-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Illinois Tax Forms - page 2

-

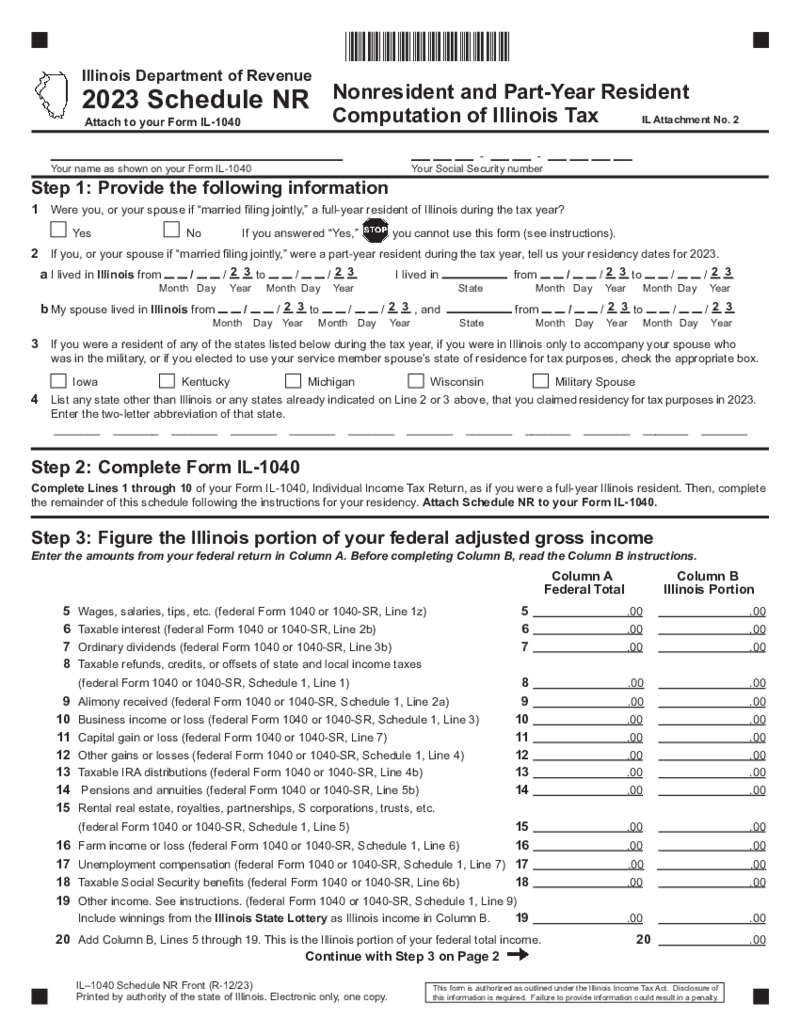

Illinois Schedule NR

Understanding the Illinois Schedule NR

The Illinois Schedule NR form is a crucial document for nonresident individuals, part-time residents, or full-time students who earned income in Illinois during the taxable year. This form allows taxpayers to calcula

Illinois Schedule NR

Understanding the Illinois Schedule NR

The Illinois Schedule NR form is a crucial document for nonresident individuals, part-time residents, or full-time students who earned income in Illinois during the taxable year. This form allows taxpayers to calcula

-

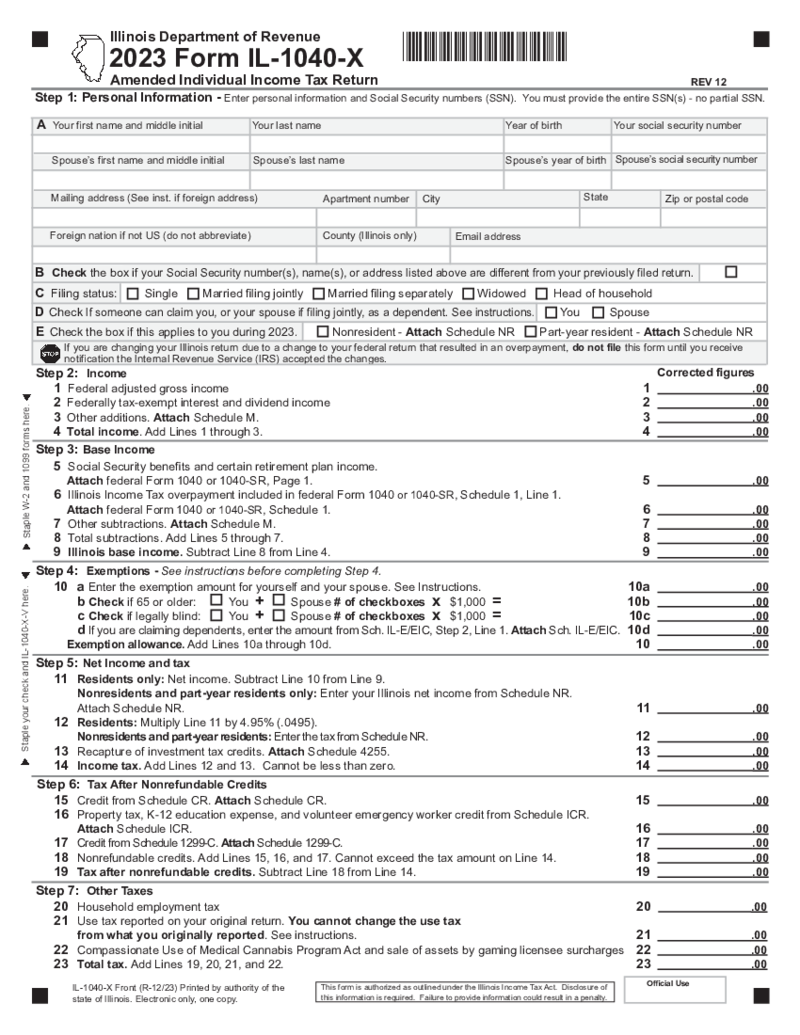

Form IL-1040-X

What Is Form IL 1040 X?

Fundamentally, form IL 1040 X is used to rectify any misinterpretations or inaccuracies made in the original tax filing process. This implies when an adjustment to your income, credit, or deduction must be made, this form springs i

Form IL-1040-X

What Is Form IL 1040 X?

Fundamentally, form IL 1040 X is used to rectify any misinterpretations or inaccuracies made in the original tax filing process. This implies when an adjustment to your income, credit, or deduction must be made, this form springs i

-

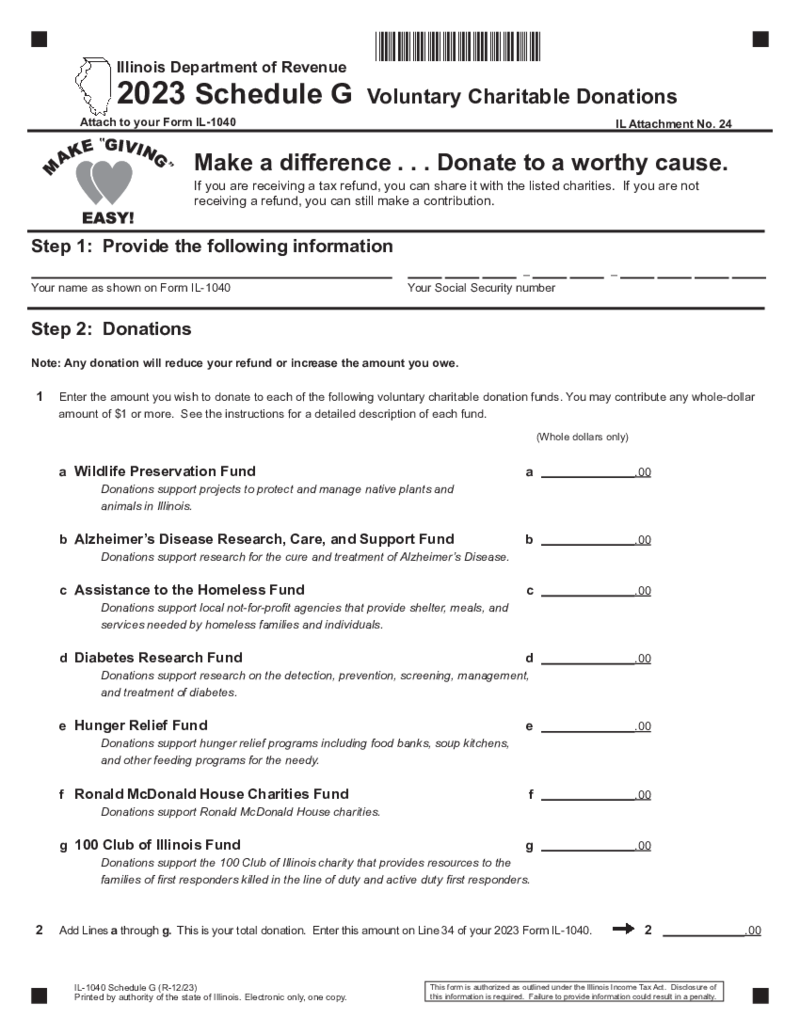

Illinois Tax Form 1040 Schedule G

Explaining Illinois Tax Form 1040 Schedule G: A Guide

Understanding tax forms can often be a daunting task. Illinois Tax Form Schedule G is one such form that may initially seem complex but serves a noble purpose. This article aims to demystify this speci

Illinois Tax Form 1040 Schedule G

Explaining Illinois Tax Form 1040 Schedule G: A Guide

Understanding tax forms can often be a daunting task. Illinois Tax Form Schedule G is one such form that may initially seem complex but serves a noble purpose. This article aims to demystify this speci

-

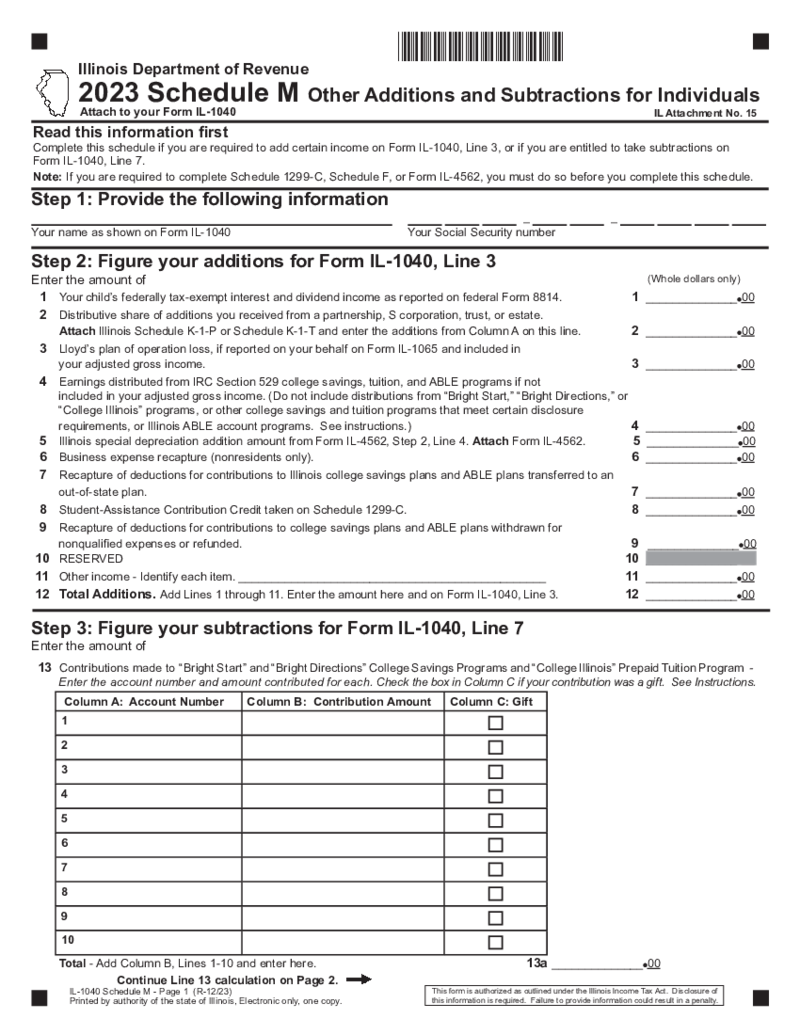

Illinois Tax Form 1040 Schedule M

What Is Illinois 1040 Schedule M?

The 1040 Schedule M tax form plays a significant role in modifying federally assessed income to reflect state-specific exemptions, deductions, and adjustments. It helps to do away with the potential of double taxation by

Illinois Tax Form 1040 Schedule M

What Is Illinois 1040 Schedule M?

The 1040 Schedule M tax form plays a significant role in modifying federally assessed income to reflect state-specific exemptions, deductions, and adjustments. It helps to do away with the potential of double taxation by

-

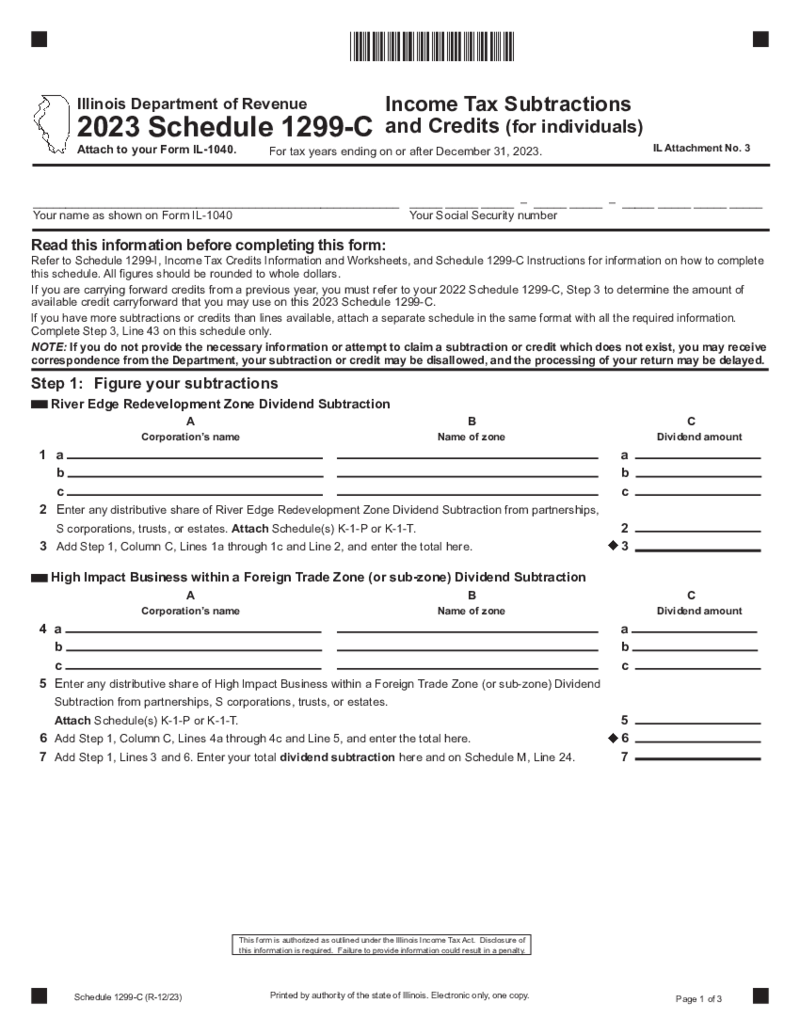

Illinois Tax Form Schedule 1299-C

What Is the Illinois Form 1299 C?

Form 1299 C is a tax schedule exclusive to the state of Illinois. It is required by residents who want to claim credits on their income tax. These credits may include property tax, education expense, or earned income cred

Illinois Tax Form Schedule 1299-C

What Is the Illinois Form 1299 C?

Form 1299 C is a tax schedule exclusive to the state of Illinois. It is required by residents who want to claim credits on their income tax. These credits may include property tax, education expense, or earned income cred

-

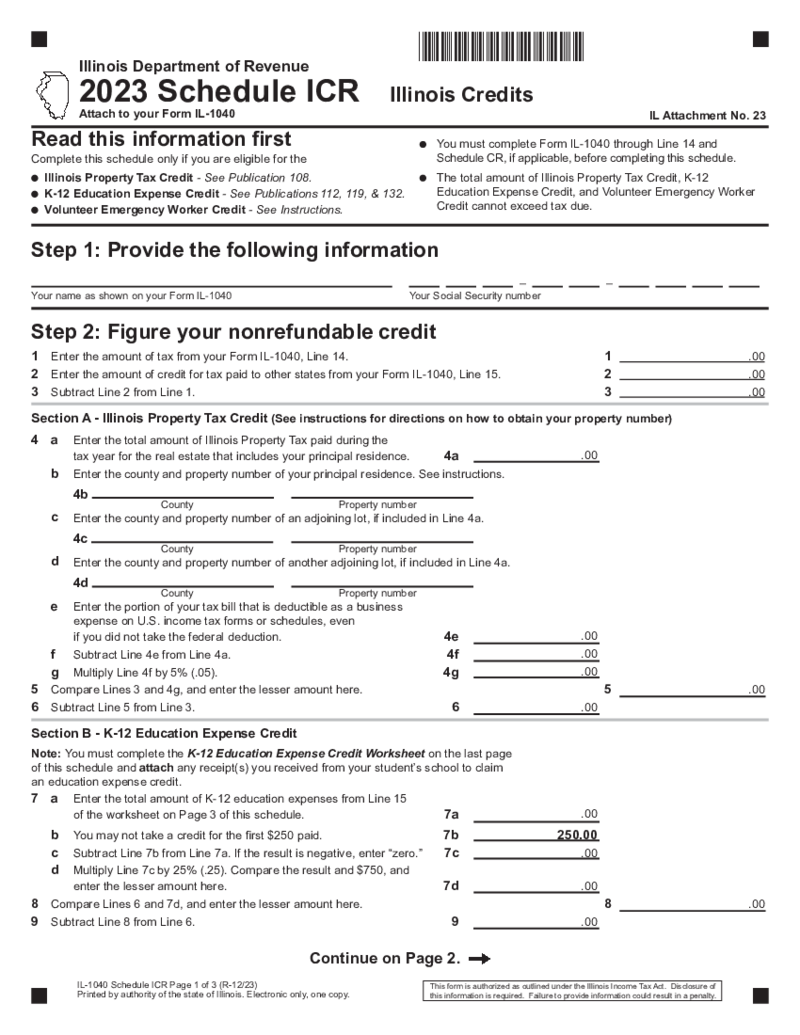

Illinois Schedule ICR

What Is Illinois 1040 Schedule ICR?

Regarded as the Illinois credit for the Senior Citizen, the Illinois Schedule ICR is primarily used to figure the tax credits available to residents of Illinois. For seniors looking to reduce their tax liabilities, this

Illinois Schedule ICR

What Is Illinois 1040 Schedule ICR?

Regarded as the Illinois credit for the Senior Citizen, the Illinois Schedule ICR is primarily used to figure the tax credits available to residents of Illinois. For seniors looking to reduce their tax liabilities, this

-

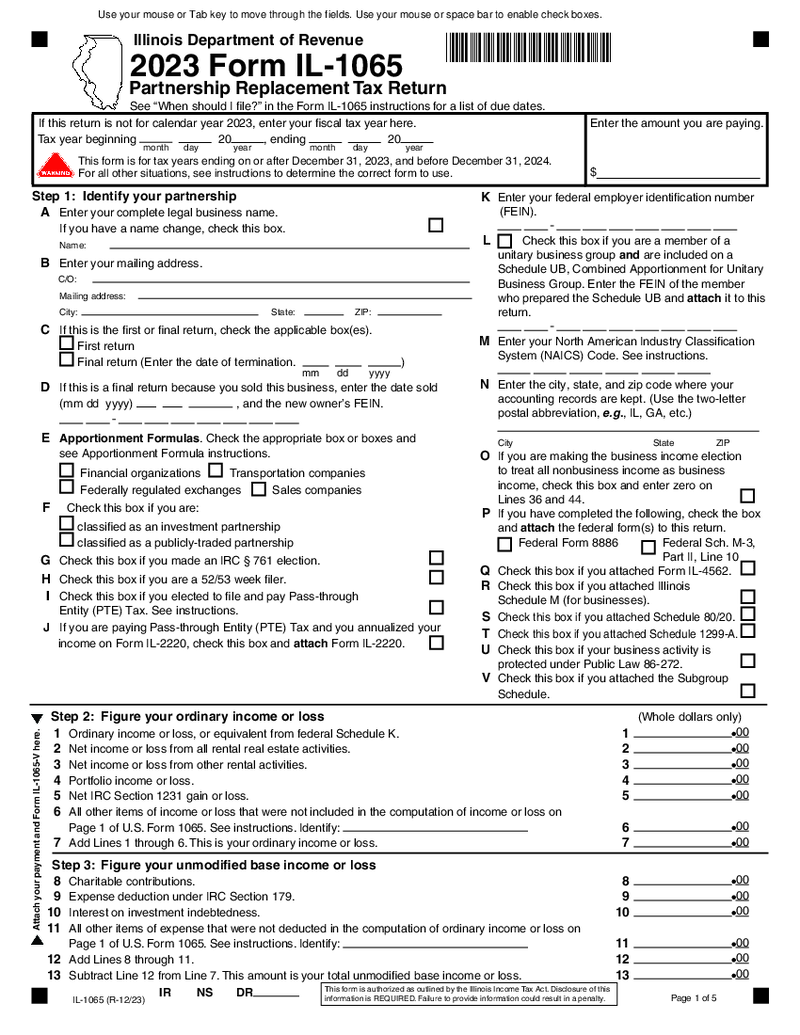

Form IL-1065 (2023)

How to Redact and Fill Out Form IL-1065 Online in 2023?

To redact and fill out Illinois form il-1065 online, you will need to follow these steps:

Obtain a copy of Form IL-1065: This form is used by partnerships to report their income, ga

Form IL-1065 (2023)

How to Redact and Fill Out Form IL-1065 Online in 2023?

To redact and fill out Illinois form il-1065 online, you will need to follow these steps:

Obtain a copy of Form IL-1065: This form is used by partnerships to report their income, ga

-

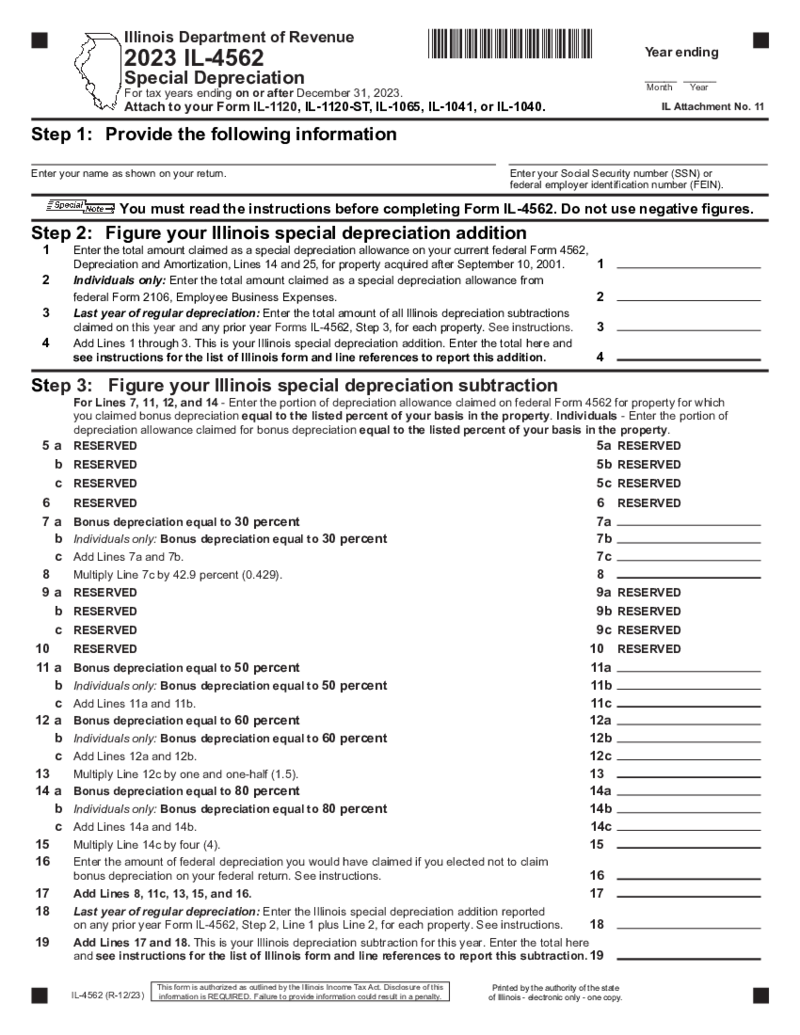

Form IL-4562

What Is Form IL-4562?

Form IL-4562, often referred to as the Special Depreciation, is a tax document used by Illinois taxpayers to claim additional depreciation for certain property. It provides the means to report the special depreciation allowance and I

Form IL-4562

What Is Form IL-4562?

Form IL-4562, often referred to as the Special Depreciation, is a tax document used by Illinois taxpayers to claim additional depreciation for certain property. It provides the means to report the special depreciation allowance and I

-

IL-501 Illinois Payment Coupon and Instructions

What Is the IL 501 Payment Coupon?

The IL form 501 is a pivotal tax document utilized by businesses in Illinois to make monthly payments for withholding income taxes. Businesses under the jurisdiction of the Illinois Department of Revenue are required to

IL-501 Illinois Payment Coupon and Instructions

What Is the IL 501 Payment Coupon?

The IL form 501 is a pivotal tax document utilized by businesses in Illinois to make monthly payments for withholding income taxes. Businesses under the jurisdiction of the Illinois Department of Revenue are required to

-

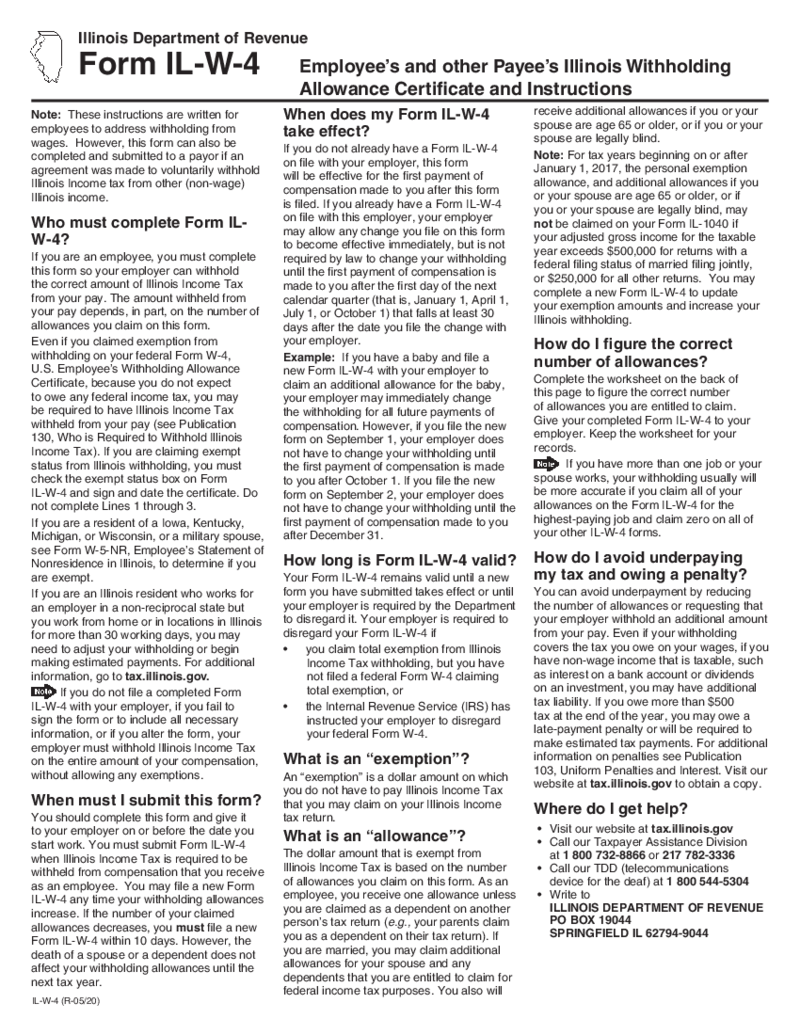

IL-W-4 - Illinois Employees and other Payees Withholding Allowance Certificate

What Is the IL W-4 Form 2023?

The form IL W-4 is an essential document for employees and other payees across the state of Illinois. It's a withholding allowance certificate that informs employers of the amount of state income tax to withhold from a pa

IL-W-4 - Illinois Employees and other Payees Withholding Allowance Certificate

What Is the IL W-4 Form 2023?

The form IL W-4 is an essential document for employees and other payees across the state of Illinois. It's a withholding allowance certificate that informs employers of the amount of state income tax to withhold from a pa

-

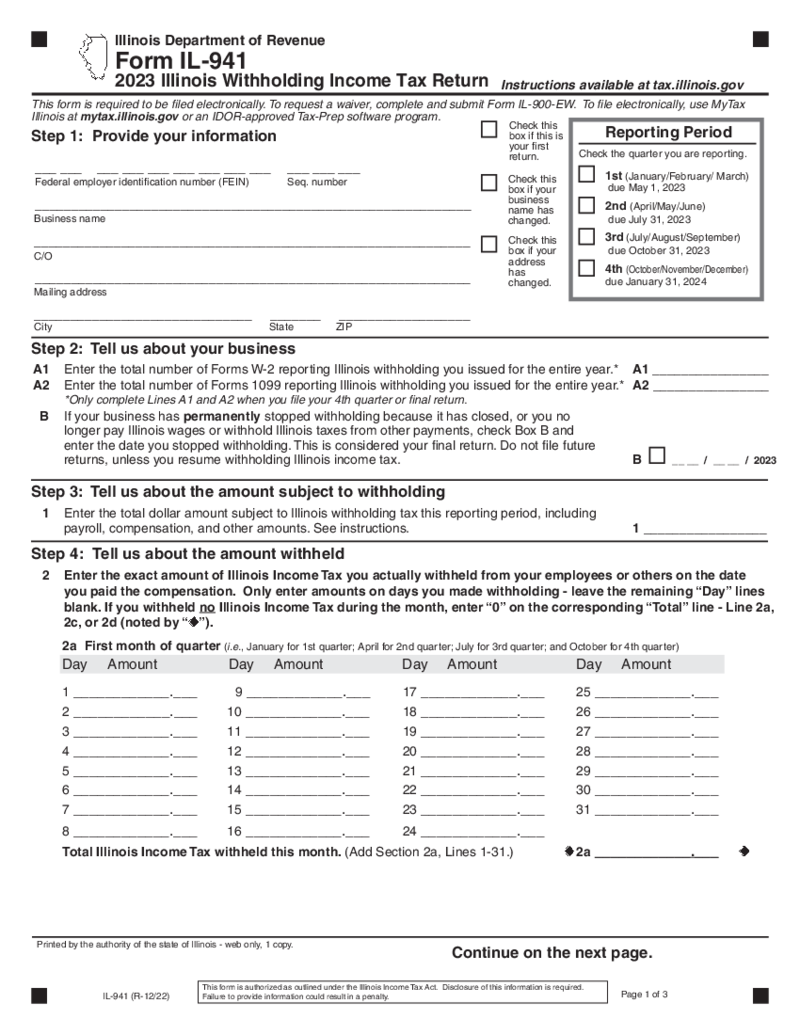

Illinois Form 941

Overview: State of Illinois Form 941

The Illinois 941 form is designed to report the amount of taxes withheld from employee wages. It includes federal income tax deductions, and social security and Medicare taxes. As a business owner or employer in Illino

Illinois Form 941

Overview: State of Illinois Form 941

The Illinois 941 form is designed to report the amount of taxes withheld from employee wages. It includes federal income tax deductions, and social security and Medicare taxes. As a business owner or employer in Illino

-

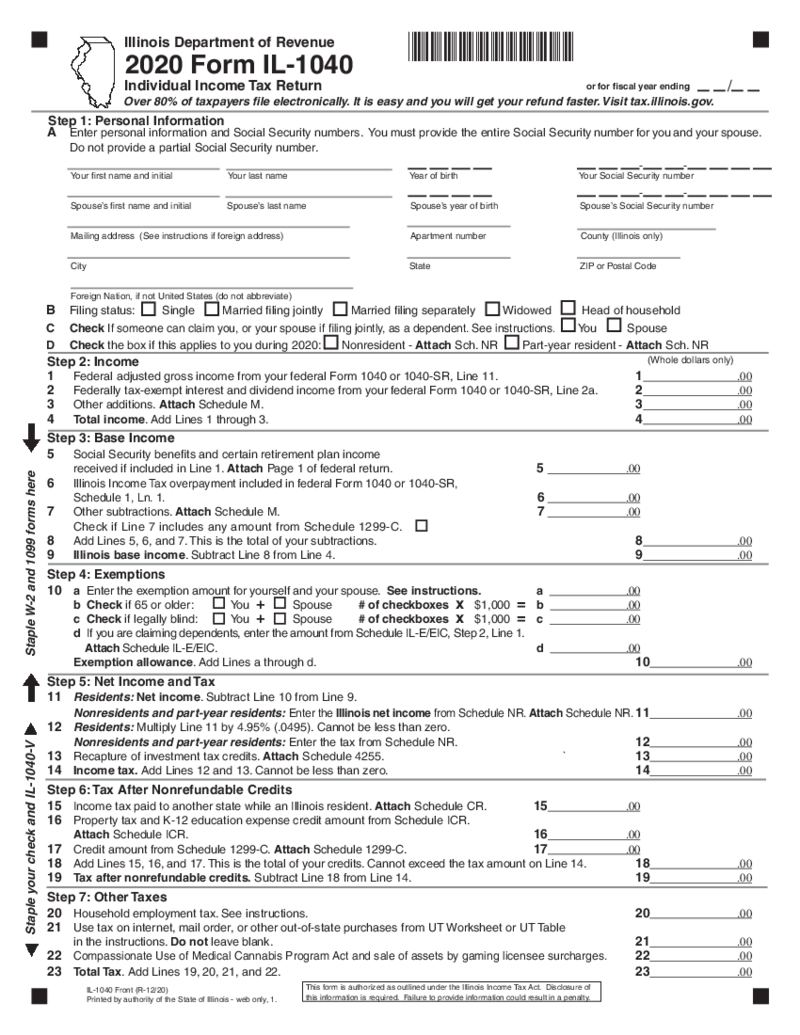

Form IL-1040 (2020)

How Do I Acquire Fillable Form IL-1040 (2020)?

Find the blank document in the PDFLiner documents library. Either push the "Fill this form" button or follow the steps below in case you need to find the form on our website letter:

Form IL-1040 (2020)

How Do I Acquire Fillable Form IL-1040 (2020)?

Find the blank document in the PDFLiner documents library. Either push the "Fill this form" button or follow the steps below in case you need to find the form on our website letter:

FAQ:

-

When can I file an Illinois state tax return?

There is a strict deadline for when you can send the form. It is better to wait till the end of the financial year before you can calculate your income and taxes. You have to follow the deadline indicated inside the document or you will be fined.

-

How do I know if I need to file an Illinois tax return?

If you have no idea whether you need to complete and send an Illinois tax return, it is better to go to the official website. Ask the support team that is available there describing your specific case. Sometimes taxpayers don’t need to fill out the form for the year.