-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Form Arkansas No-Fault Divorce (Minor Children)

Form Arkansas No-Fault Divorce (Minor Children)

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Nebraska Tax Forms

-

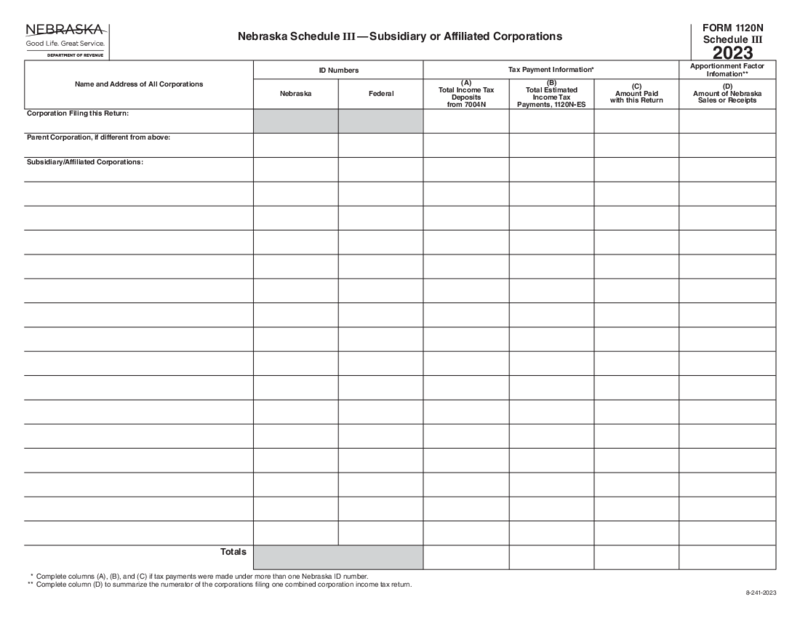

Nebraska Form 1120 N Schedule III

How Do I Get Nebraska Form 1120 N Schedule III Online?

Use PDFLiner forms catalog to obtain your form. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

Nebraska Form 1120 N Schedule III

How Do I Get Nebraska Form 1120 N Schedule III Online?

Use PDFLiner forms catalog to obtain your form. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

-

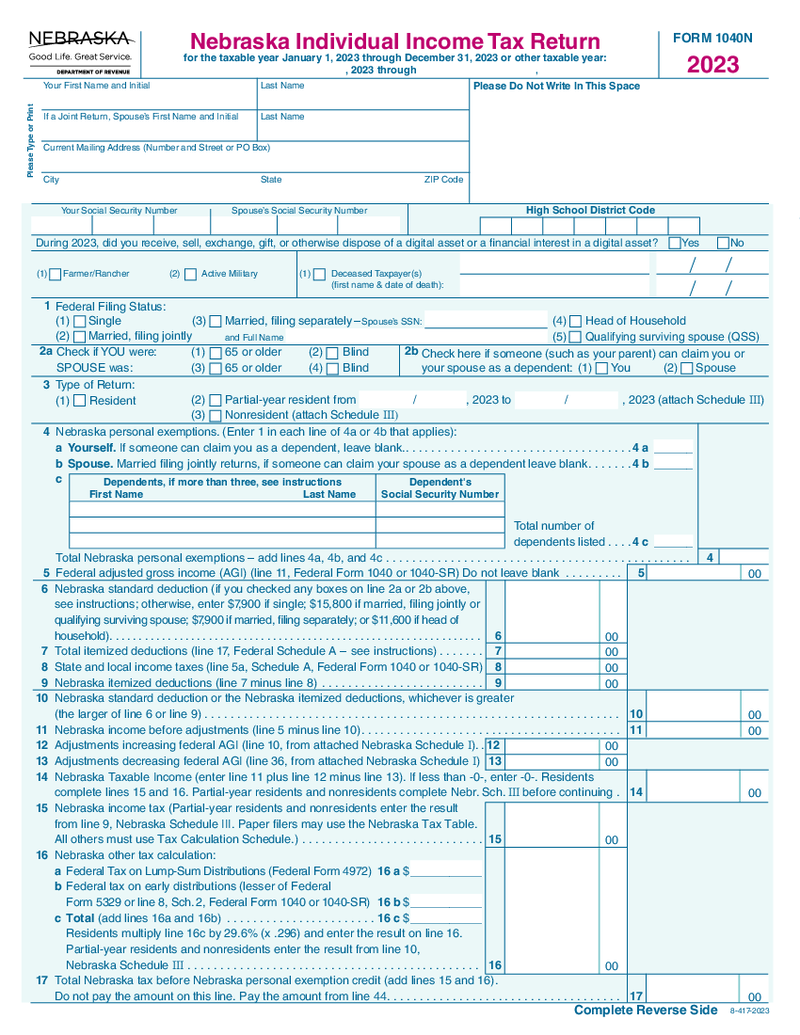

Nebraska Individual Income Tax Return - Form 1040N

What is a 1040N Form

Simply put, the Nebraska individual income tax return Form 1040N is the form you'll use to file your state income tax if you're a resident, part-year resident, or non-resident who has earned income in Nebraska. It's the st

Nebraska Individual Income Tax Return - Form 1040N

What is a 1040N Form

Simply put, the Nebraska individual income tax return Form 1040N is the form you'll use to file your state income tax if you're a resident, part-year resident, or non-resident who has earned income in Nebraska. It's the st

-

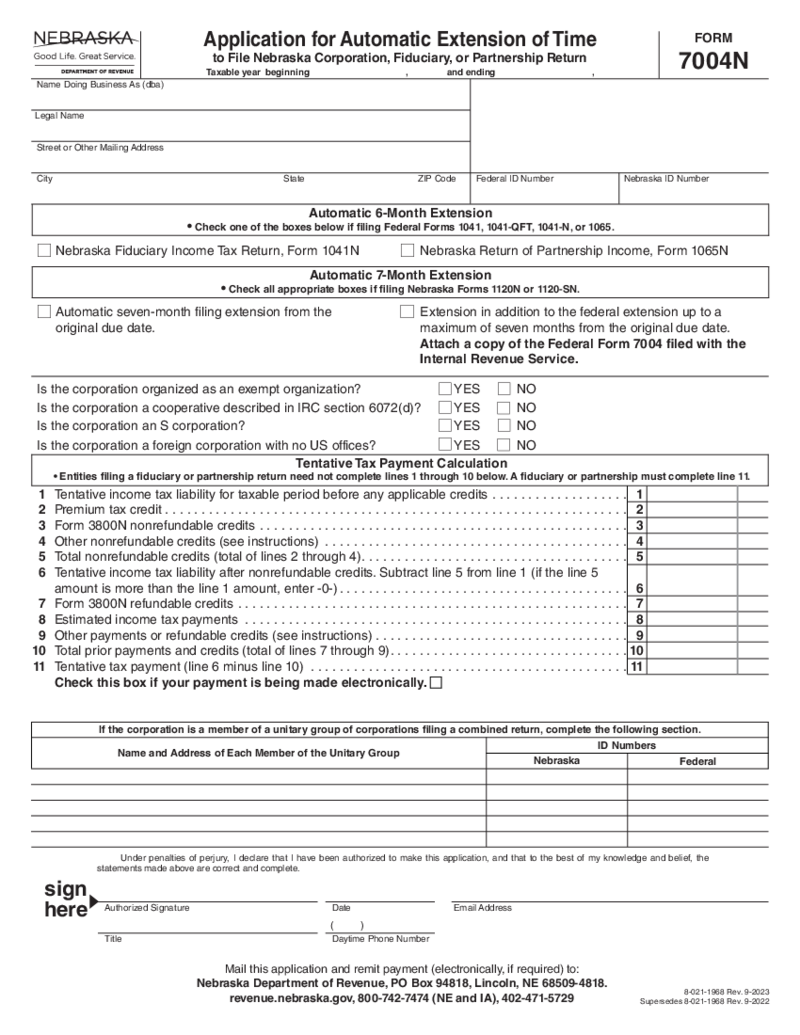

Application for Automatic Extension of Time - Form 7004N

What Is Nebraska Form 7004N?

Nebraska Form 7004N is an application form used by trusts and estates to request an extension of time to file their Nebraska income tax returns. This form is specific to the state of Nebraska and is similar in function to the

Application for Automatic Extension of Time - Form 7004N

What Is Nebraska Form 7004N?

Nebraska Form 7004N is an application form used by trusts and estates to request an extension of time to file their Nebraska income tax returns. This form is specific to the state of Nebraska and is similar in function to the

-

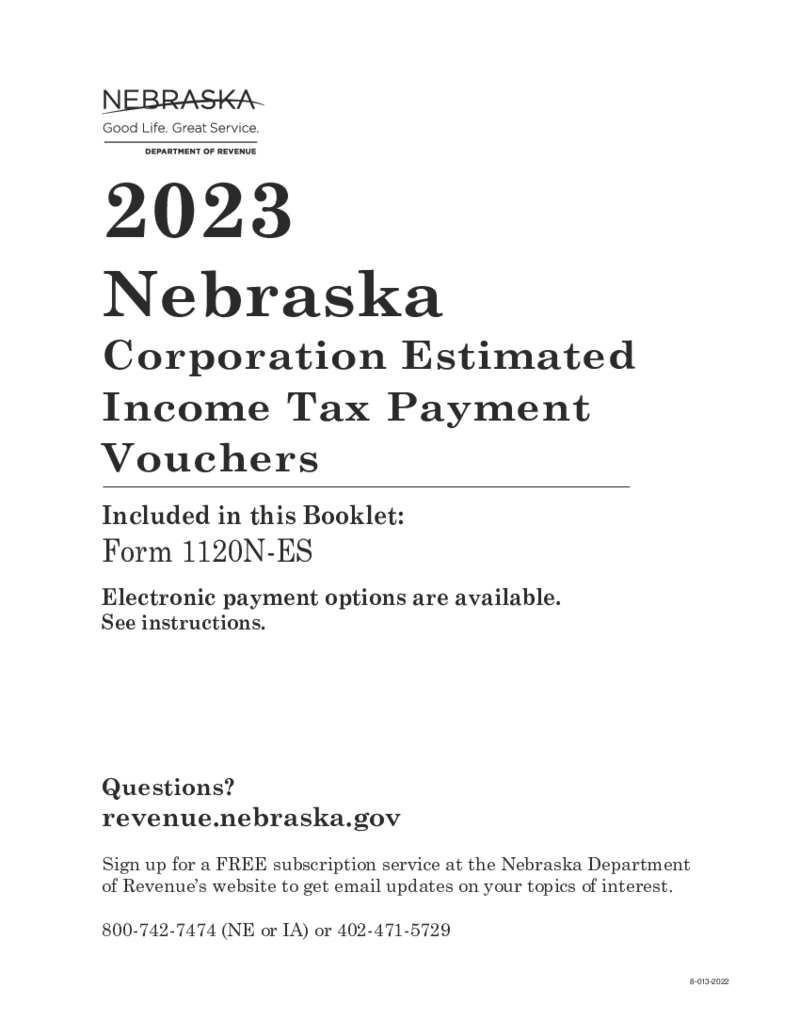

Nebraska Corporation Estimated Income Tax Payment Vouchers - Form 1120N-ES

How Do I Get Nebraska Corporation Estimated Income Tax Payment Vouchers - Form 1120N-ES Online?

You can find the blank file in PDFLiner forms library. Either push the "Fill this form" button or follow the steps below in case you need to find the

Nebraska Corporation Estimated Income Tax Payment Vouchers - Form 1120N-ES

How Do I Get Nebraska Corporation Estimated Income Tax Payment Vouchers - Form 1120N-ES Online?

You can find the blank file in PDFLiner forms library. Either push the "Fill this form" button or follow the steps below in case you need to find the

-

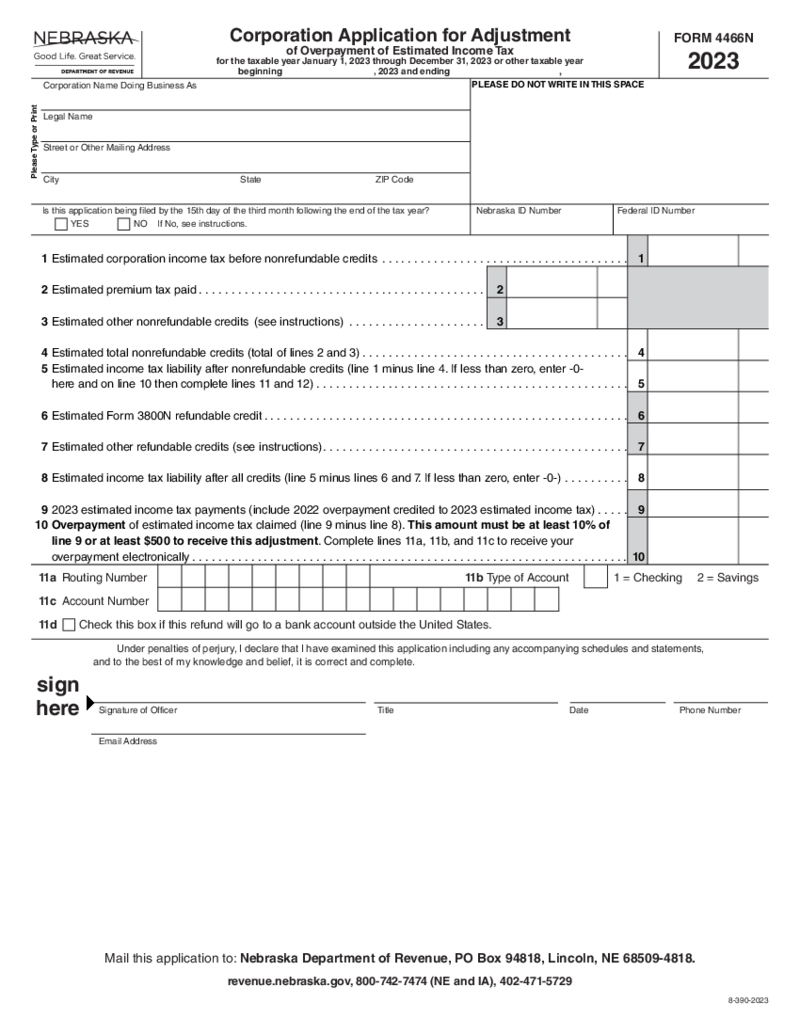

Nebraska Form 4466N

Getting a Nebraska Form 4466N PDF

Use PDFLiner forms catalog to obtain your form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to find it letter, follow the steps:

Nebraska Form 4466N

Getting a Nebraska Form 4466N PDF

Use PDFLiner forms catalog to obtain your form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to find it letter, follow the steps:

-

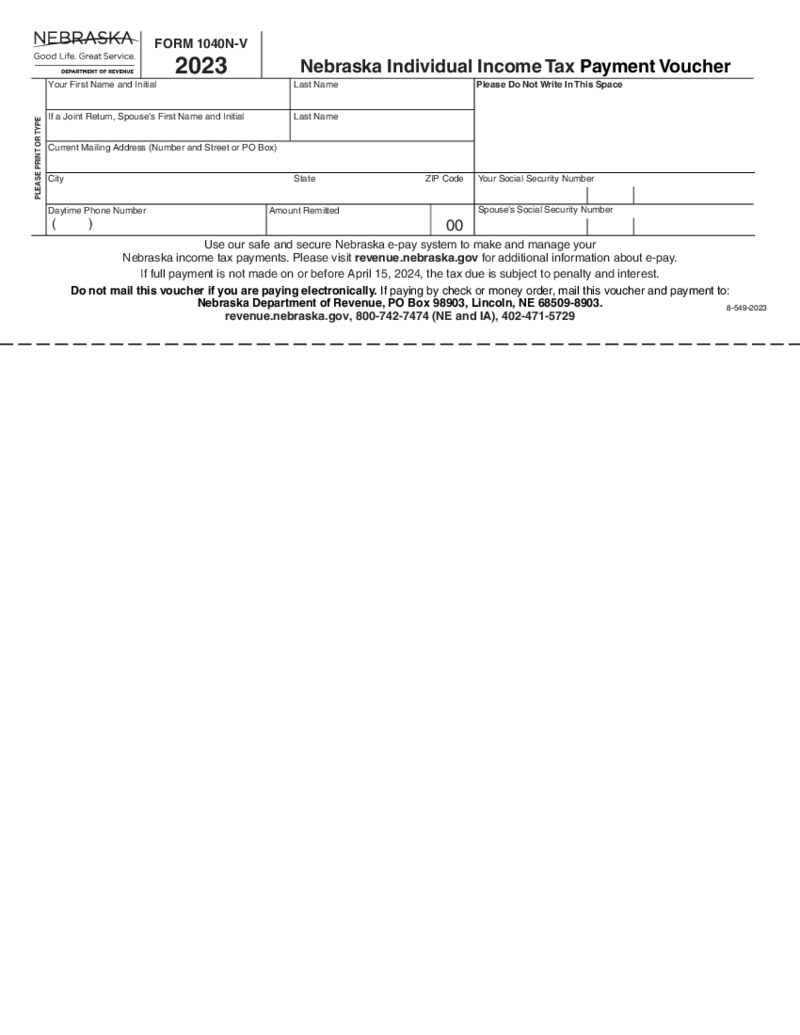

Nebraska Form 1040N-V

Understanding Nebraska Tax Form 1040N V

When it comes to tax season, understanding the specific forms required by your state is crucial. For Nebraska residents, the Nebraska tax form 1040N-V is an essential piece of the puzzle if you are making a payment

Nebraska Form 1040N-V

Understanding Nebraska Tax Form 1040N V

When it comes to tax season, understanding the specific forms required by your state is crucial. For Nebraska residents, the Nebraska tax form 1040N-V is an essential piece of the puzzle if you are making a payment

-

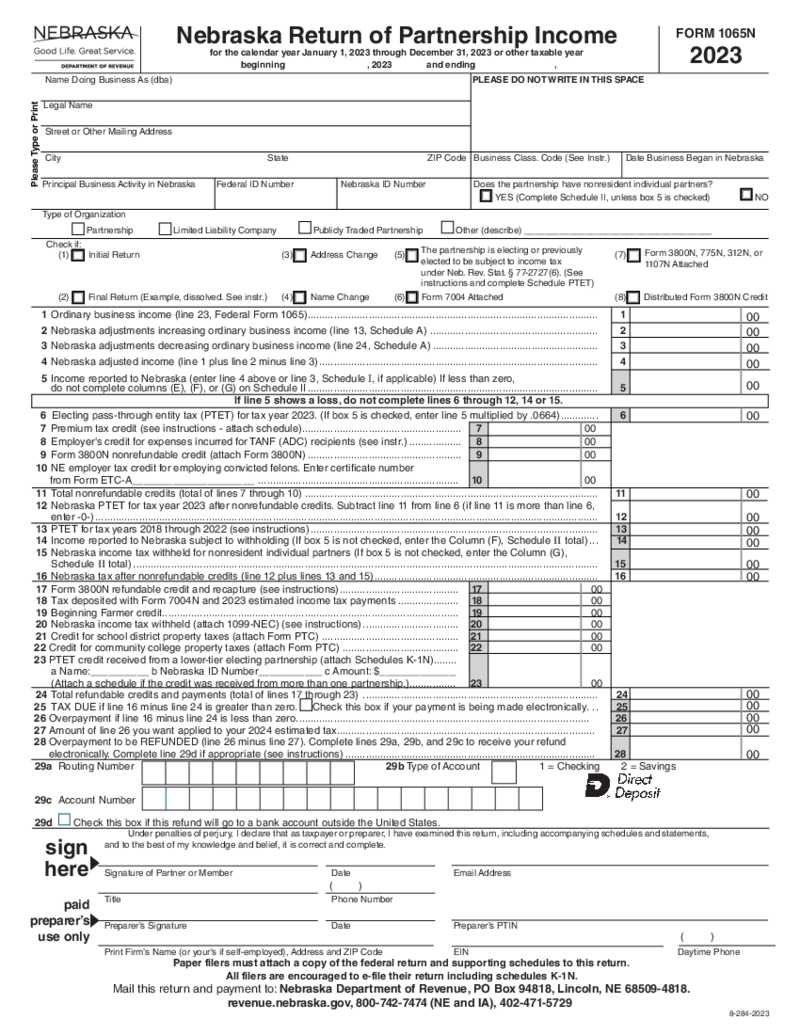

Nebraska Return of Partnership Income -1065-N

What Is Form 1065-N?

Form 1065-N is a required tax document for any partnership doing business in the state of Nebraska. It is similar to the federal Form 1065 that partnerships use to report their financial activities to the Internal Revenue Service, but

Nebraska Return of Partnership Income -1065-N

What Is Form 1065-N?

Form 1065-N is a required tax document for any partnership doing business in the state of Nebraska. It is similar to the federal Form 1065 that partnerships use to report their financial activities to the Internal Revenue Service, but

What are Nebraska Tax Forms?

Nebraska tax forms are official templates created by the state authorities to record the income and taxes paid by individuals who live and work there. You can use any form from the state you need free of charge. You have to file it by the deadline to the Nebraska Department of Revenue. Usually, Nebraska income tax forms are based on or have lots of similarities with the state tax forms created by the IRS. However, local forms contain information on the taxes related to the state.

PDFLiner offers you a wide range of templates that you can fill in right away. These documents can be sent either directly to the post box of the Revenue Department or via their electronic address. If you delay the form you may get fined to pay.

Most Popular Nebraska Tax Forms

If you are looking for specific Nebraska state income tax forms, you have to know their titles or numbers. If you are not sure, it is best to consult with local officials in advance. They will help you to find the forms you need. However, there are lots of documents that may become required during your life. It is important to have your personal library of templates updated for the next year. You can get inspired by the list of most popular Nebraska state tax forms:

- Form 1040N. The form is called Nebraska Individual Income Tax Return. This is the standard document you have to fill to provide data on your taxes. This is a local copy of the famous form 1040 you provide to the IRS every year. Apart from the document you send to the IRS, you also need to report your local taxes and gross income to the Nebraska Department of Revenue. It has strict deadlines. You can use your calculations for 1040 form.

- Form 1040N-V. It is called Nebraska Individual Income Tax Payment Voucher. Once you fill in the 1040N form you may understand you need this one as an attachment. You have to provide similar information, indicating yourself, your spouse, and your address. If you pay taxes electronically you don’t need to send the voucher anywhere. If you pay in cash or check, you have to file a voucher to the Nebraska Department of Revenue.

- Form PTXC. Among Nebraska tax fillable forms this one you need to fill if you own the property. It is called Amended Nebraska Property Tax Incentive Act Credit Computation. You can’t use this document without previously filing form 1040N to Nebraska Department of Revenue. It is used for the amended data. You need to provide the credit’s computation, and name those who paid school district property taxes. Include details you did not have enough space to mention in 1040N.

- Form 1065N-V. The form is called Nebraska Partnership Return of Income Payment Voucher. You need to provide information about you, including name, address, ID number in Nebraska, Federal ID number. Write the information on the taxable year ending and the amount remitted. The Department of Revenue offers you to use their own e-pay system to pay taxes. You can use it on their official website.

- Form 1120N-V. The blank is similar to the previous one. It is called Nebraska Corporation Income Tax Voucher. You have to provide it if you represent either C type corporation or S type corporation. You have to include information on the corporation, as well as the amount remitted and the taxable year ending.

Where to Get Nebraska State Tax Forms?

All the Nebraska estimated tax payments 2022 forms can be found on the official website of Nebraska Department of Revenue. You will find there all the forms that were created by local officials. Once you find them, you have to search for how to fill them. Another way is to go to the PDFLiner, pick the form from the Nebraska section and fill it out using the editor’s tools online. Follow these steps when you see the printable Nebraska state tax forms you need:

- Pick one of the forms and read its description.

- Press the button Fill Online.

- The editor will download this blank that you have to complete.

- You can sign the document using the e-signature option on PDFLiner and send it to the officials.

FAQ:

-

What tax forms do I need in Nebraska?

You need to search for the forms that are required by officials from taxpayers like you. Based on your specific case you may need something extra than standard tax templates. You will find them on PDFLiner too.

-

What forms do I need to file with my Nebraska state income tax return?

You will have to file form 1040N in the first place. This is a major document created by the Nebraska Department of Revenue. Make sure it is updated and can be filed this year. There are several attachments for specific cases. Read the descriptions of the tax forms above since you may need them together with 1040N.

-

Where to mail Nebraska state tax forms?

You can mail these forms to the official website of the Nebraska Department of Revenue. They accept online versions of documents. However, if you prefer regular mail, they have a PO box address indicated on every form they release.