-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Form Arkansas No-Fault Divorce (Minor Children)

Form Arkansas No-Fault Divorce (Minor Children)

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Minnesota Tax Forms

-

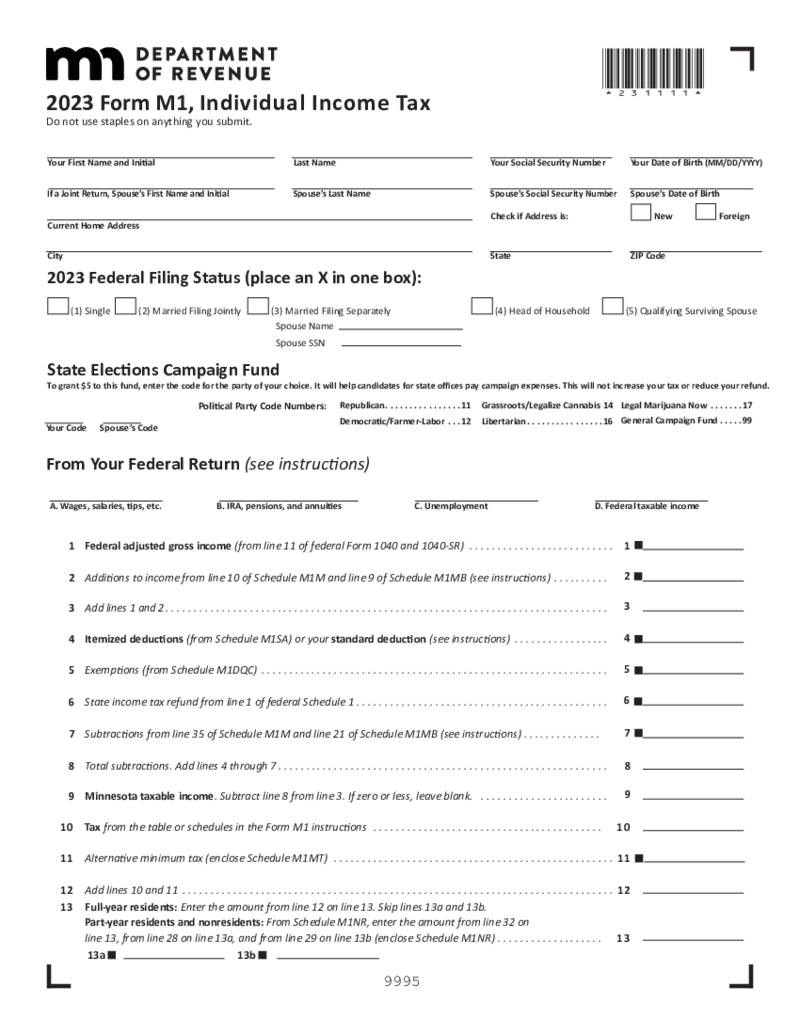

Minnesota Form M1

What Is M1 Minnesota Tax Form?

The M1 Minnesota tax form is the primary document used by taxpayers in the state of Minnesota to file their state income tax returns. This form is designed for both residents and nonresidents who have earned income within th

Minnesota Form M1

What Is M1 Minnesota Tax Form?

The M1 Minnesota tax form is the primary document used by taxpayers in the state of Minnesota to file their state income tax returns. This form is designed for both residents and nonresidents who have earned income within th

-

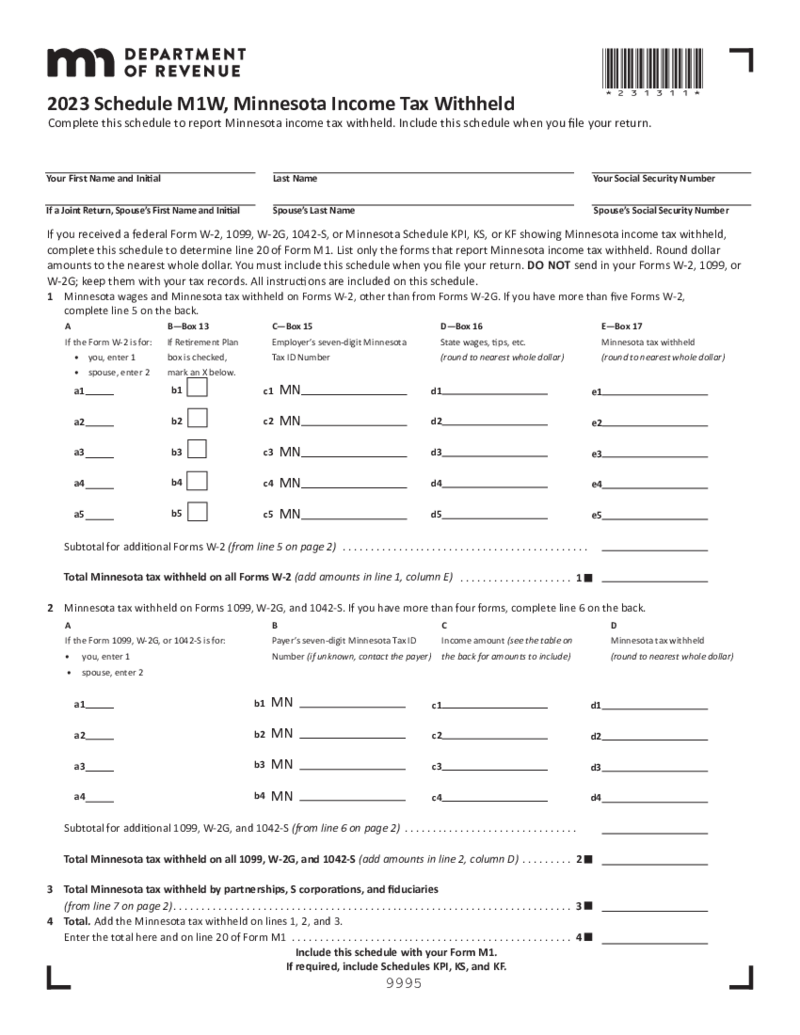

Minnesota Schedule M1W

What Is Minnesota Tax Schedule M1W?

MN Schedule M1W is a form used by Minnesota residents to report the state income tax withheld from their earnings. It accompanies the main tax return document and serves as a detailed account of the amount withheld from

Minnesota Schedule M1W

What Is Minnesota Tax Schedule M1W?

MN Schedule M1W is a form used by Minnesota residents to report the state income tax withheld from their earnings. It accompanies the main tax return document and serves as a detailed account of the amount withheld from

-

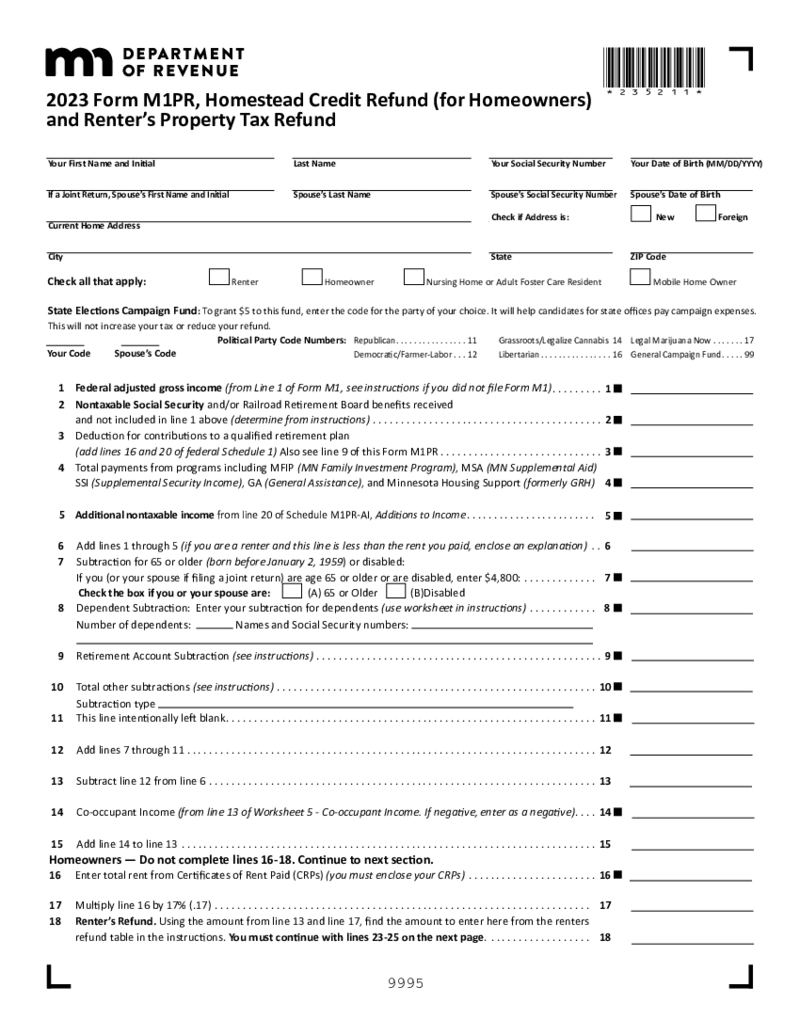

Minnesota Property Tax Refund Form M1PR

Understanding the Minnesota Property Tax Refund Form M1PR

Minnesota residents may apply for a property tax refund using the M1PR Minnesota tax form. This can help to alleviate the burden of property taxes for homeowners and renters alike, ensuring that in

Minnesota Property Tax Refund Form M1PR

Understanding the Minnesota Property Tax Refund Form M1PR

Minnesota residents may apply for a property tax refund using the M1PR Minnesota tax form. This can help to alleviate the burden of property taxes for homeowners and renters alike, ensuring that in

-

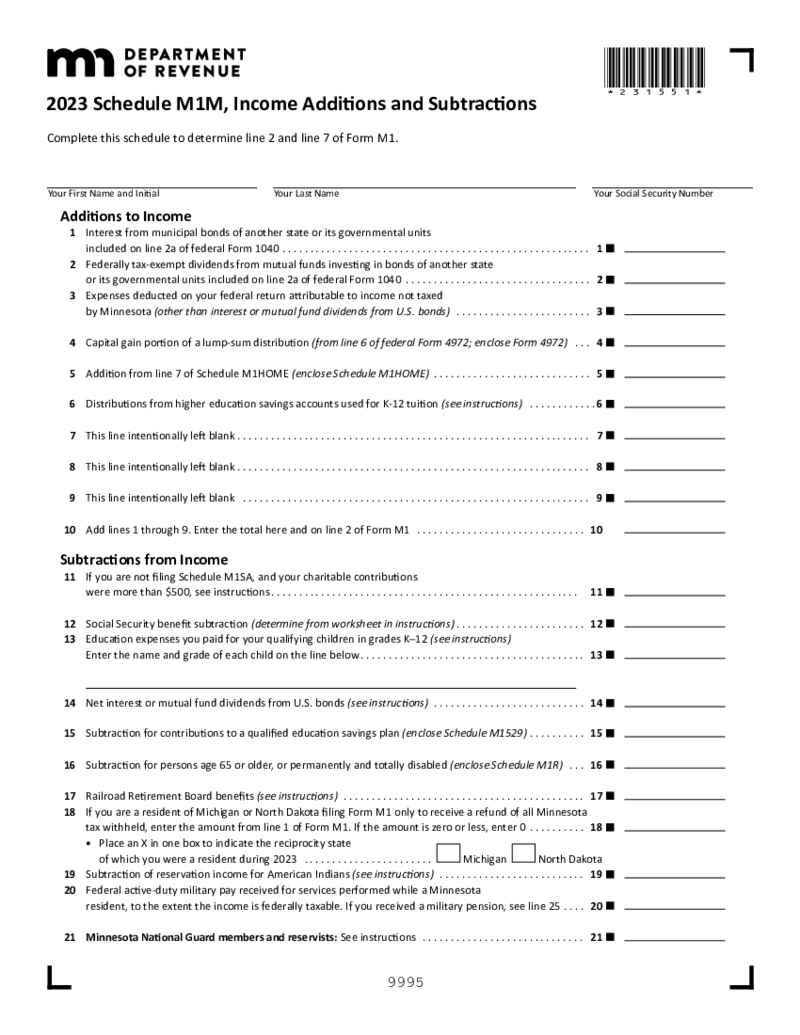

Minnesota Schedule M1M

What is Schedule M1M

Minnesota Schedule M1M is a supplemental schedule for the Form M1 individual income tax return. Taxpayers who need to report income additions, subtractions, or adjustments to their federal adjusted gross income must complete and attac

Minnesota Schedule M1M

What is Schedule M1M

Minnesota Schedule M1M is a supplemental schedule for the Form M1 individual income tax return. Taxpayers who need to report income additions, subtractions, or adjustments to their federal adjusted gross income must complete and attac

-

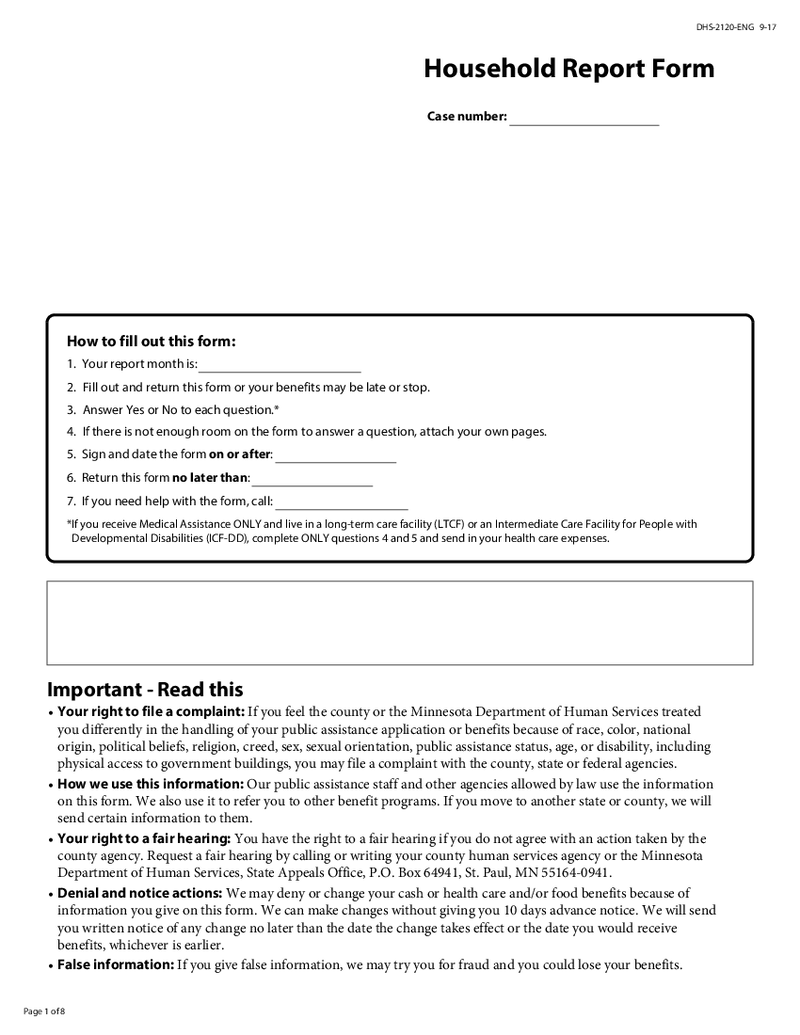

Household Report Form DHS-2120-ENG

What Is the Household Report Form?

The DHS 2120 household report form serves multiple functions for reporting household changes. From income modification to family member additions or subtractions, the form seeks to capture significant shifts that could p

Household Report Form DHS-2120-ENG

What Is the Household Report Form?

The DHS 2120 household report form serves multiple functions for reporting household changes. From income modification to family member additions or subtractions, the form seeks to capture significant shifts that could p

-

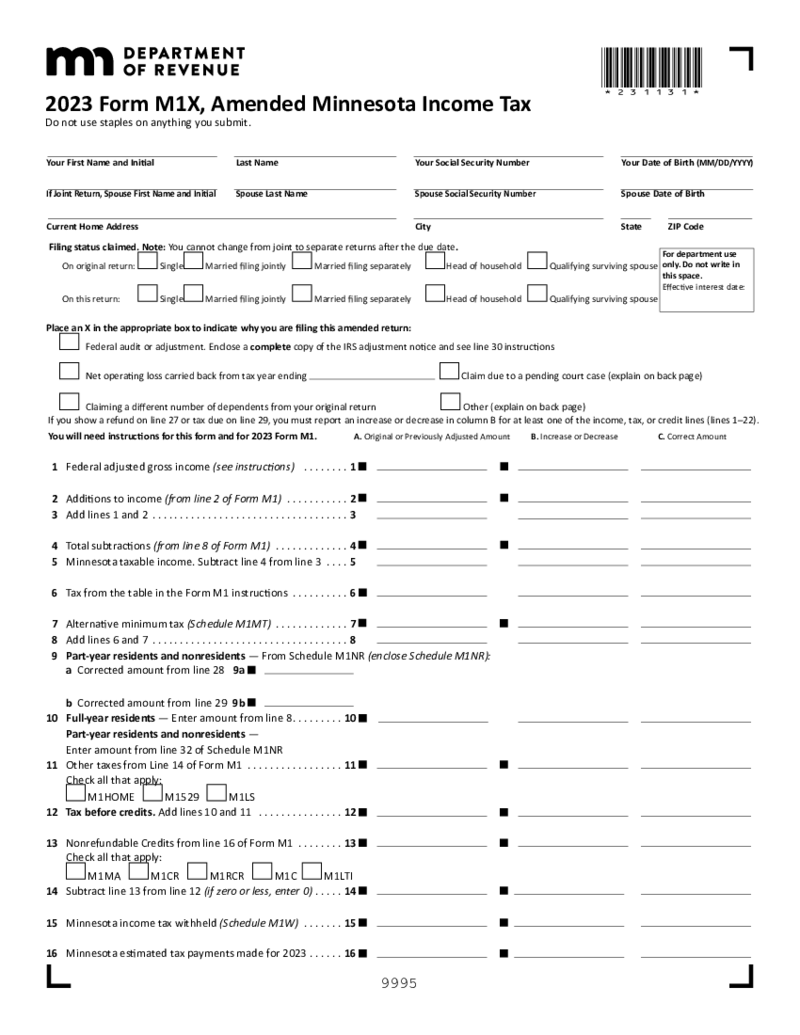

Minnesota Form M1X

Understanding M1X Minnesota Tax Form

When it comes to amending your state tax returns, understanding the Minnesota Form M1X is crucial. This document is used by Minnesota residents to make changes to their already filed state income tax returns. Whether y

Minnesota Form M1X

Understanding M1X Minnesota Tax Form

When it comes to amending your state tax returns, understanding the Minnesota Form M1X is crucial. This document is used by Minnesota residents to make changes to their already filed state income tax returns. Whether y

What are Minnesota Tax Forms?

Minnesota tax forms were created by the Minnesota Department of Revenue for all taxpayers who live or work in the state. They are made to ease the calculation and recording of income you received during the year or month, based on the form’s specifics. Many forms made by local officials have similarities with the national templates created by the IRS. You have to complete both national and state documents by the deadlines provided by officials.

PDFLiner offers a constantly growing library of documents. You may find Minnesota property tax refund forms or annual tax reports in no time. Once you find them, you can complete them online and send them to the Department of Revenue.

Most Popular Minnesota Tax Forms

Minnesota state tax forms are different for different situations. You have to find the form that matches your particular situation. Some of them are popular among locals while others are rarely used. Still, there are forms you may find useful even if you have never thought about them before. This is why it is important to keep the most used state of Minnesota income tax forms in your library. Here are top-5 popular options for you:

- Form M1. This form is called Individual Income Tax. It was created by the Minnesota Department of Revenue. This is one of the most demanded Minnesota state income tax forms since you have to provide information on your salaries and taxes. This document is similar to the federal tax report form except it provides information on the local taxes you pay. You also have to provide the information on whether you are full-year, part-time, or non-resident. Include the numbers of withheld income tax of Minnesota.

- Form M1W. Unlike other Minnesota individual tax forms, this is rather Schedule on the Minnesota Income Tax Withheld. You have to provide it together with another tax form, which is the M1 form. Although there is a similar section in M1, you have to use the M1W schedule if you need to extend the information you’ve provided. You have to include data about you, your spouse, and joint return if you have. If you have used over 5 different W-2 forms to report Minnesota tax withheld and wages, pay attention to line 5 in the schedule.

- Form M1X. The form is known as Amended Minnesota Income Tax. You can use it separately from other forms. It has numerous similarities with previous forms and is required by the Department of Revenue of the state. You need to provide information on both state-related taxes and federal. Use the information from your IRS form and Minnesota M1 form to create a report.

- Form M1PR. You may know this document as Homestead Credit Refund for Homeowners and Renter’s Property Tax Refund. It is one of the most popular Minnesota rental tax forms that works perfectly for both renters and homeowners. You may be familiar with the form as a real estate agent as well. The information on the document must be correct, including federal adjusted gross income, social security benefits that are nontaxable, and payments for the programs like MFIP.

- Power of Attorney. This is the form created by the Minnesota Department of Revenue for the residents of the state. You can use it to grant powers to the attorney you work with so the person can act on your behalf. You need to provide information about the attorney and about you.

Where to Get Tax Forms in Minnesota?

Minnesota Dept of Revenue tax forms can be easily found on the official website of the Minnesota Department of Revenue. There are numerous templates you can pick from. After that, you need to find the third-party editor that allows you to fill out the form you need. However, you can pick the simplest way. You may find and complete Minnesota tax forms online on PDFLiner. Here is what you need to do:

- Find the form you were looking for on the page with Minnesota tax forms on PDFLiner.

- Press Fill Online.

- Wait till the form appears in front of you and complete it.

- If you need, you may sign it electronically using PDFLiner tools and send it to the recipient.