-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New Mexico Tax Forms

-

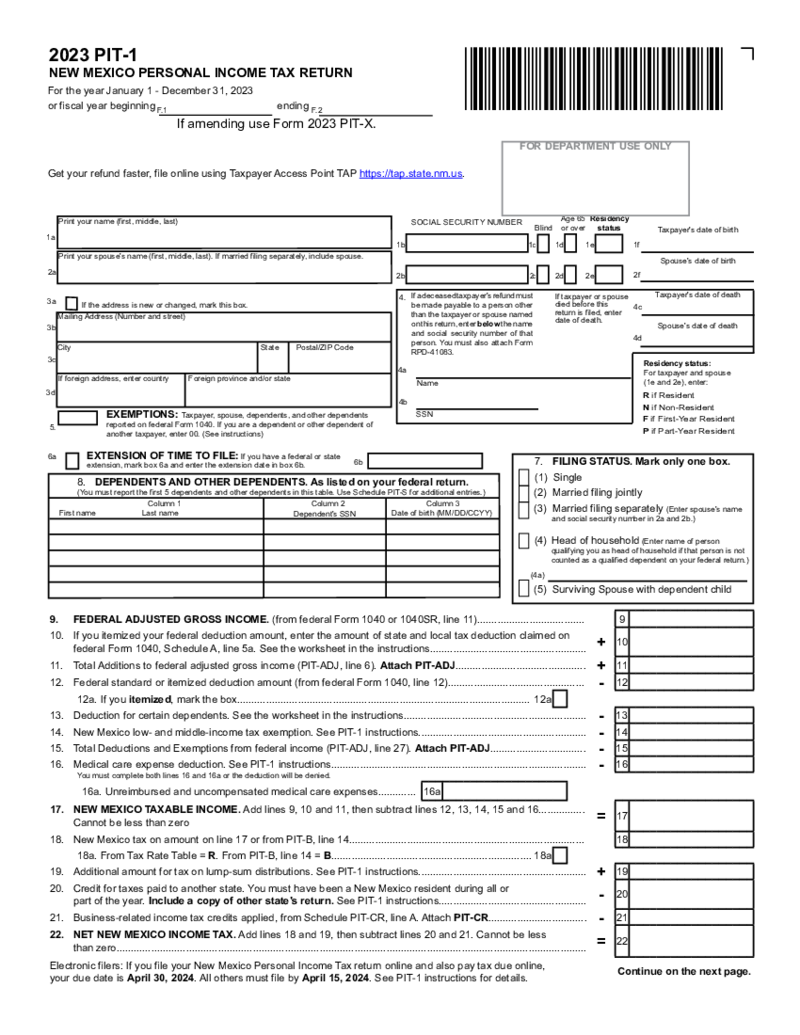

New Mexico Form PIT-1

Understanding New Mexico Tax Form PIT 1

New Mexico Form PIT-1, fondly referred to as the NM PIT 1 Form, is an essential document for state residents. It serves as the Personal Income Tax Form for the residents of New Mexico. Just like federal income tax,

New Mexico Form PIT-1

Understanding New Mexico Tax Form PIT 1

New Mexico Form PIT-1, fondly referred to as the NM PIT 1 Form, is an essential document for state residents. It serves as the Personal Income Tax Form for the residents of New Mexico. Just like federal income tax,

-

New Mexico Schedule PIT-ADJ

What Is New Mexico Schedule PIT-ADJ?

New Mexico Schedule PIT-ADJ is a schedule used for a taxpayer in case they have to claim some additions, exempti

New Mexico Schedule PIT-ADJ

What Is New Mexico Schedule PIT-ADJ?

New Mexico Schedule PIT-ADJ is a schedule used for a taxpayer in case they have to claim some additions, exempti

-

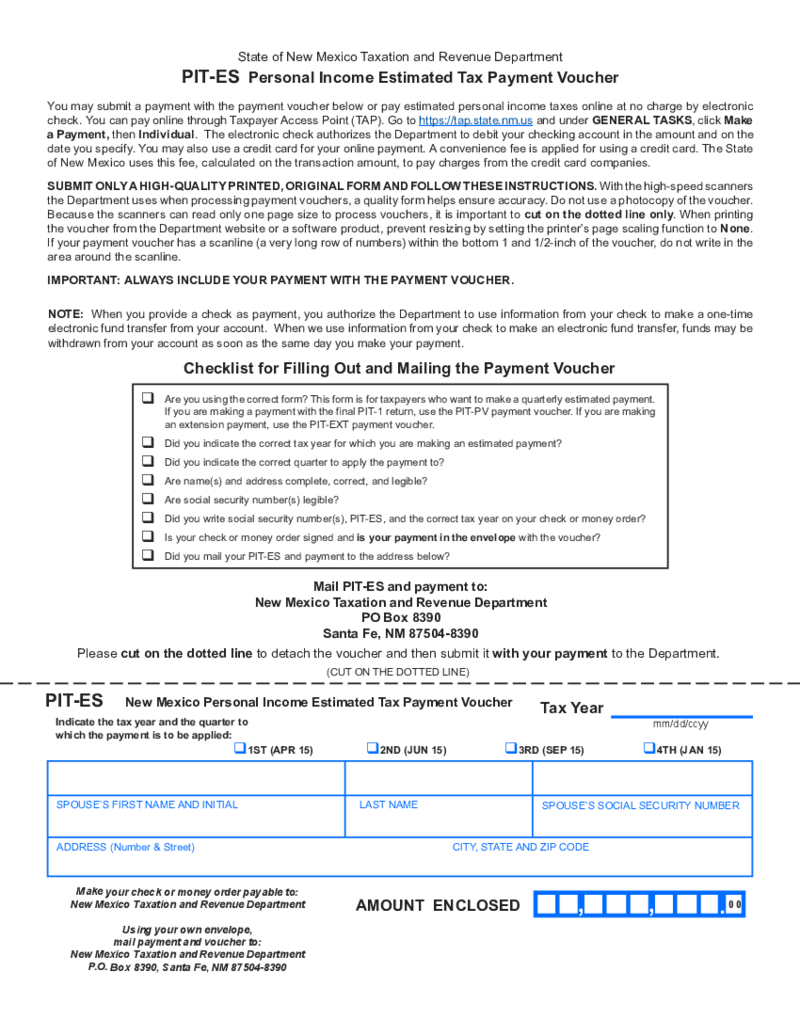

PIT-ES - Personal Income Estimated Tax Payment Voucher

Understanding NM Form PIT ES

The NM PIT ES form is a voucher utilized by taxpayers in New Mexico intending to submit estimated income tax payments. These payments are made quarterly and are required when taxpayers expect to owe tax of $200 or more at the

PIT-ES - Personal Income Estimated Tax Payment Voucher

Understanding NM Form PIT ES

The NM PIT ES form is a voucher utilized by taxpayers in New Mexico intending to submit estimated income tax payments. These payments are made quarterly and are required when taxpayers expect to owe tax of $200 or more at the

-

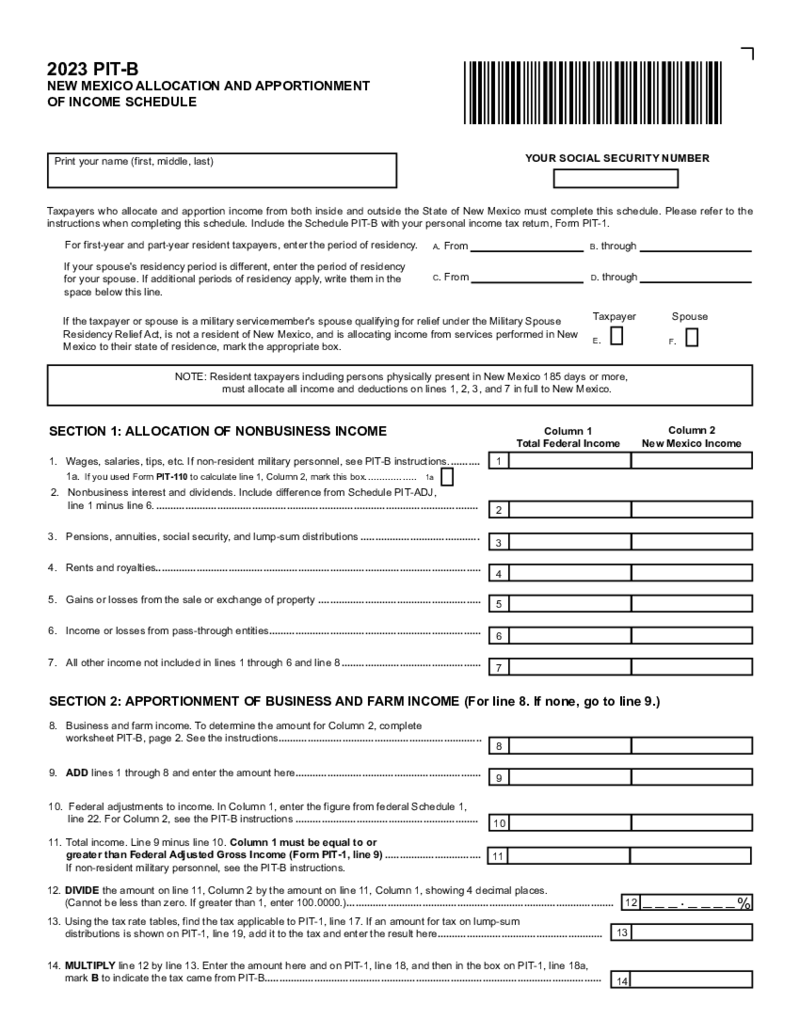

PIT-B - New Mexico Allocation And Apportionment Of Income Schedule

What Is New Mexico Tax Form PIT-B?

The Form PIT-B is a vital document that taxpayers in New Mexico need to complete and submit during the tax filing process. This form, also known as the New Mexico Allocation and Apportionment of Income Schedule, helps de

PIT-B - New Mexico Allocation And Apportionment Of Income Schedule

What Is New Mexico Tax Form PIT-B?

The Form PIT-B is a vital document that taxpayers in New Mexico need to complete and submit during the tax filing process. This form, also known as the New Mexico Allocation and Apportionment of Income Schedule, helps de

-

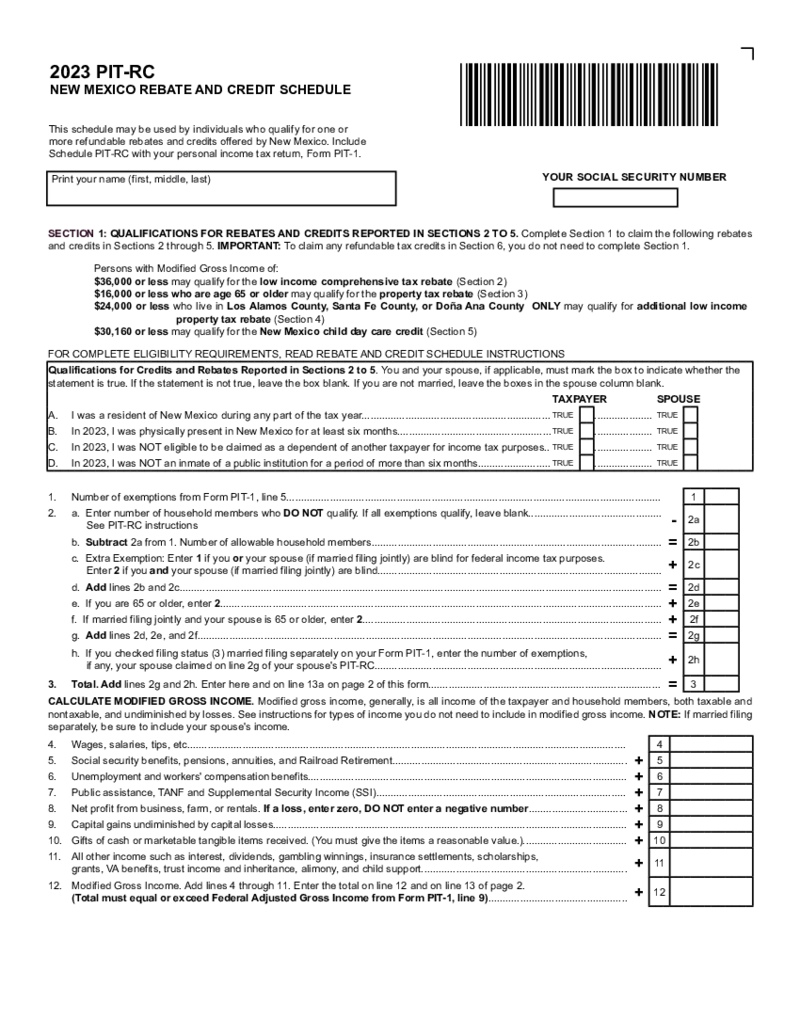

PIT-RC - New Mexico Rebate And Credit Schedule

What Is the New Mexico PIT RC Form?

The PIT-RC form, or New Mexico Rebate and Credit Schedule, is a supplemental document used by taxpayers in New Mexico to claim available rebates and credits. These rebates might be related to your income, location, or o

PIT-RC - New Mexico Rebate And Credit Schedule

What Is the New Mexico PIT RC Form?

The PIT-RC form, or New Mexico Rebate and Credit Schedule, is a supplemental document used by taxpayers in New Mexico to claim available rebates and credits. These rebates might be related to your income, location, or o

-

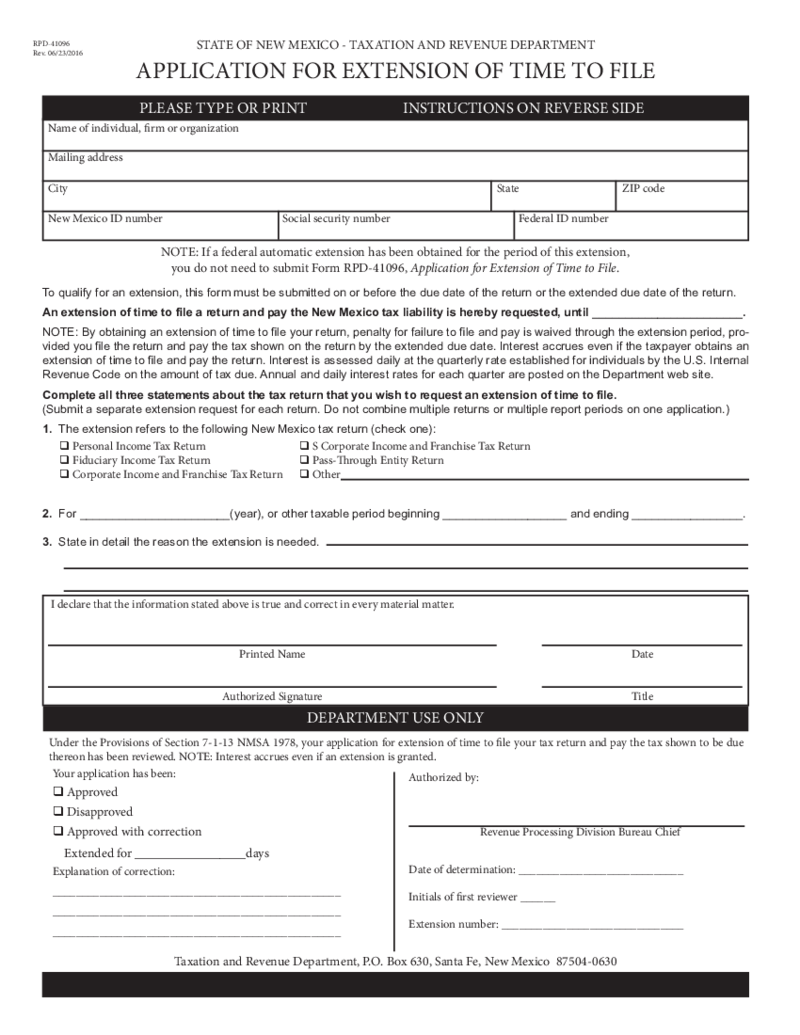

NM Form RPD-41096

What is the RPD41096 form?

The fillable RPD41096 form must be provided by the taxpayer who wants to extend the time on filing the return. If you want to postpone the business return filing, you need to file this form to the State of New Mexico Taxation an

NM Form RPD-41096

What is the RPD41096 form?

The fillable RPD41096 form must be provided by the taxpayer who wants to extend the time on filing the return. If you want to postpone the business return filing, you need to file this form to the State of New Mexico Taxation an

-

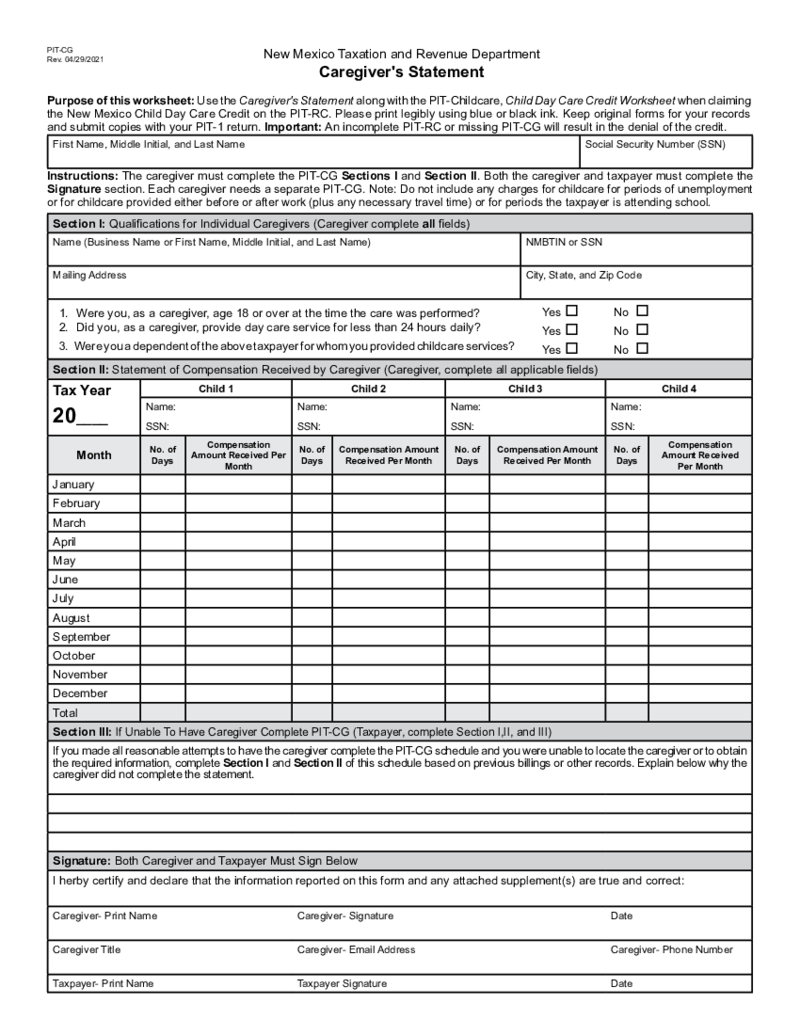

Form PIT-CG - New Mexico Caregiver Statement

PIT-CG Form: Overview

The PIT-CG form, also known as the New Mexico Caregivers Statement, is a document specifically designed for caregivers in New Mexico who support a qualifying family member. It is vital for caregivers to be well-informed about this fo

Form PIT-CG - New Mexico Caregiver Statement

PIT-CG Form: Overview

The PIT-CG form, also known as the New Mexico Caregivers Statement, is a document specifically designed for caregivers in New Mexico who support a qualifying family member. It is vital for caregivers to be well-informed about this fo

-

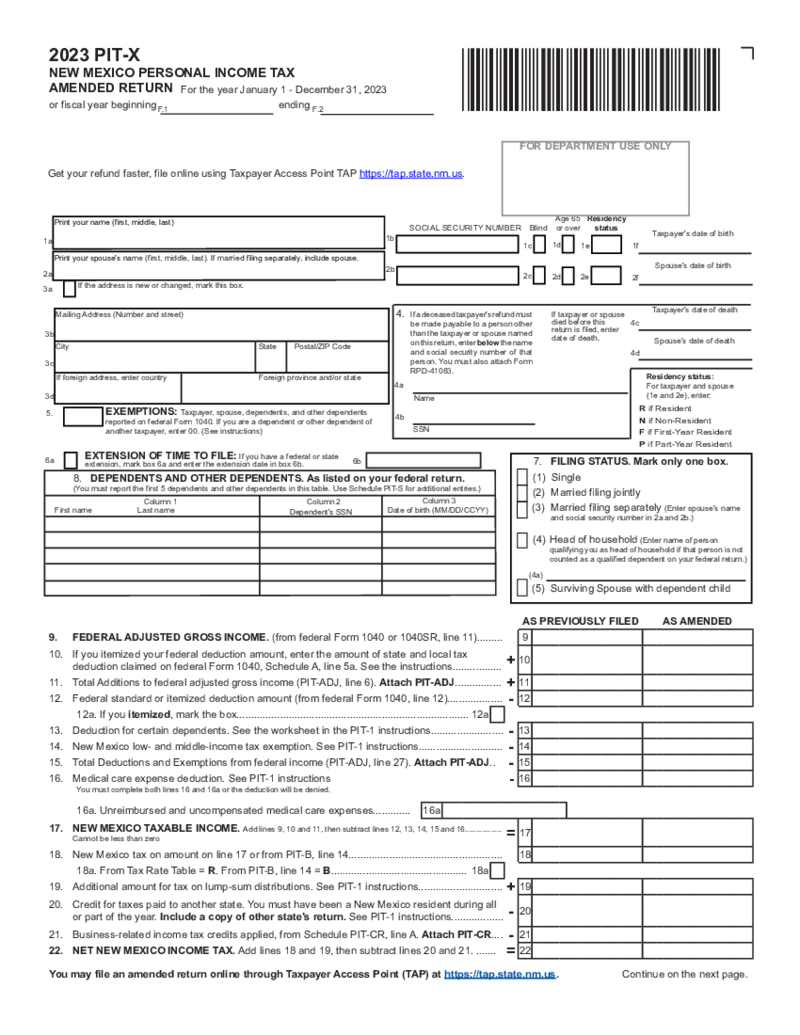

NM Form PIT-X

Understanding NM Form PIT-X

The NM Form PIT-X is an essential document for residents of New Mexico seeking to amend a previously filed personal income tax return. Circumstances that may necessitate completing this form include corrections to income, deduc

NM Form PIT-X

Understanding NM Form PIT-X

The NM Form PIT-X is an essential document for residents of New Mexico seeking to amend a previously filed personal income tax return. Circumstances that may necessitate completing this form include corrections to income, deduc

What are New Mexico Tax Forms?

New Mexico tax forms are created by state officials and have to be filled by taxpayers together with the federal forms required by the IRS. These documents do not replace one another so you can’t send one but forget about another unless you want to be fined. Apart from that, there is a strict deadline when the form must be received by the official body indicated in each of them. You have to make sure to not send the document with delay.

PDFLiner offers important New Mexico income tax forms in the section. The number of forms is growing. You will find the documents created for taxpayers about the annual or monthly income.

Most Popular New Mexico Tax Forms

New Mexico state income tax forms are limited by the area. They must be provided by New Mexico residents or by non-residents who work in the state. You will find a wide range of forms available for you. If you are not sure which one to pick, check out the description near the forms. Here are the most popular New Mexico state tax forms you may find on PDFLiner:

- Form PIT-1. This is the New Mexico Personal Income Tax Return standard form. It is similar to the IRS tax report. You have to provide information about the taxpayer, SSN, address, and dependents. You have to include the adjusted federal gross income, as well as indicate the taxable income in New Mexico. The document contains instructions on how to calculate everything. It was created by the New Mexico Taxation and Revenue Department. You have to send the original to their P.O. box.

- Form PIT-X. If you have made mistakes in the previous document with the personal income tax return calculations or need to change the address, use the New Mexico Personal Income Tax Amended Return. It is widely used with New Mexico personal income tax forms. You can fix mistakes in advance and send them to the New Mexico Taxation and Revenue Department. Department offers you to file this form online, using the Taxpayer Access Point. Don’t forget to mention the reason why you are sending the form in the section Reason for Amending.

- Form PIT-ADJ. This is the New Mexico Schedule of Additions, Deductions, and Exemptions form. It must be provided by the taxpayers who need to take exemptions from the adjusted federal gross incomes to compute the taxable income in New Mexico, who need deductions, or who need additions. Before you fill out the form, read the description of it, and make sure you are eligible to do that.

- Form RPD-41248. This is an Application to be a Qualified Employer for the Allocation of Nonresident Employee Income from Manufacturing Plants in New Mexico Within 20 Miles of the International Border. This form was created for employees who are not residents of New Mexico but work in the plant that is located near the border with Mexico. They can allocate the money they’ve earned at the plant to their own state of residence.

- Form RPD-41096. The form is known as Application for Extension of Time to File. The document is created by the State of New Mexico Taxation and Revenue Department as many other New Mexico tax forms 2022. Before you complete the document make sure you qualify for this extension. If you are, there is a deadline you need to follow, which is before or at the date of the return.

Where to get New Mexico Tax Forms?

You have to check out the official website for the New Mexico department of revenue tax forms. There are multiple forms created by the New Mexico Taxation and Revenue Department and kept for years there. Some of them are too old to use. You have to make sure that you choose the right one. It may take some time to find the one you need. There are New Mexico tax return forms on PDFLiner. The collection is simple to navigate and check the description of each form under it. You may complete them in the service, using the tools. Here is what you need to do:

- Pick the template you need.

- Press the Fill Online.

- When you see the form is opened, fill it out.

- Print it or send it online. You can sign the form online as well.

FAQ:

-

Where do I mail New Mexico tax forms?

You can mail New Mexico tax forms online or you can try a more classic way, which is to send the form by regular mail to the indicated address in the form. Each document contains instructions from the State of Mexico Taxation and Revenue Department. There you will find the address with guidance and deadlines.

-

What tax forms do I need to fill out for New Mexico state tax?

You may need any of the forms described above. The most popular are PIT-1 and PIT-X, but you still may need the form for the job near the border or extra time to file the tax report. Make sure you know where to get and how to complete these documents.