-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 25

-

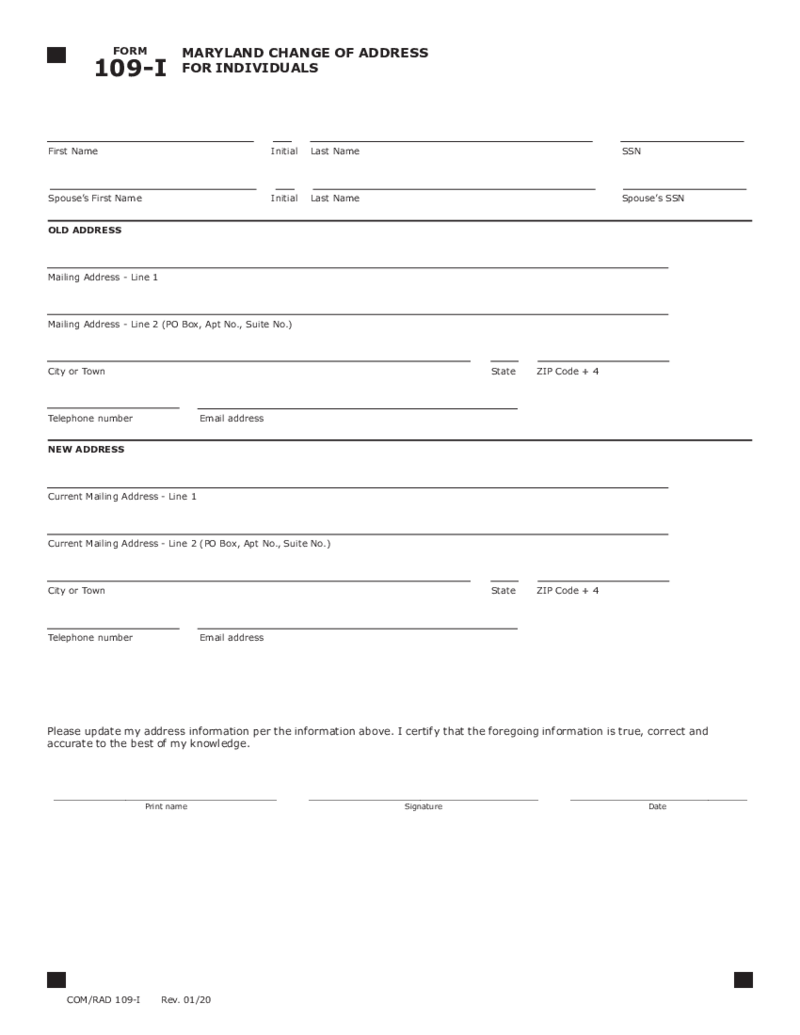

Maryland Tax Form 109-I

What Is Maryland Form 109-I?

Maryland Form 109-I is an income-based tax form used by individuals to report specific types of income that m

Maryland Tax Form 109-I

What Is Maryland Form 109-I?

Maryland Form 109-I is an income-based tax form used by individuals to report specific types of income that m

-

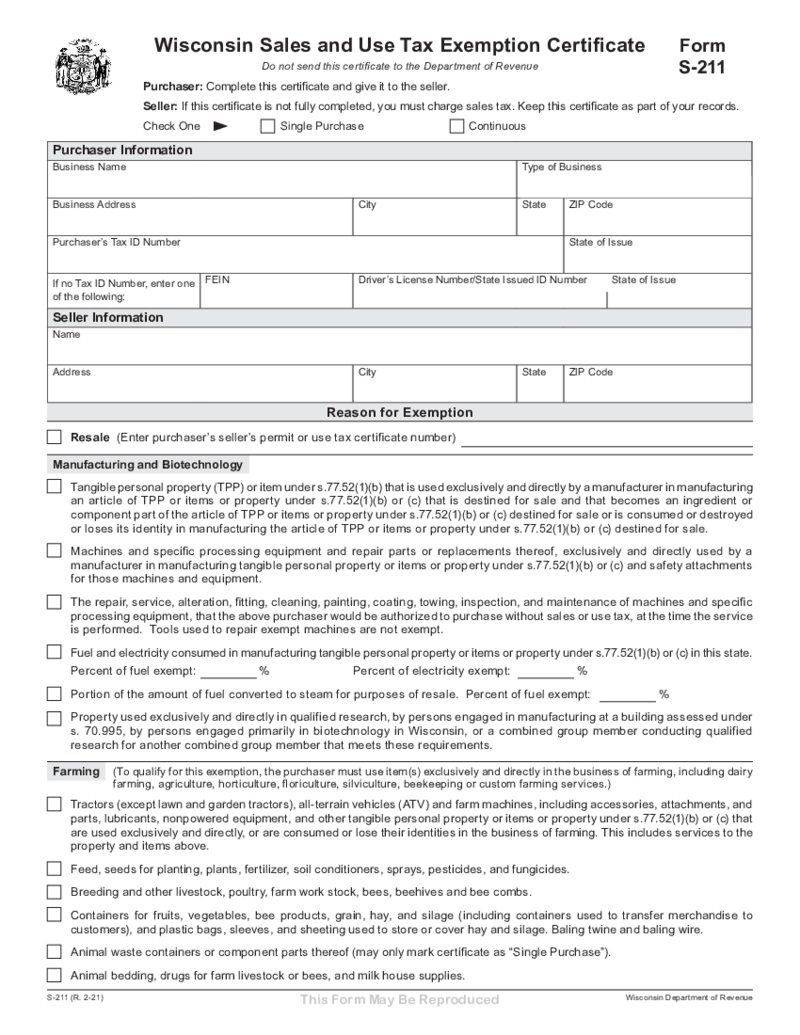

Form S-211

What is the Wisconsin Form S-211?

Known officially as the 'Wisconsin Sales and Use Tax Exemption Certificate,' the WI Form S 211 plays a crucial role for businesses and individuals alike. Its primary purpose is to allow eligible parties to documen

Form S-211

What is the Wisconsin Form S-211?

Known officially as the 'Wisconsin Sales and Use Tax Exemption Certificate,' the WI Form S 211 plays a crucial role for businesses and individuals alike. Its primary purpose is to allow eligible parties to documen

-

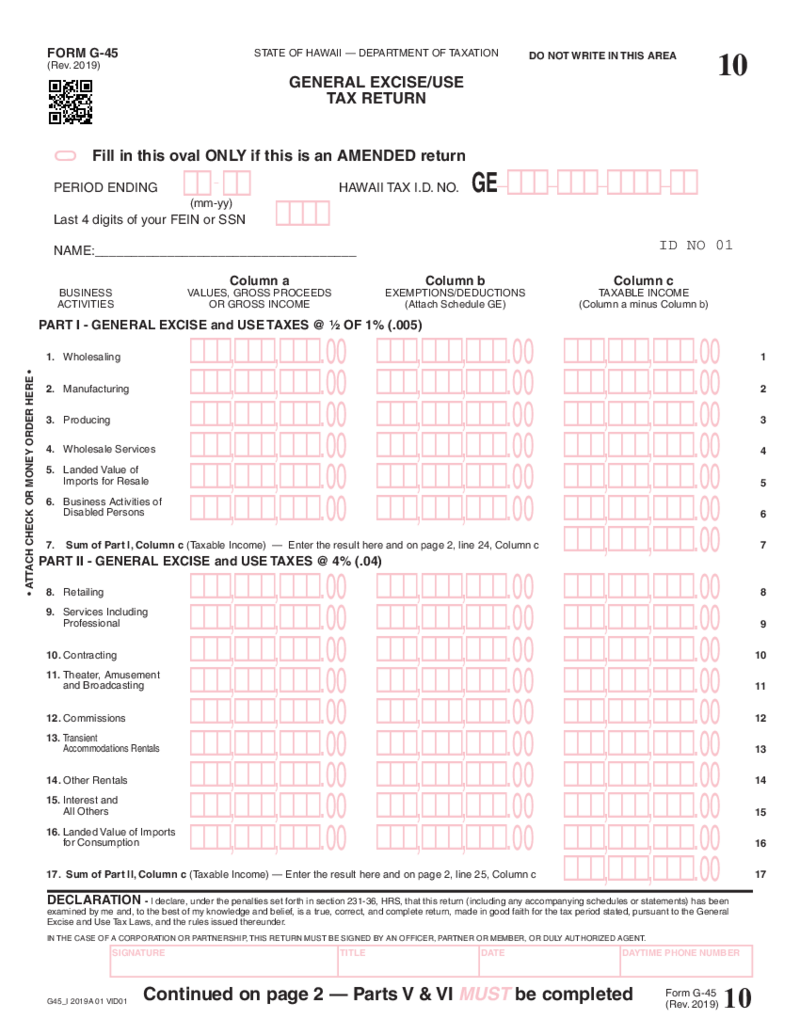

Hawaii Tax Form G-45

What Is Hawaii Tax Form G 45?

Hawaii General Excise Tax Form G-45, commonly referred to as the periodical general excise/use tax return, is a crucial document for businesses operating within the state of Hawaii. This form is used to calculate and report t

Hawaii Tax Form G-45

What Is Hawaii Tax Form G 45?

Hawaii General Excise Tax Form G-45, commonly referred to as the periodical general excise/use tax return, is a crucial document for businesses operating within the state of Hawaii. This form is used to calculate and report t

-

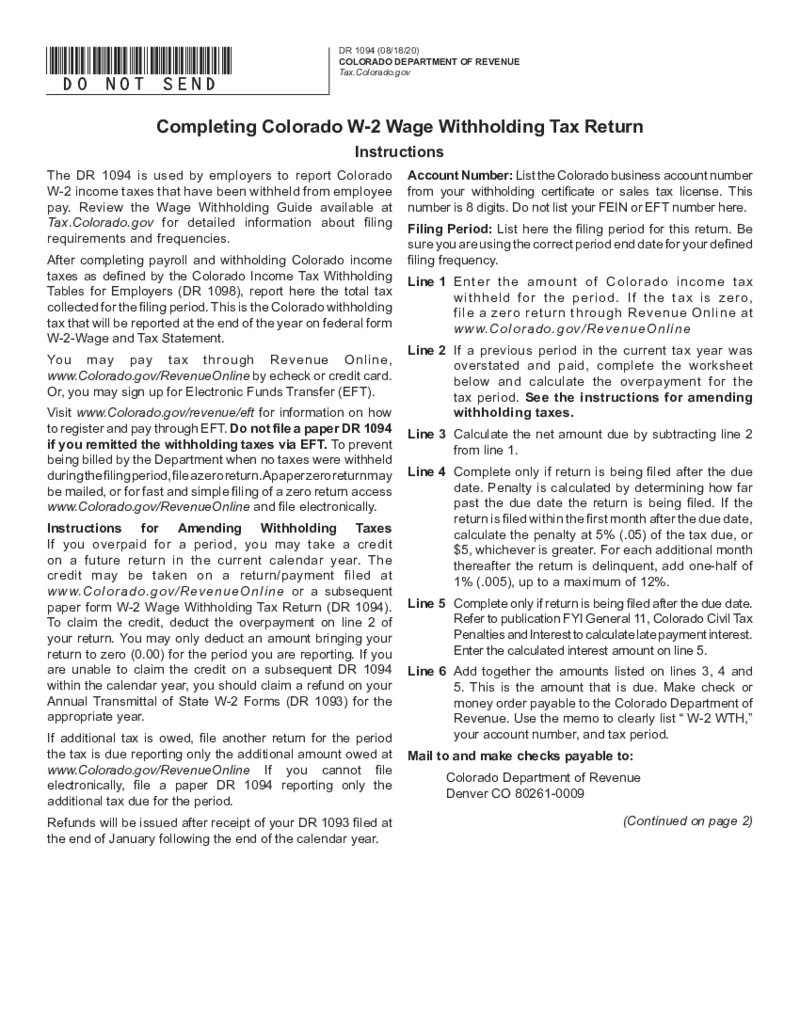

Colorado W-2 Wage Withholding Tax Return

What is Colorado W-2 Wage Withholding Tax Return?

The Colorado W-2 is a tax form that employers must file to report the income earned by their employees and the taxes withheld from their wages. The Colorado Department of Revenue uses the information provi

Colorado W-2 Wage Withholding Tax Return

What is Colorado W-2 Wage Withholding Tax Return?

The Colorado W-2 is a tax form that employers must file to report the income earned by their employees and the taxes withheld from their wages. The Colorado Department of Revenue uses the information provi

-

Form 5615 - Partial Satisfaction and Discharge of Tax Lien

What Is Missouri Tax Form 5615?

Missouri Tax Form 5615 is an essential document for Missouri taxpayers seeking partial satisfaction and discharge of a tax lien. This form is used by individuals or businesses with a lien placed on their pr

Form 5615 - Partial Satisfaction and Discharge of Tax Lien

What Is Missouri Tax Form 5615?

Missouri Tax Form 5615 is an essential document for Missouri taxpayers seeking partial satisfaction and discharge of a tax lien. This form is used by individuals or businesses with a lien placed on their pr

-

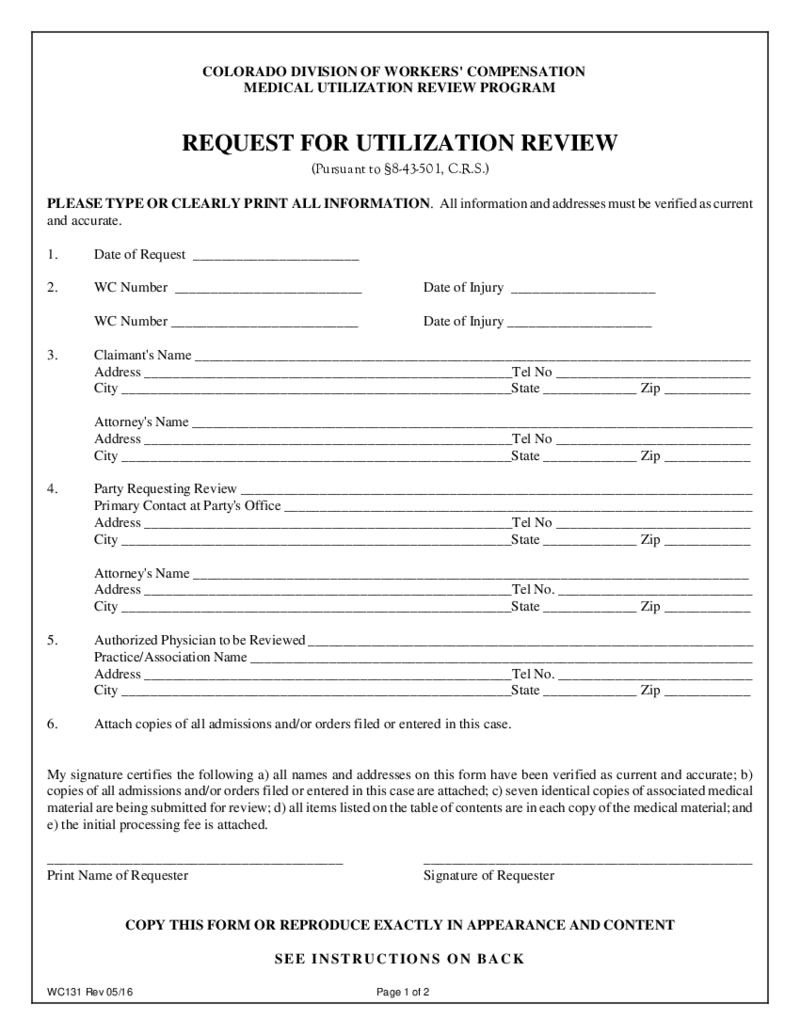

Colorado Division of Workers Compensation

What Is A Colorado Division Of Worker's Compensation

The Colorado Division of Worker's Compensation is a vital state agency responsible for overseeing the administration and regulation of workers' compensation claims within Co

Colorado Division of Workers Compensation

What Is A Colorado Division Of Worker's Compensation

The Colorado Division of Worker's Compensation is a vital state agency responsible for overseeing the administration and regulation of workers' compensation claims within Co

-

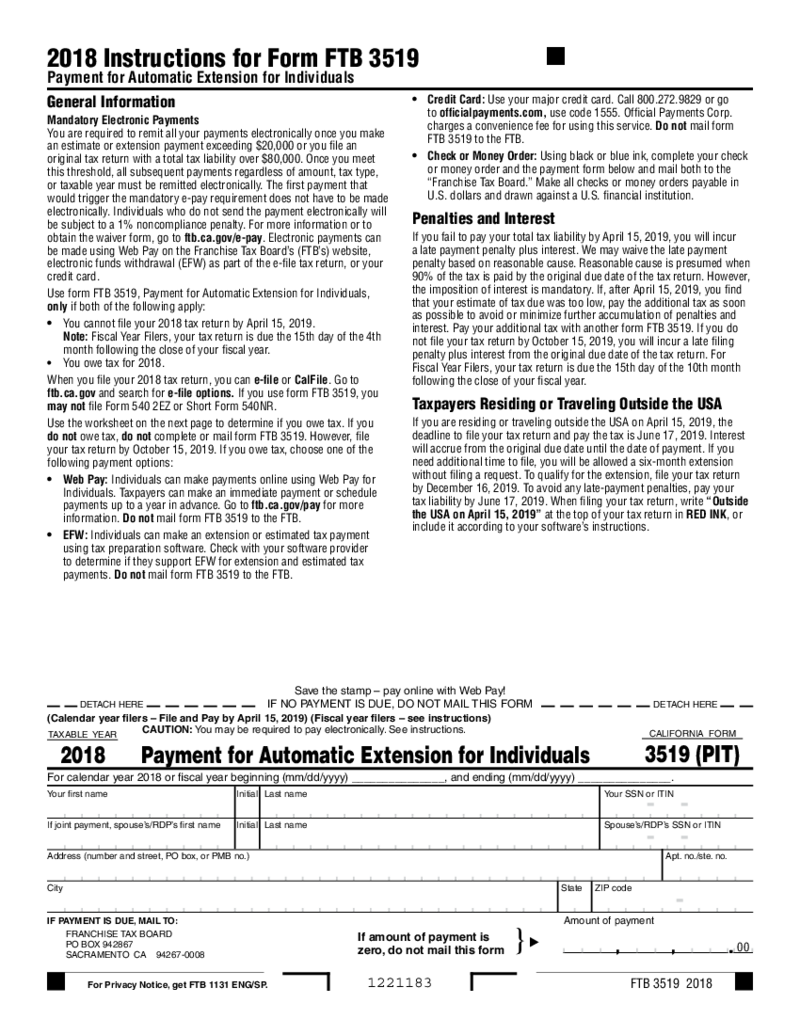

CA Form 3519 (2018)

What Is CA Form 3519?

CA Form 3519, also known as the Payment for Automatic Extension for Individuals, is a tax form provided by the California Franchise Tax Board. This form allows individuals to request an automatic extension to file their state income

CA Form 3519 (2018)

What Is CA Form 3519?

CA Form 3519, also known as the Payment for Automatic Extension for Individuals, is a tax form provided by the California Franchise Tax Board. This form allows individuals to request an automatic extension to file their state income

-

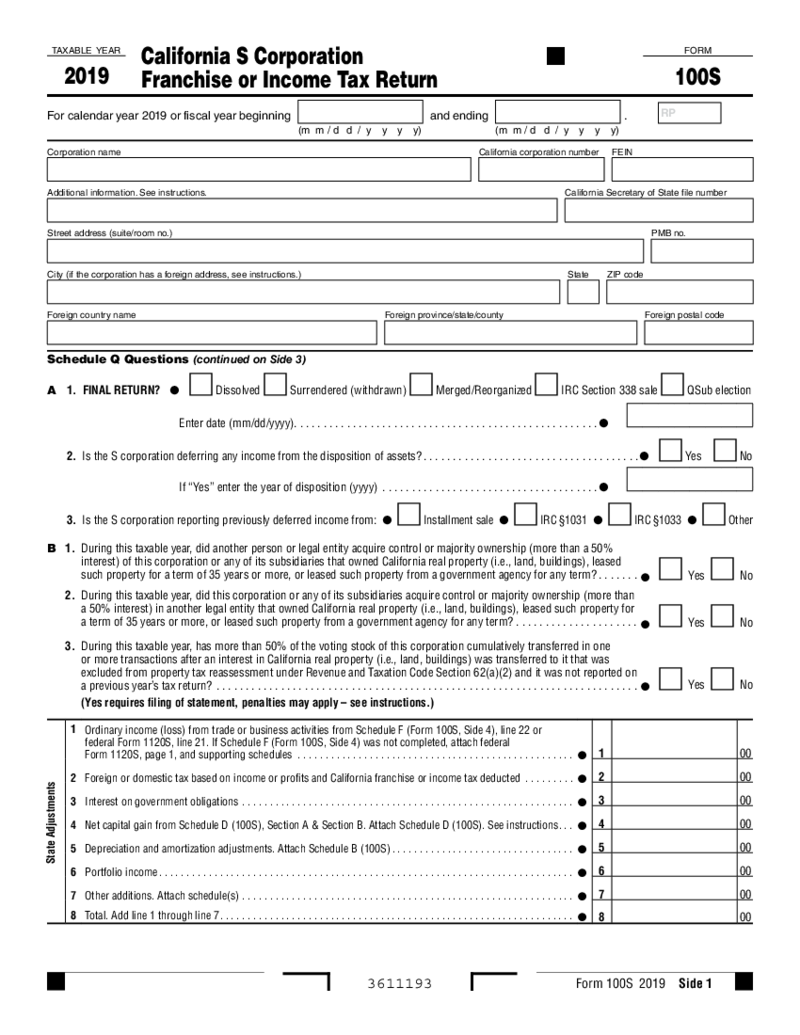

Form 100S 2019

Understanding California Form 100S 2019

Navigating through tax documentation can be challenging. One important form for S corporations in California is the 2019 ver

Form 100S 2019

Understanding California Form 100S 2019

Navigating through tax documentation can be challenging. One important form for S corporations in California is the 2019 ver

-

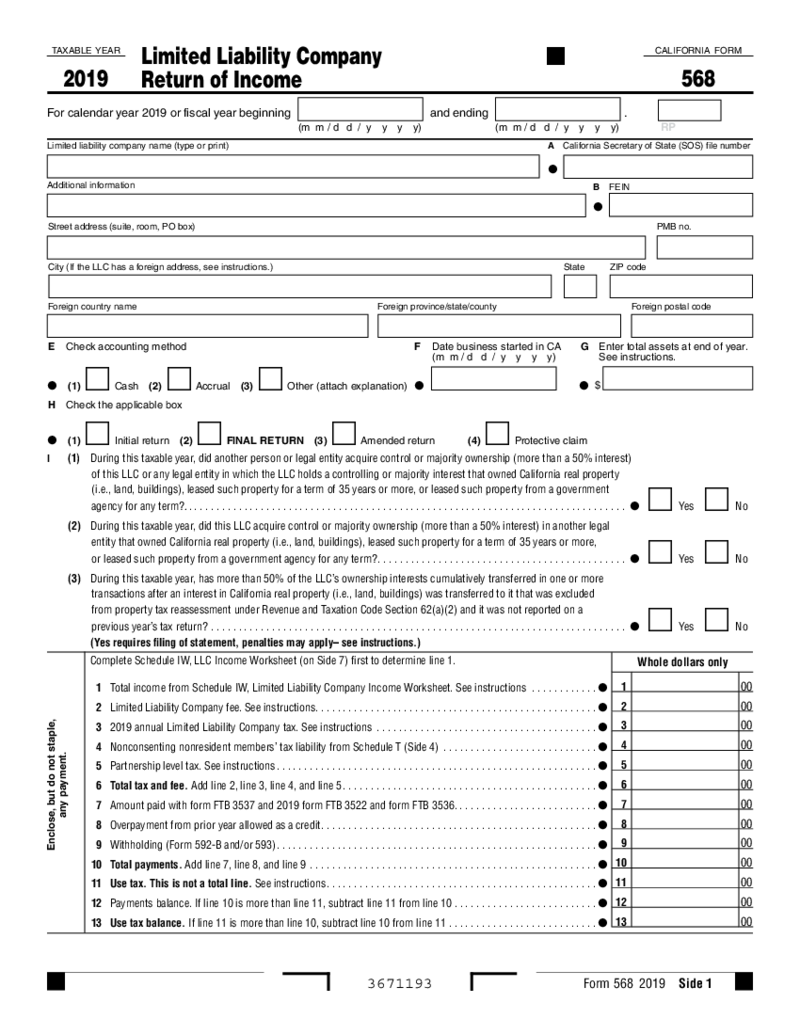

Form 568 (2019)

Understanding Form 568 2019 for California Tax Filing

Form 568 is a vital document for Limited Liability Companies (LLCs) operating in the state of California. It serves as the Return of Income that such entities must file with the California Franchise Ta

Form 568 (2019)

Understanding Form 568 2019 for California Tax Filing

Form 568 is a vital document for Limited Liability Companies (LLCs) operating in the state of California. It serves as the Return of Income that such entities must file with the California Franchise Ta

-

Alabama Form 40NR - Nonresident Individual Income Tax Return (2018)

Understanding Alabama Form 40NR for Non-Residents

When living or working in Alabama, understanding your tax obligations can be critical, especially if you're a non-resident. The Alabama Form 40NR is specifically designed for non-residents who need to

Alabama Form 40NR - Nonresident Individual Income Tax Return (2018)

Understanding Alabama Form 40NR for Non-Residents

When living or working in Alabama, understanding your tax obligations can be critical, especially if you're a non-resident. The Alabama Form 40NR is specifically designed for non-residents who need to

-

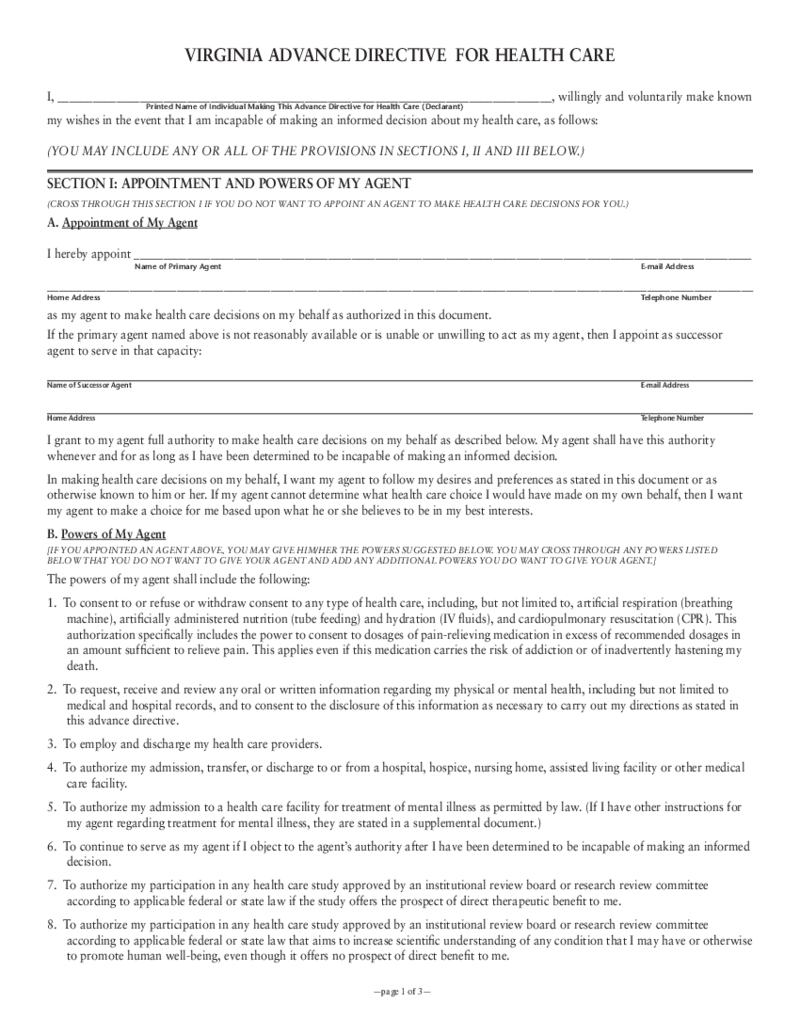

Virginia Advance Health Care Directive Form

What is Virginia Advance Directive for Health Care Form?

The fillable Virginia Advance Directive for Health Care is a mix of attorney medical power and the living will that provides a person with the selection of end-of-life treatment. This is not a busin

Virginia Advance Health Care Directive Form

What is Virginia Advance Directive for Health Care Form?

The fillable Virginia Advance Directive for Health Care is a mix of attorney medical power and the living will that provides a person with the selection of end-of-life treatment. This is not a busin

-

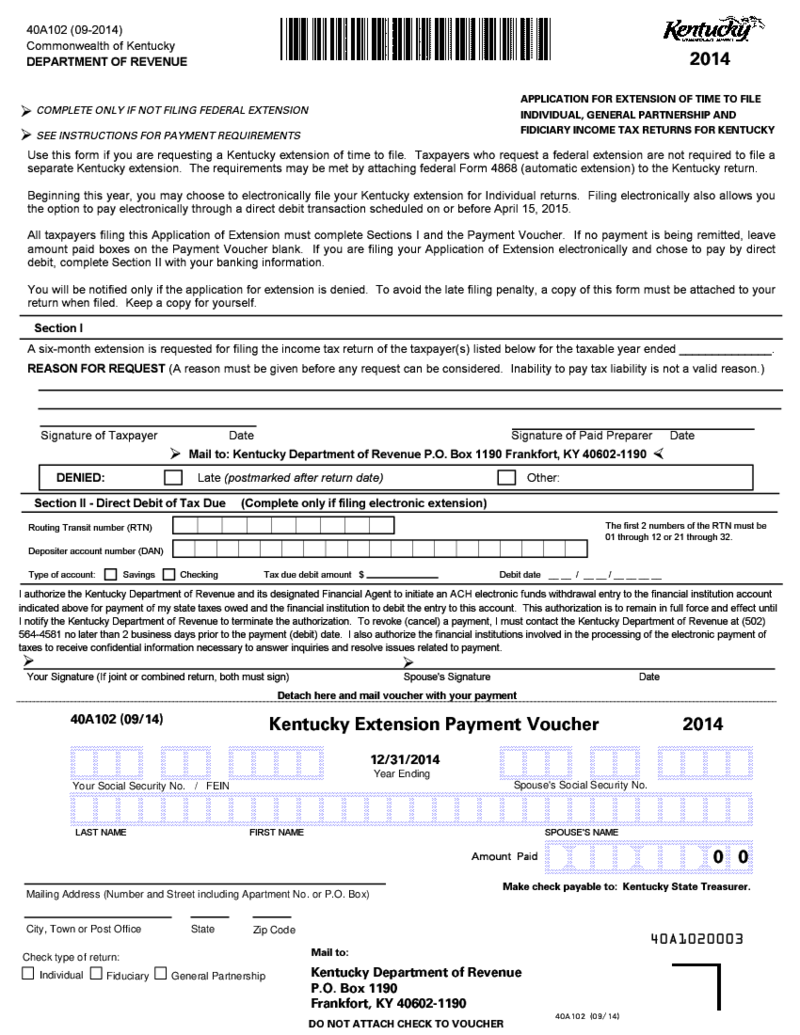

Kentucky Form 40A102

What Is Kentucky Tax Extension Form 40A102

Kentucky Tax Extension form 40A102 is an official document issued by the Commonwealth of Kentucky's Department of Revenue that allows individuals, general partnerships, and fiduciaries to request an ex

Kentucky Form 40A102

What Is Kentucky Tax Extension Form 40A102

Kentucky Tax Extension form 40A102 is an official document issued by the Commonwealth of Kentucky's Department of Revenue that allows individuals, general partnerships, and fiduciaries to request an ex

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.