-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

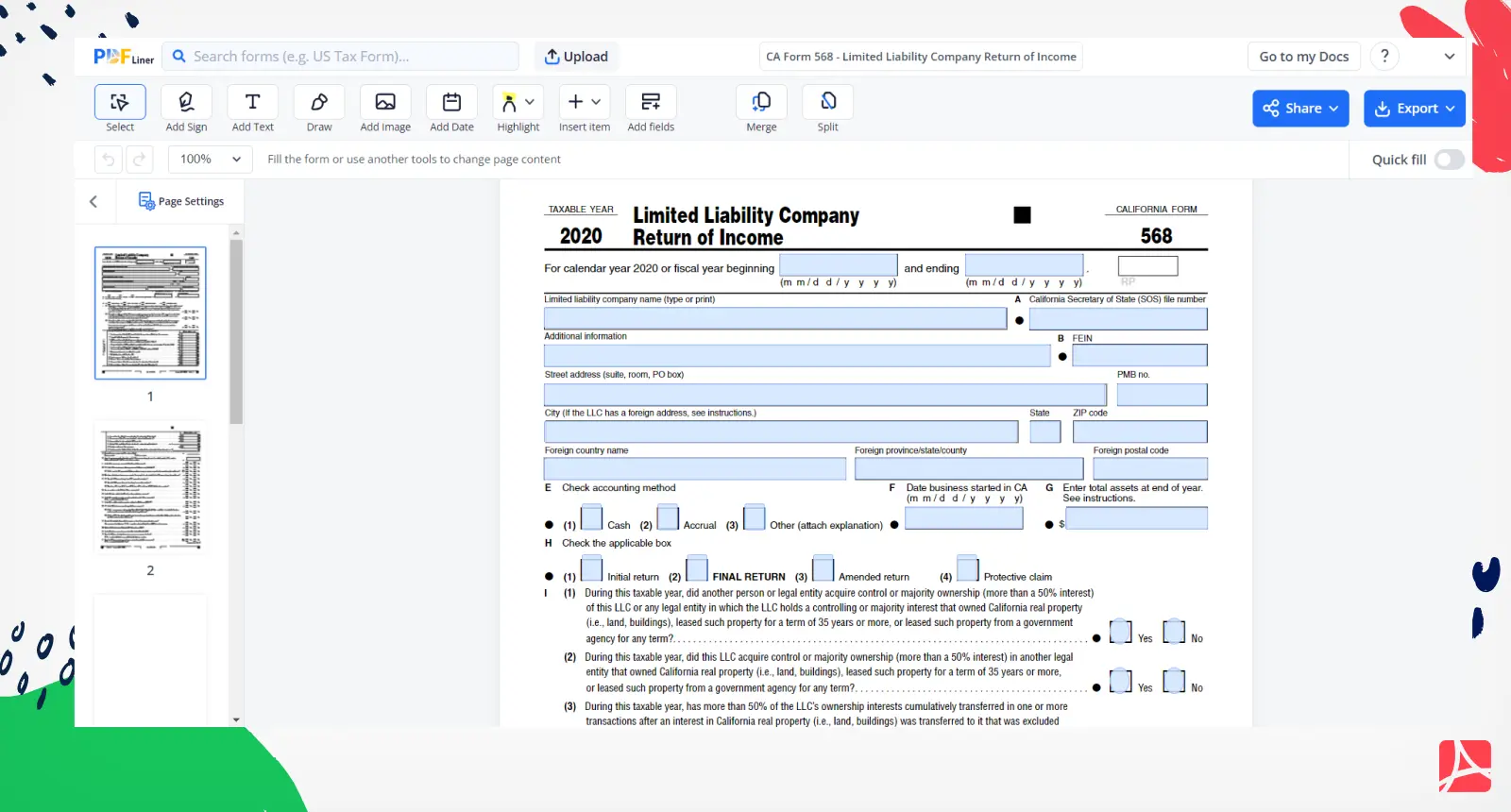

CA Form 568 - Limited Liability Company Return of Income

Get your CA Form 568 - Limited Liability Company Return of Income in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is CA Form 568

California Form 568 is specifically designed for LLCs classified as partnerships or disregarded entities for federal tax purposes. It enables LLC owners to report their income, expenses, deductions, and credits, as well as to calculate the total tax liability owed to California.

Who needs to file CA form 568

If you operate an LLC in California that is classified as a partnership or disregarded entity for federal tax purposes, you must file Form 568. This applies to both domestic and foreign LLCs conducting business within the state.

CA Form 568 vs. Form 565:

Form 565, "Limited Liability Company Return of Income," is another tax form used by LLCs in California. However, there are key differences between Form 565 and Form 568. Form 565 is used by LLCs classified as corporations for federal tax purposes, whereas Form 568 is for LLCs classified as partnerships or disregarded entities. Determining your LLC's federal tax classification is essential to determine which form to use.

How to Fill Out California Form 568

Filling out California Form 568, the Limited Liability Company Return of Income may seem daunting at first, but with a step-by-step approach, it becomes manageable. Here's a guide to help you navigate the process and ensure accurate completion of the form:

Step 1: Gather the necessary information

Before starting, gather all the relevant financial information and records related to your LLC's income, deductions, credits, and other financial activities. This includes details such as revenue from business operations, rental income, expenses, salaries, interest paid, and any other applicable items.

Step 2: Provide general information

Begin by providing general information about your LLC. Fill out the name of your LLC, the California Secretary of State (SOS) file number, the federal employer identification number (FEIN), and the principal place of business address.

Step 3: Determine the filing period

Indicate the taxable year for which you are filing the Form 568. If your LLC follows the calendar year (January 1 to December 31), simply enter the corresponding year. If your LLC operates on a fiscal year basis, enter the beginning and ending dates of the fiscal year.

Step 4: Classify your LLC

Determine the federal tax classification of your LLC as either a partnership or disregarded entity. This classification will determine whether you should be using Form 568 or Form 565. If you are unsure, consult with a tax professional or refer to the IRS guidelines for LLC taxation.

Step 5: Complete Part I - California Source Income

In Part I, report the total income earned by your LLC from California sources. This includes income from business operations, rents, royalties, capital gains, and any other income generated within the state. Follow the instructions for each line item and accurately report the income amounts.

Step 6: Complete Part II - Deductions

In Part II, report the deductions applicable to your LLC. This includes expenses such as business expenses, salaries, rent, interest paid, and other deductible expenses incurred during the taxable year. Ensure that you have proper documentation to support these deductions in case of an audit.

Step 7: Calculate the net income or loss

Subtract the total deductions reported in Part II from the total income reported in Part I to calculate your LLC's net income or loss.

Step 8: Complete Part III - Total Tax and Credits

In Part III, calculate the total tax due for your LLC based on the net income or loss calculated in the previous step. Follow the instructions provided to determine the tax amount accurately. Additionally, report any applicable tax credits or payments made throughout the year.

Step 9: Provide additional information

Provide any additional information or explanations requested in Part IV or Schedule EO (Entity Ownership) if required. Carefully review the instructions to determine if any supplemental information is necessary.

Step 10: Sign and date the form

Sign and date the completed Form 568. If your LLC has multiple members, ensure that all necessary members or authorized representatives sign the form as required.

Step 11: Keep a copy for your records

Make a copy of the completed Form 568 for your records before submitting it to the California Franchise Tax Board (FTB).

Step 12: Submitting the form

Mail the completed Form 568 to the address specified in the instructions. It's advisable to send it via certified mail or use a reputable delivery service to ensure safe and timely delivery.

Filing deadline and extension

The filing deadline for CA Form 568 is the 15th day of the fourth month following the close of the taxable year. For example, if your LLC follows the calendar year (January 1 to December 31), the filing deadline would be April 15. It's crucial to meet this deadline to avoid penalties and interest charges. You can request an extension using FTB Form 3537 if additional time is needed.

Fillable online CA Form 568 - Limited Liability Company Return of Income