-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

PIT-RC - New Mexico Rebate And Credit Schedule

Get your PIT-RC - New Mexico Rebate And Credit Schedule in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is the New Mexico PIT RC Form?

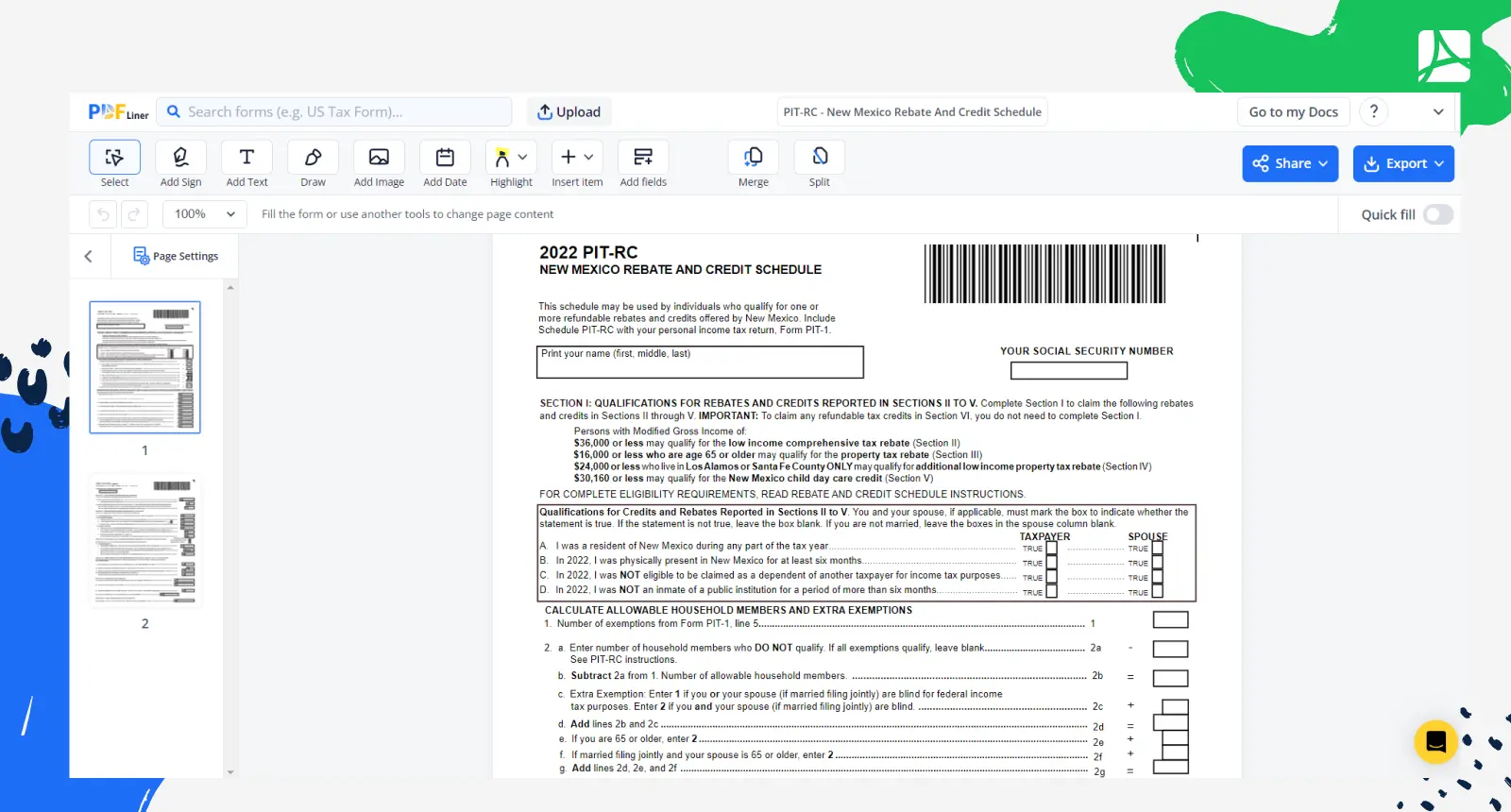

The PIT-RC form, or New Mexico Rebate and Credit Schedule, is a supplemental document used by taxpayers in New Mexico to claim available rebates and credits. These rebates might be related to your income, location, or other factors. To take advantage of these tax benefits, you must complete and submit the form pit rc alongside your state tax return.

Who needs to file the New Mexico tax form PIT RC?

Taxpayers that wish to claim one or more of the following rebates or credits should file the tax form PIT RC:

- Working Families Tax Credit (WFTC)

- Low-Income Comprehensive Tax Rebate (LICTR)

- Other refundable tax credits

Step-By-Step Filling of NM PIT RC Form

To complete the New Mexico tax form PIT RC accurately and successfully, follow these simple steps:

- To fill out the first section of the form, enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the box labeled "Social Security Number."

- Next, type your name, Spouse's name (if filing jointly), and Current Mailing Address, including city, state, and ZIP code in the appropriate fields.

- In the section titled 'Qualifications for Credits and Rebates Reported in Sections II to V,' review the list of qualifications and confirm that you meet the necessary requirements to apply for the credits and rebates listed.

- Proceed to the 'Calculate Allowable Household Members and Extra Exemptions' section, where you'll enter the number of qualifying household members and Exemptions, and then complete Boxes 3 through 6 in the same manner.

- Move on to the 'Calculate Modified Gross Income' section. Fill in your gross income, and calculate the adjustments required in Boxes B through E.

- To complete Section II: 'Low-Income Comprehensive Tax Rebate,' enter your adjusted gross income from line E1 and follow the instructions provided to figure out the amounts for line F through line K.

- If you qualify for Section III: 'Property Tax Rebate for Persons 65 or Older,' input the required information in lines L through M2.

- For Section IV: 'Additional Low Income Property Tax Rebate for Los Alamos or Santa Fe County Residents Only,’ provide data as needed for lines N1 to O3, if applicable.

- Fill out Section V: 'New Mexico Child Day Care Credit' if you have eligible childcare expenses, entering the information in lines P through S accordingly.

- In Section VI: 'Refundable Tax Credits,' list applicable tax credits on lines T1 through U3 based on your eligibility.

- For the final Section VII: 'Total Rebates and Credits Claimed,' sum up the totals from Sections II, III, IV, and VI to arrive at the Rebate and Credit amounts. Ensure that you cross-verify the figures and recheck your calculations.

- Once you have filled out all sections, review the form thoroughly for accuracy and completeness, making sure that all your entries are correct before signing and submitting the document.

Tips for completing form PIT RC

When completing the PIT-RC form, consider the following tips to help you successfully and accurately claim your rebates and credits:

- Double-check eligibility: Confirm that you qualify for each rebate or credit you are claiming on the PIT RC form.

- Gather documents: Collect supporting documents, such as receipts for medical expenses, property tax records, and childcare expense information.

- Ensure accuracy: Double-check all calculations, social security numbers, and dollar amounts entered.

- Keep copies: Maintain a copy of your completed PIT-RC form along with all supporting documents for your records.

- Use the latest form version: Remember to check that you have the most recent version of the form.

- Attach to tax return: Attach the completed PIT-RC form to your New Mexico personal income tax return (Form PIT-1) before mailing.

- Seek professional advice: Consult a tax professional for guidance if you are unsure about any rebate or credit.

- Submit on time: Note the due date for submitting the PIT-RC form along with your tax return and make sure to submit it on time.

Form Versions

2022

PIT-RC - New Mexico Rebate And Credit Schedule (2022)

Fillable online PIT-RC - New Mexico Rebate And Credit Schedule