-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

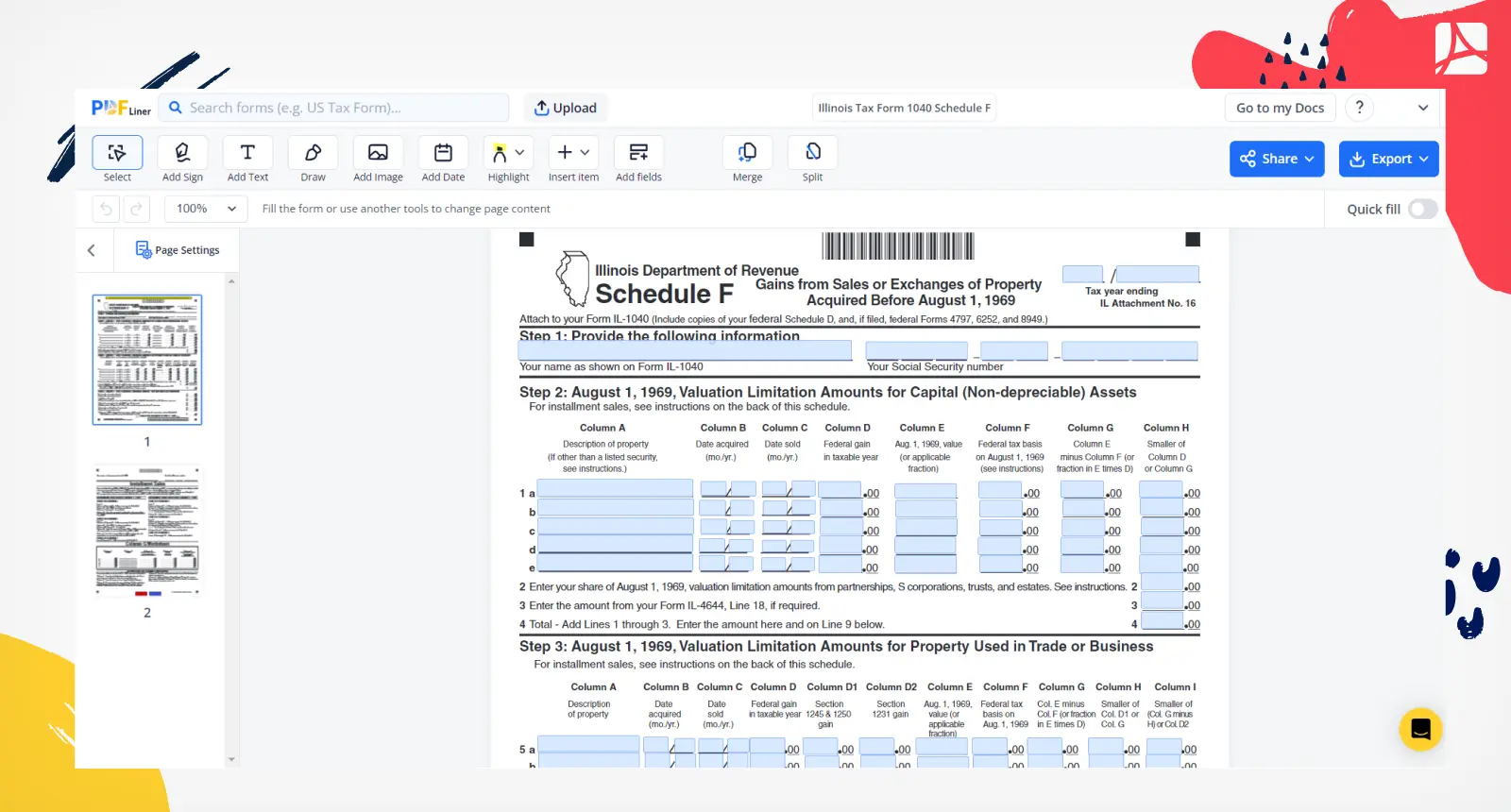

Illinois Tax Form 1040 Schedule F

Get your Illinois Tax Form 1040 Schedule F in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is A Schedule F Tax Form?

Schedule F Tax Form is an integral part of IRS Form 1040 that farmers use to state income and expenditures related to their farming operations. The form allows farmers to calculate their net profit or loss for the year, providing crucial data that can affect their income tax, self-employment tax, and deductible expenses for future years.

Using schedule F tax form with form 1040

The Schedule F form contributes to the total income or losses reported on the main tax form 1040. The federal tax form schedule F is integrated into your standard tax returns. It amounts recorded in Schedule F make a part of the final figure on your Form 1040, contributing to whether you owe more taxes or can expect a refund.

Guide to Fill Out the Tax Form 1040 Schedule F

Filling out this form may seem complex, but a simple step-by-step approach can make the process more manageable:

- Start with the section titled 'Your Name as shown on Form IL-1040'. Enter your full legal name in the provided space, ensuring that it matches the name on your IL-1040.

- Move to the next part, where you need to input 'Your Social Security Number'. Make sure to enter it correctly without any spaces or dashes.

- Scroll to the portion titled 'August 1, 1969, Valuation Limitation Amounts for Capital (Non-depreciable) Assets'. Here, provide the value of all your capital assets that aren't depreciating in the fields provided. Be honest and precise in your information input to avoid any legal issues.

- Proceed to the next portion marked 'August 1, 1969, Valuation Limitation Amounts for Property Used in Trade or Business'. Here, provide the value of all property you utilize for business or trade.

- Another section that requires your attention is 'August 1, 1969, Valuation Limitation Amount. This Part Must Be Completed'. This area is critical and should be adequately filled out with the value of your assets taking into account the valuation limitation.

- Scroll down to the 'Column G Worksheet' section. Here you'll input several figures, potentially involving complex calculations. This section is broken down into a table spanning lines 1 through 14, with each line representing different figures for your business incomes and expenses.

- Once you've filled out all individual section of the Illinois Tax Form 1040 Schedule F, ensure all information is correct and complete. Always double-check to prevent mistakes and inaccuracies that could cause trouble.

- Attach the completed Schedule F to your IL-1040 before submitting your tax return to the required State of Illinois tax department.

Remember, providing accurate and honest information is key when filling out tax forms. Always refer to your financial records and consult with a financial advisor or accountant if you are unsure or need assistance.

Why is the tax form Schedule F important?

The tax form Schedule F is particularly important for individuals who run farming or agricultural businesses. It is the tax form they use to report their farming income and expenses to the Internal Revenue Service (IRS). By properly completing and submitting Schedule F as part of their tax return, farmers ensure they accurately report their business's financial activity for the year.

Moreover, the form allows these taxpayers to take advantage of certain deductions specific to the agriculture industry, potentially reducing their taxable income. This accuracy in reporting and potential for decreased taxable income underscores the relevance and importance of the tax form Schedule F.

Fillable online Illinois Tax Form 1040 Schedule F