-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Arkansas Form AR1000ES Individual Estimated Tax Vouchers

Get your Arkansas Form AR1000ES Individual Estimated Tax Vouchers in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

The Complete Guide to Arkansas Form AR1000ES Individual Estimated Tax Vouchers

Navigating tax payments can be challenging, especially for those new to making estimated tax payments. The Arkansas Form AR1000ES is designed to aid taxpayers in managing their estimated taxes efficiently. This form is essential for individuals who expect their tax bill to exceed $1,000 for the year and do not have taxes withheld at the source. Let's dive into the details of what this form entails, how to fill it out correctly, its submission deadlines, and where it should ultimately be sent.

Understanding Form AR1000ES

Form AR1000ES, or the Individual Estimated Tax Vouchers, is used by Arkansas residents to submit their estimated tax payments for the year. This process is crucial for taxpayers who earn income not subject to withholding taxes, such as earnings from self-employment, interest, dividends, and rental income.

How to Fill Out

Filling out the AR1000ES vouchers requires a systematic approach. Here’s a step-by-step guide:

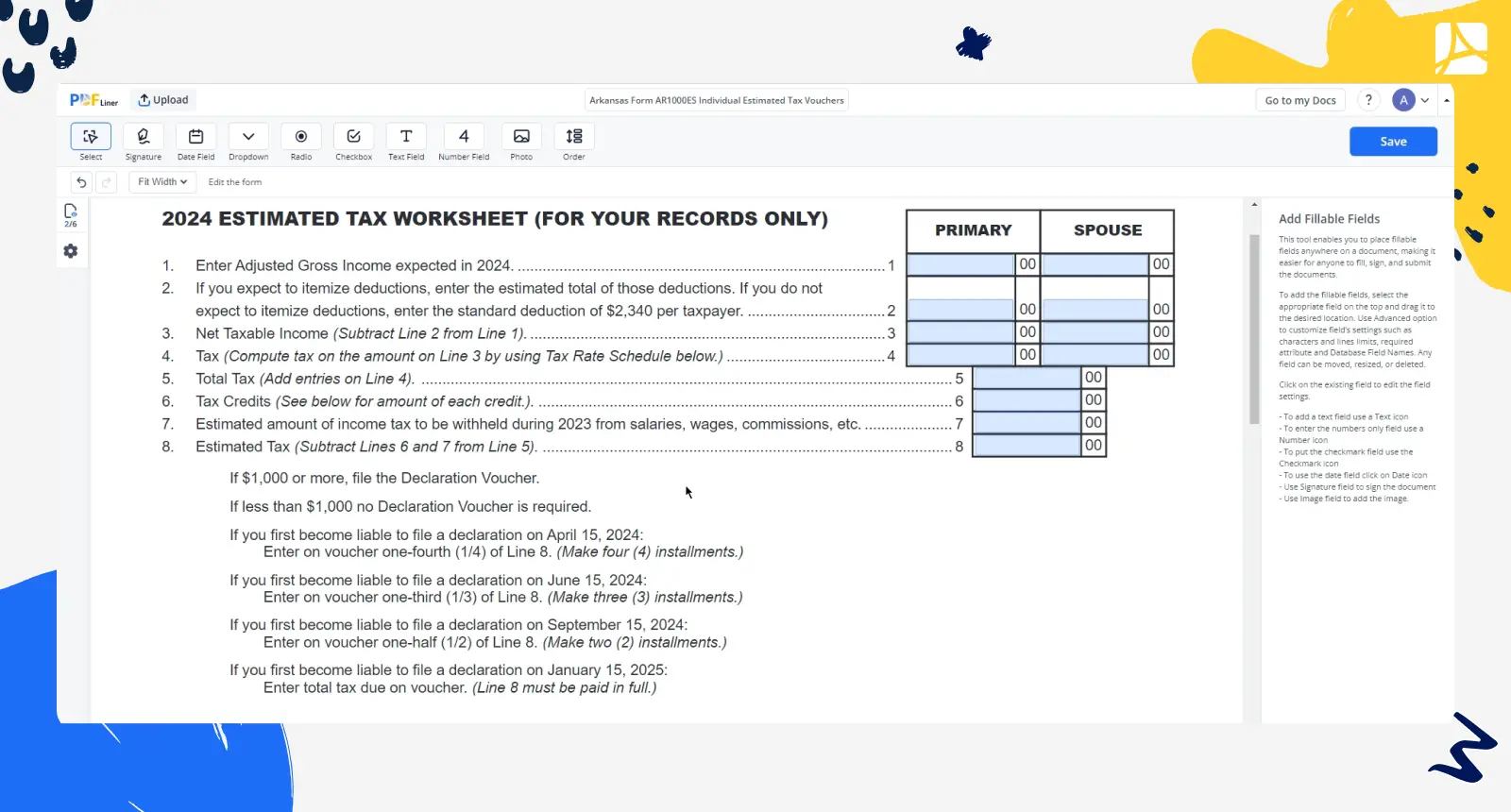

- Estimate Your Tax for 2023: Use the Estimated Tax Worksheet to calculate your estimated tax liability for 2023. Base your estimates on actual income, deductions, and credits you expect to claim for the year. Adjustments from the previous year's figures can serve as a starting point.

- Calculate Your Quarterly Payment: Divide the amount on Line 8 of the worksheet by four. This will give you the amount you need to pay for each quarter.

- Credit Overpayment: If you had an overpayment from the previous year that you’ve requested to be applied to this year's tax (from AR1000F/AR1000NR), include it in your calculation, ensuring it’s linked to the primary Social Security Number from the form mentioned.

- Prepare Your Payment: Attach a check or money order payable to the Department of Finance and Administration to your voucher. Ensure your Social Security Number is written on your payment for identification purposes.

When to Submit Your AR1000ES Voucher

For the 2023 tax year, calendar year filers need to submit the AR1000ES 2023 voucher by April 15th, 2024. Fiscal year filers have a deadline on the 15th day of the fourth month of their income year. Remember, payments are due quarterly, so keep an eye on the calendar to avoid penalties.

Where to Send Your Vouchers

Taxpayers have the option to mail their Arkansas estimated tax payments AR1000ES with the vouchers to the Department of Finance and Administration, Income Tax Section, P.O. Box 9941, Little Rock, AR 72203-99. Alternatively, for a more secure and quicker submission, payments can be made online via Arkansas Taxpayer Access Point (ATAP) at www.atap.arkansas.gov.

Properly completing and timely submitting the form AR1000ES is crucial for individuals who wish to avoid penalties related to underpayment of estimated taxes. By following these guidelines, taxpayers can ensure they stay compliant and avoid unnecessary penalties.

Form Versions

2023

Arkansas Form AR1000ES for 2023 tax year

Fillable online Arkansas Form AR1000ES Individual Estimated Tax Vouchers