-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

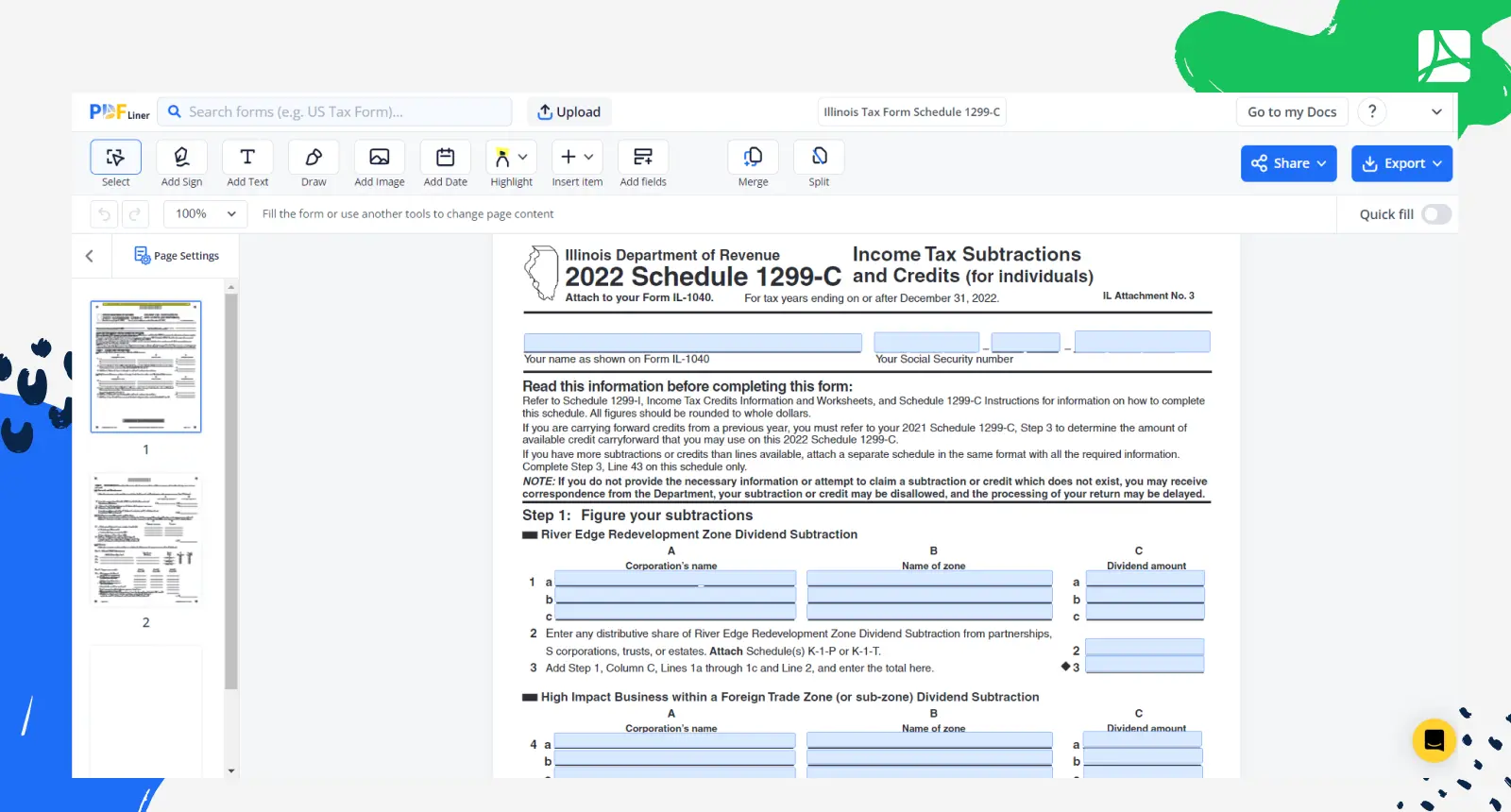

Illinois Tax Form Schedule 1299-C

Get your Illinois Tax Form Schedule 1299-C in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is the Illinois Form 1299 C?

Form 1299 C is a tax schedule exclusive to the state of Illinois. It is required by residents who want to claim credits on their income tax. These credits may include property tax, education expense, or earned income credits. By correctly filling out this form, taxpayers may substantially decrease their tax obligations.

Understanding the Illinois income tax form 1299 C

The Illinois state tax form 1299 C is divided into several parts, each with its own specific function. Part A deals with nonrefundable credits, for instance, your River Edge Redevelopment Zone Investment Credit or your Property Tax Credit. Part B, on the other hand, handles your refundable credits, like your Earned Income Credit. The form even includes a section where you can dictate how your refund, if any, will be distributed.

How to Fill Out the Illinois Tax Form 1299 C

The key question is: how to fill out this Illinois form? Here are some general steps to get you started:

- Start by filling out the "Taxpayer information" section at the top of the form, with the "Identification Number" slot referring to your social security number (SSN).

- Next, if applicable to you, fill out the "River Edge Redevelopment Zone Dividend Subtraction" section. You will need to supply the name of your corporation ("Corporation's name"), name of the specific zone ("Name of zone"), and the dividend amount ("Dividend amount").

- Proceed to the "High Impact Business within a Foreign Trade Zone (or sub-zone) Dividend Subtraction" section. As before, you will need to provide details like your corporation's name, the relevant zone, and the dividend amount.

- If you earned any of these income tax credits during your current tax year, complete the 'Worksheets' section. Here, provide information about your tax earnings and calculate accordingly.

- Move to the "Adopted Child Information" part of the form. If it does not apply to you skip this step. If it does, you'll need to provide personal details about your adopted child like their name, date of birth, and SSN.

- At this point, you're ready to tackle the "Figure your credit" section. This will involve some calculations based on previous sections, as you need to subtract any dividends you received from your total tax income to derive your credit amount.

- Finally, complete the "Figure your Income Tax Credit" section. This requires calculations based on information from previous parts of the form. Follow the instructions carefully to calculate your due tax.

- Make sure all the information you provide is correct. Afterward, you may save the form, download it, print or share it.

Tips for completing the Illinois tax form schedule 1299-C

One pro-tip when dealing with the Illinois state tax form 1299 C is to keep genuine and well-defined records throughout the year. This not only helps to authenticate your claims but also aids in ensuring that you’ve maximized every possible credit. Secondly, don’t hesitate to ask for professional guidance if you’re unsure about certain aspects of the form. Specialized tax advisors can help you navigate any uncertainties and fill in the form correctly.

Form Versions

2022

Illinois Tax Form Schedule 1299-C (2022)

Fillable online Illinois Tax Form Schedule 1299-C