-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

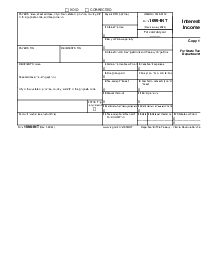

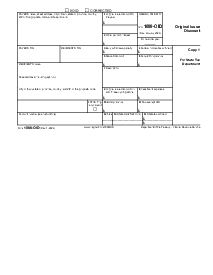

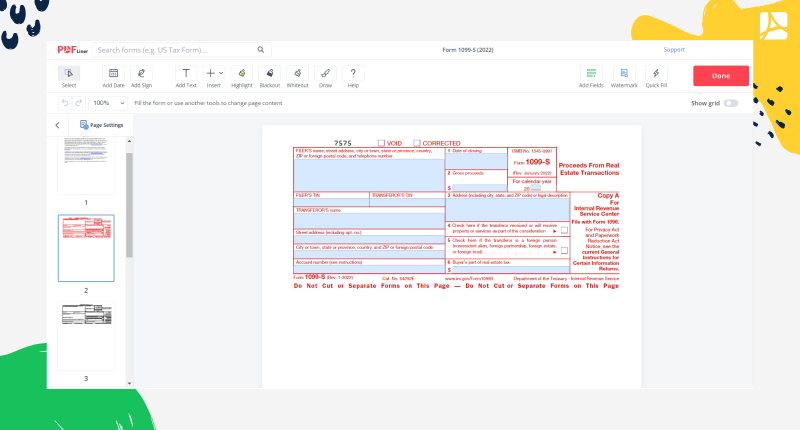

Form 1099-S (2023)

Get your Form 1099-S (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1099-S 2026?

The 1099-S is filed for reporting proceeds from a sale or exchange of real estate. It allows reporting total income from any residential real estate business, including sales, exchanges, interest, as well as timber. People who are responsible for closing transactions should fill out this fillable blank. The file includes information about both the filer and transferor.

What Is a 1099-S Form Used For?

- To inform the Internal Revenue Service about the sale or exchange of the particular type of real estate, including inherited property. They don’t cover residence if you got a certification from the seller.

- To report involuntary conversion. If the building can be confiscated, or it’s in danger of condemnation or requisition, you should submit the form.

- If you need to report the number of timber royalties payments.

How to Fill Out IRS Form 1099-S?

What is 1099-S used for? Since it’s an additional tax blank you file with other IRS documents, it doesn’t include many sections.

- Start with the filer’s information. Write the filer’s data in the first field, and indicate a TIN below.

- Then add the transferor’s TIN, name, and address. The account number is required if you file several examples of Form 1099-S for one recipient.

- Write the information about a property. Indicate the date of closing of the agreement and gross proceeds. Write down the address of the property or its legal description.

- Note the buyer’s part of the tax.

- This printable blank doesn’t require any signature, so currently, you have this document filled out.

When I Have to Report 1099-S?

According to the IRS calendar, the party responsible for filing the blank must provide it when submitting an individual tax return no later than March 31.

Organizations That Work with 1099-S

Internal Revenue Service (IRS).

Related to 1099-S Resources

Form Versions

FAQ: Let’s Go Through Popular Questions

-

Do S corps get 1099?

No, corporations do not receive these forms. It does not matter whether they are C or S corporations, 1099 forms do not require for them.

-

Where should report the 1099-S on Form 1040?

-

Do you have to pay taxes on 1099-S?

Yes, because the form is used for reporting the non-employment income. You must submit this information to the IRS to deduct taxes from the gross amount received out transactions.

-

Where do I report form 1099-S on my tax return?

The form 1099-S is reported on the tax return in the section for capital gains and losses.

-

Who issues form 1099-S?

The 1099-S certification exemption form is issued by the settlement agent when a property is sold. It should be filled out by the seller and given to the buyer at closing.

-

Who must file form 1099-S?

The seller of a piece of real estate must file form 1099-S on behalf of the buyer.

Fillable online Form 1099-S (2023)