-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Illinois Tax Forms - page 3

-

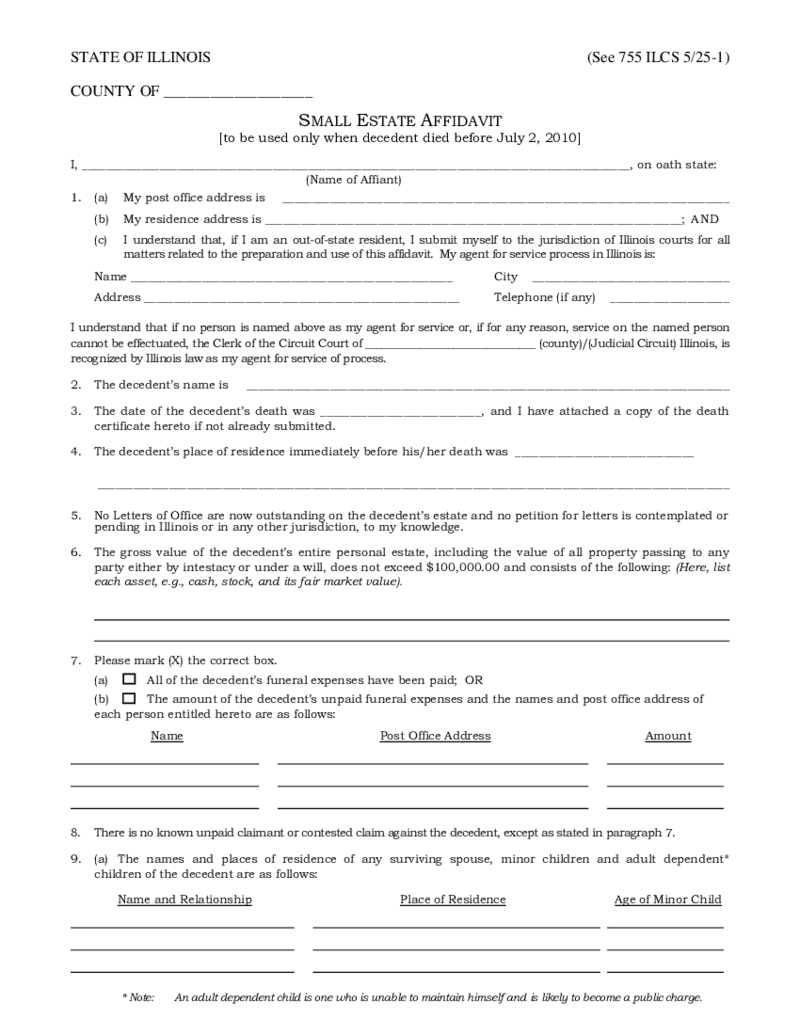

Illinois Small Estate Affidavit Form 2015-2021

What Is Illinois Small Estate Affidavit Form

The Illinois Small Estate Affidavit Form is a legal document that allows for the expedited transfer of assets from a deceased person's estate to their rightful heirs or beneficiaries. This

Illinois Small Estate Affidavit Form 2015-2021

What Is Illinois Small Estate Affidavit Form

The Illinois Small Estate Affidavit Form is a legal document that allows for the expedited transfer of assets from a deceased person's estate to their rightful heirs or beneficiaries. This

-

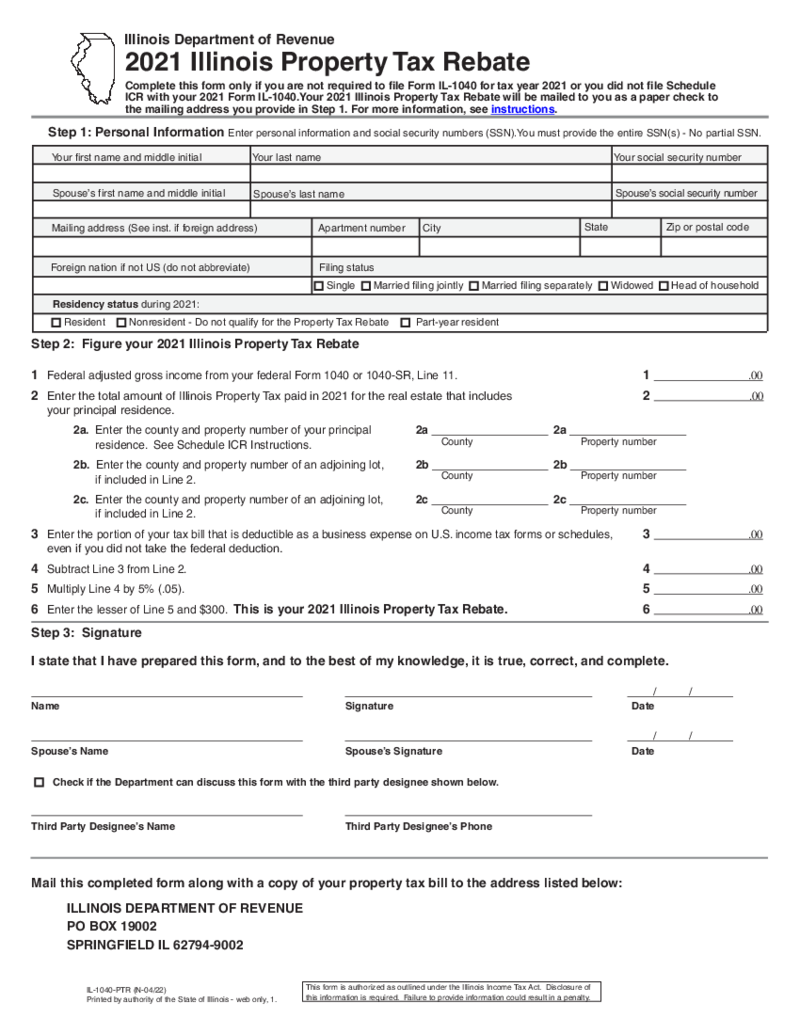

Form IL-1040-PTR

What Is the Illinois Property Tax Rebate?

Property tax rebates Illinois offer is an effort by the state government to ease the burden on homeowners. This allows them to claim back a portion of their paid property taxes. To be eligible, you must be a resid

Form IL-1040-PTR

What Is the Illinois Property Tax Rebate?

Property tax rebates Illinois offer is an effort by the state government to ease the burden on homeowners. This allows them to claim back a portion of their paid property taxes. To be eligible, you must be a resid

-

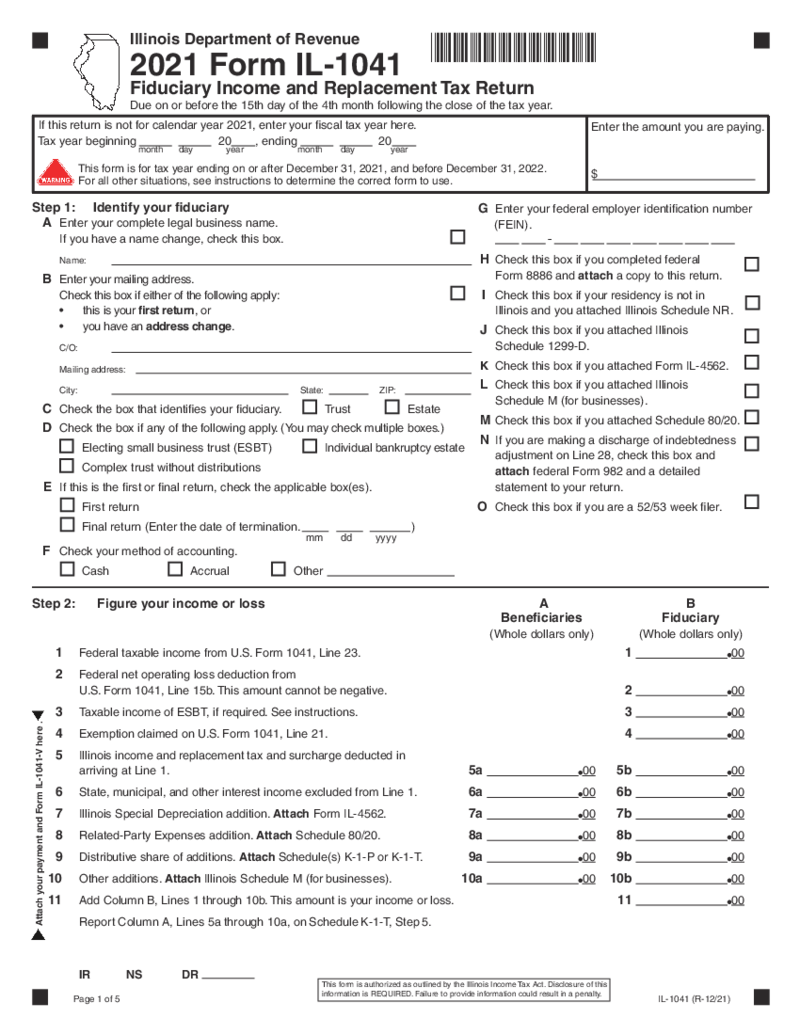

Form IL-1041

How Do I Get Form IL-1041 Online?

Find the blank document in the PDFLiner documents library. Begin by clicking the "Fill this form" button or use the step-by-step instructions below to obtain the document letter:

Log In to your

Form IL-1041

How Do I Get Form IL-1041 Online?

Find the blank document in the PDFLiner documents library. Begin by clicking the "Fill this form" button or use the step-by-step instructions below to obtain the document letter:

Log In to your

-

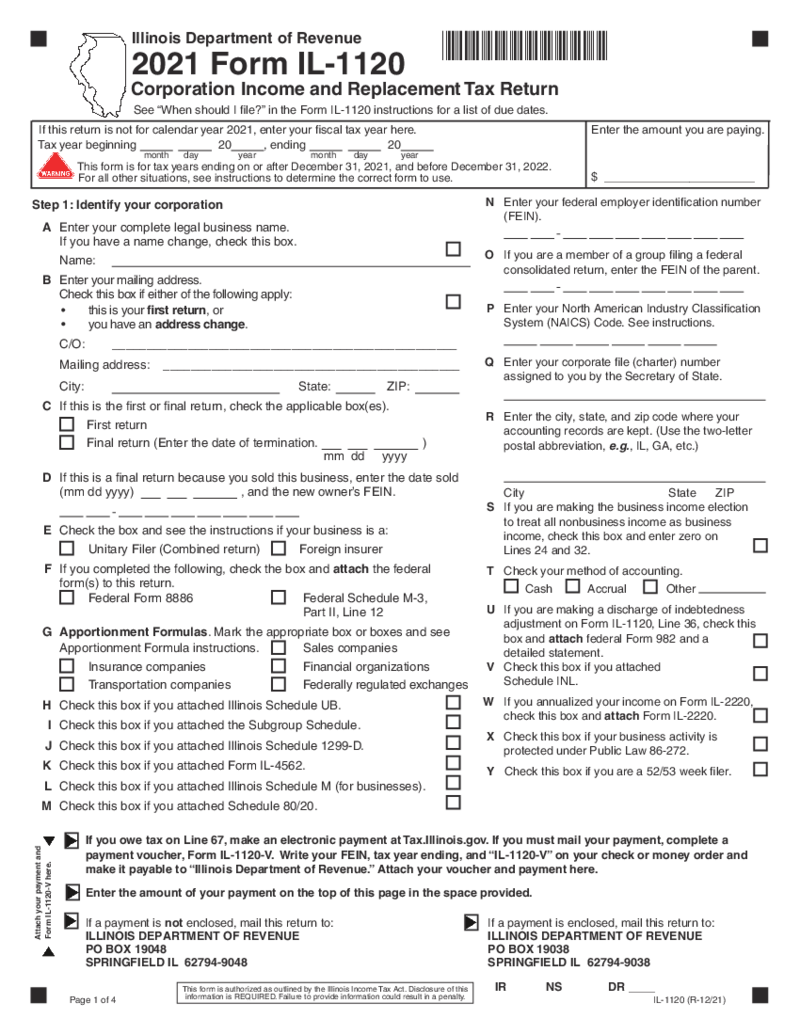

Corporation Income and Replacement Tax - IL-1120

What Is the IL Form 1120?

This is the State of Illinois Corporation Income and Replacement Tax Return form. Essentially, the IL Form 1120 is designed to determine a corporation's tax liability for the year. This form applies to all corporations c

Corporation Income and Replacement Tax - IL-1120

What Is the IL Form 1120?

This is the State of Illinois Corporation Income and Replacement Tax Return form. Essentially, the IL Form 1120 is designed to determine a corporation's tax liability for the year. This form applies to all corporations c

-

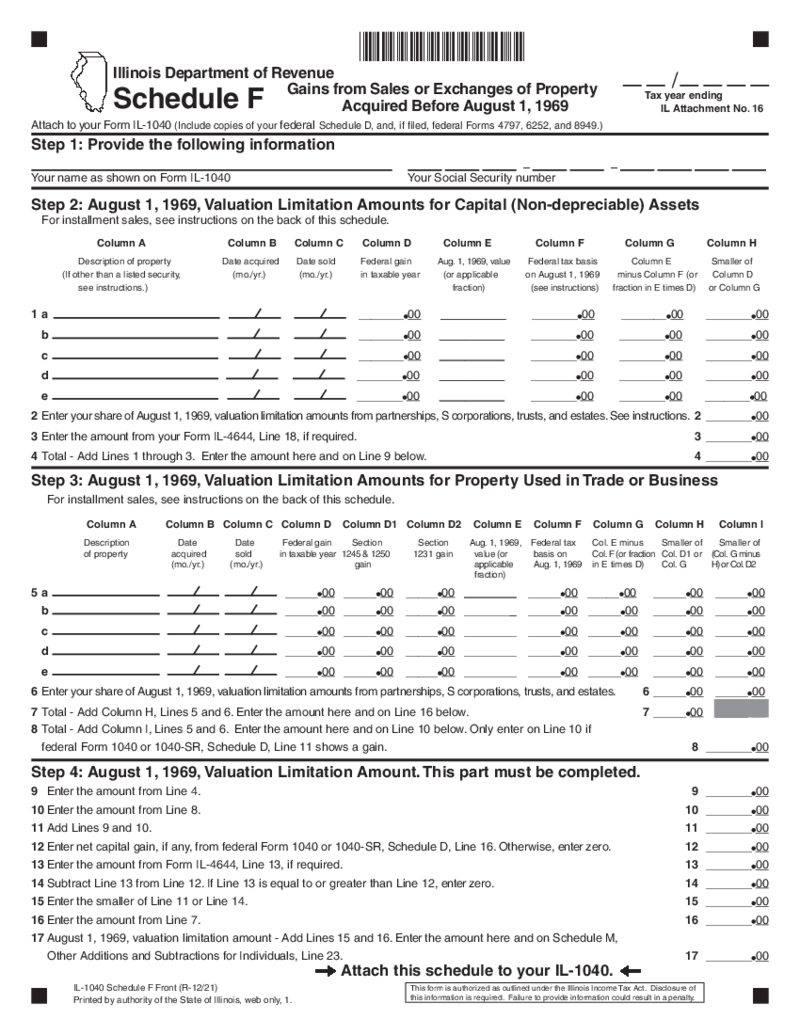

Illinois Tax Form 1040 Schedule F

What Is A Schedule F Tax Form?

Schedule F Tax Form is an integral part of IRS Form 1040 that farmers use to state income and expenditures related to their farming operations. The form allows farmers to calculate their net profit or loss for the year, prov

Illinois Tax Form 1040 Schedule F

What Is A Schedule F Tax Form?

Schedule F Tax Form is an integral part of IRS Form 1040 that farmers use to state income and expenditures related to their farming operations. The form allows farmers to calculate their net profit or loss for the year, prov

-

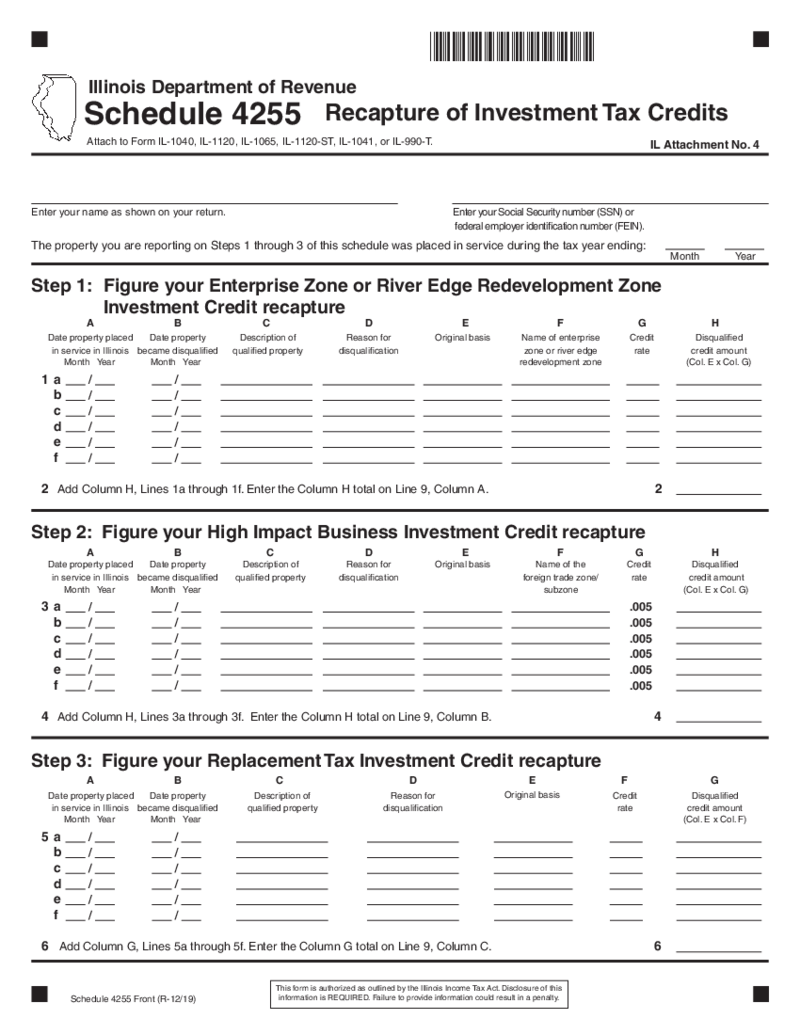

Illinois Tax Form Schedule 4255

What is Ilinois Tax Form Schedule 4255

Schedule 4255 Illinois is a critical document for taxpayers in the state who need to adjust their tax liabilities due to specific changes in their investment situations. It's primarily used for the recapture of v

Illinois Tax Form Schedule 4255

What is Ilinois Tax Form Schedule 4255

Schedule 4255 Illinois is a critical document for taxpayers in the state who need to adjust their tax liabilities due to specific changes in their investment situations. It's primarily used for the recapture of v

-

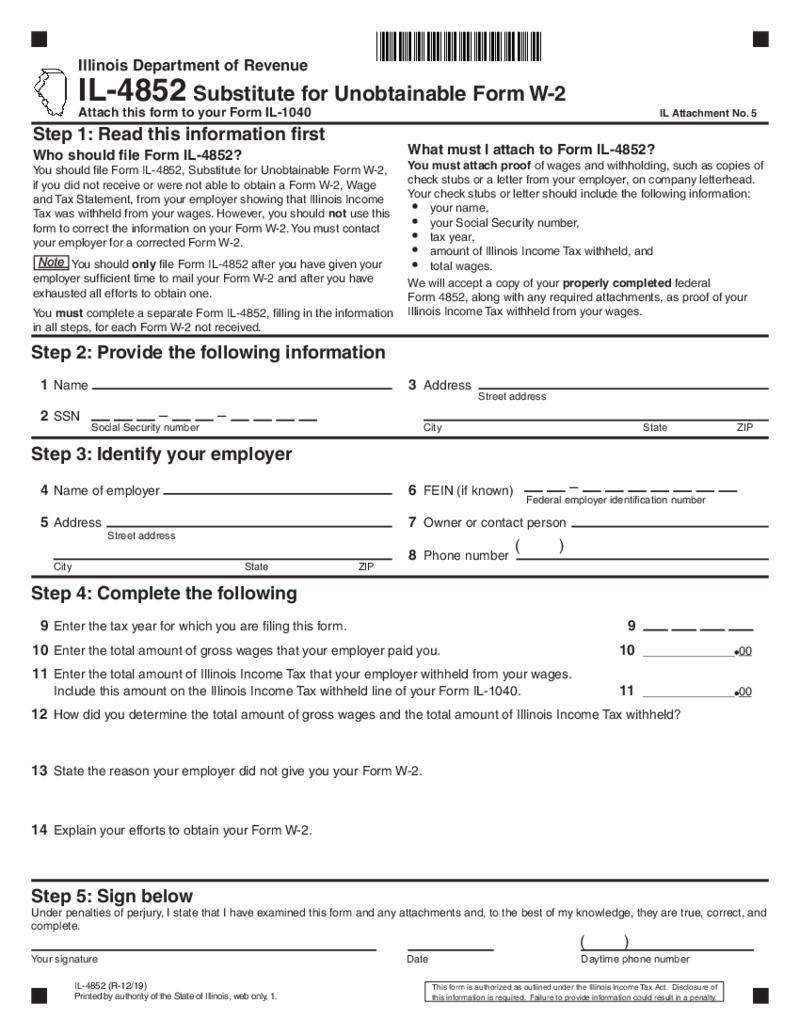

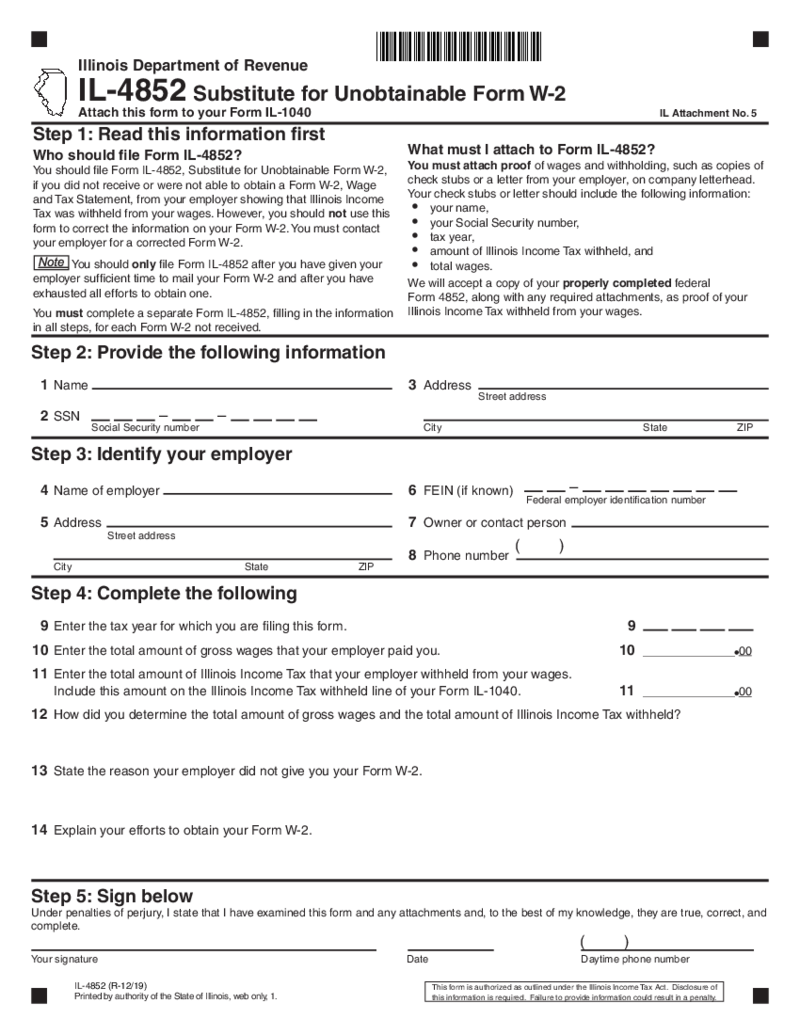

Form IL-4852

What Is a IL 4852 Form?

The Illinois Substitute for Unavailable Form W-2, W-2c, or 1099-R, also known as Form IL-4852, plays a critical role in the tax-filing process. This document serves as a stand-in for the W-2, W-2c, or 1099-R forms when the original

Form IL-4852

What Is a IL 4852 Form?

The Illinois Substitute for Unavailable Form W-2, W-2c, or 1099-R, also known as Form IL-4852, plays a critical role in the tax-filing process. This document serves as a stand-in for the W-2, W-2c, or 1099-R forms when the original

-

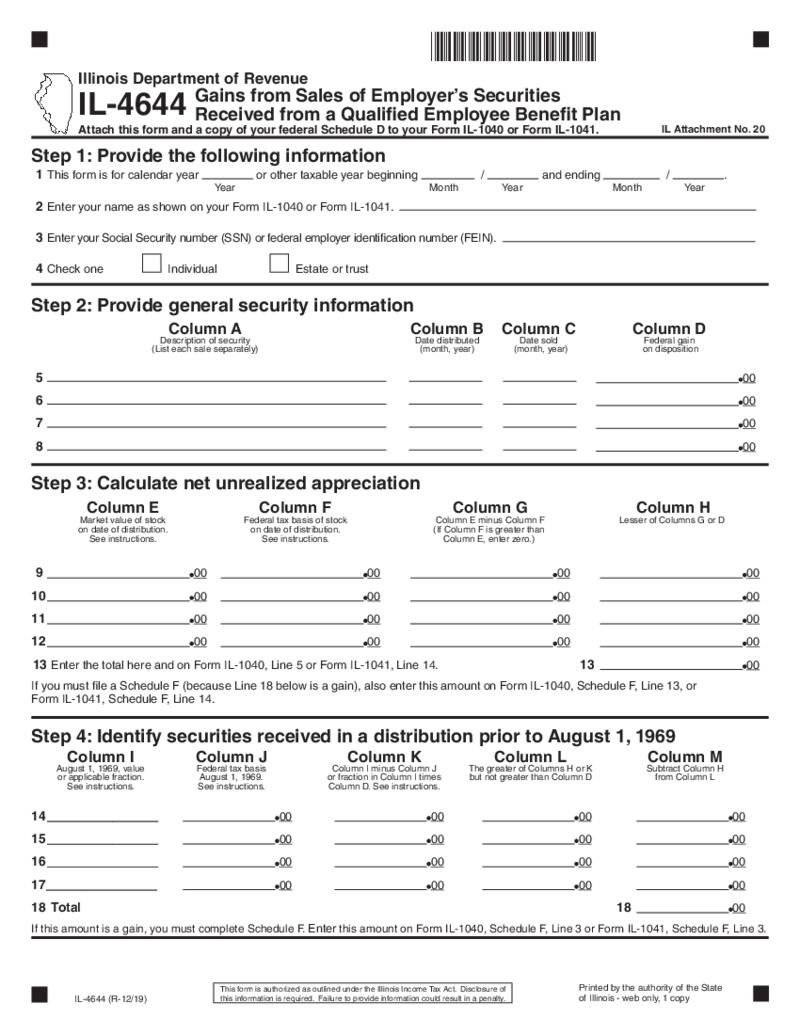

Form IL-4644

What Is IL-4644 Form?

IL-4644 Form, often referred to as the IL 4644 tax form, is specifically designed for certain transactions that involve the transfer of property within Illinois. It's a vital document used to report and pay the tax due on the pri

Form IL-4644

What Is IL-4644 Form?

IL-4644 Form, often referred to as the IL 4644 tax form, is specifically designed for certain transactions that involve the transfer of property within Illinois. It's a vital document used to report and pay the tax due on the pri

-

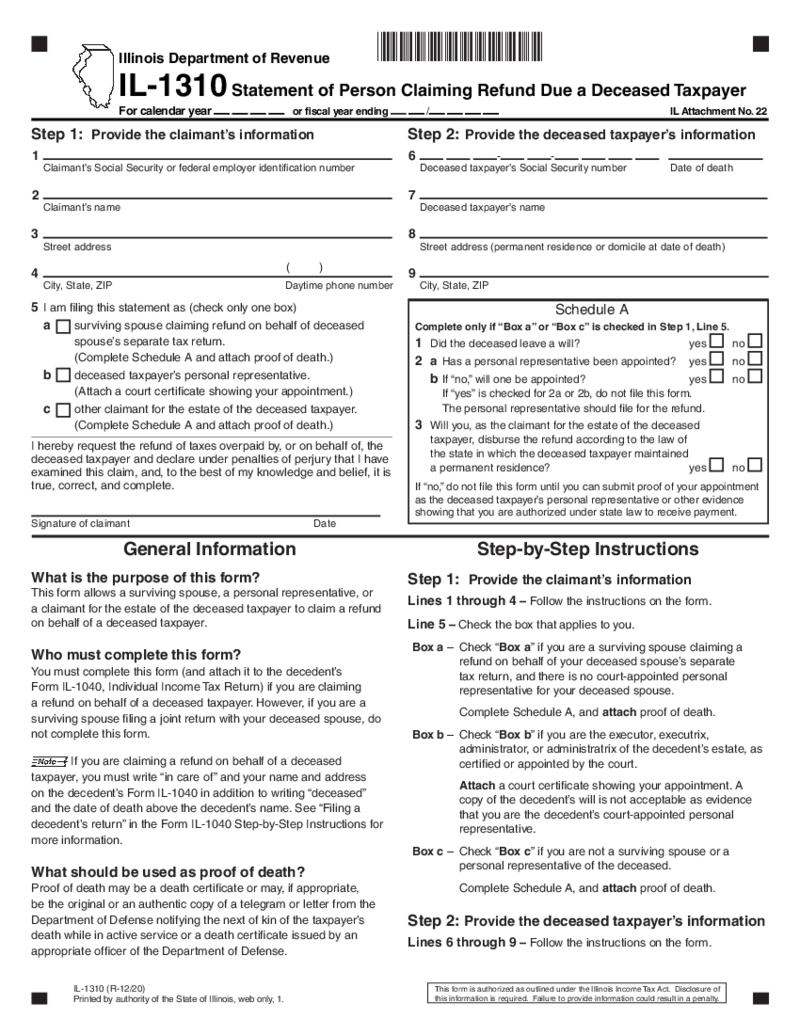

Form IL-1310

What Is IL 1310 Form?

IL 1310 Form, officially known as "Statement of Person Claiming Refund Due a Deceased Taxpayer," is specifically designed for claiming a tax refund on behalf of someone who has passed away. This form is required by the Illi

Form IL-1310

What Is IL 1310 Form?

IL 1310 Form, officially known as "Statement of Person Claiming Refund Due a Deceased Taxpayer," is specifically designed for claiming a tax refund on behalf of someone who has passed away. This form is required by the Illi

-

Illinois Form IL-4852

What is an IL-4852 form?

Form IL-4852 is used for filing with the revenue service as a replacement for Form W-2. This one-page blank can only be completed if you have not received your W-2. Form IL-4852 is filed along with your tax return, as well as pape

Illinois Form IL-4852

What is an IL-4852 form?

Form IL-4852 is used for filing with the revenue service as a replacement for Form W-2. This one-page blank can only be completed if you have not received your W-2. Form IL-4852 is filed along with your tax return, as well as pape

FAQ:

-

When can I file an Illinois state tax return?

There is a strict deadline for when you can send the form. It is better to wait till the end of the financial year before you can calculate your income and taxes. You have to follow the deadline indicated inside the document or you will be fined.

-

How do I know if I need to file an Illinois tax return?

If you have no idea whether you need to complete and send an Illinois tax return, it is better to go to the official website. Ask the support team that is available there describing your specific case. Sometimes taxpayers don’t need to fill out the form for the year.