-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

California Tax Forms

-

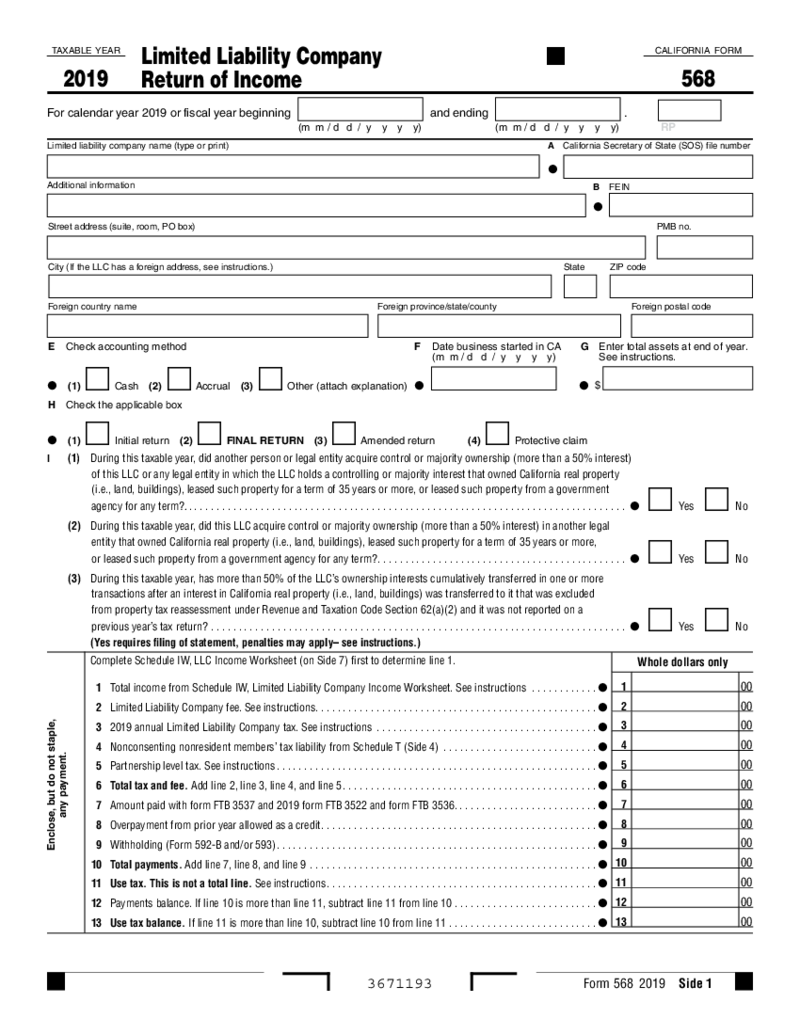

CA Form 568 - Limited Liability Company Return of Income

What Is CA Form 568

California Form 568 is specifically designed for LLCs classified as partnerships or disregarded entities for federal tax purposes. It enables LLC owners to report their income, expenses, deductions, and credits, as well as to calculate

CA Form 568 - Limited Liability Company Return of Income

What Is CA Form 568

California Form 568 is specifically designed for LLCs classified as partnerships or disregarded entities for federal tax purposes. It enables LLC owners to report their income, expenses, deductions, and credits, as well as to calculate

-

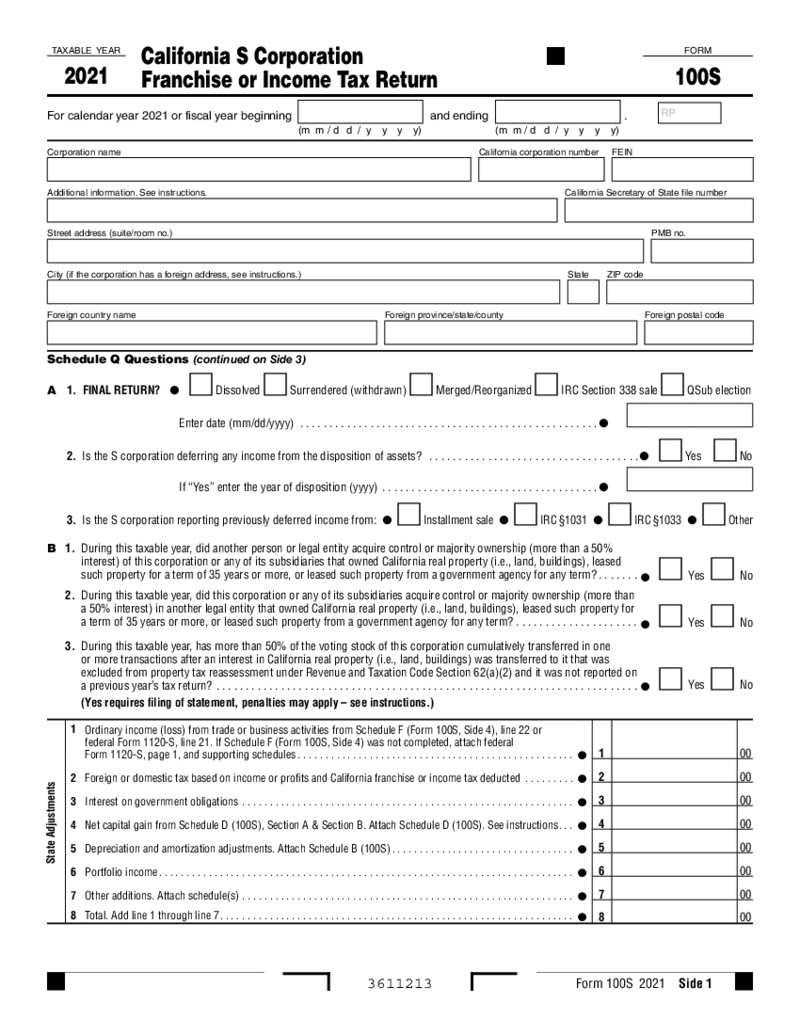

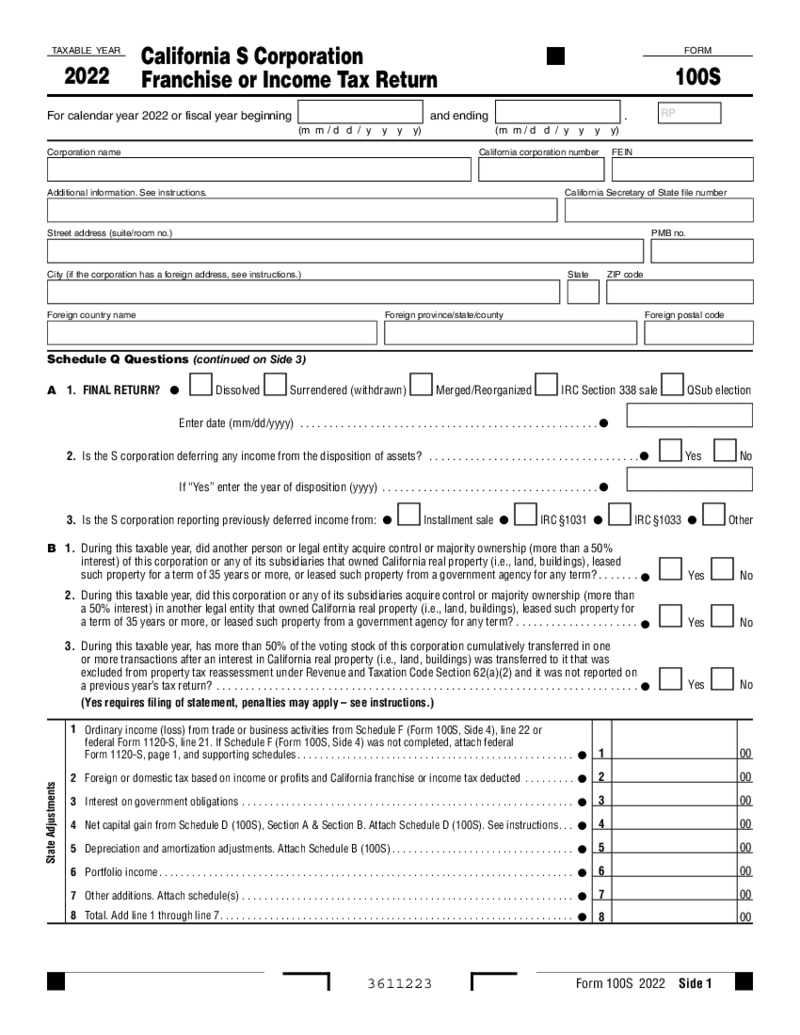

California Form 100S - S Corporation Franchise or Income Tax Return (2021)

What Is a Form 100S, Franchise or Income Tax Return 2021?

A Form 100S, Franchise or Income Tax Return is a document that California S Corporations must file annually with the California Franchise Tax Board. It is used to report the income, deductions, and

California Form 100S - S Corporation Franchise or Income Tax Return (2021)

What Is a Form 100S, Franchise or Income Tax Return 2021?

A Form 100S, Franchise or Income Tax Return is a document that California S Corporations must file annually with the California Franchise Tax Board. It is used to report the income, deductions, and

-

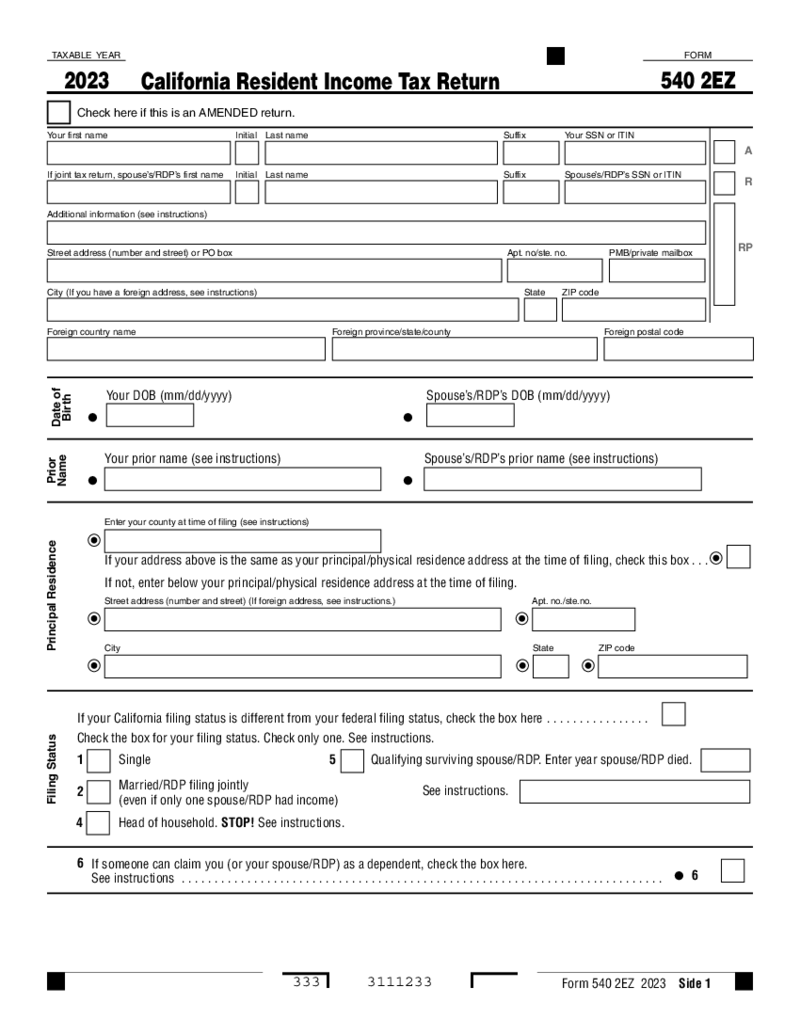

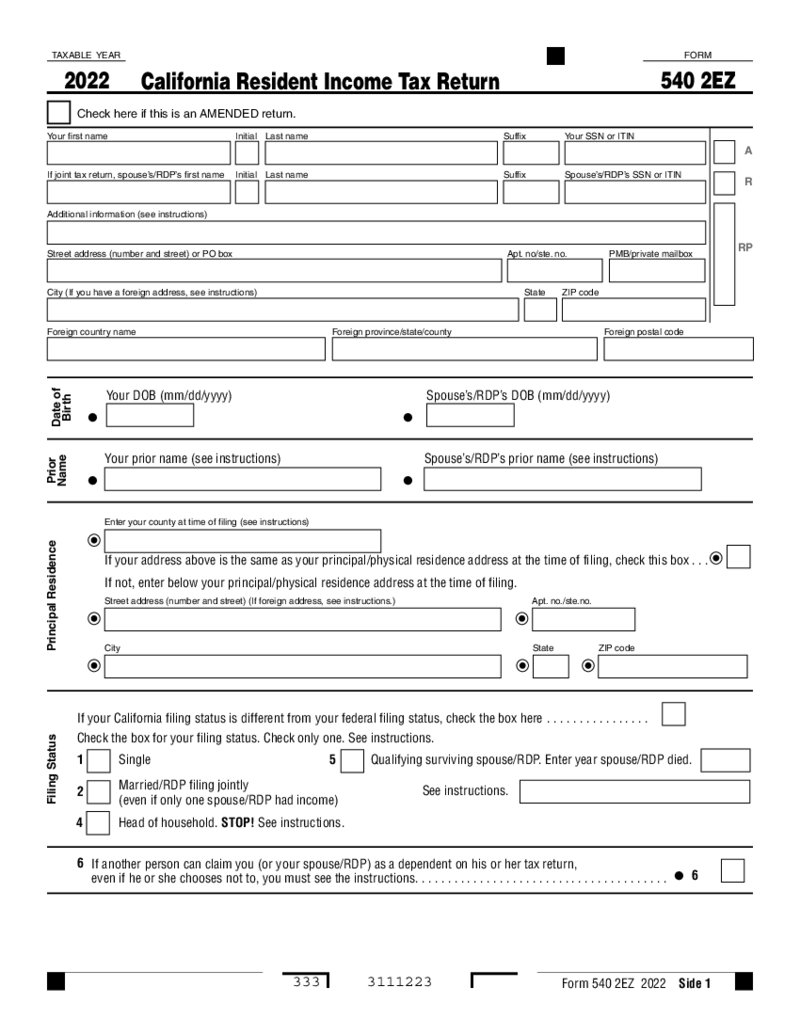

California Form 540 2EZ

What is Form 540 2EZ

In California taxes, the tax form 540 2EZ is a shorter and simplified version of the standard 540 form. It's an opportunity for qualifying individuals to file their California resident income tax straightforwardly

California Form 540 2EZ

What is Form 540 2EZ

In California taxes, the tax form 540 2EZ is a shorter and simplified version of the standard 540 form. It's an opportunity for qualifying individuals to file their California resident income tax straightforwardly

-

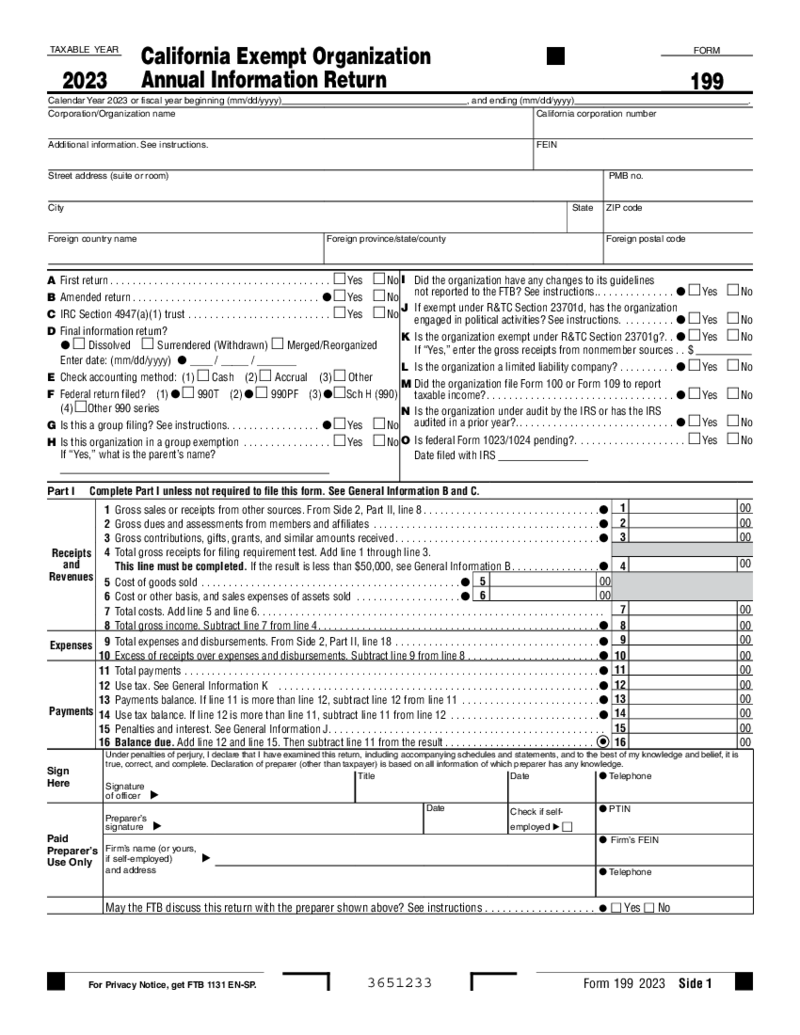

CA Form 199

What Is Form CA 199 2023 - 2024

Also known as California Exempt Organization Annual Information Return, Form CA 199 is a tax document required for tax-exempt organizations operating in California. Its purpose is to collect essential financial and operatio

CA Form 199

What Is Form CA 199 2023 - 2024

Also known as California Exempt Organization Annual Information Return, Form CA 199 is a tax document required for tax-exempt organizations operating in California. Its purpose is to collect essential financial and operatio

-

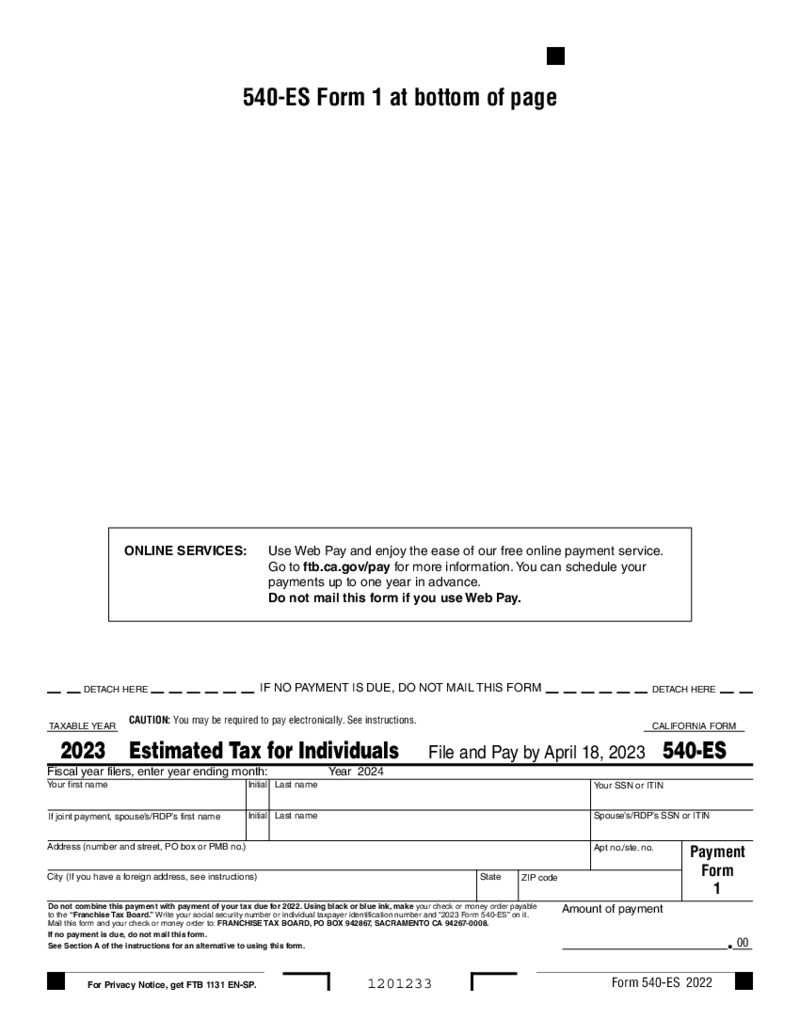

California Form 540-ES (2023)

What Is Form 540-ES California

Form 540-ES is an essential document for California residents who must handle annual income tax payments. This form serves as the voucher for estimated tax payments made by individuals. If you expect to owe

California Form 540-ES (2023)

What Is Form 540-ES California

Form 540-ES is an essential document for California residents who must handle annual income tax payments. This form serves as the voucher for estimated tax payments made by individuals. If you expect to owe

-

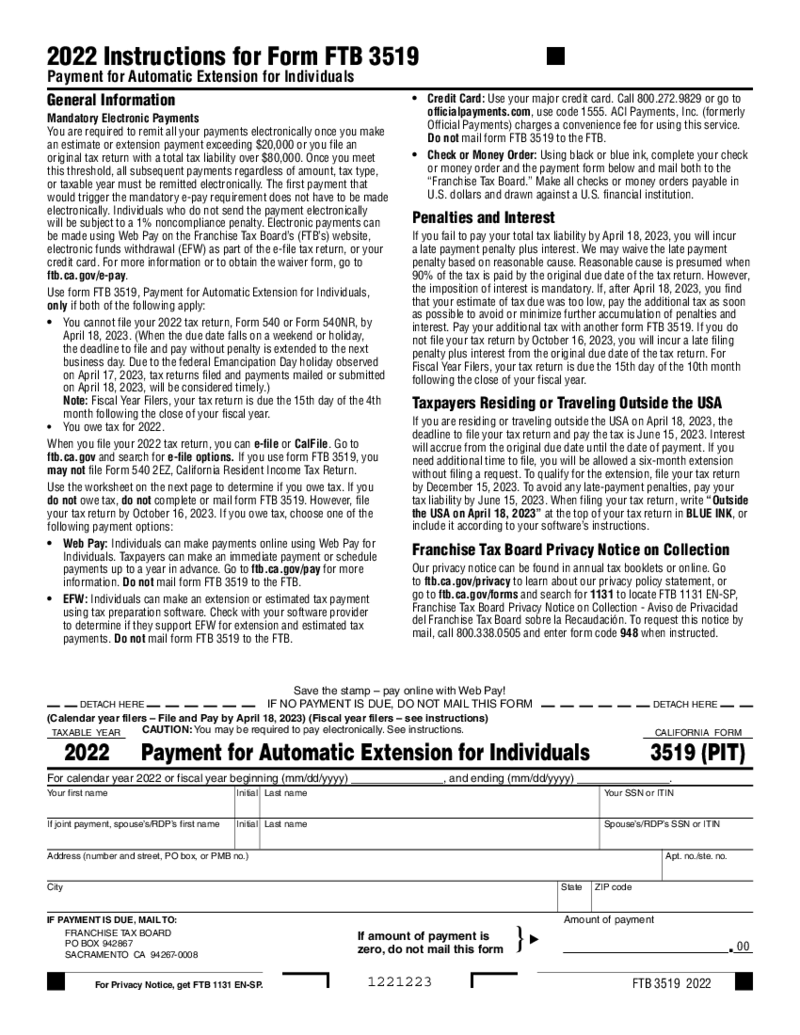

CA Form 3519 (2022)

What is CA Form FTB 3519

Form FTB 3519, also known as the Payment for Automatic Extension for Individuals, is used to pay any estimated taxes owed when filing for an automatic 6-month extension for California individual income tax returns.

Who

CA Form 3519 (2022)

What is CA Form FTB 3519

Form FTB 3519, also known as the Payment for Automatic Extension for Individuals, is used to pay any estimated taxes owed when filing for an automatic 6-month extension for California individual income tax returns.

Who

-

California Form 100S (2022)

What Is Form 100S

Also referred to as California S Corporation Franchise or Income Tax Return, 100S form is utilized by S corporations operating in California. It reports the corporation's income, deductions, and credits for state tax purposes. S corp

California Form 100S (2022)

What Is Form 100S

Also referred to as California S Corporation Franchise or Income Tax Return, 100S form is utilized by S corporations operating in California. It reports the corporation's income, deductions, and credits for state tax purposes. S corp

-

Form 568 (2019)

Understanding Form 568 2019 for California Tax Filing

Form 568 is a vital document for Limited Liability Companies (LLCs) operating in the state of California. It serves as the Return of Income that such entities must file with the California Franchise Ta

Form 568 (2019)

Understanding Form 568 2019 for California Tax Filing

Form 568 is a vital document for Limited Liability Companies (LLCs) operating in the state of California. It serves as the Return of Income that such entities must file with the California Franchise Ta

-

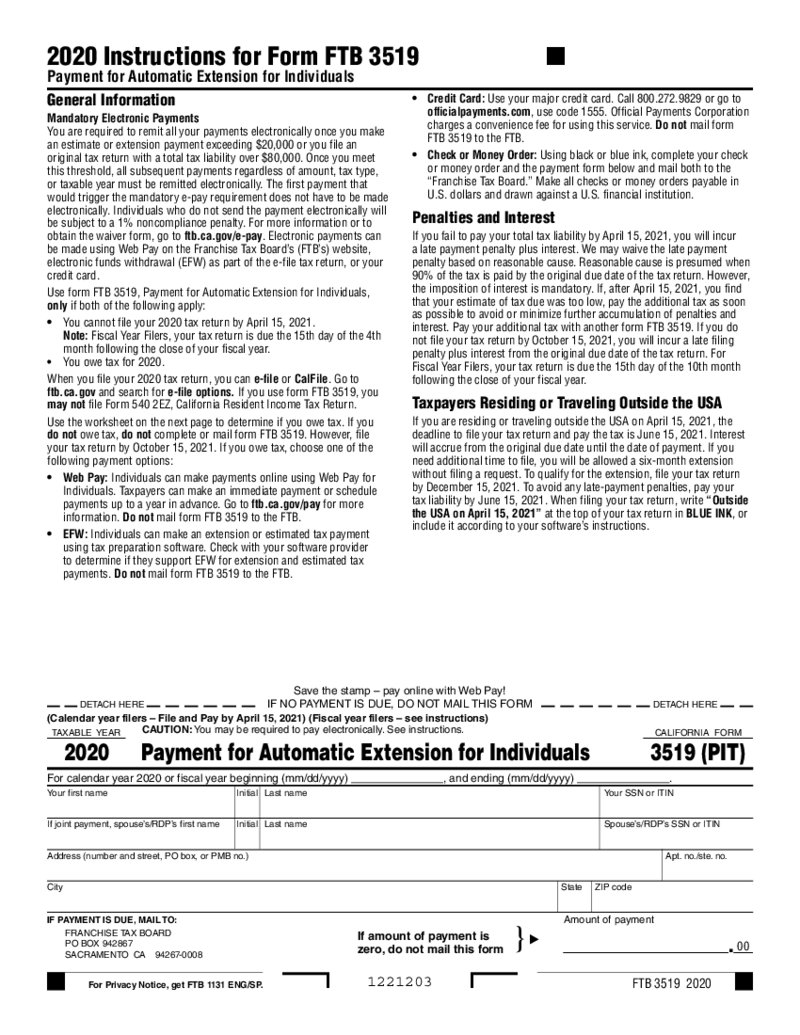

California Form 3519 (PIT)

1. What is California Form 3519?

California Form 3519 is used for individuals who require an automatic tax payment extension. It consists of a short questionnaire and a payment worksheet where you can keep your records.

2. What I need Californi

California Form 3519 (PIT)

1. What is California Form 3519?

California Form 3519 is used for individuals who require an automatic tax payment extension. It consists of a short questionnaire and a payment worksheet where you can keep your records.

2. What I need Californi

-

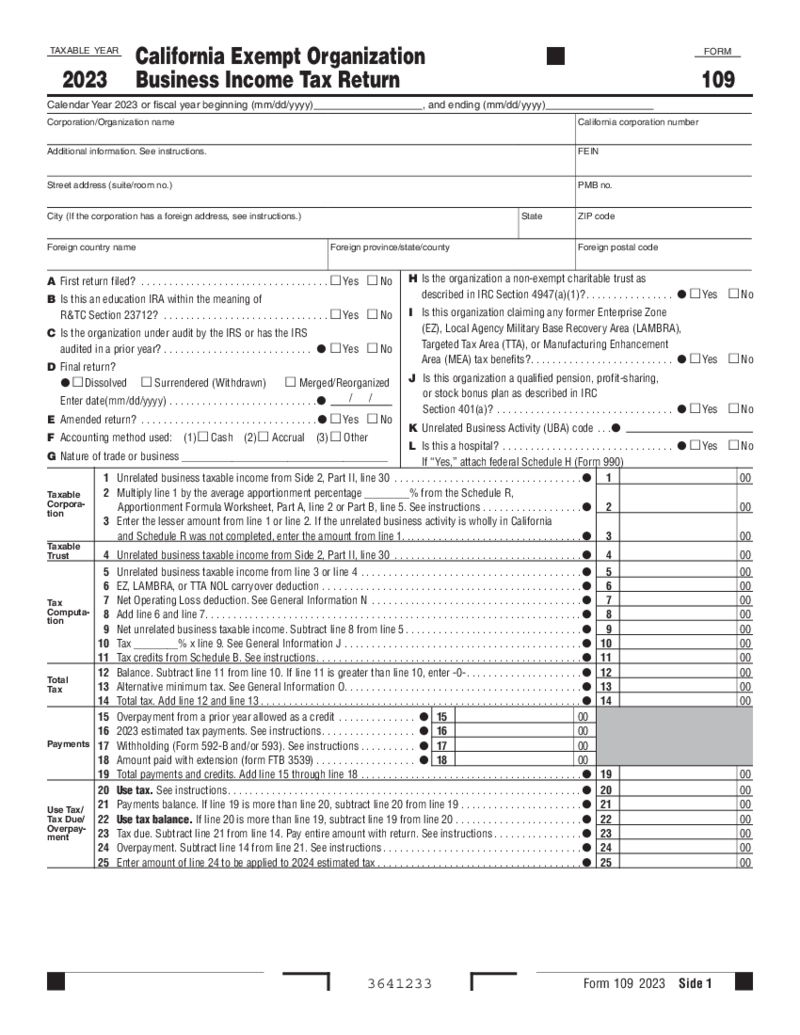

CA Form 109

What Is A Form 109 CA

The Form 109 CA is a tax document specifically used by exempt organizations in California to report their taxable income and file their business income taxes. The form is akin to a corporate tax return for non-profit

CA Form 109

What Is A Form 109 CA

The Form 109 CA is a tax document specifically used by exempt organizations in California to report their taxable income and file their business income taxes. The form is akin to a corporate tax return for non-profit

-

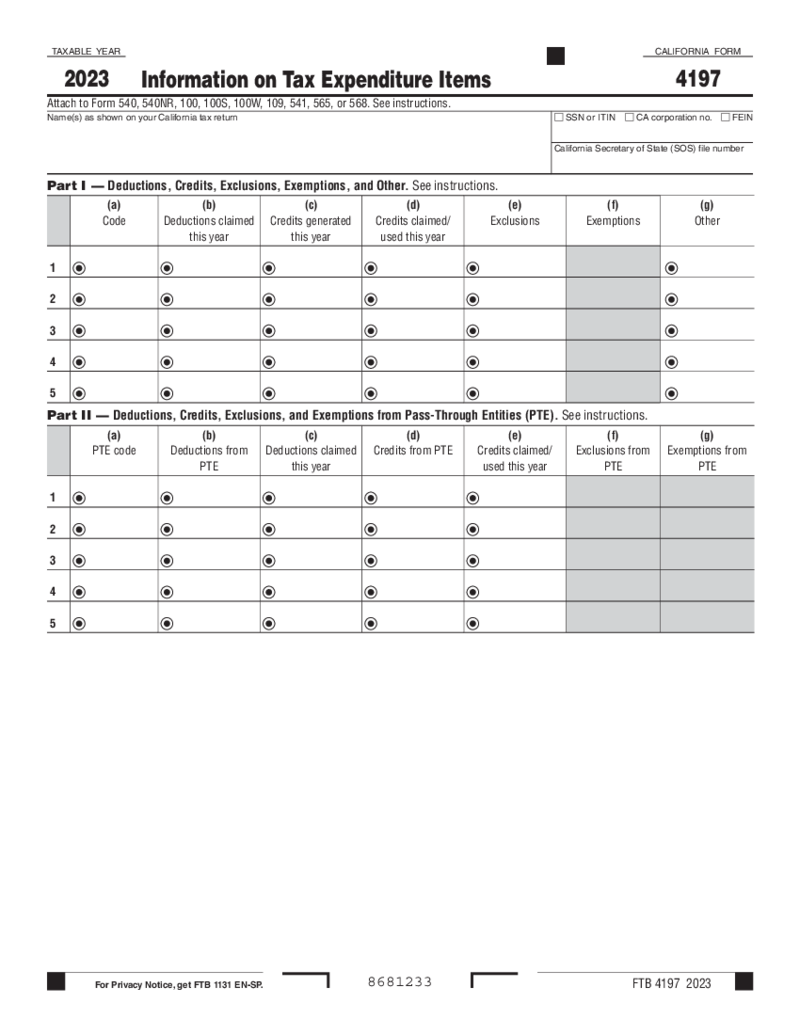

Form 4197 Information on Tax Expenditure Items

What Is California Form 4197?

California Form 4197 serves a distinct function in the realm of California tax reporting. It's designed to consolidate information on deductions, credits, exclusions, and exemptions linked to specific trade or business ac

Form 4197 Information on Tax Expenditure Items

What Is California Form 4197?

California Form 4197 serves a distinct function in the realm of California tax reporting. It's designed to consolidate information on deductions, credits, exclusions, and exemptions linked to specific trade or business ac

-

California Resident Income Tax Return 540 2EZ (2022)

Understanding California Resident Income Tax Return

The California Resident Income Tax Return, also known as Form 540 2EZ, is the income tax return form filed by California residents to report income, calculate taxes owed, claim deductions and credits, an

California Resident Income Tax Return 540 2EZ (2022)

Understanding California Resident Income Tax Return

The California Resident Income Tax Return, also known as Form 540 2EZ, is the income tax return form filed by California residents to report income, calculate taxes owed, claim deductions and credits, an

What are California Tax Forms?

Numerous California tax forms you can find on PDFLiner have one thing in common which is the area of action. These forms were created by California officials or the local department of the IRS. They are required from California citizens who pay taxes. These forms can be sent either by regular mail, handed personally to the nearest department, or sent electronically.

California tax forms 2022 you can see in front of you are documents you have to fill due to specific deadlines to report the income or limited liabilities. There are blanks on automatic extension payments and annual returns. You can use these forms no matter whether you are working for a corporation, freelancer, or own a private business.

Most Popular California Tax Forms

There are multiple different California state tax forms available in the library. Some of them are widely used by Californian citizens, while others are rare. You will find the documents that you need for your purpose in the portal in no time. You can simply use the search bar. However, if you don’t know what you are looking for, check out the forms that are on demand, perhaps they refresh your memory:

- CA form 100W. This form is called California Corporation Franchise of Income Tax Return. There are slight differences between federal law and local California law. This is why you have to use an extra form filed with the local officials during the tax return period. Normally the document may be helpful for individuals to prepare for federal tax forms.

- CA Form 109. This is the California Exempt Organization Business Income Tax Return form. It is one of the popular California tax exempt forms created by the California Franchise Tax Board, the local authority that has the power inside the state. It requires information from a corporation or organization that works in the state with details on the taxes and returns that are paid.

- CA Form 199. California Exempt Organization Annual Information Return sometimes is called the state’s version of the 990 form from the IRS. It requires similar information in the limit amounts. Normally, the Californian version needs only direct data on finances, including expenses, income during the year, and the balance sheet. Nonprofits that have tax-exempt status and work in California have to file this document annually. The only exception is churches that work in the state and received a letter of acknowledgment from California officials. To do this, they have to file FBT form 3500.

- CA Form 4197. The form is known as Information on Tax Expenditure Items. Based on the specifics of your case the form can be attached to documents like 100W, 100S, 100, 540NR, or 540. You can use the form to notify California officials about deductions, exclusions, credits, and exemptions that are related to the business or trade activities you have during the year. You have to do it annually and send it to California Legislature authorities. You need it among all California state income tax forms if you trade cannabis under a legal license, own a company with limited liability, or are a partner in a C corporation.

- CA Form 100S. This is the California S Corporation Franchise or Income Tax Return form. The form is used whenever the corporation is being elected to become an S corporation. According to California law, all such corporations have to file the form and pay part of the minimum franchise tax.

Where to find Tax Forms in California?

You have a choice here. All California income tax forms can be found on the official website of the California Government. You have to pay some time searching for them, but in the end, you will be able to see the document. If you don’t want to waste your time, you have another option, which is PDFLiner. This editor contains all California tax withholding forms and more.

The list is still growing. Unlike the official CA website, here you will be able to fill the form using editing tools online and send it to any authority you need. Here is how you can do it:

- As you can see there are 2 pages of different CA forms. Choose the one you need from the list

- Now you have to tap Fill Online.

- Wait a few seconds till the editor opens.

- Fill it, sign it, and if you need, print it.

Where to Send California Tax Forms?

These forms are not federal. You don’t have to send them to the IRS. They are local and usually made by the California Franchise Tax Board. They have similarities with federal forms, but if you belong to a specific category of taxpayers that have to send both federal tax income reports and local, you need to know where to provide them. While you may be aware of the IRS, Californian forms usually contain information on how and where to send them right inside together with instructions.

Nowadays almost all the forms you see on the list can be sent electronically either via the California Franchise Tax Board website or via email. You have to check this information in the form. Before you send anything, make sure all the lines are filled.

FAQ:

-

When will California state tax forms be available?

California state income tax forms are available on the PDFLiner or California Franchise Tax Board website at any time. You have to fill them out during the tax report period. Each of them has a specific deadline which you need to check out in advance.

-

Which California tax forms to use?

It depends on your own case. If you are part of the corporation, you have to search for those forms, if you are a private business owner, you need to fill only the documents that are made for you. Normally, Californian authorities explain their demands in advance to every taxpayer.

-

Where to pick up tax forms in California?

There are several ways to receive the form you need. They can all be found on the website of the California Franchise Tax Board. Yet, you need to investigate the website until you find the form you need. After that, you need to print the form or find a third party that allows you to fill the form online. Another option is to use PDFLiner with all the forms gathered in one section, available to you. This is an editor so once you find the form, you can complete it right away.

-

Where to mail California tax forms?

California officials widely accept electronic forms from citizens nowadays. Find out the demands for the specific form you are looking for and you will be able to send it online or by email. Check out the details in the instructions.