-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Form Arkansas No-Fault Divorce (Minor Children)

Form Arkansas No-Fault Divorce (Minor Children)

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Kansas Tax Forms

-

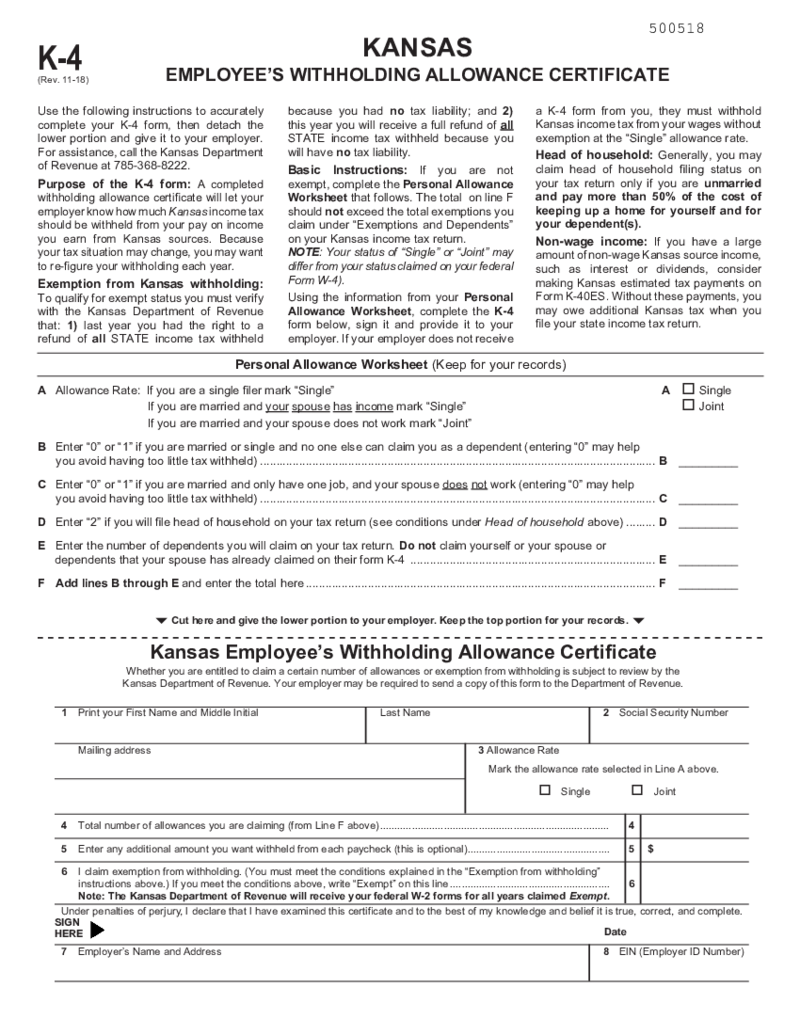

Kansas K 4 Form

How to Redact and Fill Out Kansas K 4 Form?

To redact and fill out Kansas Form K 4 online, you should follow these steps:

Go to the Kansas Department of Revenue website and find the K-4 tax form Kansas under the "Forms" section

Kansas K 4 Form

How to Redact and Fill Out Kansas K 4 Form?

To redact and fill out Kansas Form K 4 online, you should follow these steps:

Go to the Kansas Department of Revenue website and find the K-4 tax form Kansas under the "Forms" section

-

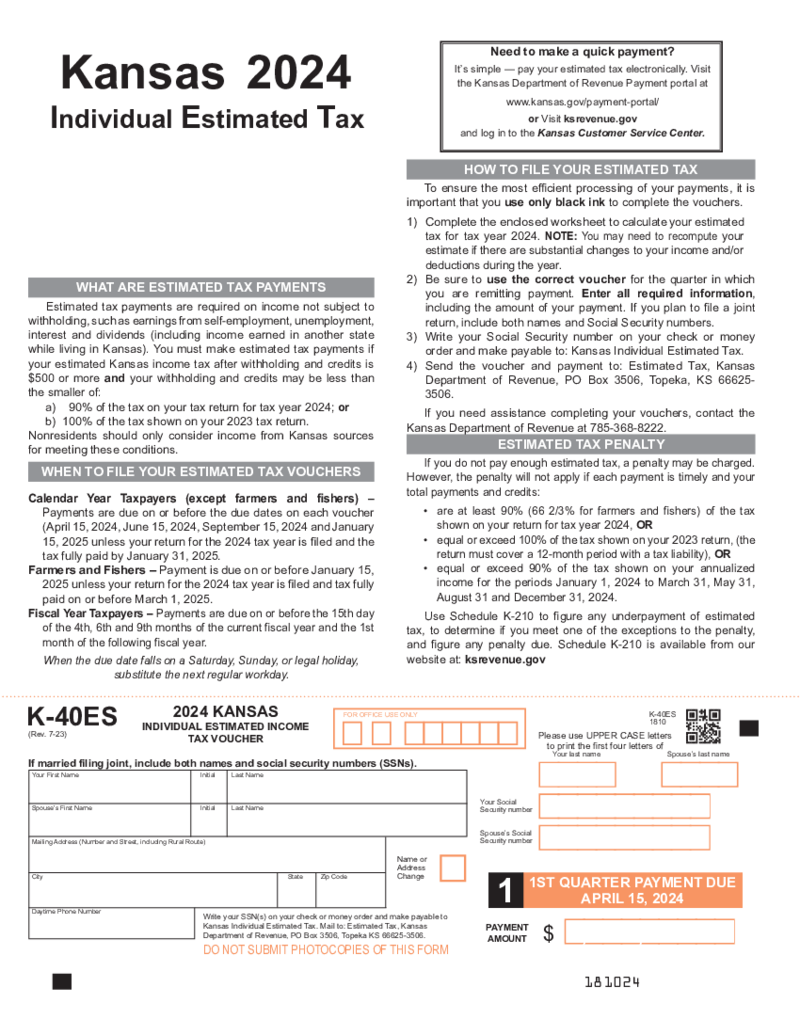

Kansas Form K-40ES

What Is A Form K 40ES

Form K-40ES, also known as the Kansas Individual Income Tax Voucher for Estimated Tax, is an essential document for state taxpayers. This form serves as a mechanism for individuals to pay income tax on earnings not subject to withhol

Kansas Form K-40ES

What Is A Form K 40ES

Form K-40ES, also known as the Kansas Individual Income Tax Voucher for Estimated Tax, is an essential document for state taxpayers. This form serves as a mechanism for individuals to pay income tax on earnings not subject to withhol

-

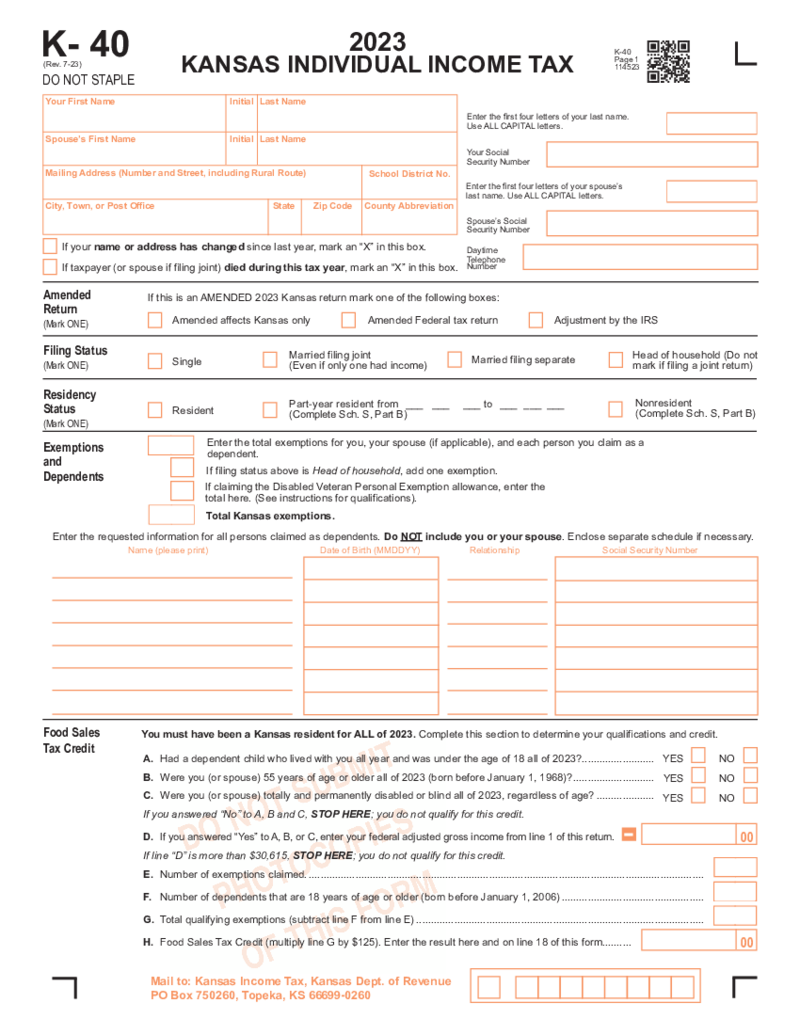

Kansas Form K-40

What Is Kansas Form K-40?

When tax season arrives, Kansas residents must prepare to submit their state income taxes using the Kansas Form K 40. It's designed for taxpayers to report their annual income, calculate their tax due, and claim any applicabl

Kansas Form K-40

What Is Kansas Form K-40?

When tax season arrives, Kansas residents must prepare to submit their state income taxes using the Kansas Form K 40. It's designed for taxpayers to report their annual income, calculate their tax due, and claim any applicabl

-

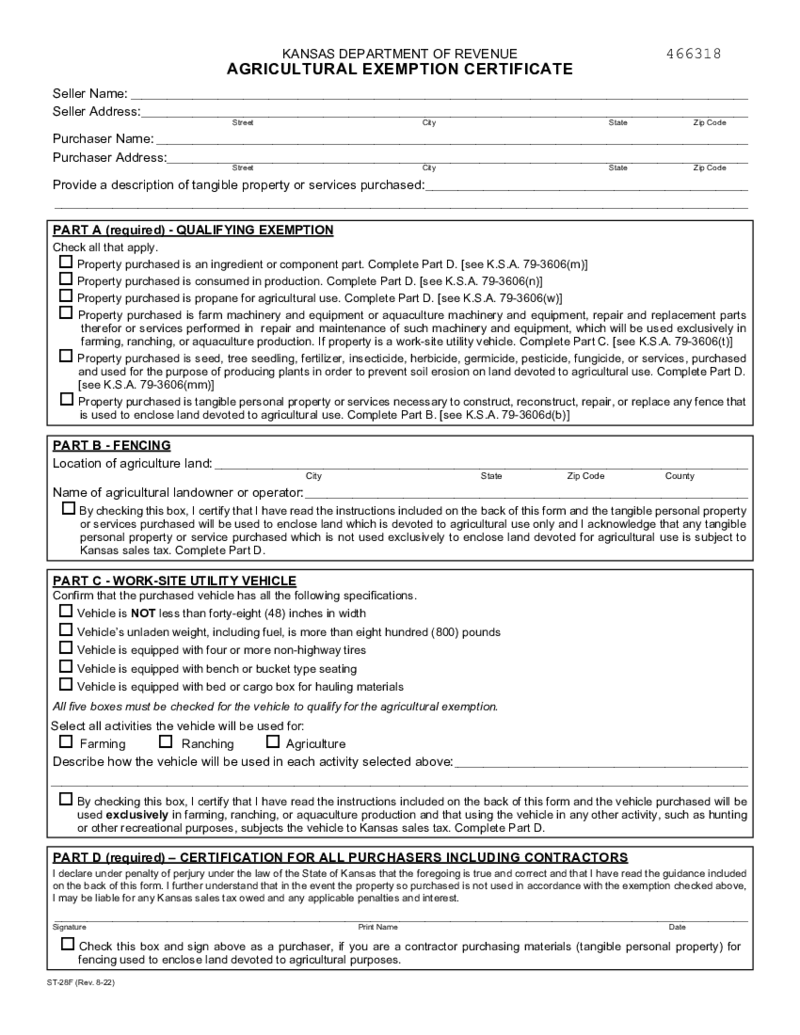

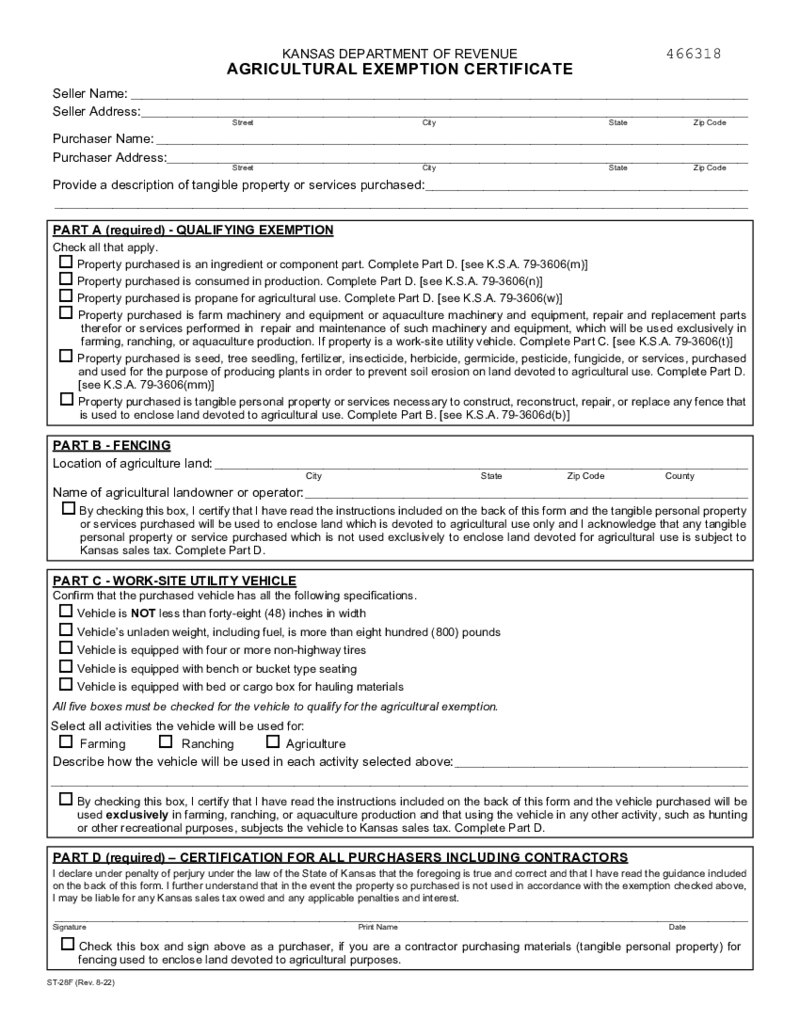

Kansas Department of Revenue, Agricultural Exemption Certificate

What Is Kansas Department of Revenue, Agricultural Exemption Certificate?

The Kansas department of revenue sales tax form is a document issued by Kansas that allows farmers and ranchers to purchase certain items, such as farm equipment, feed, seed, and ch

Kansas Department of Revenue, Agricultural Exemption Certificate

What Is Kansas Department of Revenue, Agricultural Exemption Certificate?

The Kansas department of revenue sales tax form is a document issued by Kansas that allows farmers and ranchers to purchase certain items, such as farm equipment, feed, seed, and ch

-

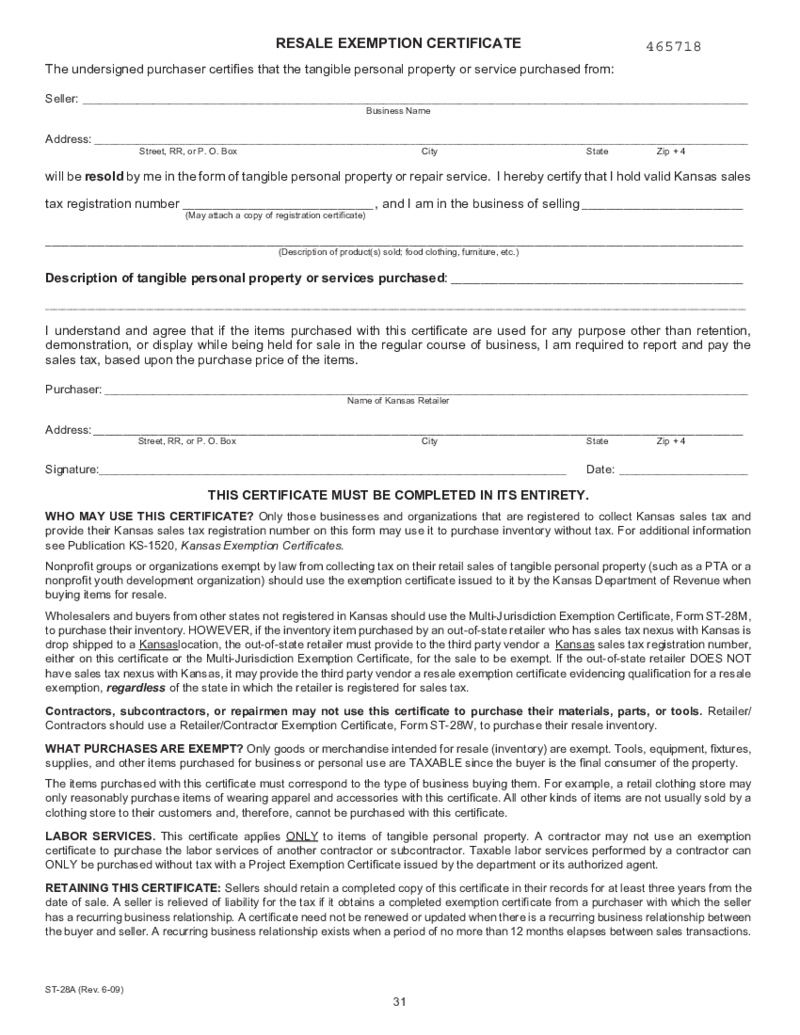

Kansas Exemption Certificates

What Is Kansas Sales Tax Exemption Certificates

In Kansas, sales tax exemption certificates are a pivotal tool for eligible businesses and organizations allowing them to make tax-free purchases that would otherwise be subject to state sal

Kansas Exemption Certificates

What Is Kansas Sales Tax Exemption Certificates

In Kansas, sales tax exemption certificates are a pivotal tool for eligible businesses and organizations allowing them to make tax-free purchases that would otherwise be subject to state sal

-

Kansas Resale Exemption Certificate

Understanding the Kansas Resale Tax Exemption Certificate

When dealing with Kansas sales tax regulations, understanding and properly using the sales tax exemption certificate Kansas is crucial for businesses engaged in tax-exempt transactions. This certif

Kansas Resale Exemption Certificate

Understanding the Kansas Resale Tax Exemption Certificate

When dealing with Kansas sales tax regulations, understanding and properly using the sales tax exemption certificate Kansas is crucial for businesses engaged in tax-exempt transactions. This certif

What are Kansas Tax Forms?

All Kansas tax forms were created by the Kansas government to simplify tax reports period for local citizens and nonresidents who work in the state. You may own the property in Kansas but neither work nor live in the state. Officials of Kansas created blanks for different occasions. Some of them look like federal forms created by the IRS due to the similar information that is required there, yet, Kansas authorities include lines about local taxes and income.

PDFLiner has a growing library of Kansas state tax forms you may need in the future. You can check them out and save them to your personal collection or just fill them online and quickly send them to the local department of revenue. The forms are free and contain detailed instructions inside.

Most Popular Kansas Tax Forms

Almost all state of Kansas tax forms have specific numbers that indicate them. It is made for your convenience and the simplicity of the searching process. You may find numerous schedules that come as attachments to the forms. If you don’t know which form to choose, check out the most popular options, and perhaps they will give you an understanding of what you need to search for. Here is the list of Kansas state income tax forms:

- Form K-40. This is a document known as Kansas Individual Income Tax. You may find lots of similarities with federal form 1040 there, but with local additions. You will have to add Kansas gross income, taxes, and residency status. Apart from that you also need to provide information on your federal taxes, income, and other data from the 1040 form. Be specific and don’t make mistakes if you don’t want to file an amended document right away. Send the form before the deadline.

- Form K-40V. This is an Individual Income Tax Payment Voucher. The voucher goes separately from Kansas income tax forms despite the fact that it is related to them. You have to place it in the envelope with the return. Yet, if you mailed the return before the voucher you can send it separately. You have to mail it by regular mail to the Kansas Income Tax Department of Revenue. Be specific about the information you provide in check. It must be sent before the deadline or you will be fined.

- Form K-40ES. This form is known as Individual Estimated Tax. It contains detailed instructions on how to fill it out. These instructions are valuable even if you send any Kansas tax return forms. You have to calculate your estimated taxes during the year you pick. If there were changes during the year you need to recompute the estimate. The form is used by self-employed or unemployed residents for dividends and interest.

- Form K-4. This is Kansas Employee’s Withholding Allowance Certificate. It provides instructions for one of the most used Kansas withholding tax forms. You have to complete the form before you provide it to the employer you work for. If you are lost in the document you can get in contact with the Kansas Department of Revenue. This form indicates to your employer the amount of income taxes in Kansas that must be withheld from you.

- Kansas Department of Revenue Agricultural Exemption Certificate. This is not a rare form among all Kansas tax exempt forms. You have to name the seller and purchaser in it, adding addresses. Make sure you describe the property or the services you’ve paid for or sold.

Where To Get Kansas State Tax Forms?

You can find Kansas tax forms online on the Kansas Department of Revenue's official website. The search process may be delayed due to the enormous amount of different forms created by the government for years. Apart from that once you found the form you need to search for the online editor to fill it out. PDFLiner helps you with it. It contains the forms you need as well as all the tools you can use to complete it. Here is what you have to do there:

- Choose one of the forms you need the most.

- Press the icon Fill Online near its description.

- Fill out the form using the tools of PDFLiner.

- Send the document online, print it, or save it to your device. Include an e-signature if you need it.

FAQ:

-

What tax forms do I need for Kansas?

It depends on your particular situation. You may need popular templates used by other taxpayers as well as rare or specific forms. The most widespread forms are tax income reports and amended forms. To avoid sending amended forms make sure all the information you include is correct.

-

Where do you order Kansas income tax forms?

You don’t need to order any forms. If you know the name of the form you can search for it online on the official website or PDFLiner. Send it to the government once you complete it or to the other party based on instructions.