-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

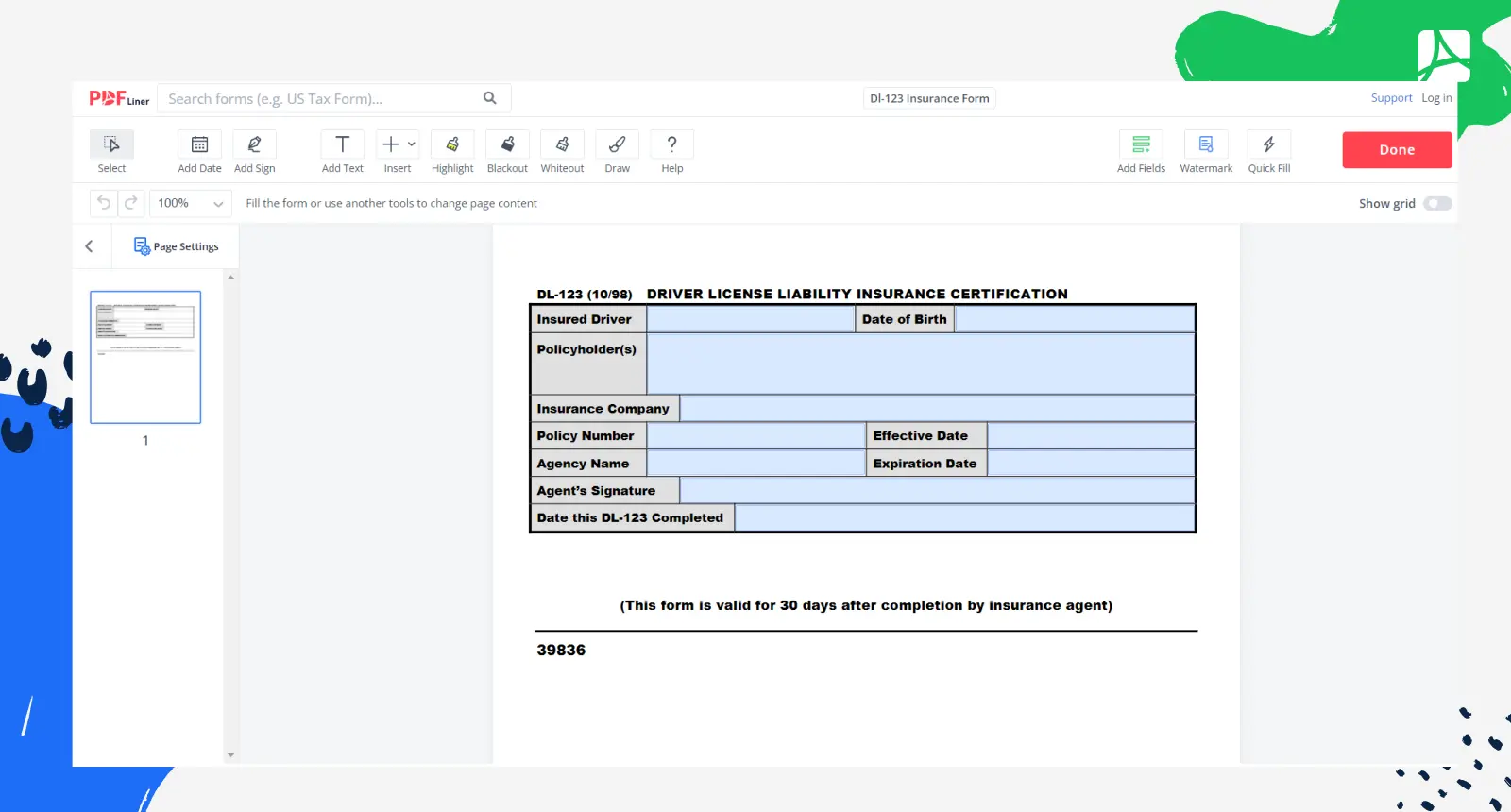

Dl-123 Insurance Form

Get your Dl-123 Insurance Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Dl-123 Insurance Form?

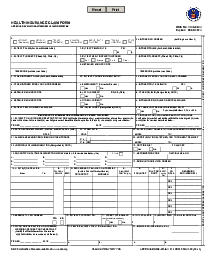

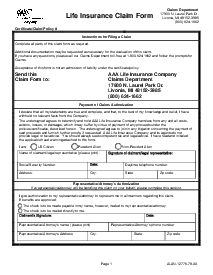

The DL-123 Insurance Form is a digital document that enables policyholders and insurance agents to provide proof of liability insurance coverage. It is primarily used in the United States for verifying auto insurance coverage. The form contains essential information about the policyholder, the insurance company, and the coverage details.

How to Get a DL-123 Form?

There are several ways to obtain a DL-123 form:

- Insurance Provider: Contact your auto insurance provider and request this form. They can generate the form for you, filling in the necessary information based on your insurance policy.

- Online Portal: Some insurance companies have online portals or customer service platforms where you can access and download various forms, including the DL-123 form. On the PDFliner website, you can fill out this form for free.

- Email Request: Send an email to your insurance provider requesting the DL-123 form. Include your policy details and any other relevant information they may need to generate the form. They can then email it to you as an attachment.

- Phone Call: Contact your insurance provider's customer service helpline and request the DL-123 form over the phone. Provide them with the required information, and they can either mail a physical copy of the form to your address or provide instructions on accessing it digitally.

- In-Person Visit: If your insurance provider has a local office or branch, you can visit them in person and ask for the DL-123 form. The staff will assist you in completing the necessary paperwork and provide you with a physical copy of the form.

How To Fill Out the Dl 123 Form Geico Online?

To get a completed DL-123 form, you should follow these steps:

- Open the fillable form DL-123, click on the first field labeled "Insured Driver" and type in the name of the insured driver.

- Move to the "Date of Birth" field and enter the birthdate of the insured driver.

- Go to the next field labeled "Policyholder(s)" and enter the name(s) of the policyholder(s).

- Fill out the "Insurance Company" field and input the insurance company's name.

- Enter the "Policy Number" into the next field.

- Fill out the "Effective Date" field with the policy's start date.

- Input the name of the "Agency Name" in the next field.

- Enter the "Expiration Date" of the policy.

- Sign the "Agent’s Signature" field if you are an agent and your name is entered into the "Agency Name" field.

- Finally, enter the date you completed the DL-123 form into the "Date this DL-123 Completed" field.

Advantages of using PDFliner for DL-123 Insurance Form Geico

PDFliner is an online platform that offers a range of tools and features for handling PDF documents efficiently. When it comes to the DL-123 Insurance Form, PDFliner provides several advantages:

- Easy Form Filling: PDFliner allows users to fill out the form template digitally, eliminating the need for manual form completion. This significantly reduces errors and saves time.

- Online Accessibility: With PDFliner, you can access and complete the DL-123 form from anywhere with an internet connection. This flexibility enhances convenience and enables collaboration between policyholders and insurance agents.

- Advanced Editing Capabilities: PDFliner provides a comprehensive set of editing tools, allowing you to modify the form as needed. You can add text, checkboxes, signatures, and even attach supplementary documents.

Fillable online Dl-123 Insurance Form