-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

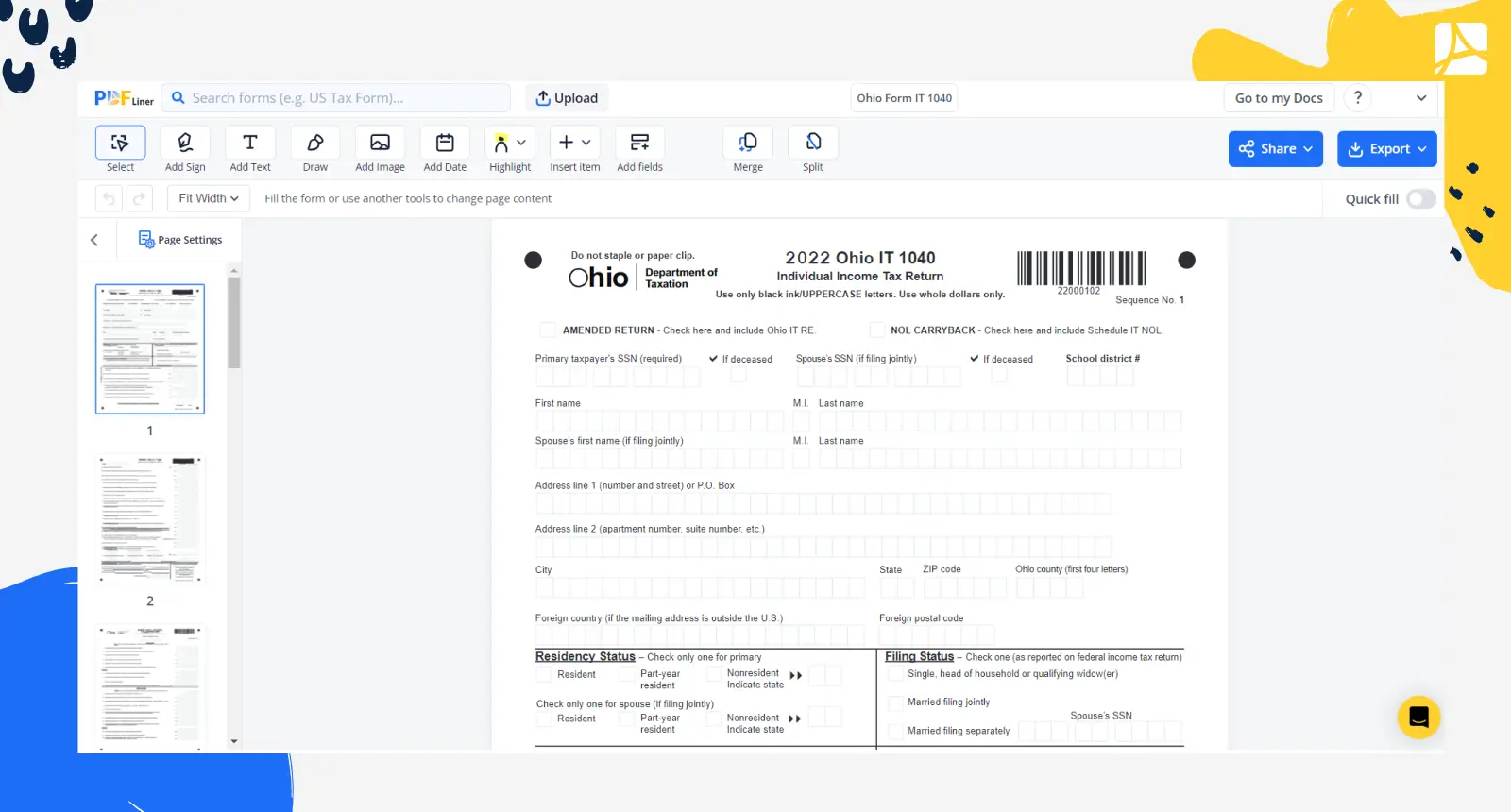

Ohio Form IT 1040

Get your Ohio Form IT 1040 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Ohio Form IT 1040: Overview

Ohio Tax Form IT 1040 is the individual income tax return form used by residents of Ohio to report their annual income to the Ohio Department of Taxation. This form is used for both full-year and part-year residents to calculate their tax liability, claim deductions and credits, and determine their refund or additional tax due. The form is typically due on April 18th of each year.

Essential elements of the Ohio IT 1040

To provide you with an idea of what to expect, let's break down the Ohio tax form IT 1040 into its key components:

- Personal Information: This section requires basic personal details such as your name, address, Social Security Number, and filing status (e.g., single, married filing jointly, head of household, etc.).

- Income: You will need to report all taxable income earned during the year. This includes wages, salaries, interest, dividends, and capital gains, among other sources of income. You will also need to report income from local, state, and federal tax refunds.

- Adjustments to Income: This section allows you to claim specific adjustments to reduce your taxable income. Examples include contributions to retirement accounts, alimony paid, and tuition expenses for higher education.

- Tax Calculation: Based on the adjusted gross income calculated above, you will calculate your Ohio income tax liability using the provided tax table. You may also need to include additional taxes, such as school district income tax and city income tax, if applicable.

- Credits: There are several tax credits available to reduce your overall tax bill. Examples include joint filing credit, personal and dependent exemptions, and credits for education expenses.

How to Fill Out Ohio Tax Form It 1040

To help guide you through the process, follow these simple steps:

- Begin filling out the form by providing your full name, social security number, and address in the appropriate fields in the "Primary Taxpayer" section. If you are filing jointly, complete the same information for your spouse in the "Spouse" section.

- Select your filing status by checking the appropriate box in the "Filing Status" section.

- Indicate the number of exemptions—yourself, spouse, and dependents—by entering the relevant numbers in the "Exemptions" section.

- Move on to the "Income" section and enter all required amounts, such as your federal adjusted gross income, Ohio adjustments, and Ohio taxable income.

- Next, fill in the "Ohio Tax" section by entering the amount of tax due based on your Ohio taxable income. Refer to the tax table from the instructions to find the correct amount.

- If you are eligible for any nonrefundable or refundable credits, fill in the respective amounts in the "Nonrefundable Credits" and "Refundable Credits" sections. Subtract the total nonrefundable credits from your tax due amount and enter the result in the "Adjusted Tax Due" field.

- Calculate your total payment by adding any penalty and interest, and enter the result in the "Total Payment" field.

- If you are owed a refund, enter the total refundable credits and the amount you wish to be refunded in the "Refund" section.

- Provide your bank account information in the "Direct Deposit" section if you want your refund to be directly deposited into your account.

- Ensure you have completed all necessary fields and complied with the form's instructions before submitting it to the Ohio Department of Taxation according to the provided guidelines.

Who needs to fill out the Ohio Department of Taxation form IT 1040?

The following individuals need to fill out the Ohio IT 1040 form template:

- Full-year Ohio residents - If you reside in Ohio for the entire tax year and have a legal obligation to file a federal income tax return, you must complete this form.

- Part-year Ohio residents - If you lived in Ohio for part of the tax year, you are required to fill out the form IT 1040, along with Schedule A detailing the income earned during your Ohio residency.

- Nonresidents with Ohio income - If you are a nonresident but earned income in Ohio, you need to fill out the form IT 1040, accompanied by Schedule A and Schedule J, to report and pay taxes on the income earned within the state.

- Married couples filing jointly - If you are married and choose to file jointly, both spouses must complete and sign the form IT 1040.

- Dependents with income - If you are dependent and have earned income that meets the minimum income requirements, you must fill out the form IT 1040 to report your income.

Form Versions

2022

Ohio Form IT 1040 (2022)

Fillable online Ohio Form IT 1040