-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Ohio Tax Forms

-

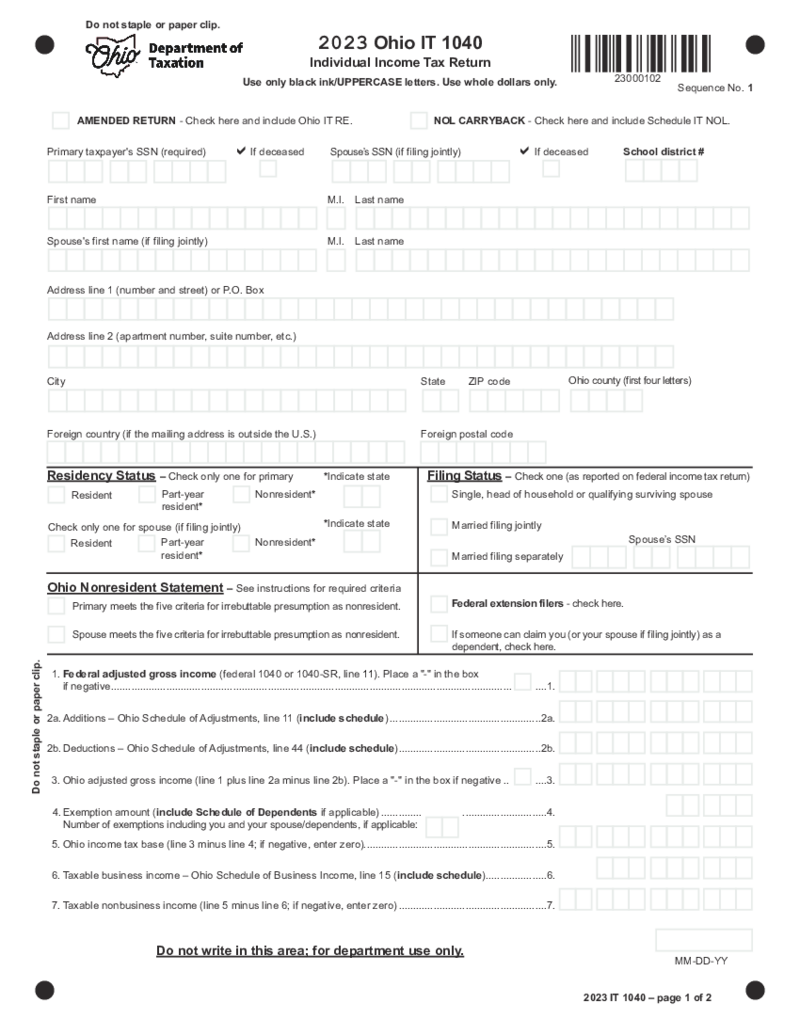

Ohio Form IT 1040

Ohio Form IT 1040: Overview

Ohio Tax Form IT 1040 is the individual income tax return form used by residents of Ohio to report their annual income to the Ohio Department of Taxation. This form is used for both full-year and part-year residents to calculat

Ohio Form IT 1040

Ohio Form IT 1040: Overview

Ohio Tax Form IT 1040 is the individual income tax return form used by residents of Ohio to report their annual income to the Ohio Department of Taxation. This form is used for both full-year and part-year residents to calculat

-

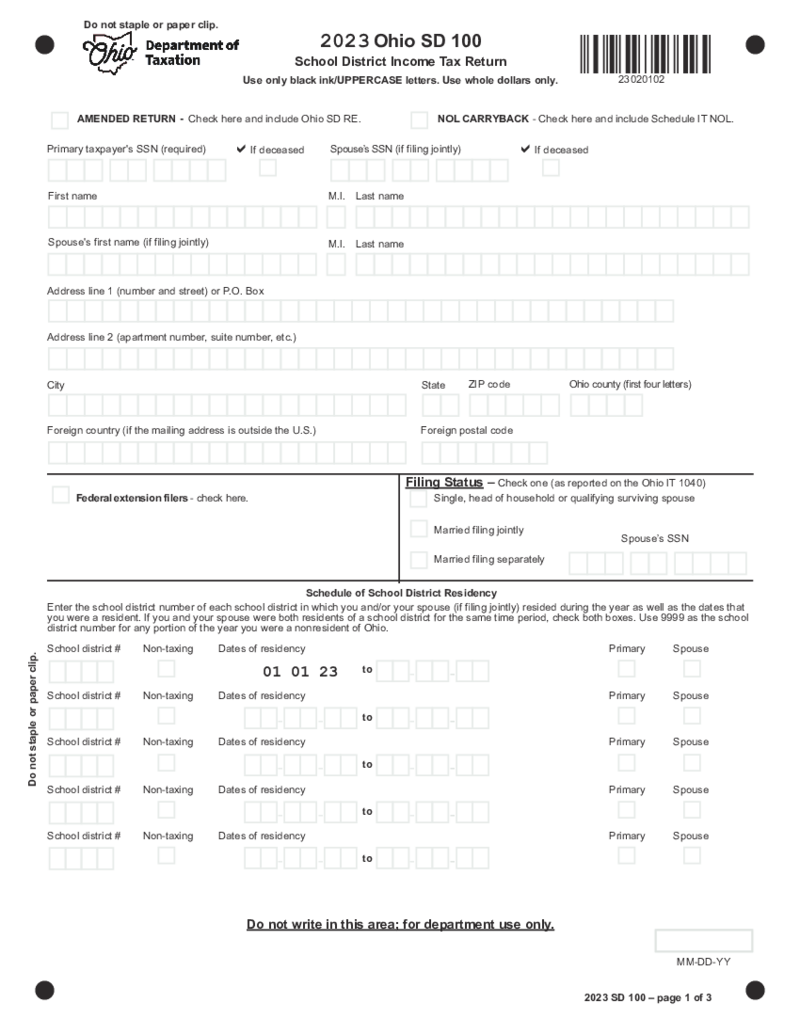

Ohio Form SD100

What Is the Ohio SD100 Form?

The Ohio form SD100 is used by residents to report their school district income tax return. The tax collected from this form is allocated directly to the individual's corresponding school district, significantly contributi

Ohio Form SD100

What Is the Ohio SD100 Form?

The Ohio form SD100 is used by residents to report their school district income tax return. The tax collected from this form is allocated directly to the individual's corresponding school district, significantly contributi

-

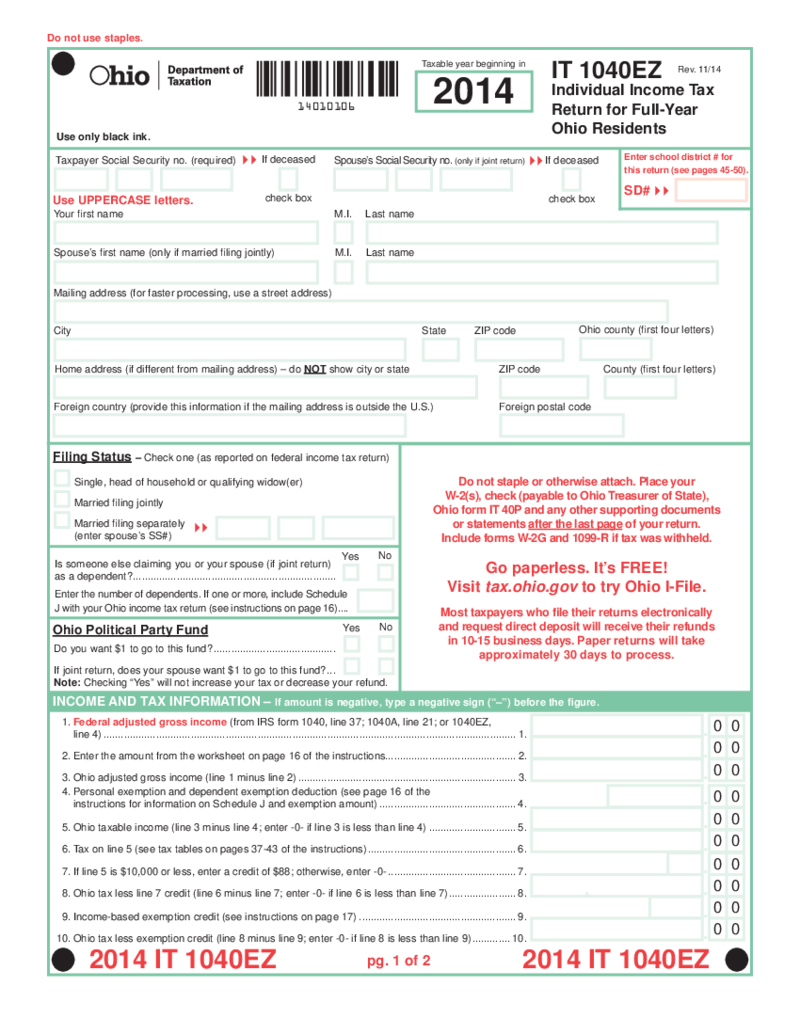

Ohio Form IT 1040EZ

What is the Ohio IT 1040EZ Form

The Ohio IT 1040EZ Form is a simplified version of the Ohio IT 1040 Form. It's designed for taxpayers who meet specific criteria, ensuring that their tax situation is simple enough to use this form. Those who have intri

Ohio Form IT 1040EZ

What is the Ohio IT 1040EZ Form

The Ohio IT 1040EZ Form is a simplified version of the Ohio IT 1040 Form. It's designed for taxpayers who meet specific criteria, ensuring that their tax situation is simple enough to use this form. Those who have intri

What are Ohio Tax Forms?

Ohio Tax forms have one thing in common. They are all made for taxpayers who dwell and work or just work in Ohio State. Whether it is a school district income tax or individual tax return, you may find these documents easy to keep up with. They were made by the Ohio Department of Taxation and have numerous similarities with federal tax forms which you still have to file to the IRS every tax report period.

PDFLiner gathers all the forms you may need from Ohio State in one section. They are easy to check out. All you need is to click on them or read the brief description under their images. The library is constantly growing. You will easily find the state of Ohio tax forms you need.

Most Popular Ohio Tax Forms

There are Ohio income tax forms that are evergreen and forms that are changing each year. You need to find the one that is currently requested by Ohio officials. If you don’t know which form you need it is better to consult with the Department of Taxation from Ohio State. They may advise you on what to do. You can also check out the most demanded Ohio state tax forms here on PDFLiner. Check them out:

- Form IT 1040. This is the Individual Income Tax Return form you need to fill in case you live and work in Ohio. There are multiple Ohio state income tax forms, but this one is vital and has to be filled out annually. You may find lots of similarities with federal tax form 1040. You have to provide your personal information, and your residency status, and calculate your income. Include federal adjusted gross income, and Ohio tax payments.

- Form SD100. This is not one of the regular state of Ohio income tax forms, but you still may need it occasionally. The form is named School District Income Tax Return. It must be completed for the specific taxing school districts. If you live in several school districts, you have to complete several forms. The form requires your personal information, filing status, and the tax type you pay. You need it to report the income you received while living in the district, so be specific about it.

- Form IT 40P. This is the Original Payment form created by the Ohio Department of Taxation. Once you send your Ohio tax returns forms, you need to fill out the voucher for the payment of the Ohio income tax return. This voucher must be sent to the Ohio Treasurer of State. Yet, you can always pay the money electronically even if the voucher is sent by paper. All the details are available on the official website of the Department of Taxation. Use it with Ohio tax withholding forms.

- Form IT 1040EZ. The form is called Individual Income Tax Return for Full-Year Ohio Residents. You can’t file the form if you are a non-resident or part-time resident only. This form does not replace the federal form. You have to report the taxes you have paid during the year and the income you’ve received, including both federal and Ohio.

- Form for the Delaware City Individual Income Tax Reform. This is not one of the Ohio sales tax exempt forms, but this form may be useful for any taxpayer who wants to learn the basics. Delaware City residents have to fill out this form together with the federal tax income form. It has detailed instructions for each section and you may find it helpful.

Where Can I Get Ohio State Tax Forms?

You may find Ohio state tax forms printable on the official website of the Ohio State Department of Taxation. You will see numerous forms there. You may even get lost in all these blanks dedicated to different areas of life. An alternative option for you is PDFLiner. It will be even easier to navigate since all the forms you are looking for are in one place. Moreover, PDFLiner is an editor that allows you to complete the forms online. You can fill in the blanks and send them right away. Here is what you need to do in PDFLiner:

- Pick the blank you have to complete.

- Open it by pressing the Fill Online button.

- When the form is there, edit it.

- Sign and print the document if you need it or send it online.

FAQ:

-

When will Ohio tax forms be available?

Ohio forms are available any time you need them. You have to check out whether they are evergreen or you need to use the new edition released by the Department of Taxation. Once you do this, start completing the form. Send it before the deadline indicated in every form by the officials.

-

Can you eFile an Ohio tax return?

Yes, some forms can be filed electronically to the Department of Taxation. You may find details on the website or on every form’s instructions provided by them. If there is an exception, you will see it mentioned before the sections you have to fill.