-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Form Arkansas No-Fault Divorce (Minor Children)

Form Arkansas No-Fault Divorce (Minor Children)

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Tennessee Tax Forms

-

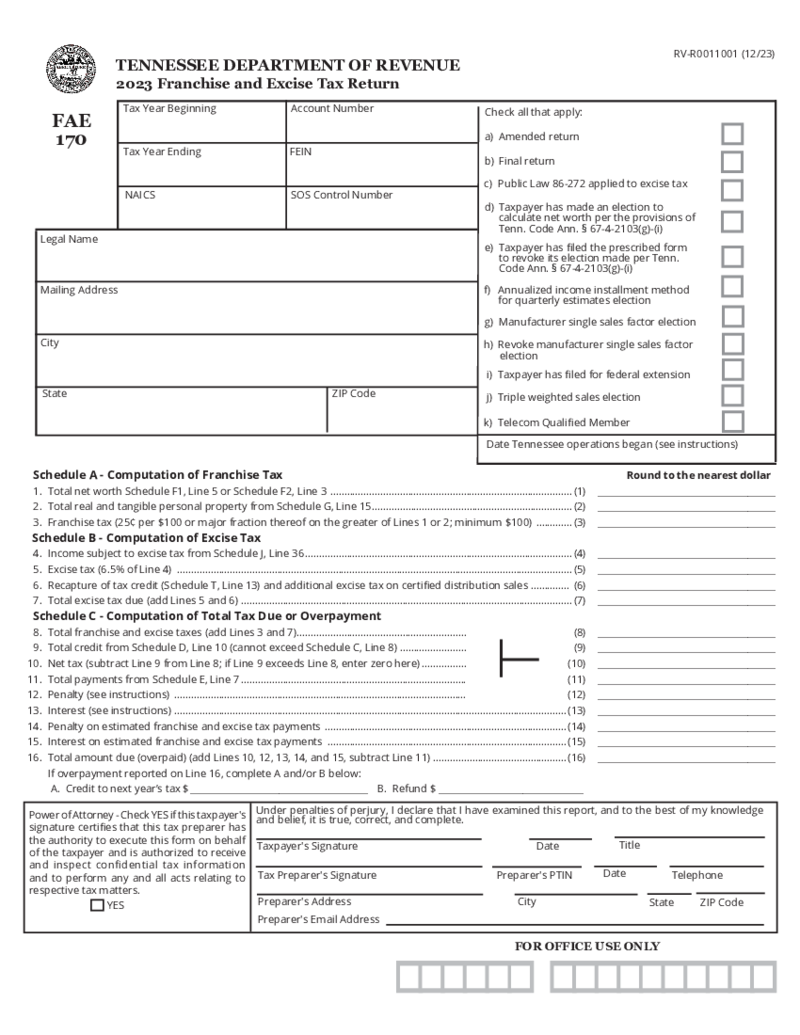

Tennessee Form FAE 170 Franchise and Excise Tax Return

What Is Form FAE170 2023

Form FAE170 is the designated document businesses in Tennessee utilize to report and remit their franchise and excise tax obligations. This form plays a crucial role in the financial and regulatory landscape of the state. For any

Tennessee Form FAE 170 Franchise and Excise Tax Return

What Is Form FAE170 2023

Form FAE170 is the designated document businesses in Tennessee utilize to report and remit their franchise and excise tax obligations. This form plays a crucial role in the financial and regulatory landscape of the state. For any

-

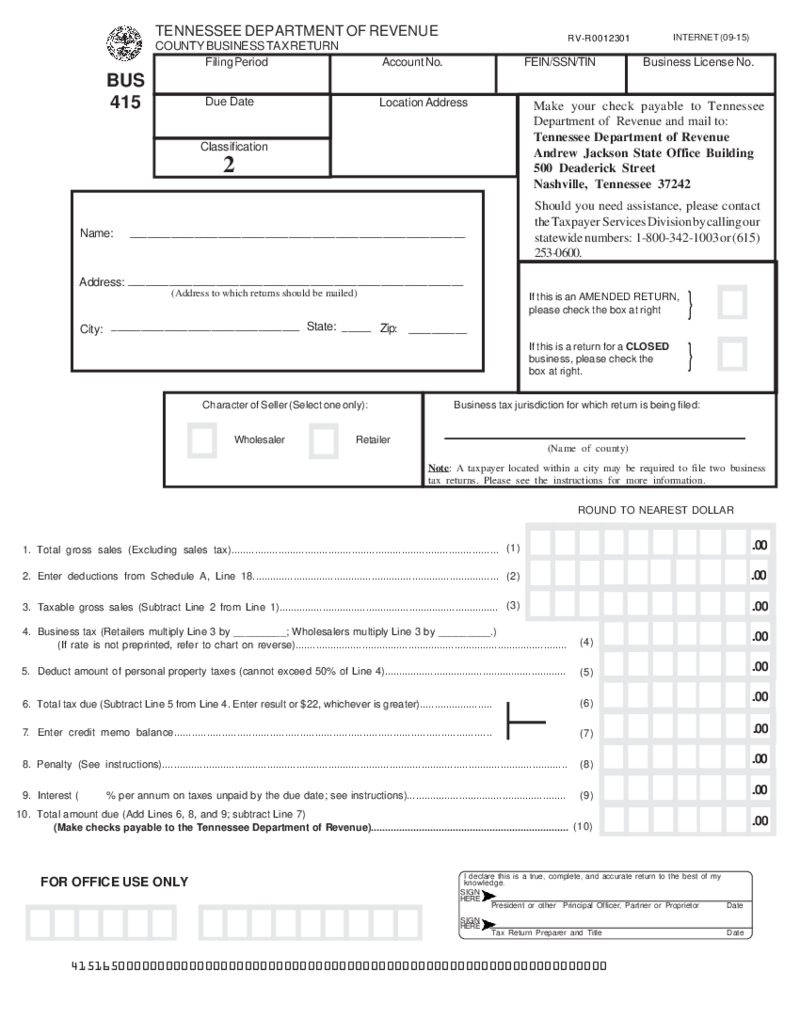

Business Tax Return (Form BUS-415)

Understanding the Business Tax Return Form

Known as Form BUS-415, this important document is the official business tax return form used by companies across the US. This form is undeniably integral to fulfilling tax obligations and ensuring all finances ar

Business Tax Return (Form BUS-415)

Understanding the Business Tax Return Form

Known as Form BUS-415, this important document is the official business tax return form used by companies across the US. This form is undeniably integral to fulfilling tax obligations and ensuring all finances ar

-

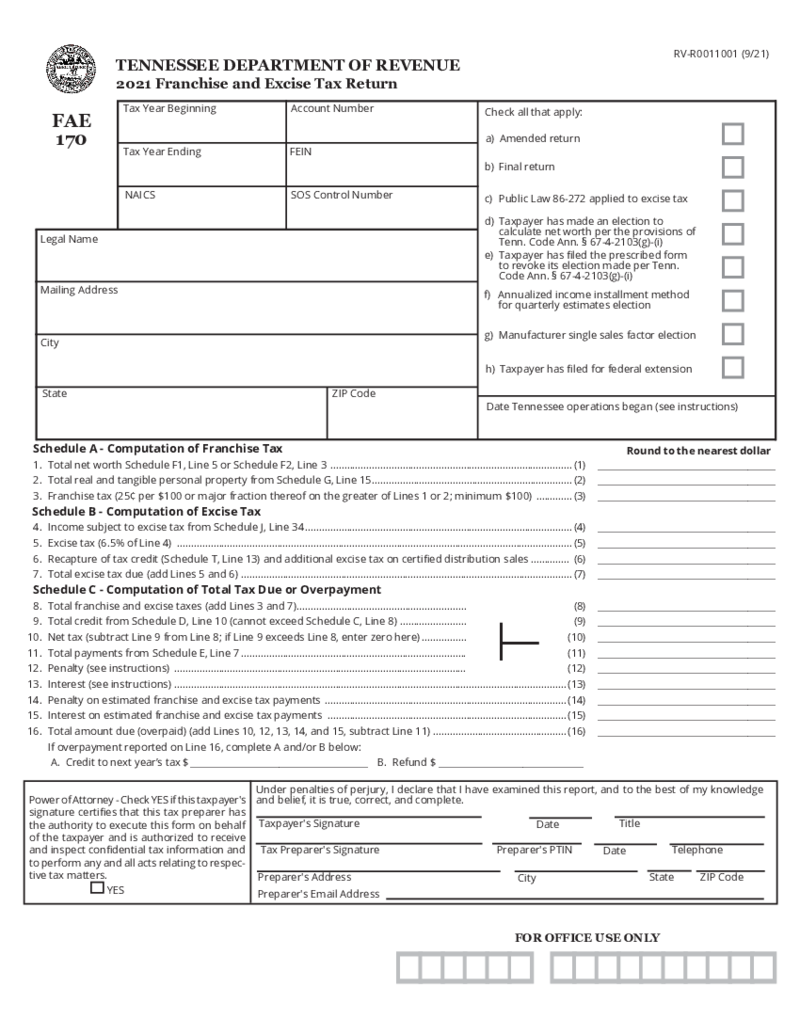

Tennessee Form FAE 170 (2021)

What Is Tennessee Form FAE 170?

When discussing the TN FAE 170 form, we're actually referring to the Tennessee Department of Revenue Form FAE 170. This is a mandatory document that incorporated businesses, LLCs, and partnerships must file annually. It

Tennessee Form FAE 170 (2021)

What Is Tennessee Form FAE 170?

When discussing the TN FAE 170 form, we're actually referring to the Tennessee Department of Revenue Form FAE 170. This is a mandatory document that incorporated businesses, LLCs, and partnerships must file annually. It

-

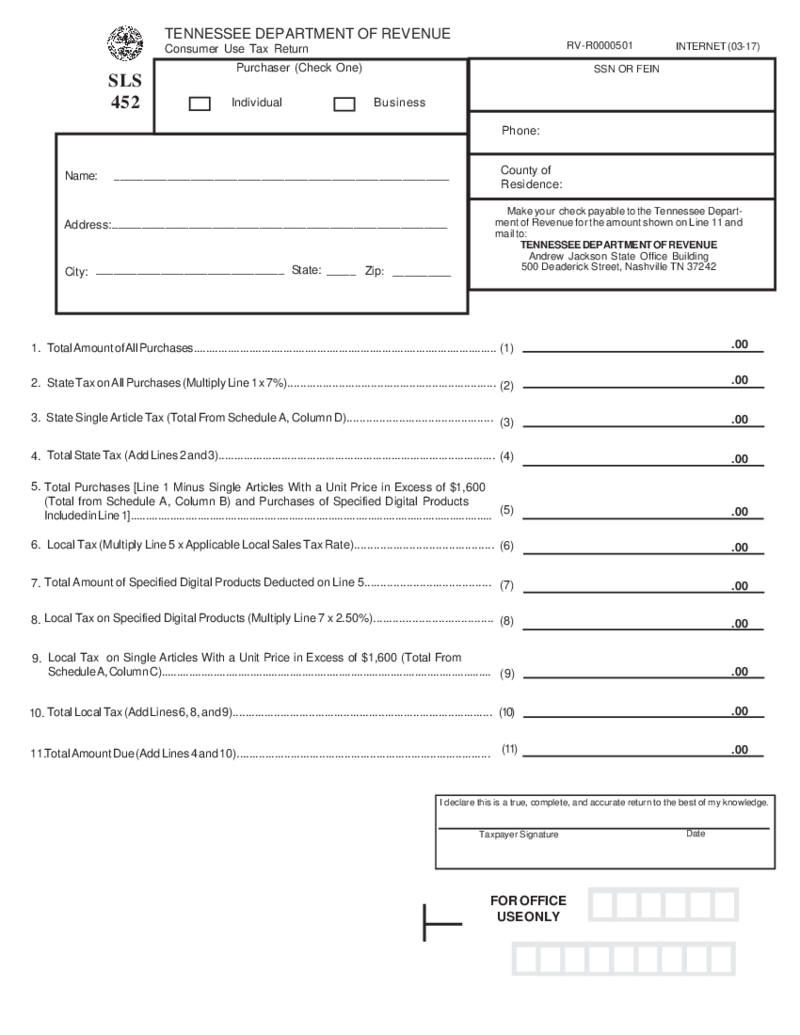

Consumer Use Tax Return SLS 452

Understanding the Consumer Use Tax Return Form

The consumer SLS 452 form provides a framework for consumers to report and pay the tax due on tangible personal property purchased outside their state but used within it. A good understanding of this form is

Consumer Use Tax Return SLS 452

Understanding the Consumer Use Tax Return Form

The consumer SLS 452 form provides a framework for consumers to report and pay the tax due on tangible personal property purchased outside their state but used within it. A good understanding of this form is

-

Tennessee Form Schedule X - Franchise and Excise Tax Job Credit Computation

Acquire a Printable Tennessee Form Schedule X - Franchise and Excise Tax Job Credit Computation Online

There is a huge forms library at PDFLiner, so you can easily find here the needed blank form. Begin by clicking the "Fill this form" button or

Tennessee Form Schedule X - Franchise and Excise Tax Job Credit Computation

Acquire a Printable Tennessee Form Schedule X - Franchise and Excise Tax Job Credit Computation Online

There is a huge forms library at PDFLiner, so you can easily find here the needed blank form. Begin by clicking the "Fill this form" button or

-

Tennessee FAE 173

Understanding the Tennessee FAE 173

The Tennessee form FAE 173, otherwise known as the franchise and excise tax return, is an essential document for businesses operating within the state of Tennessee. When it's time to file taxes, it’s important

Tennessee FAE 173

Understanding the Tennessee FAE 173

The Tennessee form FAE 173, otherwise known as the franchise and excise tax return, is an essential document for businesses operating within the state of Tennessee. When it's time to file taxes, it’s important

-

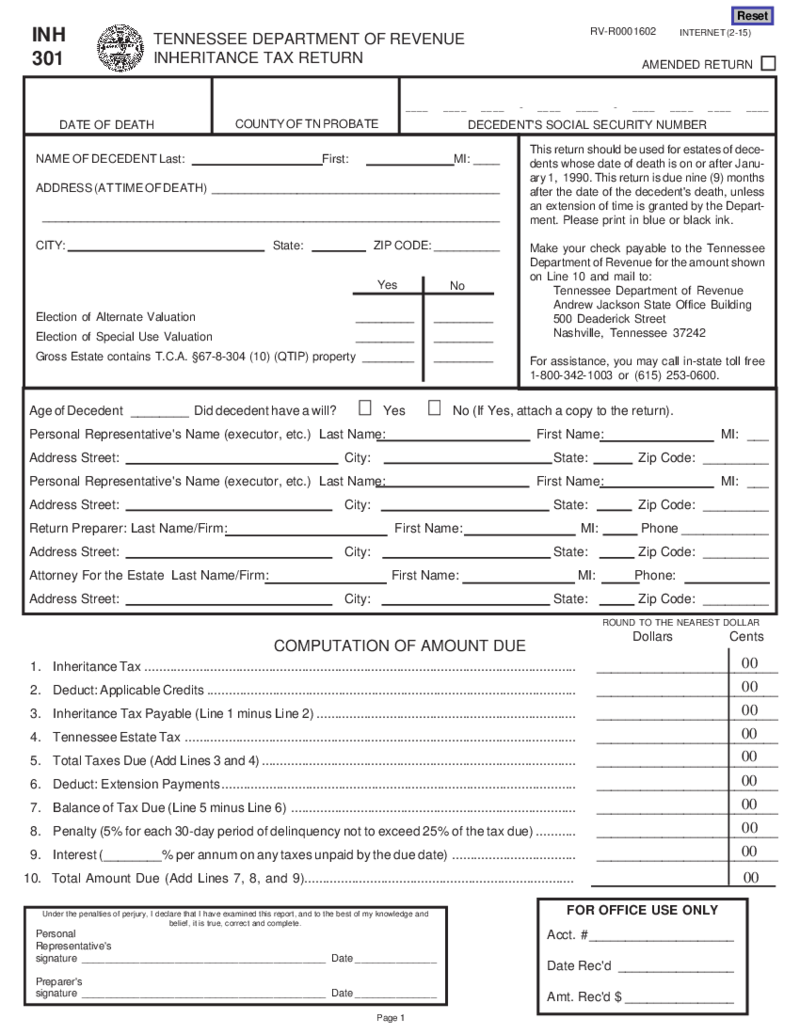

Tennessee Inheritance Tax Return (Form INH 301)

Understanding Your Tennessee Inheritance Tax Return

One essential document you'll likely encounter when settling an estate is the Tennessee Inheritance Tax Return. Traditionally known as Form INH 301, it is brought to you by the Tennessee Department o

Tennessee Inheritance Tax Return (Form INH 301)

Understanding Your Tennessee Inheritance Tax Return

One essential document you'll likely encounter when settling an estate is the Tennessee Inheritance Tax Return. Traditionally known as Form INH 301, it is brought to you by the Tennessee Department o

-

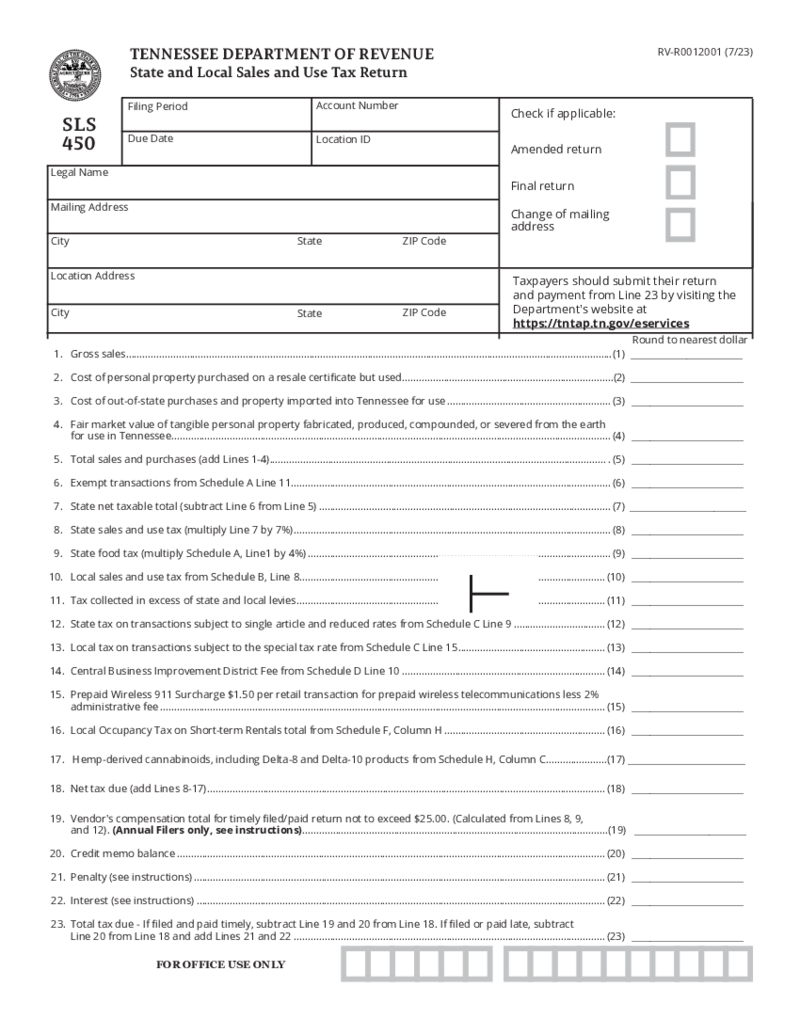

State and Local Sales and Use Tax Return (Form SLS 450)

Understanding Form SLS 450

The form SLS 450 is crucial for business owners in Tennessee. Predominantly issued by the Tennessee Department of Revenue, this essential tax return document allows businesses to keep track of and accurately remit their sales an

State and Local Sales and Use Tax Return (Form SLS 450)

Understanding Form SLS 450

The form SLS 450 is crucial for business owners in Tennessee. Predominantly issued by the Tennessee Department of Revenue, this essential tax return document allows businesses to keep track of and accurately remit their sales an

-

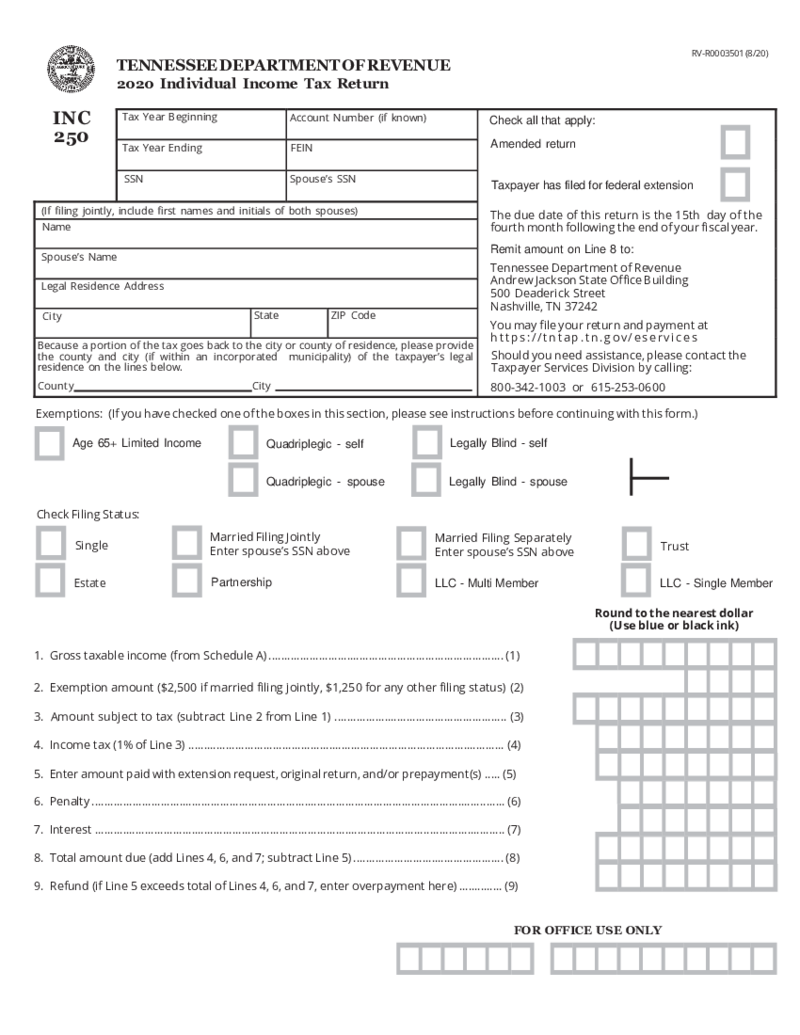

Tennessee Individual Income Tax Return - INC 250

What is the TN INC 250 form?

The Tennessee Individual Income Tax Return - INC 250 form is the tax return form used by individuals to file their state income tax in Tennessee. It should be filed by anyone who has earned income in Tennessee, regardless of w

Tennessee Individual Income Tax Return - INC 250

What is the TN INC 250 form?

The Tennessee Individual Income Tax Return - INC 250 form is the tax return form used by individuals to file their state income tax in Tennessee. It should be filed by anyone who has earned income in Tennessee, regardless of w

What are Tennessee Tax Forms?

Tennessee tax forms are made for local residents or for people who work in the state. They record the income of each person and help to calculate taxes based on it. Some of the forms look similar to the federal tax templates created by the IRS. Yet, you have to provide federal forms separately to the IRS due to the indicated deadline. Tennessee tax templates were created by the Tennessee Department of Revenue and must be sent to them once they are completed.

There are over 50 tax forms from Tennessee gathered on PDFLiner. The editor’s library is increasing each time the local Department of Revenue updates or creates a new blank. You will find all Tennessee tax forms 2022 there.

Most Popular Tennessee Tax Forms

If you are lost in the forms you need to learn the specifics of each of them and understand when they are used. PDFLiner contains a brief description of each form under its image so you don’t have to open them to read it. It is better to learn which blank you need to send before the deadline so you would not be fined. If you know what you are looking for, use the search bar to quickly get to the form. However, if you are just wondering around, here is the list of the most popular Tennessee income tax forms on PDFLiner that may inspire you:

- Form INC 250. This form is known as the Tennessee Department of Revenue Individual Income Tax Return. Don’t make mistakes! This is a local document and you still need to complete the federal tax return report to the IRS. This one contains the same information plus the local details you have to provide. Be specific about the numbers you indicate, they have to match official calculations. Include data on your gross income tax, income tax, dividends, and type of income, both from the national and state operations.

- Form 251. This is a Tennessee Application for an Extension of Filing Time/Prepayment of Individual Income Tax. This form does not grant you the right not to pay taxes. You have the possibility to delay the form or prepayment that comes with tax payment. There is a strict rule made by Tennessee officials that allows you to extend the date to the 15th day of the 4th month after the fiscal year. You have to learn whether your case matches the requirements and whether your form will be approved before you complete anything.

- Form FAE 176. The name of the form is Investment Company Special Privilege Tax Return. The form must be filled out on behalf of the company that resides in the state. If you do business outside the state you have to fill out Schedule A. Fill Schedule B with the numbers of the income and the gross profit you receive during the financial year.

- Form ALC 102. The form is used for the Wholesale Alcoholic Beverage Tax Return. You need to provide your ABC license number before you complete the form. Include the data on the distilled spirits, alcoholic beverages with the percentage of alcohol there, and wine content.

- Form PRV 413. The Bail Bond Tax Return form was created by the Tennessee Department of Revenue to ease the life of taxpayers inside the state. They offer to submit the form using their website. You have to calculate the bond number, including taxes, and the balance on your credit.

How to Get Tennessee Tax Forms?

You may find Tennessee state tax forms 2022 you need at the official website of the Tennessee Department of Revenue. There are forms gathered over many years. You may spend some time there to find the one you really need among all the documents. Later you will need to print it or use a third party to complete it online. Another alternative is PDFLiner which already contains all the forms you need in the library as well as offers editing tools to fill in the blanks online. Once you find the Tennessee state tax forms you want, follow the next steps:

- Pick the forms from the list.

- Press the icon Fill Online.

- Complete the form once it appears on your screen.

- You may put your electronic signature, create it in PDFLiner and send it to the recipient.

FAQ:

-

When will Tennessee tax forms be available?

Tax forms are always available for citizens. You have to check the website of the Department of Revenue or PDFLiner. However, some blanks can be changed with the years. It is better to wait till the end of the year to make sure that the form was updated by officials.

-

When can I file my Tennessee state taxes?

The taxes are filed to specific departments. They are provided by officials and recorded. You have to mention them in your tax reports each year or month based on the form you use.