-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms

-

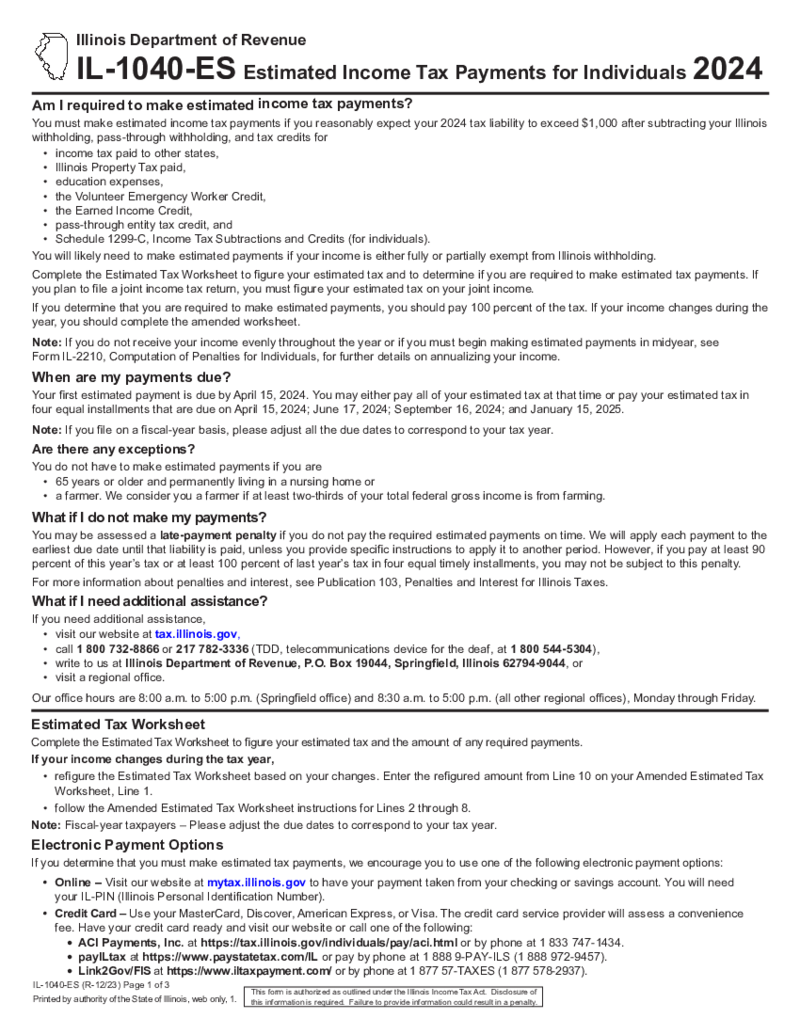

Illinois Form IL-1040-ES (2024)

Understanding the IL-1040-ES Form

Before progressing to the online payment process, it’s important to understand the IL-1040-ES form. This form is issued by the Illinois revenue department for use by residents who are due to make estimated tax payme

Illinois Form IL-1040-ES (2024)

Understanding the IL-1040-ES Form

Before progressing to the online payment process, it’s important to understand the IL-1040-ES form. This form is issued by the Illinois revenue department for use by residents who are due to make estimated tax payme

-

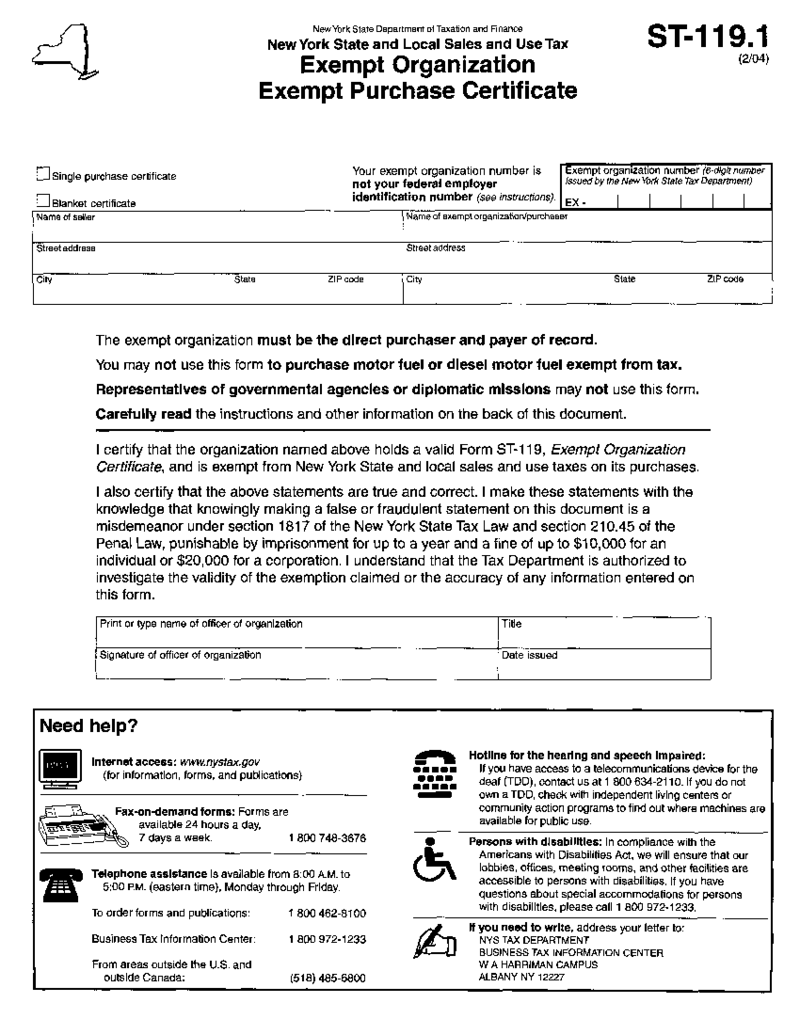

Form ST-119.1, Exempt Organization, Exempt Purchase Certificate

How to Obtain Form ST 119.1?

Complete the ST-119.2 Form Application.

Submit th

Form ST-119.1, Exempt Organization, Exempt Purchase Certificate

How to Obtain Form ST 119.1?

Complete the ST-119.2 Form Application.

Submit th

-

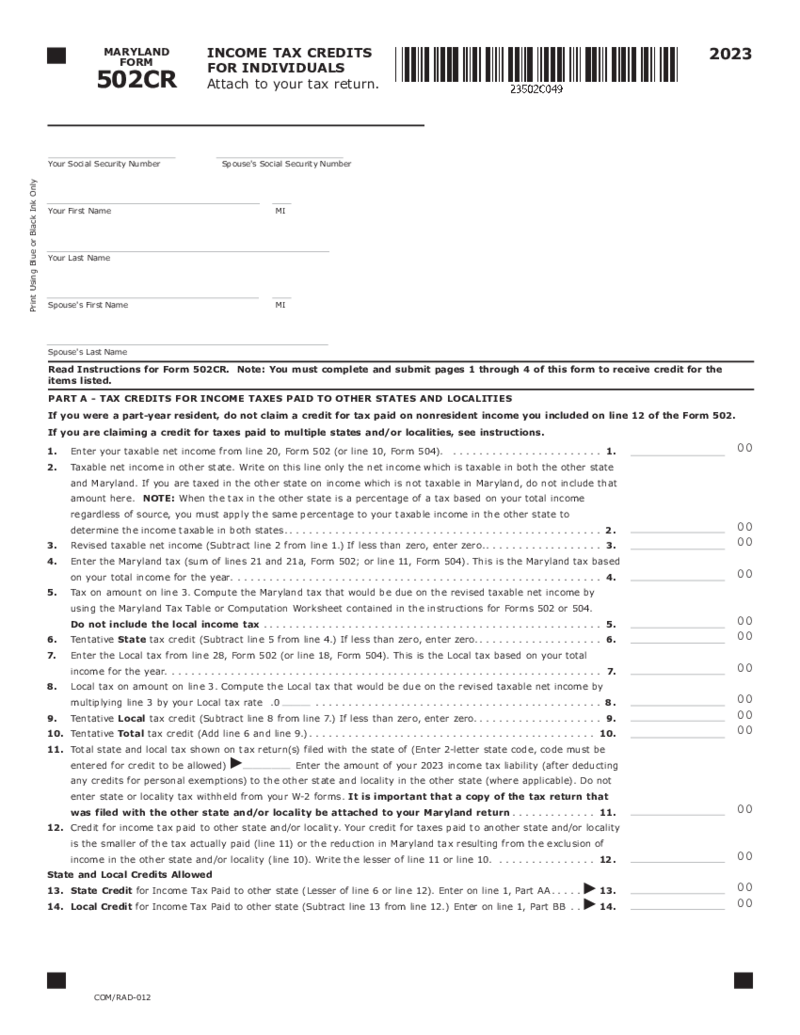

Maryland Form 502CR

What Is Maryland Form 502CR?

Maryland tax form 502CR is designed for taxpayers to calculate and state the tax credits for which they are eligible. These may include credits for income taxes paid to other states, Heritage Structure Rehabilitation Credits,

Maryland Form 502CR

What Is Maryland Form 502CR?

Maryland tax form 502CR is designed for taxpayers to calculate and state the tax credits for which they are eligible. These may include credits for income taxes paid to other states, Heritage Structure Rehabilitation Credits,

-

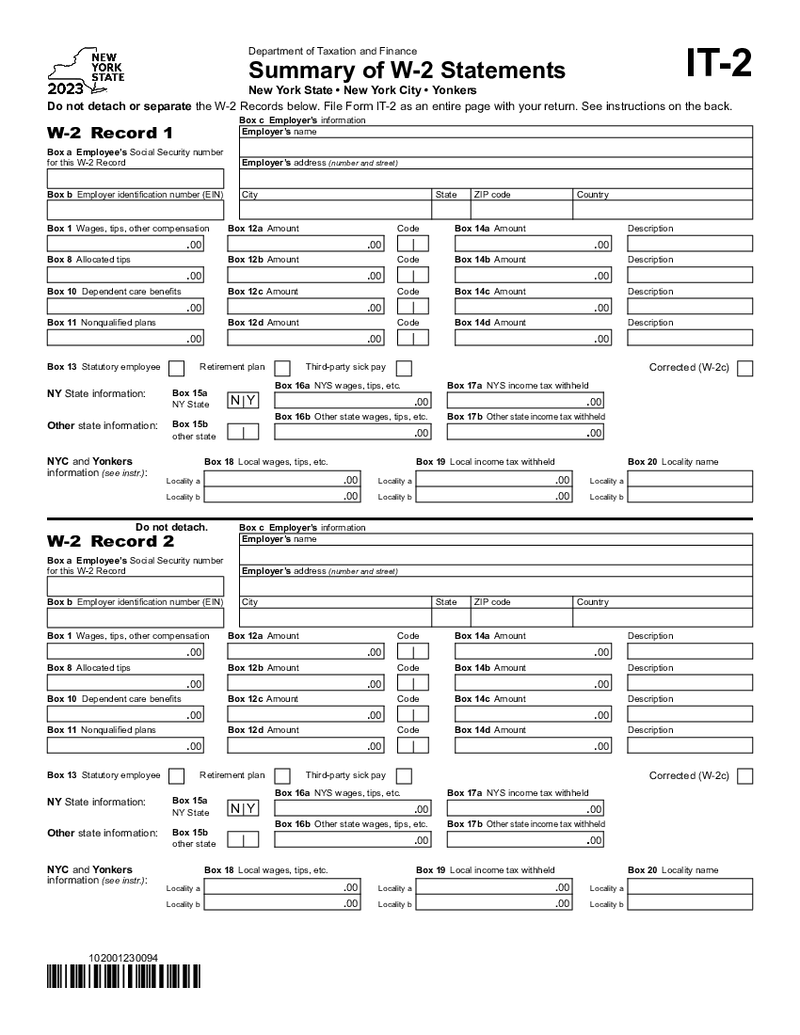

NY Form IT-2 - Summary of W-2 Statements

Understanding Form IT-2

The form IT 2 is tailored specifically for New York state residents or those who have earned income in New York, requiring them to report their earnings and tax withholdings. The clear-cut purpose of this form is to streamline the

NY Form IT-2 - Summary of W-2 Statements

Understanding Form IT-2

The form IT 2 is tailored specifically for New York state residents or those who have earned income in New York, requiring them to report their earnings and tax withholdings. The clear-cut purpose of this form is to streamline the

-

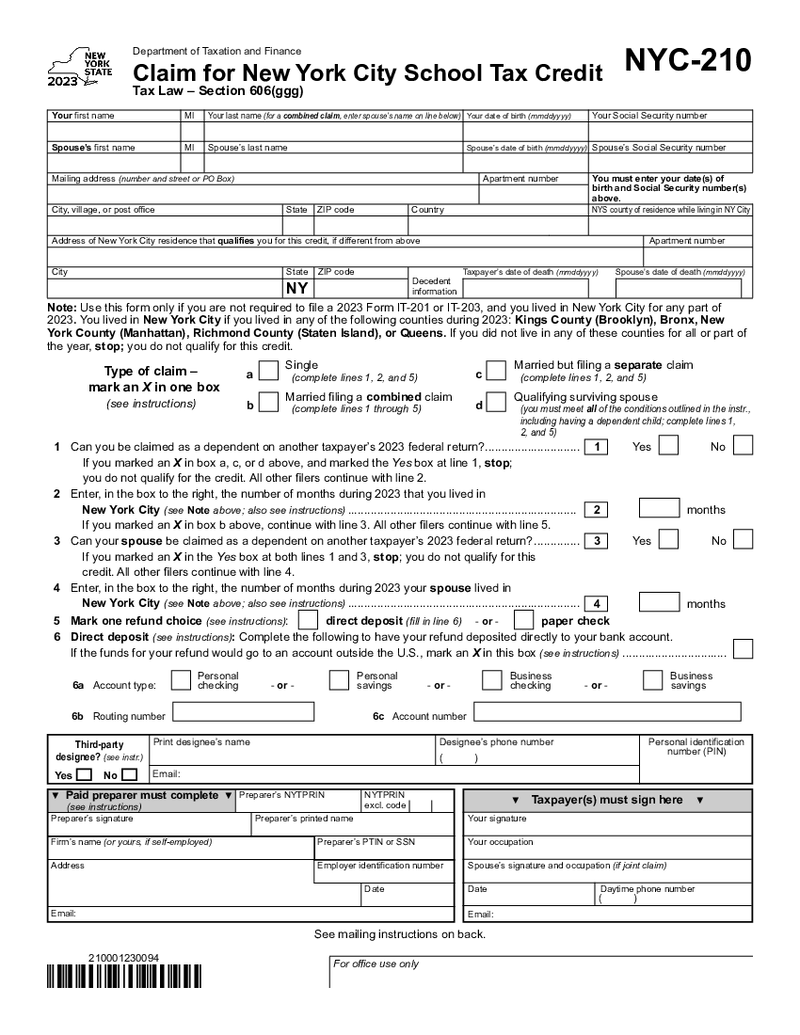

NYC 210 Form (2023)

What is NYC-210 Form 2023?

The NYC-210 form is known as Claim for New York City School Tax Credit. The form can be used to claim for the tax credit if you are a resident of New York City. The form was created by the New York City Department of Taxation an

NYC 210 Form (2023)

What is NYC-210 Form 2023?

The NYC-210 form is known as Claim for New York City School Tax Credit. The form can be used to claim for the tax credit if you are a resident of New York City. The form was created by the New York City Department of Taxation an

-

Alabama Form 40 (2023)

What Is an Alabama Tax Form 40?

Alabama individual income tax form 40 is a state income tax return form used by residents of Alabama to file their state income taxes. Alabama tax form 40 is used to report an individual's taxable income and to calculat

Alabama Form 40 (2023)

What Is an Alabama Tax Form 40?

Alabama individual income tax form 40 is a state income tax return form used by residents of Alabama to file their state income taxes. Alabama tax form 40 is used to report an individual's taxable income and to calculat

-

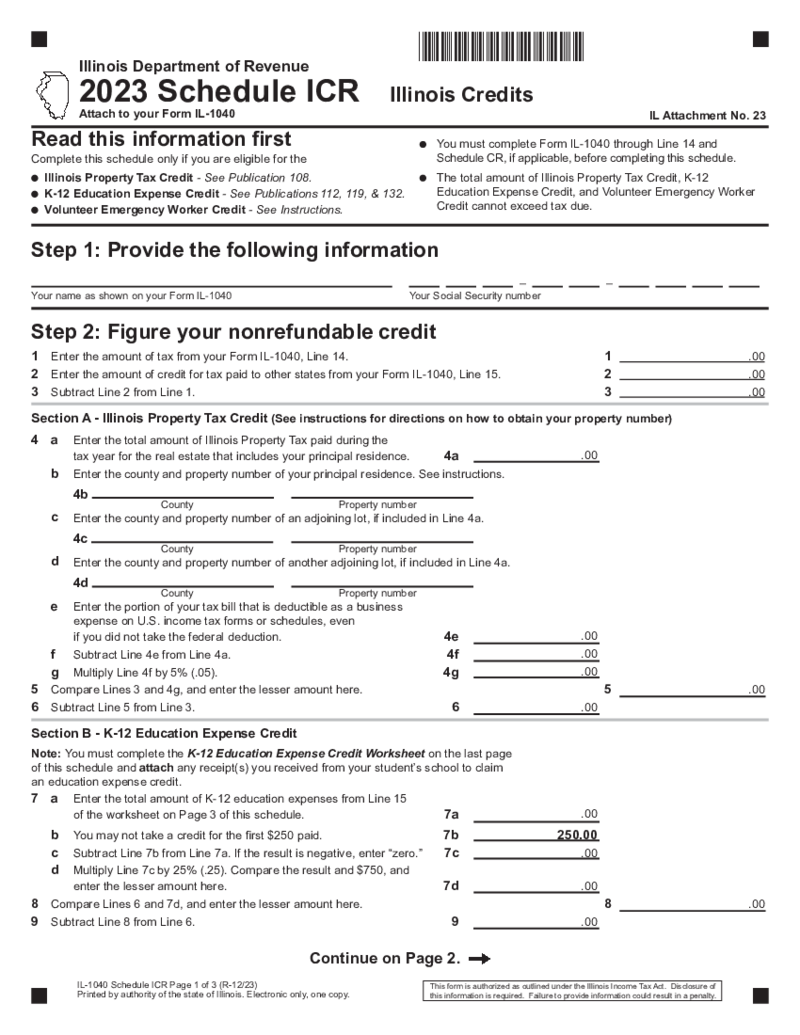

Illinois Schedule ICR

What Is Illinois 1040 Schedule ICR?

Regarded as the Illinois credit for the Senior Citizen, the Illinois Schedule ICR is primarily used to figure the tax credits available to residents of Illinois. For seniors looking to reduce their tax liabilities, this

Illinois Schedule ICR

What Is Illinois 1040 Schedule ICR?

Regarded as the Illinois credit for the Senior Citizen, the Illinois Schedule ICR is primarily used to figure the tax credits available to residents of Illinois. For seniors looking to reduce their tax liabilities, this

-

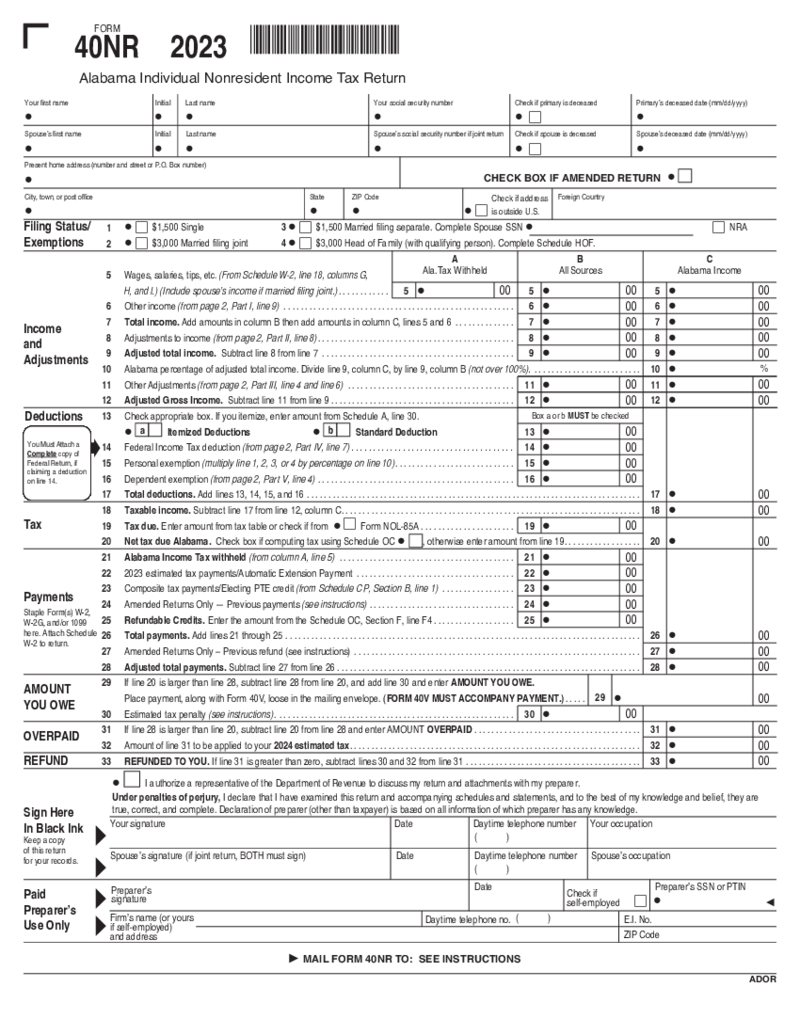

Alabama Tax Form 40NR

Understanding the Alabama Form 40NR

Form 40NR is an instrumental aspect of the Alabama state tax system. If you fall under the category of non-residents earning income in Alabama, you are required to file your income using this form. The Alabama state tax

Alabama Tax Form 40NR

Understanding the Alabama Form 40NR

Form 40NR is an instrumental aspect of the Alabama state tax system. If you fall under the category of non-residents earning income in Alabama, you are required to file your income using this form. The Alabama state tax

-

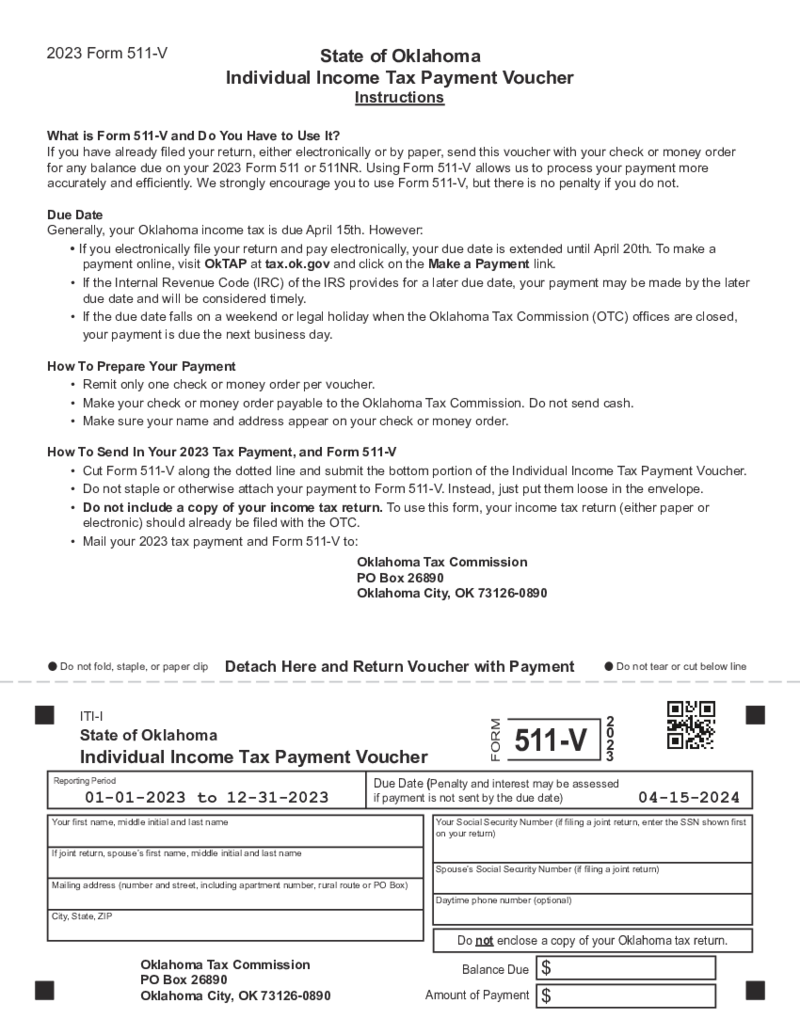

Oklahoma Form 511-V Individual Income Tax Payment Voucher

What Is Oklahoma Tax Form 511 V?

Oklahoma Tax Form 511-V is designed for use by taxpayers who need to make a payment on their state income tax but are not doing so electronically. It serves as a companion document to the primary tax return, ensuring that

Oklahoma Form 511-V Individual Income Tax Payment Voucher

What Is Oklahoma Tax Form 511 V?

Oklahoma Tax Form 511-V is designed for use by taxpayers who need to make a payment on their state income tax but are not doing so electronically. It serves as a companion document to the primary tax return, ensuring that

-

Missouri Form 5086 - Secure Power of Attorney

Understanding Missouri Power of Attorney Form 5086

Power of attorney forms are relevant legal documents granting authority to an individual, known as the agent, to act on behalf of another person, known as the principal. Missouri Form 5086, also referred

Missouri Form 5086 - Secure Power of Attorney

Understanding Missouri Power of Attorney Form 5086

Power of attorney forms are relevant legal documents granting authority to an individual, known as the agent, to act on behalf of another person, known as the principal. Missouri Form 5086, also referred

-

Cash Bond (Form 332)

What Is Form 332?

Form 332 was created and released by the Missouri Department of Revenue. This is a local form, but you may find a federal alternative if you need it. This document is also known as Cash Bond. The form was created for both personal use an

Cash Bond (Form 332)

What Is Form 332?

Form 332 was created and released by the Missouri Department of Revenue. This is a local form, but you may find a federal alternative if you need it. This document is also known as Cash Bond. The form was created for both personal use an

-

Form MO-1040ES - Estimated Tax Declaration for Individuals

Who Needs to Use the MO 1040ES Form

Anyone with income that is not subject to Missouri tax withholding might need to use Form MO-1040ES. This could include self-employed individuals, independent contractors, retirees on a pension, and individuals with a s

Form MO-1040ES - Estimated Tax Declaration for Individuals

Who Needs to Use the MO 1040ES Form

Anyone with income that is not subject to Missouri tax withholding might need to use Form MO-1040ES. This could include self-employed individuals, independent contractors, retirees on a pension, and individuals with a s

Search by State

What Are State Tax Forms?

State tax return forms are the information forms you complete upon reporting your state income tax return. Along with federal income taxes, US citizens must deal with an array of other state taxes. Some of these taxes oblige you to file a standalone tax form on a yearly basis. With that said, if you want to go through the looming tax season like a pro, explore the tax scene based on the state you live in. In this category, you’ll find the templates of these forms, as well as get the possibility to open them and fill them out online straight away. Here on PDFLiner, we are on a mission to skyrocket your tax file management to stardom.

Most Popular State Tax Withholding Forms 2022 - 2023

Below, we’ve provided the list of the most widely used state tax withholding forms. Whether you’ll decide to fill out any of them under your own steam or opt for tax expert assistance, equipping yourself with the tools offered by PDFLiner is a surefire way to succeed in your tax affairs. Remember that with our e-signature feature, you get the chance to add a legally binding digital signature to your files in a matter of minutes. That’s incredibly convenient.

Now, here are the most widely used state tax forms.

- Form IL-1040 PTR. It’s an Illinois state tax form for older taxpayers aimed at claiming a refundable property tax credit. So, if you’re in the Prairie State, feel free to utilize the file for figuring out and claiming your credit. For example, if your total property taxes come down to $2,000, and you are eligible for the senior citizen homestead exemption, you would only need to pay $1,700 in real estate taxes.

- New Mexico Form PIT-1. Also referred to as New Mexico Personal Income Tax Return, this document is utilized for calculating and reporting an individual’s yearly taxable income. It features several sections and requires you to indicate your ID information, financial history, as well as deductions, credits, and overall tax liability. Because the file contains sensitive financial data, do your best to stick with the most protected method of submission. And that’s where our secure services may come in especially handy.

- Form WTP-10005. Also known as the Oklahoma Nonresident Distributed Income Estimated Withholding Tax Report, the essence of this form is pretty much self-explanatory. The two-pager is not too complicated completion-wise. However, if the file confuses you, feel free to ask a tax expert to help you sort it out. If you’re ready to handle it under your own steam, PDFLiner offers the best instruments for fast and effortless digital file management.

- City of Delaware Individual Income Tax Form. The two-page template should contain such details about the taxpayer as full name and address, social security number, residency and employment background, marital status, detailed income history, as well as amount paid with the return.

- Nebraska Form PTCX. Also known as Amended Nebraska Property Tax Incentive Act Credit Computation, the file should feature your full name and address, as well as all the required tax details in the appropriate fields. By the way, if you need to incorporate additional fields into any of your docs, PDFLiner allows you to do it fast and easy, in the most convenient digital format.

Where to Get State Tax Forms

You can get the form you need from your state’s Department of Revenue. Alternatively, you can find it in your local library, post office, or even grocery store. However, if you’re on the prowl for templates that are easily adjustable and 100% up-to-date, PDFLiner is definitely your best bet. We update our extensive library on a regular basis to cater to our users’ most current and sophisticated needs. To crown it all, our platform is where you can start filling out the needed form on the go, right after you lay your fingertips on it.

How to Fill Out State Tax Forms 2022 - 2023

You’re welcome to fill out the needed templates via our platform. Here, you’ll make the most of a wide variety of tools designed expressly to take your online file handling to a brand new level. So, just launch any template you need and you’ll easily see an extensive menu filled with super handy features for fast and effortless PDF editing.

Type on your PDFs, add fillable fields, highlight the necessary details, add e-signatures, infuse the files with logos or watermarks, easily incorporate dates, and even draw on your files. These and many more features are up for grabs within our digital file editing platform. Irrespective of the state you live in, PDFLiner is a go-to platform for speeding up your tax affairs. Aside from a treasure trove of tax forms, here, you’ll also find thousands of other niche-focused fillable and printable templates. Our service does come with a mild learning curve, but in the long run, it is guaranteed to bring fruitful results.

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.