-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Maryland Tax Forms

-

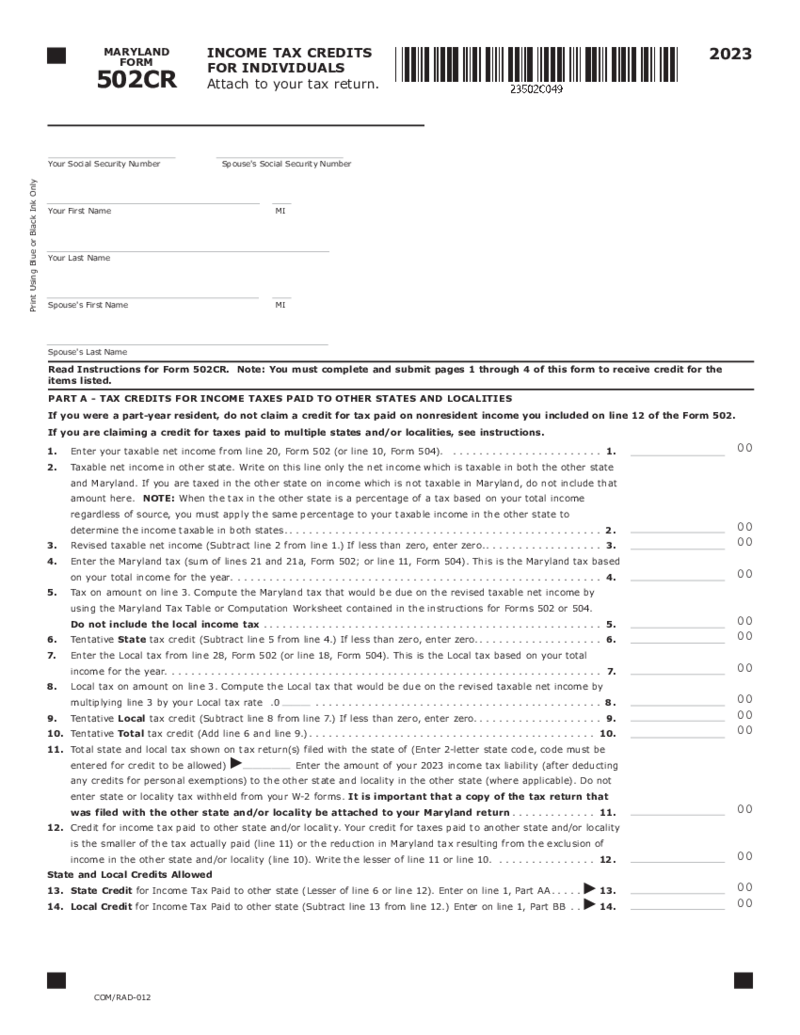

Maryland Form 502CR

What Is Maryland Form 502CR?

Maryland tax form 502CR is designed for taxpayers to calculate and state the tax credits for which they are eligible. These may include credits for income taxes paid to other states, Heritage Structure Rehabilitation Credits,

Maryland Form 502CR

What Is Maryland Form 502CR?

Maryland tax form 502CR is designed for taxpayers to calculate and state the tax credits for which they are eligible. These may include credits for income taxes paid to other states, Heritage Structure Rehabilitation Credits,

-

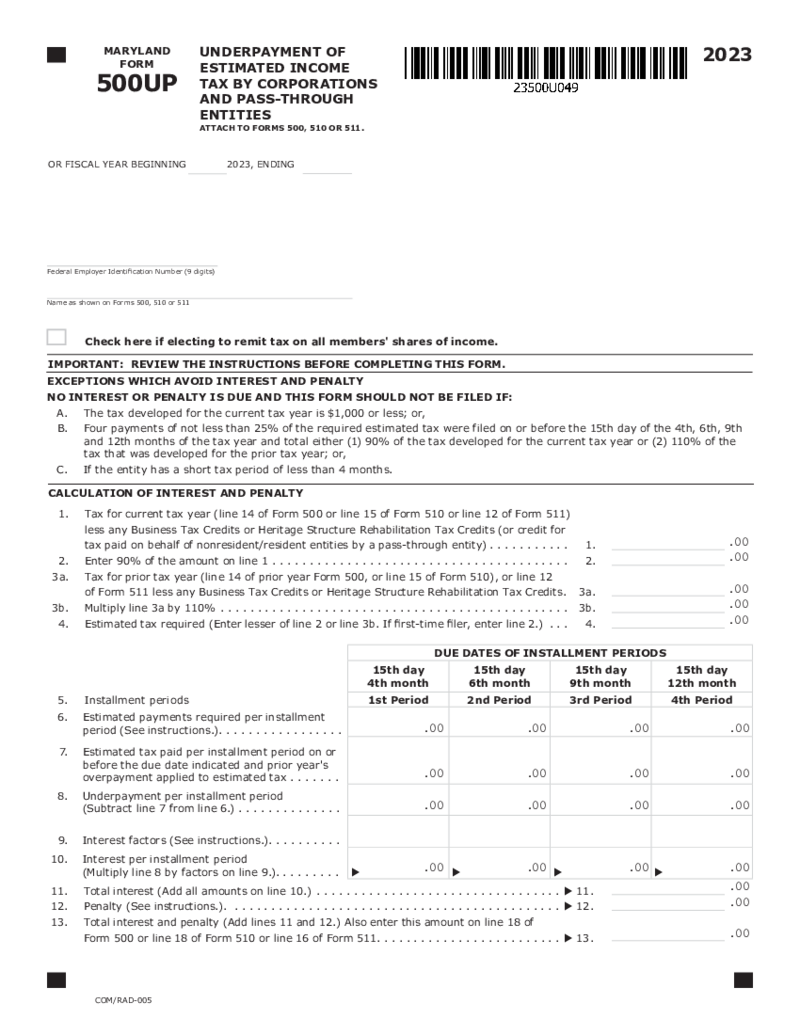

Form 500UP Underpayment of Estimated Income Tax by Corporations

What Is Form 500UP

Form 500UP is a vital document for residents and entities in Maryland who need to reconcile the underpayment of estimated income tax. This form applies to individuals and corporations who have not paid enough in state i

Form 500UP Underpayment of Estimated Income Tax by Corporations

What Is Form 500UP

Form 500UP is a vital document for residents and entities in Maryland who need to reconcile the underpayment of estimated income tax. This form applies to individuals and corporations who have not paid enough in state i

-

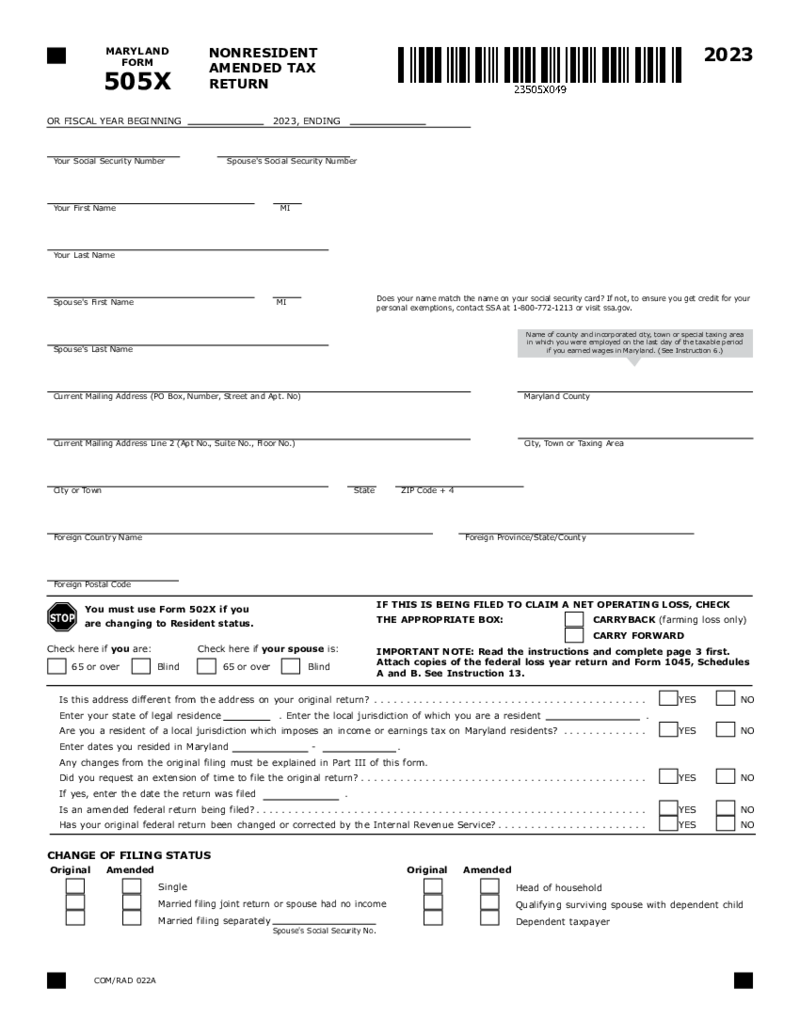

Maryland Tax Form 505X Nonresident Amended Tax Return

What Is Maryland Form 505X?

The Maryland Form 505X is the Nonresident Amended Tax Return form used by individuals who need to make changes to a filed Maryland nonresident tax return. Whether you've discovered an error or there's been a change in y

Maryland Tax Form 505X Nonresident Amended Tax Return

What Is Maryland Form 505X?

The Maryland Form 505X is the Nonresident Amended Tax Return form used by individuals who need to make changes to a filed Maryland nonresident tax return. Whether you've discovered an error or there's been a change in y

-

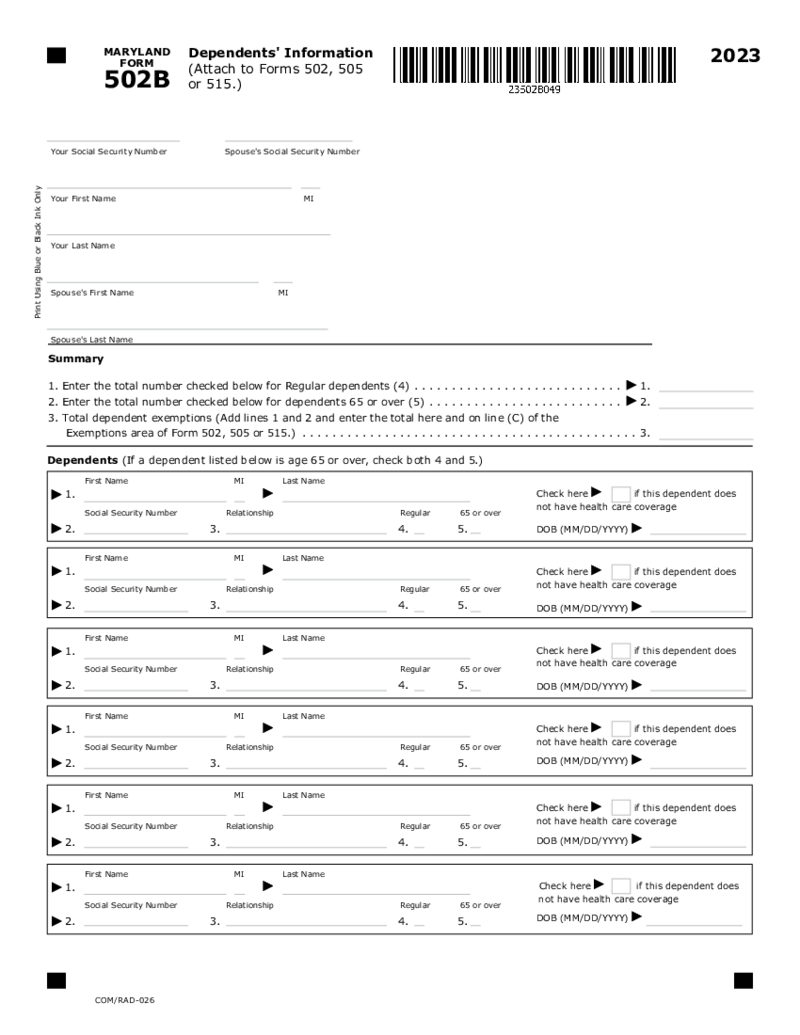

Maryland Form 502B (2023)

What Is Maryland Form 502B

Maryland Form 502B, often called Maryland income tax form 502B, is a crucial document for taxpayers. It is used primarily to claim dependent information for taxpayers. Essentially, this form provides a way for i

Maryland Form 502B (2023)

What Is Maryland Form 502B

Maryland Form 502B, often called Maryland income tax form 502B, is a crucial document for taxpayers. It is used primarily to claim dependent information for taxpayers. Essentially, this form provides a way for i

-

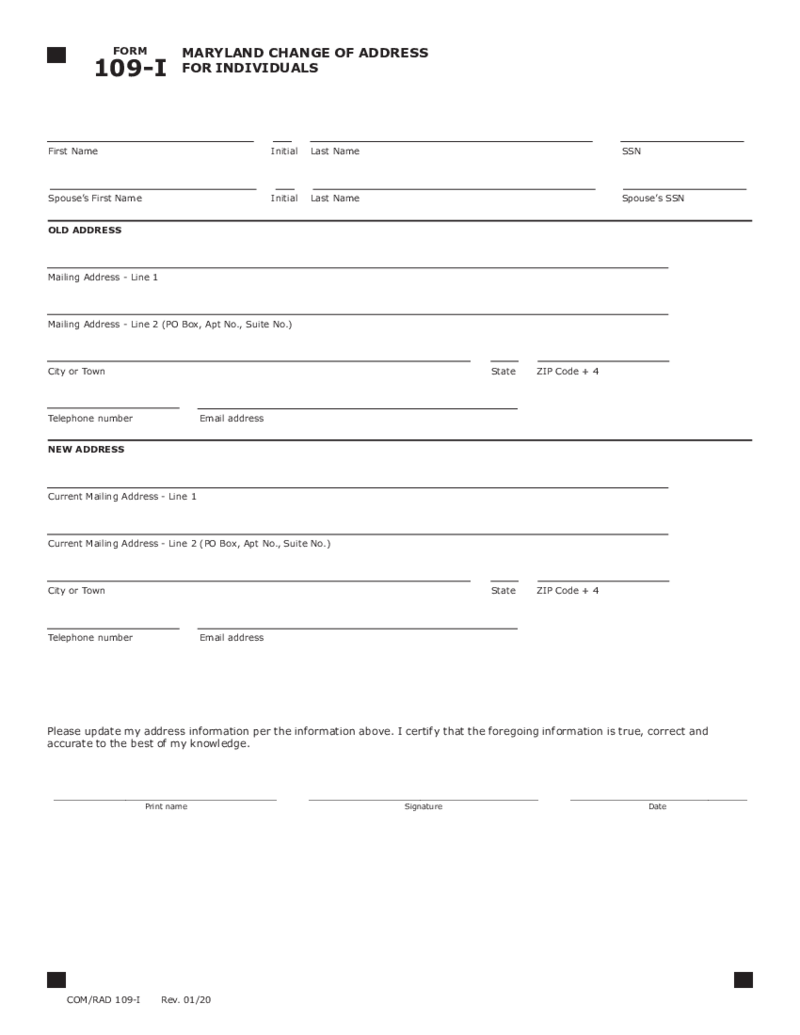

Maryland Tax Form 109-I

What Is Maryland Form 109-I?

Maryland Form 109-I is an income-based tax form used by individuals to report specific types of income that m

Maryland Tax Form 109-I

What Is Maryland Form 109-I?

Maryland Form 109-I is an income-based tax form used by individuals to report specific types of income that m

-

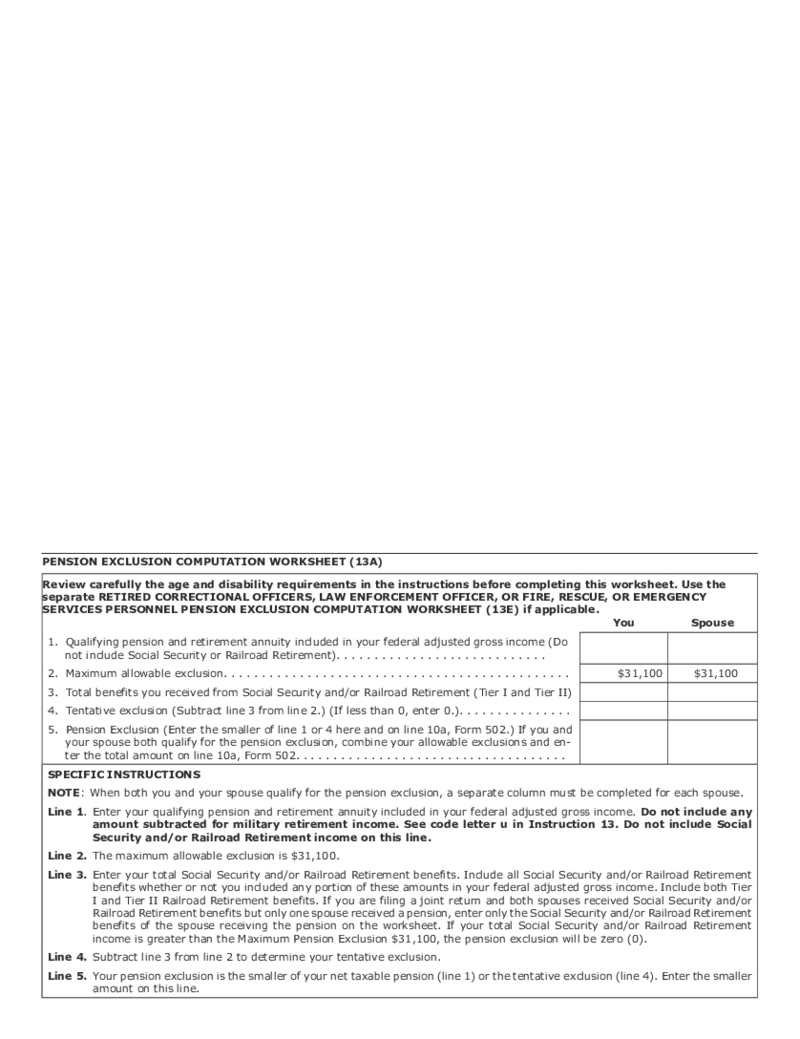

Maryland Pension Exclusion Worksheet

What Is the Maryland Pension Exclusion Worksheet?

The Maryland pension exclusion worksheet is a form designed to help Maryland retirees calculate the amount of their pension and eligible retirement income that can be excluded from state taxes. This Maryla

Maryland Pension Exclusion Worksheet

What Is the Maryland Pension Exclusion Worksheet?

The Maryland pension exclusion worksheet is a form designed to help Maryland retirees calculate the amount of their pension and eligible retirement income that can be excluded from state taxes. This Maryla

-

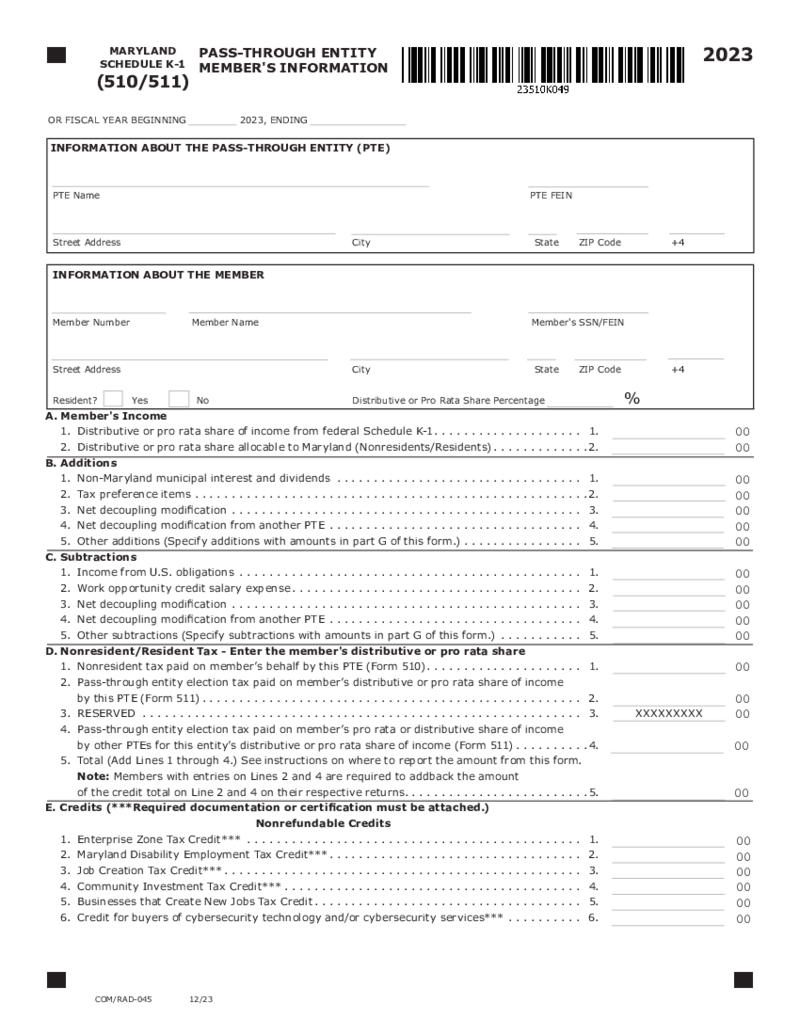

Form 510 Schedule K-1 Maryland Pass-Through Entity Members Information

What Is the Maryland Form 510 Schedule K 1?

The Maryland Form 510 Schedule K-1, or the Pass-Through Entity Members Information Form, is a state tax document used in M

Form 510 Schedule K-1 Maryland Pass-Through Entity Members Information

What Is the Maryland Form 510 Schedule K 1?

The Maryland Form 510 Schedule K-1, or the Pass-Through Entity Members Information Form, is a state tax document used in M

-

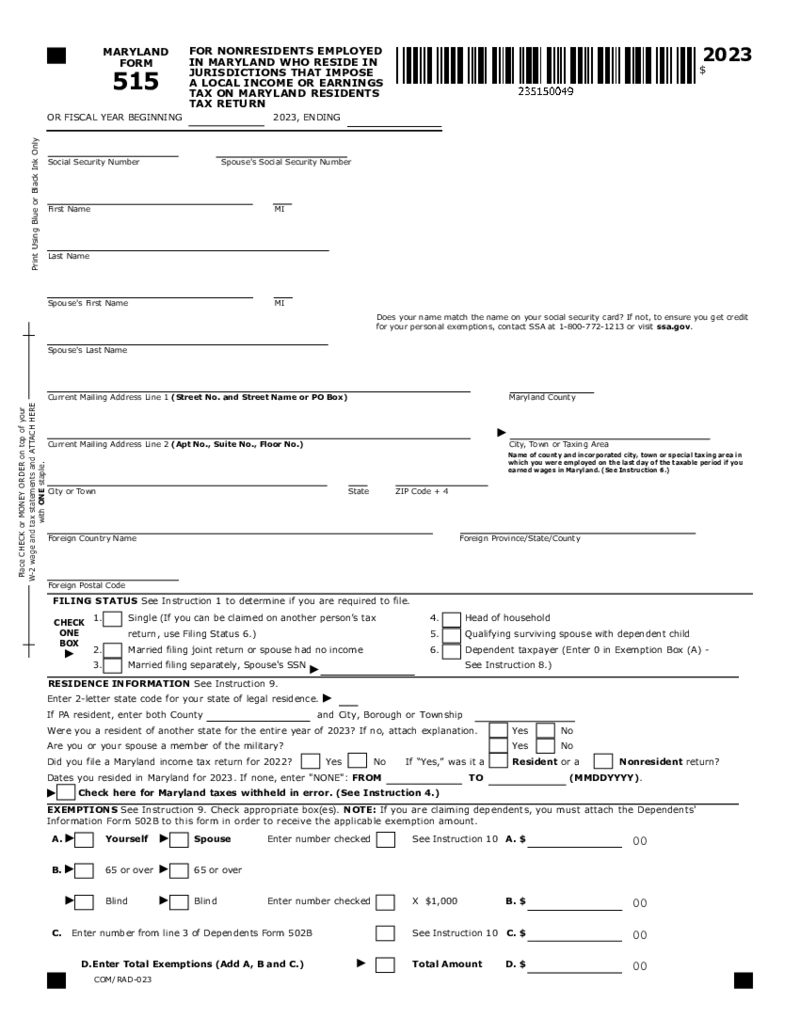

Maryland Tax Form 515

What Is Maryland 515 Form?

When tax season arrives, Maryland residents and those with income sourced from the state may find themselves fa

Maryland Tax Form 515

What Is Maryland 515 Form?

When tax season arrives, Maryland residents and those with income sourced from the state may find themselves fa

-

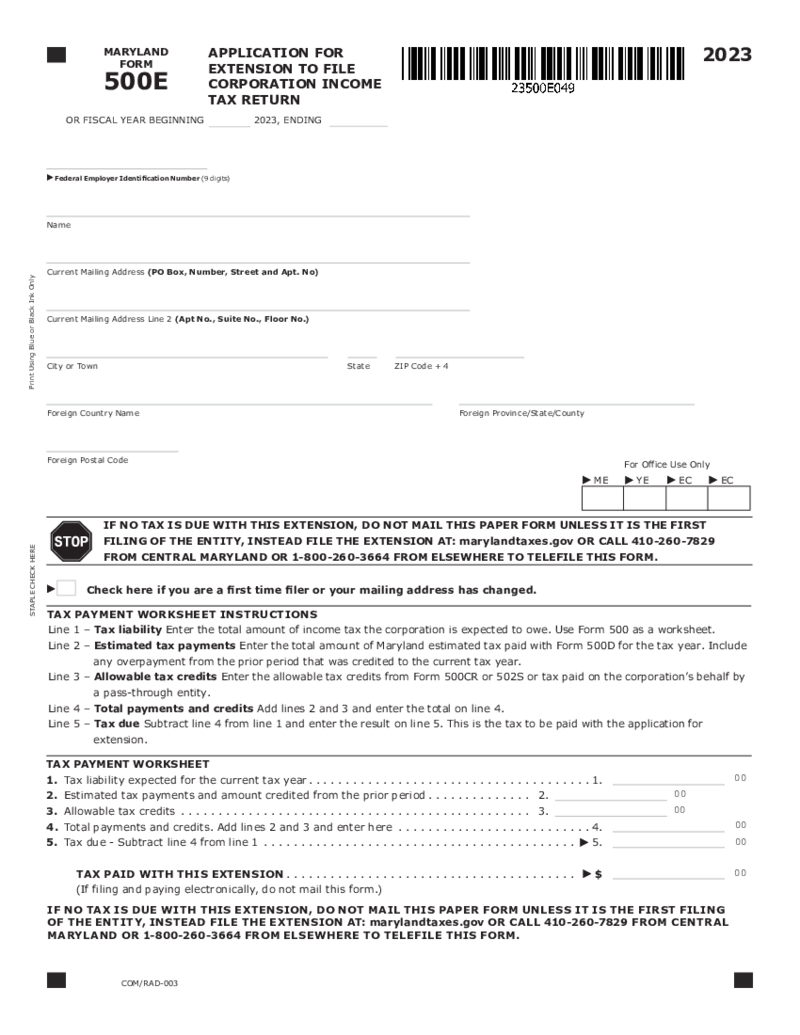

Form 500E Application for an Extension to File Corporation Income Tax Return

What Is Maryland Form 500E?

The Maryland Form 500E serves as an application that grants corporations an extension of time to file their Maryland income tax return. It's crucial for businesses that need extra time beyond the April 15 deadline to ensure

Form 500E Application for an Extension to File Corporation Income Tax Return

What Is Maryland Form 500E?

The Maryland Form 500E serves as an application that grants corporations an extension of time to file their Maryland income tax return. It's crucial for businesses that need extra time beyond the April 15 deadline to ensure

-

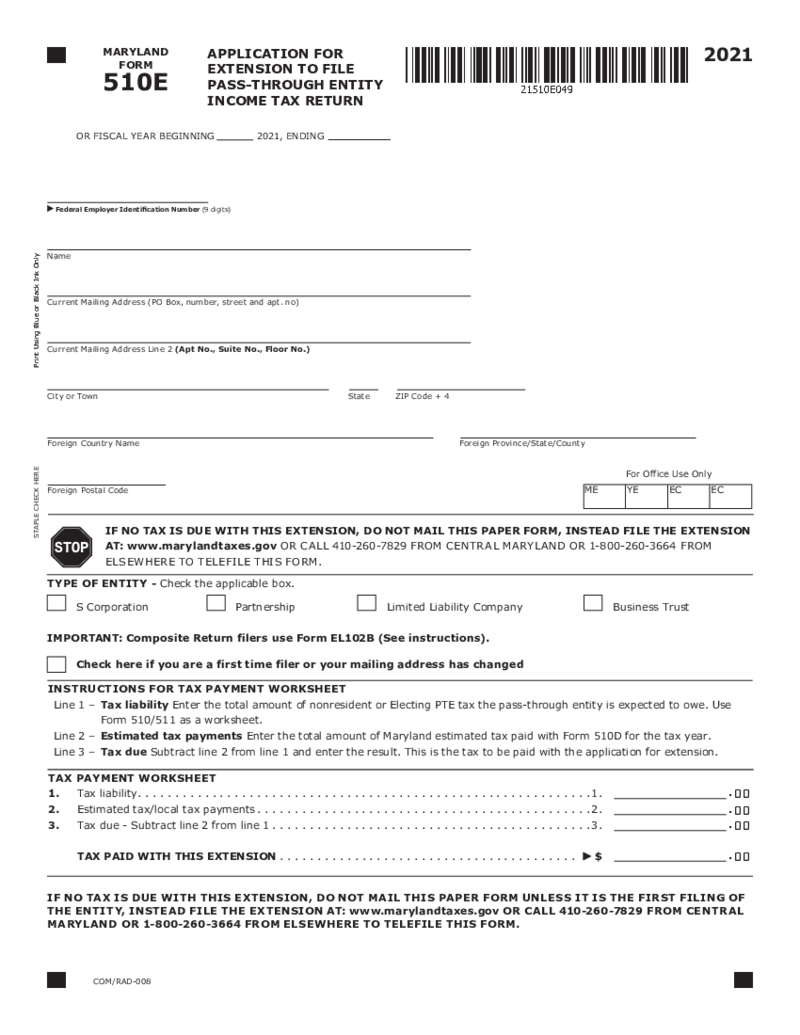

Maryland Form 510E (2021)

What Is a Maryland Form 510e

Navigating the complex world of taxes, Maryland Form 510E stands out as a beacon for entities seeking extra time to file their pass-through entity tax returns. This form, specifically designed for use in Maryland, requests an

Maryland Form 510E (2021)

What Is a Maryland Form 510e

Navigating the complex world of taxes, Maryland Form 510E stands out as a beacon for entities seeking extra time to file their pass-through entity tax returns. This form, specifically designed for use in Maryland, requests an

-

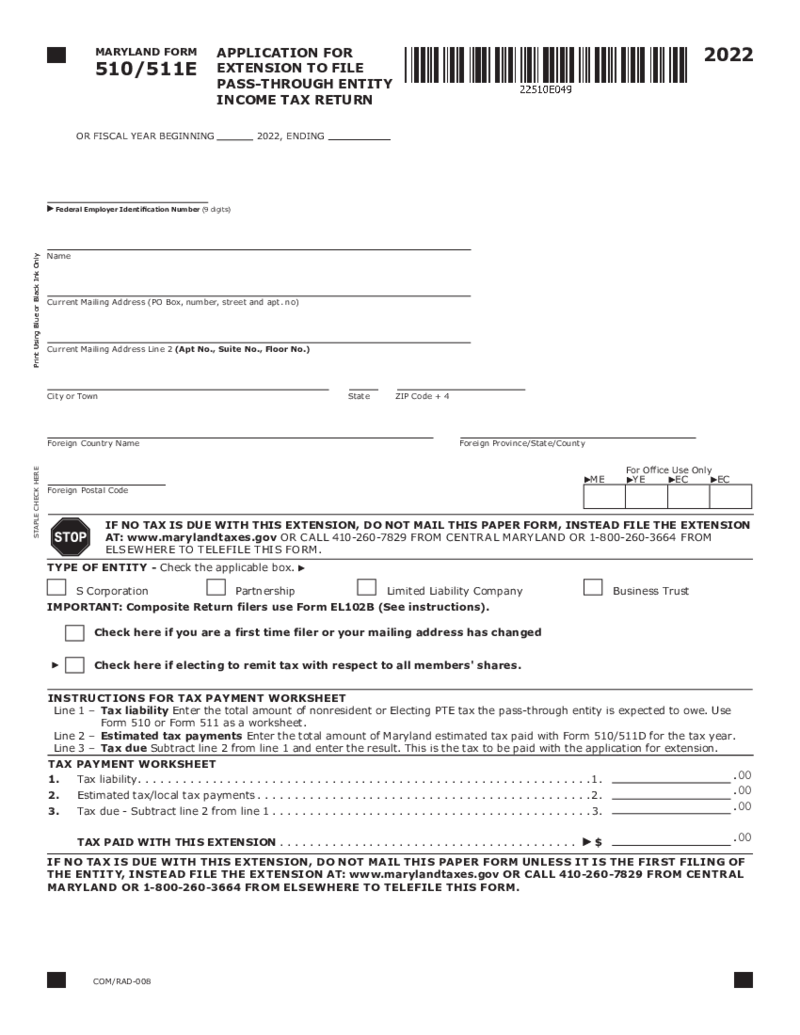

Form 510E - 511E Application for Extension to File Pass-Through Entity

What is Maryland Form 510E

The Maryland Form 510E, also known as the Application for Extension to File Pass-Through Entity Income Tax Return, is a legal document that allows pass-through entities such as S corporations, partnerships, limited liability com

Form 510E - 511E Application for Extension to File Pass-Through Entity

What is Maryland Form 510E

The Maryland Form 510E, also known as the Application for Extension to File Pass-Through Entity Income Tax Return, is a legal document that allows pass-through entities such as S corporations, partnerships, limited liability com

What are Maryland Tax Forms?

Maryland tax forms are the official documents created by the state authorities for residents and nonresidents who pay taxes. There are numerous types of tax forms gathered in one place for your convenience. You don’t need to fill all of them, however, you may use some to report your income and taxes to the state. It does not mean you have to stop filing federal tax reports which look similar but don’t provide the same information to the local authorities.

PDFLiner contains over 30 different Maryland state tax forms you can complete during the tax report period. You may find their documents that allow you to notify Maryland of your pension, salary, business, or property. Each form has its own demands and deadlines.

Most Popular Maryland Tax Forms

You may already know which state of Maryland tax forms you need. You can always ask it via the website of the Maryland Department of Revenue. If you simply want to gather your personal library in advance, to make sure that all the forms are there when you need them, you may start by building the collection. Here you will see the most widely used blanks in Maryland. Check them out:

- Form 502. This is a standard Resident Income Tax Return form. It must be filled only by Maryland residents and contain information on the fiscal year's income. You have to provide details about yourself and your spouse. Share the data on your income and taxes, including federal and state. Don’t forget to include the physical address of the taxing area in Maryland, even if you are a part-time resident of the state.

- Form 502X. It is known as the amended tax return form. Once you fill Maryland income tax forms but now fill that you have to change the information there, you can do it by using the 503X template. This form can fix the data you’ve sent not only one year but several years ago. You can change the address, name, marital status, and the numbers you’ve provided in your previous tax report. Indicate the original number you used in the previous form and the correct one you want to include now.

- Form 502V. This is not one of the Maryland forms but you may need it in your library as an example of how to fill tax payment vouchers. If you are a student of Virginia-Maryland University, you can use the form as well. This form comes from the neighboring state Virginia. It is called Virginia Pass-Through Entity Tax Payment Voucher. The form was created by Virginia officials and can be sent there online. All the pass-through entities have to submit the payments and returns electronically. This form teaches you how to do it.

- Form 505. This is the Maryland-own form for anyone who does not live in the state but works there. It is called Nonresident Income Tax Return. Nonresidents have to include information about their home addresses outside the state, their income, and taxes. The form is similar to the tax report that must be filled out by Maryland residents.

- Form 13A. You know this form as the Maryland Pension Exclusion Computation Worksheet. You can also use the 13E worksheet if you are a retired law enforcement officer, correctional officer, emergency services personnel, or fire, or rescue personnel. For other cases, you have to use this one.

Where Can You Get State Income Tax Forms For Maryland?

You will find all Maryland state income tax forms you need on the official website of the Maryland government. Among the information on the local events, new documents, and updates to numerous forms, you may find anything you need. If you want to simplify the process, use PDFLiner that already has a separate section for the tax forms from Maryland. Moreover, you can use this editor to fill out the form online. Here is what you need to do:

- Pick the form you need by reading its description and name.

- Press the Fill Online button.

- Complete the form once it is opened.

- Sign in if you need it and send it to the officials.

FAQ:

-

When will Maryland tax forms be available?

Maryland forms are always available on the official website and on PDFLiner. If you are looking for the updates they usually appear close to the time when you need to fill the report. However, you can check the website once a week. Don’t miss the deadline for tax forms or you will be fined.

-

Where to file Maryland tax forms?

Maryland officials offer two ways to send the forms. You can either send them electronically, using the website or you can send them by regular mail. Each form has its own demands and addresses mentioned by the government.