-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Arkansas Tax Forms

-

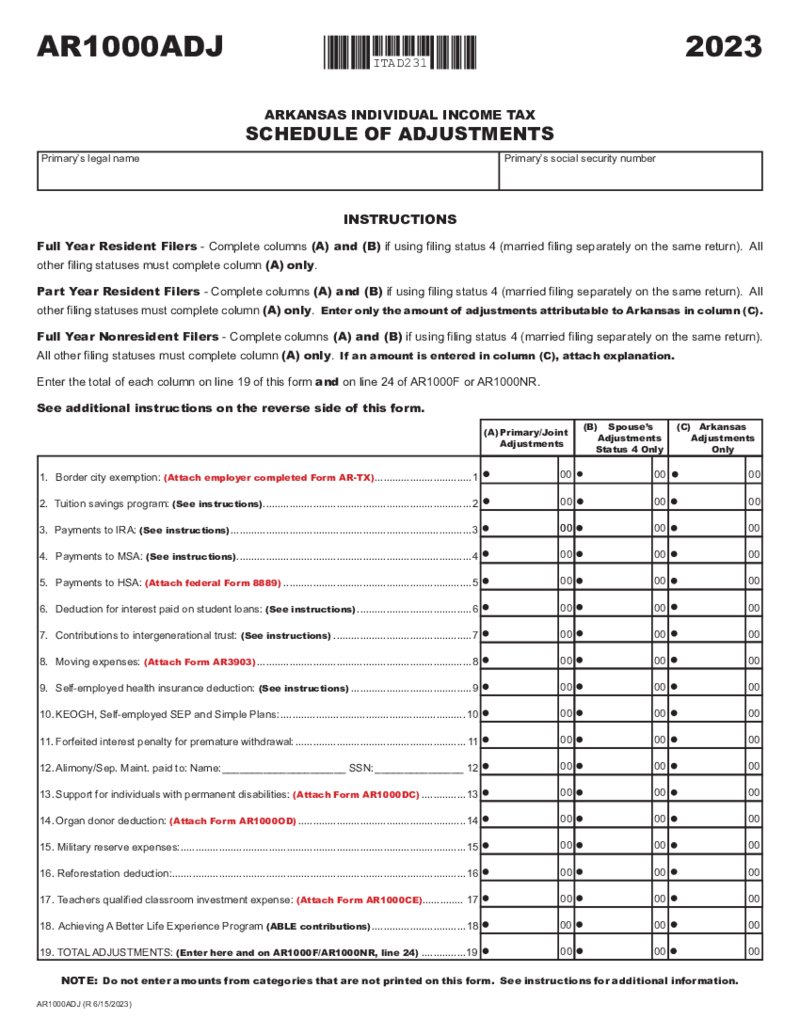

Arkansas Tax Form AR1000ADJ

What Is Arkansas Tax Form AR1000ADJ?

The AR1000ADJ is an income adjustment schedule for Arkansas residents. This form allows taxpayers to make specific adjustments to their gross income, which can affect their taxable income and, ultimately, their tax lia

Arkansas Tax Form AR1000ADJ

What Is Arkansas Tax Form AR1000ADJ?

The AR1000ADJ is an income adjustment schedule for Arkansas residents. This form allows taxpayers to make specific adjustments to their gross income, which can affect their taxable income and, ultimately, their tax lia

-

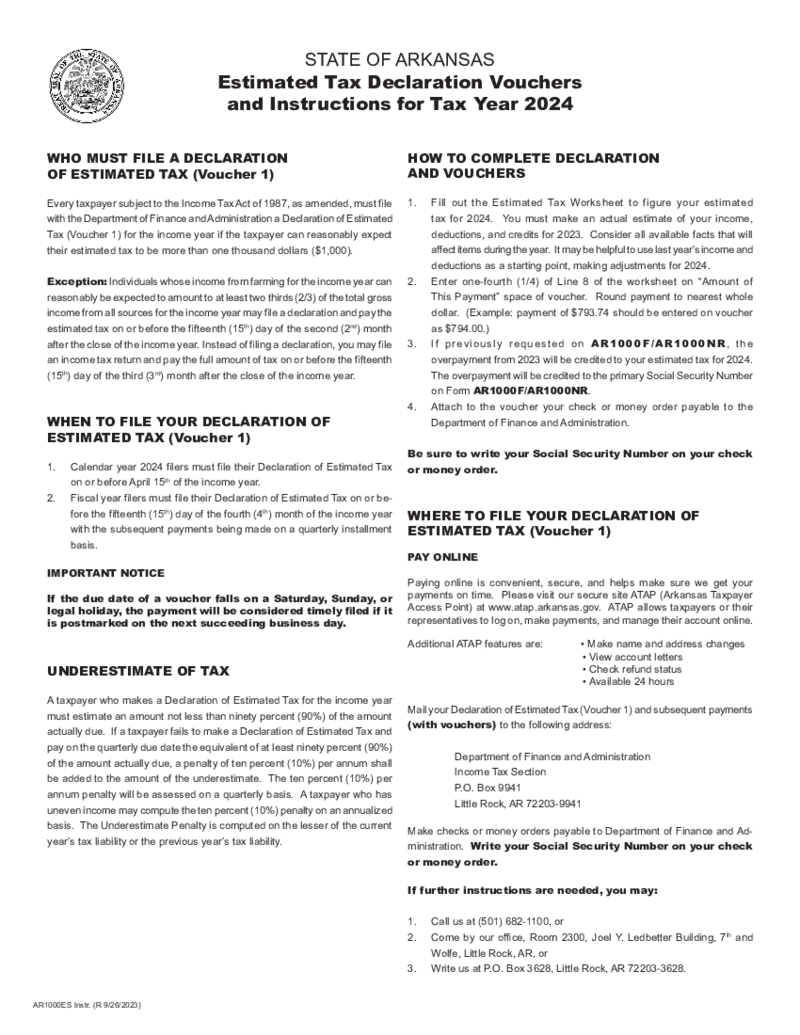

Arkansas Form AR1000ES Individual Estimated Tax Vouchers

The Complete Guide to Arkansas Form AR1000ES Individual Estimated Tax Vouchers

Navigating tax payments can be challenging, especially for those new to making estimated tax payments. The Arkansas Form AR1000ES is designed to aid taxpayers in managing their

Arkansas Form AR1000ES Individual Estimated Tax Vouchers

The Complete Guide to Arkansas Form AR1000ES Individual Estimated Tax Vouchers

Navigating tax payments can be challenging, especially for those new to making estimated tax payments. The Arkansas Form AR1000ES is designed to aid taxpayers in managing their

-

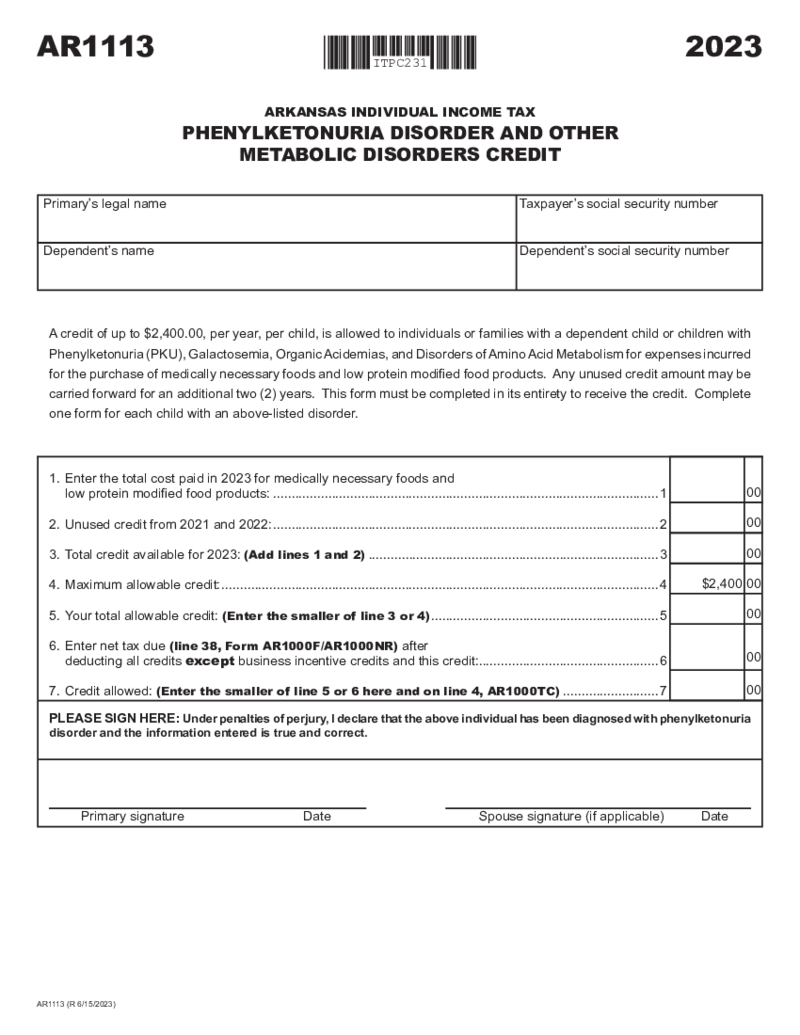

Arkansas Form AR1113 Phenylketonuria Other Metabolic Disorders Credit

Where to Get Fillable Arkansas Form AR1113 Phenylketonuria Other Metabolic Disorders Credit?

You can find the blank file in PDFLiner forms library. Begin by clicking the "Fill this form" button or use the step-by-step instructio

Arkansas Form AR1113 Phenylketonuria Other Metabolic Disorders Credit

Where to Get Fillable Arkansas Form AR1113 Phenylketonuria Other Metabolic Disorders Credit?

You can find the blank file in PDFLiner forms library. Begin by clicking the "Fill this form" button or use the step-by-step instructio

-

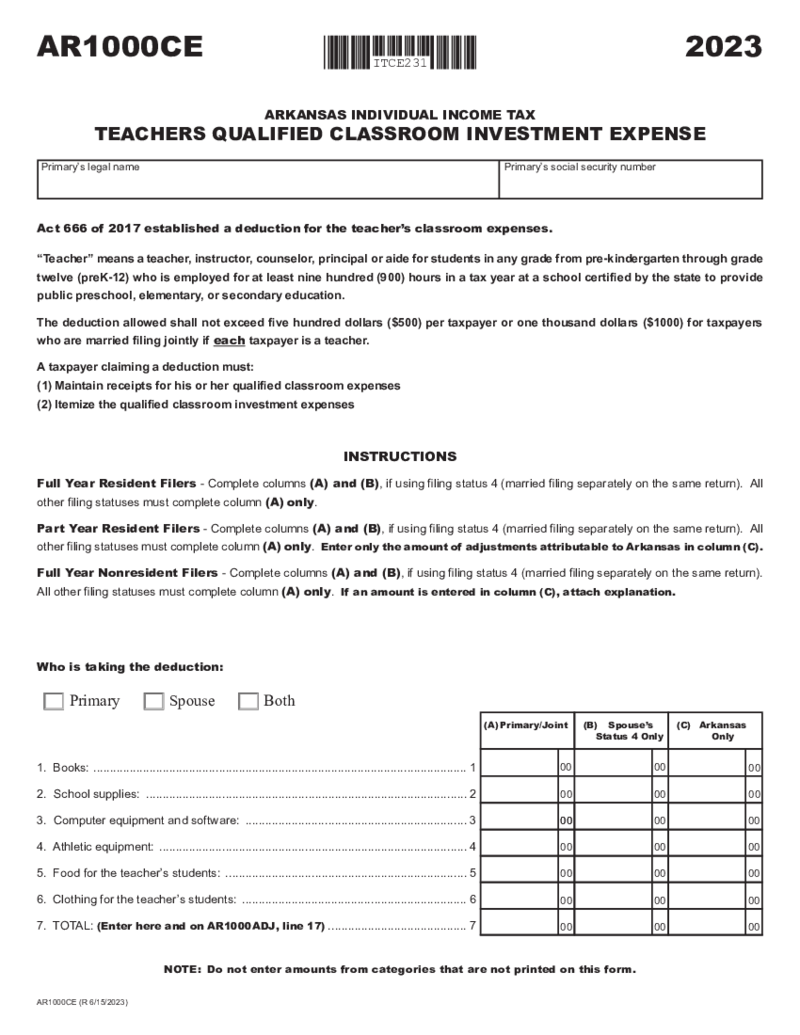

Arkansas Form AR1000CE Individual Teachers Qualified Classroom Investment Expense

Obtain a Fillable Arkansas Form AR1000CE Individual Teachers Qualified Classroom Investment Expense

The blank form is available in the PDFLiner form catalog. To start filling out the form, click the “Fill this form” button, or

Arkansas Form AR1000CE Individual Teachers Qualified Classroom Investment Expense

Obtain a Fillable Arkansas Form AR1000CE Individual Teachers Qualified Classroom Investment Expense

The blank form is available in the PDFLiner form catalog. To start filling out the form, click the “Fill this form” button, or

-

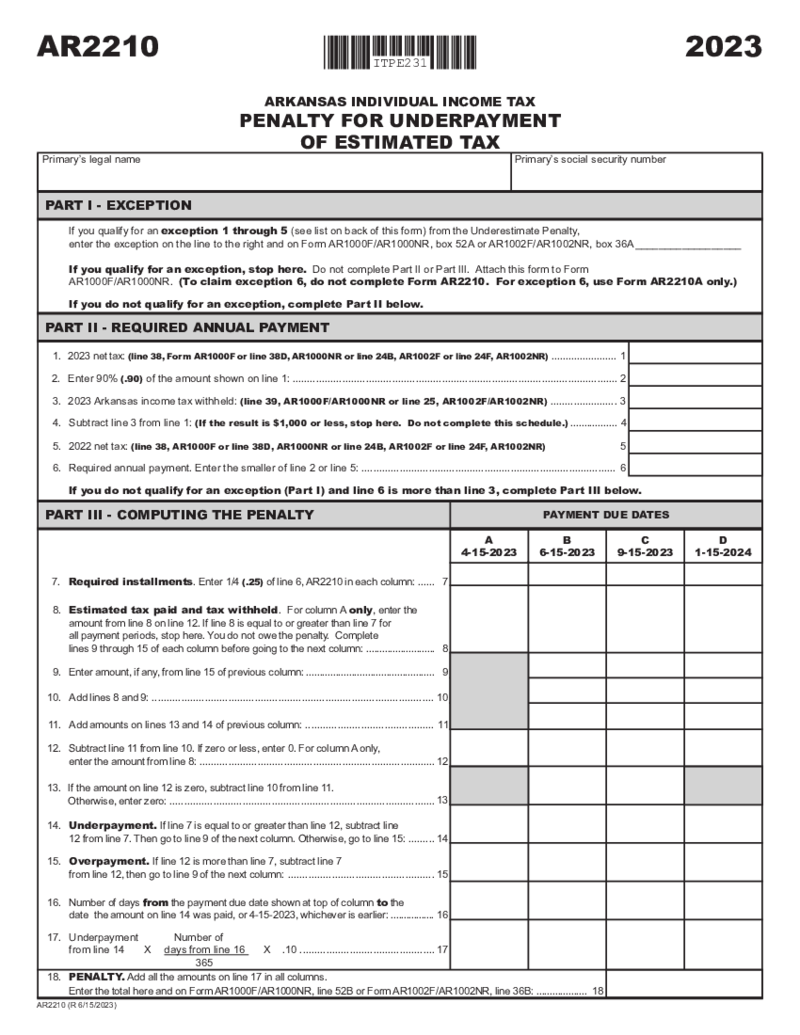

Arkansas Form AR2210 Penalty for Underpayment of Estimated Tax

What is the Penalty for Underpayment of Estimated Tax

The penalty for underpayment of estimated taxes is a consequence of not paying enough in taxes throughout the year, either through withholding or by making estimated tax payments. Rather than waiting u

Arkansas Form AR2210 Penalty for Underpayment of Estimated Tax

What is the Penalty for Underpayment of Estimated Tax

The penalty for underpayment of estimated taxes is a consequence of not paying enough in taxes throughout the year, either through withholding or by making estimated tax payments. Rather than waiting u

-

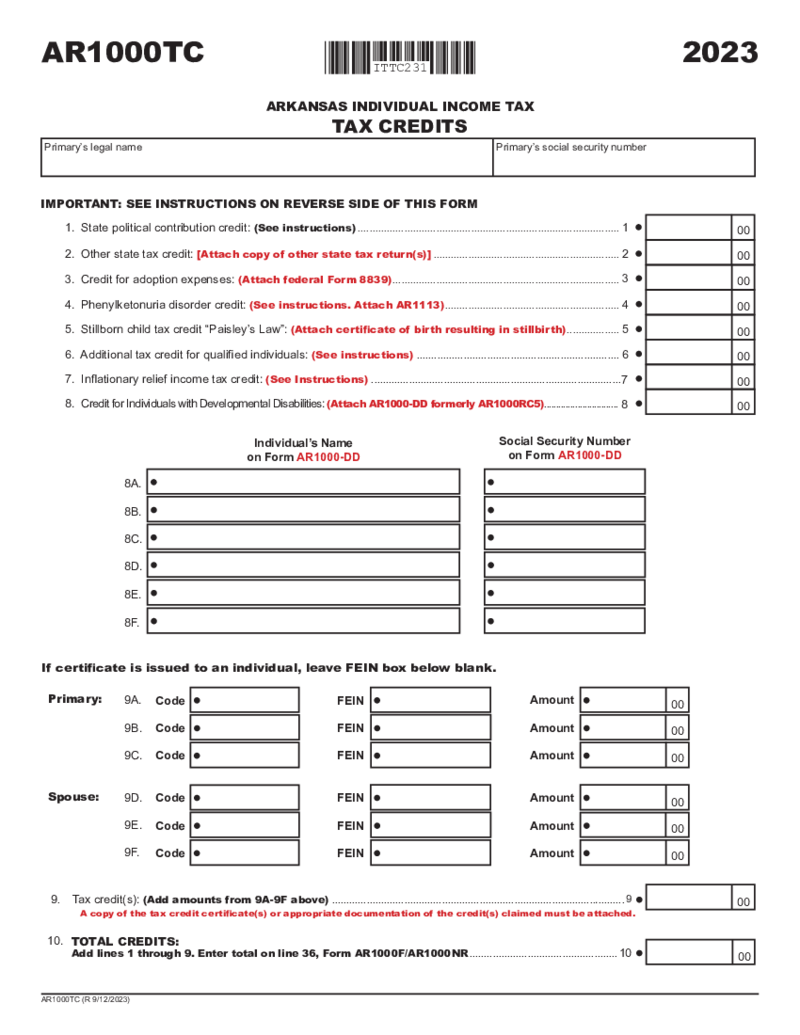

Arkansas Form AR1000TC Schedule of Tax Credits and Business Incentive Credits

The Ultimate Guide to Filing Form AR1000TC in Arkansas

Filing taxes can be a complex process, particularly when you're looking to take advantage of various tax credits for business in Arkansas. Among the forms that need special attention is AR1000TC,

Arkansas Form AR1000TC Schedule of Tax Credits and Business Incentive Credits

The Ultimate Guide to Filing Form AR1000TC in Arkansas

Filing taxes can be a complex process, particularly when you're looking to take advantage of various tax credits for business in Arkansas. Among the forms that need special attention is AR1000TC,

-

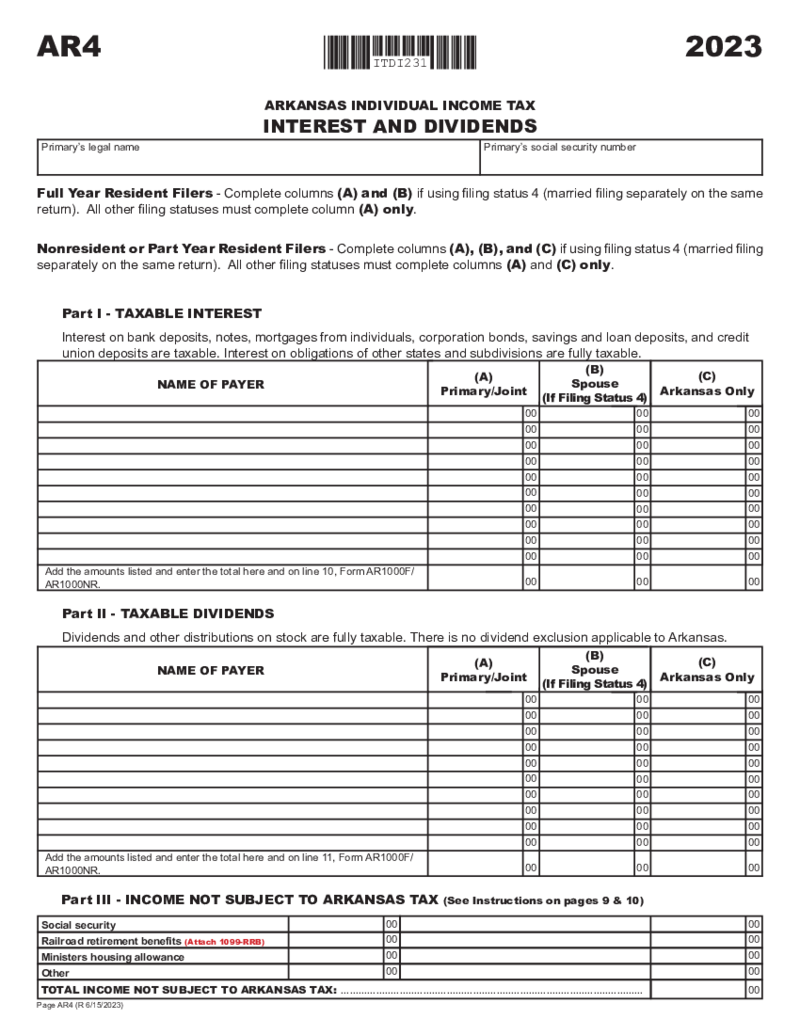

Arkansas Form AR4 Interest and Dividend

A Comprehensive Guide to Arkansas Form AR4: Interest and Dividend Income

Understanding your tax obligations can sometimes be complex, especially when dealing with specific forms for interest and dividend income. In Arkansas, Form AR4 plays a crucial role

Arkansas Form AR4 Interest and Dividend

A Comprehensive Guide to Arkansas Form AR4: Interest and Dividend Income

Understanding your tax obligations can sometimes be complex, especially when dealing with specific forms for interest and dividend income. In Arkansas, Form AR4 plays a crucial role

-

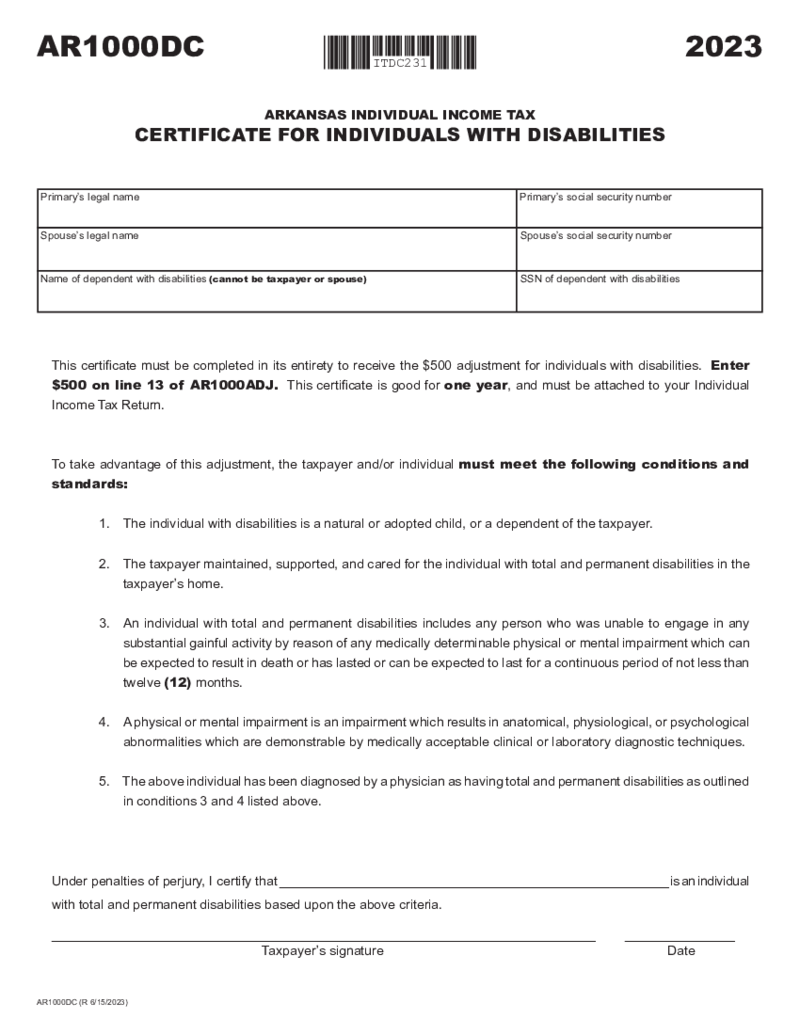

Arkansas Form AR1000DC Disabled Individuals Certificate

A Complete Overview of Arkansas Form AR1000DC

Navigating tax forms can often be confusing and overwhelming. Arkansas Form is essential for certain residents aiming to leverage their eligible deductions. This article serves as your in-depth guide to unders

Arkansas Form AR1000DC Disabled Individuals Certificate

A Complete Overview of Arkansas Form AR1000DC

Navigating tax forms can often be confusing and overwhelming. Arkansas Form is essential for certain residents aiming to leverage their eligible deductions. This article serves as your in-depth guide to unders

-

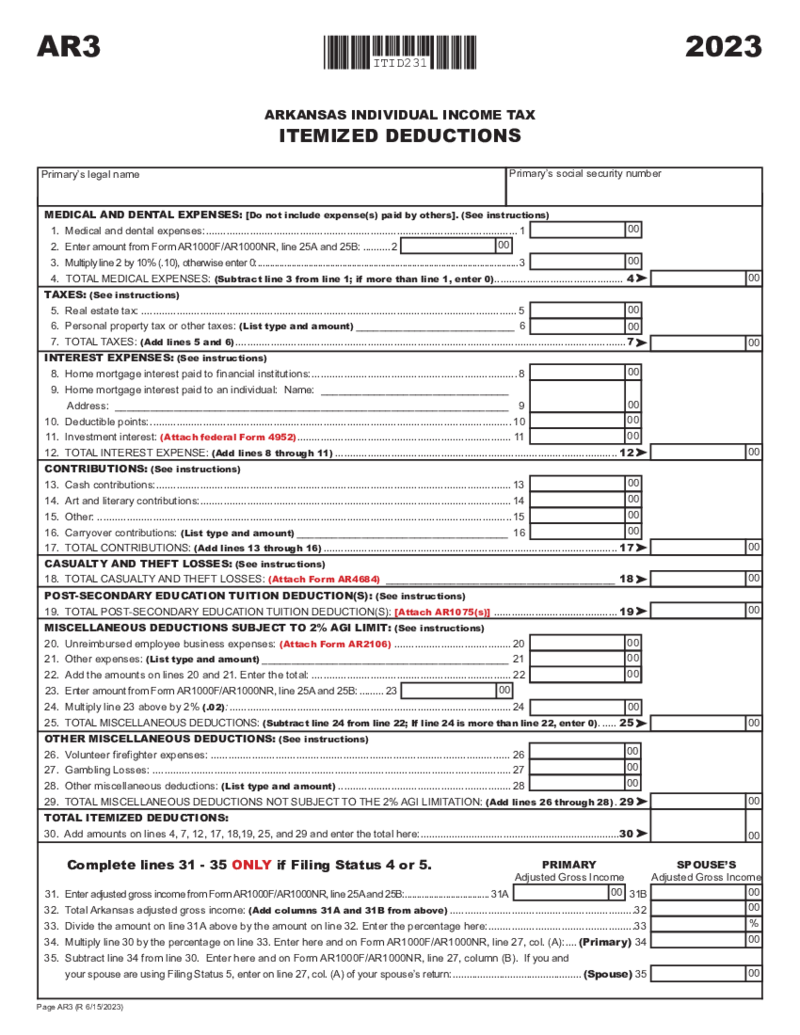

Arkansas Form AR3 Itemized Deduction

Understanding the Arkansas Form AR3

One document you don't want to overlook on your yearly tax paperwork is the form AR3. This document, known officially as the Itemized Deduction Form, is essential when you're preparing your state taxes in Arkans

Arkansas Form AR3 Itemized Deduction

Understanding the Arkansas Form AR3

One document you don't want to overlook on your yearly tax paperwork is the form AR3. This document, known officially as the Itemized Deduction Form, is essential when you're preparing your state taxes in Arkans

-

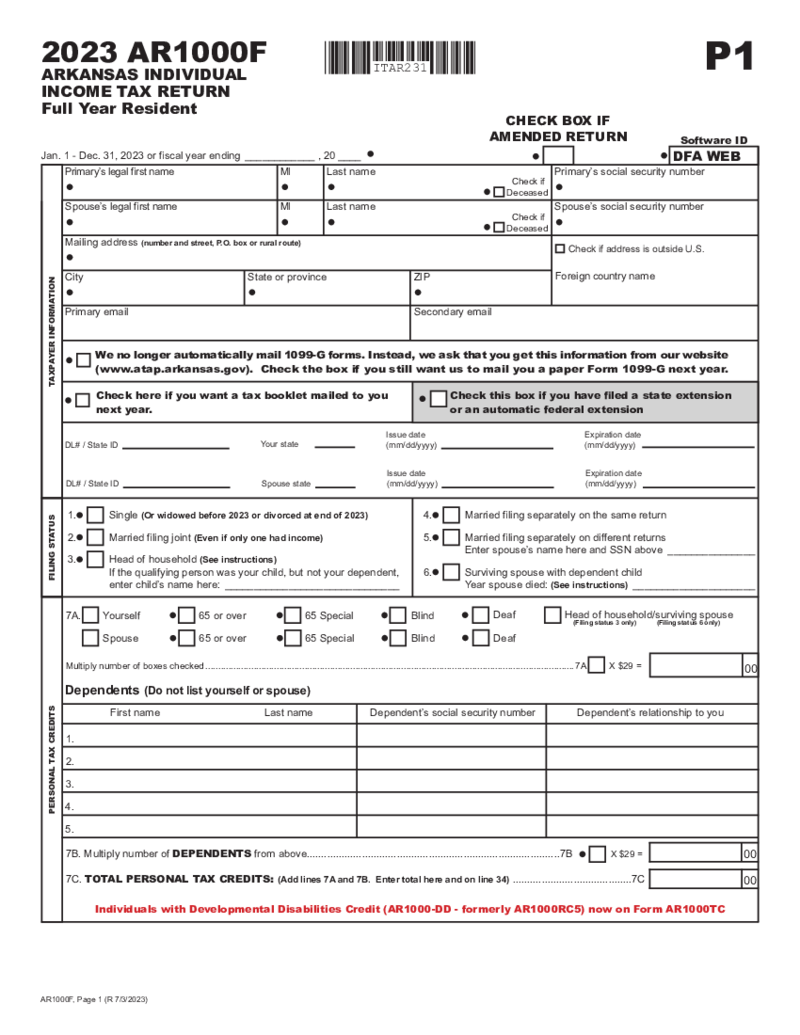

Arkansas Form AR1000F Full Year Resident Individual Income Tax Return

What is Form AR1000F

Form AR1000F is the Arkansas Individual Income Tax Return form for full-year residents. It allows individuals to report their income, claim deductions and credits, and calculate the amount of state tax they owe or the refund they are

Arkansas Form AR1000F Full Year Resident Individual Income Tax Return

What is Form AR1000F

Form AR1000F is the Arkansas Individual Income Tax Return form for full-year residents. It allows individuals to report their income, claim deductions and credits, and calculate the amount of state tax they owe or the refund they are

-

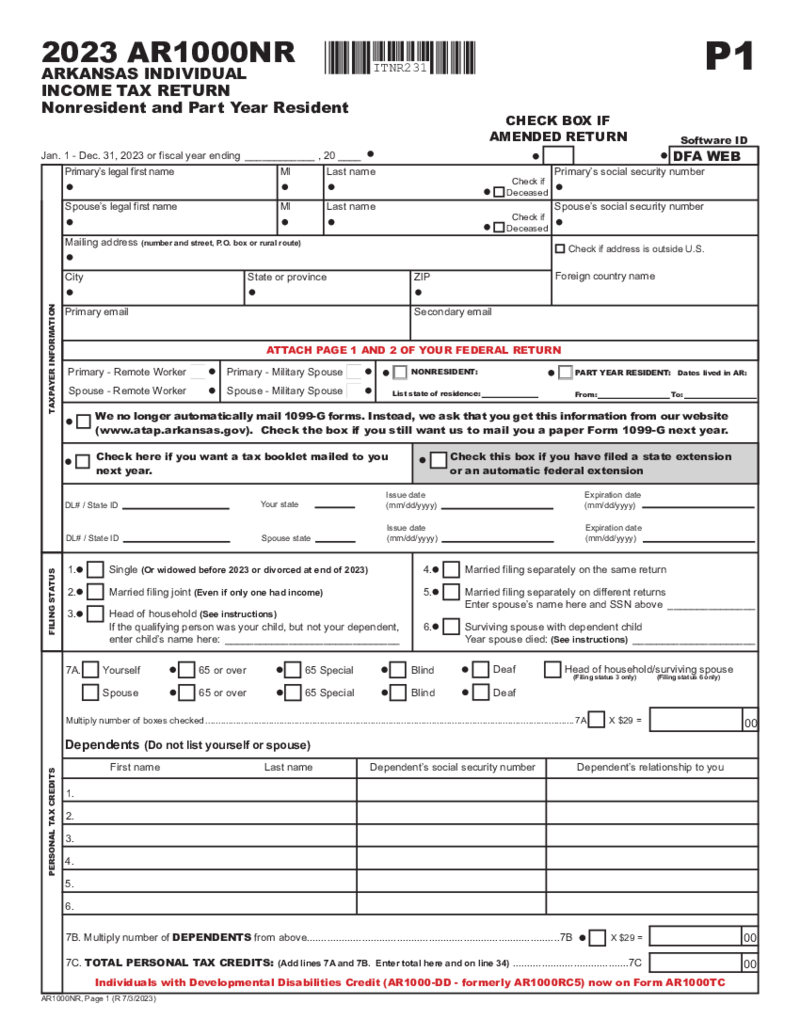

Arkansas Form AR1000NR Part Year or Non-Resident Individual Income Tax Return

What Is AR1000NR Form?

When it comes to tax season, understanding the specific forms required by each state can be a complex task. For those who have moved to or from Arkansas or have earned income within the state without being a full-year resident, the

Arkansas Form AR1000NR Part Year or Non-Resident Individual Income Tax Return

What Is AR1000NR Form?

When it comes to tax season, understanding the specific forms required by each state can be a complex task. For those who have moved to or from Arkansas or have earned income within the state without being a full-year resident, the

-

Arkansas W2

How Do I Acquire Fillable Arkansas W2?

Get your blank document online at PDFLiner. The fastest way to get the form is by clicking "Fill this form" button on this page, but in case you'll need the form letter, follow these steps:

Arkansas W2

How Do I Acquire Fillable Arkansas W2?

Get your blank document online at PDFLiner. The fastest way to get the form is by clicking "Fill this form" button on this page, but in case you'll need the form letter, follow these steps:

What are Arkansas Tax Forms?

Arkansas tax forms are state reports on the income from both individuals and organizations that must be filed annually to the local authorities. These forms were created for the taxpayers within the state. They have numerous similarities with federal tax forms and contain information on the income you receive and the part that you provide as taxes.

There are numerous Arkansas tax forms for 2022 you can find online. If you are worried you can get lost there, use smart search in PDFLiner. All the blanks dedicated to the Arkansas area are gathered in one place there. Pick the form you need based on the taxes you pay or the company you represent, fill it out, and send it to the local government that is indicated in the document.

Most Popular Arkansas Tax Forms

The number of Arkansas tax return forms is growing fast. Each year, Arkansas authorities release fresh updates to the forms you may need. Sometimes they create a new one based on the government's demands. This is why you have to keep up with the updates and demands. You can track them on the official website of the government. Some of the Arkansas income tax forms are more popular than others. You can pay attention to them, since you may probably need them the most. Here is the list:

- Form AR1000NR. This is the Arkansas Individual Income Tax Return Non-Resident or Part-Year Resident report. The form is widely used by part-year residents or nonresidents who work in the state. It contains the data you have to gather for the federal tax return form, as well as the address, SSN, dependents, deposits, salaries, rents, and income. You need to provide the form during the tax report period to the Arkansas officials.

- Form AR1000ADJ. This is one of the popular Arkansas state income tax forms, known as the Arkansas Individual Tax Schedule of Adjustments. If you need to provide adjustments to the tax report you have previously sent, you need this document. You can choose your status, whenever you are a full-year, part-year resident, or nonresident, you need to complete specific lines, based on the detailed instructions provided by local authorities. It can be used with the form AR1000NR as well.

- Form AR1075. This document is known as Arkansas Individual Income Tax Deduction for Tuition Paid to Post-Secondary Educational Institutions. While it is not that widespread among taxpayers you still have to keep it among your Arkansas state tax forms just in case. The form was created to make part of the tuition that was paid by the person to be the taxpayer’s tuition or payment for the spouse or children's education. It must be filled by the student.

- Form AR1000V. This is the State of Arkansas Individual Income Tax Payment Voucher. It was created by Arkansas State Income Tax for those who want to return payment. Once you send the form, you need to wait for the answer from the officials. If your case is approved and your return is amended you will receive the form back to you with underlined YES. You need to mail the tax return, payment, and the form to the address indicated in the form.

- Form AR4684. The form is called Arkansas Individual Income Tax Casualties and Thefts. This is not one of the standard Arkansas state tax withholding forms, and you will need it only if you have to register losses from disasters or thefts. You need to describe the property you own, evaluate it and be specific on the reimbursements.

Where To Get Arkansas State Income Tax Forms?

You may find all Arkansas state tax return forms on the website of the Arkansas Department of Finance and Administration. It contains lots of information, usually placed slightly chaotic. You may need some time to find the document you want. If you are wondering where can I get Arkansas state tax forms fast, you can use PDFLiner. This service contains all the documents released by Arkansas authorities in one place. They are visible and simple to fill. Moreover, since it is an editor that works online you can easily open the form and complete it in no time. Here is what you need to do:

- Pick the form you were looking for from the list.

- Press the big button near it called Fill Online.

- Wait till the editor opens the form.

- Complete the document, sign if you need, and send it to the officials.

Where To Send Arkansas State Tax Forms?

Officials usually require Arkansas withholding tax forms sent either online via the website or to the post box indicated in the document. Some forms can be sent via the email the local Department of Finance and Administration provided to you specifically. If you are not sure where to send the document, you have to contact Arkansas authorities. There is a support team you can reach on the website. PDFLiner offers you to print the document and send it via regular mail, send via email or save it and download it online whenever you need it. Don’t delay the report if you see that there is a specific deadline. Usually, all tax forms have a deadline after which you will be fined.

FAQ:

-

Where can I get Arkansas state tax forms?

Arkansas state forms were created by the Arkansas Department of Finance and Administration, which means that they are available on their official website. Apart from the forms you need, this website contains a wide range of information about the state, local activities, and upcoming events. You can also monitor changes in the forms there. Yet, if you need to find the form fast, use PDFLiner, which has all the Arkansas tax templates in one place, easy to reach.

-

Where do I mail my Arkansas state tax forms?

It depends on the form you are filling in at the current moment. Some forms must be sent by regular post. You have to go to the post office and use the address indicated in the form by the Arkansas Department of Finance and Administration. These forms have to be sent in advance since they require time to be delivered. Other forms can be sent via the official email of the administration. In this case, you will see the address in the form. If the form can be sent online via the website check out for the inner instructions too.

-

What forms to file with my Arkansas individual tax return?

Based on your specific case you may need to file extra forms attached to the Arkansas individual tax return. The most popular among them is Form AR1000ADJ, which is the form that contains adjustments to the original tax return document. You may need an Itemized Deduction Schedule or Check Off Contributions Schedule.