-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

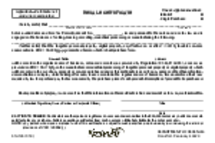

Kentucky Withholding Certificate - Form K-4

Get your Kentucky Withholding Certificate - Form K-4 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is the K 4 Form Kentucky?

The Kentucky K 4 withholding certificate is a state-specific document designed to help employers withhold the correct amount of Kentucky income tax from their employees' wages. This form accounts for an individual's filing status, allowances, and any additional withholding that the employee deems necessary. It's essential for managing state tax responsibilities and ensuring compliance with Kentucky tax laws.

Importance of Kentucky form K-4

Filling out the withholding certificate for the state of Kentucky accurately is essential for several reasons:

- It helps employees avoid underpaying or overpaying their state income tax.

- Based on your personal and financial situation, it ensures that the right amount of tax is withheld.

- Streamlines the state tax calculation and reporting process for employers.

Without a current Form K-4 on file, an employer might not withhold the correct amount of state income tax, potentially leading to issues for both the employer and the employee.

How to Fill Out the Form K 4 Kentucky

Filling out the Kentucky Withholding Certificate correctly is paramount to ensuring the appropriate taxes are deducted. Here are key instructions:

- Start by entering your full legal name and home address, including street, city, state, and ZIP code, in the designated fields.

- Insert your Social Security Number in the provided space.

- For personal allowances, enter the total number you are claiming. If unsure, use the worksheet provided with the form to calculate the correct number.

- If you have any additional allowances, specify the amount in the space provided for dependent, child, and/or excess over withholding if your expected tax liability will be less than your withholdings.

- If you are exempt due to the Servicemember Civil Relief Act and the amendments made by the Military Spouses, mark ‘yes’ in every box under Section 3.

- If you reside in a reciprocal state, check the box for the state in which you live in Section 4.

- Should you wish to have an additional amount withheld from each paycheck, write that amount in the designated section.

- Complete the declaration section by certifying the form's accuracy and swear that no attempt to fraudulently decrease Kentucky tax liabilities is intended.

- Sign and date the form in the allocated spaces at the bottom to validate the certificate.

- Keep a copy of the completed form for your records.

- Review all information to ensure accuracy before proceeding with submission.

Secure and simplify your form K-4 Kentucky with PDFliner

PDFliner is a convenient platform that empowers you to access, fill, and manage your IRS tax forms with ease, including the Kentucky withholding exemption certificate. You can fill out the form online, making it a quick and secure process to keep up with one's withholding status. The PDFliner also allows for electronic storage of completed forms, ensuring they are readily available when needed.

Form Versions

2023

Kentucky Form K-4 (2023)

Fillable online Kentucky Withholding Certificate - Form K-4