-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

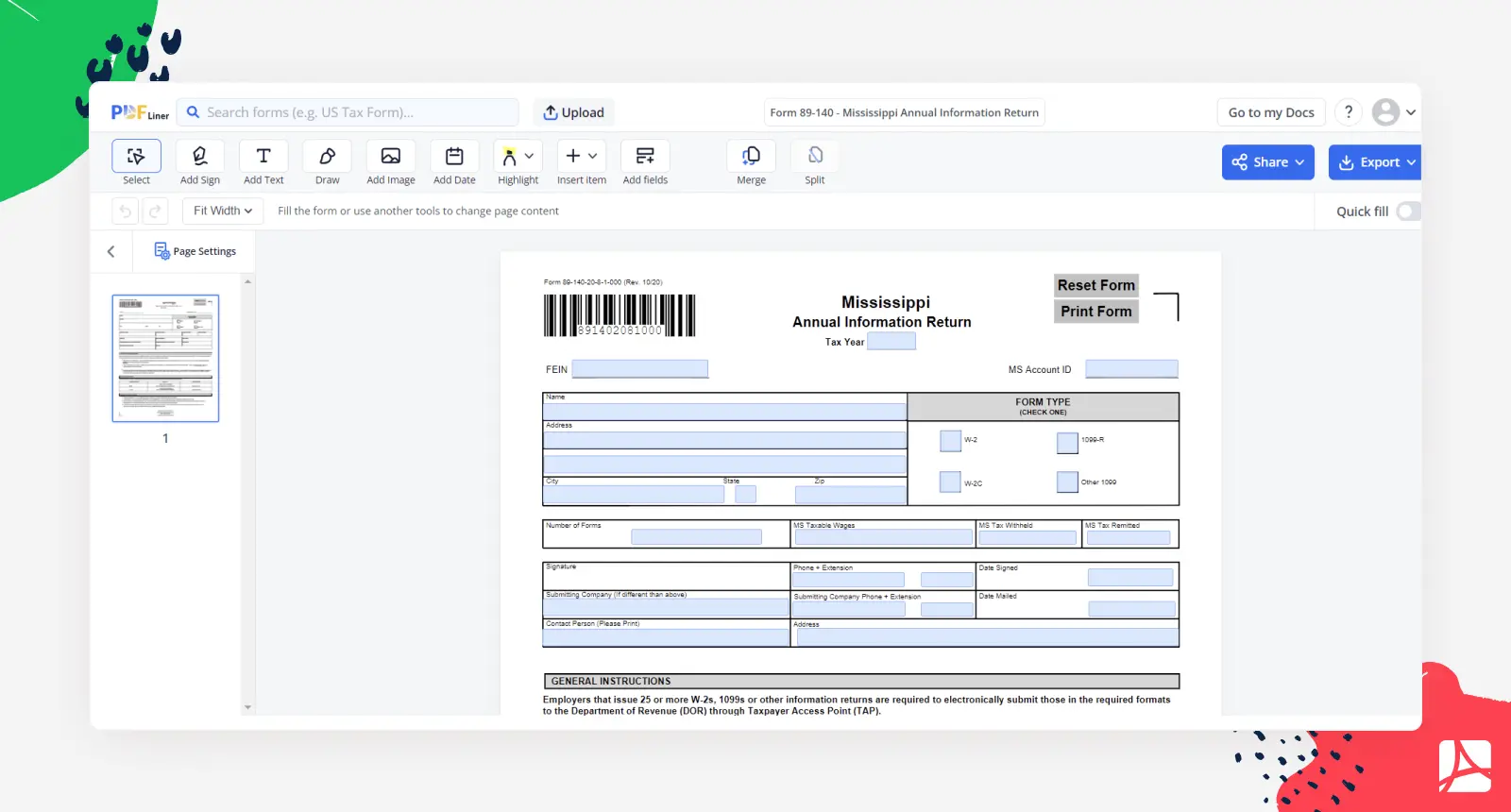

Mississippi Form 89-140

Get your Form 89-140 - Mississippi Annual Information Return in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is MS Form 89-140

The Mississippi Form 89-140, often referred to as the Mississippi Annual Information Return, is an essential tax document that's mandated by the Mississippi Department of Revenue. It is designed for particular taxpayers to report specific financial transactions to the state authorities. Like many other state forms, the 89 140 form is an efficient and organized means for the state to collect necessary data and ensure taxpayers fulfill their tax obligations.

Who Should Fill Out Mississippi Tax Form 89-140

Not every Mississippi resident or business entity must submit Form 89-140. It is typically required for:

Organizations or entities that withhold Mississippi income tax from non-wage payments to non-residents.

Those who make certain distributions, sales, or transfers, which the Mississippi Department of Revenue deems necessary to be reported.

If you have received specific instructions or have been notified by the Mississippi Department of Revenue, then you will need to fill out form 89-140. It's always advisable to consult with a tax professional or the Mississippi Department of Revenue directly if you're unsure about your obligation to file this form.

How To Fill Out MS State Form 89-140

Completing the Mississippi tax form 89-140 requires precision and a keen understanding of your financial activities over the tax year. Here's a step-by-step guide to assist you:

Step 1: Begin by providing your name or the name of your entity, address, and other necessary contact information.

Step 2: Clearly specify the tax year for which you are submitting the return.

Step 3: Depending on the type of transaction you're reporting, provide detailed information, including the total amounts, recipients' names, and their respective tax identification numbers.

Step 4: Declare any withholdings or tax deductions that pertain to the amounts you are reporting.

Step 5: Summarize all the data to provide a clear and concise overview of your annual financial transactions.

Step 6: Sign and date the form, certifying that all the information provided is accurate and complete to the best of your knowledge.

Always refer to the form's instructions or consult a tax professional to ensure you fill out each section correctly.

How To File Mississippi Form 89-140

Once you've completed the form, it's time to submit it. Here's what you need to do:

Electronic Filing

The Mississippi Department of Revenue has increasingly moved towards electronic filing for its convenience and efficiency. Check if the e-filing system is available for Form 89-140 and make your submission online.

Paper Filing

If you prefer to file on paper or if electronic filing isn't available for this form, ensure you make a copy for your records, then mail the original to the specified address provided by the Mississippi Department of Revenue.

Payment

If any payment is due, ensure it accompanies your form, whether you're filing electronically or through traditional mail.

Deadline

Make sure to file the Mississippi Annual Information Return before the set deadline to avoid any penalties or interest charges. The Due date for the form is February 28th.

Fillable online Form 89-140 - Mississippi Annual Information Return