-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

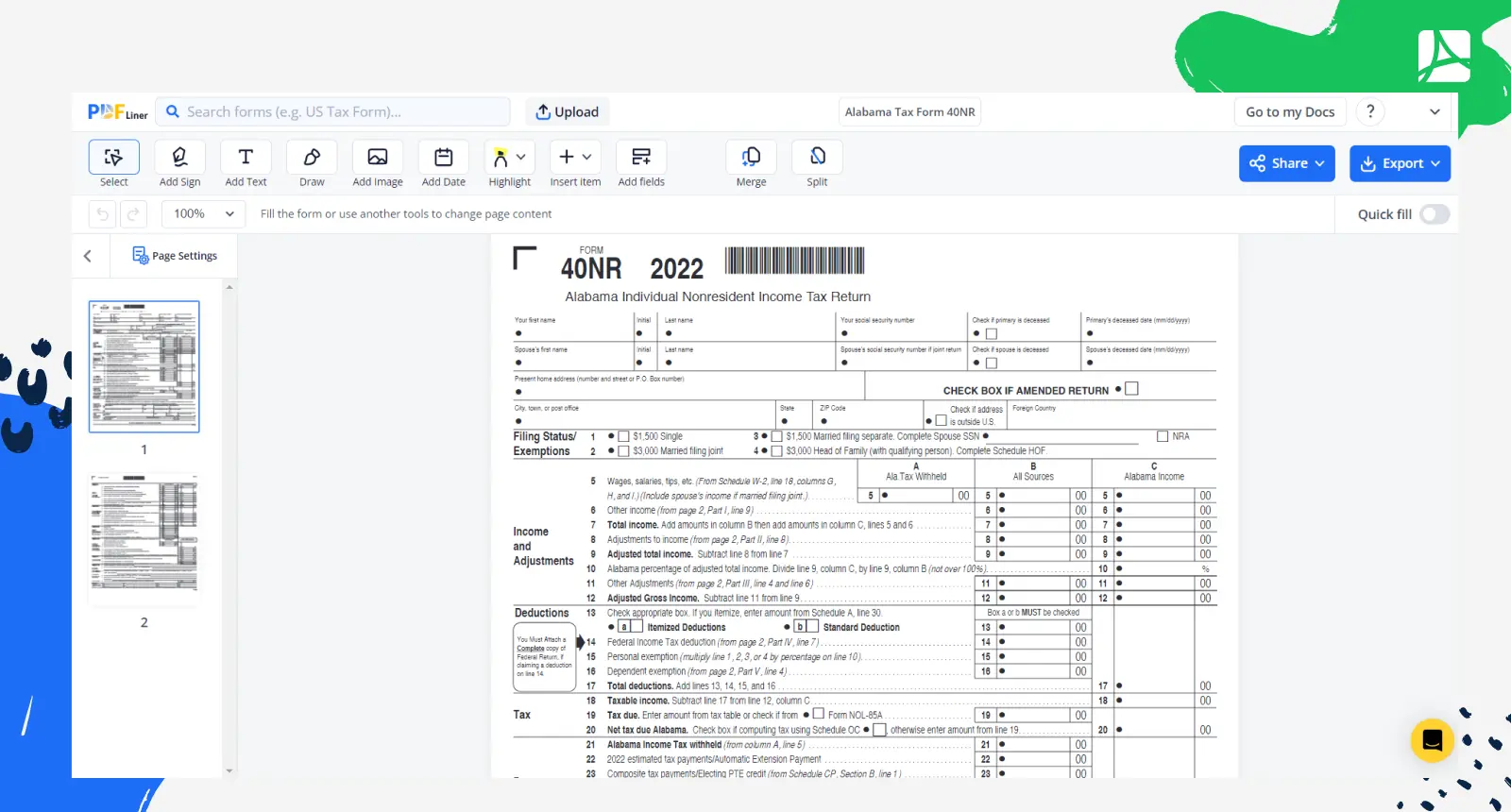

Alabama Tax Form 40NR

Get your Alabama Tax Form 40NR in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the Alabama Form 40NR

Form 40NR is an instrumental aspect of the Alabama state tax system. If you fall under the category of non-residents earning income in Alabama, you are required to file your income using this form. The Alabama state tax form 40NR serves as a crucial document that ensures non-residents account for their earnings accurately.

Components inside Alabama income tax form 40NR

Tax form 40NR is not as complicated as it may initially seem. Essentially, it records your income sources, deductions, and the total tax due. To complete it, you will require information from your W-2 or 1099 form. It also requests details about your spouse and dependents if applicable. Remember, filling this document accurately is vital to avoid discrepancies that may cause issues in the future.

Filling Out the Alabama 40NR Form

After understanding what the form is, the task that remains is knowing how to fill out the form. To do so, follow these steps:

- Start filling out the form by entering your personal information such as "Your First Name and Initial", "Your Last Name", "Date of Birth", "SSN" in the respective fields.

- If you're filing jointly, fill out your spouse's personal details in the respective columns such as "Spouse's First Name and Initial", "Spouse's Last Name", "Date of Birth", and "SSN".

- Under 'Filing Status' section, check the appropriate boxes that define your tax filing status such as Single, Married Filing Jointly, Married Filing Separately, or Head of Household.

- Fill out your mailing address details like Street, City, State, and ZIP Code. If your Physical Home Address is different from your Mailing Address, ensure you complete those details also.

- Move on to the 'Income and Adjustments' section. Fill in your federal adjusted gross income from the federal form, total interest and dividend income, other income and relevant lines.

- Continue filling up the form in the 'Tax computation' section, where you'll calculate your Taxable Income by subtracting certain adjustments from your Gross Income.

- In the ‘Payments/Credits’ section, provide information about your estimated tax payments, tax withheld, earned income credit etc. Ensure to calculate the total payments/credits.

- In the next section, calculate your total tax, tax due, and overpayment if any.

- Then, fill up the "Contributions for check-off" section if you wish to make any contributions.

- In the ‘Signature’ section, provide your signature, your spouse’s signature ( if filing jointly), and the preparer's signature (if you used a paid preparer).

- Once you have filled out all necessary fields, read through each section to make sure you didn't miss anything or don't have any incorrect information.

- You can now download, print, email, or fax the completed Alabama state tax form 40NR directly from the PDFLiner website.

Mistakes to avoid when filling tax form 40NR

Here are two common errors to evade when working with form 40NR:

- Omitting necessary income details: Ensure all income earned in Alabama is recorded.

- Incorrect calculations: An error in your calculations can impact the tax you owe. Take time to double-check your figures.

Form Versions

2022

Alabama Tax Form 40NR (2022)

2018

Alabama Tax Form 40NR (2018)

Fillable online Alabama Tax Form 40NR