-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

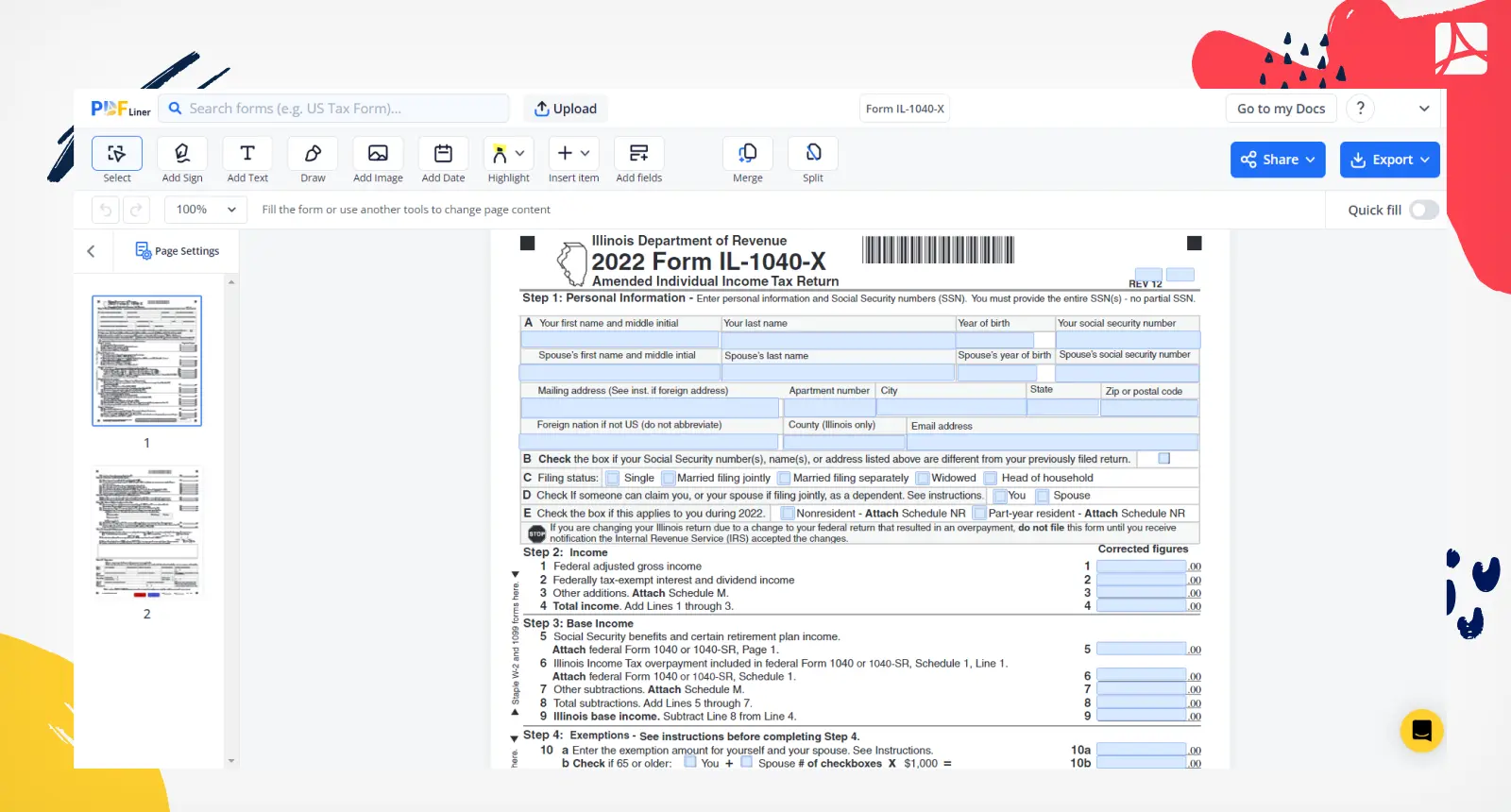

Form IL-1040-X

Get your Form IL-1040-X in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form IL 1040 X?

Fundamentally, form IL 1040 X is used to rectify any misinterpretations or inaccuracies made in the original tax filing process. This implies when an adjustment to your income, credit, or deduction must be made, this form springs into action. It guides taxpayers in detailing the adjustments made, ensuring the corrected figures match the state's financial records.

Importance of Il-1040-X form

We're all human and mistakes happen, even when dealing with important documents like tax forms. This is where the IL-1040-X form comes into play. This special form, designed by the Illinois Department of Revenue, is specifically created to rectify those errors made during the tax filing process. However, you should always endeavor to accurately complete your initial document, so you don't find yourself in need of this amendment form.

How to Fill Out Il-1040-X Form

Filling in an IL-1040-X form may seem complicated, but with a little understanding, it doesn't have to be. Here is a step-by-step process on how this can be done:

- Start by filling in your personal information. Beginning with your first name and middle initial, continue on to your last name, year of birth, and Social Security number.

- Continue by filling in the spouse's information if applicable. This includes the spouse's first name, middle initial, last name, birth year, and Social Security number.

- Proceed by entering your mailing address, including your apartment number, city, state, and zip or postal code. Make sure to also provide your email address.

- Next, you'll need to fill in the corrected figures for your income. Input the adjusted amounts for income that have changed or were omitted in your original tax report. Ensure that each correction is accurate, as any inaccuracy can lead to penalties.

- Right after, you'll need to fill in the corrected figures for your base income in the space provided. This involves entering the adjusted gross income amounts.

- Then, input the corrected figures for exemptions. The total number of exemptions you're claiming might have been adjusted from the original tax report you designed.

- The next section involves filling in the corrected net income and tax figures. Any changes in your tax calculations should be adjusted correctly here.

- In the section marked "Tax After Nonrefundable Credits," make the necessary adjustments if the total tax after non-refundable credits has changed.

- Continue by updating the figures on "Other Taxes". Adjust these numbers only if necessary based on tax credits, offsets, or changes in your taxable amount.

- In "Payments and Refundable Credit," enter the corrected total amounts of all your payments and credits.

- Proceed to "Corrected Overpayment or Underpayment" and provide the corrected details based on your calculations.

- For "Adjusted Refund or Amount You Owe," you must provide the adjusted figure based on the above recalculations.

- Proceed to the "Amended Information" section and make sure to provide all the necessary explanations for each correction made.

- In the signature section, enter your signature and date, then your spouse’s signature and date, if applicable, followed by your daytime phone number.

- If you used the help of a paid preparer, fill in their relevant information in the "Paid Preparer Use Only" section. This includes the preparer's name, signature, date, PTIN, employment status, and firm's contact information.

- Lastly, if you want a third party to discuss your return with the IRS, provide their name and phone number in the "Third Party Designee" section.

Who should file the Illinois form 1040 X?

Several types of people may need this completed form, but all of them must previously file an IL-1040 state tax return form:

- Those suspecting errors on their already filed tax return.

- People who have amended their federal return and this change will affect their state return.

- Individuals with IRS changes to their federal return post-filing will also impact the state return.

Form Versions

2022

IL-1040-X (2022)

Fillable online Form IL-1040-X