-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Fillable NY Form IT-2 - Summary of W-2 Statements

Get your NY Form IT-2 - Summary of W-2 Statements in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding Form IT-2

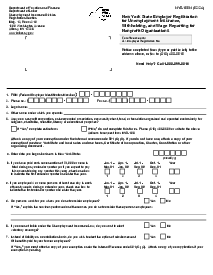

The form IT 2 is tailored specifically for New York state residents or those who have earned income in New York, requiring them to report their earnings and tax withholdings. The clear-cut purpose of this form is to streamline the reporting process by summarizing your W-2 information in one document rather than filing multiple W-2 forms. As you approach tax season, knowing the ins and outs of this form ensures a smoother filing experience.

Requirements for submitting NY form IT 2

Filing your taxes accurately requires you to understand which forms must include. As you gear up to submit your New York State Tax Form IT-2, remember that this form will be filed alongside your New York State income tax return. Any taxpayer who has received a W-2 form and is filing a state tax return in New York must include the IT-2 form. It confirms the information on your W-2, ensuring all your income and withholdings are accounted for.

How to Fill Out the IT 2 Form

Filling out the NY Form IT 2 is straightforward if you have your W-2 on hand. Start by entering your personal details and then proceed to transfer the relevant amounts from your W-2 onto the form:

- Start by entering your employer's full name and complete address, including the street number, city, state, ZIP, and country if relevant.

- Now, you must provide your own details as the employee. Input your Social Security number in the allocated space. Then, proceed to include your employer's identification number, commonly referred to as the EIN.

- Next, report your earnings and additional income as indicated on your W-2. This includes your regular pay and any tips received, other forms of compensation, any tips allocated to you that weren't directly reported, and benefits for dependent care.

- Additionally, disclose any amounts received from nonqualified plans, which are typically not eligible for tax-favorable treatment.

- Check off the relevant boxes if you are reporting as a statutory employee, are noting contributions to a retirement plan, or received payments through third-party sickness benefits.

- For the state-specific section, accurately record the amount of earnings attributed to New York State, along with the total state income tax that has been withheld from your paychecks for the tax year.

- Continue on to detail your local earnings. This should reflect what you earned in jurisdictions outside New York State. Alongside this, state any local income tax that was withheld. Finish this section by specifying the locality's name to which these local taxes pertain.

- Once all the information is duly filled in and accurately reflects the data from your W-2 statements, confirm all details are correct and free of errors before finalizing the document.

Advantages of using PDFliner to complete New York form IT 2

Online platforms have revolutionized the way we approach tax forms by offering a convenient and efficient alternative to paper filing. When you choose to fill out your Form IT-2 online on the PDFliner, you benefit from an intuitive digital environment. Features like cloud storage and instant access to IRS tax forms can significantly streamline the process. Additionally, PDFliner has the ability to e-sign directly, and you can send a finished form for signature.

Form Versions

2021

NY Form IT-2 (2021)

2022

NY Form IT-2 (2022)

Fillable online NY Form IT-2 - Summary of W-2 Statements