-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IL-1040-ES

Get your Illinois Form IL-1040-ES (2024) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the IL-1040-ES Form

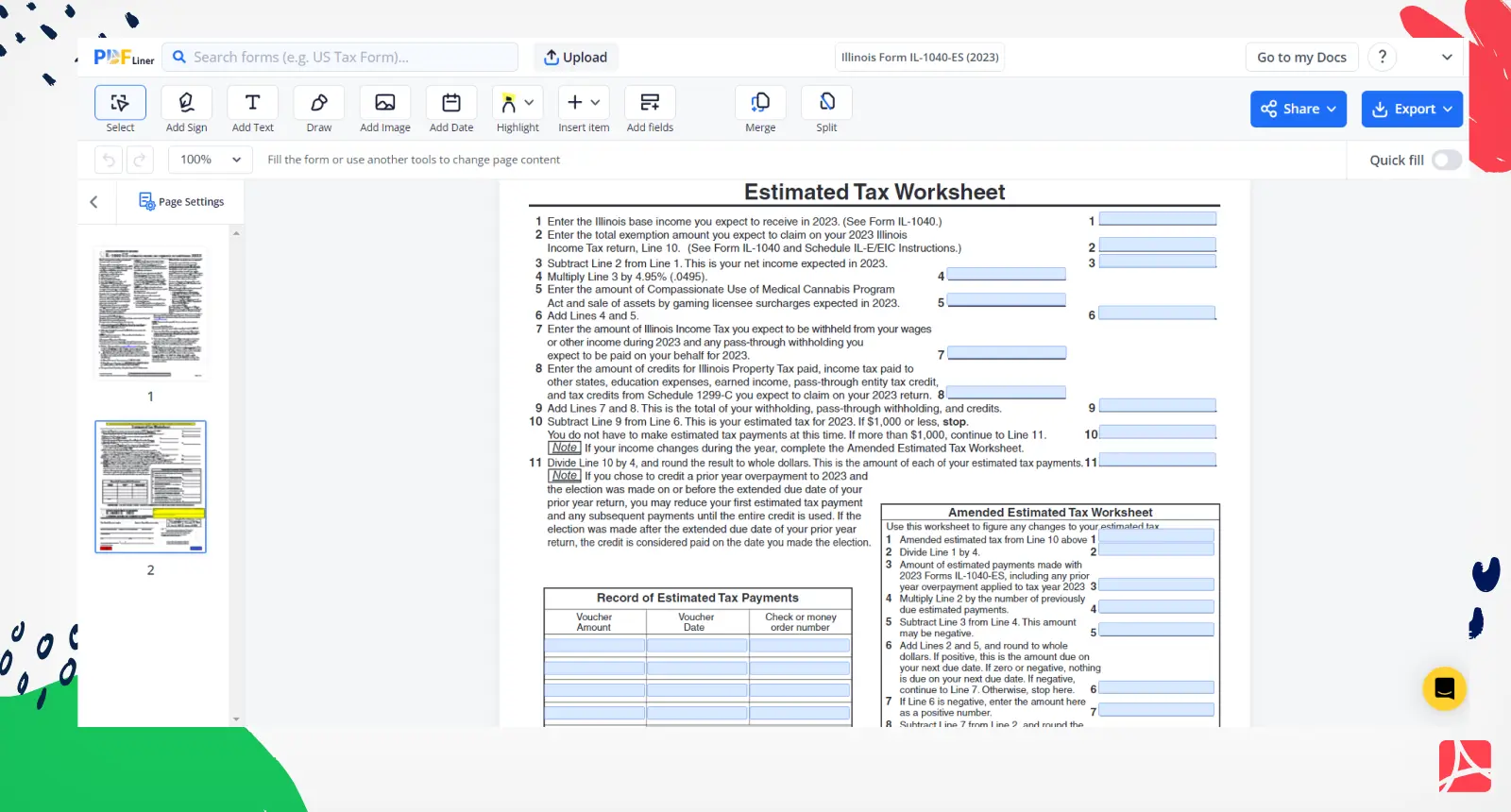

Before progressing to the online payment process, it’s important to understand the IL-1040-ES form. This form is issued by the Illinois revenue department for use by residents who are due to make estimated tax payments. Particularly, self-employed individuals, business owners, and those with additional income not subject to withholding should become well-acquainted with this form.

Key features of the form IL-1040-ES

The functionality of the form IL-1040-ES demands that taxpayers estimate the income they'll earn throughout the year and prepay their taxes accordingly. It includes multiple vouchers, each representing a fiscal quarter. These are to be filled out and sent with the corresponding estimated payment.

Steps to Fill Out IL 1040 ES Pay Online

Learning how to fill out the form is significant for a seamless tax-paying experience. Mistakes or oversights can result in processing delays or even penalties from the authorities. Here are the essential steps to fill out the IL-1040-ES:

- Enter "Your Social Security number" into the corresponding input field. Make sure to double-check this information, as it is a crucial part of your identification and tax data.

- In the "Spouse’s Social Security number" field, input your spouse's Social Security number if you are filing jointly. This is important for the verification of your joint taxes.

- Type your initial and first name in the specific space provided. Make sure your name is spelled correctly to prevent any mistakes in your tax records.

- Insert your spouse’s first name and initial in the respective space, if applicable. The correct input will ensure the smooth processing of your joint documents.

- In the appropriate field, input your last name. Ensuring the correct spelling will help prevent any issues with your tax return.

- Fill in your "street address" in the dedicated area on the form. Accurate address information is necessary for any correspondence or payments.

- Input your city name in the "City" space provided.

- Select your "state" from the drop-down menu in the given field.

- Type your "ZIP" in the dedicated space. This information is essential for proper postal route information.

- Input your daytime phone number in the respective area. This contact information will be used in case of any questions or issues regarding your document.

- In the "Amount of payment" field, input the whole dollar value of the payment you are making for your taxes. Ensure to check this figure to ensure the accurate processing of your payment.

Benefits of the form IL 1040 ES

Using the form IL-1040-ES offers taxpayers a streamlined process to pay taxes they owe throughout the year, thus avoiding one large tax bill during tax season. This helps to spread tax obligations more evenly across the year while assisting the state of Illinois in managing tax revenue flow.

Form Versions

2023

IL-1040-ES (2023)

Fillable online Illinois Form IL-1040-ES (2024)