-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

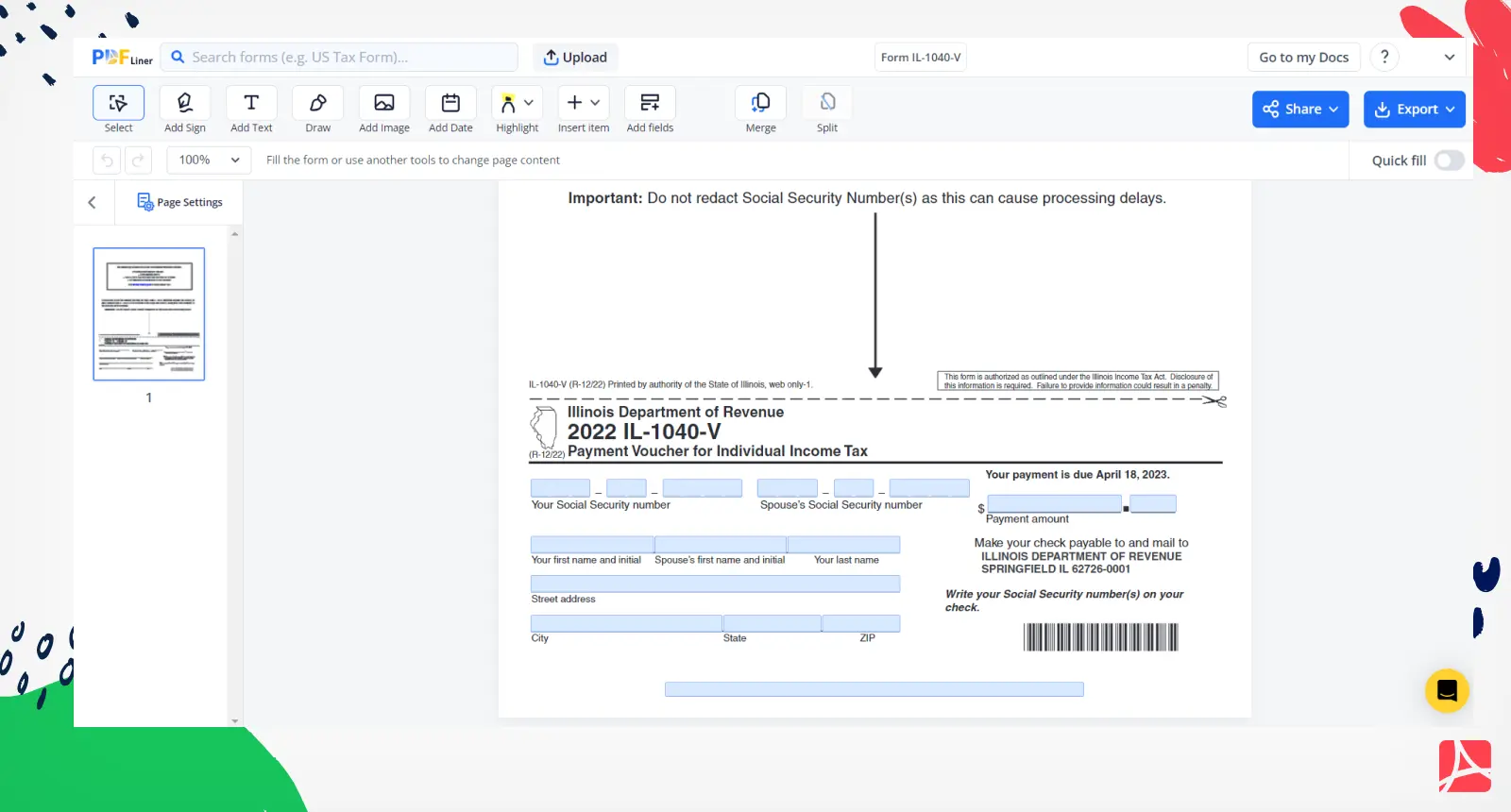

Form IL-1040-V

Get your Form IL-1040-V in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is IL 1040 V?

Understanding "IL-1040-V" is critical for those dealing with tax preparations, especially if you are an Illinois resident. This form, otherwise known as the Illinois Payment Voucher is a particular form used to make income tax payments if you owe taxes to the state.

Purpose of IL form 1040 V

This unique form, the IL 1040 V, is a payment voucher used by individual taxpayers residing in the state of Illinois. The Illinois Department of Revenue specifically designed this form to facilitate the payment of income tax.

Duties and obligations in form IL 1040 V

Taxpayers are obliged to fill this out if they owe taxes after completing the IL-1040 form, the standard Illinois income tax return. It's essential to know "how to fill out the form" accurately to avoid errors.

Completing the IL-1040-V Form

Filling out the IL 1040 V payment voucher template might seem a bit daunting, but with the right steps, it is quite straightforward. Here is a step-by-step guide on how to fill it out:

- Input Your Social Security Number: The first section of the IL-1040-V form requires you to input your SSN. You should be accurate when entering the numbers to prevent any possible mix-ups in the future.

- Enter Spouse’s Social Security Number: If you're married, the next step is to enter your spouse’s SSN. Even if you are filing separately, both you and your spouse's Social Security Numbers must be included.

- Provide Your First Name and Initial: In the third step, provide your first name and initial. Be sure to type them according to what is on your legal documentation to ensure accuracy and prevent confusion with future paperwork.

- Type in Spouse’s First Name and Initial: In the case of joint filing, you will need to write your spouse’s first name and initial. This information is necessary to ensure your forms get grouped correctly.

- Fill in Your Last Name: Your last name is the next piece of information needed. Ensure that it matches what is shown on your Social Security Card.

- Enter Your Street Address: Next, enter your street address. This should be the address where you would like the correspondence about the form to be sent.

- Type in Your city, State, and ZIP: After you've put in your street address, you'll need to give information on your city, state, and ZIP code. Be sure to input the correct details to avoid delays in processing.

- Indicate Payment Amount: Specify the amount you are paying. Ensure that you're entering the correct payment amount that matches your owed tax.

Also, please remember about the payment due date, your payment for the Il-1040-v is due on April 18, 2023. Be sure to send this in by that date to avoid any late fees or interest.

Using the Illinois tax form IL 1040 V

Finally, let's discuss the specific circumstances under which you'd use the IL 1040 V payment voucher. When you have a balance due on your state taxes and need to send that remittance through the mail – that’s when this form becomes important. Once your return has been completed and you know exactly how much you owe, this voucher is included with your payment to ensure your funds are correctly applied.

Form Versions

2022

Form IL-1040-V (2022)

Fillable online Form IL-1040-V