-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Alabama Tax Forms

-

Alabama Form 40 (2023)

What Is an Alabama Tax Form 40?

Alabama individual income tax form 40 is a state income tax return form used by residents of Alabama to file their state income taxes. Alabama tax form 40 is used to report an individual's taxable income and to calculat

Alabama Form 40 (2023)

What Is an Alabama Tax Form 40?

Alabama individual income tax form 40 is a state income tax return form used by residents of Alabama to file their state income taxes. Alabama tax form 40 is used to report an individual's taxable income and to calculat

-

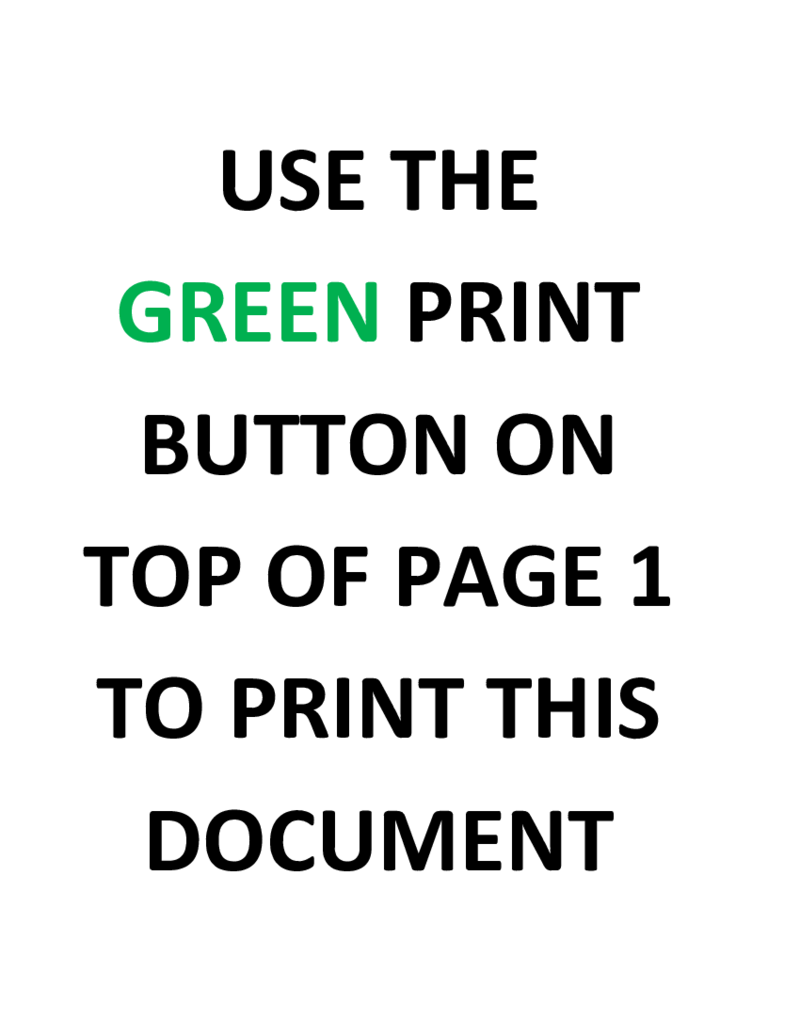

Alabama Tax Form 40A

What Is Alabama 40 A Form?

The Alabama State form 40A, also known as Alabama Individual Income Tax Return, is a tax form used by residents of Alabama to report their income and calculate their state income tax liability. It includes sections for reporting

Alabama Tax Form 40A

What Is Alabama 40 A Form?

The Alabama State form 40A, also known as Alabama Individual Income Tax Return, is a tax form used by residents of Alabama to report their income and calculate their state income tax liability. It includes sections for reporting

-

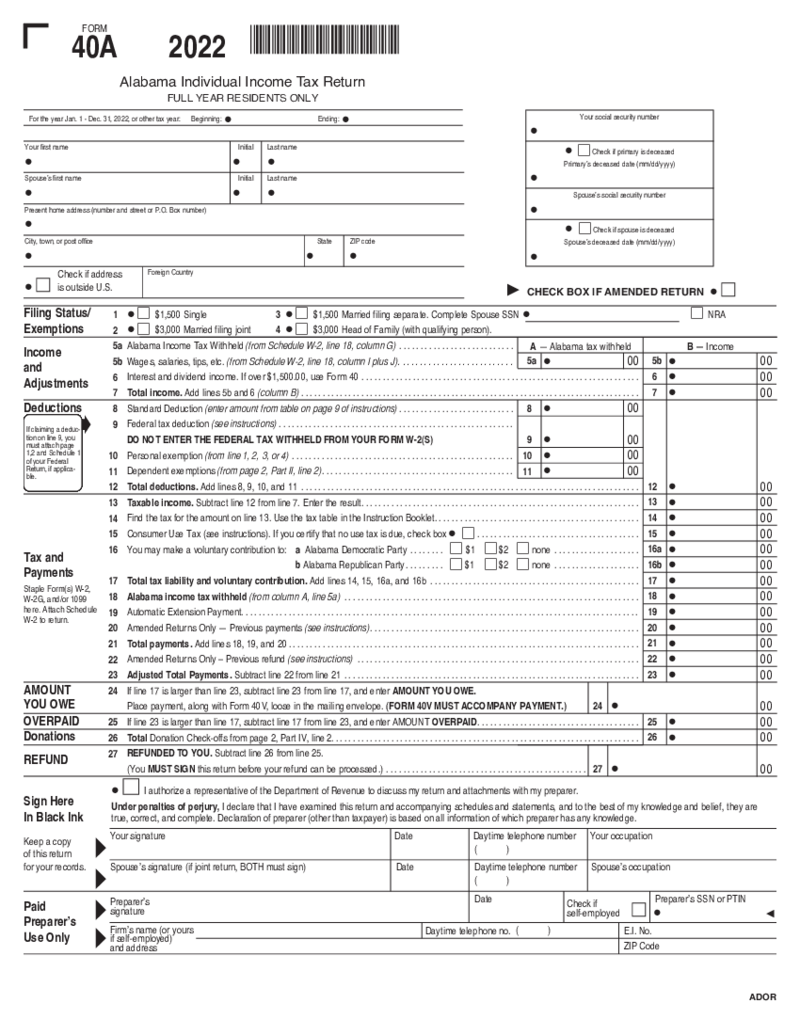

Alabama Form 40 (2019)

What Is Alabama Form 40?

The state of Alabama form 40 is the standard income tax form for Alabama residents. It enables taxpayers to calculate their total income, tax deductions, and any refunds or additional taxes owed to the state. As with federal tax f

Alabama Form 40 (2019)

What Is Alabama Form 40?

The state of Alabama form 40 is the standard income tax form for Alabama residents. It enables taxpayers to calculate their total income, tax deductions, and any refunds or additional taxes owed to the state. As with federal tax f

-

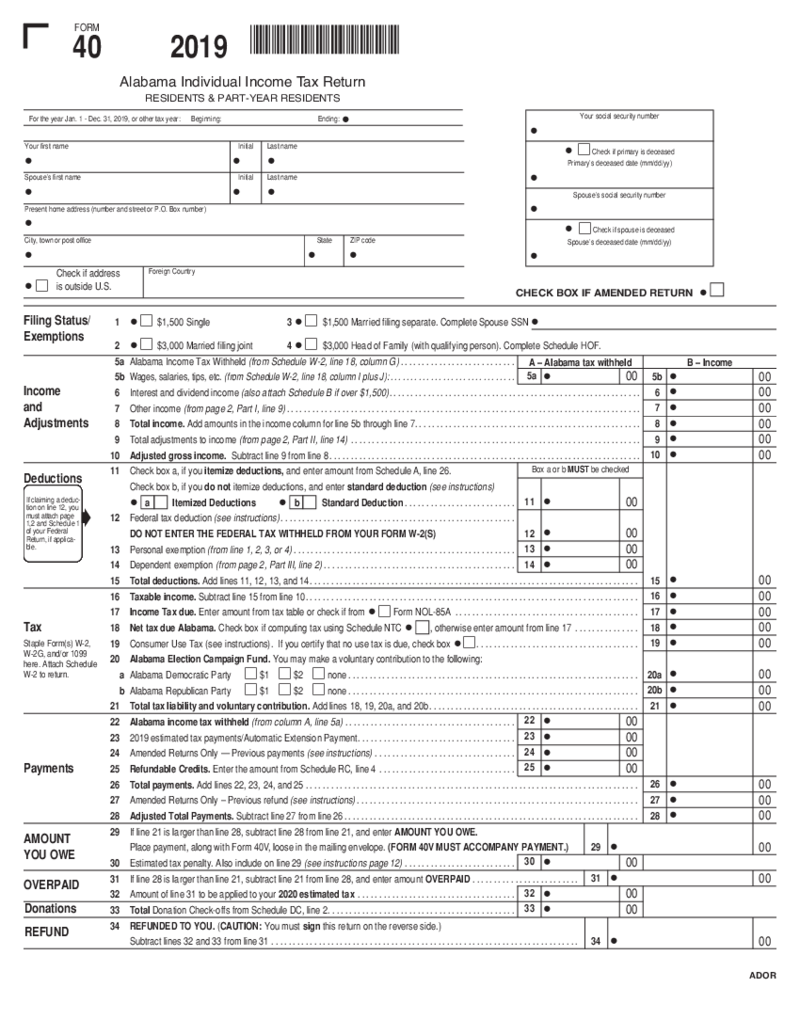

Alabama Tax Form 40NR

Understanding the Alabama Form 40NR

Form 40NR is an instrumental aspect of the Alabama state tax system. If you fall under the category of non-residents earning income in Alabama, you are required to file your income using this form. The Alabama state tax

Alabama Tax Form 40NR

Understanding the Alabama Form 40NR

Form 40NR is an instrumental aspect of the Alabama state tax system. If you fall under the category of non-residents earning income in Alabama, you are required to file your income using this form. The Alabama state tax

-

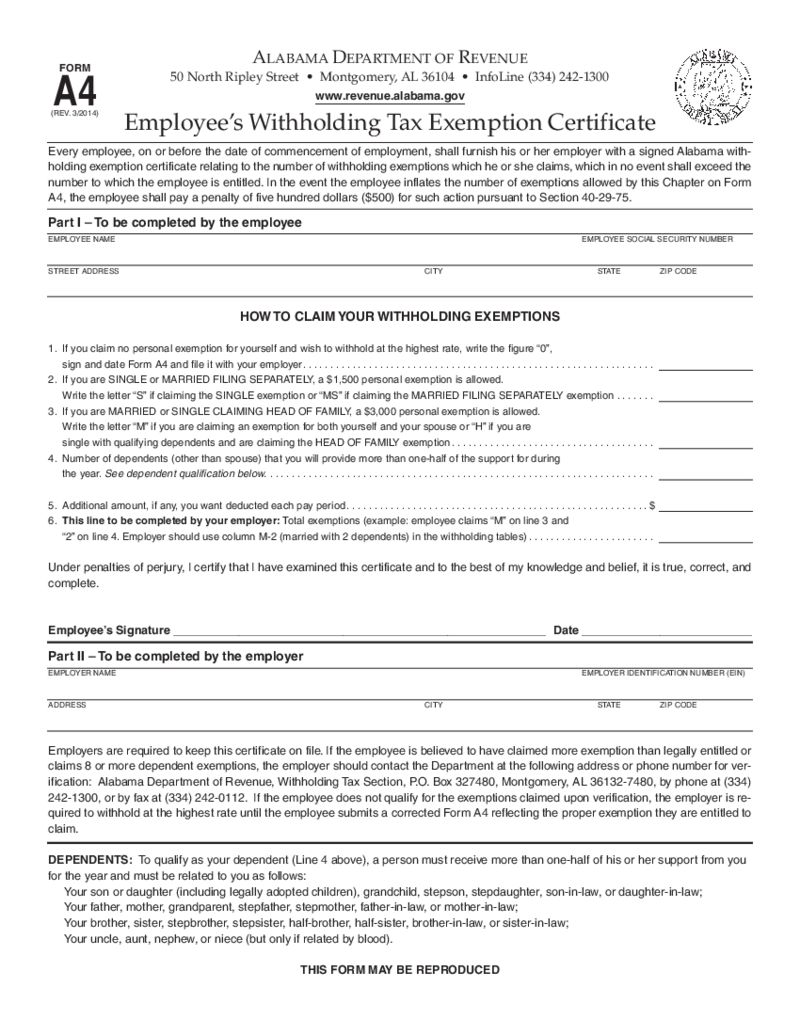

AL-A4 - Alabama Employees Withholding Tax Exemption Certificate

What Is Alabama State Withholding Form AL A4?

Often referred to as Alabama state withholding form al A4, this document's major purpose is to indicate the right amount of tax exemption to be taken into account during the employees' income disbursem

AL-A4 - Alabama Employees Withholding Tax Exemption Certificate

What Is Alabama State Withholding Form AL A4?

Often referred to as Alabama state withholding form al A4, this document's major purpose is to indicate the right amount of tax exemption to be taken into account during the employees' income disbursem

-

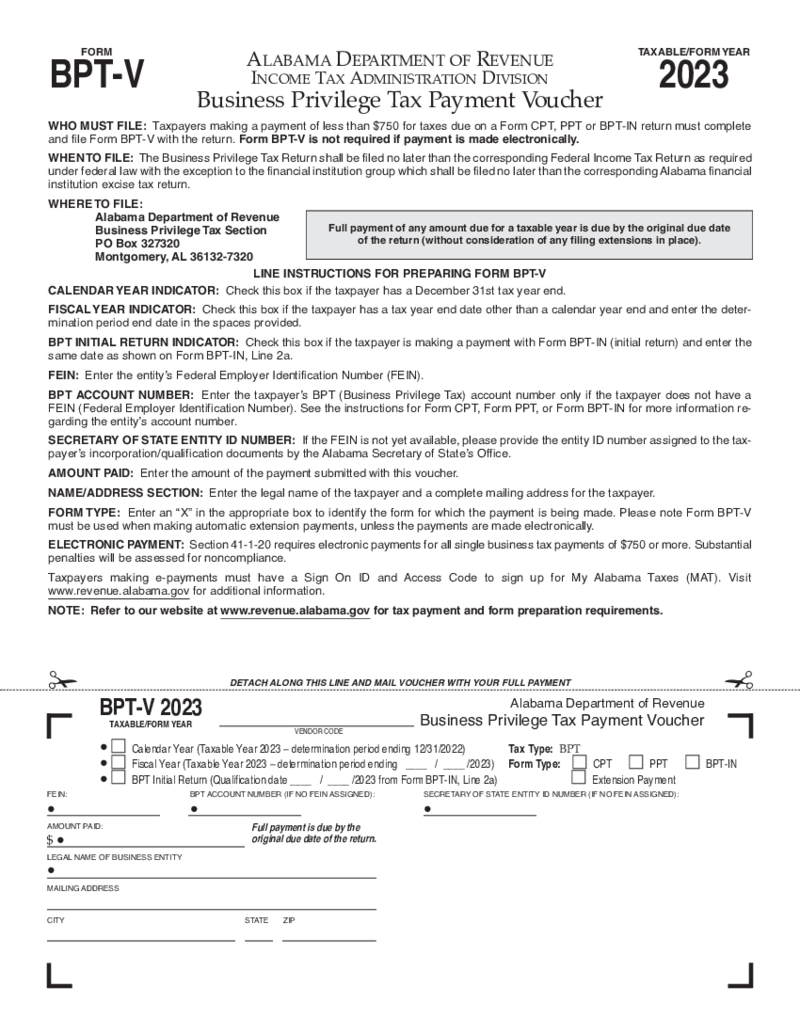

Alabama Business Privilege Tax Payment Voucher

What Is Form Alabama Business Privilege Tax Payment Voucher (BPT-V)

Alabama's thriving business environment hosts a myriad of companies, both small and large. Integral to the state's financial structure, these businesses are subject to the Alabama

Alabama Business Privilege Tax Payment Voucher

What Is Form Alabama Business Privilege Tax Payment Voucher (BPT-V)

Alabama's thriving business environment hosts a myriad of companies, both small and large. Integral to the state's financial structure, these businesses are subject to the Alabama

-

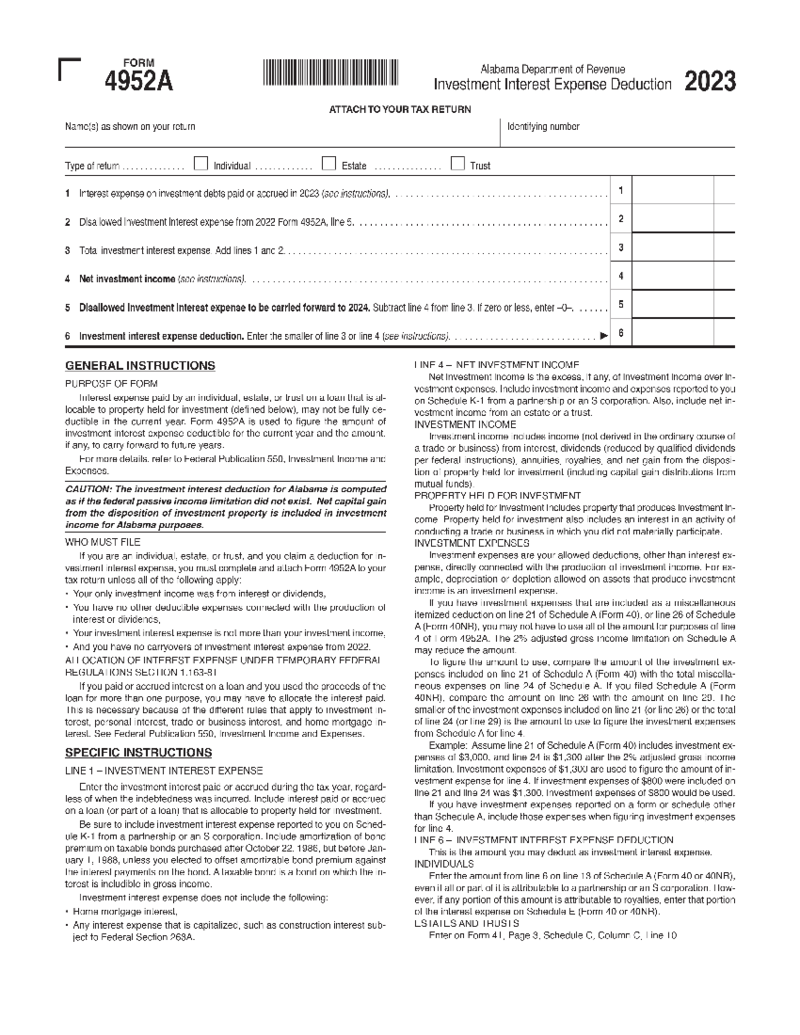

Alabama Form 4952A

Introducing Alabama Tax Form 4952A

The Alabama tax form 4952A is designed to calculate deductions related to investments. More specifically, it aids in calculating 'investment interest expense deductions.' Thus, if you have made investments with b

Alabama Form 4952A

Introducing Alabama Tax Form 4952A

The Alabama tax form 4952A is designed to calculate deductions related to investments. More specifically, it aids in calculating 'investment interest expense deductions.' Thus, if you have made investments with b

-

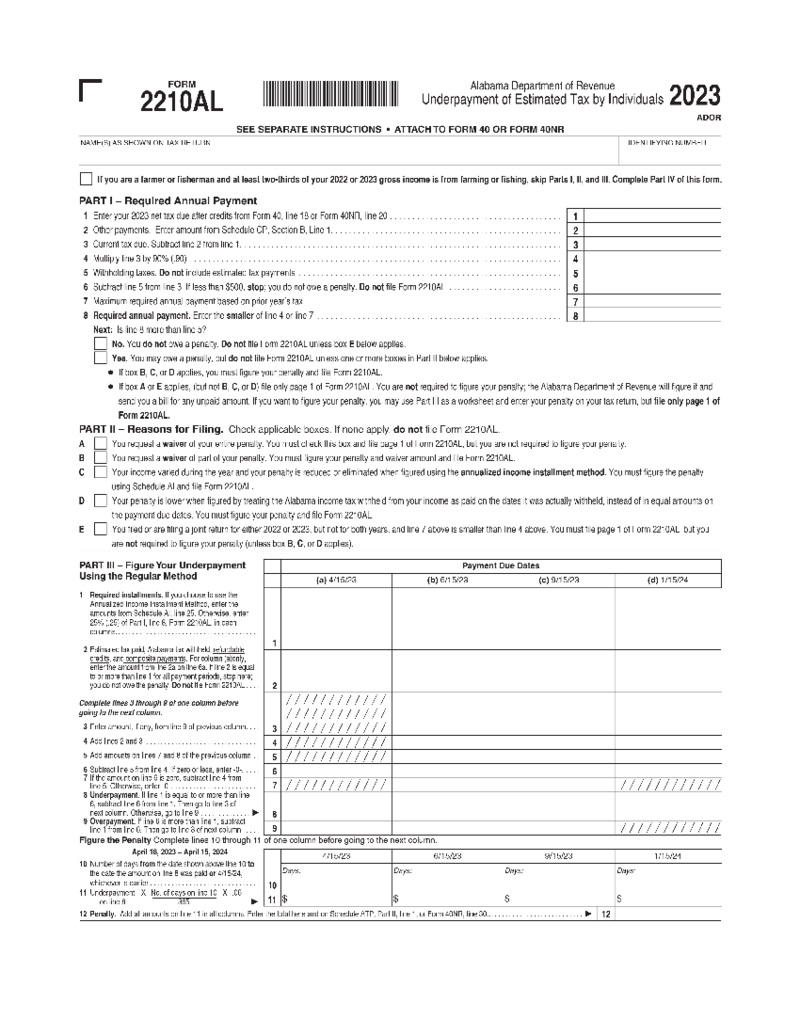

2210 - Underpayment of Estimated Taxes

What Is Form 2210 Alabama?

The underpayment of the estimated tax form is utilized by the Internal Revenue Service (IRS) in the United States to determine if you paid enough tax throughout the year. Through this form, taxpayers who didn't pay enough ta

2210 - Underpayment of Estimated Taxes

What Is Form 2210 Alabama?

The underpayment of the estimated tax form is utilized by the Internal Revenue Service (IRS) in the United States to determine if you paid enough tax throughout the year. Through this form, taxpayers who didn't pay enough ta

-

Schedule A - Schedule A Itemized Deductions

What Is the Form 1040 Schedule A?

Form 1040 Schedule A, more commonly referred to as the itemized deduction form 1040 Schedule A, is a component of your federal tax filing, which an individual can use to claim allowable deductions. By listing your expendi

Schedule A - Schedule A Itemized Deductions

What Is the Form 1040 Schedule A?

Form 1040 Schedule A, more commonly referred to as the itemized deduction form 1040 Schedule A, is a component of your federal tax filing, which an individual can use to claim allowable deductions. By listing your expendi

-

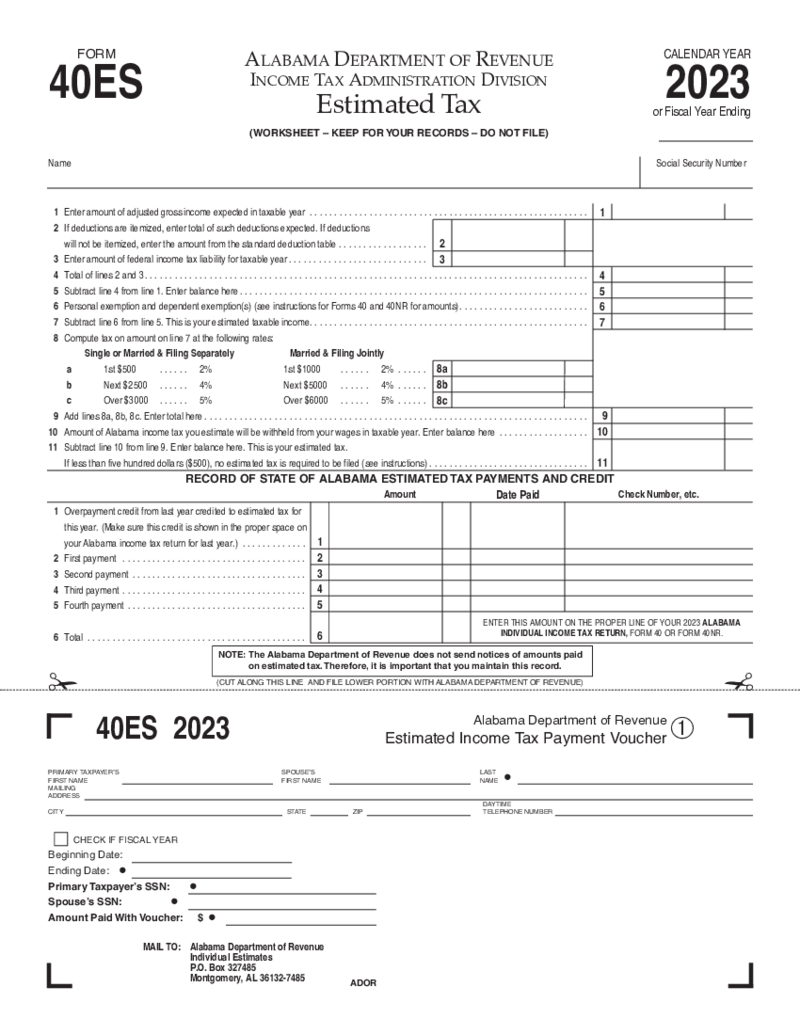

Alabama Tax Form 40ES

How Do I Acquire Fillable Alabama Tax Form 40ES?

You can get the form online at here at PDFliner. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

Write &l

Alabama Tax Form 40ES

How Do I Acquire Fillable Alabama Tax Form 40ES?

You can get the form online at here at PDFliner. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

Write &l

-

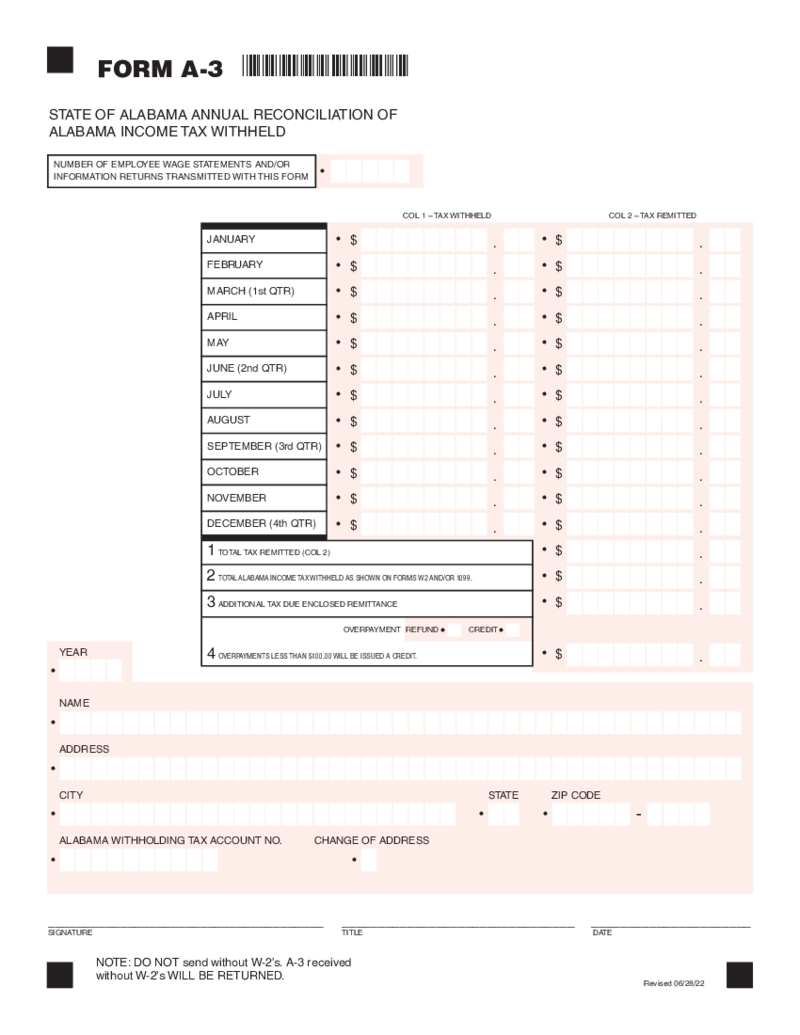

A-3 Annual Reconciliation of Alabama Income Tax Withheld

Understanding the Alabama A 3 Form

An A 3 form Alabama, also known as the Annual Reconciliation of Alabama Income Tax Withheld, is a document employers in Alabama must fill out. It details the total state income tax withheld from employees' earnings t

A-3 Annual Reconciliation of Alabama Income Tax Withheld

Understanding the Alabama A 3 Form

An A 3 form Alabama, also known as the Annual Reconciliation of Alabama Income Tax Withheld, is a document employers in Alabama must fill out. It details the total state income tax withheld from employees' earnings t

-

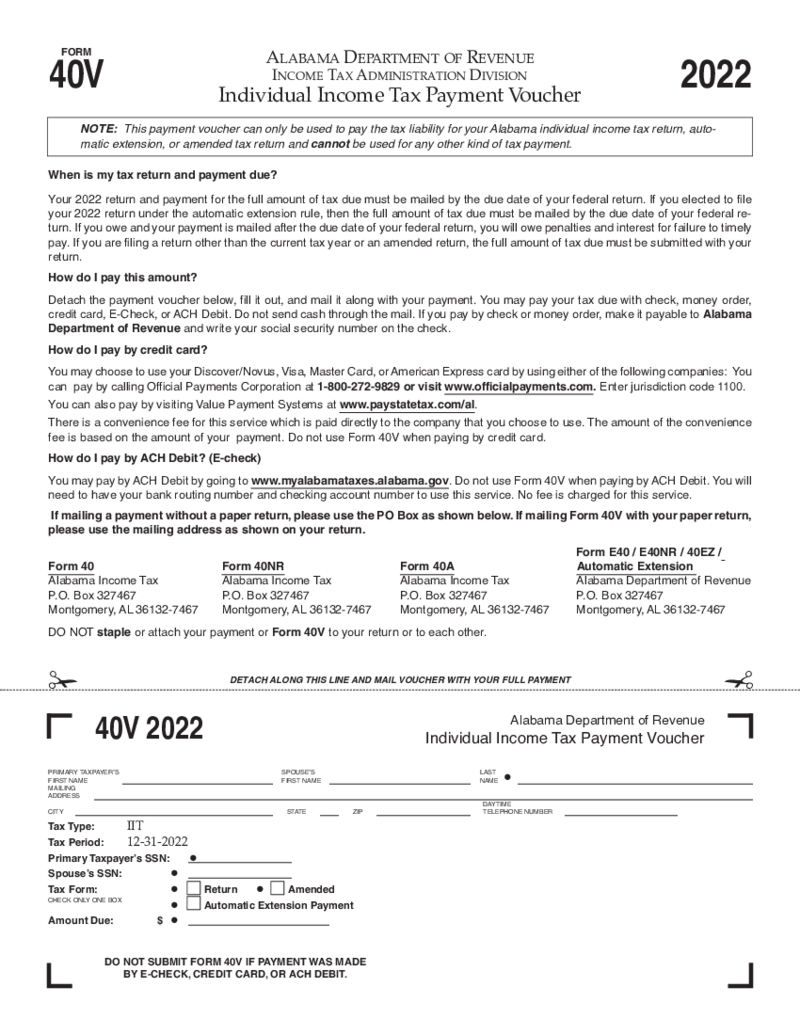

Alabama Tax Form 40V

Understanding the Alabama Form 40V

The Alabama Form 40V also referred to as the Alabama Income Tax Payment Voucher, serves a specific purpose in the world of taxes in Alabama. Before breaking down how to fill out the form, it's worth understanding why

Alabama Tax Form 40V

Understanding the Alabama Form 40V

The Alabama Form 40V also referred to as the Alabama Income Tax Payment Voucher, serves a specific purpose in the world of taxes in Alabama. Before breaking down how to fill out the form, it's worth understanding why

What Are Alabama Tax Forms?

If you (and/or your earnings) are based in Alabama, your taxes will most likely head to the Cotton State, too. And that’s where filling out Alabama estimated tax forms comes into play. They are official documents required for sorting out your tax issues in your state of residence. You’ll need quite a lot of those forms, indeed. In this piece, we’ll overview some of the most common forms you’ll need to file, such as Form 40, 40ES, 40A, 40NR, and 40V. We’ll also touch upon the deadlines, and the basic guidelines on filling out those files.

A treasure trove of Alabama tax return forms is up for grabs in our extensive catalog. So, just take a browse through the templates presented within our service to find the right form for you. In case you have difficulties filling out any of them, you’re free to turn to professional help. Remember that going digital when it comes to sorting out your Alabama estimated tax payment saves heaps of your time and thus, grants you the possibility to focus precisely on your field of work (read as earn more money).

Most Common Alabama State Income Tax Forms

Certain states have standalone versions of their tax returns for nonresidents or part-year residents. Alabama is among them. Wondering what it means? It’s simple: if you earn taxable income in the Heart of Dixie but live in a different state or only live in Alabama for a portion of the year, you’ll need to research which tax form exactly out of the standard ones listed below suits your situation.

Here’s the selection of the most common revenue Alabama gov forms you’ll need:

- form 40: this doc is usually filed by full-year Alabama residents for the purpose of determining how much they owe the state;

- form 40ES: this file is utilized for crunching numbers in terms of your quarterly income tax payments;

- form 40A: this doc is for you if you live and work in Alabama on an all-year-round basis;

- form 40NR: this doc is for you if you earn income in Alabama but live in a different state on a regular basis;

- form 40V: you’ll need to attach this file to your report if you opt for a payment with a check or money order — and then send it all to your local tax authorities.

Getting your tax documentation ready and filing it on time is vital. And it’s also quite challenging, especially if online or paper-based Alabama individual income tax filing is something that’s not related to your direct field of work. With that said, going digital in this respect is the best choice. The benefits of filling out and filing your tax docs online cannot be undervalued. Briefly speaking, here are the major perks of sorting out your Alabama tax forms digitally:

- it protects your vital documentation from getting lost or damaged;

- it allows you to effortlessly and instantly access your tax files wherever you are;

- it grants you the possibility of sharing and e-signing your docs online from almost any gadget.

Certainly, going digital comes with a certain learning curve. Yes, you’ll need to invest time and finances in mastering digital technology. But if you manage to go through this, all your efforts and investments are sure to pay off.

You’ve probably noticed that most files in the tax field come down to the PDF format. It means that to effectively get tax digitization started, you’ll need a top-notch PDF editing platform for automating your tax issues. And that’s where PDFLiner kicks in.

Here’s the outline of the major perks of using PDFLiner for managing your tax documentation:

- secure and legitimate e-signatures: this feature makes all the difference;

- extensive gallery of customizable templates: we have a multitude of top-level predesigned tax form templates aimed at streamlining your tax and accounting process;

- outstanding file sharing possibilities: share your docs fast and use the most convenient method for you.

With PDFLiner, you can easily find, fill out, digitally sign, and submit your Alabama tax forms. Despite the world’s major focus on paperless tax reporting, it’s solely up to you whether you’ll fill out the required form online or opt for printing it out. You’re welcome to make the most of our tax experts’ tips and guides whenever you come across any difficulties filling out your forms. We are here to help you save your time and thus boost your revenue.

How to Get Fillable Alabama State Tax Forms

If you’re currently on the prowl for a certain Alabama tax doc, you’re free to find it among the Alabama Department of Revenue tax forms. Since you’re here, you’re welcome to make the most of what PDFLiner has to offer.

Here’s how you can access and fill out the needed form here:

- Pick the needed form out of the ones presented within this category.

- Hit the Fill Online button.

- Complete the file online when the system loads.

- E-sign the form and print it out. Yes, it’s that fast and easy.

Make sure you are as focused, accurate, and precise when filling out the required form. If the entire process is way too challenging for you, you can always contact your bookkeeper and ask them to help you out. Tax reporting is serious, so any mistakes or misleading information may have you facing penalties in the future. In this respect, PDFLiner is going to become your go-to service, for its brilliant editing functionality allows you to adjust and correct the needed file limitlessly.

With all that said, with PDFLiner, you get the chance to:

- incorporate speedy edits into your tax files;

- scratch-create new files or shape the existing ones to your liking;

- incorporate fillable fields into your PDFs;

- share them with as many other users as you choose;

- add signature, date, and even pictures to your files;

- password-protect your tax-related data in a matter of moments.

So, whether you’re currently focused on Alabama tax forms or need to work with templates from other niches, such as healthcare, real estate, accounting, and many others — PDFLiner has got you covered. It’s what makes your life as a busy person a lot easier and saves you from stressful tax debt situations, as well as other similar calamities.

Alabama Tax Forms Filing Due Dates

You should be aware that some income taxes come with pre-determined deadlines while others depend on the situation. Below, we’ve outlined the major tax types and due dates related to them:

- Individual Income Tax: April 15;

- Corporate Income Tax for C-Corporations: depending on whether you’re on a calendar or a fiscal year, the due date is either April 15 or September 15 respectively;

- S-Corporation & Partnerships/LLCs: March 15;

- Fiduciary Tax: April 15;

- Alabama Business Privilege Tax: depending on the specificities of your organization, as well as taking the calendar-vs-fiscal-year distinction into account, the deadlines vary significantly here. Please find more details here.

In case you have questions about nuances related to the Alabama tax forms filing due dates, don’t hesitate to contact your bookkeeper and inquire about your particular situation. Double-check it all well in advance in order to make it on time. If you miss your deadlines, you are likely to face penalties in the long run, so it is in your best interest to monitor this issue closely.

How to File Alabama State Tax Forms

When submitting your well-prepared and carefully filled out forms with your local tax processing authorities, you have two major options to choose from: digitally or by mail. Both these methods have their advantages and drawbacks. When it comes to e-filing, here’s what you’ll love about it:

- instant confirmation: you’ll immediately know when the IRS receives your tax return, so always check email notifications upon submitting your files;

- security: all your financial data is under stringent protection of cutting edge technology;

- speedier processing: that’s because your local tax authorities won’t have to manually go through your return at the help center;

- error-proofness: that refers both to you and your local tax control service.

Now, when it comes to the drawbacks of e-filing, they mostly come down to one major aspect: fees. That’s because if you want to e-file like a pro, you’re going to need to invest time, effort, and money in reliable tax prep tools and services. Also, e-filing isn’t always available for certain rare scenarios and situations.

With regard to paper-based tax filing, it works great in the just-mentioned rare cases i.e., when adding images to your return is needed. Also, because paper filing isn’t automated and requires your utmost attention to detail, it extends your expertise in the field. So, if you feel like becoming all tax savvy, this method is totally right up your street.

Of course, paper filing comes with certain disadvantages. They include:

- possible errors: you won’t be able to correct them in a flash as opposed to filing online, so always double-check everything prior to sending your files away;

- missing forms: preparing and attaching all the must-include files can be challenging without digital automation, that’s a given;

- can be too hard for you if you haven’t done that before: the paper-based side of the process is just way too difficult for newbies.

With all that said, the choice of the best-suiting way of filing your tax docs is solely up to you. Now that you’re aware of all the perks and disadvantages, you can easily make an informed decision in this respect. You can e-file your taxes via the Alabama Department of Revenue online platform. Planning to submit your tax files by mail? Here are the contacts you’ll need based on your individual situation. The easiest and the most time-saving option is definitely using PDFLiner and/or hiring a solid tax professional to sort it all out for you.