-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Oklahoma Tax Forms - page 2

-

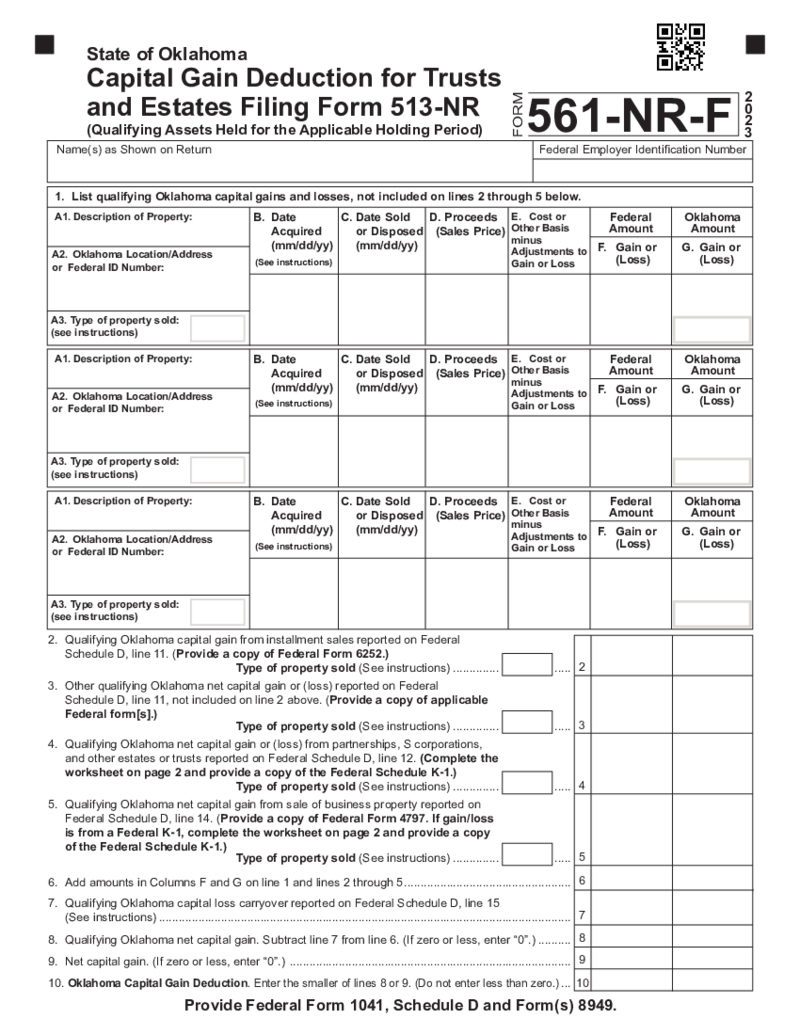

Form 561-NR-F Capital Gain Deduction for Trusts and Estates Filing Form 513NR

What Is Oklahoma Form 561 NR F?

Oklahoma Form 561-NR-F is a state-specific tax document used by trusts and estates to claim a deduction for certain capital gains. This form is relevant for nonresident trusts and estates with income sources from Oklahoma a

Form 561-NR-F Capital Gain Deduction for Trusts and Estates Filing Form 513NR

What Is Oklahoma Form 561 NR F?

Oklahoma Form 561-NR-F is a state-specific tax document used by trusts and estates to claim a deduction for certain capital gains. This form is relevant for nonresident trusts and estates with income sources from Oklahoma a

-

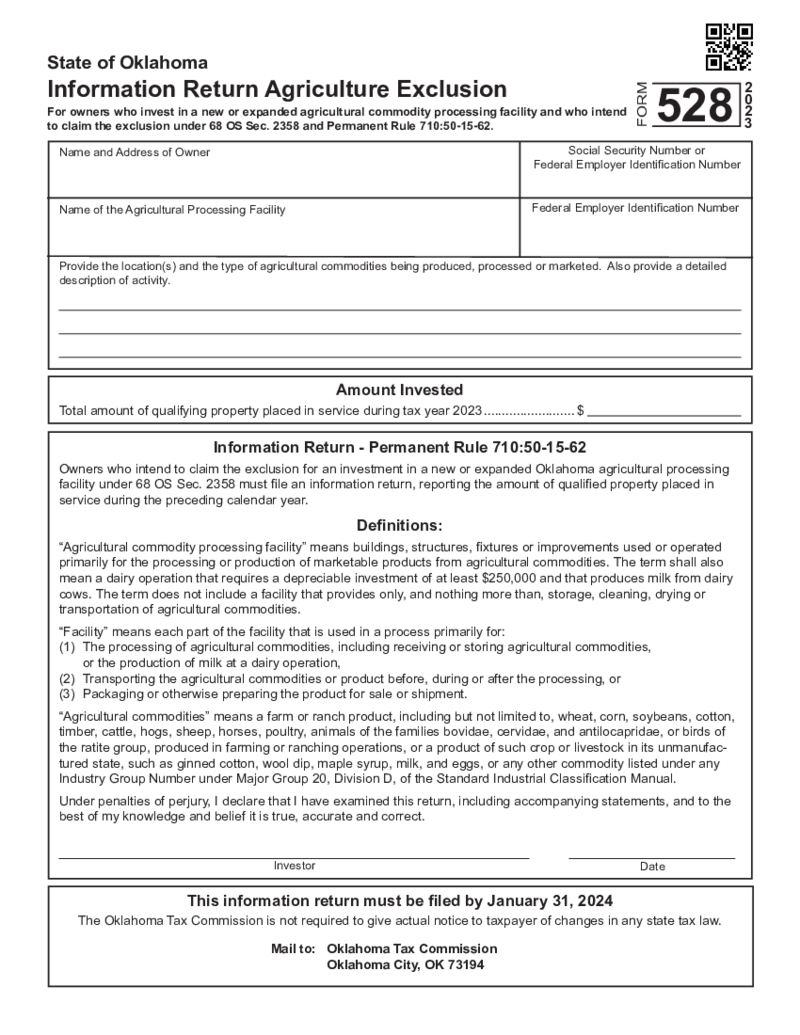

Oklahoma Form 528 - Information Return Agriculture Exclusion

What Is Oklahoma Form 528?

Oklahoma Form 528 is a tax document designed for agricultural producers who wish to claim an exclusion from sales tax for certain sales of agricultural products. This form is utilized to report qualifying transactions to the Okl

Oklahoma Form 528 - Information Return Agriculture Exclusion

What Is Oklahoma Form 528?

Oklahoma Form 528 is a tax document designed for agricultural producers who wish to claim an exclusion from sales tax for certain sales of agricultural products. This form is utilized to report qualifying transactions to the Okl

-

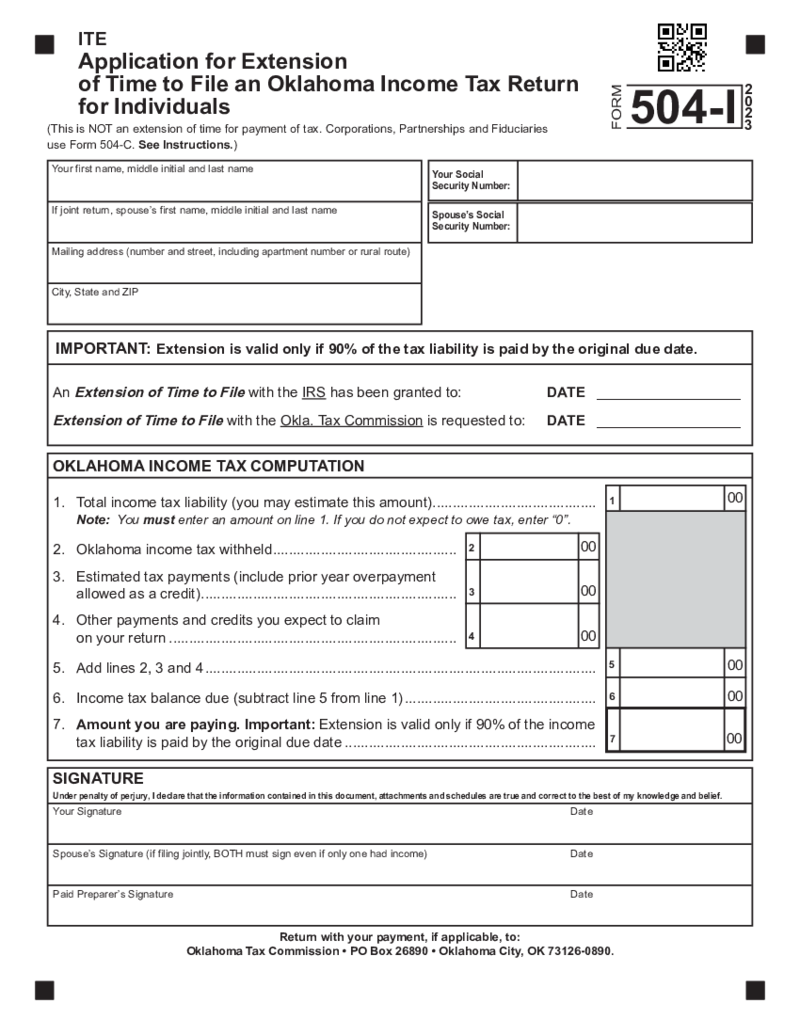

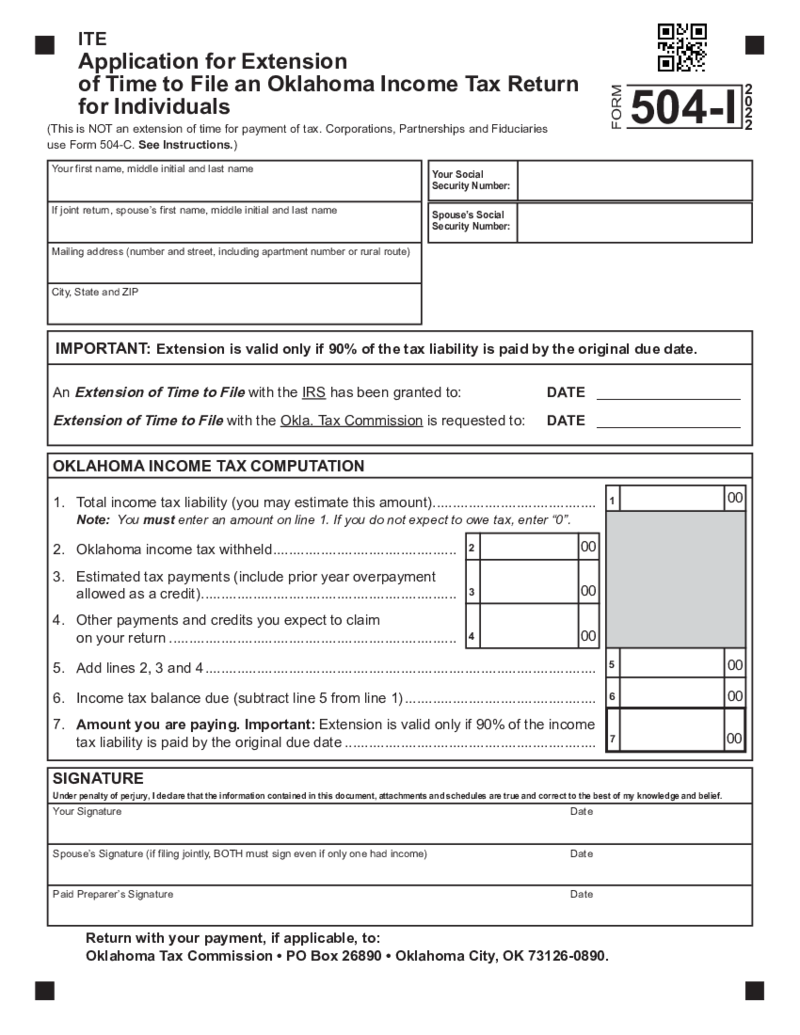

Oklahoma Form 504-I

What Is Oklahoma Tax Form 504?

Oklahoma Tax Form 504, also referred to simply as Form 504 Oklahoma, is an Application for Extension of Time to File an Oklahoma Income Tax Return. This form allows Oklahoma taxpayers to request additional time to file their

Oklahoma Form 504-I

What Is Oklahoma Tax Form 504?

Oklahoma Tax Form 504, also referred to simply as Form 504 Oklahoma, is an Application for Extension of Time to File an Oklahoma Income Tax Return. This form allows Oklahoma taxpayers to request additional time to file their

-

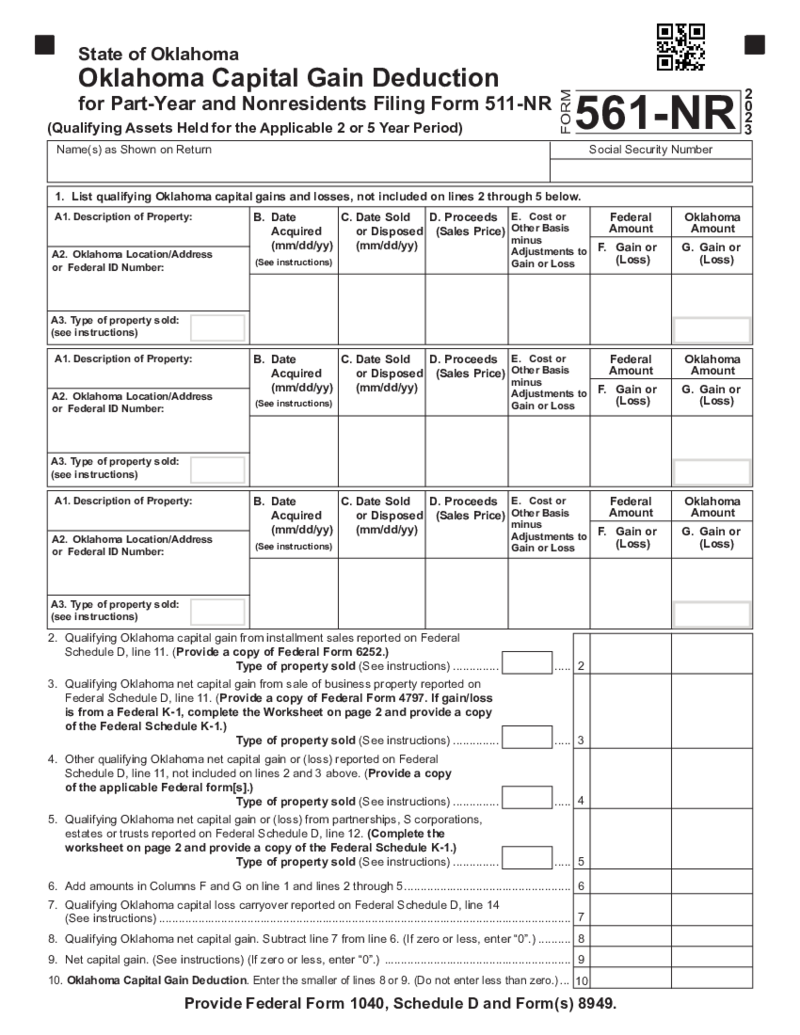

Form 561-NR Oklahoma Capital Gain Deduction for Part-Year and Nonresidents Filing Form 511NR

What Is Schedule 561 NR Oklahoma

Schedule 561 NR, also known as the Oklahoma Capital Gain Deduction for Part-Year and Nonresidents, is used by individuals who file form 511-NR to report and deduct qualifying capital gains derived from Okl

Form 561-NR Oklahoma Capital Gain Deduction for Part-Year and Nonresidents Filing Form 511NR

What Is Schedule 561 NR Oklahoma

Schedule 561 NR, also known as the Oklahoma Capital Gain Deduction for Part-Year and Nonresidents, is used by individuals who file form 511-NR to report and deduct qualifying capital gains derived from Okl

-

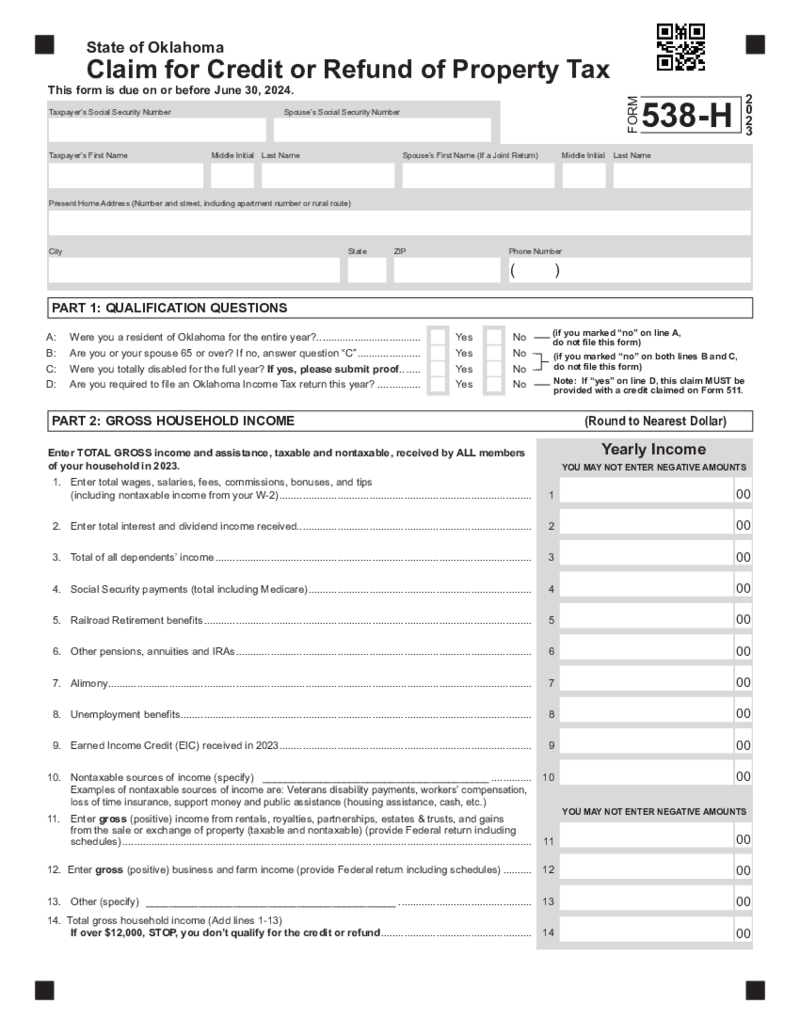

Oklahoma Form 538-H Claim for Credit or Refund of Property Tax (2023)

What Is Form 538 H

Form 538-H is a document Oklahoma residents use to apply for a refund or credit of property taxes paid. Specifically, it is designed for citizens eligible for a homestead exemption. It allows them to claim a refund of s

Oklahoma Form 538-H Claim for Credit or Refund of Property Tax (2023)

What Is Form 538 H

Form 538-H is a document Oklahoma residents use to apply for a refund or credit of property taxes paid. Specifically, it is designed for citizens eligible for a homestead exemption. It allows them to claim a refund of s

-

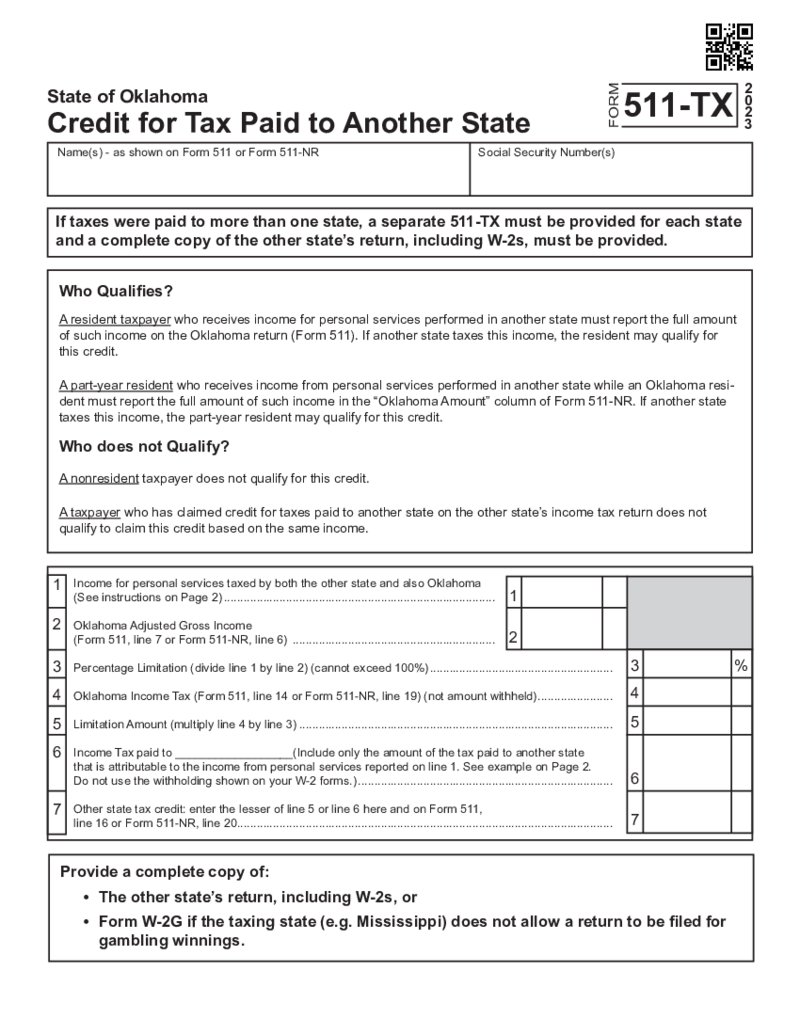

Oklahoma Form 511-TX Credit for Tax Paid to Another State

Basics of Oklahoma Form 511-TX

Form 511 TX is designed for Oklahoma residents who have paid income tax to another state. The purpose of this form is to offset the Oklahoma tax liability by the amount paid to the other jurisdiction, ensuring that taxpayers

Oklahoma Form 511-TX Credit for Tax Paid to Another State

Basics of Oklahoma Form 511-TX

Form 511 TX is designed for Oklahoma residents who have paid income tax to another state. The purpose of this form is to offset the Oklahoma tax liability by the amount paid to the other jurisdiction, ensuring that taxpayers

-

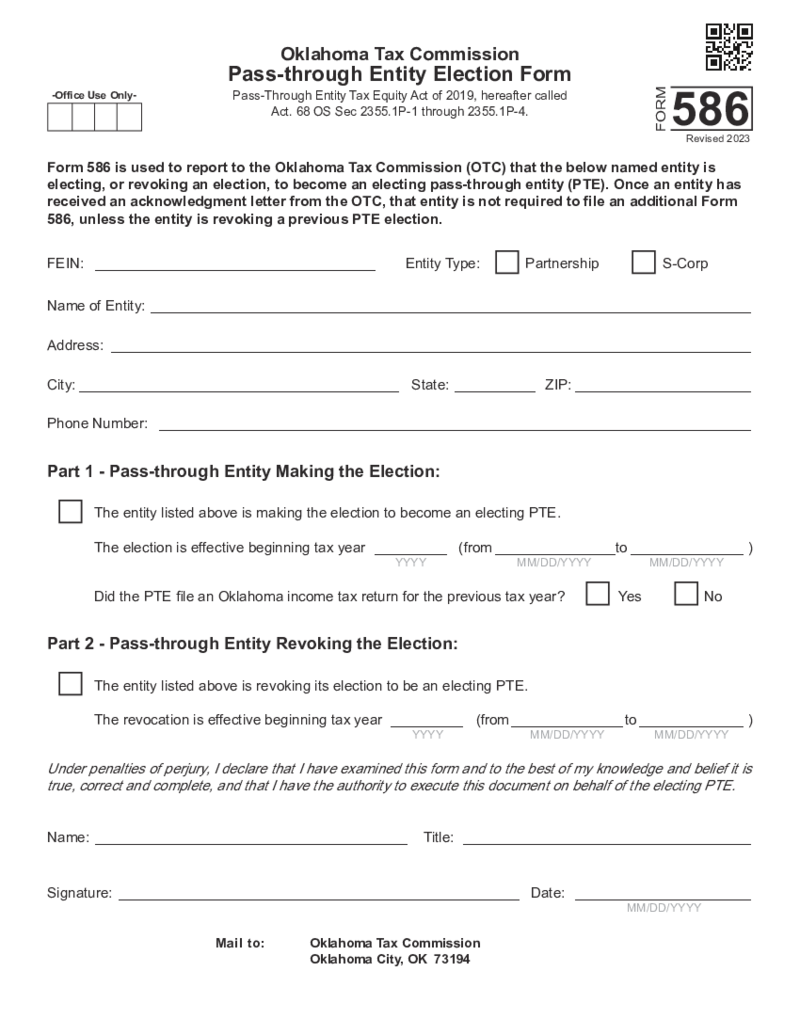

Form 586 Oklahoma Pass-through Entity Election Form

What Is Oklahoma Form 586?

Form 586 is a critical document utilized by certain business entities in the state of Oklahoma. Specifically designed for pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs).

Form 586 Oklahoma Pass-through Entity Election Form

What Is Oklahoma Form 586?

Form 586 is a critical document utilized by certain business entities in the state of Oklahoma. Specifically designed for pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs).

-

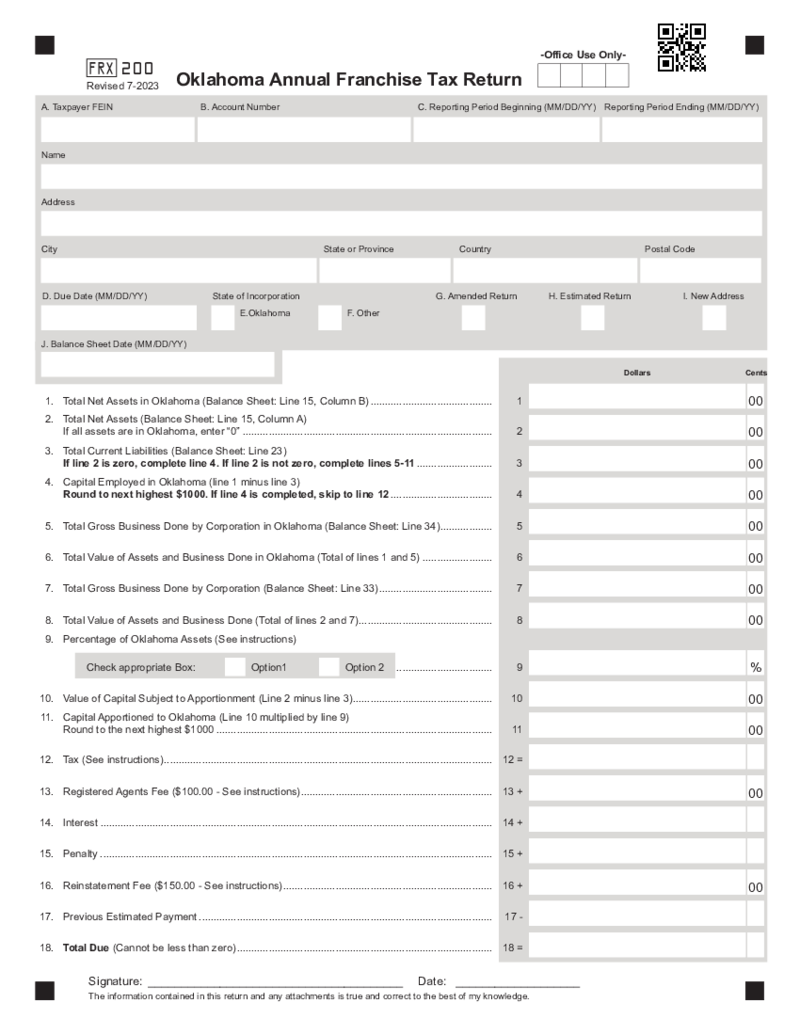

Form FRX-200 Oklahoma Annual Franchise Tax Return

Overview of the Oklahoma Annual Franchise Tax Return Form

The Oklahoma Annual Franchise Tax is levied on corporations operating within the state. It is calculated based on the company's capital invested or used in

Form FRX-200 Oklahoma Annual Franchise Tax Return

Overview of the Oklahoma Annual Franchise Tax Return Form

The Oklahoma Annual Franchise Tax is levied on corporations operating within the state. It is calculated based on the company's capital invested or used in

-

Form 512 Oklahoma Corporation Income and Franchise Tax Return Packet

What Is Oklahoma Form 512

Also known as Corporation Income and Franchise Tax Return, it’s a tax document used by corporations operating within the state. Its main purpose is to report their income and calculate the franchise tax owed to the Oklahoma

Form 512 Oklahoma Corporation Income and Franchise Tax Return Packet

What Is Oklahoma Form 512

Also known as Corporation Income and Franchise Tax Return, it’s a tax document used by corporations operating within the state. Its main purpose is to report their income and calculate the franchise tax owed to the Oklahoma

-

Oklahoma Form 504-I for Individuals

Acquire a Printable Oklahoma Form 504-I for Individuals Online

The document is ready for you to acquire at the PDFLiner library. Either push the "Fill this form" button or follow the steps below in case you need to find the form

Oklahoma Form 504-I for Individuals

Acquire a Printable Oklahoma Form 504-I for Individuals Online

The document is ready for you to acquire at the PDFLiner library. Either push the "Fill this form" button or follow the steps below in case you need to find the form

-

Form WTP-10005 Oklahoma Nonresident Distributed Income Estimated Withholding Tax Report

What Is Oklahoma Form WTP 10005?

Oklahoma form WTP-10005 is a tax-related form used within the state of Oklahoma. This Oklahoma form is typically utilized by individuals or entities that must report certain tax information to the Oklahoma Tax Commission.

Form WTP-10005 Oklahoma Nonresident Distributed Income Estimated Withholding Tax Report

What Is Oklahoma Form WTP 10005?

Oklahoma form WTP-10005 is a tax-related form used within the state of Oklahoma. This Oklahoma form is typically utilized by individuals or entities that must report certain tax information to the Oklahoma Tax Commission.

-

Form WTR-10002 Oklahoma Nonresident Royalty Withholding Tax Return

What is an Oklahoma Nonresident Royalty Withholding Tax Return?

The WTR 10002 Form is a short, one-page document that all Oklahoma nonresidents must complete annually if they have income from various royalties in a reporting period that exceeds $1000. It

Form WTR-10002 Oklahoma Nonresident Royalty Withholding Tax Return

What is an Oklahoma Nonresident Royalty Withholding Tax Return?

The WTR 10002 Form is a short, one-page document that all Oklahoma nonresidents must complete annually if they have income from various royalties in a reporting period that exceeds $1000. It

FAQ:

-

Where to send Oklahoma tax forms?

You can send Oklahoma tax return forms to the Oklahoma Tax Commission if it is indicated in the form. There are detailed instructions on how and where to send them. Normally the officials prefer to receive electronic documents via email or download them online via the website. If there is a requirement to send the form by regular mail the address is included in the form.

-

Where to mail Oklahoma tax forms?

If you are not sure where to send the form, and there is no instruction in the document, contact Oklahoma Tax Commission. Before you do that, you can check out their website. If there are no specific rules, ask the support team.