-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

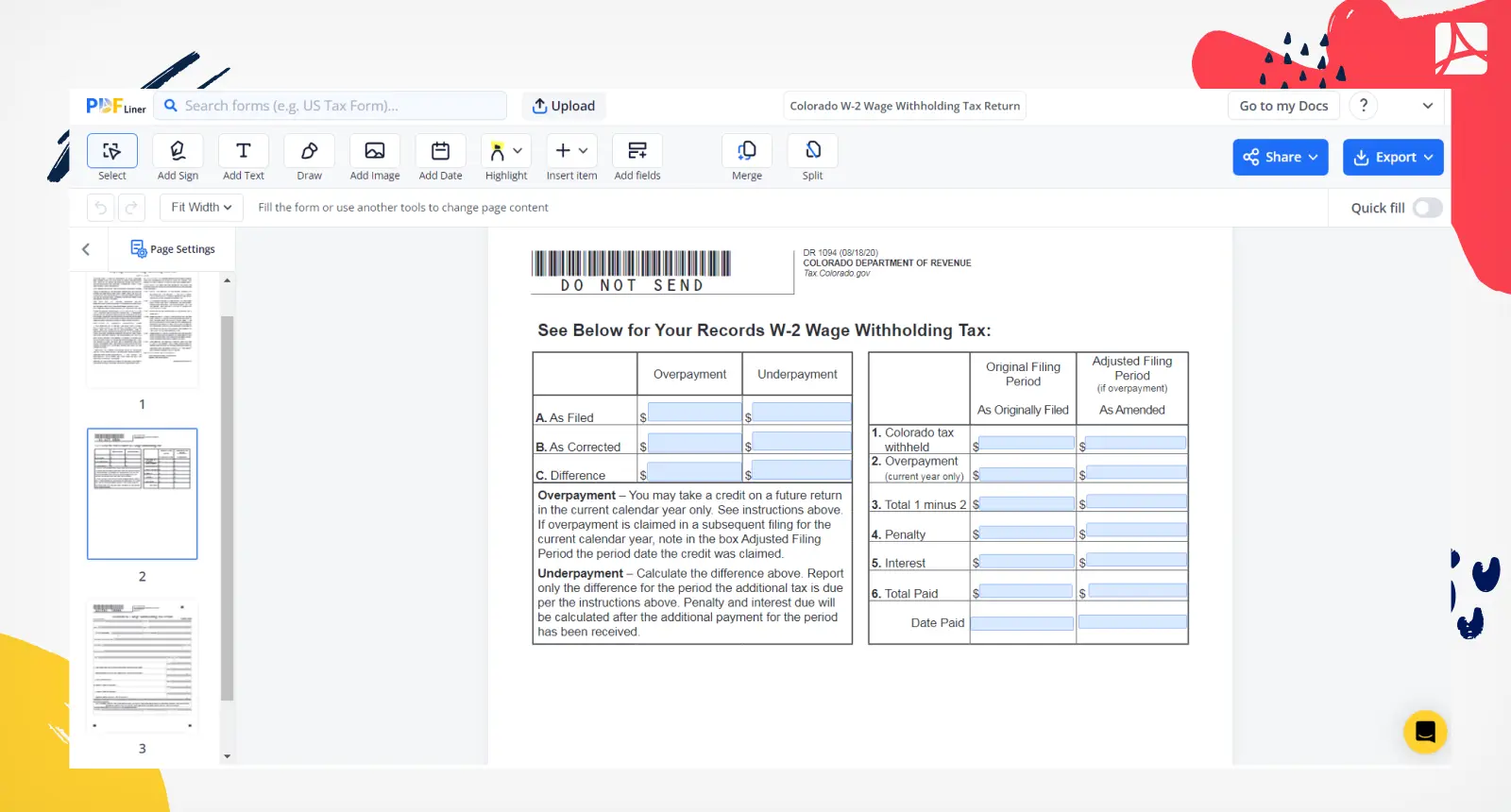

Colorado W-2 Wage Withholding Tax Return

Get your Colorado W-2 Wage Withholding Tax Return in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Colorado W-2 Wage Withholding Tax Return?

The Colorado W-2 is a tax form that employers must file to report the income earned by their employees and the taxes withheld from their wages. The Colorado Department of Revenue uses the information provided in this form to calculate the amount of tax owed or refunded to the employee. The form also provides a detailed record of the employee's income and tax withholdings for the year.

Key components of the Colorado W-2 template

The Colorado W-2 template consists of several important sections that need to be filled out carefully and accurately. These sections include:

- Employer Information: Name, address, and employer identification number (EIN)

- Employee Information: Name, address, social security number (SSN), and wages

- Wages, Tips, and Other Compensation: Total taxable income, including tips and other compensation for the employee

- Federal Income Tax Withheld: Amount of federal tax withheld from the employee's paycheck

- Social Security Wages and Tax Withheld: Total social security taxable income and the corresponding tax withheld from the employee's paycheck

- Medicare Wages and Tax Withheld: Total Medicare taxable income and the corresponding tax withheld from the employee's paycheck

- State and Local Income Tax Information: State and local income tax withheld, including the Colorado income tax withheld

How to Fill Out the Colorado W-2 Form

Filling out the Colorado Department of Revenue W2 wage withholding tax return form involves several steps. Start by gathering the necessary information, including employer and employee details and income and tax withholding data. Once you have all the necessary information, begin filling out the form by following these steps:

- Complete the Employer Information section, ensuring all details are correct.

- Fill in the Employee Information section, again ensuring accuracy.

- Calculate and input the total wages, tips, and other compensation for the employee in the appropriate section.

- Enter the amount of federal income tax withheld.

- Calculate and input the social security wages and tax withheld.

- Calculate and input the Medicare wages and tax withheld.

- Provide state and local income tax information, ensuring the Colorado income tax withheld is accurately entered.

- Double-check all entries to ensure their accuracy and make any necessary corrections.

- Once the form is completed, submit it to the Colorado Department of Revenue in accordance with their guidelines.

Troubleshooting common issues

When filling out the Colorado W-2 Wage Withholding Tax Return, some common issues may arise. Keep these tips in mind to avoid potential complications:

- Ensure accuracy: Double-check all information, including EINs, SSNs, and personal details, to prevent errors and potential delays in processing.

- Be thorough: Complete every section of the form, and do not leave any fields blank. If a field does not apply, enter "0" or "N/A" as appropriate.

- Keep records: Retain copies of submitted forms and supporting documents for your records, as they may be required for future reference or audits.

- Meet deadlines: Submit the completed form to the Colorado Department of Revenue by the specified deadline to avoid penalties or interest charges.

- Seek assistance: If you are unsure about any aspect of completing the form, seek professional advice from a qualified tax professional or consult the Colorado Department of Revenue's guidelines.

Fillable online Colorado W-2 Wage Withholding Tax Return