-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Illinois Tax Form 1040 Schedule G

Get your Illinois Tax Form 1040 Schedule G in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Explaining Illinois Tax Form 1040 Schedule G: A Guide

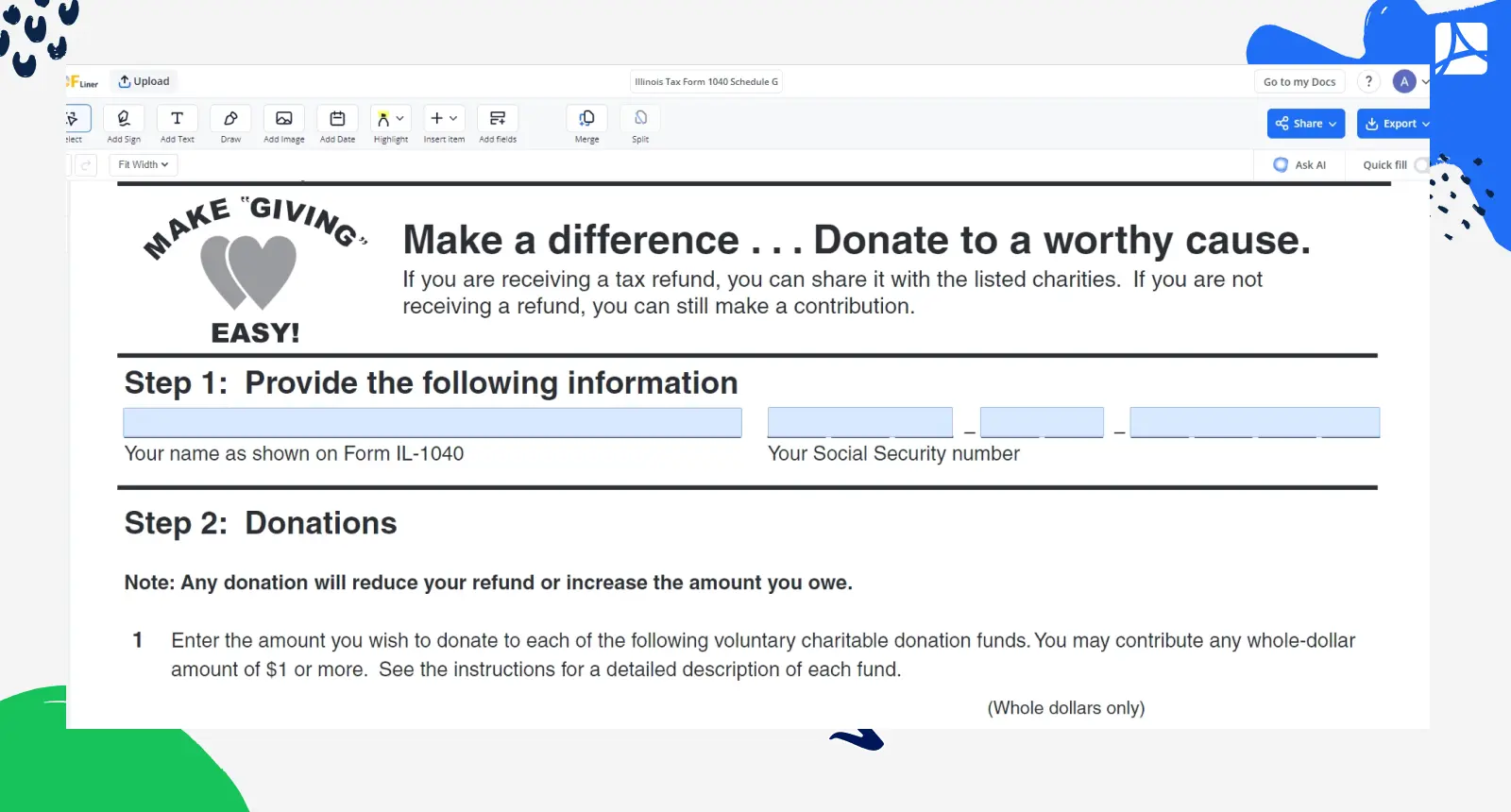

Understanding tax forms can often be a daunting task. Illinois Tax Form Schedule G is one such form that may initially seem complex but serves a noble purpose. This article aims to demystify this specific schedule for Illinois taxpayers, focusing on its intent, components, and how to properly fill it out.

Definition and Purpose of the Form

Illinois Schedule G form is crafted to facilitate voluntary charitable contributions directly from your tax return. It's specifically designed to allow taxpayers to donate to various state-supported charities, including wildlife preservation, Alzheimer's research, and support for the homeless. This schedule streamlines the process, making philanthropy an integral part of your tax filing experience.

When is it Required to be Filed?

Filing the Schedule G Illinois form is optional and entirely at the taxpayer's discretion. If you wish to donate to any of the listed charitable funds through your state tax return, including Schedule G with your IL-1040 form is necessary. It is filed alongside your regular tax return before the deadline, which is typically April 15th.

How to Fill Out the Form

The Illinois Department of Revenue provides comprehensive instructions with the IL Schedule G, guiding taxpayers on how to designate their charitable contributions, including specific details about each fund and how to allocate your donations effectively. Filling out the IL 1040 Schedule G requires attention to detail.

To correctly fill out the il schedule g, follow these steps:

Step 1: Review the list of qualified contribution funds and decide which ones to support.

Step 2: Enter the whole dollar amount you wish to donate to each selected fund next to the corresponding line items (1a-1g).

Step 3: Calculate the total amount of your donations across all selected funds and record this on Line 2.

Step 4: Transfer the total contribution amount from Line 2 to your main Form IL-1040, Line 34.

Remember, each contribution must be in whole dollars, and the minimum contribution is $1 or more for each fund.

Important Details to Keep in Mind

When contributing through 1040 Schedule G, it’s crucial to remember your contributions are:

- Irrevocable: Once submitted, you cannot amend the form to alter contributions.

- Voluntary: There is no obligation to contribute, and the decision to do so will not impact your tax liabilities or return amount.

By following this guide, taxpayers can navigate the complexities of IL Schedule G, ensuring their contributions to the causes they care about are correctly processed.

Form Versions

2022

Illinois Tax Form 1040 Schedule G (2022)

Fillable online Illinois Tax Form 1040 Schedule G