-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

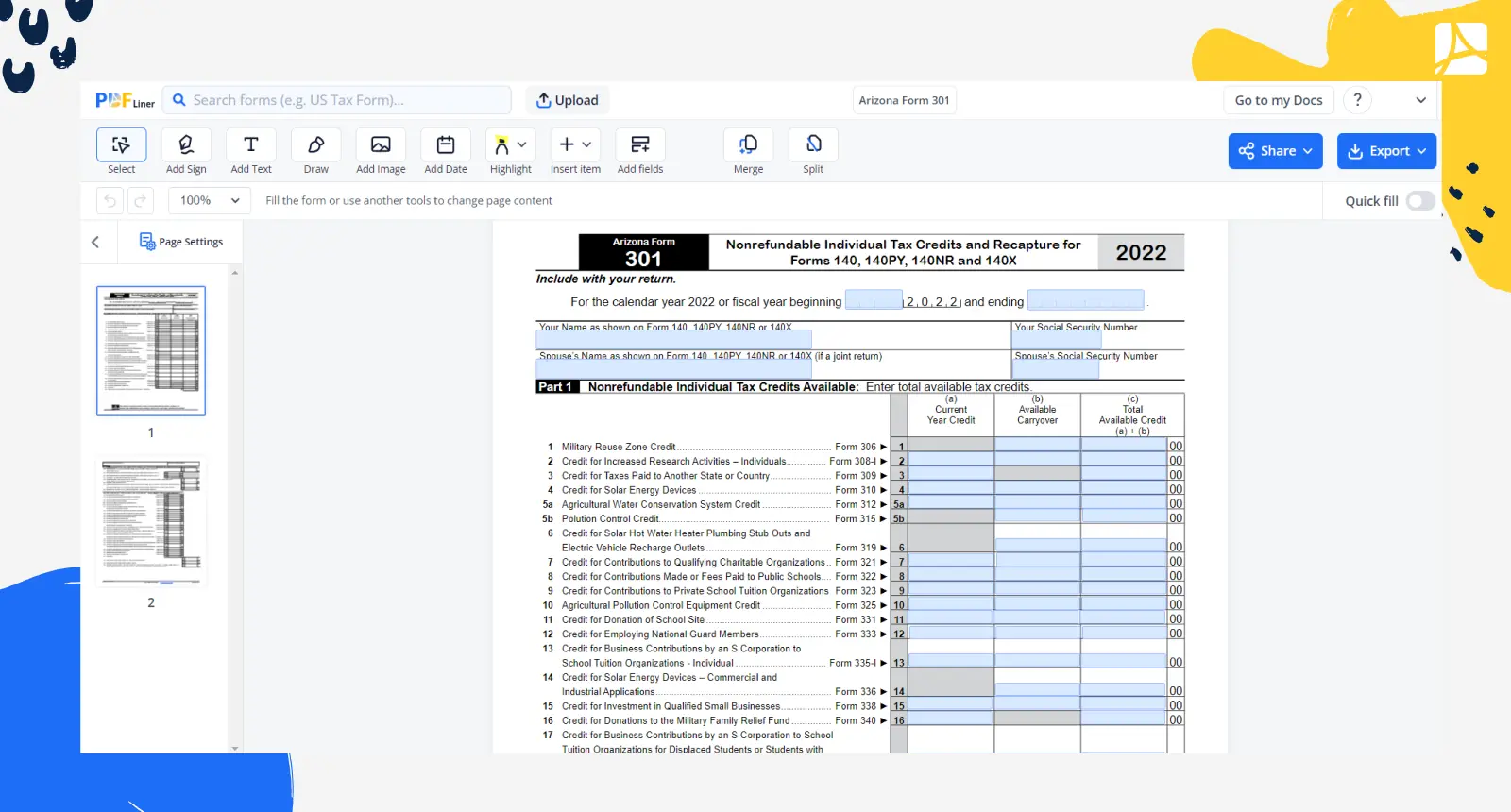

Arizona Form 301

Get your Arizona Form 301 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Arizona Form 301?

Arizona Form 301 is the initial document that needs to be prepared by taxpayers in Arizona who intend to claim one or multiple tax credits. It acts as a summary to include all the credits you may be eligible for and must accompany the corresponding credit forms. Besides these, it's also essential to submit the Arizona income tax return or corporate tax return.

Importance of Arizona state tax form 301

Understanding the significance of the Arizona Tax Form 301 is a critical step in navigating your responsibility as a taxpayer. It not only simplifies the taxpaying process but also ensures you get to benefit from any eligible tax credits. By learning to fill it properly, you minimize the likelihood of any errors that may lead to complications.

Process of Filling the Arizona Tax Form 301

Would you like some insights on how to fill out form 301 Arizona? Here's a brief look:

- Begin by entering the necessary data into the "Name" section, ensuring that the spelling matches the one you will use on your tax return.

- Fill in your "Social Security Number" in the indicated field. Your Social Security Number should be inputted without any dashes or spaces.

- Provide your "Spouse’s name" and "Spouse’s Social Security Number" if filing jointly.

- Make a selection under the "Resident Status" section. Check the appropriate box for your status such as Full-Year Resident, Part-Year Resident, or Nonresident.

- For the "Current Tax Year" section, input the corresponding tax year you are filing for.

- In the "Contributions" section, enter the amounts you are contributing for each fund listed. The total will auto-calculate at the bottom of the section.

- If applicable, complete the "Carryover Contributions from Previous Years" section.

- Move on to the "Calculate Total Contribution" section. Here, the form will automatically add up your previous contributions and any carryover.

- Provide your "Total Arizona Tax Liability" in the "Calculate Refundable Tax Credit" section.

- The form will then calculate your "Refundable Tax Credit", if applicable.

- Now you may download or print the completed Form 301 by clicking on the appropriate button. If you plan to file electronically, you can email the form directly from PDFliner.

When should I use Arizona income tax form 301?

You should use Arizona form 301 if, during the tax year, you are eligible to claim any nonrefundable individual tax credits. Nonrefundable tax credits can help decrease your tax liability to the state of Arizona. The credits encompass various classifications like donations to qualified charitable organizations, fees paid for public school extracurricular activities, or contributions to a college savings plan.

Essentially, if you've engaged in any activity that provides you with a tax credit in Arizona, Form 301 is required to detail and calculate those credits. If there's uncertainty about your eligibility or the process of completing this form, it's recommended to consult a tax professional.

Form Versions

2022

Arizona Form 301 (2022)

Fillable online Arizona Form 301