-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Wisconsin Last Will and Testament Form

Wisconsin Last Will and Testament Form

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Oklahoma Form 511-TX Credit for Tax Paid to Another State

Get your Oklahoma Form 511-TX Credit for Tax Paid to Another State in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Basics of Oklahoma Form 511-TX

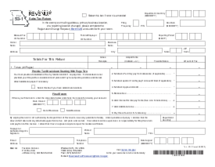

Form 511 TX is designed for Oklahoma residents who have paid income tax to another state. The purpose of this form is to offset the Oklahoma tax liability by the amount paid to the other jurisdiction, ensuring that taxpayers are not taxed twice on the same earnings. It's essential to know that the credit cannot exceed the amount of Oklahoma tax that would have been due on the same income.

How to Fill Out the OK Form 511 TX

When it comes to completing Form 511-TX, preciseness and accuracy are crucial. Taxpayers must first complete their income tax returns for both Oklahoma and the other states involved. Upon doing so, you will gather information about the gross income reported to the other state and the total tax paid. Remember to follow these steps:

- Locate the section at the top of the form for entering your full legal name exactly as shown on your Oklahoma Form 511 or Form 511-NR.

- Input your Social Security Number and, if applicable, that of your co-filer right next to the names.

- Find the section designated for income earned from work that was taxed by both Oklahoma and another state. Enter the total amount in the corresponding field.

- Enter your Oklahoma Adjusted Gross Income, which aligns with the total from your Form 511 or Form 511-NR.

- Determine the proportion of your income taxed by both Oklahoma and the other state by dividing the income from work (taxed by both states) by your Oklahoma Adjusted Gross Income. Multiply by 100 to get the percentage, but ensure the result does not exceed 100%. Record that percentage in the provided box.

- Document the total Oklahoma Income Tax as calculated from your Form 511 or Form 511-NR in the appropriate field.

- To establish the Limitation Amount, multiply your total Oklahoma Income Tax by the percentage you calculated for income taxed by both states. Write this amount in the designated space; this figure signifies the maximum credit you can claim.

- Indicate the exact amount of income tax paid to the other state for income from the services that are being double-taxed. Only include the portion related to the income earned from personal services that you included earlier and for which you're claiming the credit.

- In the section provided, briefly mention the name of the other state to which the tax was paid.

- If you've paid taxes to more than one other state, calculate the tax credit for each state separately and add up the totals for the 'Other state tax credit' box.

Tips for accurate submission

The task of filling out Oklahoma state forms can be daunting, but there are several tips to ease the process and ensure your submission is accurate:

- Double-check all information entered on the form for accuracy.

- Keep thorough records and documents to support your claims.

- Consider consulting with a tax professional if your situation is complex.

Ensuring compliance and peace of mind

Filing taxes can be stressful, particularly when dealing with multiple states. Oklahoma Form 511-TX provides a clear avenue for residents to abide by tax laws while avoiding double taxation. By approaching the process with the correct information and resources, you can successfully claim your entitled credits and maintain peace of mind come tax season.

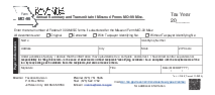

Fillable online Oklahoma Form 511-TX Credit for Tax Paid to Another State