-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Mississippi Tax Forms

-

Mississippi Annual Information Return

Understanding the Mississippi Annual Information Return

Every year, businesses and individuals involved in certain activities must navigate the intricacies of state tax requirements. In Mississippi, the Mississippi Annual Information Return Form is a nece

Mississippi Annual Information Return

Understanding the Mississippi Annual Information Return

Every year, businesses and individuals involved in certain activities must navigate the intricacies of state tax requirements. In Mississippi, the Mississippi Annual Information Return Form is a nece

-

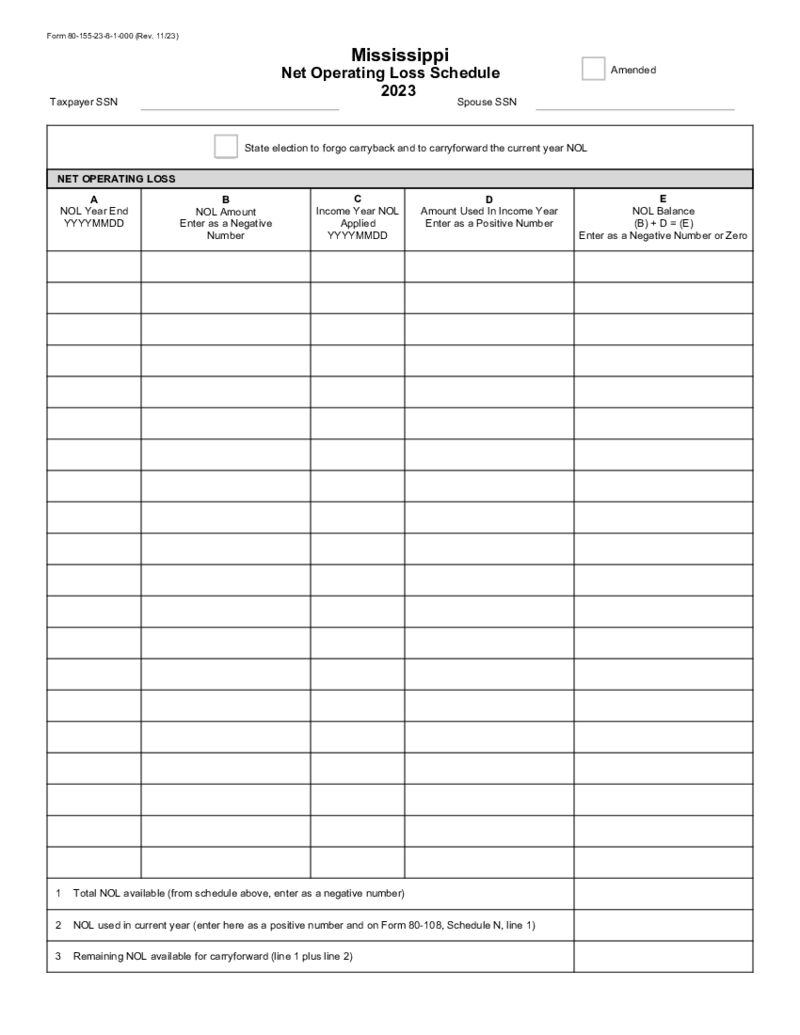

Mississippi Form 80-155 - Net Operating Loss Schedule

What Is Form 80 155

Form 80 155, known as the Mississippi Net Operating Loss Schedule, is a tax document used by taxpayers in Mississippi. This form allows individuals and businesses to calculate and report a net operating loss (NOL) for

Mississippi Form 80-155 - Net Operating Loss Schedule

What Is Form 80 155

Form 80 155, known as the Mississippi Net Operating Loss Schedule, is a tax document used by taxpayers in Mississippi. This form allows individuals and businesses to calculate and report a net operating loss (NOL) for

-

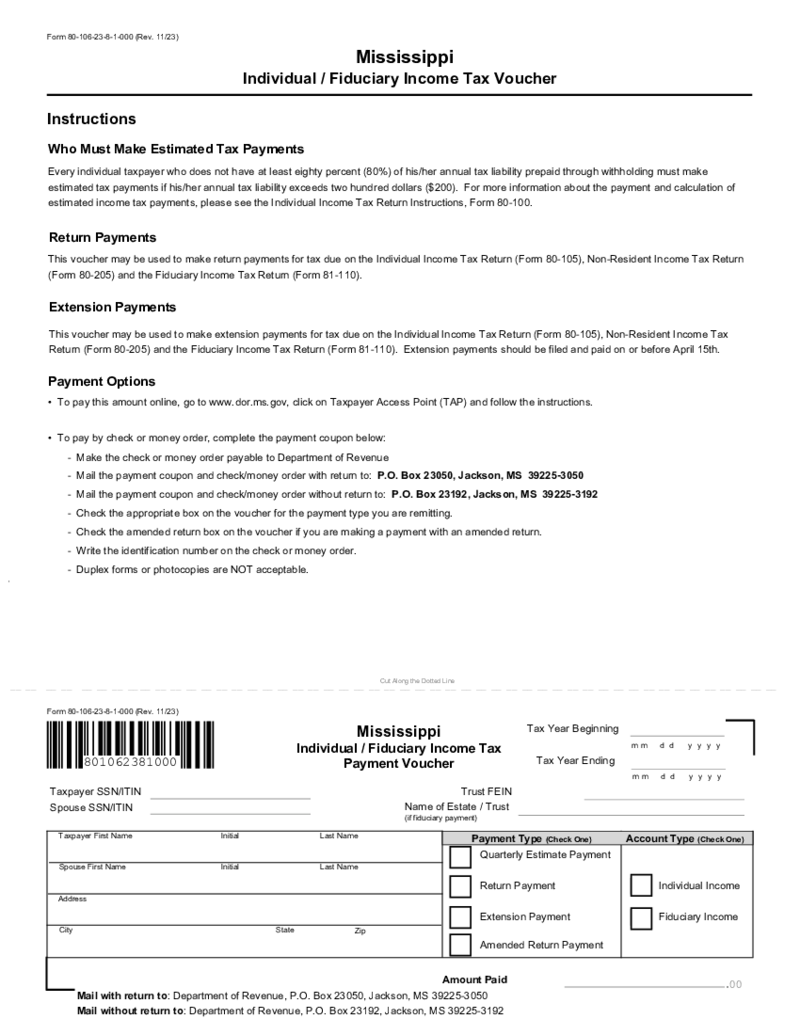

Mississippi Form 80-106 Individual-Fiduciary Income Tax Voucher

What Is A Ms Form 80 106

The Mississippi form 80-106 is an Individual-Fiduciary Income Tax Voucher designed to facilitate income tax payments. This form serves as a remittance document for taxpayers who need to make payments for tax due o

Mississippi Form 80-106 Individual-Fiduciary Income Tax Voucher

What Is A Ms Form 80 106

The Mississippi form 80-106 is an Individual-Fiduciary Income Tax Voucher designed to facilitate income tax payments. This form serves as a remittance document for taxpayers who need to make payments for tax due o

-

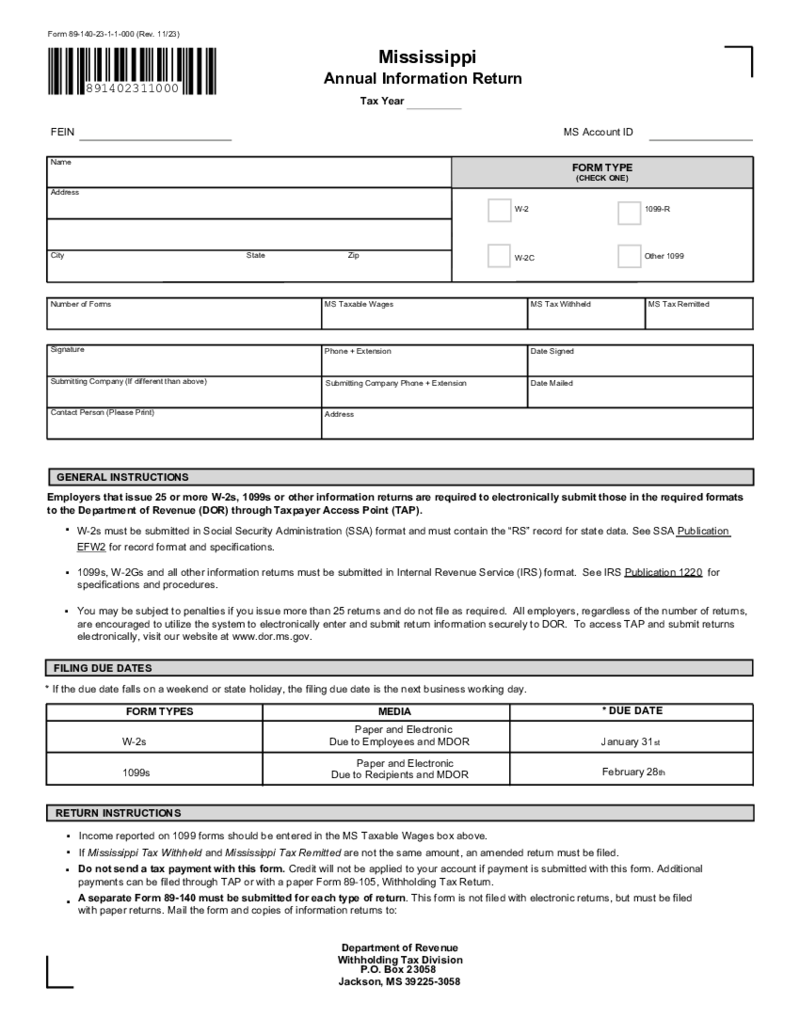

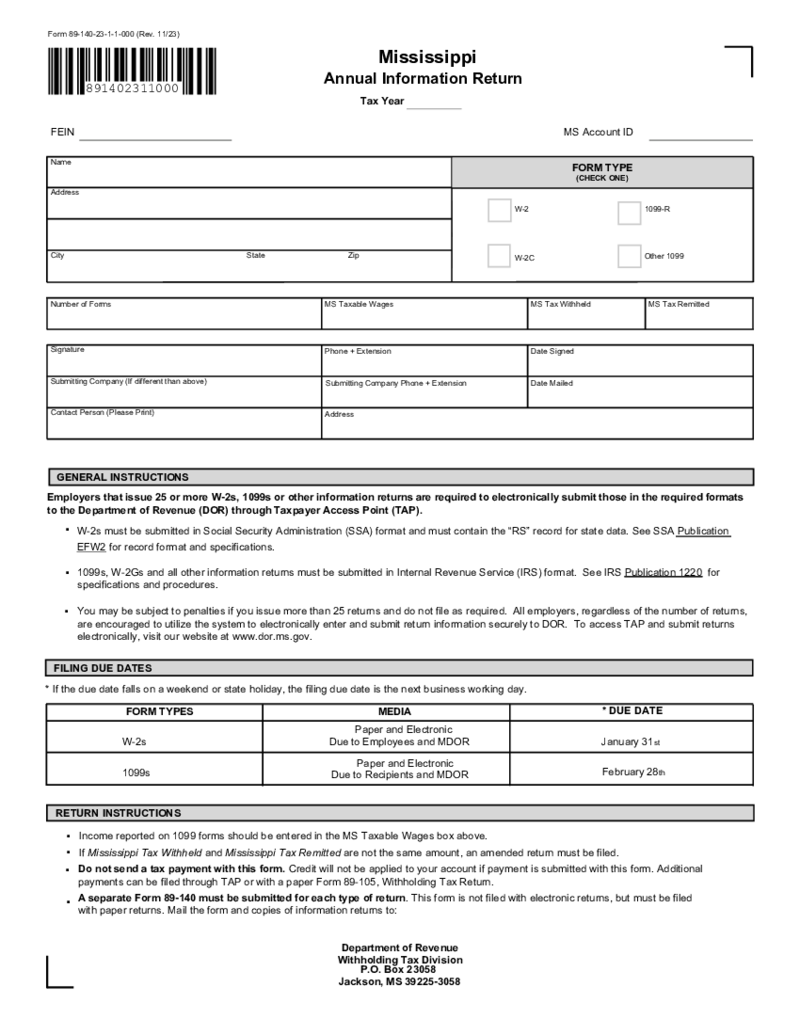

Form 89-140 - Mississippi Annual Information Return

What Is MS Form 89-140

The Mississippi Form 89-140, often referred to as the Mississippi Annual Information Return, is an essential tax document that's mandated by the Mississippi Department of Revenue. It is designed for particular taxpayers to repor

Form 89-140 - Mississippi Annual Information Return

What Is MS Form 89-140

The Mississippi Form 89-140, often referred to as the Mississippi Annual Information Return, is an essential tax document that's mandated by the Mississippi Department of Revenue. It is designed for particular taxpayers to repor

-

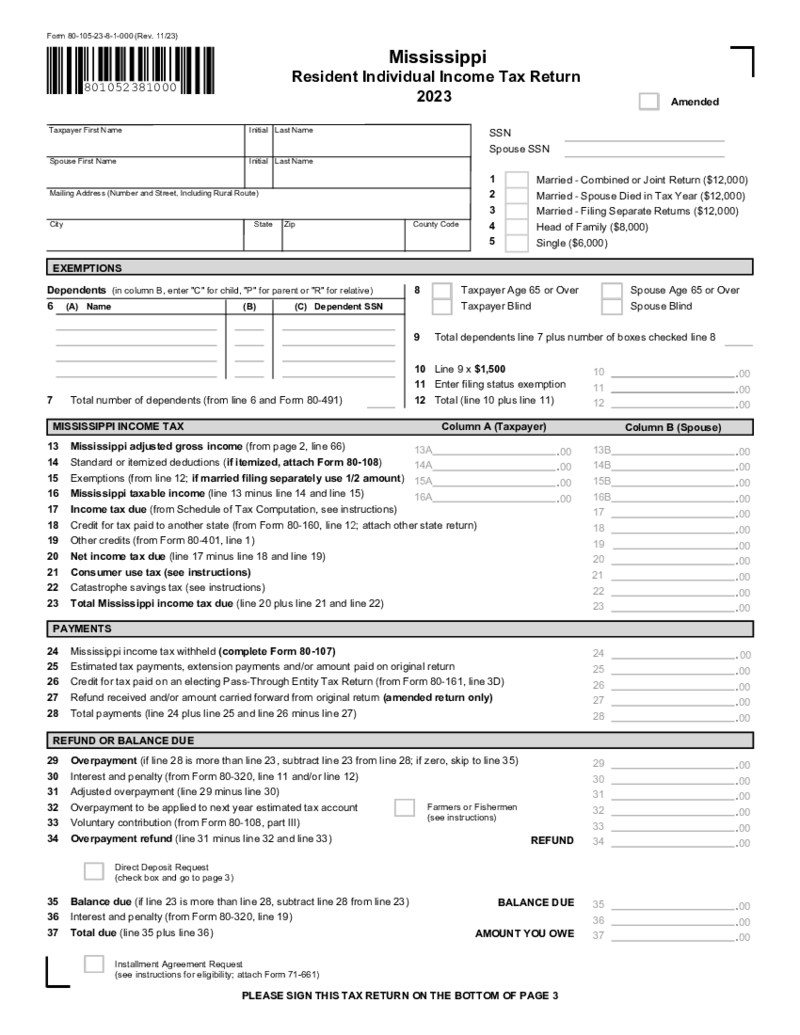

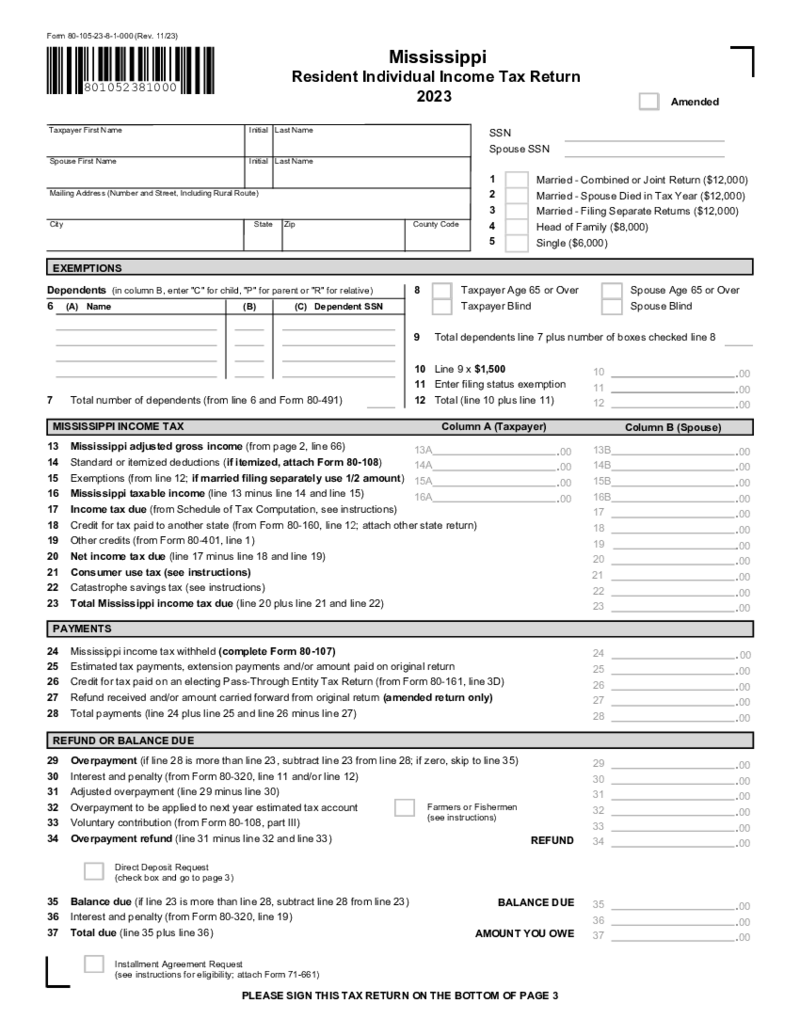

Mississippi Resident Individual Income Tax Return

What Is the Mississippi Resident Individual Income Tax Return?

The Mississippi resident individual income tax return is a form that all residents of the state must complete and submit if they meet certain income thresholds. Based on a resident's incom

Mississippi Resident Individual Income Tax Return

What Is the Mississippi Resident Individual Income Tax Return?

The Mississippi resident individual income tax return is a form that all residents of the state must complete and submit if they meet certain income thresholds. Based on a resident's incom

-

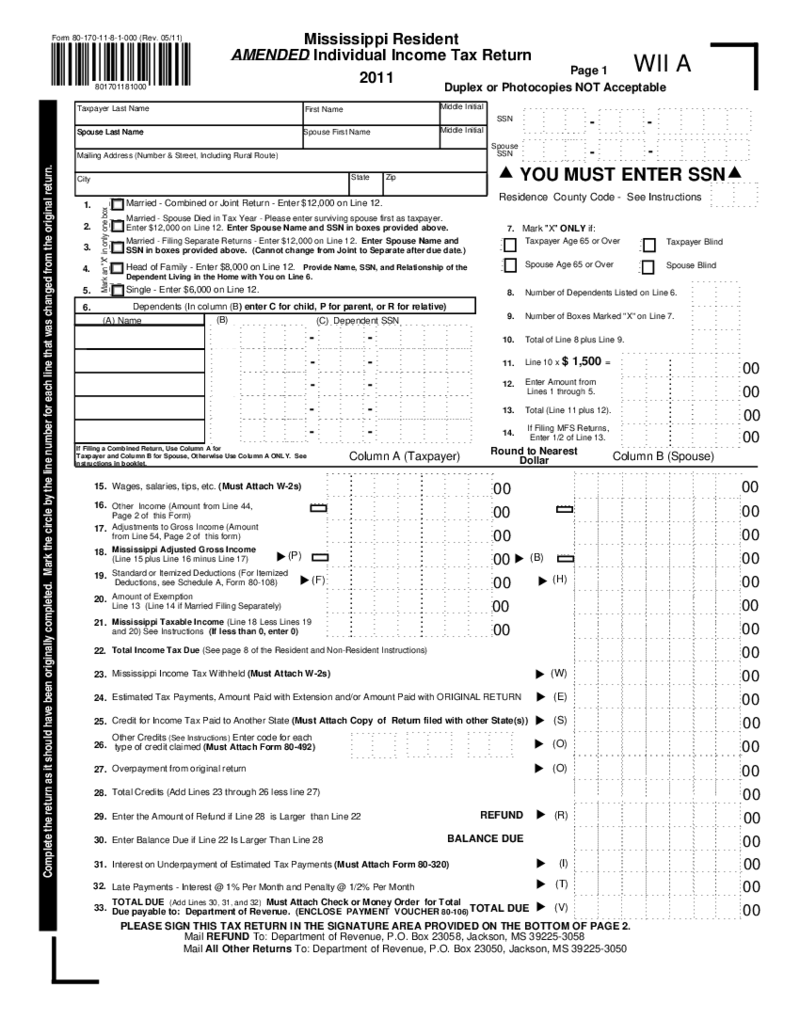

Mississippi State Tax Form 80-170

Overview of Mississippi Form 80-170

Mississippi Form 80-170, also known in full as the Resident Amended Income Tax Return, is the document that residents use to correct any information on a previously filed Mississippi tax return. Whether it's to repo

Mississippi State Tax Form 80-170

Overview of Mississippi Form 80-170

Mississippi Form 80-170, also known in full as the Resident Amended Income Tax Return, is the document that residents use to correct any information on a previously filed Mississippi tax return. Whether it's to repo

-

Mississippi State Tax Form 80-105

What Is Form 80 105

The Mississippi State Tax form 80 105 is vital for residents to comprehend when dealing with their state income tax. It serves as the Resident Individual Income Tax Return, utilized by residents to report their income,

Mississippi State Tax Form 80-105

What Is Form 80 105

The Mississippi State Tax form 80 105 is vital for residents to comprehend when dealing with their state income tax. It serves as the Resident Individual Income Tax Return, utilized by residents to report their income,

-

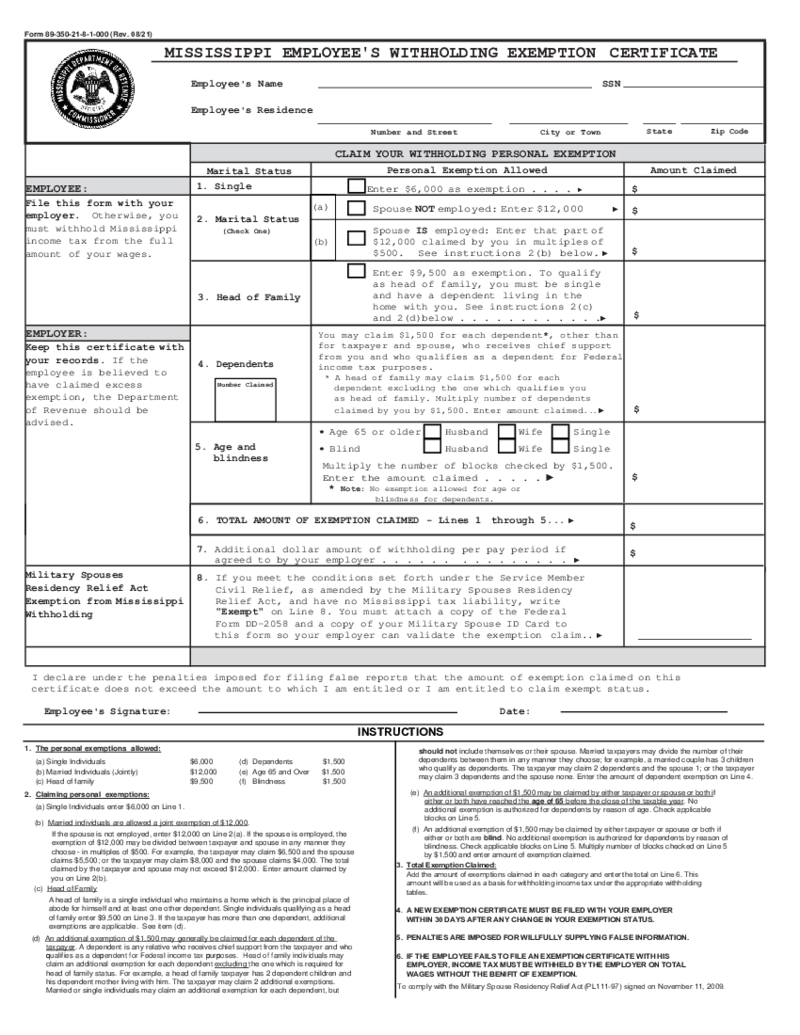

Mississippi Withholding Exemption Certificate

What Is The Mississippi Employee Withholding Exemption Certificate

The Mississippi Employee Withholding Exemption Certificate is a crucial document that an employee fills out and provides to their employer. It details the number of allowances employees cl

Mississippi Withholding Exemption Certificate

What Is The Mississippi Employee Withholding Exemption Certificate

The Mississippi Employee Withholding Exemption Certificate is a crucial document that an employee fills out and provides to their employer. It details the number of allowances employees cl

-

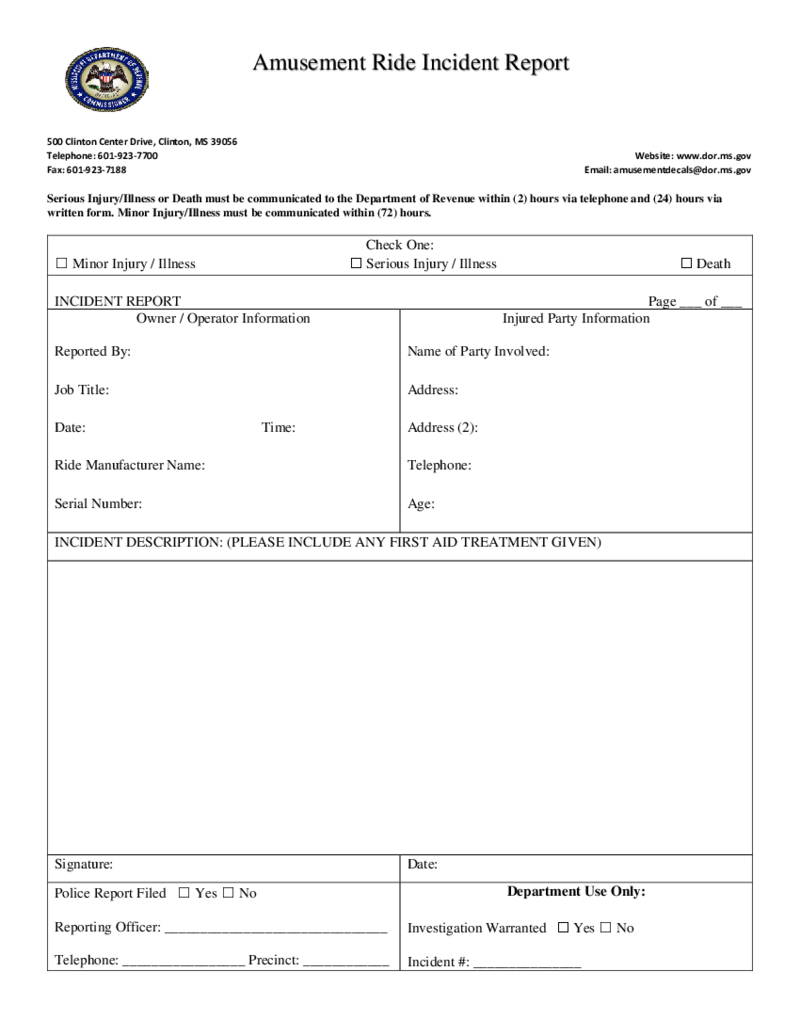

Mississippi Incident Report

What Is a Mississippi Incident Report

A Mississippi Incident Report becomes an essential document when an incident in Mississippi entails a range of situations, such as theft, property damage, accidents, or any other occurrences requiring legal, personal,

Mississippi Incident Report

What Is a Mississippi Incident Report

A Mississippi Incident Report becomes an essential document when an incident in Mississippi entails a range of situations, such as theft, property damage, accidents, or any other occurrences requiring legal, personal,

What are Mississippi Tax Forms?

Mississippi tax forms are the state records of the income that citizens and non-residents who work for the state receive. These templates were created by local authorities to make sure that people pay taxes on time, don’t overpay the exact amount of money they need, and receive all the benefits of the taxpayer they were given. There are numerous types of such forms, from Mississippi tax return forms to unemployment templates. The state tries to ease the life of taxpayers by creating user-friendly standard blanks you can send them.

PDFLiner contains all the documents you may need while reporting your taxes. It allows you to fill out the form online and send it to the officials. You can also download them and keep them on your device.

Most Popular Mississippi Tax Forms

While not everyone needs Mississippi unemployment tax forms, there are plenty of blanks you may find helpful during your life. If you live or work in the state, you have to get familiar with the forms. You may require Mississippi income tax forms once you become an employee. These forms are not complicated, but you still have to follow the instructions inside them. If you are not sure where to start, here are the most popular Mississippi tax forms 2021 for you:

- Mississippi Resident Individual Income Tax Return. This form is similar to the federal tax report that you need to provide to the IRS every year. Yet, it contains specific information that is required by the Mississippi Department of Revenue. The form is 3 pages long and mostly contains numbers on your income, federal and state-related. You need to calculate your Mississippi adjusted gross income, taxable income, overpayment refund, as well as federal.

- Form 89-140. This is a document that provides information on Annual Information Return. You need to indicate your name and address, taxable wages, and type of the form you usually provide to the officials. You have to pick whether you send a W-2 form or a 1099 form. There are explanations for each section you need to fill. You may need this information return attached to other Mississippi individual income tax forms. Once you fill it you need to send it to the Department of Revenue Withholding Tax Division.

- Mississippi Individual Income Tax Interest and Penalty Worksheet. Among popular Mississippi state estimated tax forms, this one is well-known. It is simple to complete, but you need to be accurate with numbers. Include the information on the interest on underpayment of estimated tax. There is a detailed table on the interest calculation which you can use. You also need to indicate the late payment interest.

- Mississippi Employee’s Withholding Exemption Certificate. You may need this one in your arsenal of Mississippi estimated tax forms. It must contain information about both employees and employers. You have to fill it with data on employees, including SSN, address, and marital status. The employer has to check out the form. It must be filed together or the income tax will be withheld from the amount of the total wages. There are detailed instructions inside the form.

- Affidavit for Withholding Income Tax on Sale of Real Estate by Non-Resident. The form is used by nonresidents who have to sell real estate in the state. You need to provide information about the seller and buyer, including names and addresses. You also have to describe the property you are planning to sell. This document can be later used for one of the state of Mississippi income tax forms.

How to Get Mississippi Tax Forms?

Once you decide which Mississippi state tax return forms you need, go to the state’s Department of Revenue official website. You will find there all the information you need about local activities, new forms, more updates on the documents, and the library filled with templates. Pick one of them and look for the program that allows you to complete the document online. You may use PDFLiner to avoid extra moves. There is a library filled with local tax forms. Pick the Mississippi tax commission forms you need and fill them out using PDFLiner’s tools. Here is what you need to do:

- Read the description of the forms and find the one you need.

- Press the button Fill Online.

- Wait till the form is opened and complete it.

- Sign it using PDFLiner tools and send it to the officials.

FAQ:

-

What forms to use for tax amendments in Mississippi?

There are numerous forms that you can use for tax amendments. The list above suggests 5 of them. You can find even more on PDFLiner. Start with the state income tax report which is in demand among taxpayers. If you have a specific situation that requires a special form, search for the name using the search bar.

-

How to fill out Mississippi state tax forms for new job hire?

There is no universal form for job hire. Usually, each company provides its own template. You can check the most popular on PDFLiner. If you are an employer and you want to create your own form but don’t know where to start, read different templates from other companies and add the information you need.

-

Where can I find Mississippi state tax forms and instructions?

You can find them on the official website of the Tax Department or you can find them on PDFLiner. Benefits of PDFLiner include the ability to complete the document online. Later you can send it to the tax department.