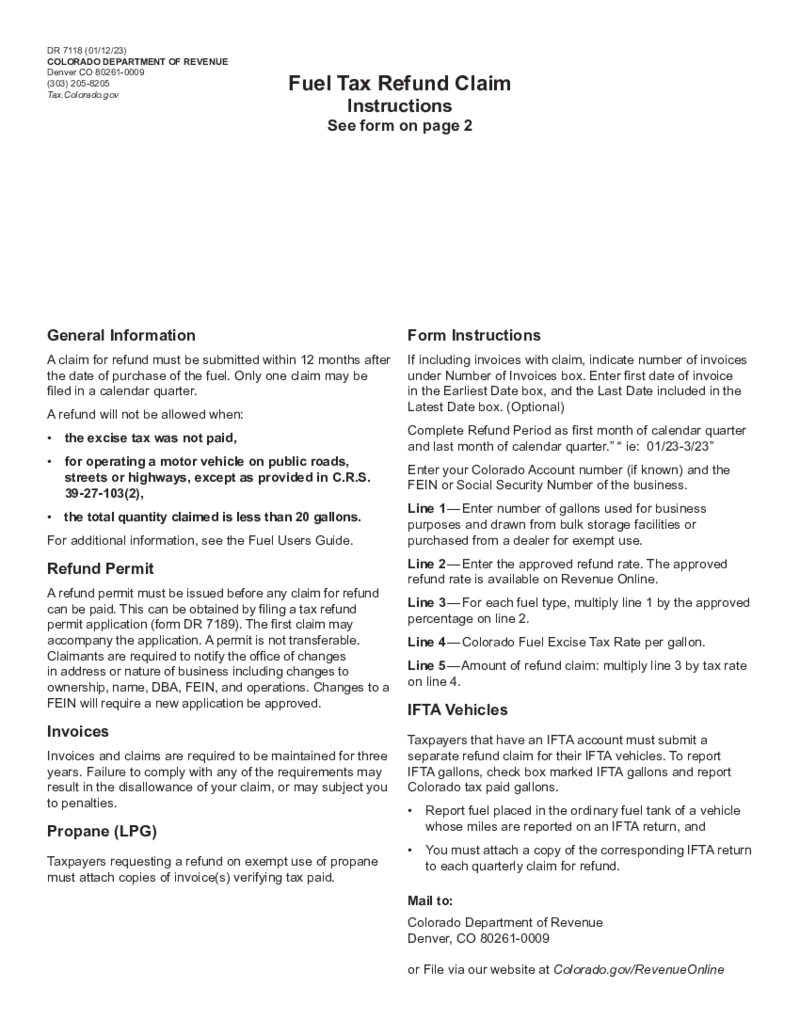

Fuel Tax Refund Claim

What Is Fuel Tax Refund Claim

Fuel tax is a levy imposed on the sale of fuel used for transportation purposes. However, when the fuel is utilized in a manner that does not pertain to its taxable purpose, taxpayers may be eligible for a Fu

Fuel Tax Refund Claim

What Is Fuel Tax Refund Claim

Fuel tax is a levy imposed on the sale of fuel used for transportation purposes. However, when the fuel is utilized in a manner that does not pertain to its taxable purpose, taxpayers may be eligible for a Fu

-

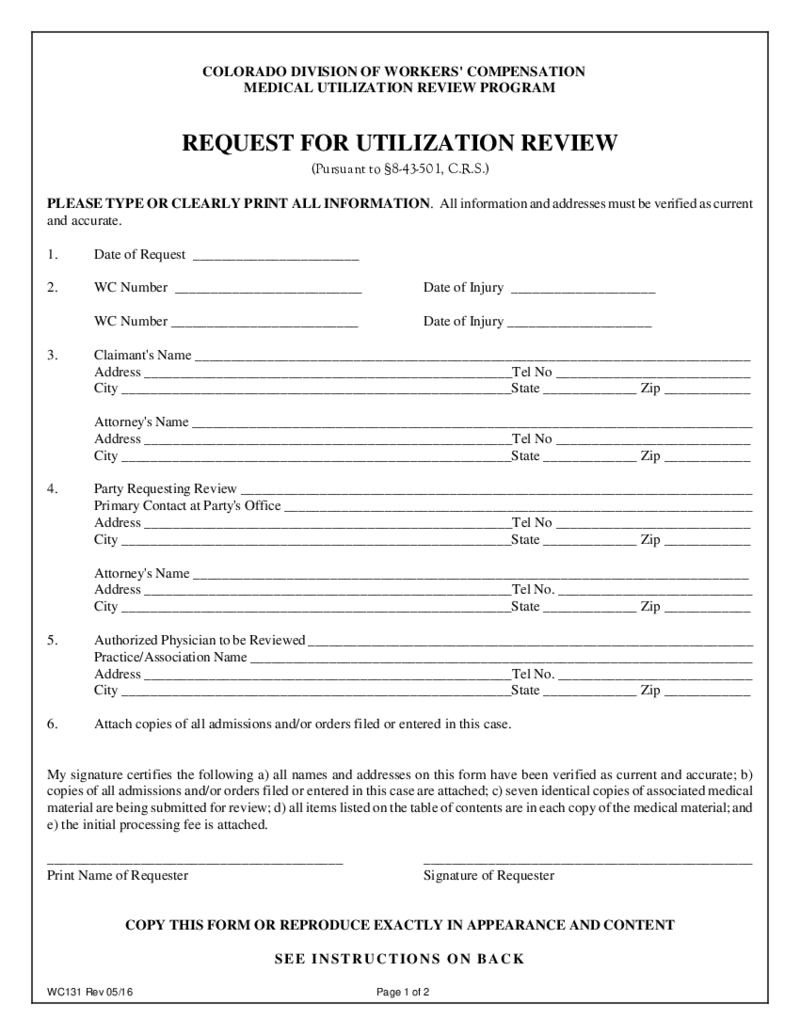

Colorado Division of Workers Compensation

What Is A Colorado Division Of Worker's Compensation

The Colorado Division of Worker's Compensation is a vital state agency responsible for overseeing the administration and regulation of workers' compensation claims within Co

Colorado Division of Workers Compensation

What Is A Colorado Division Of Worker's Compensation

The Colorado Division of Worker's Compensation is a vital state agency responsible for overseeing the administration and regulation of workers' compensation claims within Co

What are Colorado Tax Forms?

Colorado tax forms are made for taxpayers who live and work in Colorado State. The forms have multiple similarities with federal tax forms but are provided by local authorities. The Colorado Department of Revenue usually accepts these documents from taxpayers in order to keep track of the income and taxes that must be paid.

PDFLiner contains numerous different state of Colorado tax forms related to income. The library is constantly growing. You will find any template you need there from the wage withholding tax return to the monthly report of the excise tax for alcoholic beverages. There are forms for individuals and corporations. They all are official and must be sent by the deadline indicated in each form.

Most Popular Colorado Tax Forms

There are 35 Colorado income tax forms on PDFLiner dedicated to specific cases. If you need one of them and you know which one, simply use the search bar. However, if you don’t know which tax form you need, don’t worry, you will find a detailed description for everyone. Here is the list of the most demanded Colorado department of revenue tax forms by users. Maybe you will find what you need among them:

- Form W-2. This is a Colorado Wage Withholding Tax Return form made for any employer who works in Colorado and has employees. This employer needs to provide the exact numbers on the taxes withheld from each worker. Colorado income taxes must be calculated with the help of Colorado Income Tax Withholding Tables for Employers. You have to provide the numbers at the end of the year, till the deadline. There is a similar W-2 Wage and Tax Statement you have to send to the IRS.

- Form 104X. The document is known as the Amended Colorado Individual Income Tax Return. You can use this form right after the 104 form if you need to fix mistakes you’ve made there. You have to indicate the year in the form. Among Colorado state income tax forms you definitely need this one to keep close, since you may always be required to make corrections. The Colorado Department of Revenue offers you to send this template electronically to them. The document must be filed with attachments, including all the documents that were sent during the original report.

- Corporate Income Tax form. A corporation that resides in Colorado needs to pay a specific amount of money if it expects to see profit and its possible net tax liability can teach and even exceed $5,000 for the next year. In this case, there are rules for the taxes on the income that the corporation has to pay. The template was created by the Colorado Department of Revenue to help corporations to calculate their taxes and make sure they are paying the exact amount that is expected.

- Colorado Retail Sales Tax Return. The form is widely used by retailers. It is filed for every indicated period of time even if there were no sales. Without sales, there are no taxes that can be taken. However, you need to specify this situation. Usually, the Colorado Department of Revenue requires the report for every month.

- Form DR 0204. This is a Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax. If you don’t pay taxes in the arranged time, you become subject to a tax penalty. In this case, you have to provide the report.

Where to Get Colorado Tax Forms?

All Colorado state tax forms can be found on the official website of the Colorado Department of Revenue. There are numerous documents related and unrelated to the taxes, which make the search process slightly longer than you may want. Another option is to open the form on PDFLiner. This service has a neatly gathered collection of Colorado forms dedicated to taxes. Moreover, since PDFLiner is an editor, you can open any form and complete it online there, using advanced tools. Here is how you can open 2022 Colorado estimated tax forms:

- Find the form you were looking for there.

- Press the Fill Online button.

- When you see the page of the form, complete it.

- If you need, you can sign the form electronically and send it.

Where to Send Colorado State Tax Forms?

Once you complete Colorado estimated tax forms 2022 you have to send them to the address indicated in the document. Normally the Colorado Department of Revenue accepts electronic versions of the templates. You may send them online via their official website or using the electronic address provided in the form. Sometimes they require forms by regular mail, in this case, you can simply print the form and send it to the box mentioned in the instructions. If the form can be sent electronically use PDFLiner to do that. You can save the copy on your device just in case. Don’t forget to follow deadlines.