-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Arkansas Tax Forms - page 2

-

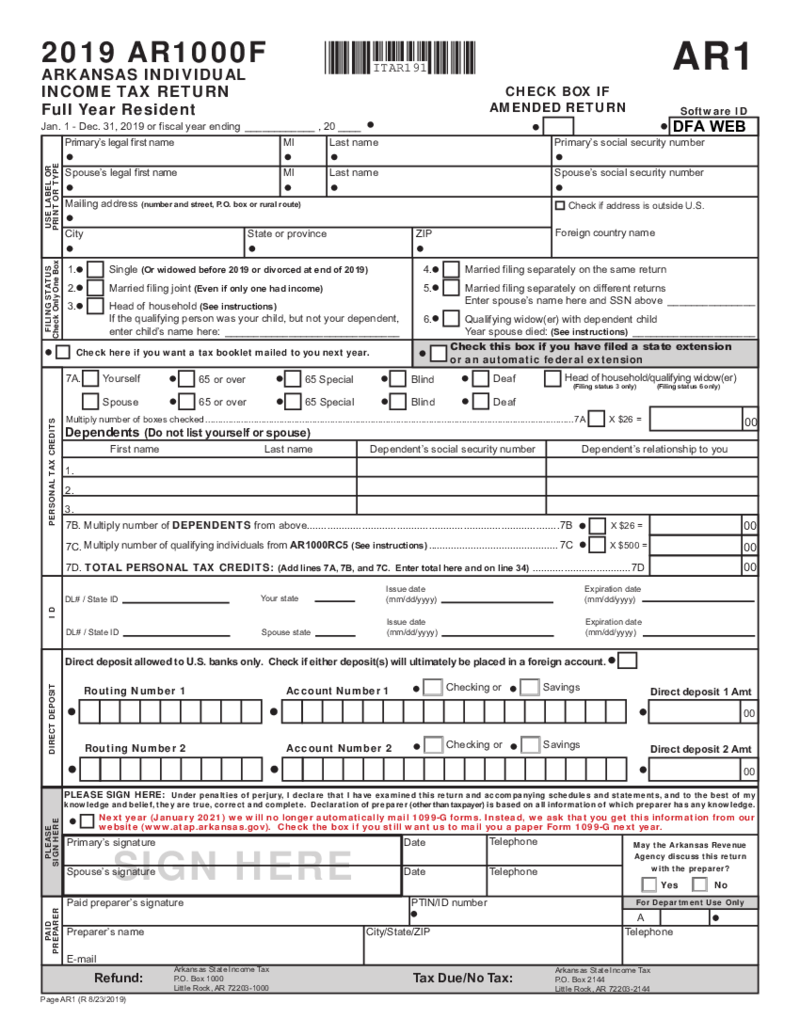

Arkansas Form AR1000F

Understanding the AR1000F Form

The AR1000F form, officially known as the Full Year Resident Individual Income Tax Return, is a key component of fiscal obligations for Arkansas taxpayers. It's a document by which residents report their annual income de

Arkansas Form AR1000F

Understanding the AR1000F Form

The AR1000F form, officially known as the Full Year Resident Individual Income Tax Return, is a key component of fiscal obligations for Arkansas taxpayers. It's a document by which residents report their annual income de

FAQ:

-

Where can I get Arkansas state tax forms?

Arkansas state forms were created by the Arkansas Department of Finance and Administration, which means that they are available on their official website. Apart from the forms you need, this website contains a wide range of information about the state, local activities, and upcoming events. You can also monitor changes in the forms there. Yet, if you need to find the form fast, use PDFLiner, which has all the Arkansas tax templates in one place, easy to reach.

-

Where do I mail my Arkansas state tax forms?

It depends on the form you are filling in at the current moment. Some forms must be sent by regular post. You have to go to the post office and use the address indicated in the form by the Arkansas Department of Finance and Administration. These forms have to be sent in advance since they require time to be delivered. Other forms can be sent via the official email of the administration. In this case, you will see the address in the form. If the form can be sent online via the website check out for the inner instructions too.

-

What forms to file with my Arkansas individual tax return?

Based on your specific case you may need to file extra forms attached to the Arkansas individual tax return. The most popular among them is Form AR1000ADJ, which is the form that contains adjustments to the original tax return document. You may need an Itemized Deduction Schedule or Check Off Contributions Schedule.