-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Illinois Tax Form Schedule 4255

Get your Illinois Tax Form Schedule 4255 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Ilinois Tax Form Schedule 4255

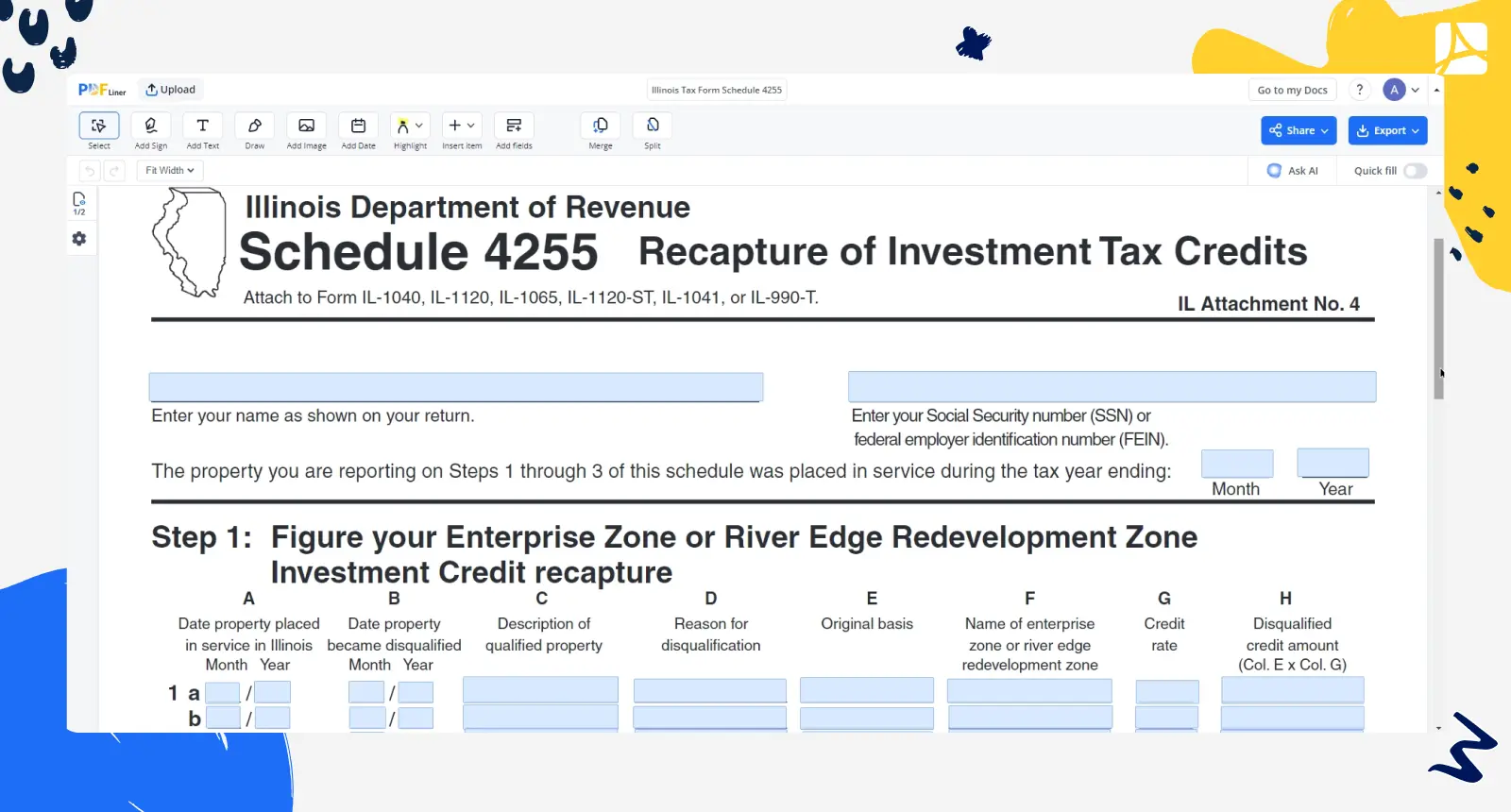

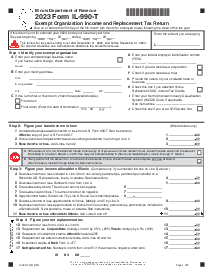

Schedule 4255 Illinois is a critical document for taxpayers in the state who need to adjust their tax liabilities due to specific changes in their investment situations. It's primarily used for the recapture of various investment tax credits previously claimed against Illinois income or replacement tax liabilities. If certain conditions are met, such as disqualification of property or investments initially qualifying for tax credits, taxpayers must file Schedule 4255 to recapture some of these credits.

Given the complexities involved, understanding how to properly complete and submit this form is crucial for maintaining compliance with Illinois tax laws.

How to Fill Out Schedule 4255 Illinois

Filling out Illinois Tax Schedule 4255 involves a step-by-step process to ensure all required information is correctly reported. The steps are as follows:

- Identify the Recapture Requirement: Determine whether you're required to recapture any specific tax credits, such as Enterprise Zone Investment Credit, River Edge Redevelopment Zone Investment Credit, or others listed in IL Schedule 4255 instructions.

- Complete the appropriate step based on the credit: Schedule 4255 is divided into steps relating to different tax credits. You must complete the step that matches the credit you're required to recapture. Each step involves filling out details about disqualified property.

- For Enterprise Zone or River Edge Investment Credits.

- For High Impact Business Investment Credits, and so on.

- Provide Detailed Property Information: For each item of disqualified property, enter the date it was placed into service, the disqualification date, a description, the reason for disqualification, and its basis for the computation of the investment credit.

- Calculate Recapture Amounts: Utilize the provided formula or percentage in each step to calculate the recapture amount for each disqualified property item.

- Total Up the Recapture Amounts: Sum the calculated recapture amounts for each type of credit being recaptured and enter the totals in the designated lines.

- Include Additional Information if Required: If you're recapturing additional income tax credits (like Angel Investment Credits), complete Step 6 with the total claimed amount to be recaptured based on specific events triggered within the tax year.

It's imperative to go through the form thoroughly and attach it to your Illinois tax return. Remember, if you're amending credits from multiple years or types, you might need to attach multiple Schedules 4255.

Submission Deadlines and Address

The submission deadline for IL tax Schedule 4255 aligns with your Illinois state tax return due date, typically April 15, unless extended.

Regarding where to send Schedule 4255, it should be attached and submitted along with your Illinois tax return (IL-1040 for individuals, IL-1120 for corporations, etc.) to the Illinois Department of Revenue (IDOR). If filing electronically, follow the e-filing service guidelines for attaching additional schedules.

In conclusion, Illinois Tax Schedule 4255 plays a vital role in adjusting tax liabilities for those who had previously claimed certain investment tax credits. Proper completion and timely submission of the schedule are essential steps in ensuring compliance with state tax regulations while accurately reflecting changes in your tax situation.

Fillable online Illinois Tax Form Schedule 4255