-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

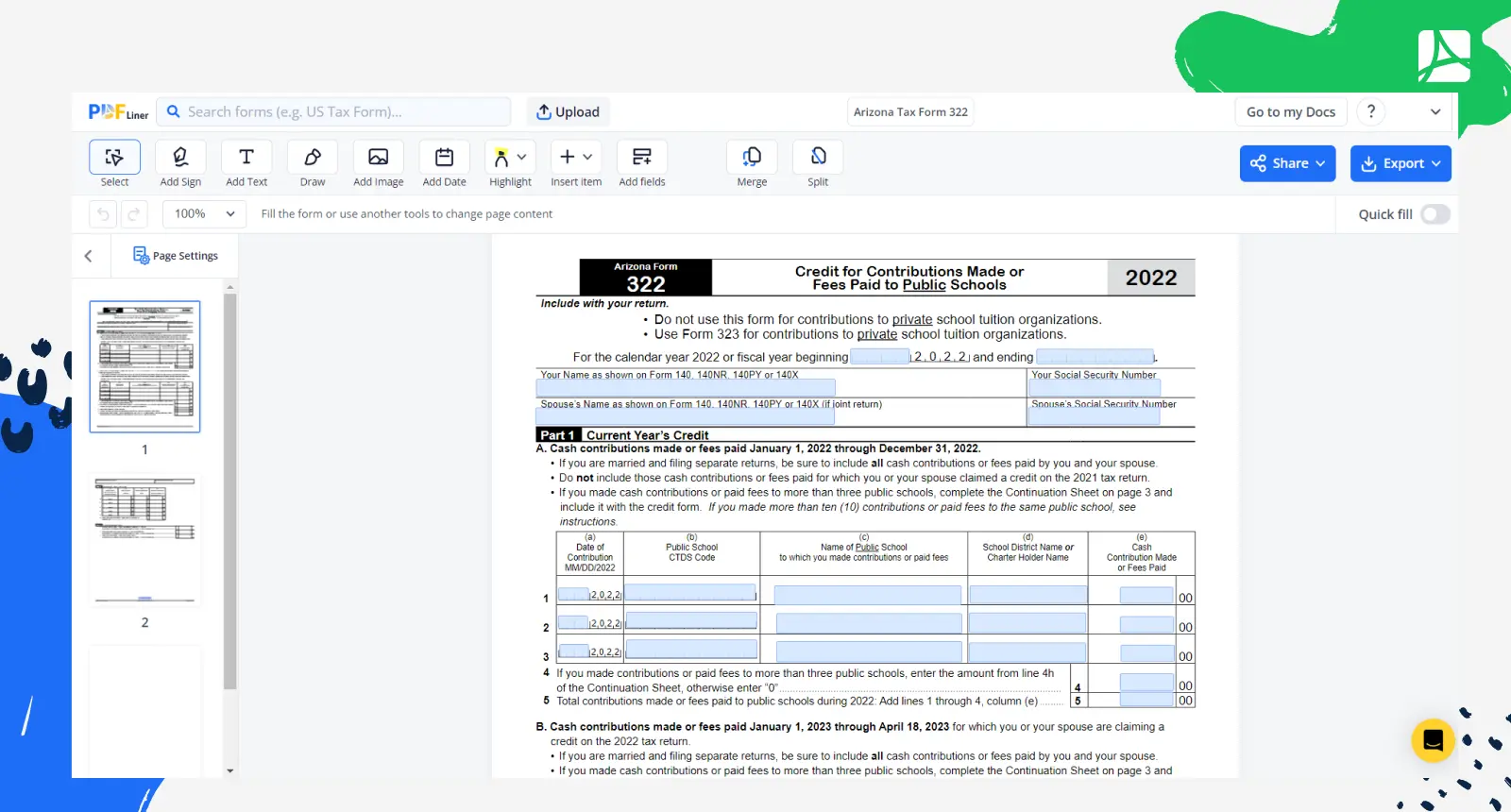

Arizona Tax Form 322

Get your Arizona Tax Form 322 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding Arizona State Tax Form 322

State of Arizona Form 322, also known as Form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their Arizona income tax return. This form is for individuals who have filed an income tax return in Arizona and paid income tax in another state on the same income. By claiming this credit, taxpayers can avoid double taxation on their income.

Eligibility requirements for Arizona tax form 322

To complete and submit the 322 Arizona tax form, you must satisfy the following conditions:

- An income tax return has been filed in Arizona;

- State income tax has been paid to another state on the same income being reported in Arizona;

- The income that was taxed by the other state is also subject to Arizona state tax;

- The credit claimed relates only to income earned or received during the tax year in question.

If these requirements are met, you can proceed with filling out the form and claiming the tax credit.

Filling Out Form 322 Arizona: Step-by-Step

Here's a step-by-step guide on how to fill out form 322 for Arizona:

- Provide Your Basic Information: At the top of the form, you will need to enter your name, address, and social security number. If filing a joint tax return, make sure to include your spouse's name and social security number as well.

- Identify the Other State: In Part I, you will need to specify the state you paid income tax to, the amount of income subject to tax in that state, and the percentage of your Arizona adjusted gross income that the out-of-state income represents.

- Calculate Credit Limits: In Part II of this Arizona form, you will be required to enter your Arizona tax liability before credits and calculate the maximum allowable credit. To do so, multiply the percentage of your out-of-state income in relation to your total adjusted gross income (determined in Part I) by your Arizona tax liability.

- Determine the Total Amount of Credit: In Part III, enter the amount of tax that was paid to the other state. Compare this amount with the maximum credit you calculated in Part II. The credit you are allowed to claim is the lesser of these two amounts. Enter this amount on the appropriate line of your Arizona tax return.

- Complete the Form and Attach it: After following these steps, attach the completed form 322 along with a copy of the income tax return you filed with the other state to your Arizona tax return.

Why it's important to complete Arizona form 322

Filling out and submitting the Arizona 322 form is crucial for corporations seeking to claim a tax credit for their charitable contributions to STOs. These contributions provide valuable financial assistance to eligible students, fostering educational opportunities and a well-rounded, diverse community. By claiming the tax credit, corporations can financially benefit from their contributions while supporting deserving students.

Form Versions

2022

Arizona Tax Form 322 (2022)

Fillable online Arizona Tax Form 322