-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

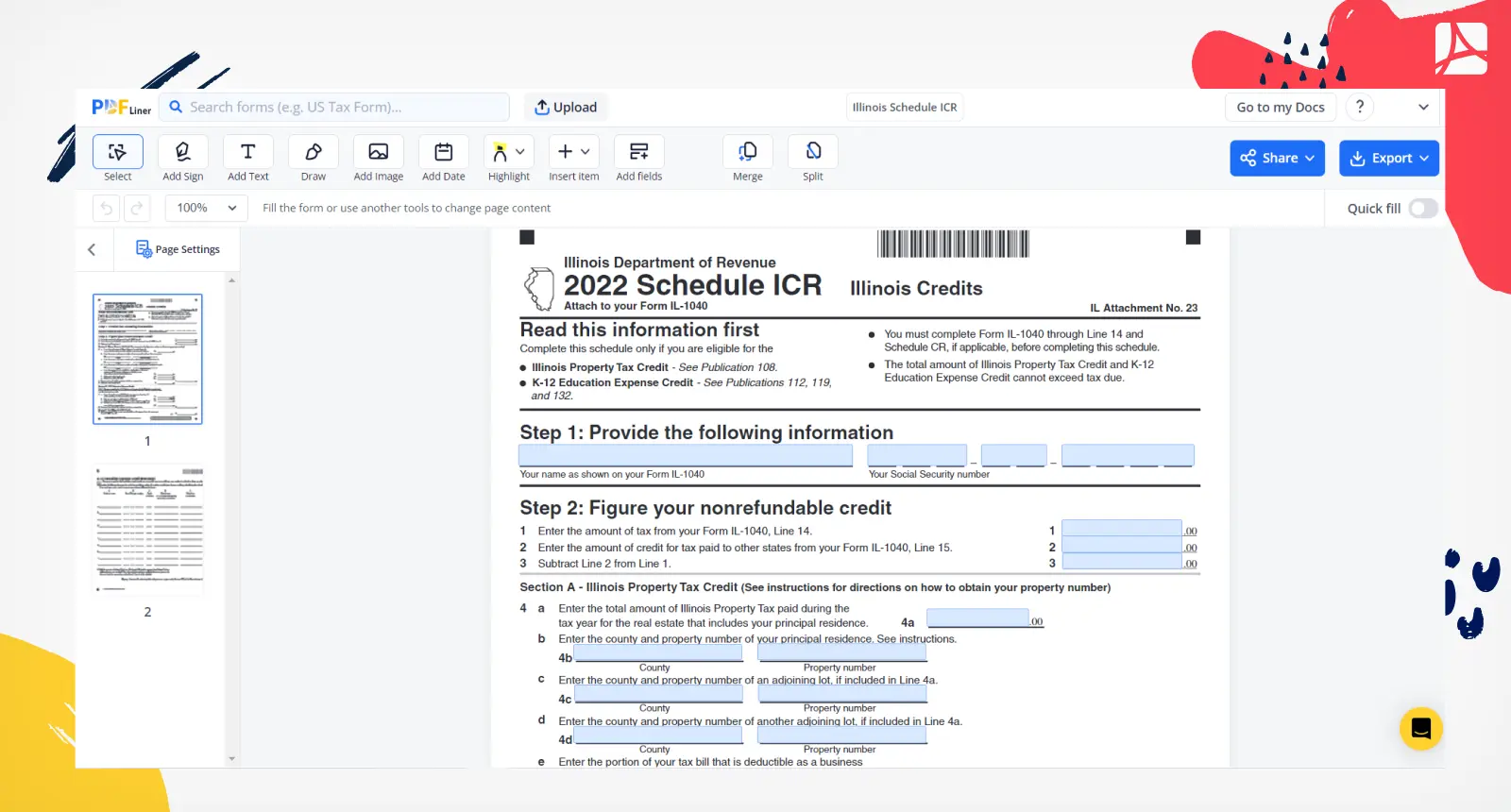

Illinois Schedule ICR

Get your Illinois Schedule ICR in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Illinois 1040 Schedule ICR?

Regarded as the Illinois credit for the Senior Citizen, the Illinois Schedule ICR is primarily used to figure the tax credits available to residents of Illinois. For seniors looking to reduce their tax liabilities, this tax form is a significant line of defense. Residents who qualify for the use of Illinois Schedule ICR can benefit from tax discounts and tax credits.

Why the schedule ICR IL 1040 matters

Pooling from a host of provisions from Illinois income tax laws, this form allows taxpayers to lay claim to their rightful credits and deductions. It's all about squeezing the most out of your hard-earned income, thereby maximizing your benefits.

Completing Schedule ICR Form

To properly fill out your IL tax Schedule ICR, please follow these steps:

- Start with your full name as shown on your IL-1040 Form in the "Your Name" field and your social security number in the "Your Social Security number" field.

- Proceed to the "Figure your nonrefundable credit" section of the form.

- In a proper box of this section, enter the total amount of your Illinois Property Tax for the current year.

- Next, mention the total amount of K-12 Education Expense Credit for the present year.

- Add the lines of the amount and calculate the Total Nonrefundable Credit and mention it in a given line.

- Next is the K-12 Education Expense Credit Worksheet section, where you need to fill in several fields; the first is 'Student’s Name' write the names of all the K-12 students for whom you are applying for the credit.

- In the SSN field, fill out the Social Security numbers corresponding to each of the students' names.

- In the next column, mention the respective classes of all the listed students.

- In adjacent fields write the name and city of the school each student is enrolled in. The cities mentioned should all be in Illinois only.

- In the 'School Type' field, mention the type of school your child attends by using the appropriate letter- "P" for Public, "N" for Non-public, and "H" for Home school.

- Lastly, in the 'Total Tuition Book/Lab Fees' field, fill in the total cost of textbooks and lab fees for each student.

- After all the details are filled in and checked for accuracy, you can save, download, and print your form.

Importance of accurately completing schedule ICR Illinois

It's essential to follow the instructions and guidelines provided by the Illinois Department of Revenue to prevent any mistakes. Your tax credits might be under-represented if incorrectly filled, leading to higher taxes. Therefore, understanding the correct process to fill out the IL schedule ICR form is of utmost importance.

Form Versions

2022

Illinois Schedule ICR (2022)

Fillable online Illinois Schedule ICR