-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Illinois Tax Forms

-

Illinois Form IL-1040-ES (2024)

Understanding the IL-1040-ES Form

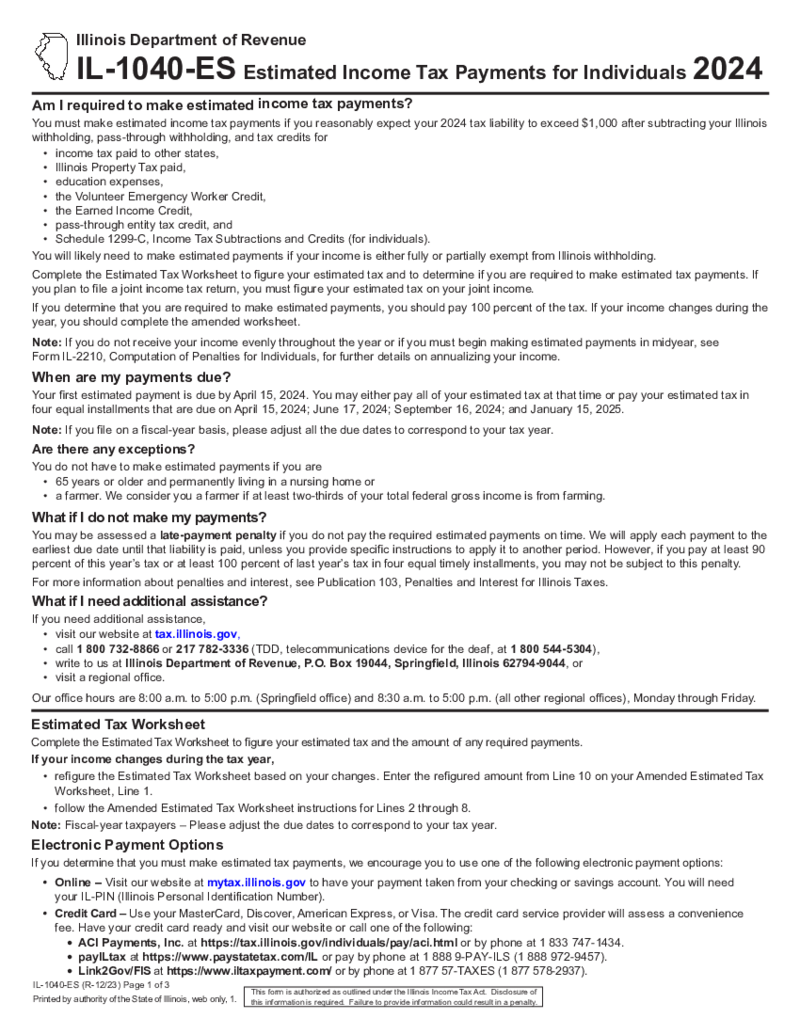

Before progressing to the online payment process, it’s important to understand the IL-1040-ES form. This form is issued by the Illinois revenue department for use by residents who are due to make estimated tax payme

Illinois Form IL-1040-ES (2024)

Understanding the IL-1040-ES Form

Before progressing to the online payment process, it’s important to understand the IL-1040-ES form. This form is issued by the Illinois revenue department for use by residents who are due to make estimated tax payme

-

Form IL-505-I

What Is Form IL 505 I?

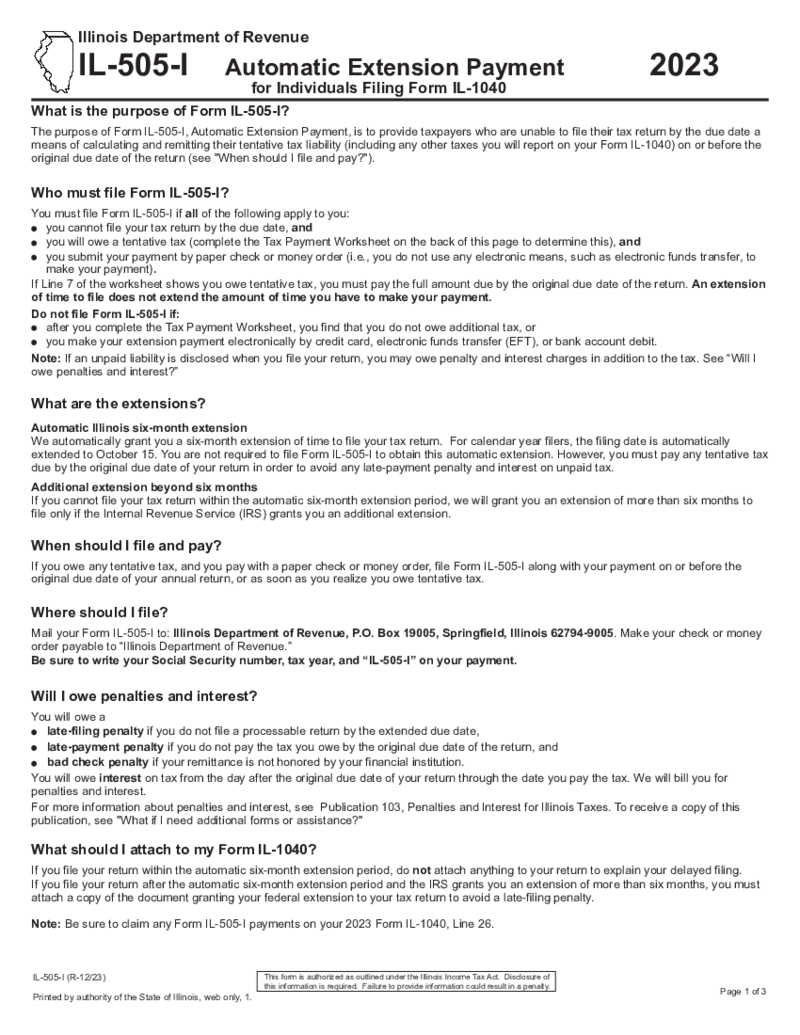

The IL 505-I, also referred to as Illinois Tax Extension Form IL 505 I, is a state-specific form used by residents and businesses in Illinois who need additional time to prepare their tax return. This form does not prolong the deadl

Form IL-505-I

What Is Form IL 505 I?

The IL 505-I, also referred to as Illinois Tax Extension Form IL 505 I, is a state-specific form used by residents and businesses in Illinois who need additional time to prepare their tax return. This form does not prolong the deadl

-

Form IL-1040-V

What Is IL 1040 V?

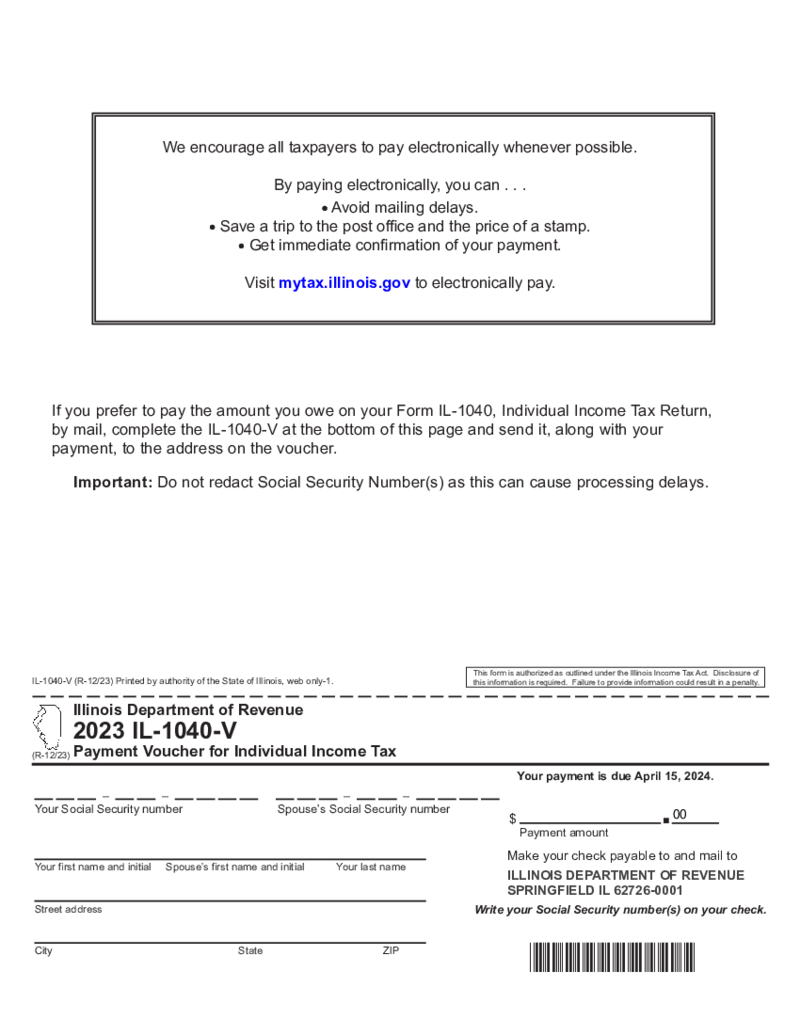

Understanding "IL-1040-V" is critical for those dealing with tax preparations, especially if you are an Illinois resident. This form, otherwise known as the Illinois Payment Voucher is a particular form used to make income tax

Form IL-1040-V

What Is IL 1040 V?

Understanding "IL-1040-V" is critical for those dealing with tax preparations, especially if you are an Illinois resident. This form, otherwise known as the Illinois Payment Voucher is a particular form used to make income tax

-

Illinois Form IL-2210 (2022)

Understanding Illinois Form IL 2210

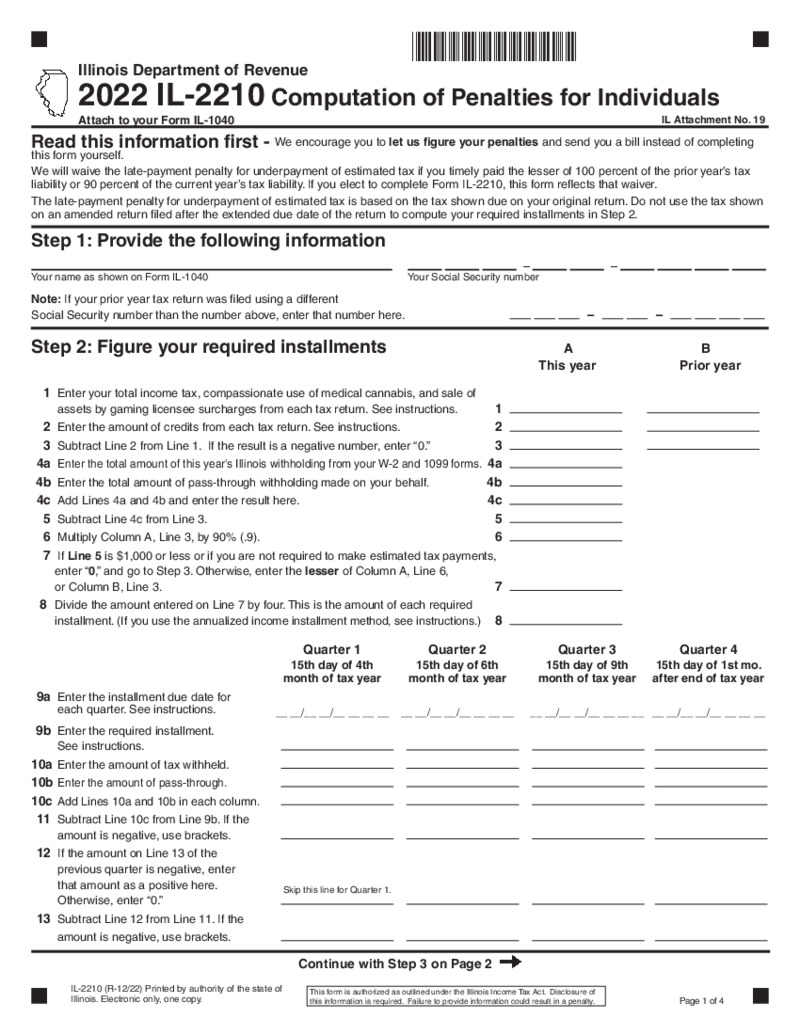

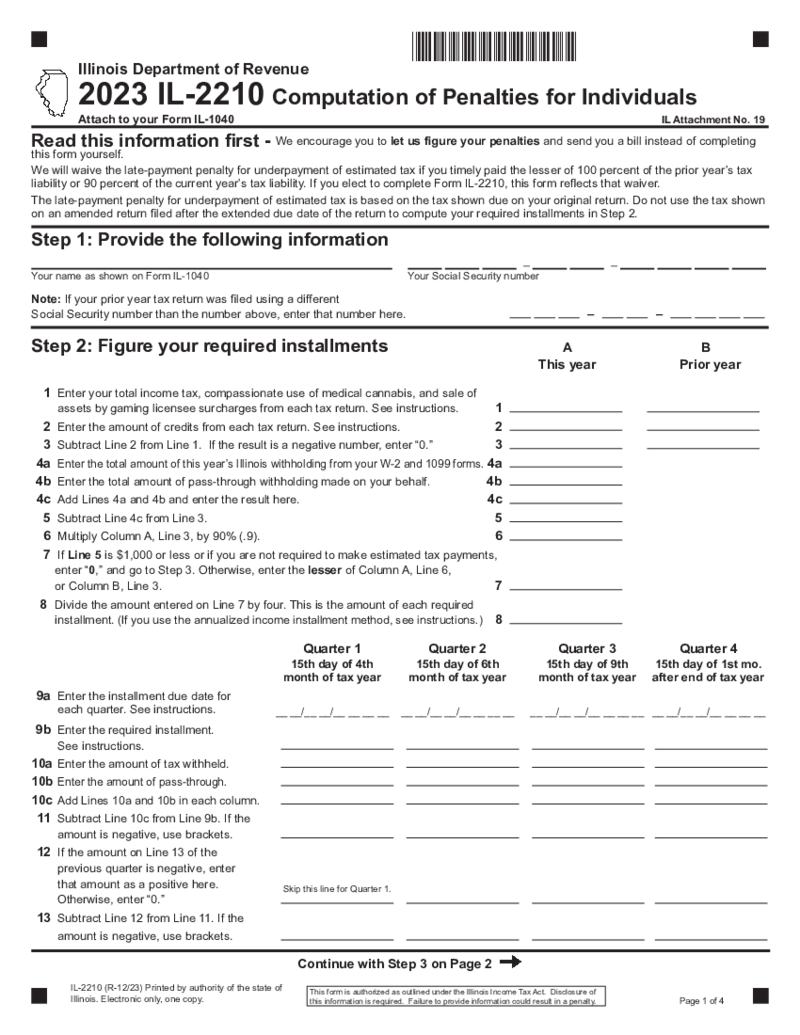

Delving into tax season can be daunting, particularly when you encounter unfamiliar documents such as the Illinois Form IL-2210. Designed by the Illinois Department of Revenue, this form is utilized to calculate penalti

Illinois Form IL-2210 (2022)

Understanding Illinois Form IL 2210

Delving into tax season can be daunting, particularly when you encounter unfamiliar documents such as the Illinois Form IL-2210. Designed by the Illinois Department of Revenue, this form is utilized to calculate penalti

-

Illinois Form IL-2210

What Is IL-2210 form?

The fillable IL-2210 form is made for the calculations of the penalties for the individual taxpayers. You may download the IL-2210 form in case the Illinois Department of Revenue can’t calculate your penalties and send you a bi

Illinois Form IL-2210

What Is IL-2210 form?

The fillable IL-2210 form is made for the calculations of the penalties for the individual taxpayers. You may download the IL-2210 form in case the Illinois Department of Revenue can’t calculate your penalties and send you a bi

-

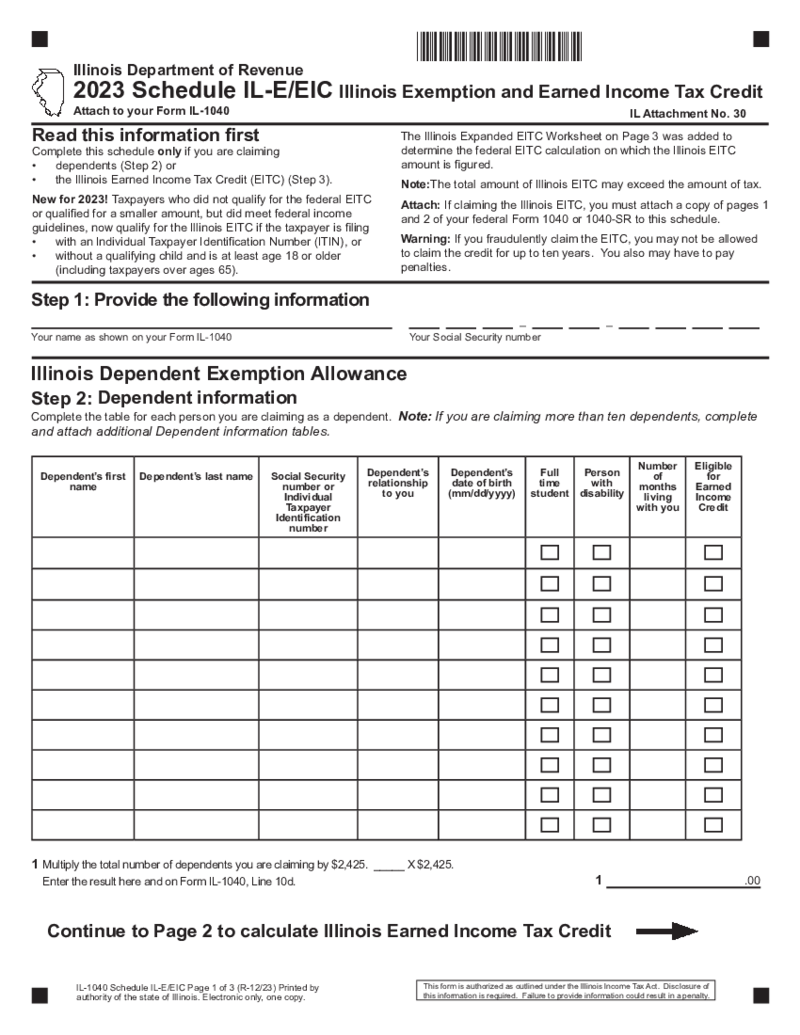

Illinois Tax Form Schedule IL-E-EIC

Illinois State Tax Guide: Navigating the IL-E/EIC Schedule

Tax season can be a maze of forms and schedules, each with its specific purpose and requirements. For Illinois residents, understanding and properly completing such documents is crucial to maximiz

Illinois Tax Form Schedule IL-E-EIC

Illinois State Tax Guide: Navigating the IL-E/EIC Schedule

Tax season can be a maze of forms and schedules, each with its specific purpose and requirements. For Illinois residents, understanding and properly completing such documents is crucial to maximiz

-

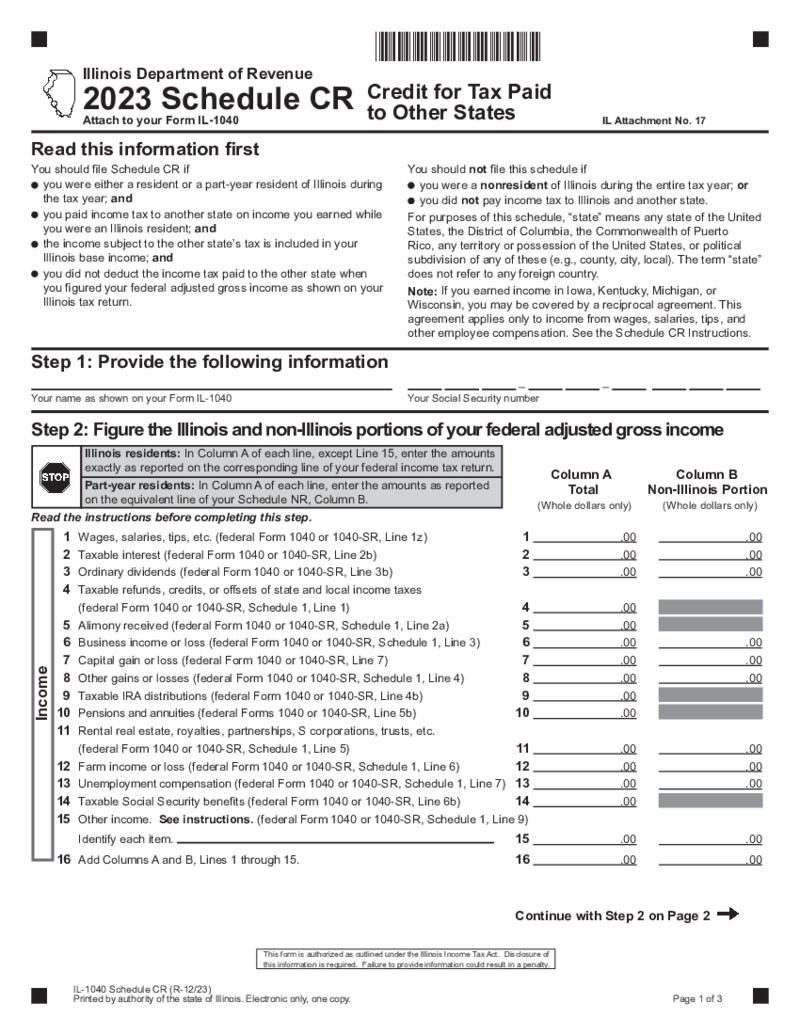

Illinois Tax Form 1040 Schedule CR

What Is Illinois Tax Form 1040 Schedule CR?

The Illinois Tax Form 1040 Schedule CR is a document designed for taxpayers in Illinois who need to claim a credit for income taxes paid to other states. This form works in conjunction with the main IL-1040 form

Illinois Tax Form 1040 Schedule CR

What Is Illinois Tax Form 1040 Schedule CR?

The Illinois Tax Form 1040 Schedule CR is a document designed for taxpayers in Illinois who need to claim a credit for income taxes paid to other states. This form works in conjunction with the main IL-1040 form

-

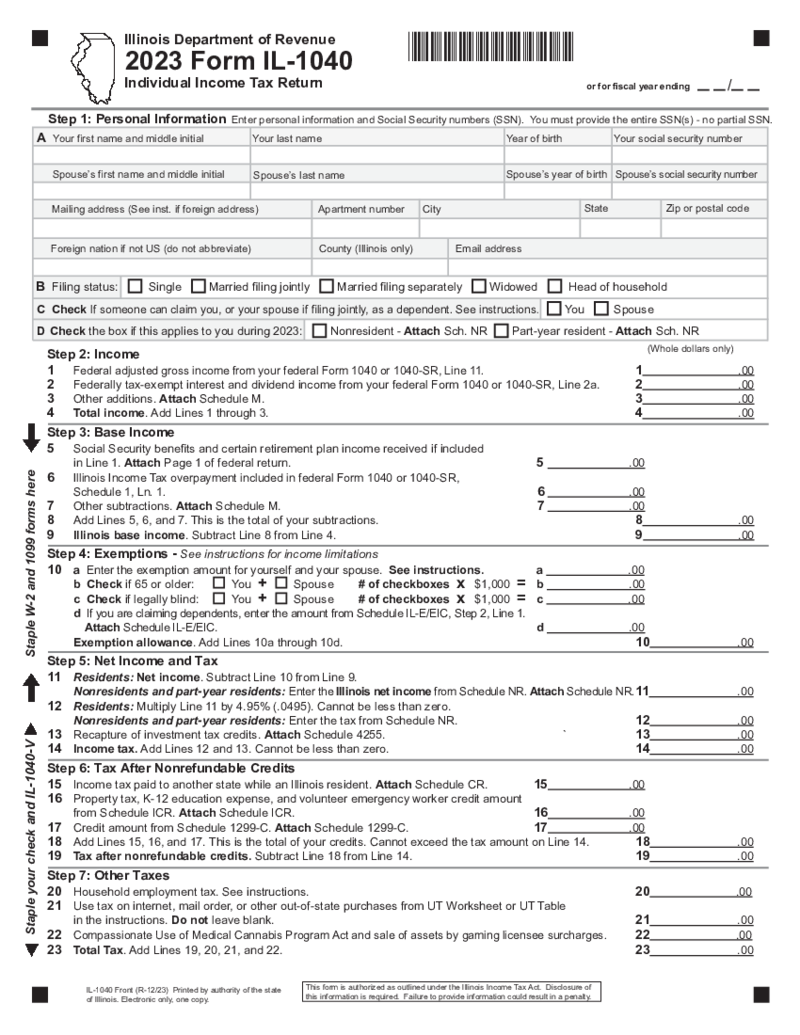

Form IL-1040

What Is a Form IL-1040?

Form IL-1040 is the general income tax return form for the state of Illinois. The form is used to report an individual's annual income and calculate their tax liability. In most cases, taxpayers will use the form to file their

Form IL-1040

What Is a Form IL-1040?

Form IL-1040 is the general income tax return form for the state of Illinois. The form is used to report an individual's annual income and calculate their tax liability. In most cases, taxpayers will use the form to file their

-

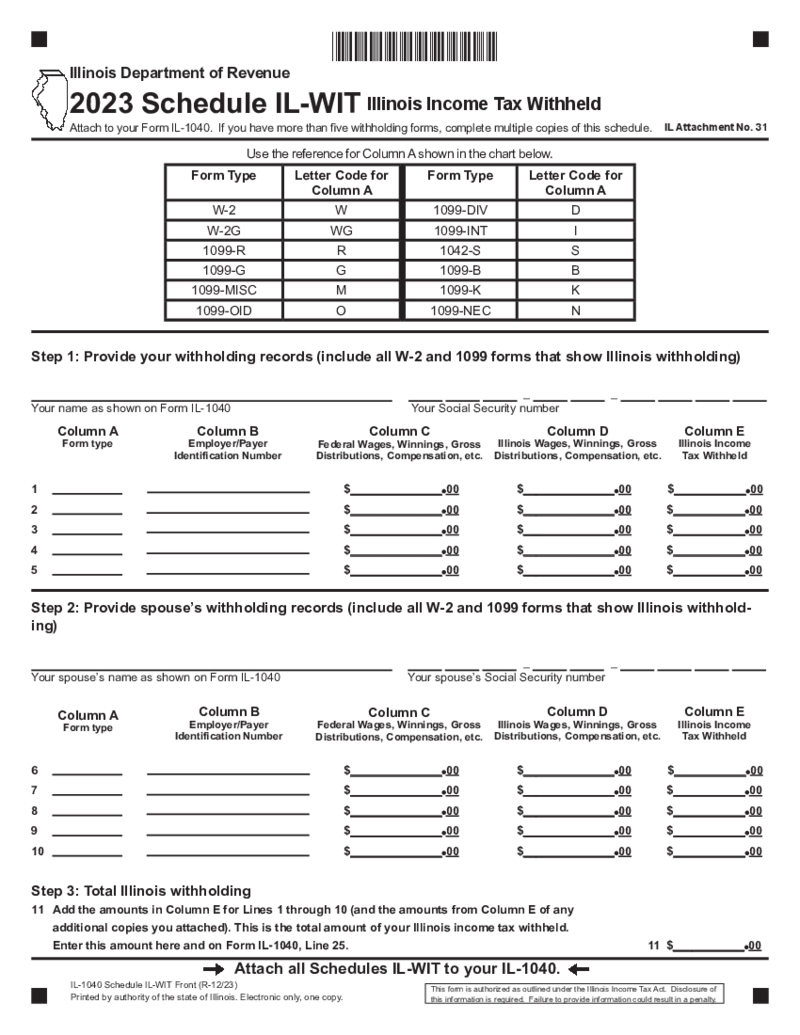

Illinois Tax Form 1040 Schedule IL-WIT

What Is Schedule IL-WIT Form?

Schedule IL-WIT is the Illinois Withholding Income Schedule. If any Illinois income tax has been withheld from you throughout the year, then you must complete and submit the form. This includes income tax withheld from salari

Illinois Tax Form 1040 Schedule IL-WIT

What Is Schedule IL-WIT Form?

Schedule IL-WIT is the Illinois Withholding Income Schedule. If any Illinois income tax has been withheld from you throughout the year, then you must complete and submit the form. This includes income tax withheld from salari

-

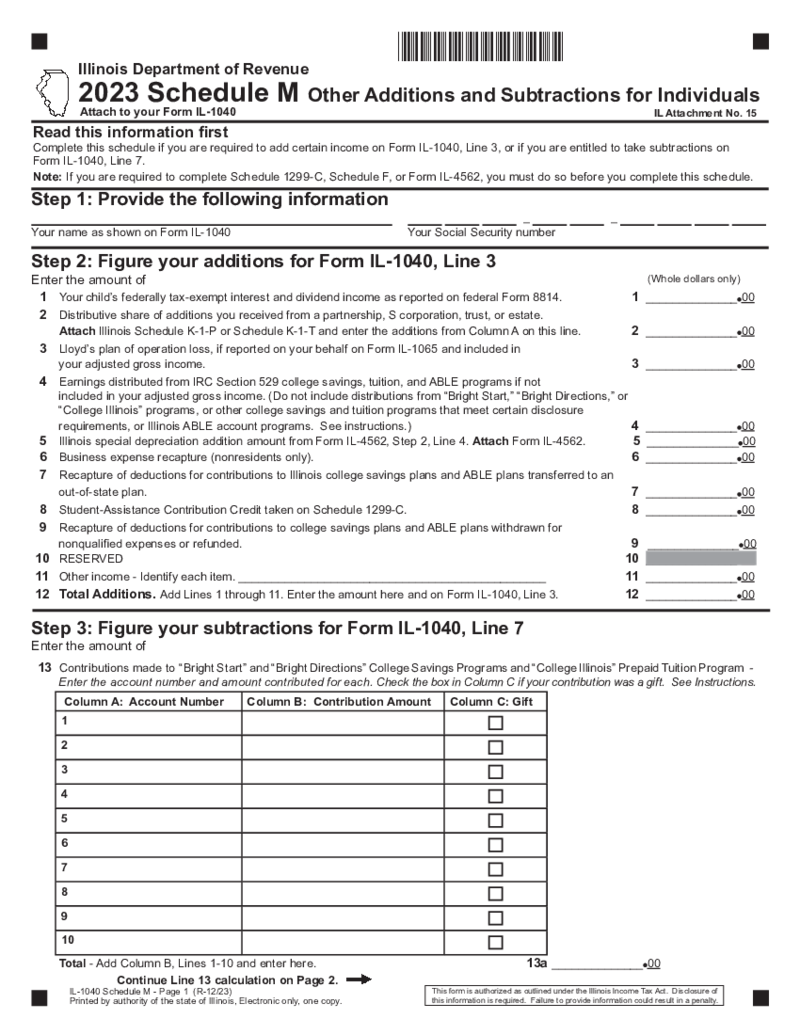

Illinois Tax Form 1040 Schedule M

What Is Illinois 1040 Schedule M?

The 1040 Schedule M tax form plays a significant role in modifying federally assessed income to reflect state-specific exemptions, deductions, and adjustments. It helps to do away with the potential of double taxation by

Illinois Tax Form 1040 Schedule M

What Is Illinois 1040 Schedule M?

The 1040 Schedule M tax form plays a significant role in modifying federally assessed income to reflect state-specific exemptions, deductions, and adjustments. It helps to do away with the potential of double taxation by

-

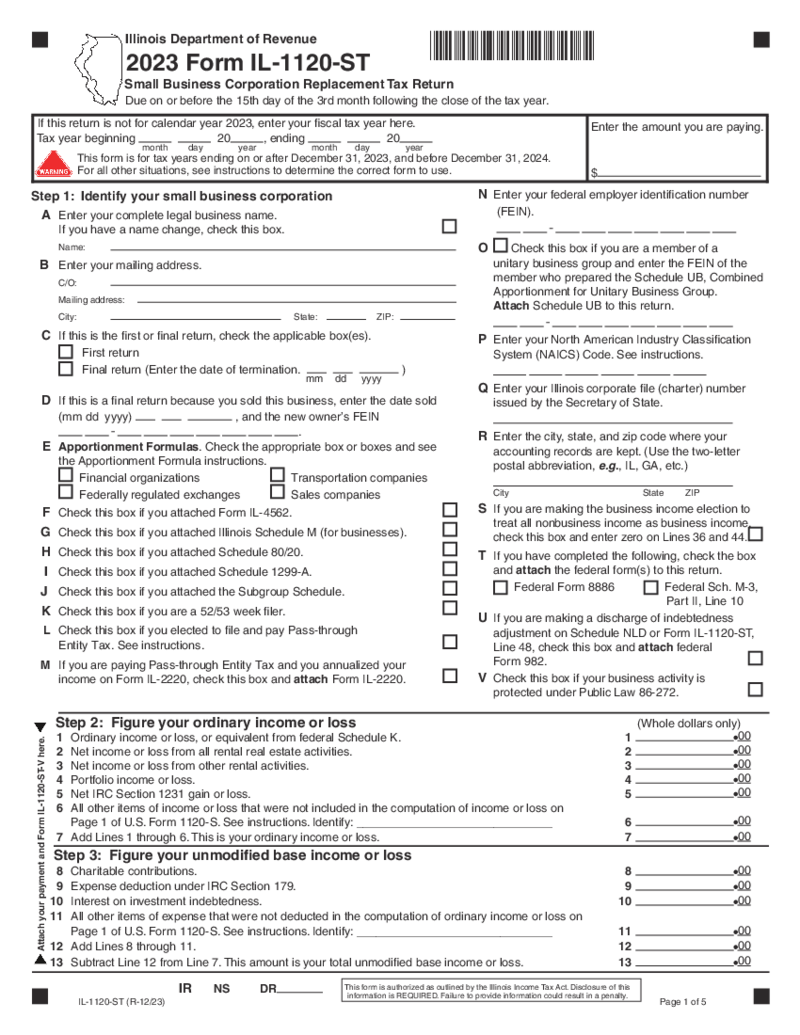

Form IL-1120-ST

What Is the IL-1120-ST Form?

Primarily used in the state of Illinois, form IL-1120-ST is used to report the income, deductions and credits of an S corporation. In essence, it aids the state in determining the amount of income tax owed by the corporation f

Form IL-1120-ST

What Is the IL-1120-ST Form?

Primarily used in the state of Illinois, form IL-1120-ST is used to report the income, deductions and credits of an S corporation. In essence, it aids the state in determining the amount of income tax owed by the corporation f

-

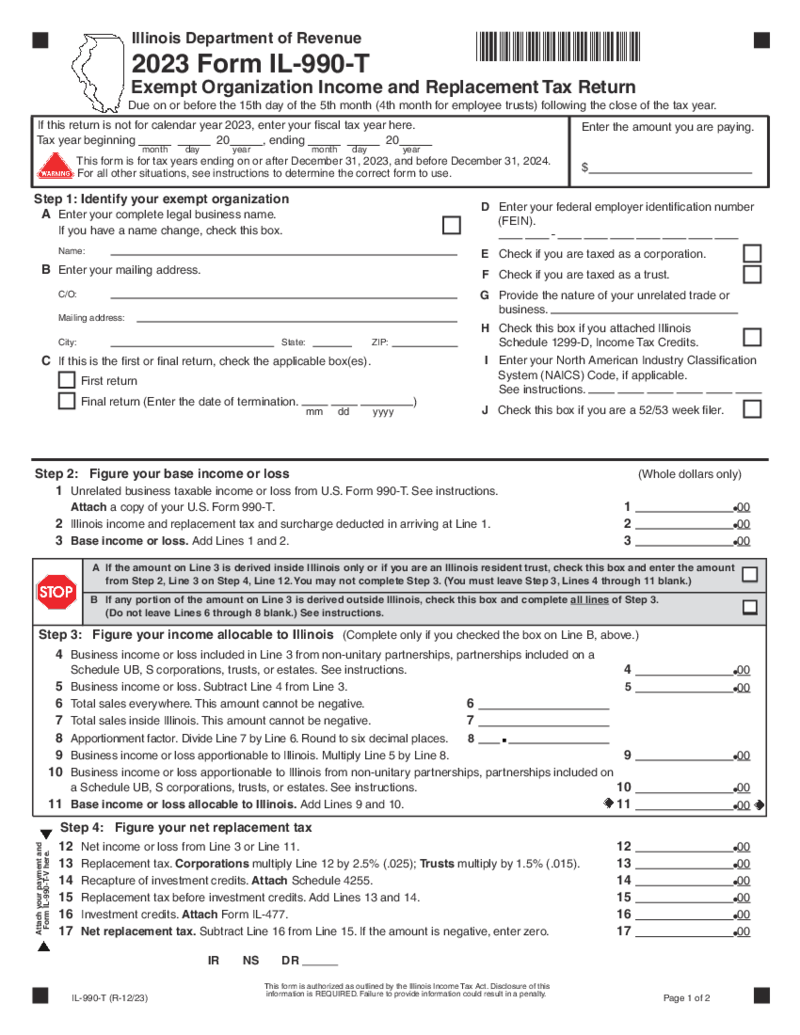

Form IL-990-T

What Is Form IL 990 T

Form IL 990 T is the official tax document used by trusts, estates, and specific other organizations in the state of Illinois to report and pay income taxes on unrelated business income. This form is tailored to identify the taxable

Form IL-990-T

What Is Form IL 990 T

Form IL 990 T is the official tax document used by trusts, estates, and specific other organizations in the state of Illinois to report and pay income taxes on unrelated business income. This form is tailored to identify the taxable

What are Illinois Tax Forms?

Illinois tax forms were created for every taxpayer who lives and works or just works in the territory of Illinois state. It was created by the Illinois Department of Revenue and must be sent to them once it is filled. Department keeps the records of your income and checks out whether you are paying taxes on time, not overpaying them, and does not have any problems. There is a wide range of blanks the department offers for the taxpayers. You can find them on PDFLiner.

Use Illinois gov tax forms, but keep in mind that you also need to file your federal tax reports. Despite the fact that many documents are similar to the ones you fill out for the IRS, you still have to provide them separately to different institutions. Don’t forget about the deadlines indicated on the forms.

Most Popular Illinois Tax Forms

Among all Illinois state tax forms there are several that are on demand by taxpayers. Every year they feel these forms and send them to Illinois authorities. If you are not sure which form to use, you can check out the list with the most popular ones and you will definitely find something you need. If you have rare demands you can connect to the Illinois Department of Revenue. Here is the list of the most required state of Illinois tax forms:

- Form IL-1040. You may be familiar with the analog of this form you file for the federal authorities form 1040. This is a local equivalent called Individual Income Tax Return. The one you receive from the Illinois department contains information on the local income and taxes you pay apart from the federal taxes. You have to include details about your income from form 1040 into IL-1040. You start with the personal information, and base income you have during the tax year. This form can be filled out and sent online to the officials.

- Form IL-1040-PTR. This is one of the common Illinois income tax forms that can misplace IL-1040 for a year. It is called Illinois Property Tax Rebate. You can fill it if you don’t need IL-1040 or Schedule ICR attached to IL-1040. You have to check for it every year and fill only if you know that you are not completing IL-1040. The document can be sent to your mail by the Illinois Department of Revenue as a check once you fill in the information about your address in the form.

- Schedule ICR. This schedule was already mentioned above. You have to use it as an attachment to the IL-1040-PTR form. It is called the Illinois Credits document. There are strict rules for this blank you need to follow. You only can use it if you fill IL-1040-PTR and can provide K-12 Education Expense credits. Before you start this form, you have to complete lines from 1 to 14 in IL-1040. You also have to make sure that the amount of the property tax credit you pay plus the K-12 education credit does not exceed the tax due.

- Form IL-2210. It is called the Computation of Penalties for Individuals. If you need to file this document, pay attention to the previous Illinois department of revenue tax forms you’ve completed. It comes as an attachment to IL-1040. Yet, you may not fill this document at all. The Illinois Department of Revenue offers you to expect to see their own calculations of penalties which they share with you in the bill.

- Form IL-1040 ES. This is one of the Illinois estimated tax forms for those who expect their income to exceed $1000 after all the withholding, tax credits, and even education expenses. It is called Estimated Income Tax Payments for Individuals.

Where Can I Get Illinois Tax Forms?

The first you can go for Illinois sales tax forms is the official website of the Illinois Department of Revenue. You will find multiple forms in different areas. If you want to save time, you can go to the PDFLiner. It contains the tools you can use to complete blanks online and send them right to the other party. The documents you’ve filled can be later printed or saved to your device. Here is what you need to do once you get to the PDFLiner:

- Search for the form you need.

- Press on it Fill Online.

- When the form opens, start to fill in the lines.

- Sign it when the form is ready and send it to the revenue department.

FAQ:

-

When can I file an Illinois state tax return?

There is a strict deadline for when you can send the form. It is better to wait till the end of the financial year before you can calculate your income and taxes. You have to follow the deadline indicated inside the document or you will be fined.

-

How do I know if I need to file an Illinois tax return?

If you have no idea whether you need to complete and send an Illinois tax return, it is better to go to the official website. Ask the support team that is available there describing your specific case. Sometimes taxpayers don’t need to fill out the form for the year.